Oilseed Market Size and Forecast 2025 to 2034

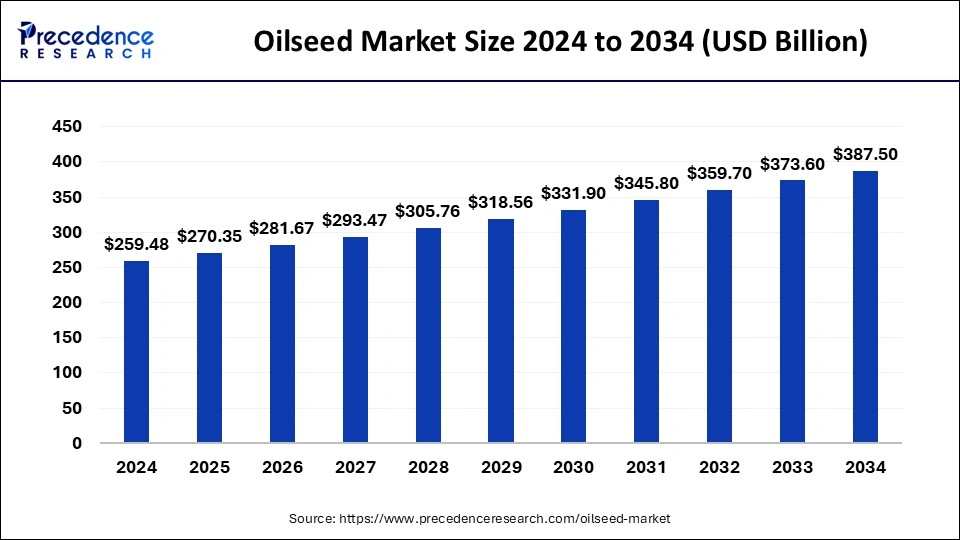

The global oilseed market size accounted for USD 259.48 billion in 2024 and is predicted to increase from USD 270.35 billion in 2025 to approximately USD 387.50 billion by 2034, expanding at a CAGR of 4.08% from 2025 to 2034.

Oilseed Market Key Takeaways

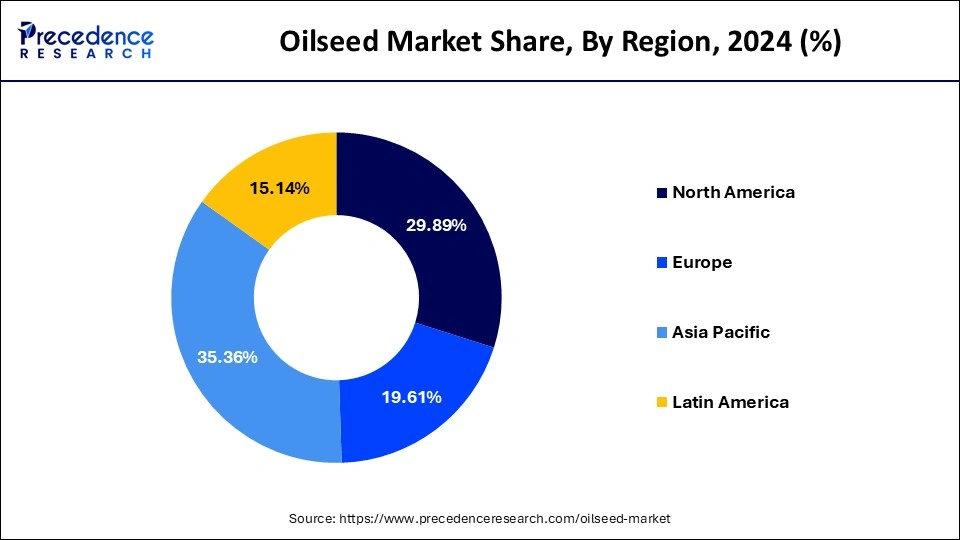

- Asia-Pacific contributed more than 35.12% of revenue share in 2024.

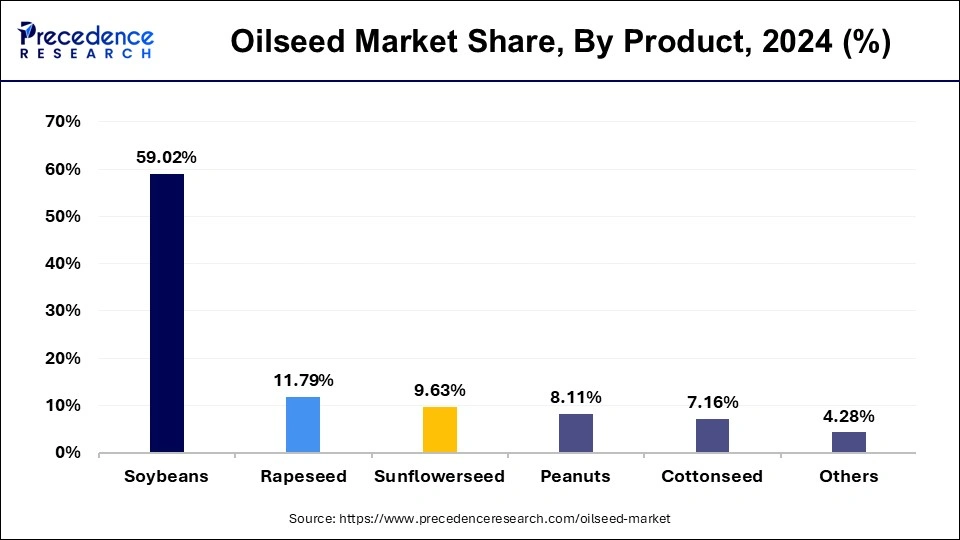

- By Product Type, the soybeans segment contributed more than 59.02% of revenue share in 2024.

- By Type, the animal feed segment had the largest market share of 56.14% in 2024.

- By Biotech Trait, the herbicide tolerant segment captured the largest market share of 40.99% in 2024.

- By End User, the commercial or corporate sector segment registered the highest market share of 47.82% in 2024.

- By Food Product, the sauces, spreads, and dressings has captured 30.90% of revenue share in 2024.

- By Vegetable Oil, food products segment has generated 74.33% revenue share in 2024.

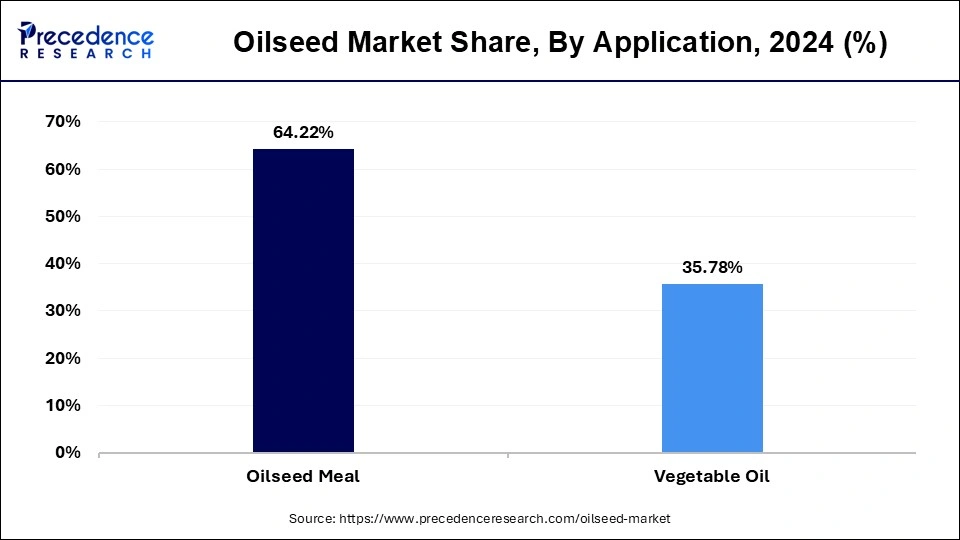

- By Application, the oilseed meal segment has generated 64.22% of revenue share in 2024.

What is the role of AI in the Oilseed Market?

Artificial intelligence (AI) algorithms can help farmers and industries in different ways while taking production and processing of oilseed crops. There are many benefits of using AI technologies for seed quality checking, especially for pulses, cereals, and oilseed crops. This AI technology allow farmers to produce more oilseeds with fewer inputs, leading to cost savings and enhanced food security. AI automates time consuming tasks like crop monitoring and yield forecasting, helping farmers plan more effectively and avoid unnecessary costs.

The benefits of AI based crop management include enhanced resource allocation, accurate yield predictions, accurate fertilizer application recommendations, improved irrigation schedules, and early detection of crop stress and disease.

Asia Pacific Oilseed Market Size and Growth 2025 to 2034

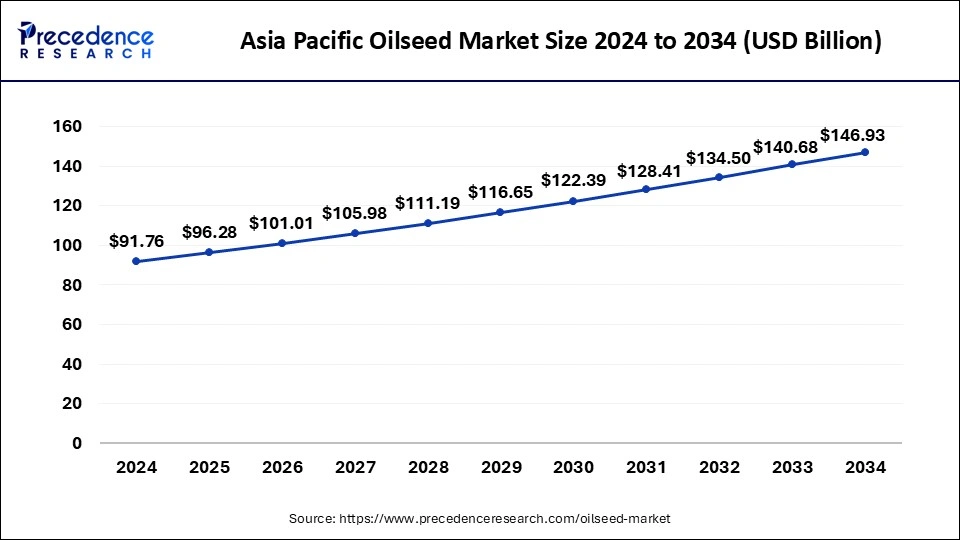

The Asia Pacific oilseed market size was evaluated at USD 91.76 billion in 2024 and is projected to be worth around USD 146.93 billion by 2034, growing at a CAGR of 4.81% from 2025 to 2034.

Asia-Pacific leads the oilseed market with a large market share of 35.12% in 2024 due to the growing food processing industry and increasing soybean production. India is considered the 4th largest producer of oilseeds and about 39.46 million tons of oilseeds were produced in 2018. Furthermore, soybean is the most important crop grown in India and hit 95% of the total production, which increases the use of soybean oil and thus drive the growth of the market.

However, North America held a market share of 29.89% in 2024. This is due to the increased use of cooking oil in regular cooking, which increases oilseed production. Moreover, soybean production in the United States has increased, so the growth in soybean oil consumption is continuing to accelerate the growth of the market. The United States is the world's largest soybean producer and second largest exporter. Soybeans hit about 90% of US oilseed production.

Asia Pacific dominated the global oilseed market in 2024.

- In October 2024, National Mission on edible oils-oilseeds to boost domestic oilseed production to 69.7 million tonnes by 2030-31 was approved by the Union Cabinet.

(Source: Government launches National Mission on Edible Oils-Oilseeds to boost domestic oilseed production | India News - Times of India)

North America is anticipated to grow at the fastest rate in the market during the forecast period. - In April 2025, the United States Department of Agriculture (USDA) has released its updated April forecast for the 2024/25 oilseed and grain crop. According to the report, global oilseed production will be 676.6 million tons which is 2.75 million tonnes less than in the March forecast.

(Source: USDA updated the rating of oilseed production countries in MY 2024/25)

Market Overview

Oilseeds like sunflower, groundnut and soybean are mainly used as vegetable oil in households. People use these oilseeds as they are very beneficial to health and also they generate income and employment. These crops are not only limited to domestic use; they can also be applied in various other industry sectors like food, pharmaceuticals, cosmetics and animal feed. Because of this versatility of oilseeds, they are now in more demand and for that reason the market is booming worldwide. The oil produced from oilseed is used in human food products, while the oil residue is used as animal feed.

Vegetable oil is an invaluable product in the whole world. Due to increased acceptance and a vast area under cultivation anticipate the market to be augmented. Soybeans contain fiber, protein and are cholesterol free. Cottonseed oil is cooking oil made from the seeds of Gossypium hirsutum and gossypium herbarium cultivated for cotton plants, especially cotton fibre and animal feed, and like other oilseeds, such as sunflower seeds, cotton seeds have and oily core surrounded by a hard outer shell. Oil is removed from the grain during processing. Oil is extracted from soybean to use it as a vegetable oil. It is the second most consumed oil. Soybean is not only used for extracting oil but also for consumption as a seed legume in human diet. Soybean meal is an important component of formulated poultry and fish meals. Soybean protein is referred to as a complete protein because of its amino acid content. It is well known for its nutritional significance in the treatment of heart disease and diabetes.

Printing inks (soy ink) and oil paints use processed soybean oil as a foundation for drying oils. Sesame seed is one of the world's oldest oilseed crops, having been domesticated over 3,000 years. Many other species of Sesame exist, the majority of which are wild and native to Sub-Saharan Africa. The cultivated type, S. indicium, is from India. It thrives in drought-stricken areas, where other crops have failed. The oil content of sesame is among the greatest of any seed. It's a common component in cuisines all across the world because of its rich, nutty flavor. It, like other foods, has the potential to cause allergic responses in some people. Japan imports the most sesame in the world. Sesame oil, peculiarly from roasted seeds, is a significant component of Japanese cuisine and has traditionally been the seed's primary purpose. World's second-largest importer of sesame is China, primarily oil-grade sesame. China sells food-grade sesame seeds at a reduced cost, primarily to Southeast Asia.

Market Trends

- Growing consumer awareness

- Expanding consumer base in many countries

- Stringent environmental regulations

- Significant R&D investments

- Infrastructure development

Oilseed Market Growth Factors

The market is booming as the production of soybean oil has increased as the result of its demand by the population due to its nutritional value. Some of the reasons driving the growth of the oilseeds market include the need for healthy and organic oilseed-processed goods, public-private collaborations in varietal development, and molecular breeding in oilseeds. Sunflower seeds are used for the purpose of producing sunflower oil.

Sunflower oil is extensively used as frying oil in food and as a lubricant in cosmetic applications. It contains linoleic acid, a polyunsaturated fat and oleic acid, a monounsaturated fat. It also consists of huge amounts of Vitamin E. Unrefined sunflower oil is used as a salad dressing in Eastern European cuisines as it contains omega-6 fatty acids and is very nutritious. It is generally used by the public for its health benefits. Sunflower butter contains sunflower oil as well. When sunflower oil is extracted, the crushed seeds are left behind, which are high in protein and dietary fibre and can be utilized as animal feed, fertilizer, or fuel. PEG-10 sunflower glycerides are the polyethylene glycol derivatives of mono- and diglycerides generated from sunflower seed oil with an average of 10 moles of ethylene oxide, and are a pale yellow liquid with a “slightly fatty” odour.

Sunflower glycerides PEG-10 are widely utilized in cosmetic compositions. When mixed with diesel in the tank, sunflower oil can be utilized to run diesel engines. In frigid temperatures, viscosity is enhanced due to the high quantities of unsaturated fats. Because it is a rich source of oil, ash calcium, carbohydrate and protein, the sunflower segment in this market is expected to grow at the quickest rate. Sunflower seeds are widely employed in the feed business as sunflower meal, which is increasingly being used as an alternative for soybean meal due to its higher price. Canola or rapeseed oil is produced by Rapeseed, which is also known as rape or colza, which is a mustard plant cultivated for its seeds. Canola oil is multifarious in nature as it is used for cooking, as a soap and margarine ingredient, and as a lamp fuel (colza oil). Jet engines use the liquefied form of the oil to lubricate and can also be converted to biodiesel.

Fodder is produced, as a result of the seeds which are left over after oil extraction. The plant can be used as a green manure and cover crop. After soybean and palm oil, rapeseed was the world's third-largest source of vegetable oil in 2000. After soybean, it is the world's second-largest source of protein meal. Rapeseed meal is produced as a byproduct of the oil extraction process. A high-protein animal feed is produced as a byproduct, which is competitive with soybean. The feed is mostly used for cattle, although it is also used for pigs and fowl. Natural rapeseed oil, on the other hand, includes 50% erucic acid and large quantities of glucosinolates, lowering the nutritional value of rapeseed press cakes for animal feed.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 270.35 Billion |

| Market Size by 2034 | USD 387.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.08% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Type, Breeding, Biotech Trait, End User, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising adoption of advanced technologies:

New advanced eco-friendly technologies namely supercritical fluid extraction, ultrasound assisted extraction, microwave assisted extraction, and enzyme-assisted extraction can easily overcome the shortcomings of the conventional methods and holds the potential to meet the increasing demand of edible oils. Consequent upon the setting up of technology mission on oilseeds is a major innovation in increasing oilseeds production was achieved through an integrated approach by introducing new crop production technologies, better supply of inputs, and extension service support for marketing, post harvesting technologies, and more.

Restraint

Supply chain disruptions:

Supply chain disruptions in oilseeds include changes in consumer demand, disease outbreaks, intentional human made disruptions, and natural disasters cause problems which are compounded by long, global supply chains, and volatile markets. The most common supply chain challenges include extreme weather events, manufacturing delays, lack of labor mobility, and port congestion. A systemized supply chain is critical for maintaining the quality of products from start to finish and ensuring that all resources used are of best quality.

Opportunity

Increasing investment in research and development:

Boosting oilseed productivity needs significant R&D investment in developing high yielding, drought resistant varieties and modern agronomic practices. These investments can focus on both the public and private sectors, promoting innovations. Investing in research and development to improve seed technology can lead to the creation of high-yielding and disease resistant seeds.

End-user Insights

The household or residential area segment dominated the market. The commercial or corporate sector segment is projected to expand rapidly in the market in the coming years.

Product Insights

The soyabean segment held a dominant presence in the market in 2024.The peanut segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- In June 2023, a groundnut futures contract in 2006, only to retract it in December 2009 due to business concerns was launched by NCDEX.

NCDEX to resume groundnut futures trading after 13 years | Stock Market News

Oilseed Market Revenue, By Product, 2022-2024 (USD Billion)

| By Product | 2022 | 2023 | 2024 |

| Soybeans | 141.65 | 147.29 | 153.15 |

| Rapeseed | 27.90 | 29.22 | 30.60 |

| Sunflowerseed | 22.70 | 23.81 | 24.98 |

| Peanuts | 19.60 | 20.31 | 21.05 |

| Cottonseed | 17.07 | 17.81 | 18.59 |

| Others | 10.13 | 10.61 | 11.11 |

TypeInsights

The animal feed segment accounted for a considerable share of the market in 2024. The edible oil segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- In March 2025, National Mission on Edible Oils-Oilseeds (NMEO-OS) with an outlay of Rs.10103.38 crore to boost the domestic oilseed production to 70 million tonnes by 2030-31 from the current 39 million tonnes, Minister of State for Consumer Affairs, Food and Public Distribution Nimuben Jayantibhai Bambhaniya was said in parliament was launched by the Union government.

Centre aims to increase oilseed production to 70 million tonnes by 2031 - The Hindu

Oilseed Market Revenue, By Type, 2022-2024 (USD Billion)

| By Type | 2022 | 2023 | 2024 |

| Animal Feed | 135.01 | 140.24 | 145.68 |

| Edible Oil | 104.03 | 108.81 | 113.81 |

Breeding TypeInsights

The genetically modified segment held the largest share in oilseed market. Increasing the production of oilseed crops is one of the main goals of genetic modification. Higher yields per acre are a result of traits including enhanced tolerance to environmental conditions like drought and resilience to pests, diseases, and herbicides. Genes that confer pest resistance may also be included into genetically modified oilseed crops. For example, crops like cotton and soybeans frequently include Bt (Bacillus thuringiensis) characteristics, which offer protection against particular insect pests. From an economic perspective, farmers may experience cost reductions from GM oilseed crops. Higher yields, less need for pesticides, and more effective weed control all help to bring down production costs and possibly increase profits.

The conventional segment is expected to be fastest growing market. The term "conventional" in the oilseed industry usually refers to the conventional or non-genetically modified (non-GMO) oilseed varieties. These are seeds that have not undergone genetic alteration and have been cultivated using traditional farming techniques. Genetically modified (GM) or biotech oilseeds—varieties that have been genetically altered to have certain characteristics like insect or herbicide resistance—are frequently contrasted with conventional oilseeds. For generations, conventional oilseeds have been the standard, and they continue to account for a sizable share of the world oilseed market. Some customers value them because they like things that are thought to be more conventional or natural. The need for conventional oilseeds in those areas is further supported by the stringent laws governing the use and labeling of genetically modified organisms (GMOs) in several markets, namely in Europe.

The genetically modified segment led the market. The conventional segment is set to experience the fastest rate of market growth from 2025 to 2034.

Biotech Trait Insights

The herbicide tolerant segment registered its dominance over the market in 2024. The insecticide resistant segment is anticipated to grow with the highest CAGR in the market during the studied years.

- In April 2022, a new insecticide Exponus for caterpillars and thrips was launched by BASF in India. The pioneering solution is powered by BASF's new active ingredient, Brofranilide in a specialized formulation. New mode of action for effective & long duration protection in various largely cultivated crops under oil seeds , pulses, & vegetable segment.

BASF in India launched new Insecticide Exponus for caterpillars and thrips

Application Insights

The oilseed meal segment maintained a leading position in the market in 2024.

In February 2025, the launch of micro grain and oilseed future contracts to include corn, Chicago wheat, soybean, soybean oil, and soybean meal features was announced by the Chicago Mercantile Exchange (CME) Group.

CME Plans Launch of Micro Grain and Oilseed Futures Contracts

The vegetable oil segment is projected to expand rapidly in the market in the coming years.

Oilseed Market Revenue, By Application, 2022-2024 (USD Billion)

| By Application | 2022 | 2023 | 2024 |

| Oilseed Meal | 154.14 | 160.27 | 166.65 |

| Vegetable Oil | 84.90 | 88.78 | 92.83 |

Recent Developments

- In March 2025, a comprehensive training programme aimed at improving the cultivation techniques of oilseed crops for farmers in the northeastern region was launched by the Central Agriculture University (CAU) in Imphal West.

(Source: CAU Imphal Launches Training to Boost Oilseed Cultivation in Northeast) - In October 2024, two missions on edible oils and palm oil in a bid to ensure food security and end its reliance on its imports were launched by the Indian government. The aim is to enhance edible oilseed production and oils availability in the country by harnessing oil palm area expansion, increasing crude palm oil (CPO) and reducing imports.

(Source: India launches national missions on edible oils and palm oil in bid…)

Oilseed Market Companies

- Archer Daniels Midland Company

- BASF SE

- Bayer AG

- Burrus Seed Farms, Inc

- Cargill Incorporated

- Corteva Agriscience

- Gansu Dunhuang Seed Industry Group Co., Ltd.

- KWS SAAT SE & Co.

- Mahyco Seeds Ltd

- Syngenta Crop Protection AG.

Segments Covered in the Report

By Product

- Sunflower

- Soybean

- Peanut

- Cottonseed

- Rapeseed

- Others

By Type

- Animal Feed

- Edible Oil

By Breeding

- Genetically Modified

- Conventional

By Biotech Trait

- Herbicide Tolerant

- Insecticide Resistant

- Other Stacked Trait

By End User

- Household or Residential Area

- Commercial or Corporate sector

- Automobiles

By Application

- Oilseed Meal

- Food Products

- Bakery & confectionery products

- Sauces, spreads, and dressings

- Meat products

- Others

- Feed

- Industrial products

- Food Products

- Vegetable Oil

- Food products

- Bakery & confectionery products

- Sauces, spreads, and dressings

- Meat products

- R.T.E., snacks, and savory products

- Industrial products

- Food products

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting