What is the Pay TV Market Size?

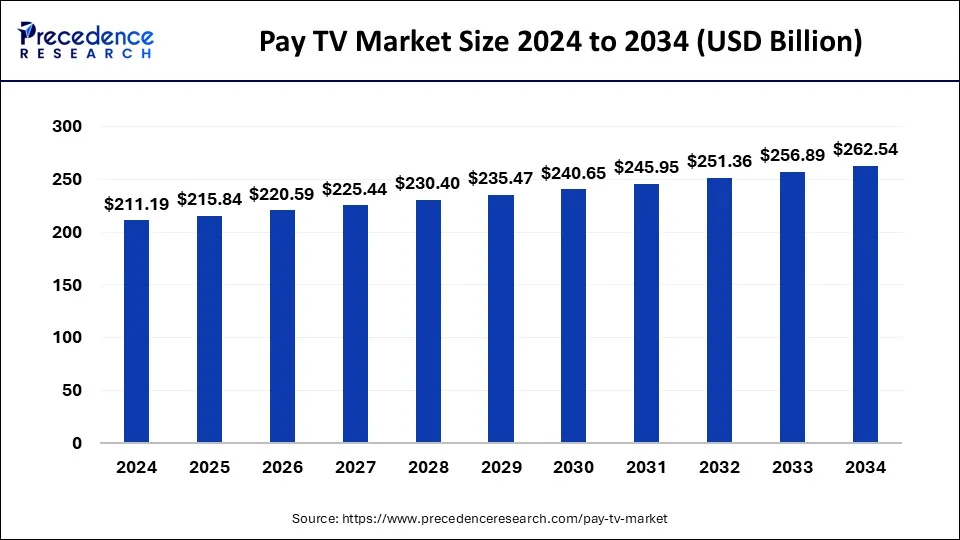

The global pay TV market size is accounted at USD 215.84 billion in 2025 and predicted to increase from USD 220.59 billion in 2026 to approximately USD 262.54 billion by 2034, expanding at a CAGR of 2.2% from 2025 to 2034.

Pay TV Market Key Takeaways

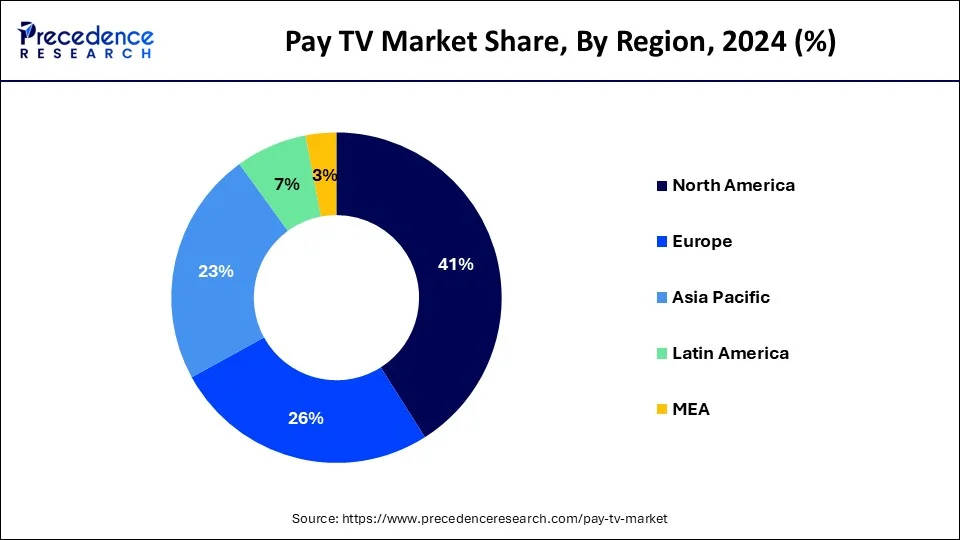

- North America led the global market with the highest market share of 41% in 2024.

- By type, the satellite TV segment dominated the market with a market share of 48% in 2024.

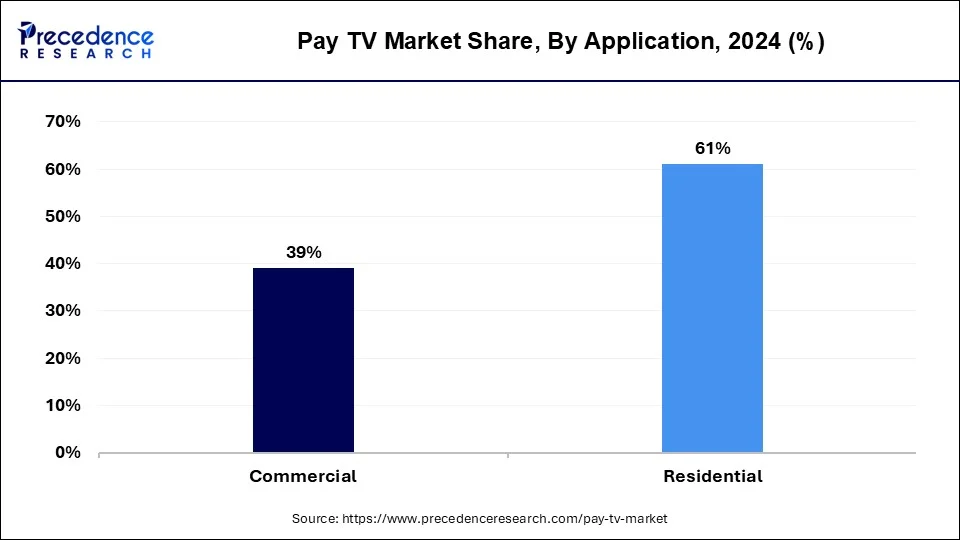

- By application, the residential segment registered a maximum market share of 61% in 2024.

Pay TV Market Growth Factors

The growth of the pay TV market is being driven by an emerging demand among the consumers to leverage enhanced quality content with high picture resolution. In addition to this, the ability of pay TV technology to provide an access to high-quality content from various service providers on a single platform at affordable prices boosts growth of the market.

Moreover,rising trend of Internet Protocol television along with thereduced subscription costs is projected to fuel growth of the market during forecast period. Furthermore,pay TV service providers are providinga number oflucrative value-added services such as internet connectivity, reduced subscription rates, customizable channel subscriptions, and bundled packages as per the demand of the consumer. This factor is expected to create several profit generation opportunities to the pay TV service providers; thus, boosting growth of the market in upcoming years.

Pay TV Market Outlook:

- Global Expansion: It is prominently fueled by high-quality content, bundling with other services, and the progression of evolving markets like the Asia-Pacific region.

- Major Investor: In August 2025, Switzerland's ‘Lex Netflix' investment obligation raised $37m to fund films and TV series.

- Startup Ecosystem: In March 2024, Vobble (India, 2024), an audio OTT platform for kids aged 4-12, providing story series, music, and podcasts, secured seed funding.

Market Scope

| Report Highlights | Details |

| Market Size in 2026 | USD 220.59 Billion |

| Market Size in 2025 | USD 215.84 Billion |

| Market Size by 2034 | USD 262.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.2% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application |

| Regional Scope | North America, APAC, Europe, Rest of the World |

Type Insights

By type, in 2024, satellite TV dominated the market with around 48% share in terms of revenue of the total market. Satellite TV service providers are actively diversifying their service offerings by providing bonus features, newer networks, and more modern channels; hence, growth of this segment is primarily boosted by rising demand among the consumer to face such offerings. On the other hand, satellite TV service providers have the ability to meet trending demand of the high-quality viewing experiences such as Ultra HD (UHD) and 4K picture quality among the users without bandwidth limitations. This factor is further expected to encourage growth of the segment during the forecast period.

However, IPTV segment is projected to witness highest growth rate during the forecast period. This is mainly attributed to the technological advancementsin the pay TV market and surge in the number of subscribers for IPTV. In addition, huge penetration of Internet-based streaming services is projected to propel growth of the market.

Application Insights

By application, in 2024, the residential segment dominated the market with around 61% share in terms of revenue of the total market. Growth of this segment is mainly attributed to the upsurge in popularity of pay TV in developing countries. For instance, according to the survey by Media Partners Asia, by 2025 over 96% of India's pay-TV homes will be digitalized as well as the base of the pay-TV subscribers would be expanded to 134 million by then. On the other hand, this segment is expected to grow at the lucrative growth rate throughout the forecast period.

Regional Insights

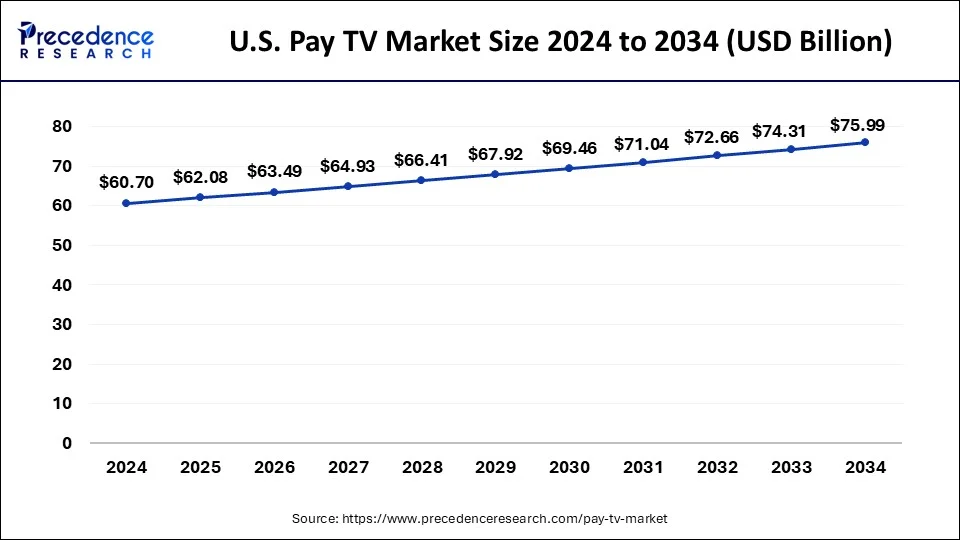

U.S. Pay TV Market Size and Growth 2025 to 2034

The U.S. Pay TV market size is estimated at USD 62.08 billion in 2025 and is predicted to be worth around USD 75.99 billion by 2034, at a CAGR of 2.27% from 2025 to 2034.

North America dominated the pay TV market and accounted for the largest revenue share of 41% in 2024. The increased usage of television and internetin this regionsignificantly contributed to the regional revenue generation. For instance, according to California State University, 99% of the households possess at least one television in America is and over 56% Americans uses pay TV.Despite higher revenue share, the region has been witnessing a decline in the growth of the market due rapid penetration of internet-enabled mediums coupled withanemergence of OTT platforms. On the contrary, rising focus towards adoption of the Integrated Broadband-Broadcast (IBB) system among the pay TV service providers is projected to boost growth of the North America pay TVmarket in forecast period.

The Asia Pacific is expected to witness the fastest growth rate over the forecast period. This is mainly attributed to the rising demand for High Definition (HD) video content, specifically in India, China, and Japan. For instance, according to The Asia Video Industry Report 2020, the total pays TV subscribers in the region is 611 million. However, India and China continue to be the largest markets in terms of subscribers, accounting for about 80% of the region's overall pay-TV households. In addition to this, prominence of Internet Protocol TV (IPTV) due to digitalization across the Asia-pacific creates lucrative growth opportunities for the market growth during the forecast period.

A Surge in Virtual MVPDs (vMVPDs) & Hybrid Models: US Market Trend

As a key country around the globe, the US is increasingly involved in innovative technological advances, which significantly encompass virtual MVPDs (vMVPDs), i.e. Internet Protocol Television (IPTV) and virtual multichannel video programming distributors like YouTube TV, Hulu + Live TV, and FuboTV. Furthermore, the US leaders are encouraging hybrid models, like Charter Communications, testing a new "Life Unlimited" video plan that combines popular streaming services, especially Disney+, ESPN+, Paramount+, Max, and Peacock.

Rising Shift Towards OTT & UHD Content: Chinese Market Trend

The Chinese market is primarily empowered by the enhancement in Over-The-Top (OTT) streaming platforms' preferences. However, the National Radio and Television Administration has a goal for UHD to be the extensive format for television and online videos by 2026. This further encompasses strategies for over 20 new UHD TV channels by the end of 2025 and supports hotels to upgrade their equipment.

Enforcement of the Leading Companies is Propelling Europe

A lucrative expansion of Europe in the pay TV market will be impacted by the presence of significant leaders, such as Canal+, Sky, BT Group, and Vodafone, which are imposing bundled services (TV, internet, and phone). Alongside, they are increasingly investing in localized content and exclusive sports programming to attract and retain customers.

Impactful Novel Tenant Laws: German Market Trend

In 2024, a new step was taken by Germany in the prohibition of the integration of broadband and pay-TV services into tenant leases (the "TV operating costs privilege"). Whereas major players, such as Sky Deutschland, have unveiled optional, direct-to-consumer cable TV options for tenants.

Extensive Technological Shift to IPTV & Fiber is Assisting South America

South America's population is moving from traditional cable and satellite (DTH) technologies to Internet Protocol Television (IPTV), which is the most rapidly developing technology segment. Meanwhile, many operators are actively investing in Fibre-to-the-Home (FTTH) networks, which leverage these advanced services and facilitate higher-quality content.

Expanding Consolidation and Strategy Shifts: Mexico Market Trend

Particularly, in April 2024, Grupo Televisa bought AT&T's residual stake in Sky Mexico, consolidated its control over the DTH pay TV operator, and signalled a planned movement to better position itself in the emerging market. As well as in June 2025, Fox acquired Caliente TV to boost its sports presence in Mexico and Latin America.

Adoption of Phenomenal Advances & Content Plan is Bolstering MEA

In MEA, the pay TV market has been greatly executing significant technological advances, like the adoption of High Definition (HD) and Ultra HD (4K) content and enhanced user interfaces. The MEA is securing exclusive premium content, especially live sports events, concerts, and niche documentaries (e.g., beIN Sports, OSN), and remains a vital plan for pay TV providers to attract and retain subscribers.

Key Players and Their Market Offerings

| Company | Contributions | Offerings | Highlights |

| Airtel Digital TV | Enhances India's DTH market with digital transition and OTT integration. | Offers HD channels, hybrid set-top boxes, and flexible channel packs. | Strengthening the market through possible merger talks with Tata Play. |

| DIRECTV | Pioneered satellite Pay TV in the U.S., evolving toward hybrid streaming. | Provides internet-based bundles and unified streaming-satellite services. | Simplified packages to retain users amid rising OTT competition. |

| Carter Communications | Operates as a small regional communication service provider. | Provides limited broadcast and network solutions. | Minor presence in Pay TV, focusing on consultancy. |

| Foxtel | Dominates Australia's Pay TV sector with satellite and IPTV. | Offers entertainment, sports, and movie bundles across devices. | Adjusting pricing and content to match OTT disruption. |

| DISH Network Corporation | Leading U.S. satellite Pay TV and streaming innovator. | Provides DISH TV and Sling TV services. | Expanding streaming base while offsetting satellite subscriber losses. |

Pay TV Market Companies

- Rostelecom

- Fetch TV Pty Limited

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved pay TV products and services to boost their market presence and generate new revenue streams. Moreover, they are also focusing on maintaining competitive pricing.

For instance, Dish TV India Ltd., the direct-to-home service provider launchedScan QR and Pay, the QR scan feature for D2H subscribers, and 'Scan To Pay' for DishTV subscribers. This launch is attributed to the commitment of Dish TV India Ltd. to a digital-first strategy driven byincreasing preference of consumersfor self-help options.

Furthermore, ongoing collaborations among the streaming services providers are pay TV service providers is projected to enable pay TV market players to strengthen their geographical and industry presence. For instance, in 2019, Netflix, the SVOD pioneer partnered with over 15 pay-TV operators such as Comcast Cable. This has enabled Netflix to have an access to more than 300 million pay-TV households who link worldwide via their set-top box.

Segments Covered in the Report

By Type

- Cable TV

- Satellite TV

- Internet Protocol TV (IPTV)

By Application

- Residential

- Commercial

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting