Microcars Market Size and Forecast 2025 to 2034

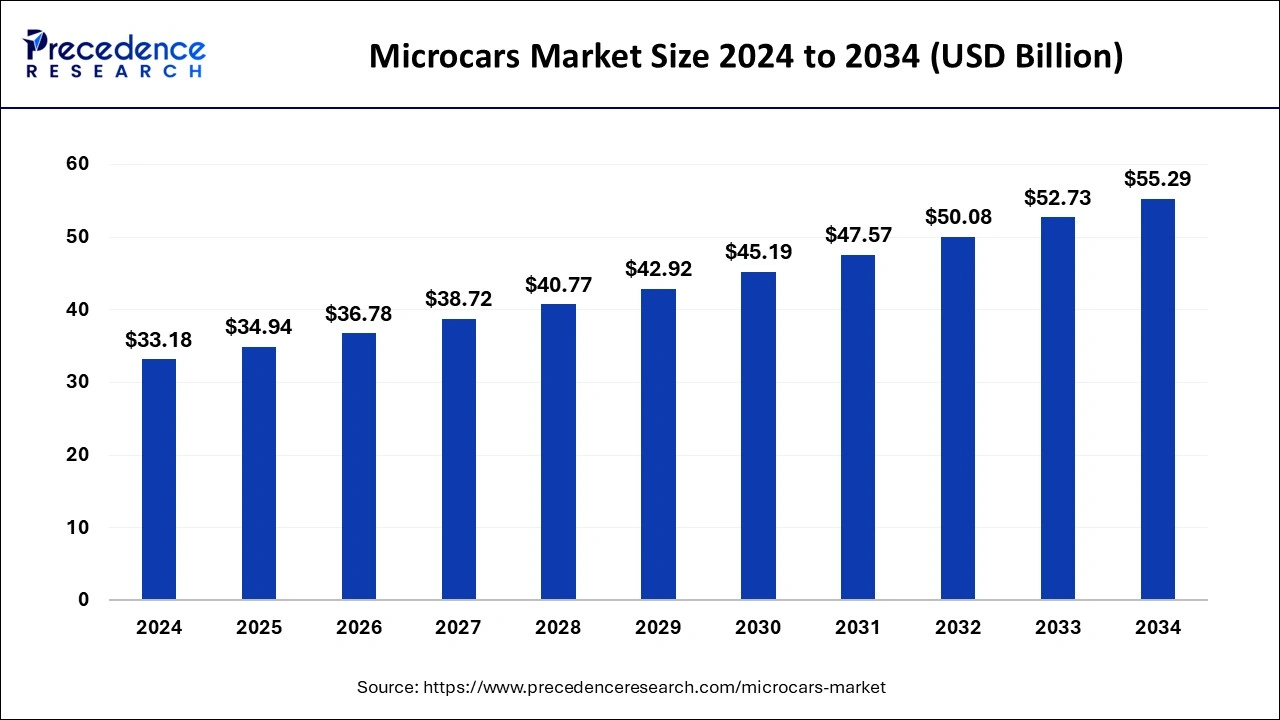

The global microcars market size was estimated at USD 33.18 billion in 2024 and is predicted to increase from USD 34.94 billion in 2025 to approximately USD 55.29 billion by 2034, expanding at a CAGR of 5.24% from 2025 to 2034.

Microcars Market Key Takeaways

- In terms of revenue, the global microcars market was valued at USD 33.18billion in 2024.

- It is projected to reach USD 55.29billion by 2034.

- The market is expected to grow at a CAGR of 5.24% from 2025 to 2034.

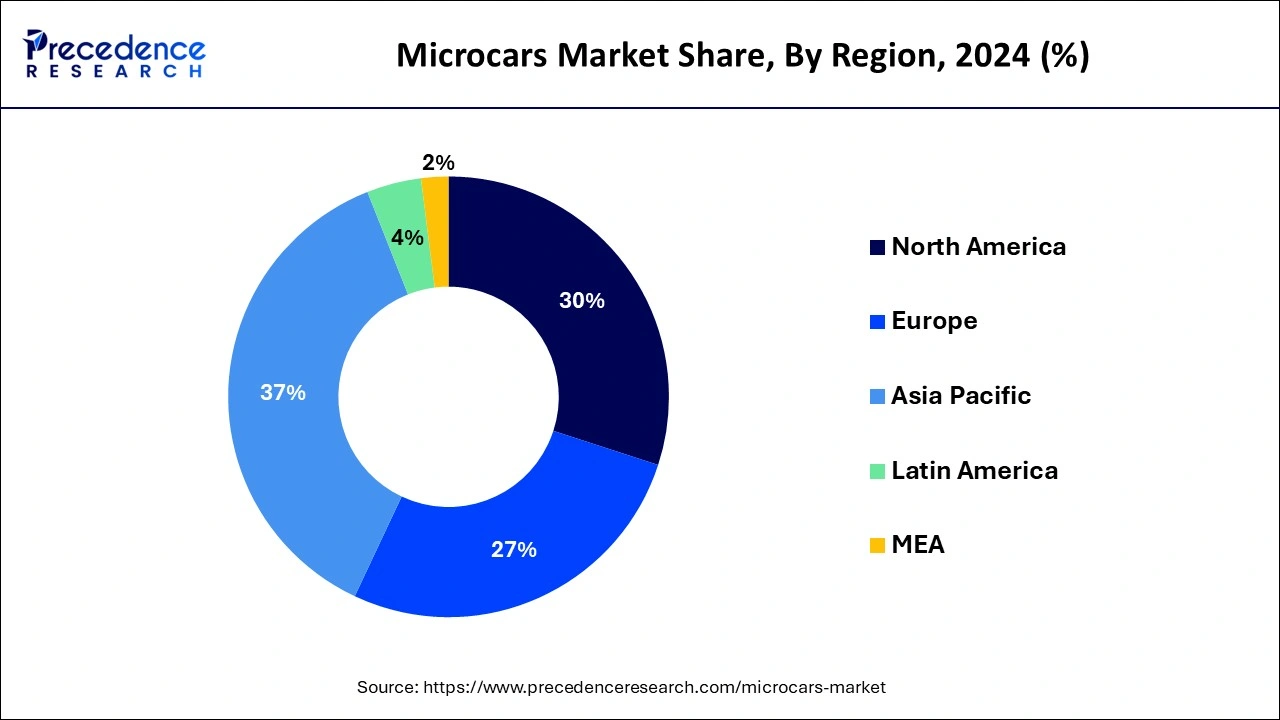

- Asia Pacific dominated the microcars market with the largest market share of 37% in 2024.

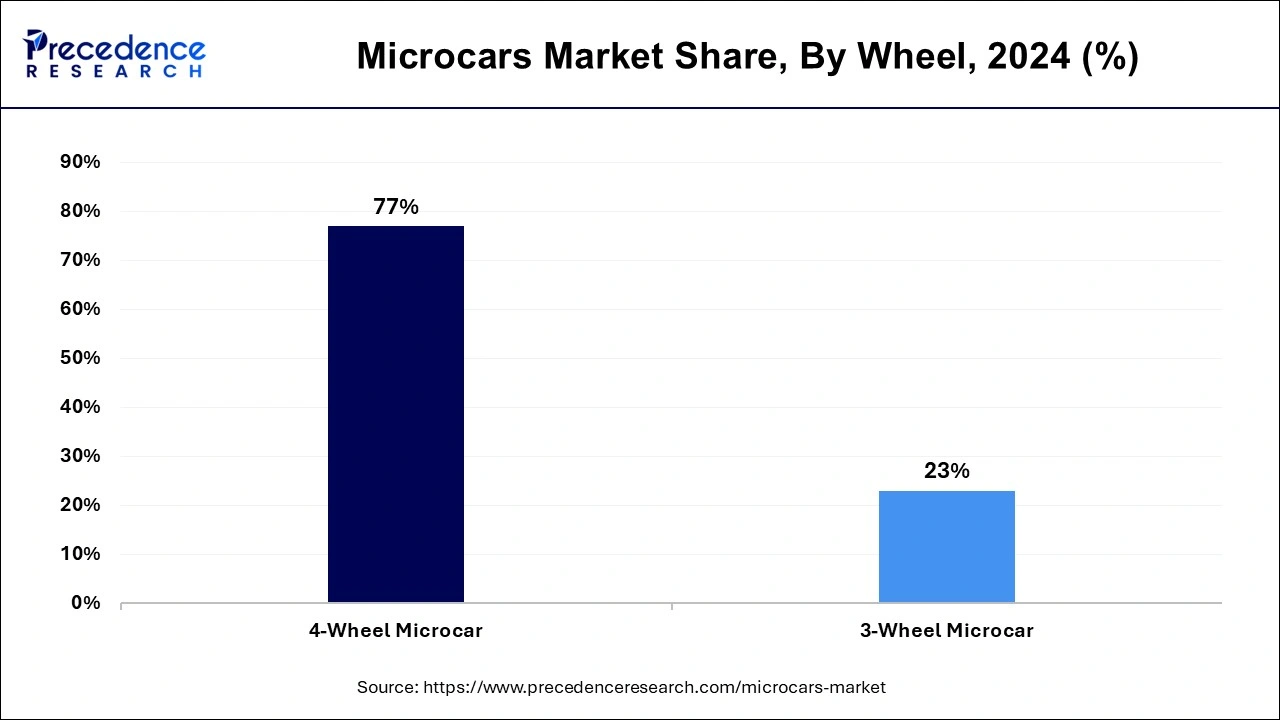

- By Wheel, the 4-wheel segment held the dominating share of 77% in 2024.

- By drive type, the all wheel drive segment captured the largest market share in 2024.

- By fuel type, the electric segment held the largest share of the market in 2024.

- By application, the personal segment dominated the microcars market in 2024.

Asia Pacific Microcars Market Size and Growth 2025 to 2034

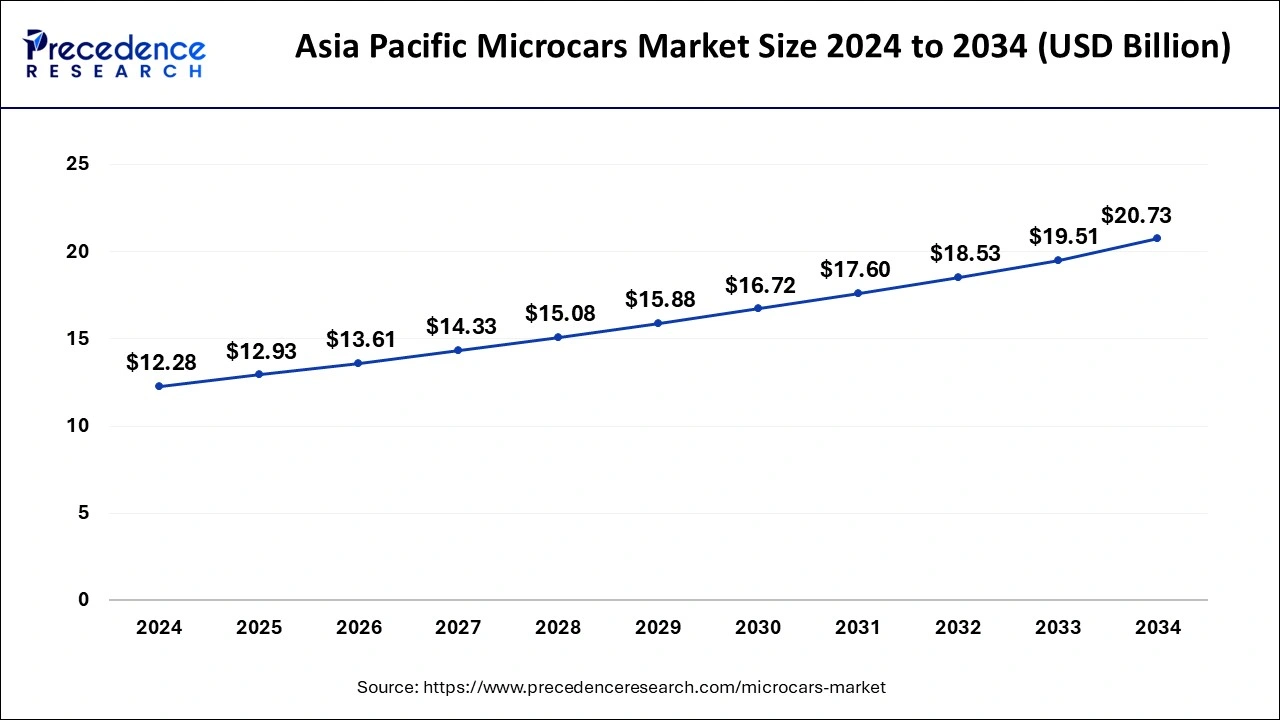

The Asia Pacific microcars market size was valued at USD 12.28 billion in 2024 and is predicted to reach around USD 20.73 billion by 2033, poised to grow at a CAGR of 5.38% from 2025 to 2034.

Asia Pacific led the market with the biggest market share of 37% in 2024. Asia Pacific, particularly India, is emerging as a prominent player in the microcars market, driven by factors such as a burgeoning middle class and a significant portion of the population transitioning out of poverty. The rapid economic growth in India has resulted in an increase in per capita GDP, enabling individuals to afford consumer items like automobiles, thus fueling the demand for microcars. Over the past decade, India has witnessed a substantial 55% increase in per capita GDP, leading to a surge in microcar sales. To capitalize on this growing market opportunity, microcar manufacturers must continue to prioritize safety and environmental standards while maintaining affordability.

A crucial price point for success in the Indian market is below $3000, as cars priced higher struggle to compete, regardless of additional features. The preference among most Indians is for basic cars over those with extensive features, making affordability a key consideration for manufacturers aiming to capture a larger market share. By focusing on producing basic yet reliable microcars at affordable price points, firms can tap into a larger target market and seize the opportunity presented by India's evolving automotive landscape.

As India's microcar revolution unfolds, there remains ample opportunity for firms to enter the market early and establish a strong foothold. By recognizing and catering to the unique needs and preferences of Indian consumers, manufacturers can position themselves for long-term success in this dynamic and rapidly growing market segment.

- In November 2022, PMV EaS-E, an electric vehicle startup, revealed a two-seat microcar in India. The company asserted that it had introduced a novel category of personal mobility vehicles (PMVs) within the rapidly growing electric vehicle sector. The vehicle is designed to accommodate two passengers along with a child.

Market Overview

Microcars, defined as vehicles with three or four wheels and engine sizes typically under 700 cc, are gaining popularity worldwide. The microcars market offers vehicles that benefit from relaxed regulations in some regions, making registration and licensing easier. Their compact size, electric drivetrains, and affordability contribute to their appeal. In urban environments where road expansion is limited, microcars offer a precise solutions. They provide advantages over motorcycles and bicycles by offering shelter from adverse weather and personal storage space. Additionally, they are more culturally accepted in certain societies.

Modern microcars feature short front-end designs with dense engine arrangements, prioritizing passive safety standards. However, this leads to stiffer front structures, potentially increasing compartment acceleration. Nonetheless, advancements in the automotive industry and related institutes continue to refine microcar design, emphasizing safety and efficiency.

- In January 2024, VinFast is set to unveil its electric pickup concept, the VF 3 microcar, at CES.

Microcars Market Growth Factors

- Microcars are increasingly recognized as sustainable and efficient transport solutions with a low carbon footprint, making them a preferred choice for fulfilling the rising demand for last-mile deliveries in crowded urban settings, thereby driving microcars market's expansion.

- The compact size of microcars results in a reduced turning circle radius, contributing to market growth.

- Their easy maneuverability in heavy traffic, narrow streets, and congested areas makes microcars an ideal solution for addressing last-mile delivery challenges in urban environments, further stimulating market growth.

- Microcars' user-friendly nature makes them a popular choice among women, the elderly, and young individuals, fueling market expansion.

- Additionally, microcars offer cost advantages over larger vehicles, with lower maintenance and purchase expenses, driving further market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 55.29 Billion |

| Market Size in 2024 | USD 33.18 Billion |

| Market Size in 2025 | USD 34.94 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.94% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Wheel, Drive Type, Fuel Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Driving affordability and efficiency in urban transportation

While prices of leading full-size electric cars have seen slight declines recently, affordability remains a significant barrier, with a $50,000 Tesla still substantially more expensive than electric micro-cars, which can cost a quarter of the price. These smaller electric vehicles, including NEVs (neighborhood electric vehicles) and LSVs (low-speed vehicles), offer distinct advantages over their larger counterparts, extending beyond cost savings. This factor promotes the growth of the microcars market.

Primarily suited for urban areas, beach communities, planned neighborhoods, and locations without high-speed roads, electric micro-cars are driving growth in the market. Their affordability and practicality make them an attractive option for consumers seeking efficient and economical transportation solutions. However, it's important to acknowledge that electric microcars may only be suitable for some demographics or regions, given their specific use cases and limitations.

Urbanization-driven demand and agility

The trend of urbanization is reshaping automotive research and development, with cities becoming denser and demanding lighter, more agile transportation options. This shift has led to the creation of micro-cars tailored specifically for urban use. As more people move to cities and require personal transportation, the demand for automobiles has surged, resulting in increased traffic and pollution in major urban centers.

There is a growing need for innovative, energy-efficient small vehicles that can navigate crowded city streets and alleviate parking space difficulties to address several challenges in the automobile industry. Additionally, rising concerns about urban air pollution underscore the importance of developing environmentally friendly microcars; there is a clear opportunity for the development of affordable, easily maneuverable microcars that meet both environmental and urban mobility needs. This presents a significant growth factor for the microcars market.

Restraints

Safety concerns and emerging alternatives

Safety concerns arise due to mass incompatibility in front crashes, particularly as current front crash tests are not adequately representative of light vehicles like microcars, posing significant safety hazards. This limitation, coupled with the restricted range and power of microcars, may deter potential customers from purchasing them, thus hindering market expansion; the emergence of alternative transportation solutions, such as urban air mobility and drone delivery, presents a threat to microcar revenues. These alternatives target similar application areas, particularly shared mobility, potentially diverting consumer interest away from microcars and limiting microcars market's growth.

Limitations in space, safety, and performance

Microcars face several drawbacks, including limited seating and storage capacity, making them less suitable for families or transporting large items. Additionally, they may lack safety features found in larger vehicles, increasing potential risks for occupants. The smaller engines in microcars result in weaker performance during long drives or on hilly terrain. Furthermore, the reduced comfort and amenities compared to larger cars impact their suitability for longer trips. These limitations collectively constrain the growth potential of the microcars market.

Opportunities

Sustainable urban transportation

Among growing concerns about environmental impact and urban congestion, the demand for energy-efficient and emission-reducing automobiles has escalated. The proliferation of personal vehicles, coupled with increasing road traffic density and parking challenges in large cities, underscores the need for compact transportation solutions; the development of electric microcars presents a compelling opportunity. These vehicles offer zero emissions, making them environmentally friendly and well-suited for urban environments.

With their affordability and maneuverability, electric microcars emerge as a promising option to enhance the sustainability of personal transportation in cities. This presents a significant opportunity for the microcars market to capitalize on the demand for environmentally friendly and efficient urban transportation solutions. By offering electric microcars tailored to the needs of city dwellers, manufacturers can tap into a growing market segment and contribute to a greener future for urban mobility.

Enhanced safety features

The integration of new technologies into microcars is poised to revolutionize the safety standards of future American vehicles, thereby driving demand in the automotive market. By prioritizing safety advancements in microcars, manufacturers can position these vehicles as superior alternatives to other forms of personal transportation. With improved safety features, microcars offer consumers peace of mind and confidence in their choice of transportation. This reassurance is expected to significantly increase demand for microcars, presenting a lucrative opportunity for the microcars market.

As safety becomes a key differentiator in the automotive industry, investing in the development and marketing of safer microcars can strengthen market positioning and drive growth in the microcar segment. This presents a compelling opportunity for automotive firms to meet evolving consumer preferences and enhance their competitive edge in the market.

Wheel Insights

The segment featuring 4-wheel vehicles held the largest share of 77% in the microcars market in 20234In numerous countries, four-wheeled microcars qualify for lower taxes and are licensed under motorcycle regulations. This distinct classification enables manufacturers to design these vehicles with less stringent requirements, paving the way for market expansion.

By offering four-wheel microcars, manufacturers can tap into a unique niche within the automotive industry. These vehicles not only provide consumers with a cost-effective alternative to traditional cars but also offer greater maneuverability and convenience in urban settings. The favorable taxation and licensing benefits associated with four-wheel microcars further bolster their appeal, driving demand and fostering growth in the microcars market.

As consumers increasingly seek practical and efficient transportation solutions, the availability of four-wheel microcars presents an attractive proposition. Manufacturers can leverage this product insight to develop innovative offerings tailored to meet the evolving needs and preferences of urban commuters, thereby strengthening their position in the competitive microcars market.

- In October 2023, Honda unveiled the CI-MEV, a two-seater electric microcar equipped with level-4 ADAS, at an event in Japan.

Drive Type Insights

The all wheel drive (AWD) microcars segment currently holds the largest share in the microcars market. The primary advantage of AWD vehicles lies in their superior traction capabilities. AWD systems distribute power evenly to all four tires, ensuring enhanced traction even if one tire slips or skids. This traction advantage translates into several benefits, contributing to the growth of the microcars market. AWD microcars exhibit stronger towing capacity due to the more evenly distributed weight and superior traction. This makes them well-suited for various applications, including hauling and transporting goods. Moreover, optimal traction facilitates superior acceleration in AWD microcars.

By providing power to all wheels simultaneously, AWD vehicles deliver improved acceleration, which is particularly beneficial in wet or snowy conditions. This capability enhances the overall performance and versatility of AWD microcars, driving their popularity and market demand. As consumers increasingly prioritize safety and performance features in their vehicle choices, the traction advantages offered by AWD microcars position them as desirable options in the microcars market. Manufacturers can leverage this insight to further innovate and develop AWD microcars tailored to meet the evolving needs and preferences of urban commuters, thereby solidifying their market dominance.

Fuel Type Insights

The electric segment held the largest share in the fuel type segment of the microcars market in 2024. This dominance is attributed to several key factors that contribute to their popularity and market growth. The compact size of electric microcars makes them ideal for short journeys, offering operators convenience and ease of use. Their small footprint also translates to reduced parking space requirements, addressing a significant challenge in large cities and enhancing their appeal to urban commuters.

With fewer moving parts and no gearbox engine, breakdowns are infrequent, leading to decreased maintenance expenses and increased reliability for operators; electric microcars boast lower maintenance costs compared to traditional vehicles. Sustainability is another compelling selling point for electric microcars. With zero fuel consumption and emissions, they offer environmentally conscious transportation solutions. The affordability of charging, approximately three euros every 100 kilometers, further enhances their cost-effectiveness for operators. The expansion of city-wide charging networks contributes to the growth of the electric microcars market.

As charging infrastructure continues to improve, consumers are increasingly inclined to adopt electric microcars, driving market expansion and solidifying their position as a leading fuel type segment in the microcars market. Manufacturers and stakeholders in the automotive industry can leverage these insights to capitalize on the growing demand for electric microcars, further innovating and enhancing offerings to meet the evolving needs of urban commuters and environmentally conscious consumers.

- In April 2023, Avantier Motors, a subsidiary of Cenntro, announced the release of its electric microcars designed for urban use.

Application Insights

The personal application segment held the largest share of the microcars market, catering to diverse needs such as shopping, school runs, social visits, and short trips. Microcar designs offer innovative benefits, with the three-wheeled design, standing out for its patented tilting technology, enabling drivers to navigate through traffic jams efficiently. Microcars serve multiple purposes in urban environments, including passenger transport for ride-sharing/taxi services, personal mobility, and cargo transport for last-mile deliveries. Their compact size and adherence to varying regulations related to maximum speed and engine capacity make them well-suited for addressing urban mobility needs effectively.

With the increasing demand for convenient and efficient transportation solutions in densely populated areas, microcars play a pivotal role in providing flexible and practical mobility options. The versatility of microcars in meeting various personal transportation needs drives market growth and underscores their importance in urban mobility ecosystems. Manufacturers and stakeholders in the automotive industry can capitalize on this insight by continuing to innovate and tailor microcar offerings to meet the evolving preferences and demands of urban commuters. By focusing on enhancing features such as maneuverability, versatility, and sustainability, they can further solidify the dominance of microcars in the personal application segment of the market.

Microcars Market Companies

- Group PSA

- Smart (Mercedes Benz)

- Toyota Motor Company

- Honda Motor Company

- General Motors

- PMV Electric

- LIGER Group

- Geely

- Micro Mobility Systems (Microlino)

- Group Renault S.A.

- Nissan Motors Co. Ltd.

Recent Developments

- In September 2023, the Microcars Coalition was formally launched, with six founding members setting the category strategy during the initial assembly.

- In April 2023, Cenntro Subsidiary Avantier Motors introduced an Urban Micro Car in the European and Central American markets.

- In May 2023, DFCC Leasing and Micro Cars partnered to offer enhanced value to customers through a joint leasing promotion

Segments Covered in the Report

By Wheel

- 4-Wheel Microcar

- 3-Wheel Microcar

By Drive Type

- All Wheel Drive

- 2 Wheel Drive/1 Wheel Drive

By Fuel Type

- Electric

- Petrol/Diesel

- Hybrid

By Application

- Commercial

- Personal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting