What is the Radiotherapy Market Size?

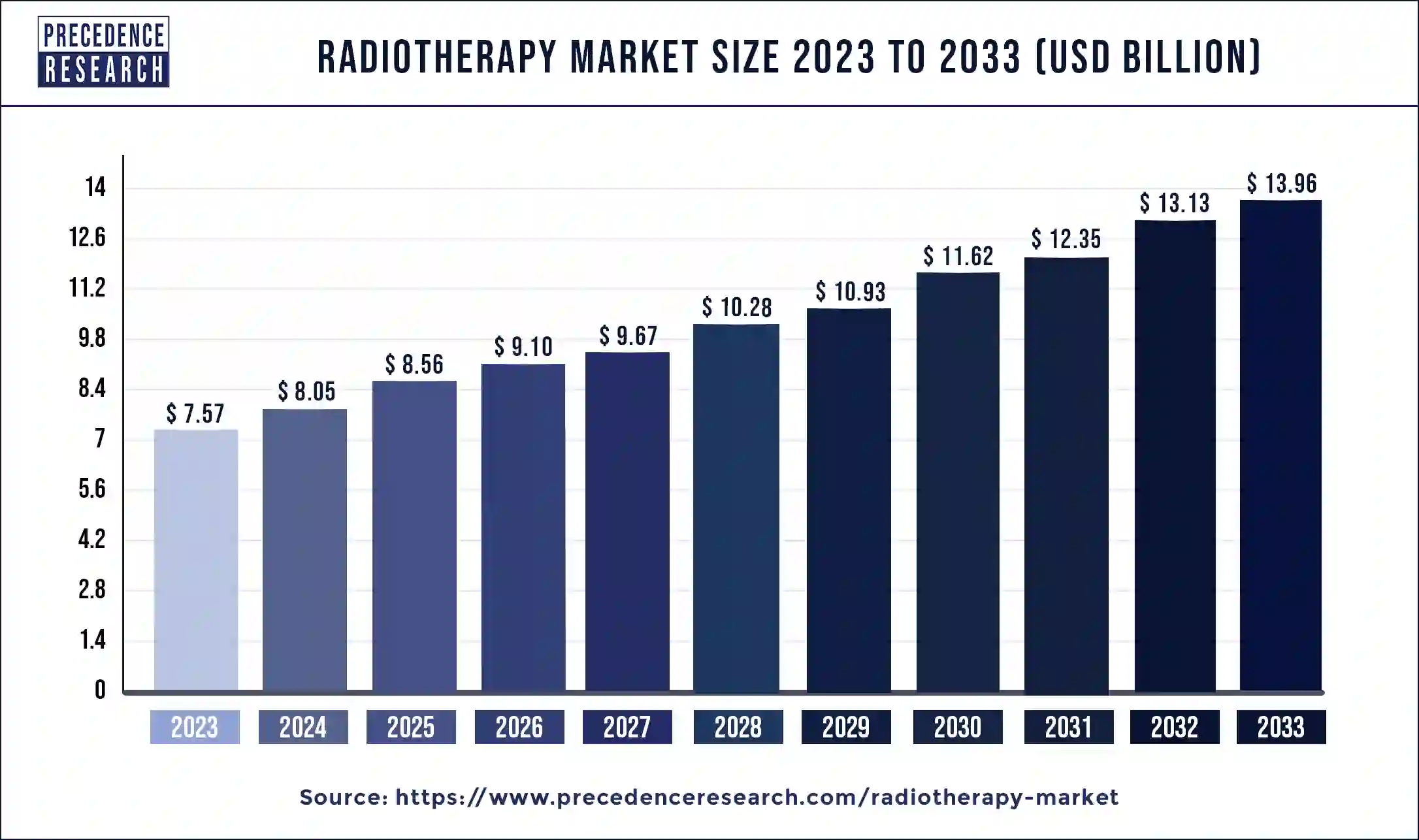

The global radiotherapy market size is valued at USD 8.56 billion in 2025 and is predicted to increase from USD 9.10 billion in 2026 to approximately USD 14.76 billion by 2034, expanding at a CAGR of 6.25% from 2025 to 2034. The radiotherapy market is driven by technological advancements and growing awareness.

Radiotherapy Market Key Takeaways

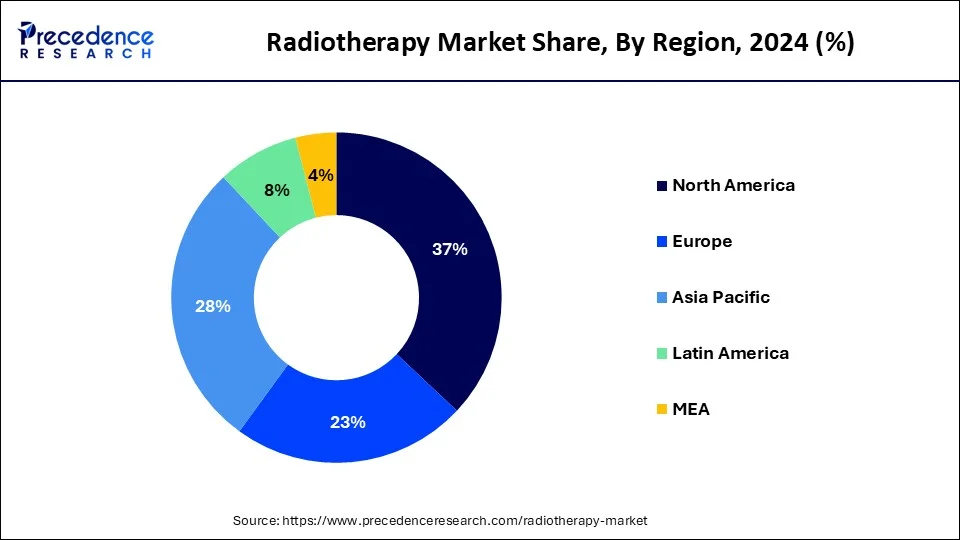

- North America dominated the market with the largest revenue share of 37% in 2024.

- Asia Pacific is expected to grow at the highest CAGR in the market during the forecast period.

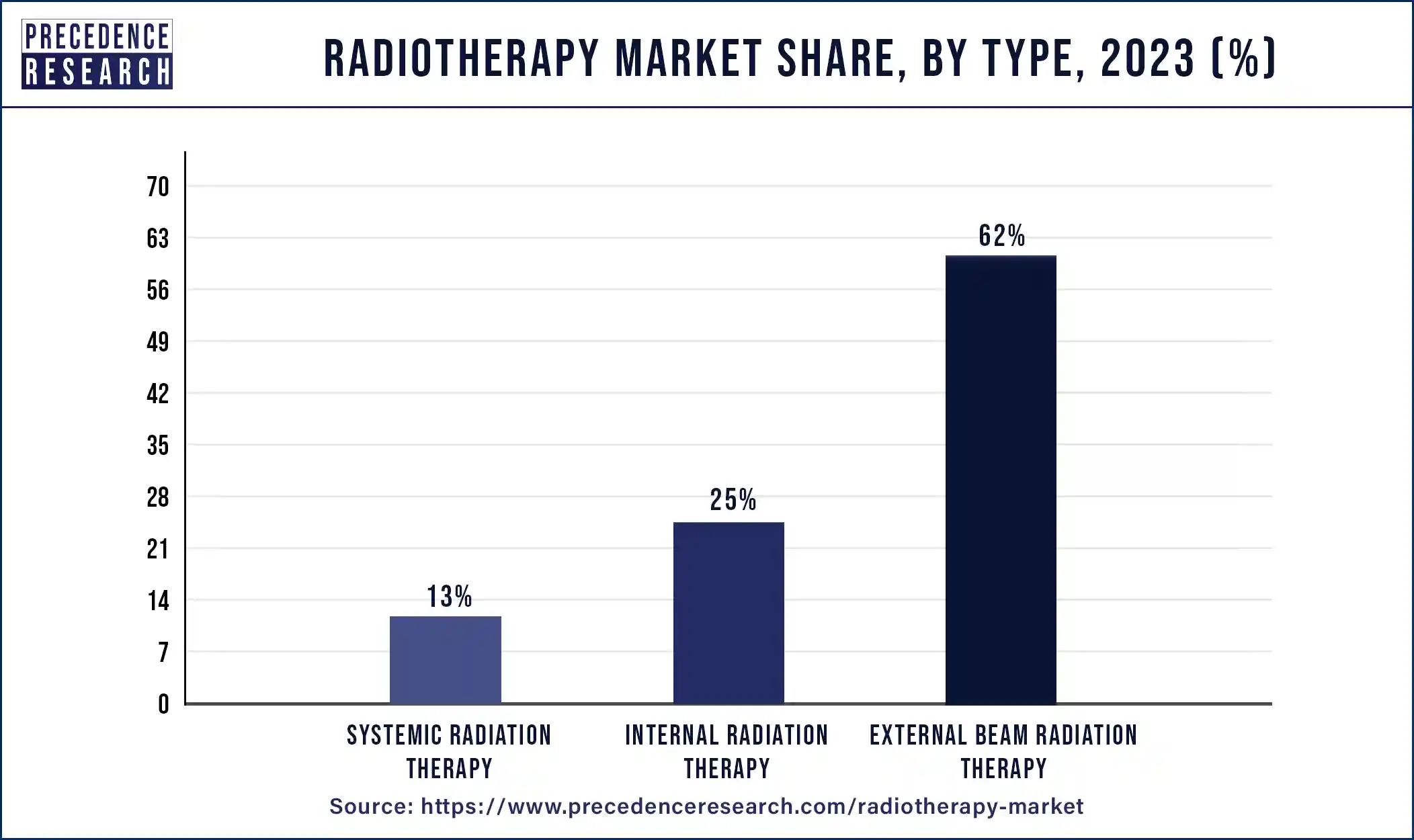

- By type, the external beam radiation therapy segment held a major revenue share in 2024.

- By type, the internal radiation therapy segment is expected to show notable growth in the market during the forecast period.

- By end users, the hospitals & clinics segment has contributed more than 51% of revenue share in 2024.

- By end users, the other segment is expected to grow rapidly in the market during the forecast period.

What is Radiotherapy?

The radiotherapy market refers to the industry that deals with the use of high radiation doses in radiotherapy as a medical procedure to destroy cancer cells and reduce tumor size. The radiation causes damage to DNA cells, which stops the cells from proliferating and reproducing. There are different types of radiotherapy, including external beam radiation therapy, internal radiation therapy, and systemic radiation therapy. The radiotherapy market is driven by the growing adoption of radiotherapy devices and procedures and the rising incidence of cancers.

Radiation therapy contributes to 40% of all cancer cures world-wide as well as improving the quality of life for many others. Despite this great benefit, the total cost of radiation therapy to the Commonwealth government is less than 9 cents in every dollar spent on all cancer diagnosis and treatment. Each year of life saved in Australia by radiation therapy costs us less than one saved using other cancer treatments.

The radiotherapy market is fragmented with multiple small-scale and large-scale players, such as Eckert & Ziegler Group, Elekta AB, Ion Beam Applications SA, Becton, Dickinson and Company, MEVION MEDICAL SYSTEMS, INC., Isoray, Inc., Siemens Healthineers AG, ICAD INC., Accuray Incorporated, Nordion Inc.

Radiotherapy Market Outlook

- Industry Growth Overview: From 2025 to 2030, the radiotherapy market is expected to undergo substantial growth as cancer rates are rising and the adoption of precision treatment systems is deepening. Investment is occurring as hospitals seek advanced treatments (IMRT, IGRT, proton therapy) and advanced technologies to adopt to offer treatments, with the most growth occurring in Asia-Pacific and in North America.

- Geographical Expansion: Various major companies expanded operations in Southeast Asia, Eastern Europe, and LATAM to improve access to oncology treatment and to help close treatment gaps in the market. Elekta and Varian sought to increase the number of linear accelerator installations in countries like India, Brazil, and Poland to position themselves for growth in various high-potential markets, where cancer screening and cancer treatment are improving, as healthcare access improves in certain regions.

- Key Investors:Private equity and strategic investors have engaged in radiotherapy due to established high technical barriers to entry, healthy margins, and a long-term demand for oncology care. Several companies have invested in cancer care centers, radiotherapy equipment suppliers, and AI-based planning platforms in hopes of financing a growing international cancer care treatment need.

- Startup Ecosystem: The field of radiotherapy startups has created a supported ecosystem for innovation around AI-based planning, adaptive therapy, and miniaturized proton systems. This has led large venture capital groups to invest in observing the launch of new products and services offered by companies like RefleXion and Leo Cancer Cancel, resulting in safer and more accurate approaches for advanced cancer treatment to help hospitals with capacity.

What are the Growth Factors in the Radiotherapy Market?

- Governments of various countries are showing their commitment to the overall development of the healthcare sector in the form of grants and schemes. This promotes the entrance of key players into the market, especially the radiotherapy market.

- Dedication to business is observed in the form of adaptation of newer technologies and research.

Radiotherapy Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.56 Billion |

| Market Size in 2026 | USD 9.10 Billion |

| Market Size by 2034 | USD 14.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.25% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising incidence of cancers

The rising incidence of cancers can boost the radiotherapy market. The need for efficient treatment alternatives rises in tandem with the number of cancer patients. One of the mainstays of cancer treatment is radiotherapy, which can be administered either on its own or in conjunction with other therapies like chemotherapy and surgery. The need for radiation services increases as the number of cancer patients receiving a diagnosis rises.

- According to the Journal of American Cancer Society, Worldwide, an estimated 19.3 million new cancer cases (18.1 million excluding nonmelanoma skin cancer) occurred in 2020. Female breast cancer had surpassed lung cancer as the most commonly diagnosed cancer, with an estimated 2.3 million new cases (11.7%), followed by lung (11.4%), colorectal (10.0 %), prostate (7.3%), and stomach (5.6%) cancers. Lung cancer remained the leading cause of cancer death, with an estimated 1.8 million deaths (18%), followed by colorectal (9.4%), liver (8.3%), stomach (7.7%), and female breast (6.9%) cancers. Overall incidence was from 2-fold to 3-fold higher in transitioned versus transitioning countries for both sexes, whereas mortality varied <2-fold for men and little for women.

Growing the adoption of radiotherapy devices and procedures

The growing adoption of radiotherapy devices and procedures can grow the radiotherapy market. The effectiveness and safety of treatment are improved by the ongoing development and use of cutting-edge radiation equipment and methods. Enhancing patient outcomes and reducing harm to surrounding healthy tissues, innovations like intensity-modulated radiation treatment (IMRT), stereotactic radiosurgery (SRS), and image-guided radiation therapy (IGRT) allow for more accurate targeting of malignancies. This promotes the use of these technologies by more healthcare professionals, hence growing the market.

Restraint

Lack of skilled professionals

The lack of skilled professionals to operate the radiotherapy may slow down the radiotherapy market. Medical physicists, radiologic technologists, and radiation oncologists are among the highly skilled individuals needed for radiotherapy in order to handle complicated equipment and guarantee precise treatment delivery. The number of patients that can be treated is limited by a lack of these specialists, which lowers the total capacity of radiation treatments.

Opportunity

Production of advanced technology

The advancement of technology in radiotherapy presents an opportunity to enhance the radiotherapy market. This includes the use of multileaf collimators, integrating imaging techniques such as positron emission tomography (PET) and computed tomography (CT), employing advanced dose calculation algorithms, and implementing delivery techniques that improve tumor dose distribution and reduce normal tissue toxicity. These advancements have the potential to boost the market.

Segment Insights

Type Insights

The external beam radiation therapy segment dominated the radiotherapy market by type in 2024. Technological advancements in EBRT include image-guided radiation treatment (IGRT), volumetric modulated arc therapy (VMAT), intensity-modulated radiation therapy (IMRT), and stereotactic body radiation therapy (SBRT). Because of these developments, external beam radiation therapy is now the recommended option for many cancer therapies because of its increased safety, efficacy, and accuracy. Because of its adaptability, external beam radiation therapy may be used to treat a variety of malignancies, such as those of the head and neck, breast, lung, and prostate. Its versatility to different tumor sizes and locations makes it a therapeutic option that is extensively used, which contributes to its supremacy. Due to its shown efficacy and comparatively reduced setup costs when compared to other cutting-edge therapies like proton therapy, EBRT has been implemented in many healthcare institutions, particularly in developed nations. This extensive accessibility has increased its broad availability.

The internal radiation therapy segment is expected to show notable growth in the radiotherapy market during the forecast period. The portion of internal radiation therapy is sometimes referred to as internal radiation therapy. By positioning radioactive sources inside or close to the tumor, internal radiation therapy enables very precise delivery of radiation doses. This improves therapeutic efficacy and reduces harm to nearby healthy tissues, improving patient outcomes. Internal radiation therapy is now being used to treat malignancies other than those that are typically treated with it, such as skin, rectal, and prostate cancer. Its acceptance and market expansion is accelerated by this wider range of applications. The safety and effectiveness of internal radiation therapy have been greatly increased by developments in imaging and delivery methods. Internal radiation therapy is becoming more and more popular among patients and physicians thanks to innovations like high-dose-rate (HDR) internal radiation therapy and the incorporation of imaging technology like MRI and CT for treatment planning.

End-user Insights

The hospitals & clinics segment dominated the radiotherapy market in 2024. Comprehensive cancer care, including diagnosis, treatment, and follow-up, is frequently offered by hospitals and clinics. They are the main locations for cancer treatment because they have the facilities and tools needed to provide a variety of radiation services. Modern radiation technology, including linear accelerators, CT simulators, and MRI equipment, is usually found in hospitals and clinics. The patients looking for the newest and most efficient treatments are drawn to them because of their capacity to purchase and maintain cutting-edge technology.

The other segment is expected to grow rapidly in the radiotherapy market during the forecast period. The other category includes outpatient radiation centers, research institutes, and specialty cancer centers. Modern radiation therapies and technologies are frequently provided by specialized cancer clinics and outpatient radiotherapy facilities, which concentrate solely on the treatment of cancer. The patients seeking specialized cancer care are drawn to them because of their specialty, which enables them to perform radiation therapy with a high degree of knowledge and efficiency. The specialized facilities and research institutes are frequently at the forefront of innovative radiation practices. They take part in research investigations and clinical trials that result in the implementation of state-of-the-art procedures and technology. Their capabilities and attractiveness are improved by their ongoing innovation. The patients can receive treatment at outpatient radiation clinics without having to be admitted to the hospital, which is convenient for them. This type is especially attractive to patients who need frequent radiation treatments, which is helping to propel this market forward.

Regional Insights

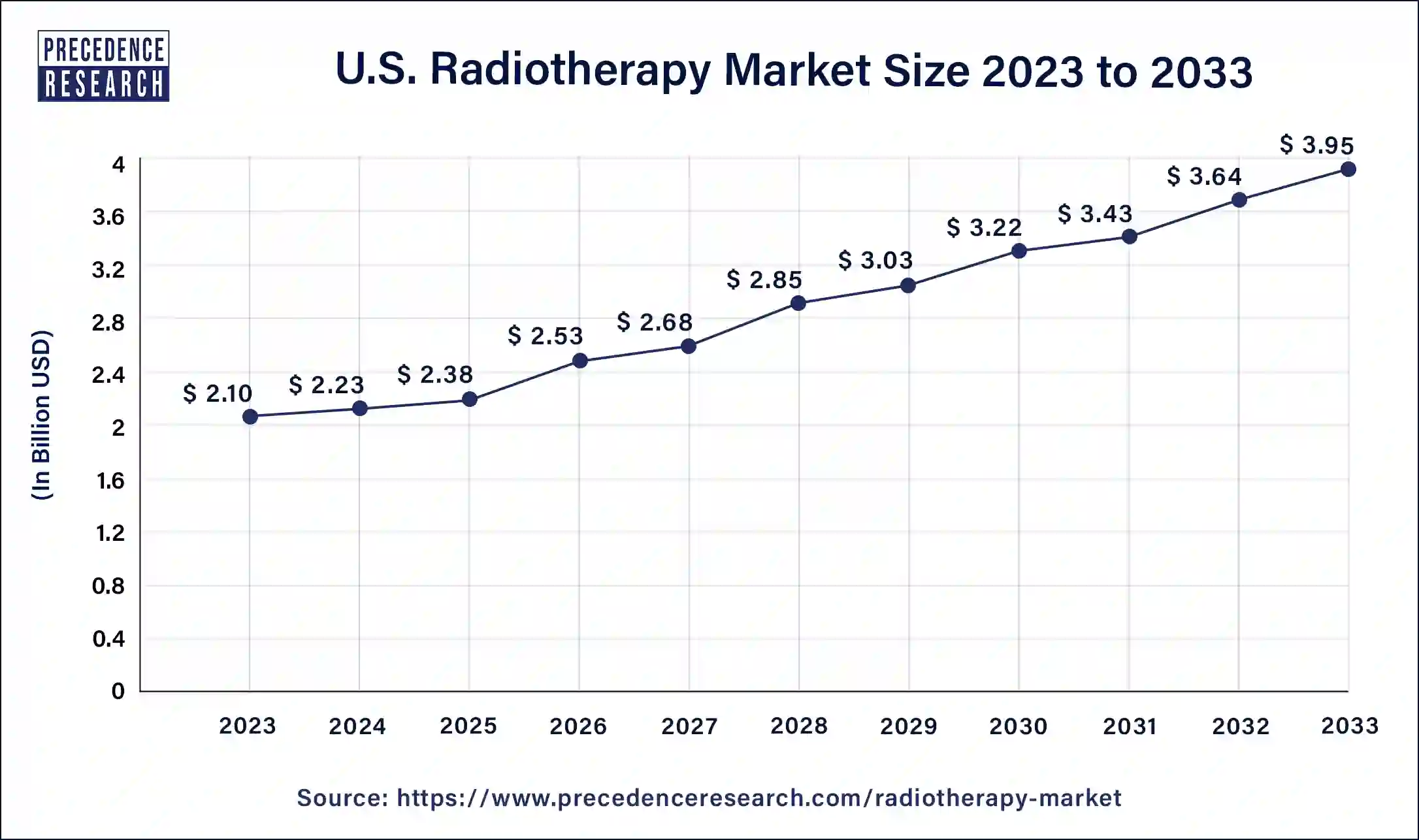

U.S. Radiotherapy Market Size and Growth 2025 to 2034

The U.S. radiotherapy market is estimated at USD 2.38 billion in 2025 and is predicted to be worth around USD 4.19 billion by 2034, at a CAGR of 6.51% from 2025 to 2034.

North America dominated the radiotherapy market in 2024. The healthcare infrastructure in North America, especially in the U.S. and Canada, is highly developed and facilitates the use of advanced medical treatments like radiotherapy. Due to the high level of healthcare spending in the area, large investments in advanced radiotherapy facilities and equipment are possible. The innovation and research in medicine are centered in North America. North America is home to several important research institutes and producers of radiotherapy treatment equipment, which propels innovation and the early uptake of new technology.

- In October 2023, The University of Texas Health Science Center at San Antonio (UT Health San Antonio) announced the successful launch of Pluvicto, a radiopharmaceutical used to treat patients with advanced metastatic prostate cancer.

- In February 2024, the American Oncology Institute launched the Halcyon Machine, an advanced radiotherapy machine at Nangia Speciality Hospital. The Halcyon Machine is known for its special and efficient therapy, which signifies a paradigm shift in cancer treatment technology that enhanced the patient's comfort, reduced the time of treatment, and superior treatment technology that simplifies critical techniques such as craniospinal irradiation for patients with central nervous system malignancies.

Asia Pacific is expected to grow at the highest CAGR in the radiotherapy market during the forecast period. One of the main factors driving the need for radiotherapy in the region is the rising incidence of cancer. Due to aging populations, changing lifestyles, and other risk factors, countries like China and India have noticed an increase in cancer cases, leading to the need for more advanced treatment options like radiotherapy. Proton therapy, intensity-modulated radiation therapy (IMRT), and image-guided radiotherapy (IGRT) are among the advanced radiotherapy technologies being adopted in Asia Pacific. By providing more individualized care, these technologies improve patient outcomes and spur the radiotherapy market expansion.

Why did Europe expand at a robust rate in the radiotherapy market?

Europe expanded at a robust rate due to its cooperative focus on upgrading older cancer centers and to the implementation of new radiotherapy equipment to treat cancer. Countries spent heavily on precision treatment, AI planning tools, and the establishment of proton therapy centers. Strong regulations supported the high quality of treatment. The region also benefited from active cancer research programs that collaborated with universities, hospitals, and technology companies. Increased opportunities emerged in portable radiotherapy devices, digital treatment planning, and cancer care solutions that included screening early for cancer.

Germany Radiotherapy Market Trends

Germany led the European market due to its well-developed hospital systems, extensive public funding for cancer research, and early adoption of advanced radiotherapy technologies. The nation focused on building new proton therapy centers and working with advanced planning systems for the treatment of cancer. Training programs for oncologists continue to enhance patient care. Germany also assists manufacturers of medical equipment as they develop and expand the export of radiotherapy technologies.

Why did Latin America experience considerable growth in the radiotherapy market?

Latin America experienced considerable growth because many countries were increasing their investment in cancer care and enhancing their hospital infrastructure. The governments took steps to address treatment delays caused by shortages of radiotherapy centers by opening new radiotherapy centers. The growth of medical tourism and partnerships with international equipment manufacturers helped stock hospital equipment. There were also major opportunities in more affordable radiotherapy systems, training new technicians, and mobile cancer screening programs that reached rural populations throughout Latin America.

Brazil Radiotherapy Market Trends

Brazil led the Latin American market overall, as the largest healthcare system in the region, increasing the number of cancer treatment centers. The government also invested in new radiotherapy machines that decreased patient wait times. Private hospitals also more fully embraced new advanced technologies and improved the quality of care. Brazil also benefited from significant partnerships with global cancer organizations that supported training and equipment availability.

What made the Middle East & Africa region experience steady growth in the radiotherapy market?

The Middle East & Africa region experienced steady growth over the last 5 years as governments built advanced cancer centers and worked at improving access to treatment. Wealthier countries in the Gulf built modern oncology hospitals and added new radiotherapy machines. African countries prioritized expanding basic radiotherapy services. Beyond direct patient treatment, significant opportunities emerged within training programs, affordable radiotherapy equipment, and international partnerships that contributed to strengthening the infrastructure in cancer care across the region.

The UAE Radiotherapy Market Trends

The UAE led the region because it constructed advanced cancer centers and adopted modern radiotherapy systems at a faster rate than others. The UAE invested significantly in the healthcare system, as academics and the government actively sought to form partnerships with global technology companies. Medical tourism increased as international patients had more trust in the country to provide high-quality and effective oncology services.

Radiotherapy Market Companies

- Eckert & Ziegler Group

- Elekta AB

- Ion Beam Applications SA

- Becton, Dickinson, and Company

- MEVION MEDICAL SYSTEMS, INC.

- Isoray, Inc.

- Siemens Healthineers AG

- ICAD INC.

- Accuray Incorporated

- Nordion Inc.

Recent Developments

- In May 2024, The SoR worked alongside other professional bodies to develop a policy advisory on the provision of radiotherapy in the UK and is urging ministers to heed its recommendations. The Society of Radiographers, the Royal College of Radiologists, and the Institute of Physics and Engineering and Medicine have collaborated to launch the “Recovering Radiotherapy Services in England: Our Plan for Action” guide.

- In July 2023, American Oncology Institute (AOI) Hyderabad launched Ethos Radiotherapy, an advanced radiotherapy equipment to treat cancer patients. Manufactured by the U.S.-based Varian Medical Systems, Ethos Radiotherapy applies Artificial Intelligence and Machine Learning to generate adapted plans within minutes to guide doctors while the patient is still undergoing treatment.

- In June 2023, The Hitec City branch of Yashoda Hospital launched an MRI-guided radiotherapy unit for cancer treatment. The technology, combining magnetic resonance imaging (MRI) with precise radiation delivery, is the country's first Unity MR Linac, the hospital said.

Segment Covered in the Report

By Type

- External Beam Radiation Therapy

- Internal Radiation Therapy

- Systemic Radiation Therapy

By End-user

- Hospitals and Clinics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting