What is the Feminine Hygiene Products Market Size?

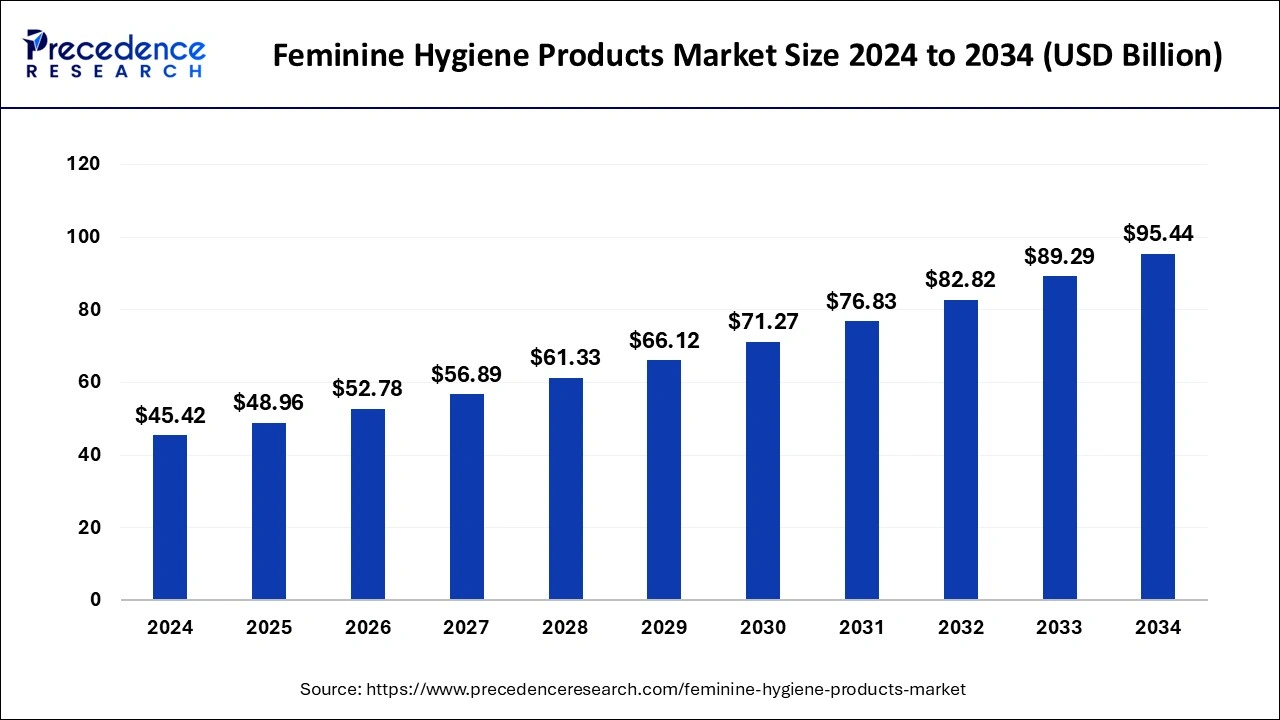

The global feminine hygiene products market size was accounted at USD 48.96 billion in 2025 and predicted to increase from USD 52.78 billion in 2026 to approximately USD 101.80 billion by 2035, representing a CAGR of 7.59% from 2026 to 2035. Rising literacy about intimate and menstrual health is driving the market's growth.

Feminine Hygiene Products Key Takeaways

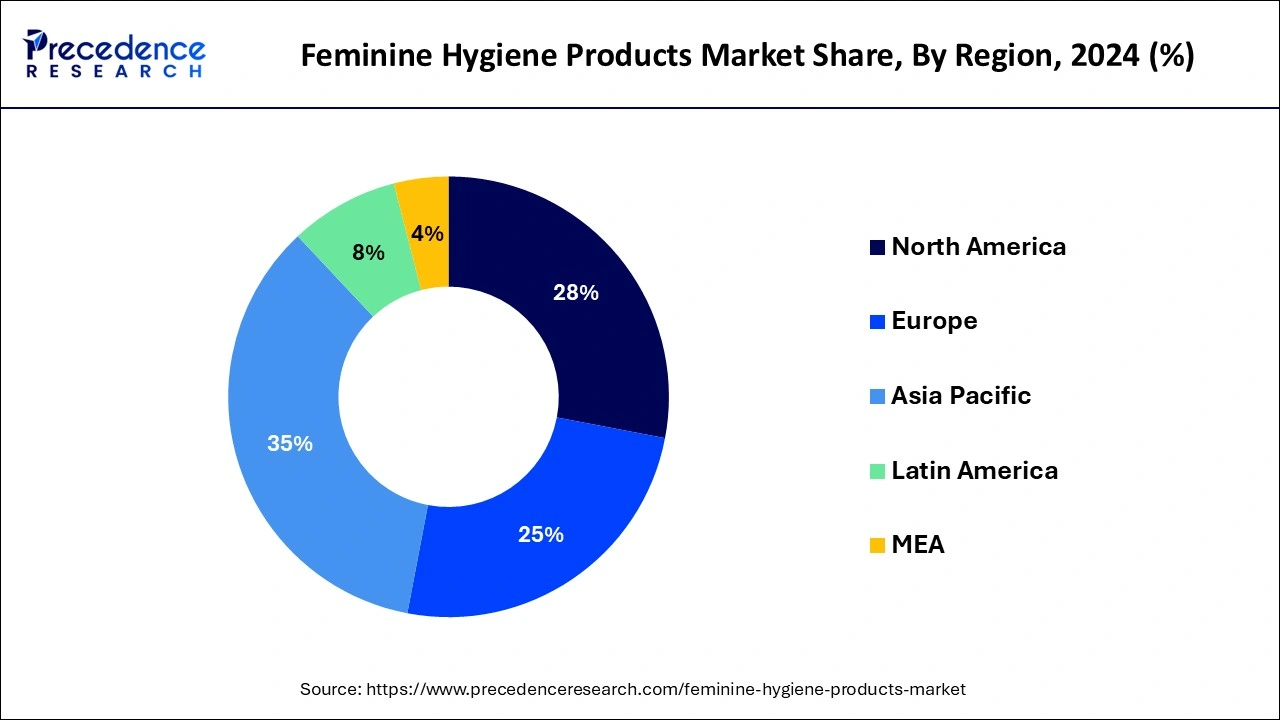

- Asia Pacific dominated the global market with the largest market share of 35% in 2025.

- North America is expected to witness the fastest growth during the forecast period.

- By product, the menstrual care products segment dominated the market in 2025.

- By distribution channel, the hypermarkets/supermarkets segment had the largest market share in 2025.

Market Overview

The feminine hygiene products market provides various hygiene products needed for better hygiene, especially during teenage and adulthood. Some feminine hygiene products include menstrual care products (pads, tampons, menstrual cups, and period pants), intimate cleansers (panty liners and others), moisturizers, pain relief products, and others. Feminine hygiene products are found in both the disposable and reusable categories. Feminine hygiene products are an important part of women's lives.

They help manage various hygiene and health-related aspects. The rising awareness about menstrual health drives the demand for various menstrual products like sanitary pads, tampons, and others to manage the blood flow during menstruation and maintain intimate hygiene. The increasing literacy about healthcare and intimate health in women, rising urbanization, and availability of products are driving the growth of the feminine hygiene products market.

Feminine Hygiene Products Market Growth Factors

- The increasing prevalence of hygiene-related diseases in women drives the growth of the feminine hygiene products market.

- The increasing marketplaces for women's hygiene-related products like sanitary products, panty liners, tampons, and others are driving the market's growth.

- The rising intervention of the various competitors in the market to cater to the evolving demand for feminine hygiene products and the availability of varieties of feminine hygiene products are driving the market's growth.

- The technological adoption in the manufacturing of such products results in increased production capacity and helps grow sales of feminine hygiene products.

- The ongoing research and development activities in the innovative product launched in feminine hygiene products accelerate the market's growth.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 7.59% |

| Market Size in 2025 | USD 48.96 Billion |

| Market Size in 2026 | USD 52.78 Billion |

| Market Size by 2035 | USD 101.80 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising concern about intimate hygiene

The rising female population globally and the increasing literature rate, urbanization, and modernization are causing higher awareness about intimate hygiene. The rising prevalence of hygiene-related issues in women is driving the demand for feminine hygiene products. The shift in lifestyle and the rising disposable income are driving the sales rate of feminine hygiene products. The rising awareness about menstrual hygiene is driving the demand for hygiene products like sanitary pads, menstrual cups, tampons, and others to maintain intimate hygiene during the menstrual cycle, which is contributing to the growth of the feminine hygiene products market. The increasing awareness about menstrual hygiene is due to the rising cases of urinary tract infections, reproductive tract infections, and genital rashes during menstrual cycles.

Restraint

Unawareness and social stigma in underdeveloped and rural areas

Unawareness and social stigma are some of the major challenges associated with the expansion of feminine hygiene products in underdeveloped countries and rural areas. The social stigma about menstruation and intimate hygiene is limiting from adopting the hygiene products and accessing the information about the products. Government initiatives to create awareness and provide information regarding basic and advanced feminine hygiene via schools and communal programs can help mitigate this challenge.

- For instance, in March 2024, the Karnataka state government in India re-launched the Shuchi scheme, under which the government distributed around 19 lakh free sanitary napkins to female students.

Opportunity

Evolution of feminine hygiene products

The ongoing evolution in feminine hygiene products in terms of sustainability, technological integration, customization, and others is driving the opportunity for market growth. The rising demand for sustainable, environmentally friendly hygiene products is due to the rising awareness about environmental pollution and carbon footprints in the atmosphere. The increasing demand for sustainable hygiene products drives manufacturers to produce products that meet the standards of sustainability and consumer expectations.

Additionally, technological integration into feminine hygiene products enhances the consumer experience with more efficiency, comfort, and safety. Revolutionary changes in the material from the traditional material improve comfort and absorbency, and smart products are used to manage menstrual health. The rising demand for personalized products is also attracting consumers and driving the demand for feminine hygiene products in the feminine hygiene products market.

- For instance, in July 2023, Saudi Sisters Joud and Nora Alorainy developed and launched the Kingdom's first biodegradable female hygiene product.

- In October 2023, Gals Bio mentioned Tulipon, an AI-powered menstrual care product. Tulipon is capable of health monitoring through which users can screen-specific health markers while staying in their homes.

Segment Insights

Product Insights

The menstrual care products segment dominated the feminine hygiene products market in 2025. Menstrual care products are one of the major feminine hygiene products. The increasing awareness regarding menstrual hygiene is due to the rising menstrual education and literacy rate among the population. Menstrual care products like sanitary pads, tampons, panty liners, and others manage menstrual discomfort and provide safety and comfort during the menstrual cycle. Sanitary pads are one of the most selling products worldwide for managing menstrual cycles.

Sanitary napkins or pads are the most effective and hassle-free menstrual products. Tampons are another type of menstrual hygiene product made with cotton tightly packed into a tent or cylindrical shape. It is inserted into the vaginal canal and absorbs the blood flow into the vaginal canal; it is removed by pulling the attached string that hangs out for pulling out the tampon. Panty liners, menstrual cups, and period underwear are some examples of menstrual care products. The evolution and ongoing research on menstrual product development and launch are driving the growth of these products in the feminine hygiene products market.

- For instance, a significant proportion of the world population is menstruating individuals. According to research, it was found that around 1.8 billion menstruate monthly around the globe.

Distribution Channel Insights

The supermarkets/hypermarkets segment is projected to have the largest share in the feminine hygiene products market in 2025. The growth of the segment is attributed to the higher availability of a wide range of female hygiene products with attractive pricing and discounts. It is the one-stop solution for females to buy hygiene products like pads, tampons, intimate hygiene wash, and other hygiene products in bulk at discounted prices. Tampons and sanitary pads are generally higher in price and are not affordable for middle-class or lower-income people. The supermarket provides the best quality products with different offers and discounted prices. The rising urbanization in the counties results in the increased presence of supermarkets/hypermarkets in the cities, which drives the higher adoption of these segments for purchasing hygiene and other products.

Regional Insights

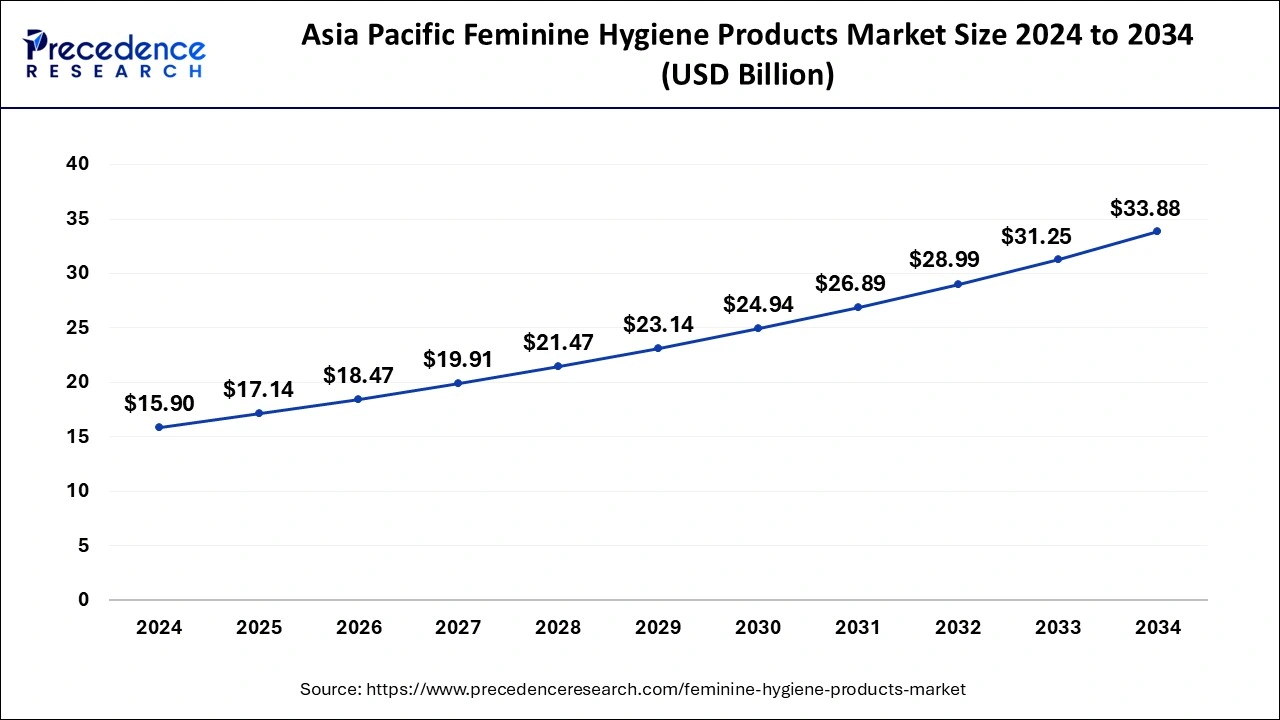

Asia Pacific Feminine Hygiene Products Market Size and Growth 2026 to 2035

The Asia Pacific feminine hygiene products market size was estimated at USD 17.14 billion in 2025 and is predicted to be worth around USD 36.26 billion by 2035 with a CAGR of 7.78% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific led the feminine hygiene products market with the largest market share in 2025. The growth of the market in the region is increasing due to the evolving population, especially the women population in the region, and the rising awareness regarding feminine hygiene that drives the growth of the market. The changing lifestyle increased disposable income, and rising urbanization are driving the demand for luxury and hassle-free lifestyles. The surge in investment in living standards and the higher availability of several competitor products with different price categories drive the adoption of feminine hygiene products in the market in the region.

India is a major contributor to the Asia Pacific market, as the country is focusing on transforming reusable solutions, especially menstrual cups, reusable cloth pads, and even reusable menstrual discs to raise affordability and lower waste. Alongside, brands, such as Saathi, are using banana and bamboo fibers for biodegradable pads.

For instance,

- In December 2025, Baghpat District Administration partnered with UNICEF and the Indian Red Cross Society, and also introduced NIRA, an initiative that facilitates eco-friendly cotton reusable menstrual pads to women and girls.

- For instance, In India, there are about 242 million adolescents, 18% of the total population, of which 16 million are girls. Menstruation is one of the important physical changes in adolescent girls. Feminine hygiene plays an important role in personal hygiene and health and in the dignity and empowerment of girls.

- According to the latest trends and reports, 64.5% of adolescent girls use sanitary pads, 49.3% use cloth, and 15.2% use locally produced napkins. The use of sanitary pads has increased by 22% in the last five years, contributing to the growth of the feminine hygiene products market.

What Makes North America the Fastest-Growing Region in the Feminine Hygiene Products Market?

North America is expected to witness the fastest growth during the forecast period. The region is showing significant growth in the market due to the rising women population that anticipated the higher demand for feminine hygiene products. The rising cases of hygiene-related problems among women in regional countries are driving the demand for female hygiene products in the market. The increased presence of the major market players in women's hygiene is also propelling the expansion of the feminine hygiene products market in the region.

In the North American region, countries like the U.S. and Canada promote the growth of the market. The U.S. is a highly developed country and is a hub for various hygiene products companies such as Johnson & Johnson, Procter & Gamble, Kimberly-Clark, Natracare LLC, First Quality Enterprises, Inc., and so on. They are known for launching new and better products, which not only improve female hygiene but also improve sustainability and reduce negative environmental impact.

- For instance, in April 2024, Kimberly-Clark launched its new product in the U.S.. Liv by Kotex is a female hygiene product offering dual protection from menstrual and bladder leaks. It keeps users 10 times drier than regular products and is capable of absorbing up to 24 milliliters.

How is the Opportunistic Rise of Europe in the Market?

Europe is experiencing an opportunistic rise in the feminine hygiene products market due to growing consumer preference for sustainable, reusable, and eco-friendly products such as biodegradable pads. The emergence of innovative brands like WUKA, combined with increasing awareness of organic and plastic-free options, is further driving market growth across the region.

What Potentiates the Feminine Hygiene Products Market in Latin America?

The feminine hygiene products market in Latin America is being driven by increased focus from governmental and non-governmental organizations on menstrual equity, supporting policy reforms, education campaigns, and improved access to products in schools and public institutions. Initiatives like Guyana removing all taxes and customs duties on feminine hygiene products are further boosting affordability and accessibility, fueling market growth.

Feminine Hygiene Products Market Companies

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag (publ)

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd.

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc.

- Bingbing Paper Co., Ltd.

Recent Developments

- In July 2025, the Thiruvananthapuram Corporation unveiled a project to facilitate menstrual cups for girl students across government schools in the city.

(Source: thehindu.com) - In June 2025, Meghalaya Chief Minister Conrad Sangma initiated the ‘She-Rise' production unit, a Zero Waste Period Mission under the Green Meghalaya Initiative by the Shubham Charitable Association.

(Source: northeasttoday.in) - In May 2024, Carefree, a leading feminine care brand, introduced the expansion of its product portfolio, which includes liners and pads. The brand is launching pads made to meet the most trying feminine care challenges faced by moms.

- In May 2024, Medicare Hygiene Limited, the organization focused on the manufacturing and exporting of surgical non-woven disposable products and medical bandages, comes in the cosmetics segment with the introduction of its Earthika Eco-friendly Wet Wipes.

Segments Covered in the Report

By Product

- Menstrual Care Products

- Sanitary Pads/Napkins

- Panty Liners

- Tampons

- Others

- Cleaning And Deodorizing Products

By Distribution Channel

- Hypermarkets/Supermarkets

- Drugs Stores

- Convenience Stores

- Others (Online Stores and Departmental Stores)

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting