What is the Halal Cosmetics Market Size?

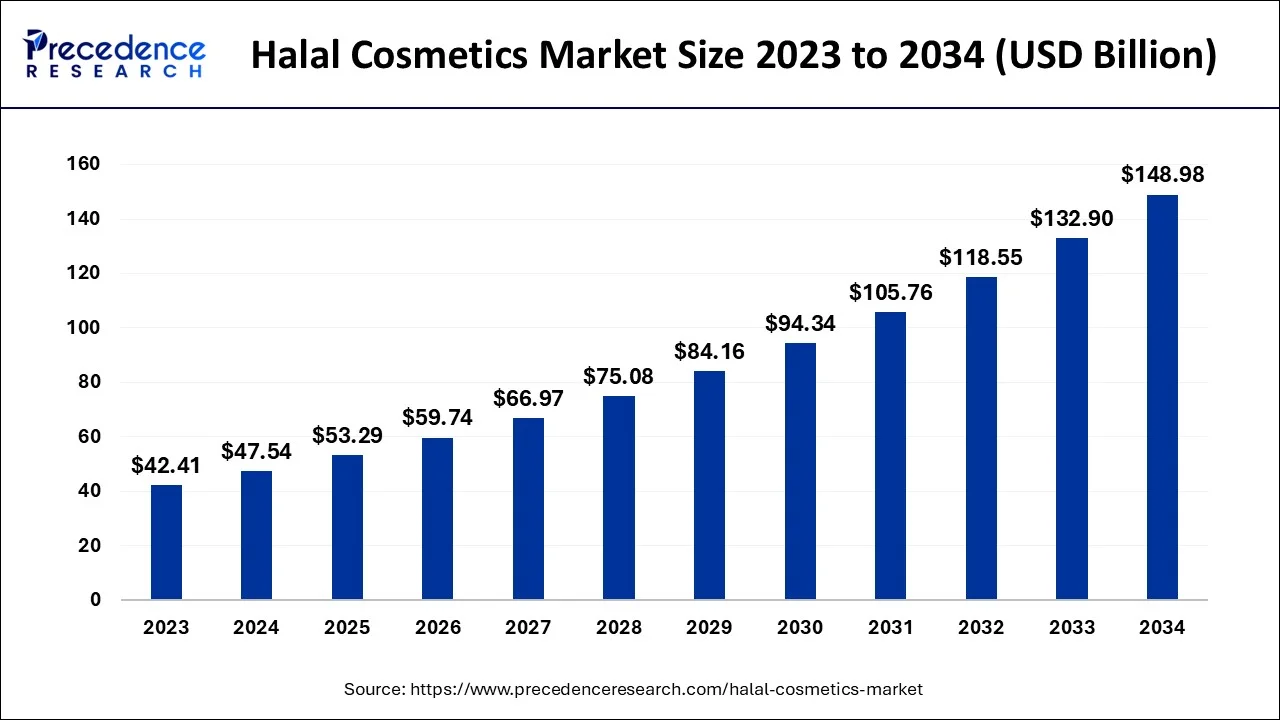

The global halal cosmetics market size is calculated at USD 53.29 billion in 2025 and is predicted to increase from USD 59.74 billion in 2026 to approximately USD 163.91 billion by 2035, expanding at a CAGR of 11.89% from 2026 to 2035.

Market Highlights

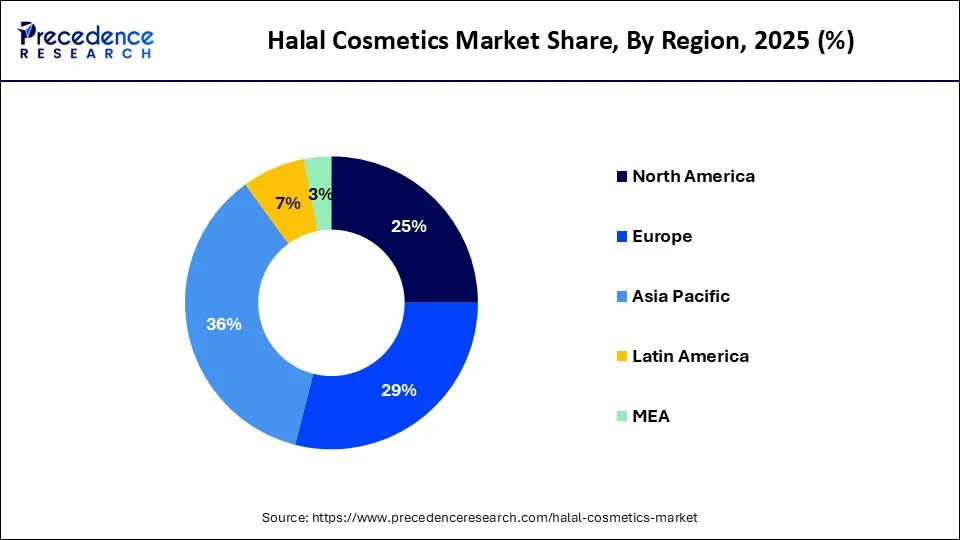

- North America dominated halal cosmetics market in 2025.

- By product, personal care products segment dominated the market in 2025.

- By application, hair care segment led the market in 2025.

Market Overview

Halal cosmetics are products that are made of ingredients that are not nonpermissible by Islamic law. All cosmetics are free from any animal products or genetically modified organisms ingredients. The increasing Muslim population has led to a rapid rise in the market for halal cosmetics. An increasing number of women, especially Muslim women entering into the cosmetics and fashion industry, becoming professionals are all leading the way for the demand for halal cosmetics products. These products are free from animal cruelty. Due to a growing trend for personal grooming and the use of beauty products that adhere to the religious norms of the Muslim community, there is a growth in the use of these products. Products like the lipstick Lip Balms Foundation, skin care products, creams, moisturizers, lotions, and products of personal hygiene and personal care are all manufactured under this domain.

The market for halal cosmetics is expanding, especially in regions dominated by the Muslim population. In countries like Saudi Arabia, UAE, Indonesia, Turkey, and Malaysia, there's a growing demand for halal cosmetics. Since Muslims constitute a great part of the global population. This cosmetic industry is expected to grow. There's an increase in the production of Sharia-compliant products. India ranks third in terms of the high Islamic population. Growing standard of living and rapid urbanization has boosted the halal cosmetics market growth in India. There's an increasing demand for Sharia-compliant products or halal-certified products.

The halal cosmetics market was also hit by the COVID-19 pandemic. Look cosmetics market was largely affected as new products were needed like hand sanitizers and eye care. As wearing the mask was a social norm the cosmetics products market had become sluggish.

Halal Cosmetics Market Growth Factors

The compliance with halal certification and the increase in the population of the Muslim community, there is a group in the demand for halal cosmetics. Major market players in the cosmetics industry are also entering the halal cosmetics market. The high cost, which is associated with these cosmetics hampers the market. The increased purchasing power of the growing women Muslim population is expected to increase the demand for halal cosmetics. As young Muslim women are taking interest in fashion and makeup there is growth in this market. There's growth in the fragrances market due to a desire for personal grooming.

The market is expected to grow due to the growing concern among people about animal welfare and their living rights. The trend for veganism is also gaining attention and many people are boycotting animal-based products, so all of these factors are expected to help in the growth of the market. Earlier, the choice of halal cosmetics was extremely timid, but in recent years due to the increased portfolio of various companies, there is an increase in the range of products that are provided.

Many halal-certified cosmetic manufacturers have entered the market. Halal products are not just in demand because of the muslin population but as they symbolize cleanliness, hygiene, and safety non-Muslim women or men are also resorting to halal cosmetic products. Not just the production, but the packaging of these products also require hygiene. All of these reasons are helping in driving the demand for these products in many non-Muslim countries also.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 53.29 Billion |

| Market Size in 2026 | USD 59.74 Billion |

| Market Size by 2035 | USD 163.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.89% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered |

By Product Type,Application, Distribution Channel, and region |

| Regions Covered |

North America,Europe,Asia-Pacific,Latin America,Middle East & Africa |

Segment Insights

Product Type Insights

On the basis of the product, the halal cosmetics market is segmented into Fragrance, color cosmetics, and personal care. Personal care is sub-segmented into hair care and skincare.

On the basis of the product, personal care products hold the largest market share and it is driven by the number of Muslim women population, which are increasingly using such products. These products are a combination of personal hygiene and religious observances. Halal cosmetics market has a vast product portfolio and a great application in the consumer's lives. Most halal cosmetics do not cause any skin irritation and also do not have any long-term side effects on health. With the increased disposable income and the adoption of modern lifestyles, it is expected that the market shall grow during the forecast period. For the non-Muslim population, varieties of vegan products are proving to be a good skin care segment.

Application Insights

On the basis of application, the hair care segment has the largest market share and is expected to remain the same during the forecast. Hair massage creams, shampoo conditioners, hair oil, hair gels, etc. are all the products that come under the Hair care segment. The hair care segment has grown in the previous years, and it is expected to grow during the forecast period due to specific interest and desire for healthy hair among Muslim women.

Distribution Insights

On the basis of distribution channels, there are two modes, online mode, and offline mode. Halal cosmetics are majorly distributed across the globe with the help of offline channels like Specialty Stores, brand stores, boutiques, and brand outlets. Post COVID-19pandemic e-commerce activities have also increased across the world. Due to the pandemic, there has been the involvement of e-commerce with halal cosmetics. The distribution of halal cosmetics through hypermarkets and supermarkets or even convenience stores is doing well. The store-based segment is expected to have the highest share and is expected to grow well during the forecast.

Regional Insights

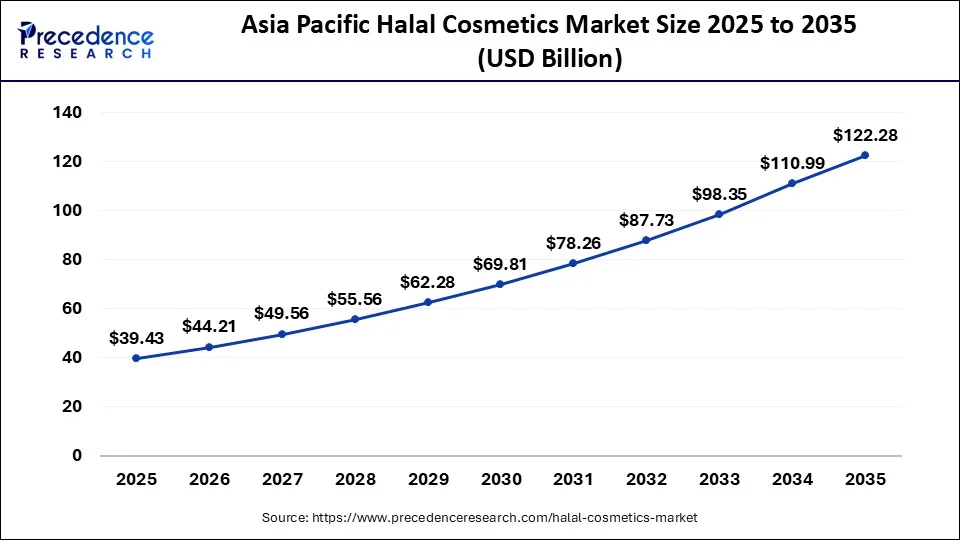

Asia Pacific Halal Cosmetics Market Size and Growth 2026 to 2035

The Asia Pacific halal cosmetics market size is evaluated at USD 39.43 billion in 2025 and is predicted to be worth around USD 122.28 billion by 2035, rising at a CAGR of 11.98% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Halal Cosmetics Market?

Asia Pacific dominated the halal cosmetics market with the largest revenue share in 2025. This is mainly due to its large Muslim population, which drives strong demand for products that comply with religious and ethical standards. Rising disposable incomes and strong demand for ethical, clean-label beauty products also support the region's dominance. Countries in the region are witnessing higher adoption of certified halal skincare, color cosmetics, and personal care as consumers prioritize ingredient transparency and religious compliance.

Malaysia Halal Cosmetics Market Analysis

Malaysia is a major contributor to the market within Asia Pacific due to its well-established halal certification ecosystem and strong regulatory infrastructure. The country plays a central role in global halal standards and acts as a hub for halal-certified beauty brands, driving robust domestic consumption and export potential. Additionally, Malaysia's strategic focus on promoting halal exports and innovation in beauty and personal care products has positioned it as a key driver of the region's market growth.

What Potentiates the Halal Cosmetics Market in North America?

The market in North America is driven by the region's growing multicultural and Muslim populations, which drive demand for ethically and religiously compliant beauty products. Rising consumer awareness of ingredient transparency, clean beauty, and cruelty-free formulations also aligns with halal standards, boosting market appeal. Furthermore, the expansion of online retail and the availability of international brands make halal-certified cosmetics more accessible, accelerating adoption across diverse consumer segments.

U.S. Halal Cosmetics Market Trends

The U.S. leads the regional market with growing product launches and expanding specialty retail presence. The country's multicultural demographic base, combined with rising awareness about ingredient purity and sustainability, is fostering the adoption of halal-certified skincare, haircare, and personal care products.

What Opportunities Exist in Europe for the Halal Cosmetics Market?

Europe offers immense opportunities for the halal cosmetics market, driven by rising multicultural populations and a growing shift toward vegan, cruelty-free, and ethical beauty categories. European consumers, both Muslim and non-Muslim, show rising interest in clean-label and ingredient-safe formulations, encouraging brands to adopt halal certification. Additionally, expanding e-commerce platforms and the presence of international halal brands allow for easier market penetration and brand visibility across diverse European countries.

UK Halal Cosmetics Market Trends

In the UK, the market is growing due to a rising Muslim population, increasing awareness of halal-certified and cruelty-free products, and strong demand for ethical, clean-label beauty. Expanding multicultural consumer bases, wider product availability through online retail, and growing acceptance of halal cosmetics among non-Muslim consumers further support market expansion.

How is the Opportunistic Rise of Latin America in the Halal Cosmetics Market?

Latin America is experiencing an opportunistic rise in the market as increasing consumer awareness about halal-certified, ethical, and clean beauty products draws both Muslim and non-Muslim customers seeking safer alternatives to conventional cosmetics. Growing interest in cruelty-free, alcohol-free formulations and the expansion of e-commerce and social media platforms are making halal beauty products more accessible and boosting regional demand. Additionally, major global and local brands are beginning to introduce halal product lines and partner with certification bodies to capitalize on this emerging niche, creating new market opportunities across countries like Brazil, Mexico, and Argentina.

What Drives the Market in the Middle East & Africa?

The Middle East & Africa halal cosmetics market is driven primarily by a large and growing Muslim population that values products compliant with Islamic law, ensuring a strong baseline demand for halal-certified beauty and personal care products. Cultural preferences for alcohol-free, animal-free, and ethically produced cosmetics, combined with rising beauty consciousness, especially among young and urban consumers, are increasing regional consumption across skincare, haircare, and fragrances. Additionally, expanding e-commerce adoption, rising disposable incomes, and wider availability of halal brands through modern retail and digital channels are enhancing market accessibility and fueling growth throughout the region.

Halal Cosmetics Market - Value Chain Analysis

- Product Development

Halal cosmetics are created through processes like sourcing halal-certified ingredients, plant-based extraction, alcohol-free formulation, emulsification, product stabilization, and cruelty-free manufacturing. These products avoid prohibited substances such as pork derivatives, non-halal animal fats, and intoxicants.

Key players: Amara Halal Cosmetics, Iba Cosmetics, INIKA Organic, PHB Ethical Beauty. - Quality Testing and Certification

Halal cosmetics require certifications that ensure compliance with Islamic law, ingredient purity, ethical sourcing, and safety. Important certifications include Halal Certification (JAKIM/MUIS), ISO quality standards, GMP cosmetic manufacturing, and cruelty-free verification.

Key players: JAKIM (Malaysia), MUIS (Singapore), Halal Accreditation Council, ISO (International Organization for Standardization). - Distribution to Industrial Users

Halal cosmetics are provided to specialty retailers, halal beauty stores, online marketplaces, pharmacies, salons, and personal care product manufacturers.

Key players: Wardah, Ivy Beauty Corporation, Halal Beauty Cosmetics.

Halal Cosmetics Market Companies

- Amara Halal Cosmetics: Amara is a leading brand in the halal cosmetics industry, providing makeup and skincare products free from alcohol, animal-derived ingredients, and harmful chemicals. The company focuses on ethical sourcing, cruelty-free formulas, and strict compliance with halal certification standards.

- INIKA Organic: INIKA Organic provides halal-certified, vegan, and organic beauty products, including foundations, mineral makeup, and skincare lines. The brand is known for its clean formulations, plant-derived ingredients, and commitment to sustainability, appealing strongly to conscious beauty consumers.

- Clara International Beauty Group:

Clara International is a leading halal-certified cosmetics and skincare manufacturer with a strong presence in Asia. The company offers a wide range of herbal-based products, beauty treatments, and personal care solutions backed by halal-compliant manufacturing processes. - Ivy Beauty Corporation: Ivy Beauty offers multiple halal-certified brands across cosmetics, personal care, and skincare products, tailored for Muslim consumers globally. The company focuses on natural ingredients, value-driven pricing, and wide distribution across Southeast Asia and the Middle East markets.

- Wipro Unza Holdings Ltd.: Wipro Unza provides halal-certified personal care and beauty products through several of its brands. The company focuses on dermatologically safe formulations, alcohol-free products, and strong positioning in Muslim-majority markets across Asia and the Middle East.

Other Major Key Players

- IBA Halal Care

- Mena Cosmetics

- PHB Ethical Beauty

- Sampure Minerals

- Wardah Cosmetics

- Brataco Group of Companies

- Clara International Beauty Group

- Halal Cosmetics Company

Recent Developments

- Novel halal-sanctioned skin care products were presented by a Muslim-possessed skincare brand Flora and Noor in June 2021. This company offers various products that are cruelty-free, vegan, and halal-approved. There are toners, serums, cleansers, body scrubs, bath bombs, and moisturizers.

- In order to cater to a diverse consumer base, ex-L'Oreal executives launched a halal brand in August 2020.

- Boozer, is a Brazilian cosmetics company. Located in Amazon. Has a range of products called Simbioze Amazonica. And these products have received halal certification in December 2019.

- In July 2024, South Korea's cosmetics ODM firm Kolmar Korea launched halal-certified products in the UAE, entering the Middle Eastern market to meet rising demand for halal beauty items.(Source: https://www.cosmeticsdesign-asia.com)

- In October 2024, Vietnam launched the National Halal Certification Center (HALCERT) and new halal standards to boost halal product development across food, cosmetics, pharmaceuticals, and fashion, supporting both local and global markets.(Source: https://hanoitimes.vn)

- In July 2024, Sensatia Botanicals launched a halal-certified hair care line, featuring a shampoo, conditioner, and hair mask made with natural ingredients for ethical and sustainable hair care.(Source: https://www.sensatia.com)

- In June 2024, Lady K Malaysia launched a range of halal and vegan skincare products, including mists, toners, and cleansers, along with a pop-up store in the country.(Source: https://themalaysianreserve.com)

Segments Covered in the Report

By Product Type

- Personal Care Products

- Color Cosmetics

- Fragrances

By Application

- Skin Care

- Face Care

- Hair Care

- Beauty Care

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting