What is the Materials Informatics Market Size?

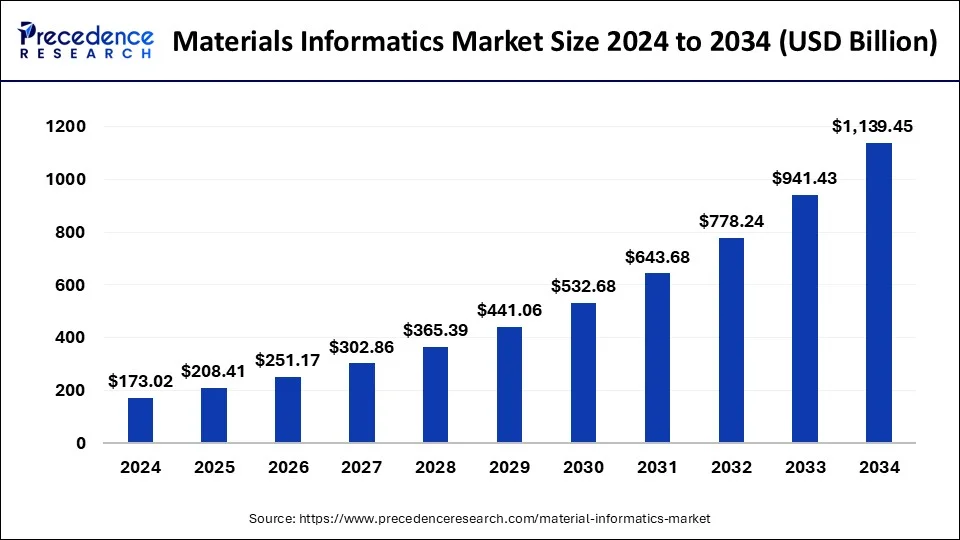

The global materials informatics market size is calculated at USD 208.41 million in 2025 and is predicted to increase from USD 251.17 million in 2026 to approximately USD 1,139.45 million by 2034, expanding at a CAGR of 20.80% from 2025 to 2034. The materials informatics market utilizes data-driven methodologies, including AI and machine learning, to expedite the discovery, design, and optimization of new materials across various industries. The market is experiencing significant growth due to the escalating demand for advanced, sustainable, and cost-effective materials in sectors such as electronics, chemicals, pharmaceuticals, and aerospace.

Market Highlights

-

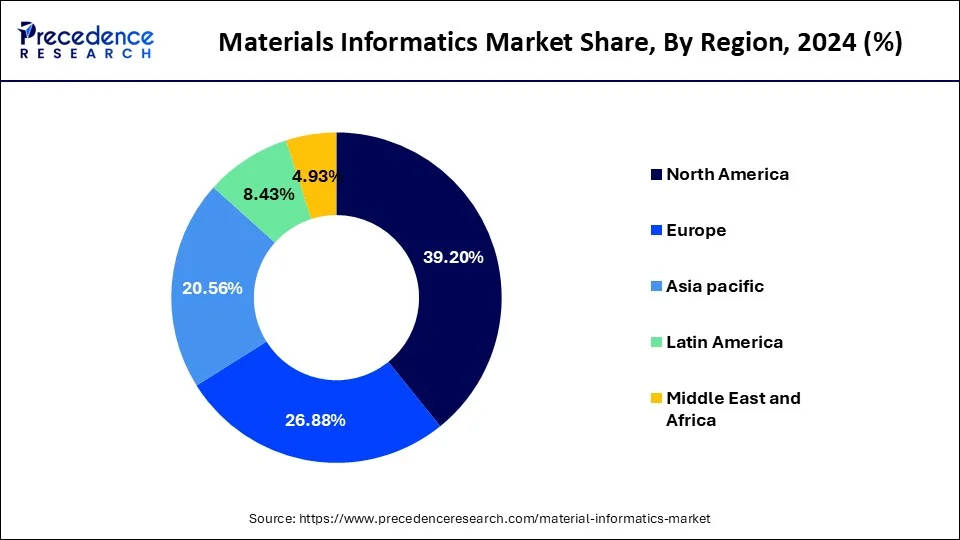

North America dominated with a 39.20% share in 2024, driven by strong adoption in pharmaceuticals, electronics, and chemicals

-

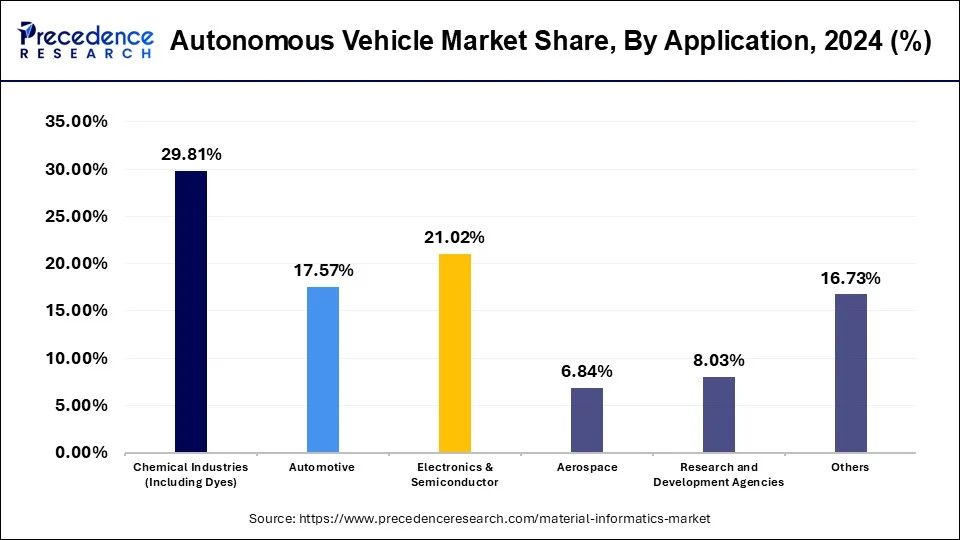

By application, the chemical industries segment led with 29.81% share in 2024, while the electronics & semiconductor segment is forecast to grow fastest .

-

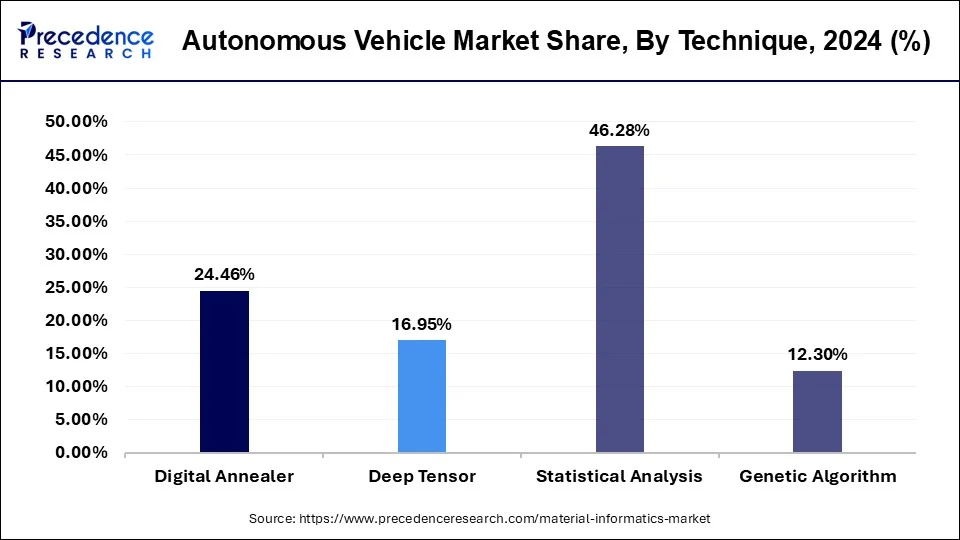

By technique, the digital annealer segment captured 37.63% share in 2024, but the deep tensor segment is projected to expand at the highest CAGR .

-

By deployment, the cloud-based segment held a 51.21% share in 2024, reflecting enterprise preference for scalable infrastructure.

-

By end user, chemical & petrochemical industries accounted for a 23.95% share in 2024, remaining the largest contributor.

-

Major players include Schrödinger, Kebotix, Citrine Informatics, Domo Chemicals, DeepMatter Group, and Exabyte.io, focusing on AI integration and partnerships .

-

A key trend is the growing use of AI and machine learning in materials discovery to accelerate product innovation, reduce R&D costs, and enable sustainable material design.

Material Informatics: The New Frontier of Innovation

Material Informatics is the interdisciplinary field that applies data science, machine learning, and computational tools to the discovery, development, and optimization of materials. It involves the collection, analysis, and modeling of materials data, ranging from molecular structures to performance characteristics, to accelerate innovation, reduce experimentation costs, and enhance the efficiency of R&D processes across industries such as electronics, energy, aerospace, and pharmaceuticals.

What is Material Informatics?

Material Informatics is the interdisciplinary field that applies data science, machine learning, and computational tools to the discovery, development, and optimization of materials. It involves the collection, analysis, and modeling of materials data, ranging from molecular structures to performance characteristics to accelerate innovation, reduce experimentation costs, and enhance the efficiency of R&D processes across industries such as electronics, energy, aerospace, and pharmaceuticals.

How has AI benefited the material informatics market?

Artificial Intelligence (AI) is transforming how the material informatics industry operates in an effort to empower scientists to discover, evaluate, and manufacture new materials more quickly. AI tools can examine vast quantities of data created from experimentation and anticipate how materials will respond and demonstrate characteristics. Reducing effort and time spent developing updated high-performing materials addresses the materials needs of different industries, including aerospace, automotive, and electronics.

For example, instead of running tests of hundreds of combinations in the lab, AI would identify quality examples of the several potential combinations that the human mastery was involved with. Furthermore, companies are now developing materials that are higher performing and safer for the surrounding world. AI identifies patterns we do not notice and allows us to make more intelligent decisions regarding pursuits across research and development of materials. This gives way to potential acceleration in solving real-world problems by leveraging AI technology and material informatics.

- For instance, ICL entered into a collaboration with NobleAI to expedite and advance the discovery of high-performance, safer materials, making use of NobleAI's today AI tools that reduce testing of trial-and-error in the lab.

What are the Core Components of Material Informatics?

- Materials Data:Structured and unstructured datasets containing chemical compositions, properties, and performance metrics of materials.

- Data Infrastructure: Tools and platforms for collecting, storing, managing, and sharing large-scale materials datasets securely and efficiently.

- Machine Learning & AI Algorithms: Models that analyze patterns in materials data to predict properties, discover new materials, and optimize formulations.

- Simulation & Modeling Tools: Computational methods (like DFT or molecular dynamics) used to simulate material behavior and generate synthetic data.

- Materials Ontologies & Metadata Standards:Frameworks that ensure consistent labeling, classification, and interpretation of materials data across systems.

Top Government Initiatives for Material Informatics

| Country/Region | Initiative/Program Name | Description |

| United States | Materials Genome Initiative (MGI) | Launched by the U.S. government to accelerate the discovery and deployment of advanced materials using data and modeling. |

| European Union | Horizon Europe – Advanced Materials 2030 Initiative | Supports collaborative R&D in material science, focusing on digital tools and informatics integration. |

| Japan | MI2I (Materials Integration for Revolutionary Design System of Structural Materials) | Government-funded project using informatics for integrated materials design and innovation. |

| Germany | Fraunhofer Materials Data Space | A national project under the Fraunhofer Society to create a structured data ecosystem for materials R&D. |

| South Korea | South Korea Digital New Deal – AI and Big Data in Materials R&D | Invests in AI-based materials research to promote next-gen manufacturing and innovation. |

| China | Made in China 2025 – Smart Materials Development | Strategic initiative promoting intelligent materials design using big data and informatics tools. |

| India | INSPIRE and IMPRINT Programs | Government-led academic-industry collaborations for advanced material discovery, increasingly adopting informatics-based approaches. |

What is Driving the Growth of the Material Informatics Market?

- Increasing integration of material informatics and Artificial Intelligence (AI): Artificial Intelligence (AI) has proved to be boon in the research & development industry as it helps to analyze the 3-dimentional concept of the material without actually being developed. In addition, the rising penetration of AI across various industries particularly in the electronics, pulp & paper, food science, chemical, dyes, and many other industries likely to propel the market growth for material informatics in the coming years. Further, several startups are raising their funds for the integration of material informatics and AI in order to capture the upcoming market opportunities and to strengthen their footprint in the global market again anticipated to accelerate the market revenue during the forthcoming years.

- Rising penetration of data mining and machine learning in the material informatics field: Data mining has revolutionized the material science sector and open up new and alluring opportunities in the near future. Further, ongoing developments in the new data mining concepts for different types of materials data along with the proliferation of material property databases, this expected to have a continued impact on material design. In addition, the rising penetration of data mining and machine learning technologies in the material informatics market is predicted to further drive the market growth to new heights of achievements.

Market Outlook

- Industry Growth Overview: The market is experiencing significant growth due to the escalating demand for advanced, sustainable, and cost-effective materials in sectors such as electronics, chemicals, pharmaceuticals, and aerospace.

- Global Expansion:The market is dominated by North America, which held the largest market share in 2024, but the Asia-Pacific region is projected to be the fastest-growing regional market over the forecast period.

- Major investors: Major investors in the market include venture capital firms like JPMorgan Chase's private investment arm and CM Venture Capital, corporate investors such as BASF and IBM Research.

- Startup Ecosystem: The materials informatics startup ecosystem is a rapidly growing field that emphasizes using AI, machine learning, and computational techniques to accelerate material discovery and optimization.

Materials Informatics Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 208.41Million |

| Market Size in 2026 | USD 251.17 Million |

| Market Size by 2034 | USD 1,139.45Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.80% |

| Leading Region in 2024 | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technique, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Materials Informatics Market Dynamics

Driver

Sustainability and Green Materials

Researchers and engineers are focused on examining enormous volumes of data about the characteristics, functionality, and environmental effects of materials owing to materials informatics. Life cycle assessment (LCA) data can be integrated into materials informatics systems to assess the environmental effects of materials at each stage of their life cycle, including extraction, production, use, and disposal. Based on available data, materials informatics machine learning algorithms and data analytics may predict material properties with high accuracy.

Researchers can create materials that are simpler to recycle and reintegrate into the manufacturing cycle, hence lowering waste and resource consumption, by examining the compositions, qualities, and possibilities for recycling of materials. Thereby, the emergence of green materials for sustainability causes creates a significant driver for the market.

Restraint

Cost of Implementation

Software for materials informatics frequently has subscription or license costs. The services provided, the quantity of users, and the length of the subscription can all affect these costs. One major cost component can be obtaining and integrating data from multiple sources, including literature, modeling findings, and experimental data. This covers standardization, normalization, and data cleaning. Whether the company chooses on-premises or cloud-based solutions will determine the infrastructure

expenditures related to networking, storage, and hardware. Material informatics consultants and service providers can assist organizations with strategy formulation, execution, and optimization. The length and scope of the engagement can affect how much consulting services cost.

Opportunity

The materials informatics market is growing with many exciting opportunities over the coming period. The most prominent opportunity in the material informatics market is developing sustainable materials. Many companies want to innovate ways to cut down on waste and pollution by designing materials that are safer for human health and combination with our planet. AI can assist with this, better material faster than traditional means. Another significant opportunity will be research into batteries and electronics. Electric vehicles and smart devices are growing rapidly in use, and therefore, there is a need for powerful, safe, and longer-lasting materials. Healthcare is another area of growth, with applications of AI for the discovery of new medicines and to create materials for instruments for surgical tools and therapy. Materials informatics will also create better materials for lighter and stronger parts for cars and planes, which may be the most efficient form of travel. Companies that invest in AI tools and move to open digital labs will surely lead this shift.

Segment Insights

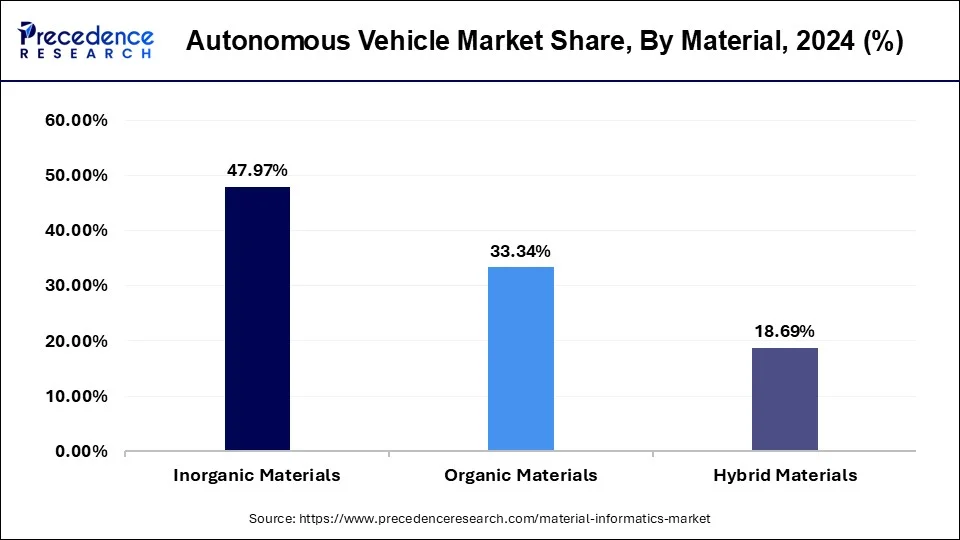

Material Analysis

The inorganic materials segment led the material informatics market with the largest share of 50.48% in 2024, primarily due to their extensive use in energy storage, catalysis, and structural applications. Materials such as ceramics, metal oxides, and alloys have complex property-performance relationships, making them ideal candidates for data-driven optimization. For example, lithium-ion battery cathodes, often composed of layered metal oxides, have benefited greatly from machine learning models that predict conductivity and stability. The vast datasets and critical industrial applications of inorganic materials make them a natural fit for informatics-based exploration.

The hybrid materials segment is expected to grow at the fastest rate, driven by their versatile functionality and increasing relevance in high-performance applications. These materials, such as metal-organic frameworks (MOFs) and polymer composites combine organic and inorganic properties to deliver superior strength, thermal stability, or tunable porosity. Their complex structures require sophisticated computational modeling and machine learning to predict behaviors, making material informatics an essential tool for their design and development. The growing interest in sustainable packaging, flexible electronics, and clean energy solutions is accelerating this trend.

Materials Informatics Market Revenue, By Materials, 2022 to 2024 (USD Million)

| Materials | 2022 | 2023 | 2024 |

| Inorganic Materials | 57.38 | 68.99 | 83 |

| Organic Materials | 40.55 | 48.35 | 57.68 |

| Hybrid Materials | 21.51 | 26.38 | 32.34 |

Application Analysis

The chemical industries segment held the largest share of 29.81% in 2024, owing to its heavy reliance on materials innovation for formulation, processing, and performance enhancement. Chemical companies are leveraging informatics to optimize catalysts, surfactants, polymers, and additives, enabling faster product development and reduced R&D costs.

- For instance, material informatics has been used to identify new corrosion-resistant coatings and eco-friendly plasticizers, helping companies meet environmental and performance targets more efficiently.

On the other hand, the electronics and semiconductor segment is expected to grow at the fastest rate, fueled by the industry's constant demand for smaller, faster, and more energy-efficient components. Informatics tools are now used to discover high-k dielectrics, next-generation semiconductors, and thermally stable conductive materials.

One notable application is the search for alternatives to silicon, where machine learning models have been instrumental in identifying 2D materials like transition metal dichalcogenides with promising electrical properties. The accelerated pace of innovation in electronics makes material informatics indispensable in staying ahead of performance and miniaturization curves.

Materials Informatics Market Revenue, By Application, 2022 to 2024 (USD Million)

| Application | 2022 | 2023 | 2024 |

| Chemical Industries (Including Dyes) | 35.17 | 42.58 | 42.58 |

| Automotive | 21.07 | 25.30 | 25.30 |

| Electronics & Semiconductor | 24.31 | 29.73 | 29.73 |

| Aerospace | 8.37 | 9.95 | 9.95 |

| Research and Development Agencies | 9.76 | 11.64 | 11.64 |

| Others | 20.77 | 24.52 | 24.52 |

Technique Analysis

The statistical analysis segment held the largest share of the market in 2024, as traditional statistical methods remain essential for exploratory data analysis, correlation discovery, and model validation. Techniques such as regression analysis, principal component analysis (PCA), and clustering are widely used to identify key variables that influence material behavior.

- For instance, in the pharmaceutical sector, statistical screening helps narrow down candidate materials for drug delivery systems based on solubility and bioavailability patterns. These methods offer transparency, are computationally efficient, and are deeply embedded in most research workflows.

Moreover, the deep tensor segment is expected to grow at the fastest rate during the forecast period, powered by the increasing need to handle complex, multi-dimensional materials data. Deep tensor learning can capture intricate structural relationships and high-order interactions within materials, far beyond what traditional models can achieve. It has proven especially effective in areas like protein-ligand interaction prediction, crystal structure analysis, and molecular property forecasting. As materials datasets become richer and more layered, tensor-based deep learning models are becoming critical for uncovering insights that were previously hidden or unattainable.

Materials Informatics Market Revenue, By Technique, 2022 to 2024 (USD Million)

| Technique | 2022 | 2023 | 2024 |

| Digital Annealer | 29.78 | 35.50 | 42.32 |

| Deep Tensor | 19.44 | 23.88 | 29.33 |

| Statistical Analysis | 55.63 | 66.73 | 80.08 |

| Genetic Algorithm | 14.59 | 17.61 | 21.28 |

Regional Insights

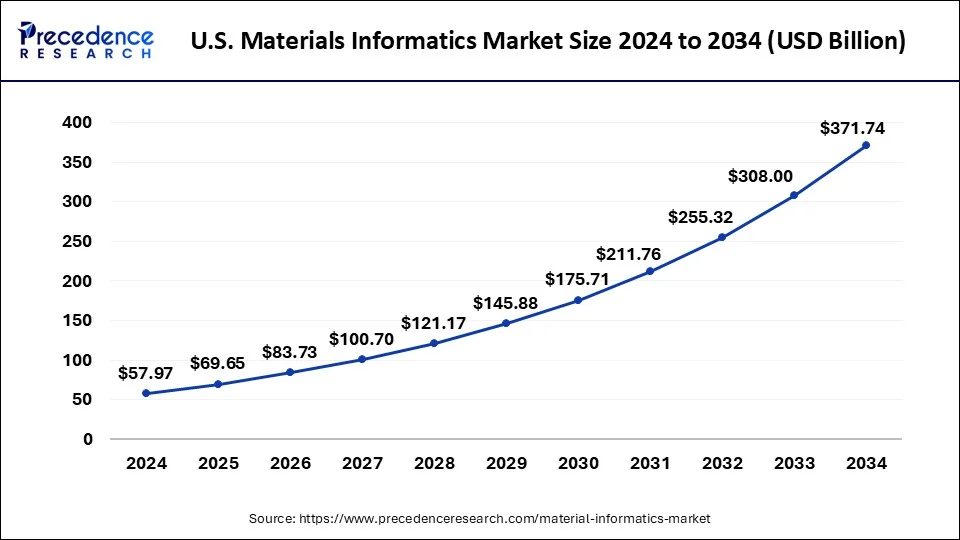

How Big is the U.S. Materials Informatics Market Size?

According to Precedence Research, the U.S. materials informatics market size is valued at USD 69.65 million in 2025 and is expected to grow from USD 83.73 million in 2026 to nearly USD 371.74 million by 2034, accelerating at a notable CAGR of 20.50% from 2025 to 2034.

The U.S. is the leading country in material informatics in the North America region. It has many leading research centers, universities, and technology companies developing new materials. U.S.-based companies are applying AI to develop new materials for batteries, electronics, space, and more. The U.S. government strongly supports the clean energy and advanced manufacturing industries and drives growth in this market. Many of the emerging new startup companies based in the U.S. are building tools and processes, utilizing AI to discover new materials with faster and more affordable methodologies.

North America held the majority of market revenue share in the global material informatics market in the year 2024 because of the increasing investments in the field of material science and analysis along with rising research & development activities across various sectors such as electronics, chemicals, and many others. Further, the region being a technology leader also leads in the implementation of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), big data, and data analytics. Integration of AI, ML, and data science have opened up new paradigm for the future market prospects.

The Asia Pacific emerged as the fastest growing region during the forthcoming years owing to the rapid development across the technology integration sector. AI, ML, and big data are ought to be the fastest growing technologies in the region as well as their penetration in the electronics industry has also created alluring opportunities for the market players during the forecast time frame.

Asia-Pacific is the fastest-growing region for the material informatics market as it has developed industries and a growing population that is utilizing smart devices and electric vehicles. Asia-Pacific is investing in clean energy, advanced electronics, and healthcare. All industries need better and safer materials. Companies are using AI, which speeds up material discovery and testing which saving time and costs. The governments in this region are also helping businesses and industries grow by funding research and development. As more manufacturing takes place in Asia, companies are accelerating their materials development by utilizing AI. The combination of a large population, technology development, and investment makes this a growth-friendly region.

- North America materials informatics market size was valued at USD 67.82 million in 2024 and it is expanding around USD 423.88 million by 2034 with a CAGR of 20.10% from 2025 to 2034.

- Europe materials informatics market size was estimated at USD 46.50 million in 2024 and it is projected to hit around USD 309.13 million by 2034 and growing at a CAGR of 20.9% from 2025 to 2034.

- China materials informatics market size was accounted for USD 11.99 million in 2024 and it is projected to reach around USD 88.19 million by 2034 registering at a CAGR of 22.1% from 2025 to 2034.

- Japan materials informatics market size was exhibited at USD 3.67 million in 2024 and it is anticipated to surpass around USD 31.38 million by 2034 with a CAGR of 23.9% from 2025 to 2034.

China is at the forefront of material informatics within the Asia-Pacific region. The nation has made huge investments in research, smart manufacturing, and AI. All of this investment is being deployed by many Chinese companies to enhance their ability to create better batteries, solar panels, and electronics. Additionally, China is actively working in the area of green energy, which will require new materials that are strong and environmentally sustainable. Partnerships between universities and firms in China are increasing their ability to develop fast AI tools to evaluate new materials. The large number of manufacturing operations within China allows it to capitalize on the opportunity to investigate all material informatics opportunities.

How is North America leading in the Materials Informatics Market?

North America is the largest market for materials informatics due to its cutting-edge technological infrastructure, extensive research and development collaborations, and early move to digital transformation in the field of material science. The region also has strong industry-academia cooperation and is incorporating AI, ML, and computational tools into materials design. The market is further strengthened by the rising demand from the aerospace, automotive, and electronics industries.

United States Materials Informatics Market Trends

The U.S. is the leading country in the regional market because of its strong innovation network, research funding, and the use of AI for the faster discovery of new materials. The industrial ecosystem in the U.S. is already advanced, and the focus on sustainable and high-performance materials speeds up the commercialization process. There is more collaboration now among tech firms, universities, and government programs, which allows for the development and deployment of materials informatics solutions in sectors like energy, healthcare, and manufacturing.

How is Asia-Pacific performing in the Materials Informatics Market?

The Asia-Pacific region is experiencing a huge expansion in the field of materials informatics due to the combination of industrial growth, digitalization, and substantial government support. The area's ability to manufacture and its emphasis on automation, AI, and smart materials innovation accelerate the environment for adoption. Industries like semiconductors, electronics, and automotive are increasingly accepting data-driven design approaches, which are a strong factor for market growth and international collaborations in materials research and technology deployment.

China Materials Informatics Market Trends:

Digitalization of industries and rapid advancements in AI and manufacturing are the main factors contributing to the growth of China's market. The country is in the process of creating a materials informatics ecosystem that will enable the innovation of semiconductors, automotive, and energy industries. The combination of strategic R&D investments and the government-led initiatives aimed at self-reliance in materials technology makes China a strong contender in the race for developing next-generation materials.

What are the driving factors of the Materials Informatics Market in Europe?

One of the main reasons for Europe's great success in the global market is its focus on sustainability, digital transformation, and innovation in materials research. The region is the leader in the integration of principles of the circular economy into material design. There is a strong ecosystem of both government and private funding that supports R&D of materials with eco-friendly and high-performance properties, besides bringing together industries and research institutions to help the spread of materials informatics.

Germany Materials Informatics Market Trends:

Germany is the largest market in Europe for the development of advanced materials, with its focus on industrial innovation and sustainability within the continent. The engineering and science bases of the country are so strong and its research infrastructure so advanced that it becomes easy to integrate AI and informatics in material design. There are already strategic partnerships between academia, industry, and government in Germany that not only enhance research outcomes but also position the country as a destination for advanced materials solutions.

Who are the Key Companies in the Material Informatics Market?

- Exabyte.io

- Alpine Electronics Inc.

- Phaseshift Technologies

- Nutonian Inc.

- Schrodinger

- Citrine Informatics

- Materials Zone Ltd.

- BASF

- Kebotix

- AI Materia

Recent Developments

- In February 2025, Collins Aerospace, which is a part of RTX, announced the 2025 edition of its Powered by Collins Initiative at Aero India, inviting deep tech SMEs to partner with it in the areas of material informatics and quantum enabled navigation. It also launched the Powered by Collins ecosystem on the Switchpitch platform to promote startup cohort engagement with investors and accelerators year-round.[Source: https://www.rtx.com]

- In February 2025, ICL Industrial Products partnered with NobleAI to speed up the discovery of safe, high performance materials. By using its Science Based AI tools to reduce wasted resources and accelerate time to market for flame retardant development, NobleAI helped ICL seek its stated purpose of promoting sustainability and improving R&D productivity. [Source: https://www.globenewswire.com]

- In February 2025, 3M took another big step forward in its new Digital Materials Hub to change how customers access verified material data cards, modeling data, and specifications. With the new Digital Materials Hub, it could securely capture and share data in a collaborative and user-friendly way, enabling engineers to compare the performance of many products like tapes and adhesives with one easy-to-use tool that improved modeling and simulation, and reduced design and overall costs for companies in the automotive, aerospace, and other industries.

[Source: https://news.3m.com]

Value Chain Analysis

- Procurement: It takes care of integrating the process of getting raw materials, components, software, and data, which are considered the core inputs for the production of informatics-based materials.

Key players: BASF, Dow Chemical, Honeywell - Inbound Logistics: It is in charge of warehousing, receiving materials, software, and data, and making them available for production operations.

Key players: Dow Chemical, BASF - Operations: The process of Design, Testing, and Quality Control is responsible for turning the raw materials and data into finished informatics-based materials.

Key players: Citrine Informatics and Kebotix - Outbound Logistics: It deals with the packaging, distribution, and delivery of the finished products to both individual and business customers.

Key players: Dow Chemical, BASF, Dassault Systèmes - Marketing and Sales: Informatics-based materials are getting a boost through advertisements, competitive pricing, and effective management of the sales channels.

Key Players: Citrine Informatics, Kebotix, Schrödinger, Mat3ra - Technology Development: It includes research and development, continuous improvement of design, and merging of AI and data-centric approaches for material innovation.

Key players: Citrine Informatics, Kebotix

Segments Covered in the Report

By Material

- Organic Materials

- Inorganic Materials

- Hybrid Materials

By Technique

- Digital Annealer

- Deep Tensor

- Statistical Analysis

- Genetic Algorithm

By Application

- Chemical Industries

- Dyes

- Research and Development Agencies

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting