January 2025

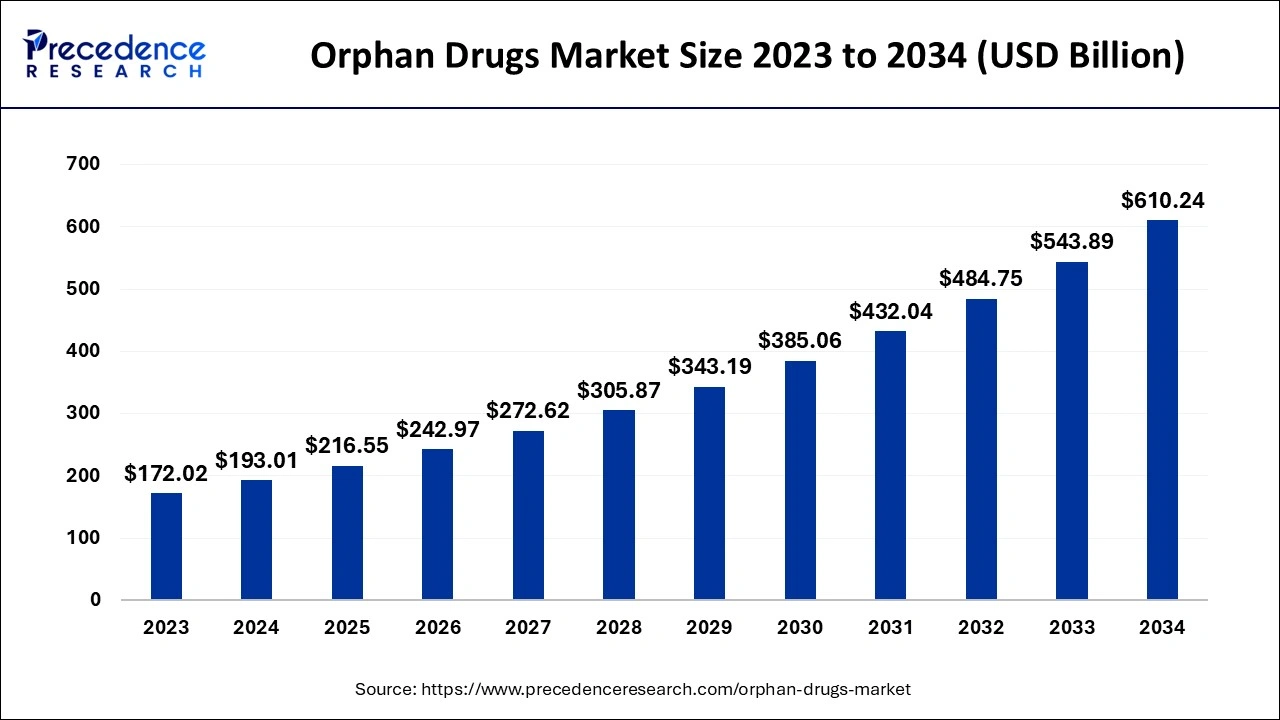

The global orphan drugs market size is estimated at USD 193.01 billion in 2024 and is predicted to increase from USD 216.55 billion in 2025 to approximately USD 610.24 billion by 2034, at a CAGR of 12.20% from 2025 to 2034.

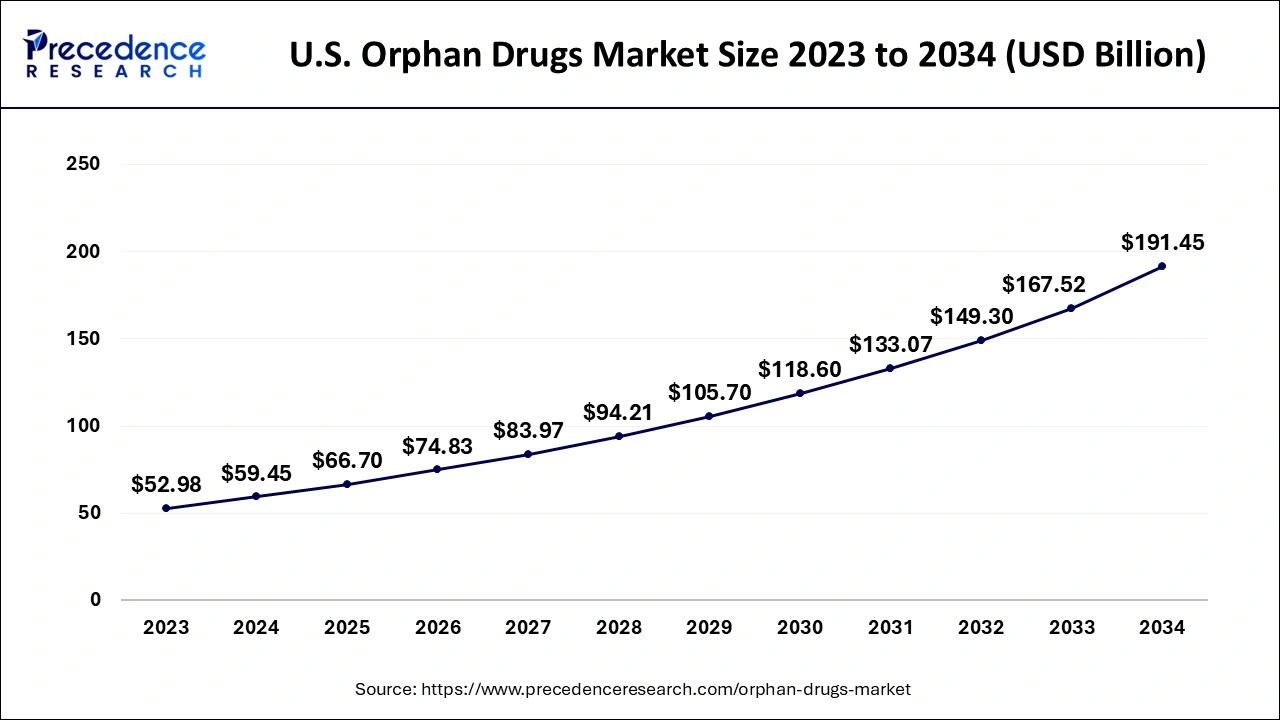

The U.S. orphan drugs market size is evaluated at USD 59.45 billion in 2024 and is predicted to be worth around USD 191.45 billion by 2034, rising at a CAGR of 12.39% from 2025 to 2034

The United States is the country with the most market share in North America. The fact that an FDA-approved orphan medicine enjoys past years of advertising exclusivity, tax deductions, and user fee reduction upon approval for a particular indication is one of the factors contributing to the market's growth in the U.S. There has been a rise in the number of orphan pharmaceuticals authorized in the region as a result of these incentives, encouraging pharmaceutical companies to participate in orphan drug research. Many rare diseases remain without effective treatments despite over 500 orphan drug therapies having been approved in the United States. However, a growing focus by researchers and the FDA on rare disease therapies has resulted in a dramatic increase in the number of new therapeutic options for these patients over the past few years.

On the basis of regional analysis, North America holds the largest market share due to the presence of major market players and presence of major population of patients with orphan diseases. Furthermore, increasing number of orphan product approvals, significant number of orphan drugs in developing phase and increased expenditure on orphan drugs in the region are also the factors dominating the North America region in orphan drugs market.

European region followed by Asia Pacific market are anticipated to witness higher CAGR over the forecast period due to improved government initiatives and supporting policies to research and development in orphan drugs. In addition to this, increased product adoption and strong healthcare infrastructure are another factor creating footprints of these regions in the global orphan drugs market.

Orphan drugs are used to treat rare diseases or conditions which affects very few patients among the population but can be severe and life-threatening disorder. Although orphan diseases are rare, there are around 7000 different types of orphan diseases detected. To add to it, around 400 million people are suffering from such diseases globally. Though, only less than 5% therapies are made available to treat them and rest 95% disease conditions have no approved treatments available till now.

In 1983, U.S. government has passed a law, the Orphan Drug Act for providing pharmaceutical companies certain financial benefits for the development and adoption of orphan drugs that are safe to use and effective against orphan diseases. This act entirely changed the face of orphan disease therapeutics. After the introduction of Orphan Drug Act, U.S. FDA approved around 49 orphan products in 1991.

The Centre for Drug Evaluation and Research (CDER), which is a part of U.S. FDA approved 31 orphan products out of the novel 53 drugs in 2020 and approved 26 orphan drugs out of 50 novel drug approvals in 2021.

| Report Coverage | Details |

| Market Size in 2024 | USD 193.01 Billion |

| Market Size in 2025 | USD 216.55 Billion |

| Market Size by 2034 | USD 610.24 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.20% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Therapy, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing research and development activities in orphan drugs development is one of the significant driving forces in the global market. Prominent market players constantly working on developing novel product offerings also drives the growth of orphan drugs market. Pharmaceutical companies and other stakeholders are highly attracted towards investing in this market due to growing patient population related to the orphan diseases.

A rising awareness and consciousness about rare diseases among major population have been observed. Patients suffering from rare disease conditions are seeking effective and promising treatments which further increases the demand and propels the market growth.

The implementation of effective government policies supporting the development and adoption of innovative orphan drug therapies is also contributing to the growth of the global orphan drugs market. The high cost associated with orphan drugs can be a restraining factor for the growth of orphan drugs market. As orphan diseases are rare, the availability of orphan drugs is also selective. This selected availability and vigorous investments on research and development activities results into high cost of orphan drugs.

Though increasing incidences of orphan diseases creates a great opportunity for market players in the global orphan drugs market. Furthermore, even though orphan diseases are rare, around 7000 different types of orphan diseases have been detected and more than 400 million people are suffering from such diseases. This creates huge opportunity for market players in orphan drugs market.

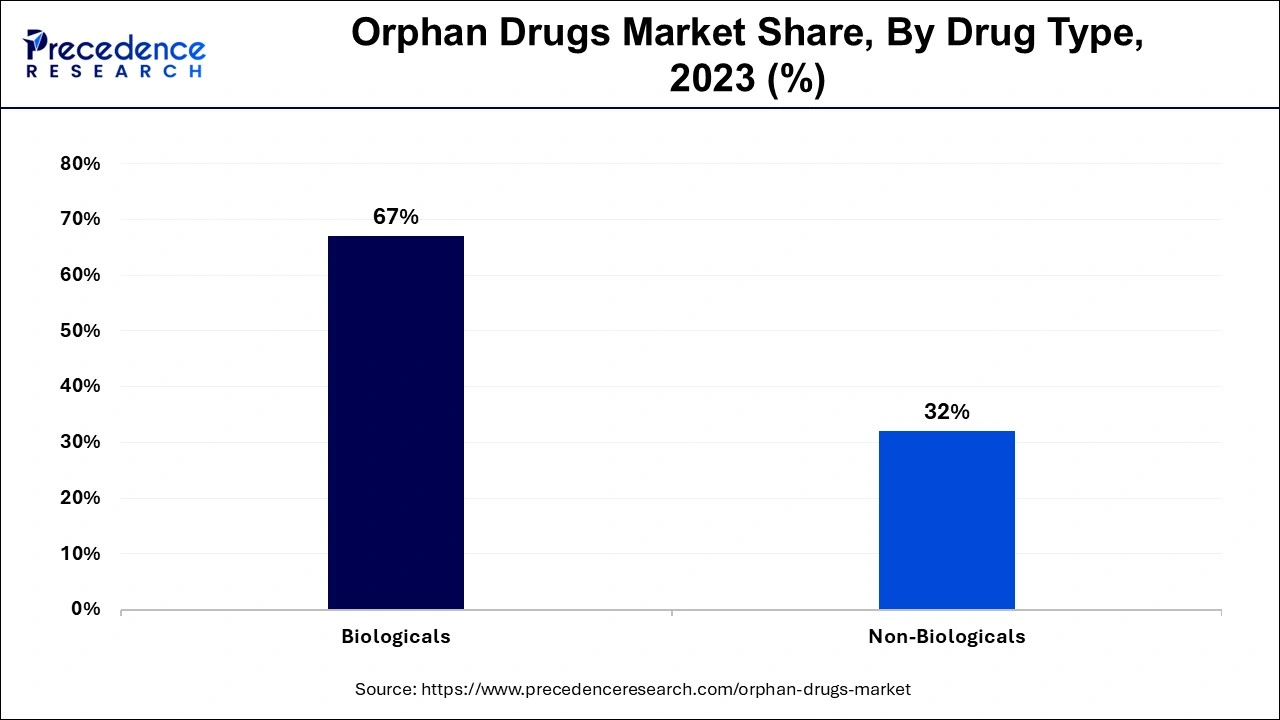

Depending on the drug type, orphan drugs market can be further segmented into biological and non-biological orphan products. According to the World Health Organization (WHO), biologics or biological products are a diverse group of medicines which include vaccines, growth factors, monoclonal antibodies, immune modulators, as well as products derived from human blood and plasma. Increased number of biological product offerings by major market players leads to dominate the biological orphan drugs segment.

As a result of rising number of cutting-edge biomedical research, biological segment is expected to show a higher growth over non-biological segment over the forecast period. In addition to this, increasing number of biological orphan products undergoing different phases of clinical trials also dominates the biological orphan drugs segment.

On the other hand, non-biological orphan products are anticipated to show comparatively low CAGR than biological orphan drugs over the forecast period.

On the basis of therapy, orphan drugs market is further segmented into oncology, haematology, neurology, infectious diseases, metabolic disorders, endocrinology, immunology and other rare diseases. The oncology segment holds the largest market share in the global orphan drugs market and expected to grow at a higher CAGR over the forecast period. Rising number of clinical developments in oncology and presence of possibly available orphan drug treatments for cancer patients dominates the segment. For instance, In June 2022, ALX Oncology Holdings Inc. received U.S. FDA grant as orphan drug designation (ODD) to Evorpacept, for the treatment of patients with Acute Myeloid Leukaemia.

Rising number of investors, investing enormous amounts in oncology for bringing up solutions with rare treatments for patients suffering for rare cancer disorders also dominates the oncology segment in orphan drugs market.

The haematology segment is anticipated to be the second largest segment in orphan drugs market over the forecast period, as a result of increasing number of haematological orphan product approvals. Furthermore, increasing incidences of rare haematological disease conditions among major population also dominates this segment.

The neurology segment is also projected to register a higher growth over the forecast period due increased incidences of rare neurological disease conditions such as Duchenne muscular dystrophy, multiple sclerosis and neurometabolic disorders.

Based on distribution channel, the hospital pharmacies segment is expected share largest market share in the orphan drugs market. Patients with orphan diseases needs to be treated and administered with the IV doses of drugs only under the supervision and monitoring of trained healthcare professionals. This leads to ensure the availability of orphan drugs preferably at hospital pharmacies, which further dominates this segment in orphan drugs market. Retail pharmacies, online pharmacies and other drug stores are projected to witness comparatively low CAGR over the forecast period due limited number of approved orphan products.

By Drug Type

By Therapy

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2025

May 2025

June 2025