What is the Rolling Stock Market Size?

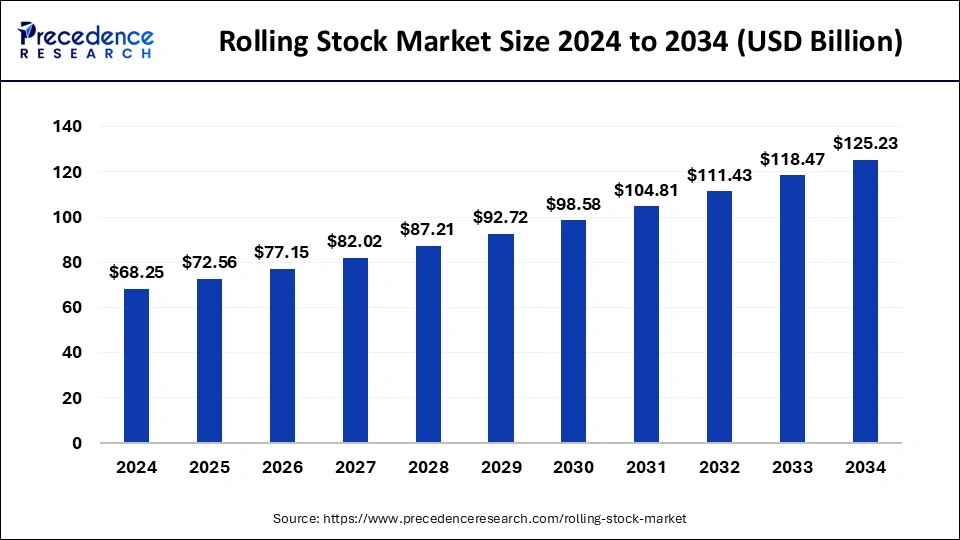

The global rolling stock market size is calculated at USD 72.56 billion in 2025 and is predicted to increase from USD 77.15 billion in 2026 to approximately USD 125.23 billion by 2034, expanding at a CAGR of 6.26% from 2025 to 2034.

Rolling Stock Market Key Takeaways

- The global rolling stock market was valued at USD 68.25 billion in 2024.

- It is projected to reach USD 125.23 billion by 2034.

- The rolling stock market is expected to grow at a CAGR of 6.26% from 2025 to 2034.

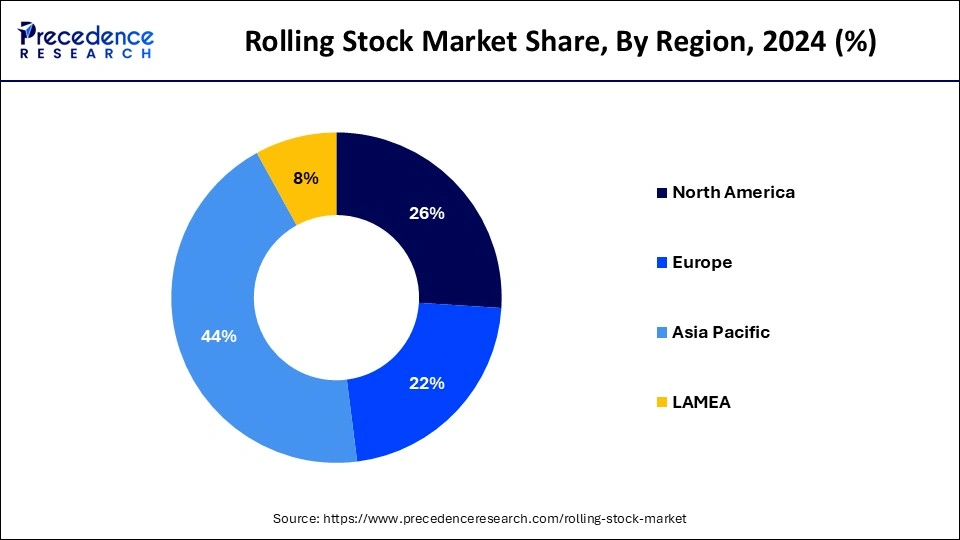

- Asia Pacific dominated the market with the largest revenue share of 44% in 2024.

- North America is expected to host the fastest-growing market during the forecast period.

- By type, the metro segment has held a major revenue share of 22% in 2024.

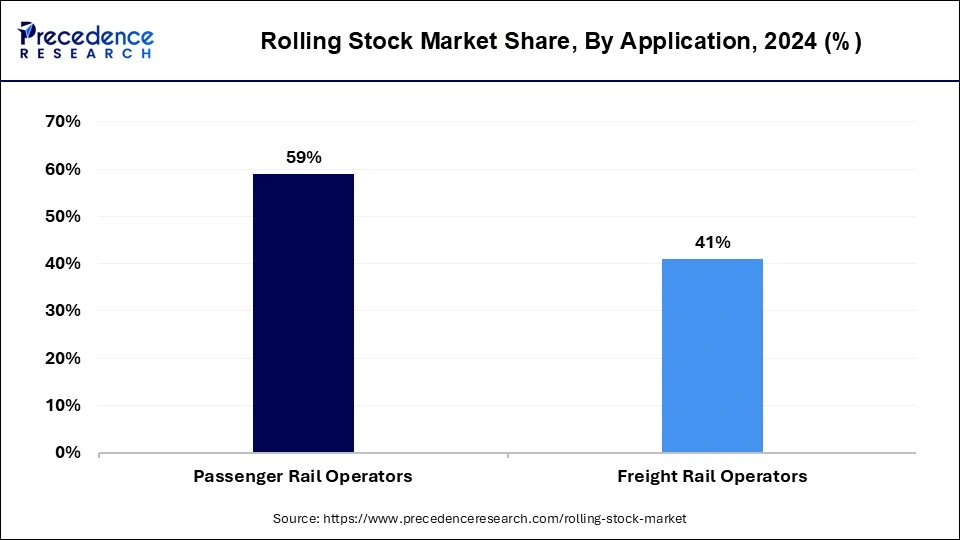

- By application, the passenger rail operators segment has contributed more than 59% of revenue share in 2024.

- By application, the freight rail operators segment is expected to grow at the highest CAGR in the market during the forecast period.

Rolling Stock Market: Vehicle Type, Population Systems, and Major Companies

The rolling stock market refers to the vehicles that travel on a railroad track, which are referred to as rolling stock. It includes all-wheeled vehicles, powered and un-powered, that are utilized on railroads. They are run by electricity from third rails that have been electrified or from overhead wires. Diesel engines are commonly employed in situations where electricity wires are not accessible.

Historically, steam power was largely utilized by historic railroads. Long-distance passenger transportation is provided by coaches and carriages, which are frequently furnished with seats, bathrooms, and occasionally sleeping quarters. The multiple units, often known as electric multiple units (EMUs) or diesel multiple units (DMUs), are self-propelled carriages that are frequently utilized for regional and suburban services. The metro Cars are made especially for metropolitan metro systems, which frequently operate in high-frequency, high-capacity settings.

The rolling stock market is fragmented with multiple small-scale and large-scale players, such as ABB, Alstom, American Industrial Transport, Inc., Bombardier, CAF, Construcciones y Auxiliar de Ferrocarriles, S.A., Caterpillar, CRRC Corporation Limited, Hitachi, Ltd., Hyundai Rotem Company, Japan Transport Engineering Company, Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, National Steel Car Limited.

Rolling Stock Market Trends

- The increasing demand for eco-friendly and sustainable solution in transportation amid rising environmental concerns un regions drives the growth of the market.

- Expanding global rail network and globalization the demand for rolling stock is growing and which is aligning with the expansion of the rolling stock market.

- The demand for urban transportation which is fast, comfortable and reliable with travel options within city subway drives the market and supports the growth.

- Heavy investment by rolling stock leasing companies in the operation and production supports the growth of the market.

Rolling Stock Market Growth Factors

- The rising preference for railway transportation can boost the rolling stock market.

- The growing trend of switching from diesel to electric and electro-diesel locomotives can grow the rolling stock market.

Market outlook

- Industry Growth Offerings- The market grows through advanced propulsion systems, digital monitoring, energy-efficient designs, and automation. Manufacturers focus on sustainability, upgraded rail infrastructure, smart maintenance, and expanding fleets to meet rising passenger demand, freight capacity needs, and global rail modernization goals.

- Global Expansion- Global expansion is driven by large-scale rail infrastructure projects, cross-border connectivity initiatives, and strategic partnerships among OEMs. Emerging markets in Asia, Middle East, and Africa are boosting procurement of modern trains, metro units, and freight wagons.

- Startup Ecosystems- The rolling stock startup ecosystem is emerging with companies focusing on innovative train technologies, automation, energy efficiency, and smart rail solutions. Startups are attracting investments and partnerships to modernize rail transportation and improve operational efficiency.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 125.23 Billion |

| Market Size in 2025 | USD 72.56 Billion |

| Market Size in 2026 | USD 77.15 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.26% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increase in the need for a safe, effective, and secure transportation system

The increase in the need for a safe, effective, and secure transportation system can boost the rolling stock market. Therefore, a major factor in the expansion of the global market is the growing requirement for a safe, secure, and effective transportation system. Since trains are thought to be the most affordable and safest form of transportation, demand for railroads has increased.

The World Health Organization (WHO) fact sheet states that among those between the ages of 15 and 29, traffic injuries are the primary cause of mortality, translating to 1.25 million road accident-related deaths annually. Furthermore, low- and middle-income nations account for 90% of global road deaths while possessing around 54% of the world's vehicle fleet.

Restraint

Increasing the maintenance of the current rolling stock

The increasing the maintenance of current rolling stock may slowdown the rolling stock market. These days, end users are gravitating toward the availability of resources to advance society. However, rolling stock restoration projects offer a great way to finish overhauling the present fleet. Therefore, rail operators are not buying new cars. It may impede the rolling stock market's growth in the next years.

Opportunity

Increase in funding allocated for railway development

By devoting a larger budget, emerging nations like China, India, and others are concentrating on building their railway infrastructure. In the same vein, other nations across the world are consistently raising their budgets for rail in order to implement cutting-edge technologies and upgrade their infrastructure.

- The UK government spent more than $6.28 billion (£5.3 billion) in 2019 and 2020 on upgraded and new rail equipment.

- In India, the railways were allotted a budget of approximately $15.06 billion (?1.10 lakh crore) for the financial year 2021–2022, with a total capital expenditure outlay of $30.80 billion (?2.15 lakh crore). This indicates a 33% increase in total capital expenditure for 2021–2022, over $22.4 billion (?1.61 lakh crore) for 2020–21.

Segment insights

Type Insights

The metro segment held a significant share of the rolling stock market in 2024. Global urbanization is accelerating, particularly in emerging nations, which has increased the need for effective urban transportation networks. In highly populated cities, metros are necessary to provide dependable mass transit and to ease traffic congestion. The metros are a great option for high-capacity public transportation because of their high population concentrations in metropolitan regions. As part of larger urban infrastructure projects, governments are making significant investments in the growth and development of metro networks.

The objectives of these initiatives are to solve transportation-related issues and enhance urban mobility. The funding and support for metro developments have risen as a result of policies that favor public transportation over private automobiles as a means of reducing pollution and traffic. By reducing the number of private automobiles on the road, metros are viewed as a sustainable form of transportation that helps minimize carbon emissions. Creating environmentally friendly urban transportation networks is becoming more and more important.

The metros fit in nicely with these sustainability objectives since they are less polluting and use less energy. The metro systems are now more appealing and effective thanks to developments in automation, intelligent signaling systems, and energy-efficient design. The attraction of metro systems has risen due to enhanced safety measures, real-time information systems, and greater passenger comfort.

Application Insights

The passenger rail operators segment dominated the rolling stock market in 2024. In many regions of the world, the rate of urbanization is increasing, which has increased demand for effective urban public transportation systems, such as light rail, subway, and train systems. In order to move large numbers of people effectively, there is an increased demand for high-capacity transportation options due to growing populations, especially in metropolitan regions.

Governments all throughout the world have been making significant investments in public transportation infrastructure in an effort to improve urban mobility, cut carbon emissions, and ease traffic congestion. This covers financing for both brand-new passenger rail initiatives and the updating of already existing train networks. In order to achieve more general environmental and sustainability goals, several governments have put rules in place to encourage the use of public transit rather than private automobiles.

The freight rail operators segment is expected to grow at the highest CAGR in the rolling stock market during the forecast period. International trade is still expanding, which has raised the need for dependable and effective freight transportation. For huge volumes of commodities across long distances, rail freight is frequently more economical and ecologically benign than other means of transportation. Strong rail freight infrastructure is becoming more and more necessary to facilitate the effective flow of products as global supply chains become longer and more complicated.

The amount of items that require transportation has expanded dramatically due to the growth of e-commerce. When transferring massive amounts of cargo between regions and from distribution hubs to metropolitan areas, rail freight is an effective option. In order to manage the large amounts of commodities connected with e-commerce, investments in freight rail have been driven by the necessity for effective distribution networks and logistics.

Regional Insights

Asia Pacific Rolling Stock Market Size and Growth 2025 to 2034

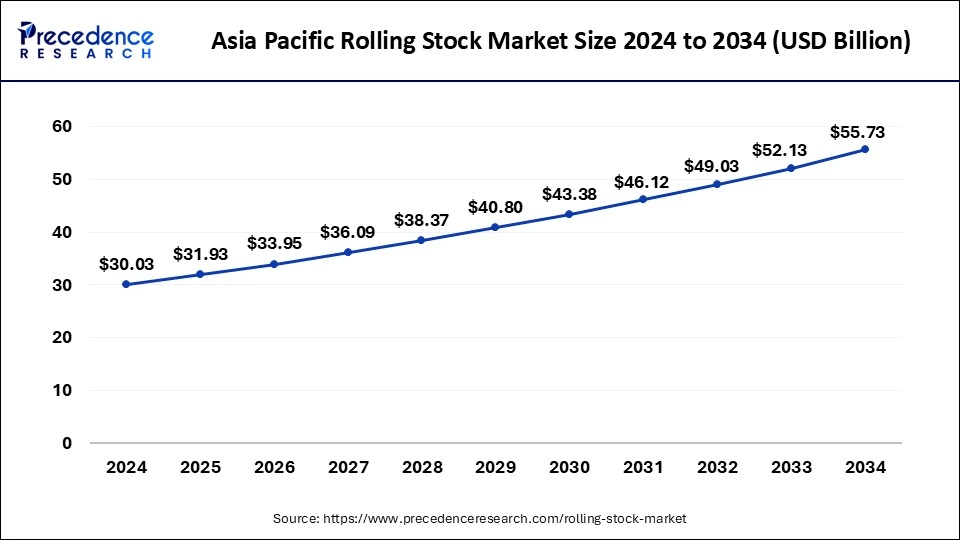

The Asia Pacific rolling stock market size is exhibited at USD 31.93 billion in 2025 and is projected to be worth around USD 55.73 billion by 2034, poised to grow at a CAGR of 6.38% from 2025 to 2034.

How Urbanization and Infrastructure Investment Boosted Asia Pacific's Rolling Stock Market

Asia Pacific held the largest share of the rolling stock market in 2024. Significant urbanization has been occurring in several Asia Pacific nations, especially China and India. The need for effective, high-capacity public transportation systems, such as trains and metro systems, has grown as a result. These nations' rapid economic progress has made large expenditures in infrastructure projects, including the creation and extension of rail networks, possible.

To improve their transportation infrastructure, governments in Asia Pacific have introduced a number of programs and regulations. For instance, significant rail projects are part of China's Belt and Road Initiative, which aims to increase connectivity throughout the area. Many nations in the area have made investments in high-speed rail projects, including China's CRH, Japan's Shinkansen, and the upcoming high-speed train connection between Kuala and Banglore.

Why North America is Emerging as the Fastest-Growing Rolling Stock Region?

North America is expected to host the fastest-growing rolling stock market during the forecast period. The governments of the United States, Mexico, and Canada have been investing heavily in modernizing and growing their rail networks. The American Jobs Plan, for example, provides significant financing for rail infrastructure modernization.

Advanced Rail Technologies Accelerate U.S. Rolling Stock Growth

In the United States, there are high-speed rail projects that are either underway or proposed, such as the California High-Speed Rail project and possible lines in Texas and the Northeast, which support market expansion. The expansion is anticipated to be driven by the use of cutting-edge technology, includingelectrification, automated systems, and energy-efficient trains. These developments raise the attraction and efficiency of rail transportation. Increased procurement is a result of the need to replace outdated rolling stock with more contemporary, effective, and ecologically friendly options.

Why is China's Rolling Stock Market Growing so Rapidly?

China's market is growing due to massive investments in high-speed rail, urban metro expansion, and intercity connectivity projects. Government-led infrastructure development, rising passenger demand, and modernization of existing fleets are accelerating the adoption of advanced EMUs, metro cars, and freight wagons. Additionally, strong domestic manufacturing capabilities, technology innovation, and export-oriented production by companies like CRRC further support market expansion.

What factors Are Powering the Expansion of Europe's Rolling Stock Market?

Europe's market is expanding due to increasing investment in sustainable transportation, modernization of aging rail fleets, and strong emphasis on reducing carbon emissions. The rise of high-speed rail, cross-border connectivity projects, and urban metro upgrades is boosting demand for advanced EMUs, metro cars, and hybrid locomotives. Additionally, supportive EU policies, technological innovation, and the presence of leading manufacturers like Alstom and Siemens are driving steady market growth.

Why is the UK Rolling Stock Market Experiencing Strong Growth?

The UK market is increasing due to continued investments in railway modernization, electrification projects, and replacement of aging train fleets. Expansion of intercity, commuter, and metro networks—along with upgrades for greener, more energy-efficient trains is driving new procurement. Government-backed initiatives, rising passenger demand, and a shift toward digitalized, low-emission rolling stock are further accelerating market growth across the country.

Value Chain Analysis

Raw Material Sourcing

- Rolling stock manufacturing depends on securing core materials like steel, aluminum, and lightweight composites.

- Material selection varies by train type, with modern rail vehicles increasingly using lighter options to boost speed, reduce energy use, and support sustainability goals.

- A strong and stable supply chain is essential to maintain consistent material quality and avoid production delays.

- Raw materials form a major share of total manufacturing costs, making strategic sourcing crucial.

Key Players: ArcelorMittal, Nippon Steel, Alcoa, POSCO, Toray Industries

Component Manufacturing

- Rolling stock manufacturing includes creating essential components such as traction motors, braking systems, bogies, and structural assemblies.

- It also covers advanced subsystems like electrical wiring, control electronics, HVAC units, and interior fittings.

- Precision engineering and high-quality standards are crucial to ensure safety, durability, and performance across all components.

- Collaboration with specialized suppliers helps manufacturers meet technical, regulatory, and customization requirements.

Key Players: Siemens Mobility, Alstom, Bombardier (Alstom), Hitachi Rail, Wabtec Corporation

Testing and Quality Control

- Involves multi-stage evaluation across design, parts, and full system levels.

- Ensures trains meet strict safety, durability, and operational standards.

- Checks include mechanical testing, electrical validation, braking efficiency, and environmental endurance.

- Verifies reliability before large-scale manufacturing and deployment.

Key Players: CRRC, Siemens Mobility, Alstom, Hitachi Rail, Stadler Rail, Bombardier

Rolling Stock Market Companies

- Alstom Transport: Alstom delivers integrated rolling stock solutions, including high-speed trains, metros, trams, and locomotives. The company also provides signaling, digital mobility services, and long-term maintenance, focusing on energy-efficient, modern, and connected rail systems for global markets.

- GE Transportation: GE Transportation (now part of Wabtec) offers advanced diesel-electric locomotives, digital rail optimization systems, and freight solutions. Their portfolio includes predictive maintenance, automation technologies, and fuel-efficient propulsion systems tailored for heavy-haul and passenger operations.

- Stadler Mobility: Stadler manufactures customized rail vehicles such as regional trains, metros, trams, and narrow-gauge units. They focus on lightweight designs, low-noise operation, and modular technology with strong after-sales services, including modernization and maintenance support.

- Trinity Rail:Trinity Rail specializes in freight railcars, tank cars, and intermodal solutions. The company provides leasing, fleet management, and maintenance services, delivering durable rolling stock optimized for bulk commodities, chemicals, energy products, and logistical efficiency.

Other Major Key Players

- CRRC Corporation Limited

- Hitachi Rail System

- Hyundai Rotem

- Kawasaki Heavy Industries, Ltd.

- Siemens Mobility

- The Greenbrier Co.

Recent Developments

- In May 2025, Massachusetts Bay Transportation Authority (MBTA) in partnership with Keolis launched a diesel pilot programme to asses alternative fuel use on part of the Commuter Rail fleet in the Greater Boston region. The initiative is to use sustainable chemicals in place of the traditional diesel, which is Hydrotreated Vegetable Oil (HVO), which is extensively produced from vegetable oil and animal fat waste, which also helps in reducing carbon emissions in comparison to that of petroleum-based fuels, which aligns with the environmental concerns. ( Source: https://railway-news.com )

- In February 2025, Serbia is set to invest 90 million euros in railway rolling stock modernization, the state has signed a loan agreement with the European financial institution, for the development of its railway transport, which will commence with improved train quality and passenger comfort. The company will use the money to acquire six electric locomotives which will help in expanding technical capabilities of transport. ( Source: https://www.railway.supply

In February 2024, Siemens Mobility launched a smart train lease GmbH, which aims to revolutionize the regional rail transportation sector through innovation in the lease mode. This marks as a sustainable initiative in rail stock by introducing flexible rentals of cutting edge-battery, electric multiple unit trains and hydrogen. This shift towards sustainable and eco-friendly transportation is in increasing demand. ( Source: https://urbantransportnews.com ) - In March 2024, Caltrain retired 32 diesel passenger cars ahead of the launch of its new electric fleet. Caltrain's new electric trains will replace the retired diesel units, which are nearly 40 years old. These old units have now been shipped to Sonoma, California, to be stored in Petaluma with Sonoma-Marin Area Rail Transit (SMART) until a buyer is found.

- In February 2024, German rolling stock manufacturer Siemens Mobility founded a leasing subsidiary to allow for short notice and flexible use of its Mireo Smart trains in Europe. The Smart Train Lease (STL) subsidiary will offer the battery, hydrogen, and electric versions of the multiple-unit trains for rental at short notice, with the service initially beginning in Germany ahead of a planned expansion through Europe “in the medium term.”

- In April 2023, The Smart Rolling Stock Maintenance Research Facility (SRSMRF) inside the University's Institute of Railway Research (IRR) was part of a £1.8 million project to investigate how cutting-edge technology and data analysis can improve the efficiency and reliability of how the UK's railway rolling stock is maintained.

- In February 2023, Stadler Rail AG collaborated with Utah State University and ASPIRE Engineering Research Centre to build a battery-powered passenger train based on the FLIRT Akku concept. Within the scope of the project are the creation, construction, and testing of a two-car multi-unit powered by a FLIRT Akku battery.

- In January 2022, MASU, a top producer of friction products for the rail and automobile industries, was purchased by Wabtec Corporation. Wabtec Corporation will be able to increase its installed base and accelerate the expansion of its braking product line thanks to this purchase.

Segment Covered in the Report

By Type

- Locomotive

- Diesel

- Electric

- Electro-diesel

- Others

- Metro

- High-speed Trains

- Tramway

- Passenger Railroad Cars

- Others

By Application

- Passenger Rail Operators

- Freight Rail Operators

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content