What is the PVC Pipes Market Size?

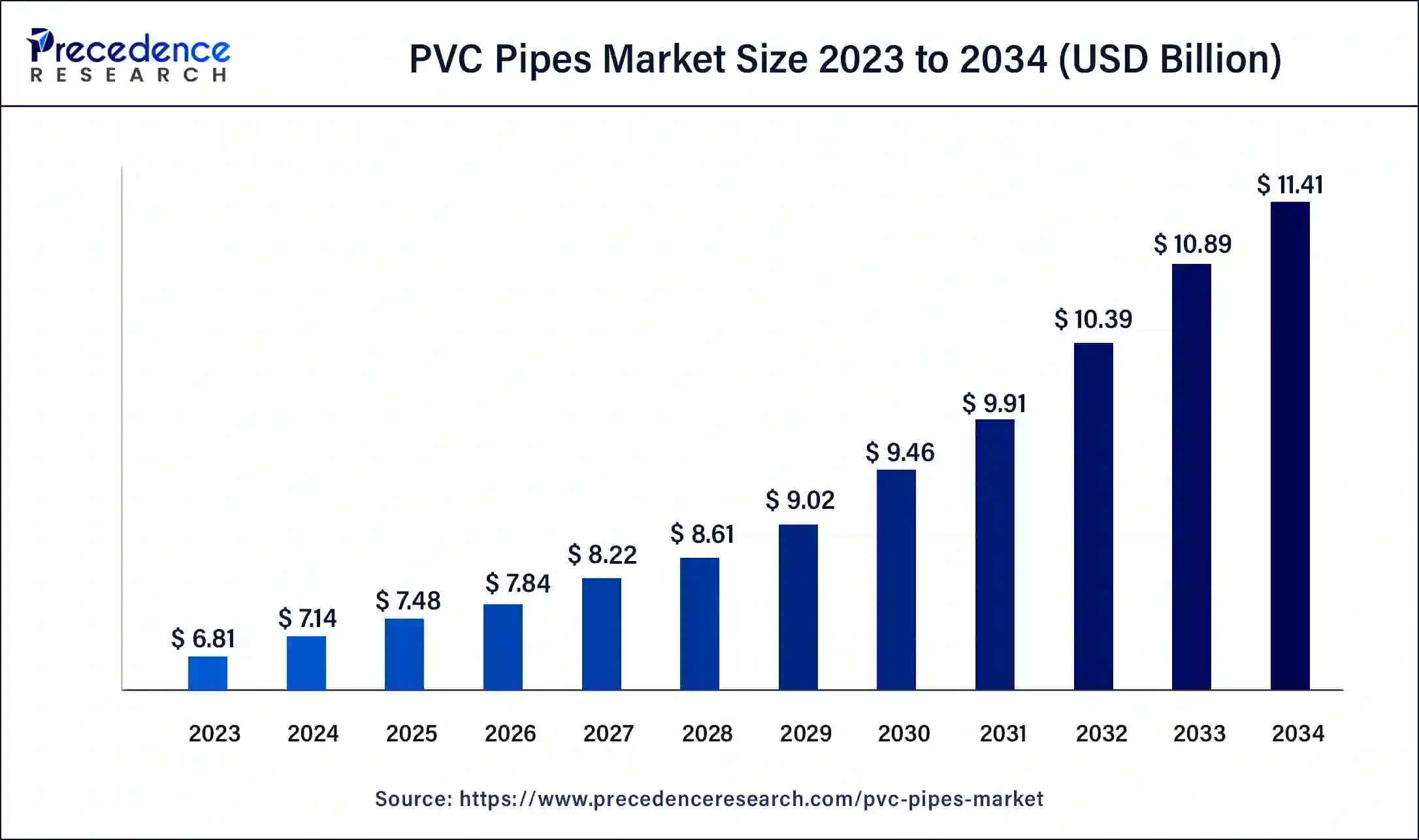

The polyvinyl chloride (PVC) pipes market size is calculated at USD 7.48 billion in 2025 and is predicted to increase from USD 7.84 billion in 2026 to approximately USD 11.92 billion by 2035, expanding at a CAGR of 4.77% from 2026 to 2035.

PVC Pipes Market Key Takeaways

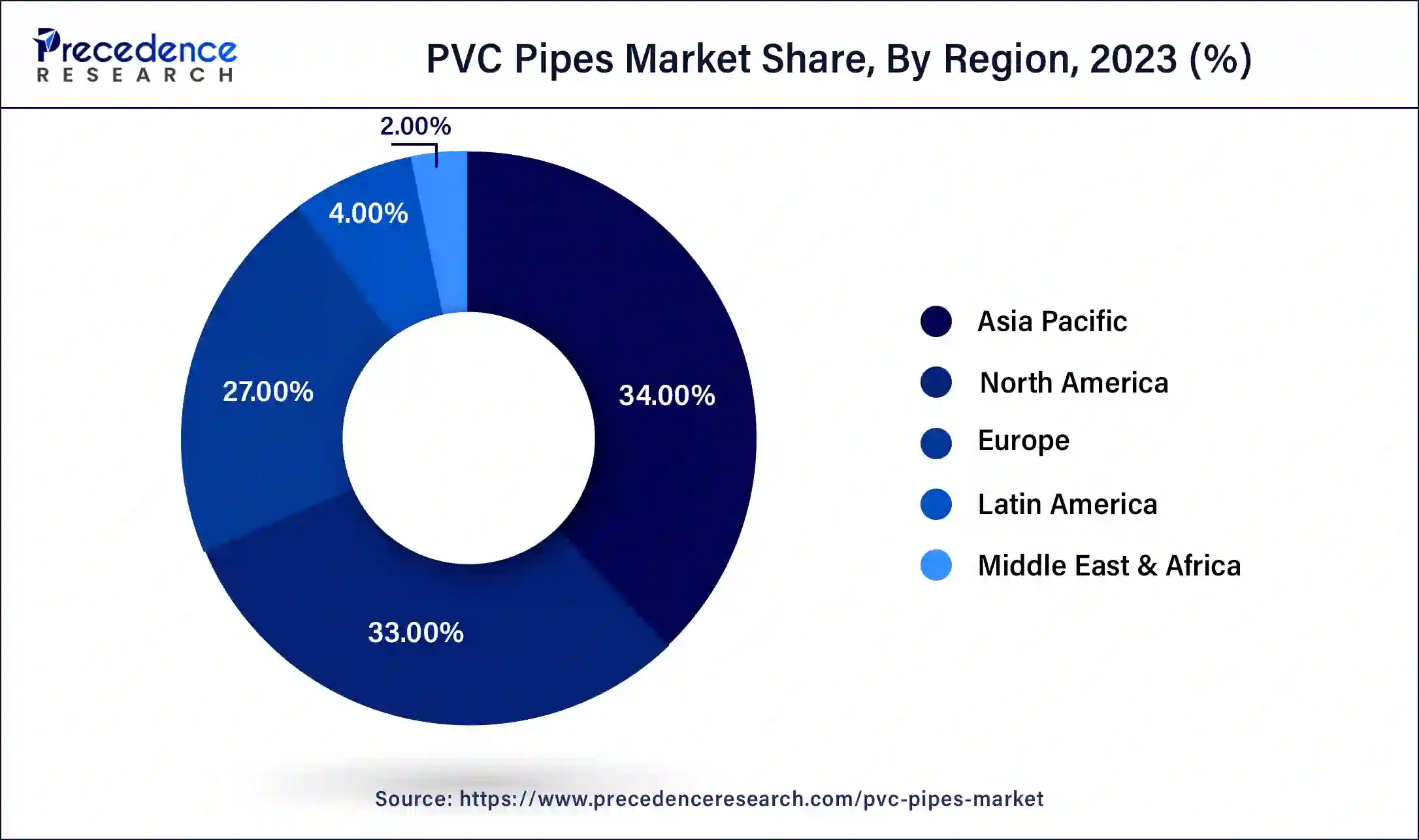

- North America led the global market with the highest market share of 34% in 2025.

- By type, the post-chlorinated segment has held the largest market share in 2025.

- By application, the water supply segment captured the biggest revenue share in 2025.

- By end user, the agriculture segment registered the maximum market share in 2025.

PVC Pipes Market Growth Factors

The polyvinyl chloride (PVC) is considered as top selling material all around the world. The polyvinyl chloride (PVC) is cost-effective and durable in nature. Similarly, polyvinyl chloride (PVC) pipes are of low cost and corrosion resistant. The polyvinyl chloride (PVC) pipes are used for various purposes such as water supply, irrigation, and drainage system.

One of the key factors driving the growth of the global polyvinyl chloride (PVC) pipes market is growing investments in research and development activities. These investments are made by either government agencies or market players. In addition, the growth of the global polyvinyl chloride (PVC) pipes market is being driven by the surge in demand for polyvinyl chloride (PVC) pipes in various industries and sectors. The polyvinyl chloride (PVC) pipes provide various benefits that are the reason; the demand for them is growing at a faster rate.

Another factor driving the growth of the global polyvinyl chloride (PVC) pipes market is the technological advancements and adoption of innovative technologies. The molecular orientation technology is used for the manufacturing of polyvinyl chloride (PVC) pipes in the global market. These kinds of pipes are eco-friendly in nature. In addition, it is cost effective and efficient in nature.On the other hand, the alternatives for polyvinyl chloride (PVC) pipes are hindering the growth of the polyvinyl chloride (PVC) pipes market.

The impact of the COVID-19 pandemic on the growth of the global polyvinyl chloride (PVC) pipes market was quite negative. The supply chain disruption and halt of manufacturing units had negative impact on the expansion of the global polyvinyl chloride (PVC) pipes market.

The industries such as agriculture and building and construction are developing at a rapid pace all around the world. The polyvinyl chloride (PVC) pipes are widely used in these industries. In agriculture, the polyvinyl chloride (PVC) pipes are used for irrigation purpose. In addition, the polyvinyl chloride (PVC) pipes are used for roofing and flooring purpose in building and construction purpose.

To keep up with the fierce market competition, the major players in the worldwide polyvinyl chloride (PVC) pipes market used research and development, business expansion, product introduction, joint venture, and acquisition. The polyvinyl chloride (PVC) pipes manufacturers, who sell their products to a variety of industries around the world, are among the polyvinyl chloride (PVC) pipes market's participants. Moreover, the market players are collaborating with government, which is creating lucrative opportunities for the growth of the global polyvinyl chloride (PVC) pipes market.

PVC Pipes Market Outlook

- Industry Growth Overview: The PVC pipe market is expected to grow significantly between 2025 and 2034, fueled by rapid urbanization, expansive infrastructure projects, and rising demand for cost-effective, durable piping solutions in construction and agriculture for high-temperature uses.

- Innovation and Regulatory Adaptation Trend:The PVC industry is propelled by Product Innovation, such as advanced materials like molecular-oriented pipes, and Regulatory Adaptation, such as shifting to lead-free, sustainable additives. Industry collaboration, like the VinylPlus program, is institutionalizing circular economy efforts through large-scale recycling.

- Global Expansion: Market leaders are expanding geographically to capitalize on rising infrastructure investment in emerging economies. Asia-Pacific dominated the market due to rapid urbanization and government projects like water supply and irrigation schemes. Other growth regions include Europe, North America, Latin America, and the Middle East and Africa, supported by large-scale infrastructure projects.

- Major Investors: Investment is driven by the steady demand for infrastructure and replacement needs. Key investors include large corporations such as Westlake Chemical Corporation, Aliaxis Group, and Formosa Plastics Corporation. Companies are focused on expanding manufacturing facilities, R&D, and strategic acquisitions to remain competitive.

- Startup Ecosystem:While dominated by established players, startups and smaller firms are emphasizing innovative manufacturing techniques and niche applications. Automation, 3D printing for custom fittings, and smart piping solutions with embedded sensors are emerging trends. These innovations aim to boost efficiency, shorten installation times, and enable proactive system monitoring.

Major Trends Influencing Growth in the PVC Pipes Market

- The increased use of UV-stabilized, antimicrobial, and specialty PVC formulations will continue to enhance the durability of PVC pipes in various applications.

- The continued expansion of intelligent piping systems with embedded sensors will enable leak detection and pipeline monitoring.

- There is an increased application of recycled PVC content due to the increased number of sustainability programs.

- The rapid increase in the number of global water supply, sanitation, and sewer infrastructure projects will continue throughout the Asia Pacific market.

- The increased number of PVC pipes being utilized in agricultural irrigation systems will continue to grow due to the industry's need for water-use efficiency.

- The shift toward using lead-free and non-toxic PVC formulations will continue to be necessary to meet the increasing number of regulatory and environmental requirements.

Trade Analysis of the PVC Pipes Market

- According to Volza, a global trade data source, between June 2024 and May 2025, a total of 175,083 PVC pipe exports were shipped across the globe and demonstrating continued global trade activity. Major exporting countries include Vietnam, China, and India. High-volume shipments were sent to Mexico and India.

- Major importing regions for PVC pipe solutions include Vietnam, Cambodia, and Costa Rica, demonstrating a wide range of end-market demand.

- As it relates to India, during the ten months of October 2023 to September 2024, India recorded approximately 9,931 export shipments and has shown consistent growth in exports to support India's continued role in the global commerce of PVC pipe. (Source: https://www.volza.com/ )

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 11.92 Billion |

| Market Size in 2026 | USD 7.84 Billion |

| Market Size in 2025 | USD 7.48 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.77% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End User, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Segments Insight

Type Insights

The post-chlorinated segment dominated the polyvinyl chloride (PVC) pipes market in 2024. The post-chlorinated polyvinyl chloride (PVC) pipes are more flexible in nature as compared to other type of polyvinyl chloride (PVC) pipes. These type of polyvinyl chloride (PVC) pipes are used to transfer cold water as well as hot water. The post-chlorinated polyvinyl chloride (PVC) pipes are also used for welding, machining, and forming.

The plasticized segment is fastest growing segment during the forecast period. The demand for plasticized polyvinyl chloride (PVC) pipes is growing due to surge in demand for wastewater management. In addition, government is heavily investing for the installation of new pipelines. This factor is driving the growth of the segment.

Application Insights

The water supply segment led the market in 2024. The polyvinyl chloride (PVC) pipes were initially used for supplying water from one place to another. The polyvinyl chloride (PVC) pipes help to supply water at a faster rate as compared to metal and concrete pipes. The growing population has resulted to the surge in demand for water supply. This is possible due to growing installation of polyvinyl chloride (PVC) pipes globally.

The oil and gas segment is fastest growing segment over the forecast period. The oil and gas companies consider polyvinyl chloride (PVC) pipes as cost effective solution. This kind of pipes is light in weight and is resistant to the corrosion. Thus, the demand for polyvinyl chloride (PVC) pipes for oil and gas sector is growing at a rapid pace.

End User Insights

The agriculture segment dominated the polyvinyl chloride (PVC) pipes market in 2024. The polyvinyl chloride (PVC) pipes in agriculture are used for the purpose of supplying water in farms. The polyvinyl chloride (PVC) pipes are mainly used for irrigation purpose. In addition, the polyvinyl chloride (PVC) pipes are used for sprinkle of pesticides and fertilizers in the farms. Due to the low cost of polyvinyl chloride (PVC) pipes, the demand for this kind of pipes is growing for agriculture purpose.

The building and constructions segment is expected to hit highest growth in near future. The polyvinyl chloride (PVC) pipes are considered as most beneficial pipes as compared to other pipes for building and construction purposes. The polyvinyl chloride (PVC) pipes are cost effective and safety product that are used for roofing and flooring of the buildings. Thus, all of these factors are driving the growth of the segment.

Regional Insights

What is the Asia Pacific PVC Pipes Market Size?

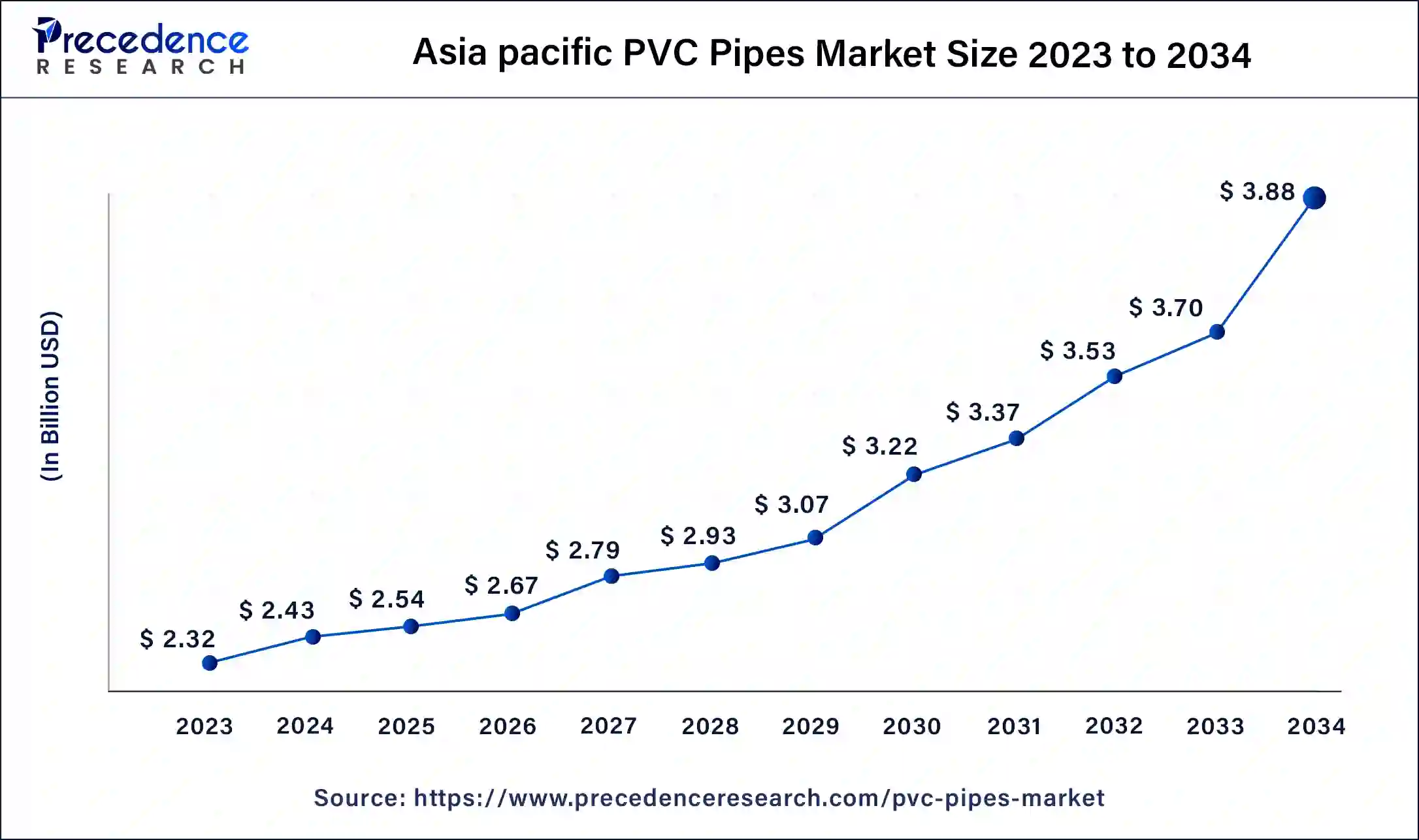

The Asia Pacific polyvinyl chloride (PVC) pipes market size is estimated at USD 2.54 billion in 2025 and is predicted to be worth around USD 4.05 billion by 2035, at a CAGR of 4.78% from2026 to 2035.

Asia-Pacific dominated the polyvinyl chloride (PVC) pipes market in 2024. China dominated the polyvinyl chloride (PVC) pipes market in Asia-Pacific region. The factors such as rising industrialization and urbanization, growing investments for the infrastructural development, and growing government initiatives for the development of infrastructure in agriculture sector are driving the growth of the polyvinyl chloride (PVC) pipes market in the region over the forecast period.

China PVC Pipes Market Trends

China is a major contributor to the Asia Pacific PVC pipes market, driven by its massive infrastructure development and rapid urbanization. The country's extensive construction activities, including residential, commercial, and industrial projects, create a strong demand for durable and cost-effective piping solutions. Government initiatives to improve water supply, sanitation, and irrigation systems further support market growth. Additionally, the presence of large domestic manufacturers and increasing adoption of advanced PVC formulations help China maintain a leading position in the regional market.

Why is Europe Considered the Fastest-Growing Market?

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the polyvinyl chloride (PVC) pipes market in Europe region. The polyvinyl chloride (PVC) pipes market in Europe is being driven by growing applications of polyvinyl chloride (PVC) pipes in diverse sectors. In addition, existence of major market players in this region is also boosting the growth of polyvinyl chloride (PVC) pipes market.

Germany PVC Pipes Market Trends

The market in Germany is driven by a constant need to modernize existing infrastructure, demand for high-quality HVAC systems due to extreme weather, and the robustness of the country's construction industry. German manufacturers focus on quality, longevity, and adherence to rigorous national and EU standards, ensuring a promising future.

How is the Opportunistic Rise of North America in the PVC Pipes Market?

North America is experiencing significant growth in the market, mainly driven by widespread infrastructure upgrades. The region is known for strict regulations that encourage durable, corrosion-resistant, and cost-effective PVC solutions for replacing old water and sewer lines. Additionally, North America leads in adopting innovative technologies like molecular-oriented PVC (PVC-O) and emphasizes sustainable building practices and recyclability to meet green standards.

U.S. PVC Pipes Market Trends

The U.S. leads the market in North America, serving as both a major consumer and an innovation hub. Its role is heavily shaped by large government investments through programs like the EPA's lead service line replacement initiatives, which generate strong demand for PVC pipes in municipal projects. Additionally, the steady U.S. residential and commercial construction sectors strengthen the country's key position in the global PVC supply chain and demand cycle.

Latin America PVC Pipe Landscape

Latin America is experiencing robust growth in the market, fueled by rapid urbanization, large infrastructure investments, and technological advancements. The region's growing population and developing economies are increasing demand for reliable and cost-effective piping solutions in water supply, sewage systems, and agricultural irrigation. The inherent properties of PVC pipes, such as corrosion resistance, durability, and ease of installation, make them a preferred alternative to traditional materials.

Brazil PVC Pipes Market Trends

Brazil is a major contributor to the market, driven by major investments in construction, real estate, and the modernization of water transport systems, often through public-private partnerships. The need to replace outdated galvanized iron and copper pipelines, combined with a strong government push for clean water and sanitation, is accelerating the adoption of PVC and more advanced CPVC options.

What Potentiates the Growth of the Middle East and Africa PVC Pipes Market?

The growth of the Middle East and Africa PVC pipes market is fueled by large infrastructure projects, rapid urbanization, and increased investments in water and wastewater management systems. Governments across the region are executing national development plans that require extensive piping networks. The market benefits from the low cost, durability, and corrosion resistance of plastic pipes, making them ideal for the region's tough environmental conditions due to smart city initiatives and desalination projects.

Saudi Arabia PVC Pipes Market Trends

Saudi Arabia is a key player in the market in the MEA, driven largely by government projects such as NEOM and the Red Sea Project. The country is diversifying its economy and heavily investing in water management, desalination plants, and a strong construction sector. There is high demand for durable, cost-effective, and low-maintenance PVC pipes for sewerage, drainage, and water supply systems, which account for the largest share of managing extensive piping networks.

Value Chain Analysis

- Raw Material Sourcing and Compound Preparation - This stage involves sourcing PVC resin and various additives like stabilizers and plasticizers, then mixing them into a uniform compound for manufacturing.

Key Players: Supreme Industries, Finolex Industries, Astral Pipes, Prince Pipes. - Manufacturing and Production - This stage involves converting the compound into finished pipes through heating, extrusion, cooling, cutting, and quality control processes to meet specific standards.

Key Players: Supreme Industries, Finolex Industries, Astral Pipes, Ashirvad Pipes (Aliaxis Group), JM Eagle, Apollo Pipes, Vectus Industries. - Distribution and Supply Chain Management - This stage involves moving pipes and fittings from plants to a wide network of dealers, distributors, and retailers, utilizing efficient logistics and warehousing. A strong distribution network is key.

Key Players: Supreme Industries, Ashirvad Pipes, Prince Pipes. - Sales and End-User Application - This stage involves the final sale and use of pipes in various applications like plumbing, irrigation, and sewage systems, with demand driven by construction and government initiatives.

Key Players: Construction companies, real estate developers, the agricultural sector, government bodies, and residential consumers.

Top Companies in the PVC Pipes Market and Their Offerings

- China Lesso Group Holdings Ltd.: Provides a vast range of PVC products, including pipes and fittings for applications like municipal water supply, fire protection, and agriculture. The company also offers drainage, electrical conduit, and chemical transport products.

- JM Eagle Inc.:A major North American manufacturer of PVC pipes for utility, plumbing, electrical conduit, natural gas, irrigation, and potable water and sewage systems. It is known for its high-grade products used globally.

- Astral Polytechnik Limited:An Indian market leader offering a comprehensive range of PVC and CPVC pipes and fittings for various applications, including plumbing, drainage, agriculture, fire protection, and electrical conduits.

- Finolex Industries Ltd.:A leading Indian manufacturer specializing in PVC and CPVC pipes and fittings. Its products are widely used in residential, commercial, and agricultural sectors. The company also has its own PVC resin production.

- IPEX Inc.:A North American manufacturer of integrated thermoplastic piping systems. Its products include PVC pipes and fittings for municipal, plumbing, industrial, electrical conduit, and irrigation applications.

PVC Pipes Market Companies

- Polypipe PLC

- NAPCO

- Advanced Drainage Systems Inc.

- National Pipe and Plastics Inc.

- Amancio

Recent Developments

- February 2025 – Malpani Pipes & Fittings Launches PVC Pipe Line:

Malpani Pipes & Fittings Ltd. launched a new PVC pipe production line in February 2025 with a capacity of 1,800 MT per annum, targeting diverse applications. These applications include plumbing, drainage, irrigation, and water distribution to strengthen its product portfolio.

(Source: https://www.malpanipipes.com ) - North American Pipe Corporation, a Westlake Chemical Corporation affiliate, introduced the latest molecularly oriented polyvinyl chloride (PVC) pipesin December 2021. In comparison to other water main materials, the latest polyvinyl chloride (PVC) pipe has a lower carbon impact. North American Pipe Corporation (NAPCO)'s manufacturing power at its fittings factory in Ontario will be bolstered by the investment in sophisticated technologies. The latest polyvinyl chloride (PVC) pipe product family demonstrate the company's dedication by incorporating cutting edge manufacturing processes that reduce environmental impact while providing end users with high performance polyvinyl chloride (PVC) pipes and fittings.

Segments Covered in the Report

By Type

- Post-chlorinated

- Plasticized

- Unplasticized

By Application

- Sewerage

- Plumbing

- Water supply

- Oil and gas

- Irrigation

- Others

By End User

- Agriculture

- Building and construction

- Telecommunication

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting