Microwave Oven Market Size and Forecast 2025 to 2034

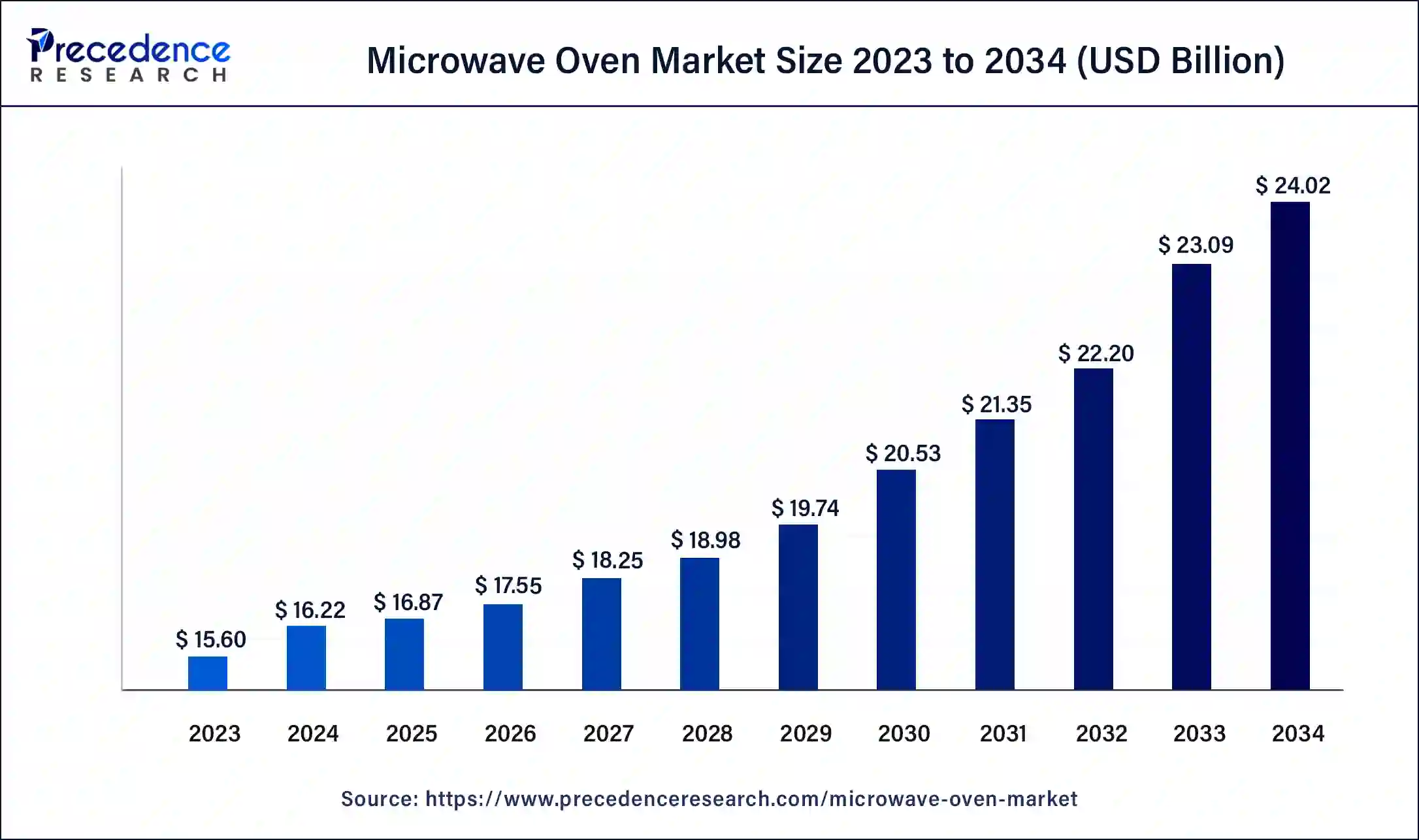

The global microwave oven market size accounted at USD 16.22 billion in 2024, and is expected to reach around USD 24.02 billion by 2034, expanding at a CAGR of 4% from 2025 to 2034.

Microwave Oven Market Key Takeaways

- In terms of revenue, the microwave oven market is valued at $16.87 billion in 2025.

- It is projected to reach $24.02 billion by 2034.

- The microwave oven market is expected to grow at a CAGR of 4% from 2025 to 2034.

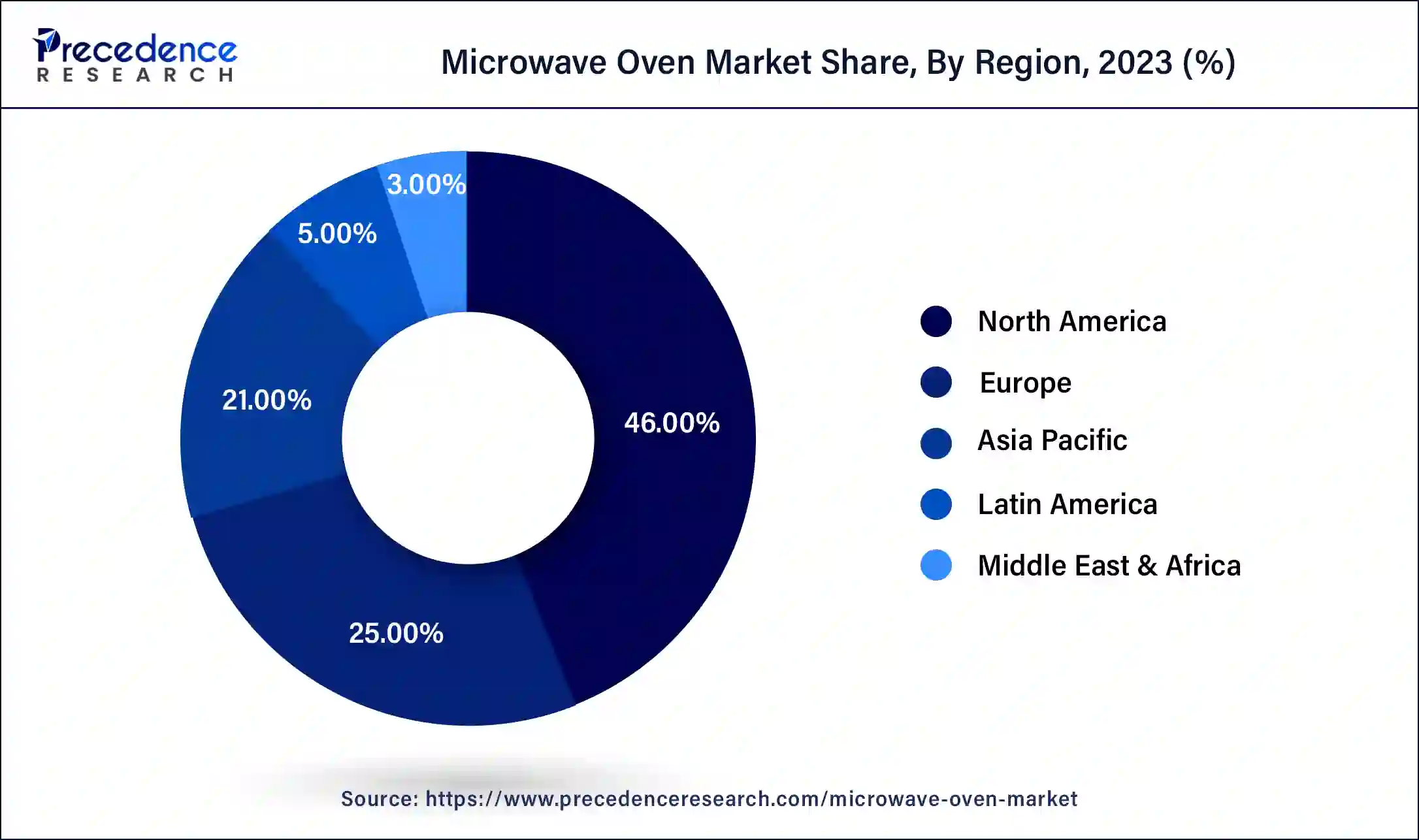

- North America held the dominating share of 46% in the market in 2024.

- On the other hand, Asia Pacific is forecasted to be the fastest growing at a CAGR of 19.5% during the forecast period.

- By product, in 2024, the convection segment held the largest share of 43% in the microwave oven market.

- By structure, the built-in segment dominated the market with 69% of the market share in 2024.

- By control feature, the digital control segment held the largest share of 56% in 2024.

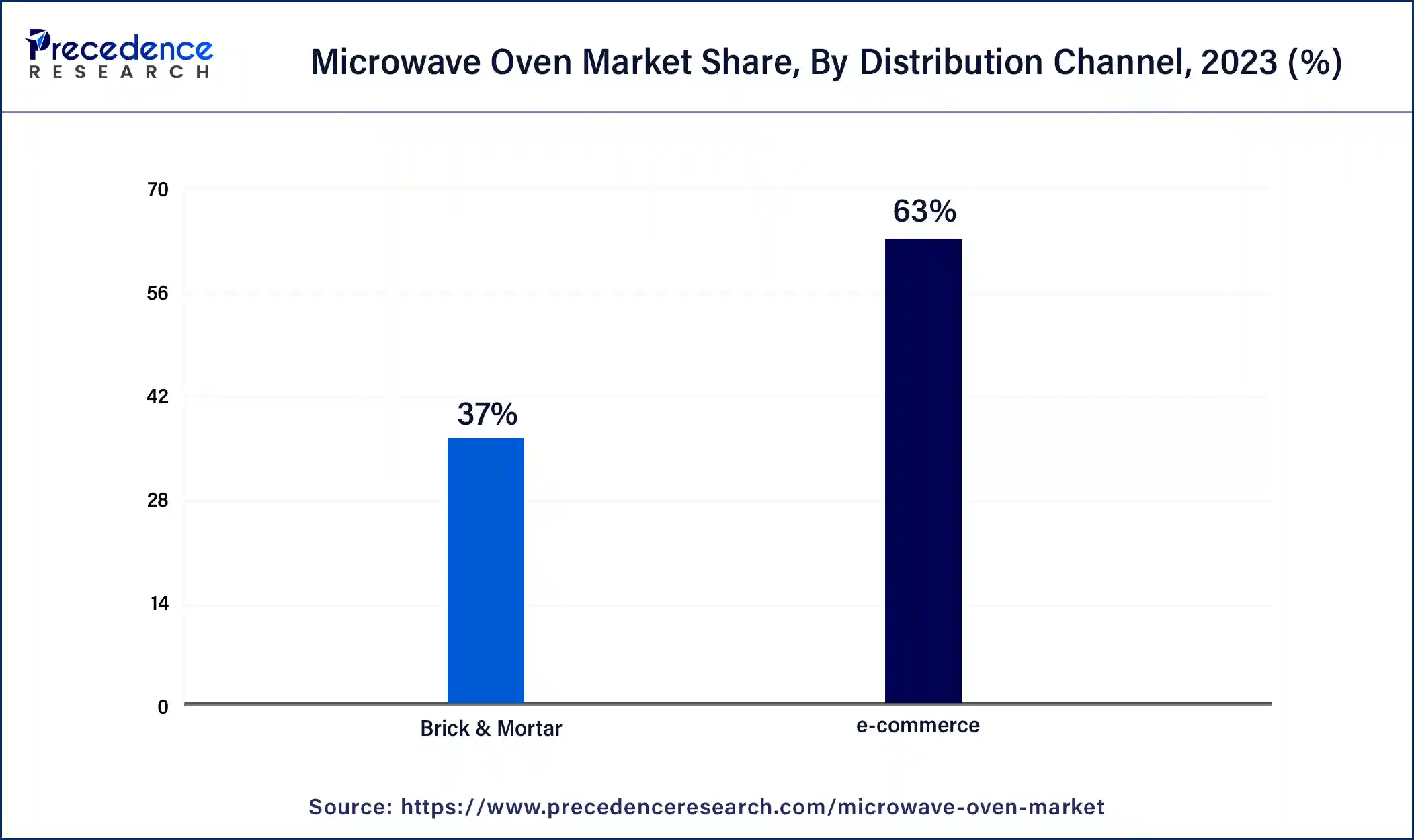

- By distribution channel, the e-commerce segment held 63% of the market share in 2024.

U.S. Microwave Oven Market Size and Growth 2025 to 2034

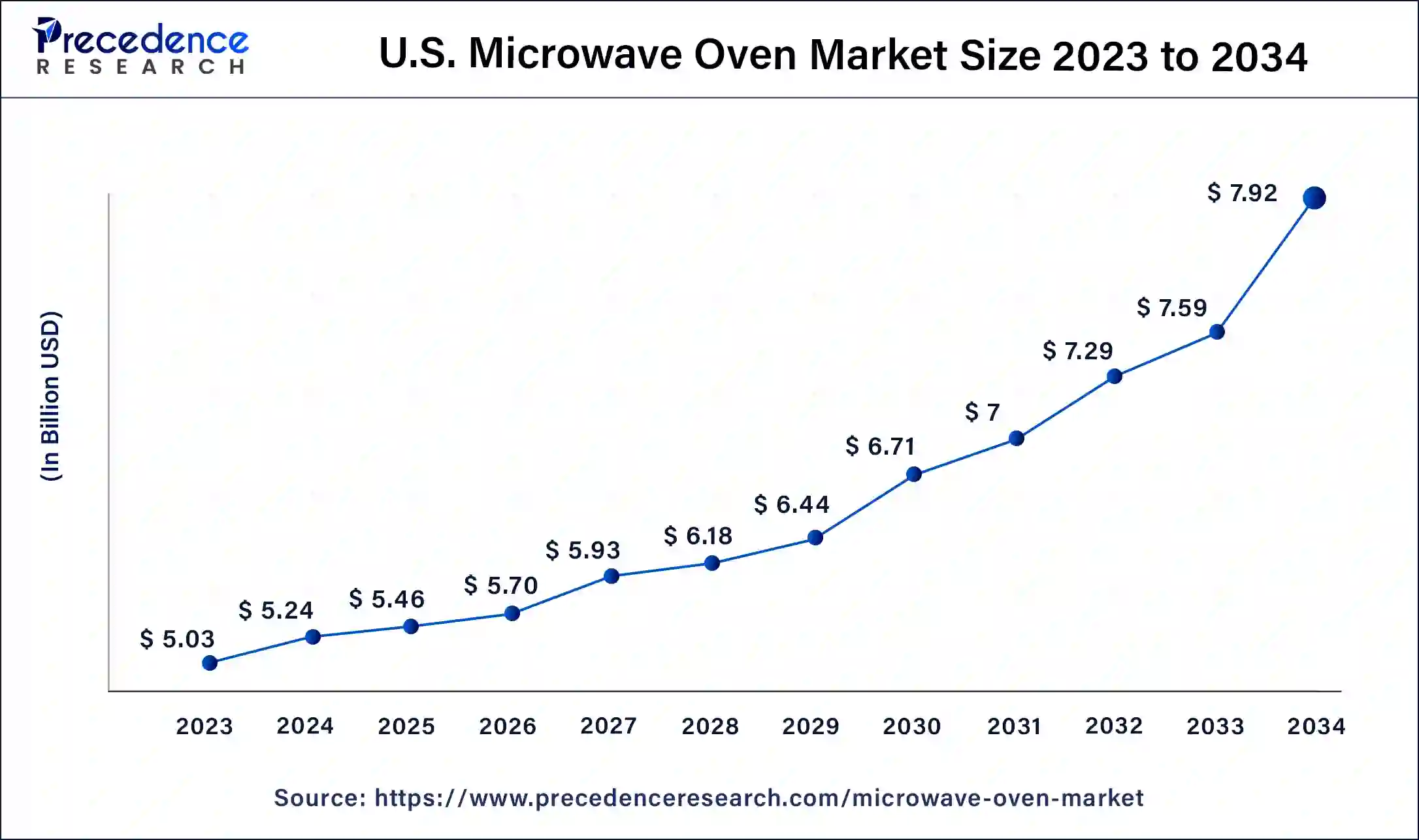

The U.S. microwave oven market size was estimated at USD 5.24 billion in 2024 and is predicted to be worth around USD 7.92 billion by 2034, at a CAGR of 4.22% from 2025 to 2034.

North America held the largest share of the microwave oven market while contributing 46% of the market share in 2024. The incorporation of advanced technologies such as smart features, inverter technology, and cooking sensors has significantly augmented the functionality and versatility of ovens in the region. These technological enhancements have contributed to making ovens more attractive to consumers. With an increasing emphasis on environmental consciousness influencing consumer purchasing decisions, manufacturers in North America are adapting by producing microwaves with energy-efficient features and materials.

Currently, North America is dominating the microwave oven market. North America holds the largest number of advanced appliance manufacturers. The basic use of a microwave oven is a popular need for the population in the region. The appliance industry is fueling the market due to the rising demand of the collective population.

Asia Pacific is poised for a robust growth rate at a CAGR of 19.5% during the forecast period. The region is currently experiencing rapid urbanization, resulting in smaller living spaces and kitchens. This shift in living trends is driving the demand for compact and space-saving appliances like ovens, which play a crucial role in quick and convenient meal preparation. Economic growth, particularly in countries such as China and India, has been accompanied by a rise in disposable income. As more households attain the financial capacity to invest in modern kitchen appliances, the demand for microwave ovens is anticipated to experience a substantial upswing in the Asia Pacific region.

Market Overview

The microwave oven market offers electronic devices that utilize electromagnetic waves to cook and heat food and beverage products quickly. These ovens generate microwaves, which are a form of electromagnetic radiation, to produce heat. The microwaves emitted by the oven interact with water molecules present in the food, causing them to vibrate and generate heat. This rapid heating process allows for efficient cooking and reheating of various food items. Microwave ovens have become a common kitchen appliance due to their convenience and time-saving capabilities.

The surge in the popularity of frozen food items is reshaping consumer cooking habits worldwide, with a consequential impact on the widespread adoption of rapid cooking appliances, notably microwave ovens. Frozen foods offer a compelling solution for those seeking convenience and time efficiency in meal preparation.

The rapid cooking capabilities of microwave ovens align seamlessly with the demand for quick and hassle-free cooking methods in today's fast-paced lifestyles. Consumers are drawn to the versatility of microwave ovens, which effortlessly handle a diverse range of frozen items, from complete meals to snacks. Beyond convenience, these appliances contribute to the preservation of nutritional value, a crucial consideration for health-conscious individuals.

Microwave Oven Market Data and Statistics

- In February 2022, GE Appliances (GEA) unveiled its latest product lineup, the GE Profile, featuring innovative solutions for both laundry and kitchen appliances. This new series represents a leap forward in technological advancements, addressing the needs of modern lifestyles. Equipped with advanced features such as voice control, artificial intelligence (AI), and smart upgrades, these appliances are designed to simplify the lives of consumers. The integration of cutting-edge technologies not only enhances the performance of the appliances but also aligns with the growing trend of smart and interconnected home devices. This launch reaffirms GE Appliances' commitment to providing forward-thinking and problem-solving solutions that cater to the evolving demands of contemporary living.

- In 2021, the microwave oven market is experiencing growth propelled by an increase in household spending, as indicated by statistical data from the Organization for Economic Cooperation and Development. In the United States, consumer spending witnessed a notable rise, reaching US$ 15.9 trillion in 2021, compared to US$ 14.11 trillion in the previous year (2020). This upward trend in household spending reflects a positive impact on the microwave oven market, signifying an augmented demand for these appliances. As consumers allocate a significant portion of their spending towards various products and services, the microwave oven market benefits from the overall economic dynamics and changing consumer preferences.

Microwave Oven Market Growth Factors

- Continuous advancements in microwave oven technology, such as the integration of smart features, convection capabilities, and improved energy efficiency, attract consumers looking for innovative and high-performance kitchen appliances.

- The popularity of frozen and ready-to-eat foods, coupled with the need for quick preparation, boosts the demand for microwave ovens. These appliances offer a convenient solution for reheating frozen meals.

- The availability of microwave ovens through online platforms and the growing trend of online shopping contribute to market expansion. E-commerce channels provide consumers with a wide range of options and convenient purchasing experiences.

- Microwave ovens are often considered more energy-efficient than traditional cooking methods, leading to their adoption as environmentally friendly appliances. The emphasis on sustainability and energy conservation supports microwave oven market's growth.

What Technologies are Driving Growth in the Microwave Oven Market

Technological advancements in the microwave oven market feature smart connectivity, inverter technology, and sensor-based heating. The inverter technology adjusts power levels in the cooking process. This eliminates the most concerning risk of undercooking and overcooking. The sensor-based heating detects moisture in food, elevating the taste of the food. The smart connectivity consists of wifi, a mobile app, and touch screens for monitoring the cooking process.

The modern technology contributing largely to the microwave oven market is voice recognition and application control, with popular examples Google Assistant and Alexa. This helps in pre-programming recipes, making it more reliable and convenient for the customers. The advancement is encouraging new brands and their ideas to the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 16.22 Billion |

| Market Size in 2025 | USD 16.87 Billion |

| Market Size by 2034 | USD 24.02 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Structure, By Control Feature, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Demand for quick and efficient cooking solutions

The microwave oven market is on a robust growth trajectory driven by urbanization and the rise in the number of working individuals with hectic schedules have significantly boosted the demand for quick and efficient cooking solutions. The trend towards nuclear families, coupled with the increasing preference for frozen and ready-to-eat foods, has fueled the adoption of microwave ovens. The market is further propelled by the growth of the hospitality sector, catering contracts for large-scale events, and the surge in smart kitchen appliance sales.

As consumers seek convenience in their busy lives, the microwave oven market benefits from innovations in connectivity, inverter-based technology, and the overall increase in consumer spending on advanced kitchen appliances. The evolving lifestyles, improving standards of living, and a willingness to invest in time-saving solutions contribute to the expanding market for microwave ovens, making it a dynamic and promising industry for manufacturers.

Restraint

High power consumption

Despite the significant growth in the microwave oven market, there are restraints that need to be addressed. One notable concern is the high power consumption associated with these appliances. As energy conservation becomes a global priority, consumers are increasingly conscious of the environmental impact of their household appliances.

The microwave oven market may face obstacles as consumers seek more energy-efficient alternatives, driven by a growing awareness of sustainability. This challenge highlights the need for innovation in microwave oven technology, focusing on energy efficiency and environmentally friendly practices to align with evolving consumer preferences and global efforts toward conservation. Balancing the convenience offered by microwave ovens with energy-conscious considerations will be crucial for sustained market growth.

Opportunity

Shifting in consumer behavior

The microwave oven market is poised to capitalize on the increasing disposable income of consumers, presenting a higher growth potential. As consumers experience a boost in their financial capacity, there is a growing inclination towards investing in smart appliances that enhance convenience in daily life. This shift in consumer behavior contributes to a rising demand for convection microwave ovens, creating more opportunities within the market.

The dynamics of the market are further influenced by changing consumer preferences and socio-economic factors, including a growing global population and the subsequent rise in disposable income. The ongoing trend of urbanization on a global scale is expected to fuel the adoption of ovens, as consumers are increasingly willing to invest in gadgets that simplify their daily household tasks. The market stands to benefit from these evolving consumer trends, marking a positive trajectory for the microwave oven industry.

Product Insights

The convection segment dominated the market with the majority share in the global microwave oven market while contributing 43% of the market share in 2024. Convection microwaves are equipped with a fan that circulates hot air around the food, leading to faster and more uniform cooking. This technology has gained popularity for its convenience and versatility, enabling users to perform baking, roasting, grilling, and traditional microwave functions. The increasing trend toward healthier eating habits has contributed to the appeal of convection microwaves, offering a healthier alternative to deep-frying and other high-fat cooking methods. Additionally, the compact size of these appliances makes them suitable for smaller kitchens and households. As consumers prioritize space-saving and multi-functional appliances, the demand for convection ovens is expected to continue growing.

Structure Insights

The built-in segment dominated the microwave oven market with 69% of market share in 2024. Built-in ovens are designed to seamlessly integrate into kitchen cabinets, contributing to a sleek and stylish appearance. Additionally, they offer convenience by freeing up counter space and providing easy operation with a simple push of a button. Built-in microwaves are known for their energy efficiency, as they are incorporated into the electrical system of the kitchen.

The increasing demand for built-in microwaves can be attributed to the growing popularity of smart homes. With the advent of Internet of Things (IoT) technology, consumers are increasingly opting for appliances that can be controlled remotely or through voice commands. Built-in microwaves fall into this category, as they can be connected to a smart home system and controlled using a mobile application or virtual assistant.

Control Feature Insights

The digital control feature segment took the lead in the microwave oven market while holding 56% of the market share in 2024. This segment is experiencing robust growth, driven by the increasing demand for microwaves equipped with advanced digital controls. A growing number of consumers prefer microwaves that offer sophisticated controls and settings, enabling them to cook meals with ease and speed. This trend is expected to persist in the future as technology continues to advance, and consumers integrate digital devices into their daily routines. Microwave manufacturers are responding to this demand by introducing new models with enhanced digital control features, aiming to simplify the process of food preparation.

Distribution Channel Insights

The e-commerce segment emerged as the frontrunner in the global microwave oven market while holding 63% market share in 2024and is anticipated to exhibit the swiftest CAGR throughout the forecast period. The preference for the convenience of shopping from the comfort of one's home and the ability to compare product features and prices across various online platforms has propelled the dominance of e-commerce.

While traditional brick-and-mortar stores offer a tactile shopping experience, online sales still constitute a substantial portion of the market. Manufacturers and retailers are strategically focusing on maintaining a robust presence in both online and physical channels to reach a broad customer base and sustain competitiveness.

Microwave Oven Market Companies

- Midea Group (China)

- Miele (Germany)

- Alto-Shaam Inc. (USA)

- Amazonbasics (Amazon.Com) (USA)

- Brandt (France)

- Breville (Australia)

- BSH Home Appliances Group (Germany)

- Dongbu Daewoo Electronics (South Korea)

- Electrolux AB (Sweden)

- Galanz (Guangdong Galanz Enterprises Co. Ltd.) (China)

- GE Appliances (USA)

- ITW Food Equipment Group (USA)

- LG Electronics (South Korea)

- Moulinex (Group SeB) (France)

- Panasonic Corporation (Japan)

- Samsung Electronics (South Korea)

- Sharp Corporation (Japan)

- Smeg S.P.A (Italy)

- Toshiba Corporation (Japan)

- Whirlpool Corporation (USA)

Recent Developments

- In March 2025, Panasonic launched the HomeChef Connect 4-in-1 multi-oven, revolutionizing everyday cooking with the kitchen+ App that connects with Fresco. The transitional shift from selling the product, with cooking guidance, has enhanced the business strategy. (Source: na.panasonic.com )

- In July 2024, LG Electronics India launched a new range of microwave ovens for 2024, featuring technology and modern designs. The new lineup from LG includes nine new models, with seven from the Scan to Cook series and two from the premium object series. (Source: hindustantimes.com )

- In December 2024, Cucu Electronics, a general home appliance company, launched a microwave oven that anyone can easily use with dial operation in a compact appearance that fits the minimalist trend. (Source: mk.co.kr )

- In August 2023, Miele introduced the Miele Steam Oven featuring the HydroClean feature. This innovative self-cleaning function is designed to eliminate stubborn food residues. Users can pour a liquid cleaner into the strainer at the oven's base, and the appliance will automatically mix it with fresh water and disperse the cleaning solution throughout its interior.

- In August 2023,LG Electronics unveiled a lineup of home appliances with A-grade energy efficiency, intended for the 'Net-Zero House.' These appliances are crafted to contribute to a more sustainable lifestyle, addressing the increasing demand for reduced power consumption, operational costs, and environmental impact. The lineup encompasses kitchen, laundry, and living solutions to meet the evolving needs of environmentally conscious consumers.

- In September 2021,Qorvo, Inc. introduced two Bulk Acoustic Wave (BAW) filters, namely QPQ3500 and QPQ3501. These filters are pin-compatible, delivering reduced insertion loss and improved out-of-band rejection. They are designed to cater to Original Equipment Manufacturers (OEMs) involved in providing 5G base stations.

- In June 2021, Thales Group launched a series of L-band satellite solutions designed to enhance mobility while incorporating the benefits offered by Iridium. The series features an embedded 802.11b/g Wi-Fi access point with capabilities for multiple users.

- In June 2021, Teledyne Technologies introduced the RESON SeaBat T51-R Multibeam Echosounder. This echosounder is designed to provide full swath coverage for shallow water operations at 800 kHz, offering enhanced efficiency.

- In July 2020,Analog Devices, Inc. released the ADRV9002 RF transceiver, capable of handling wideband and narrowband operations in a single device. The transceiver operates in the frequency range of 30 MHz to 6 GHz.

Segments Covered in the Report

By Product

- Convection

- Grill

- Solo

By Structure

- Built-in

- Cooktop

By Control Feature

- Digital

- Analog

By Distribution Channel

- e-commerce

- Brick & Mortar

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting