What is the Set Top Box Market Size?

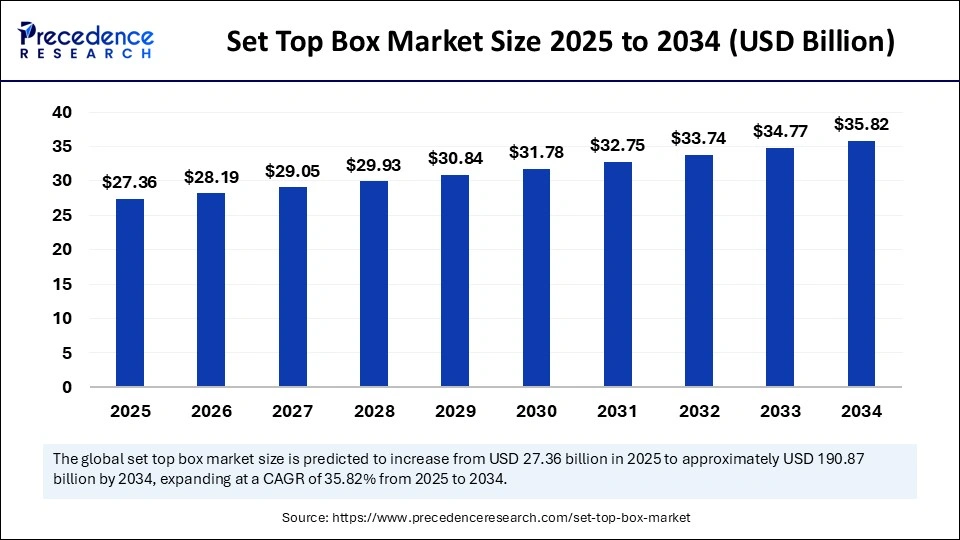

The global set top box market size accounted for USD 27.36 billion in 2025 and is predicted to increase from USD 28.19 billion in 2026 to approximately USD 36.86 billion by 2035, expanding at a CAGR of 3.03% from 2026 to 2035. The global market is propelled by the rapid adoption of OTT platforms, smart ecosystems, and high-speed internet.

Set Top Box Market Key Takeaways

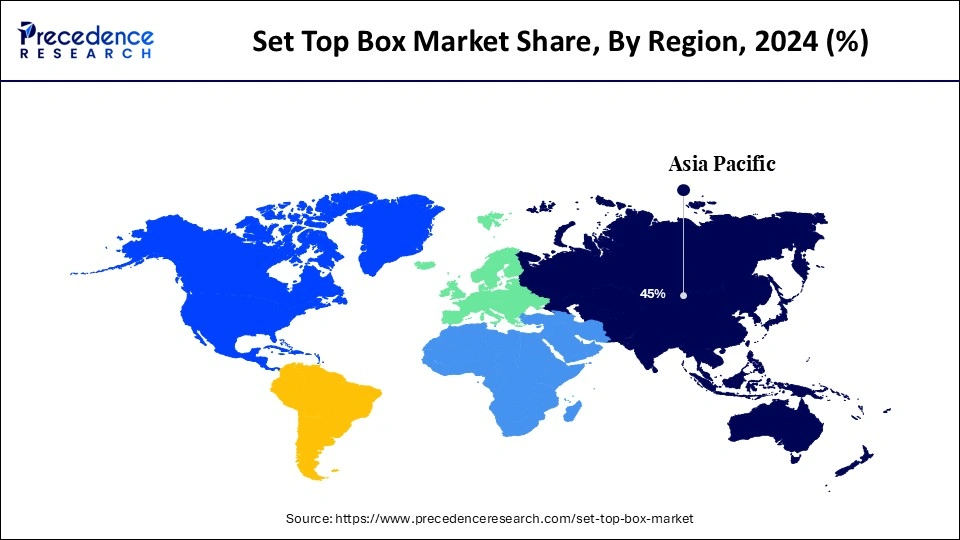

- Asia Pacific dominated the global market with largest market share of 45% in 2025.

- North America is anticipated to witness the fastest growth during the forecasted years.

- Europe emerged as a significant player in the global market.

- By product, the OTT segment held a significant market share in 2025.

- By product, the cable segment is anticipated to show considerable growth over the forecast period.

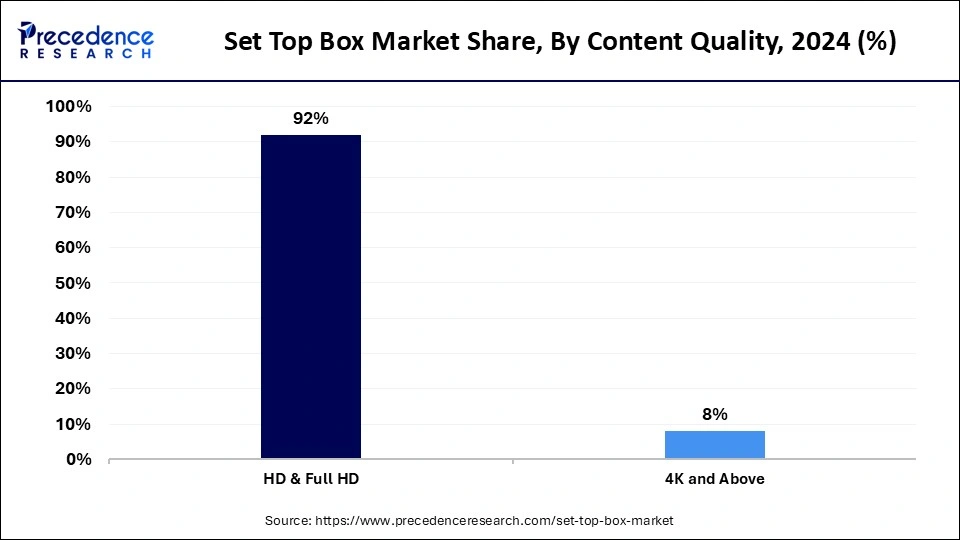

- By content quality, the HD and full HD segments contributed the biggest market share of 92% in 2025.

- By content quality, the 4K and above segment is anticipated to show considerable growth in the forecast period.

- By operating system, the Linux segment held a significant share in 2025.

- By operating system, the Android segment is anticipated to show considerable growth over the forecast period.

- By application, the residential segment generated the major market share in 2025.

- By application, the commercial segment is anticipated to show considerable growth in the market over the forecast period.

- By distribution channel, the offline segment held a significant market share in 2025.

- By distribution channel, the online segment is anticipated to show considerable growth over the forecast period.

Artificial Intelligence Integration in the Set-Top Box Market

The implementation of artificial intelligence systems by set top box producers serves to satisfy customers also enhances the operational efficiency of their production facilities. STB vendors apply AI technologies to deliver personal content suggestions while decreasing operational expenses and enhancing information transportation features. Voice recognition technology allows users to execute managerial tasks on channels while watching the weather forecast while listening to music, and tracking signal strength through verbal commands.

Market Overview

Physical television displays require a set top box (STB) to access digital broadcasting. Set-top boxes enable the conversion of standard televisions into updated multimedia controllers required by modern homes in commercial operations. The modern media environment requires set top boxes to have flexible viewing options since they must handle streaming content delivery.

This sector grows steadily because digital broadcasting trends increase, and smart televisions gain widespread use as digital forms of content exceed analog solutions in customer interest. Digital set top boxes gained increased popularity among consumers because they added voice recognition and cloud DVR features with 4K streaming abilities. The set top box market shows strong growth prospects because of technology improvements and better connectivity, together with increasing consumer interest in digital content.

Set Top Box Market Growth Factor

- Adoption in Commercial Spaces:These devices continue their market growth outside residential zones because hotels, hospitals, and waiting areas use them to broadcast content as well as offer customized entertainment services.

- Rising Demand for High-Quality Home Entertainment:Upgraded television technology purchases stem from improved household finances, which makes the digital set top boxes desirable because users get high-quality viewing and access to premium content and streaming services, and interactive features.

- Growth of E-commerce:Online shopping provides customers with different options and customer evaluation results during the shopping process, which expands electronic sales throughout urban and rural areas.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 36.86 Billion |

| Market Size in 2025 | USD 27.36 Billion |

| Market Size in 2026 | USD 28.19 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.03% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Content Quality, Operating System, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Adoption of OS-based set top boxes

Operating system-based set top box installation rates drive the expansion of the worldwide set top box market. Manufacturers in this market segment have selected either Android TV or RDK (Reference Design Kit) platforms to create entertainment delivery systems that provide connected, dynamic user experiences to consumers. The evolution of STBs created multifunctional entertainment platforms that customers now use.

Modern television systems deliver an improved user interface that combines advanced recommendation systems and voice-controlled functionality to create better user interactions. The market transition supports dual service models where consumers can access conventional pay-TV services and OTT content, thus providing viewers more flexibility and diverse content choices.

Restraint

High cost of advanced STB capabilities

Advanced set top boxes have expensive features that act as limitations to market growth because they include 4K resolution, HDR support, voice control, and smart integration technologies. User-friendly features in set top boxes represent a market restriction since they establish pricing thresholds that block price-sensitive customers from developing market purchases. Most purchasing decisions in emerging markets are direct results of product affordability since these customers demonstrate extreme sensitivity to prices.

Opportunity

Expansion in emerging markets

Due to digital innovation and customer behavior changes, the set top box market can discover major business opportunities in emerging markets. STB system subscribers are rising throughout Asia, Latin America, and Africa because governments support digitalization through income growth and internet accessibility expansion. STBs with modern HD and UHD support, along with streaming capabilities, have become fundamental because the market for high-definition and smart televisions continues to grow quickly in these regions. The primary advantages of STBs attract customers from these regions through integrated features that support voice commands, together with smart home functions and application store facilities.

Segment Insights

Product Insights

The OTT segment held a significant set top box market share in 2025. The technological developments of streaming services equipped OTT platforms with better viewing options, such as high definition image quality, improved audio quality, and time-shifting capabilities. The OTT segment will continue dominating the market because of its fast-growing viewership and ongoing technological progression.

The cable segment is anticipated to show considerable growth over the forecast period. Cable providers have adjusted their operations for modern times by implementing STB-based features that include HD channels, personalized, and interactive viewing functionality. The combination of traditional broadcasting features with streaming platform capabilities makes cable providers sustain their market position. Rural populations continue to depend on cable TV service because they lack sufficient internet connectivity; thus, cable maintains its relevance.

Content Quality Insights

The HD and full HD segments donated the largest set top box market share in 2025. HD content is available through multiple broadcasting systems, including cable, satellite, and IPTV, so broadcasting services widely use it as their primary resolution standard. The devices attract more users through built-in features that enable digital video recording services along with streaming solutions. The worldwide household market selects HD STBs because they provide outstanding visual quality and robust audio output to fulfill consumers' rising need for premium viewing experiences.

The 4K and above segment is anticipated to show considerable growth in the forecast period. High-resolution displays on these products enable superior image quality by producing intense colors with enhanced definition to meet customers who value technological innovations. Multiple platforms are enabling 4K content access through streaming services, broadcasters, and content providers, thus creating rising demand because of their ongoing delivery of 4K content. Set-top box marketing experiences a technological surge with this crucial development, which drives the industry into cutting-edge entertainment while fostering sustained set top box technical advancements.

- In August 2024, Jio released its home-grown TV operating system, Jio TVOS, for the Jio Set-top Box. The software update introduced an enhanced Hello Jio voice assistant through AI processing to offer users a refined third-party application launching experience with Netflix and other services as examples.

Operating System Insights

The Linux segment held a significant share of the set top box market in 2025. Linux permits manufacturers to reduce costs with customizable options, and it also provides flexibility to developers who can create set top boxes with custom features for an updated user experience. This flexibility and cost efficiency make Linux a popular solution for manufacturers who want to furnish value-added services to their customers. The widespread implementation of Linux in set top boxes importantly contributes to the overall growth of the industry, particularly in low-cost regions.

The Android segment is anticipated to show considerable growth over the forecast period. This rise is being driven by the rise of OTT platforms and video-sharing services, which are already pre-loaded in Android devices. In addition, a further boost to this growth is from the switch-over to smart TVs, where Android set top boxes provide smart functionality, such as the ability to install apps, use voice commands, and stream content. This gives consumers better features and connectivity potential, increasing demand for set top boxes in residential and business markets, contributing to growth in the market.

Application Insights

The residential segment donated the largest set top box market share in 2025. The robust market position is fueled by the extensive use of digital television services in homes, which has greatly boosted the need for set top boxes to access cable, satellite, and internet content. As high-definition, ultra-high-definition, and 4K televisions become increasingly popular, consumers need compatible set top boxes to fully enjoy improved viewing experiences. As the utility of set top boxes is dependent on the flexibility and multi-functionality in conjunction with the need for improved audio and visual quality, exhibiting devices are becoming more integrated into our home environments, which adds to the overall growth for this market.

The commercial segment is anticipated to show considerable growth in the market over the forecast period. The adoption of a set top box will also continue to grow as companies and organizations adopt them more frequently to use for multiple forms of functions that include displaying information, video conferencing, and digital signage content. Set-top boxes expand the ability to be connected to multiple televisions and being able to provide a high-quality content experience on a variety of usages for business applications, making them a reasonable option for these particular industries, like restaurants, bars, hotels, and corporate office environments.

Distribution Channel Insights

The offline segment held a significant set top box market share in 2025. The physical presence of trained sales staff lets consumers receive assistance to understand product features and get help during installation, while fixing any product-related issues. People feel more confident about their purchases because they can examine set top boxes directly before buying, at which time they can check both the quality standards and operational functionality by touch. Most consumers decide to buy set top boxes through offline channels because these channels provide them with both physical inspection convenience and instant purchase options.

The online segment is anticipated to show considerable growth over the forecast period. Home consumers can shop multiple set top boxes through e-commerce platforms from their residences and discover this as a suitable alternative to physical retail stores. Market-aware consumers use this channel because it delivers products directly to their homes as well as offering various benefits through discounts and shipment freebies. The changing consumer behavior shows that people choose to make purchases online instead of going to stores because e-commerce provides better flexibility and convenience.

Regional Insights

What is the Asia Pacific Set Top Box Market Size?

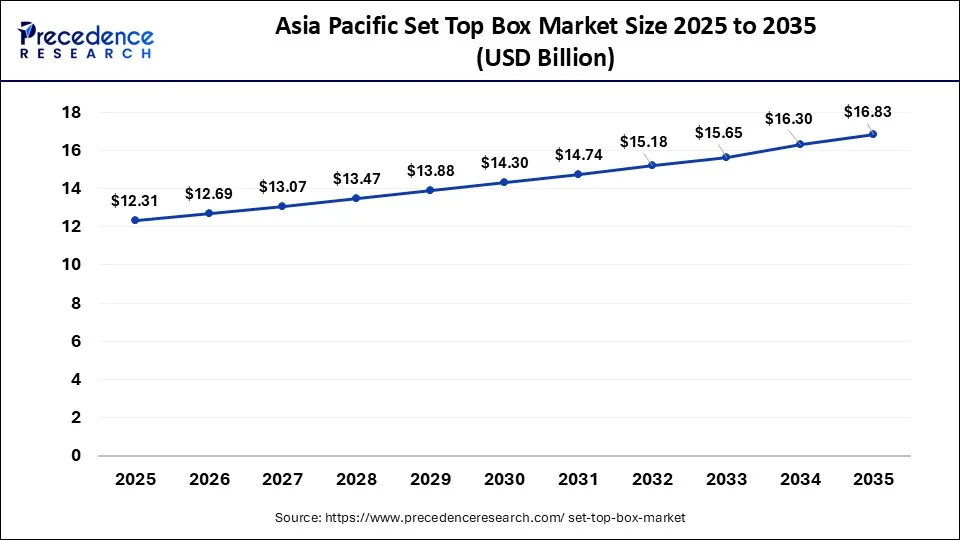

The Asia Pacific set top box market size was exhibited at USD 12.31 billion in 2025 and is projected to be worth around USD 16.83 billion by 2035, growing at a CAGR of 3.18% from 2026 to 2035.

Asia Pacific held the largest share of the market in 2025. The combination of digitalization at high speed throughout emerging economies with the increasing popularity of pay-TV services drives this growth. The combination of many residents and increasing consumer spending levels makes the area very attractive for business expansion. Fast 5G networks enable new high-end capabilities, and the ability to support different content specifications leads to better user satisfaction.

Set-top boxes in China are experiencing quick market growth with the rising number of digital and intelligent television systems. OTT services have replaced cable TV as the primary viewing choice because extensive high-speed internet access and rising smart device popularity have swept through the television market.

North America is seen growing at a rapid pace in the set top box market during the forecast period. Major tech companies and content providers in the region created consumer preferences for devices with AI capabilities and voice commands, as well as integrated OTT platform connections. The manufacturing industry delivers affordable products with advanced features to offer solutions for different consumer groups. HITech operators maintain proactive measures to modernize their systems to deliver better bandwidth and higher content quality. The U.S. set top box sector continues to transform fast because consumers prefer streaming platforms and smart televisions.

U.S. Set Top Box Market Trends

The U.S. market is driven by a shift towards hybrid models, which combine conventional cable or satellite with OTT streaming apps. Key trends involve rising need for 4K/UHD content, voice-activated controls, and AI-based personalized recommendations.

Europe also emerged as a significant market for smart contracts, accounting for a substantial market share in 2025 because consumers wanted new features that allowed them to watch across multiple rooms through integrated streaming capabilities. The integration with intelligent home systems makes set top boxes develop into primary controllers managing connected home entertainment through Internet of Things networks. The set top box market of Europe experiences transformation due to modern advancements and sustainability commitment, and customization requirements.

Germany Set Top Box Market Trends

Germany's market is influenced by shifting user behavior towards consuming media content via television and the internet, mainly considering ongoing transitions in the digital TV domain. In addition, the market is being boosted by the rising penetration of the internet and broadband services, as well as the rising preference for high-definition (HD) channels and on-demand video services.

Changing Media Consumption Patterns Impacting the Latin America Set Top Box Market

Latin America's market shows notable growth during the forecast period. This is due to its evolving digital landscape, rising broadband penetration, and increasing consumer need for high-quality entertainment services. The region's transition from conventional cable and satellite TV to digital, along with OTT (over-the-top) streaming platforms, underscores the demand for advanced, feature-rich set top box's which support hybrid content delivery, 4K resolution, along with smart functionalities.

Brazil Set Top Box Market Trends

Brazil's market is driven by increasing user adoption of digital entertainment, expanding broadband infrastructure, and regulatory initiatives encouraging digital inclusion. The transition towards high-definition, along with smart TV integration, is accelerating segment diversification, with high-expansion potential in connected and hybrid set-top boxes.

Emerging Opportunities in the MEA Set Top Box Market

MEA's market shows rapid growth during the forecast period. It is driven by technological innovation, increasing user requirements for high-definition content, and the proliferation of digital broadcasting standards globally. As users seek seamless entertainment experiences over multiple devices, manufacturers are aiming to integrate smart capabilities, improve user interfaces, and fund emerging formats such as 4K and HDR.

South Africa Set Top Box Market Trends

South Africa's market is driven by the integration of smart features, like voice control and artificial intelligence, that are becoming increasingly prevalent, improving user experience and engagement. Furthermore, the need for high-definition and even ultra-high-definition content is influencing the design and functionality of new devices, as users seek superior viewing experiences.

Set Top Box Market Companies

- Echostar Corporation: EchoStar Corporation provides a comprehensive suite of digital set-top boxes, specializing in DVR-enabled, high-definition, and hybrid IP or satellite technologies, mainly through EchoStar Technologies (ETC).

- Huawei Technologies Co., Ltd: Huawei Technologies Co., Ltd provides advanced, high-performance Android-driven smart TV boxes programmed to transform traditional TVs into interactive entertainment centres.

- KaonMedia: KaonMedia Ltd provides a numerous range of advanced set-top boxes designed for service professionals, featuring Android TV, RDK-V, Linux, and even AI-enabled devices. Their solutions fund hybrid, 4K IPTV, OTT, along with IoT services, combining high-performance hardware with personalized, operator-tier software to allow advanced user experiences, like voice control and multimedia hubs.

- Sagemcom SAS: Sagemcom SAS is a major player in the Set-Top Box market, customizing in high-end, operator-branded video terminals which combine 4K UHD content with advanced audio and connectivity features.

Other Major Key Players

- Advance Digital Broadcast (ADB)

- Commscope (ARRIS International, plc)

- Coship Electronics Co., Ltd.

- Samsung Electronics Co. Ltd.

- Technicolor SA

- LG CNS Co., Ltd

Recent Developments

- In May 2025, KT unveiled Genie TV Set-Top Box 4, featuring the most recent artificial intelligence (AI) technology, which enables users to encounter personalized viewing experiences. Users benefit from AI Select to browse content easily, as this feature helps them watch preferred singer and actor performances within the content.

- In March 2024, ZTE joined forces with Telecab to launch the B866V2FA set top box operating on Android TV for 4K resolution. The partnership provided Telecab with an upgraded system designed to boost their Pay TV business operations while letting customers access third-party streaming platforms.

- In January 2024, Tata Sky unveiled India's inaugural 4K set top-box, offering both existing and new subscribers access to ultra HD 4K picture clarity for forthcoming cricket matches. The box combines SD and HD television channels with 4K video materials.

Segments Covered in the Report

By Product

- IPTV

- Satellite

- Cable

- DTT

- OTT

By Content Quality

- HD & Full HD

- 4K and Above

By Operating System

- Android

- Linux

- Others

By Application

- Residential

- Commercial

By Distribution Channel

- Offline

- Online

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting