Short-term Rental Market Size and Forecast 2025 to 2034

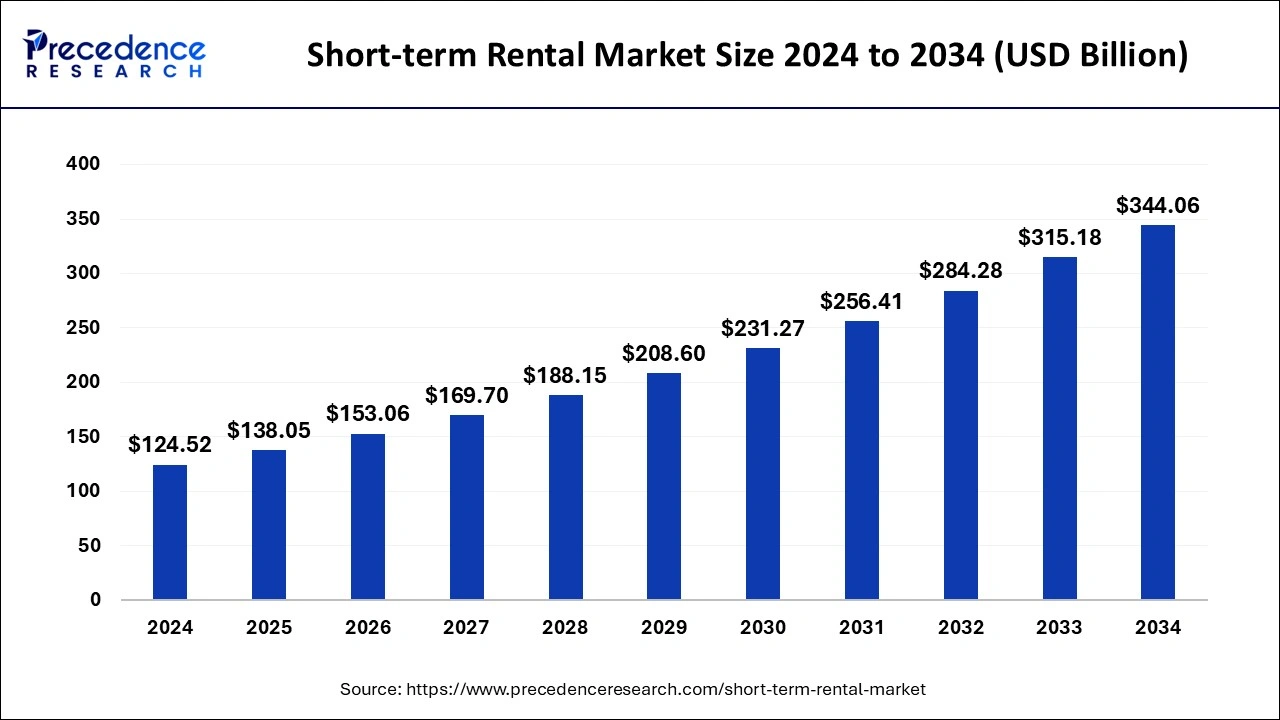

The global short-term rental market size was estimated at USD 124.52 billion in 2024 and is predicted to increase from USD 138.05 billion in 2025 to approximately USD 344.06 billion by 2034, expanding at a CAGR of 10.70% from 2025 to 2034. The short-term rental market is driven by the traveler appears shifting in favor of distinctive and genuine experiences.

Short-term Rental MarketKey Takeaways

- In terms of revenue, the global short-term rental market was valued at USD 124.52 billion in 2024.

- It is projected to reach USD 344.06 billion by 2034.

- The market is expected to grow at a CAGR of 10.70% from 2025 to 2034.

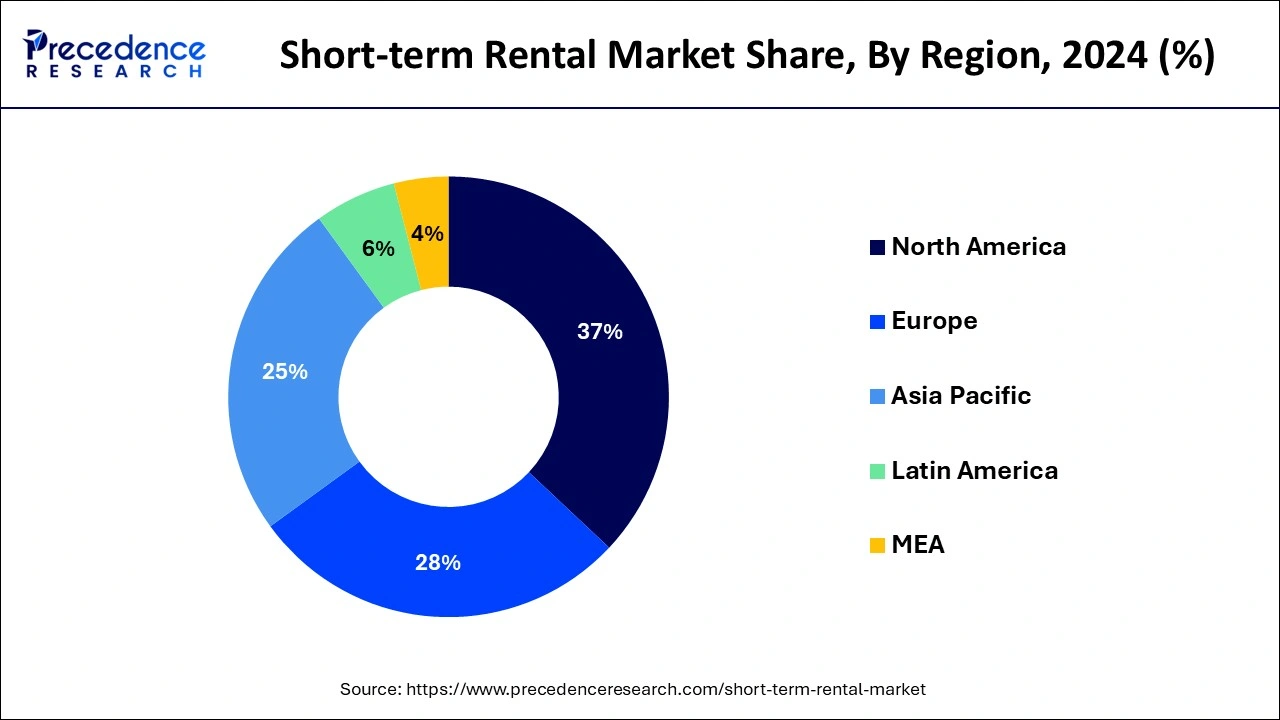

- North America dominated the short-term rental market with the biggest market share of 37% in 2024.

- By accommodation type, the home segment dominated the market with the largest share in 2024.

- By booking mode, the online/platform-based segment dominated the market largest market share in 2024.

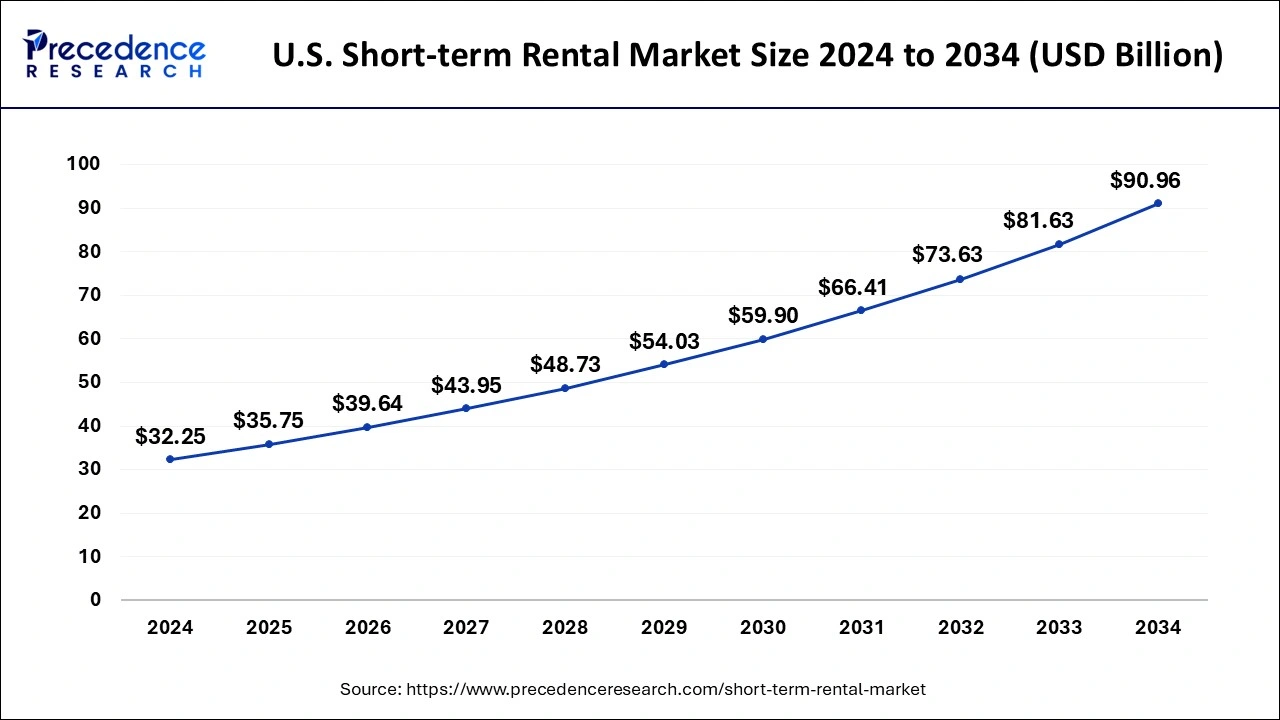

U.S.Short-term Rental Market Size and Growth 2025 to 2034

The U.S. short-term rental market size was valued at USD 32.25 billion in 2024 and is anticipated to reach around USD 90.96 billion by 2034, poised to grow at a CAGR of 10.93% from 2025 to 2034.

North America dominated the largest market share of 37% in 2024. Initially originating in North America, companies like Airbnb and HomeAway achieved early market momentum. For instance, the 2008 founding of Airbnb in San Francisco gave the area a head start in creating and popularizing the idea of short-term rentals. There has been a shift in culture to embrace the sharing economy, especially in North America, where there has been a general acceptance of short-term personal property rentals. The market for short-term rentals has expanded due to this societal acceptance.

North America has been a center for technology innovation, offering the know-how and resources required to create Internet marketplaces that enable short-term rentals. Modern digital platforms and smartphone apps have made it simple for guests to book accommodations and for hosts to list their properties.

- For instance, in February 2024, under new ideas by Michael Gove, Airbnb Inc. may see a decrease in the number of short-term rentals accessible in the United Kingdom. Planning approval is required before hosts rent short-term rentals on websites like Airbnb.

Asia-Pacific is the fastest growing in the short-term rental market during the forecast period.In nations like China, India, and Southeast Asia, the demand for lodging options other than traditional hotels has increased due to rapid urbanization and rising disposable incomes. Additionally, property owners may now offer their spaces for short-term rentals more quickly because of the growth of digital platforms and online booking services, increasing the market's supply side. The sector's expansion in the area has also been aided by shifting traveler preferences toward genuine and unique experiences and the flexibility and cost that short-term rentals provide.

Market Overview

Around the world, the short-term rental market is expanding and includes vacation rentals, business trips, and short-term housing options. It was fueled by more travel, flexible job schedules, and shifting lodging tastes. Short-term rentals are flexible and affordable for business visitors, particularly for extended stays or project-based work. Co-working spaces and other amenities draw digital nomads and businesses. This covers stays for moving, getting medical attention, or helping after a calamity. Short-term rentals offer comfort and flexibility to individuals or families needing short-term housing.

For hosts and property managers, automation technologies, dynamic pricing, and guest communication platforms simplify operations and improve the visitor experience. Travelers are becoming more and more interested in eco-friendly services and practices. Therefore, hosts are adopting green initiatives and highlighting them in their listings. To differentiate from the competition, hosts provide distinctive experiences. This could entail customized touches, specialized lodging, or local relationships.

- In May 2023, Leading travel website MakeMyTrip announced a partnership with Microsoft to offer voice-assisted booking in Indian languages, hence expanding the reach of travel planning. The new technology stack combines Azure Cognitive Services and Microsoft Azure OpenAI Service to allow customers to receive customized travel recommendations based on their interests.

Short-term Rental Market Data and Statistics

Airbnb has settled with Italian authorities worth €576 million ($621 million) to resolve a protracted tax battle that escalated last month when the nation's public prosecutor ordered money to be taken from the vacation rental platform.

- In February 2024, the ad-supported tier of American video-on-demand provider Netflix saw the addition of Expedia Group as its first worldwide advertising partner for a multi-market campaign. The historic alliance will benefit Expedia Group's global expansion strategy and Netflix's multi-country advertising service for advertisers and subscribers by reaching over 23 million monthly active users worldwide through Netflix's ad-supported plan.

Short-term Rental MarketGrowth Factors

- The growing popularity of corporate travel, adventure travel, and staycations drives demand for distinctive, cozy lodging.

- More homeowners are drawn to short-term rentals as a source of revenue.

- Gen Z and millennials favor internet booking services and the distinctive experiences that short-term rentals provide.

- New entrants and specialty platforms that target passenger demographics increase options, promising the expansion of the short-term rental market.

- Growth in the market is driven by rising disposable income and travel spending.

- Automation technologies that simplify operations and draw hosts include self-check-in and keyless entrance.

- Governments must balance growth and worry about affordability, safety, and noise.

- The industry can benefit from clear regulations fostering professional management and trust.

- There is a greater need in large cities for flexible housing choices.

- Energy-efficient rentals and eco-friendly operations can draw eco-aware tourists.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.70% |

| Market Size in 2025 | USD 138.05 Billion |

| Market Size by 2034 | USD 344.06 Billion |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Accommodation Type, Booking Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Shifting travel preferences

More and more tourists are choosing customized experiences over hotels' typical lodging. Options from comfortable apartments to opulent villas that suit various tastes and budgets are available through short-term rental services like Airbnb. Rather than staying in tourist districts dominated by hotels, many travelers fully immerse themselves in the local way of life and culture. This is frequently made more accessible by choosing to stay in residential communities. Such shifting travel preferences are observed to act as driver for the short-term rental market.

Short-term rentals can occasionally be more affordable, particularly for large parties or families making multiple trips. Compared to hotel stays, sharing costs and using the cooking facilities for self-catering might result in significant savings.

Evolving urbanization and workstyles

More people can work from anywhere because of the growth of remote work and flexible work schedules. Since people may now travel and work from different places for longer periods, there is a greater need for short-term rental accommodation. Short-term rentals have become a popular way for people to supplement their income because of the opportunity to rent apartments on websites like Airbnb. As a result, plenty of rental homes are available in various locations, satisfying the increasing need for short-term housing.

Authentic and immersive experiences are what many travelers seek out when they visit new places. Compared to standard hotels, short-term rentals, especially those provided by people or local hosts, offer a more genuine and customized experience.

Restraint

Economic dependence on tourism

The demand for short-term rentals is highly dependent on tourism seasonality. The demand for short-term rentals may soar during the busiest travel seasons, while sharp declines in demand during off-peak periods may result in unstable earnings. Economic downturns can significantly affect tourism, lowering demand for short-term rentals and limiting travel. In times of economic uncertainty, this susceptibility may put short-term rental operators in financial danger. Over-reliance on tourism may pressure the community's utilities, public services, and transportation networks. The ability of the short-term rental markets to expand and meet rising demand may be restricted by this pressure.

Opportunity

Catering to niche experiences

Property owners can set themselves out, draw in specific target markets, and fetch greater prices. Focusing on specialty experiences allows hosts to capitalize on passengers' interests and preferences instead of providing generic lodging. Themes, including wellness retreats, pet-friendly vacation rentals, eco-friendly lodging, gastronomic adventures, or even historical or cultural immersion, could be included. By customizing their offers to these niches, hosts may create unforgettable and personalized experiences that appeal to guests looking for unique and customized stays. In addition to increasing guest happiness and loyalty, this strategy allows hosts to differentiate themselves in a congested market and meet niche customer needs. Such factors that cater to niche experiences create a significant opportunity for the short-term rental market.

Accommodation Type Insights

The home segment dominated the short-term rental market with the largest share in 2024. From houses and villas to flats and condos, home rentals provide a wide range of possibilities to suit the interests and tastes of different travelers. Visitors who stay in homes fully integrated into the local way of life and culture have a more genuine experience than staying in a hotel.

Travelers can enjoy more flexibility and convenience during their stay by taking advantage of the many home rentals that provide flexible check-in/check-out schedules, self-catering options, and amenities like kitchens and laundry facilities. House rentals are often more affordable than typical lodging when considering longer stays or larger groups, providing greater value overall.

The resort/condominium segment is the fastest growing in the short-term rental market during the forecast period. The demand for vacation rentals in resort regions and condominiums is driven by consumers' growing desire for distinctive and customized travel experiences. Resorts and condos appeal to travelers since they are frequently found in well-known tourist locations and provide easy access to beaches, attractions, and other leisure pursuits. Compared to standard hotels, short-term rentals in resorts and condominiums offer more flexibility and give visitors the advantage of a fully furnished kitchen, more room, and privacy.

Booking Mode Insights

The online/platform-based segment dominated the short-term rental market with the largest share in 2024. Due to online platforms, short-term rentals are now widely available for both hosts and visitors. Anyone with an internet connection can look for lodging or sell their property. These platforms provide a global reach, enabling hosts to draw visitors from around the world and vice versa. When compared to more conventional approaches, this dramatically expands the market. Most internet platforms provide safe payment options, giving hosts and visitors peace of mind. This lowers the possibility of fraud or payment problems, promoting more transactions.

The offline segment shows a significant growth in the short-term rental market during the forecast period. Renters can still be drawn using traditional offline strategies like local advertising and word-of-mouth recommendations, particularly in places with strong community links. In addition, to save money on online platform costs and keep more control over the rental process, some property owners would instead handle their rents offline. The segment's growth has also been aided by the emergence of boutique rental agencies and property management firms that focus on offline rentals and provide individualized services and local knowledge.

Short-term Rental Market Companies

- 9flats.com PTE Ltd.

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia Group, Inc.

- Hotelplan Management AG

- MakeMyTrip Pvt. Ltd.

- NOVASOL A/S

- Oravel Stays Private Limited

- Tripadvisor, Inc.

- Wyndham Destinations, Inc.

Recent Developments

- In January 2023, through a strategic relationship with the Danish vacation rental broker Sol og Strand, which offers more than 6,000 vacation houses and flats, the Interhome Group expanded its inventory to include Denmark. Denmark has grown in popularity as a travel destination in recent years, offering a wide variety of regional diversity and expansive coastline vistas between its North Sea and Baltic seaboard.

- In August 2022, Zumper raised an additional $30 million for its Series D fundraising round and declared the formal debut of its short-term renting product. The extra capital, which brings the company's total funding to $178 million, is designated for short-term rentals considering consumer demand and, in some cases, legal requirements for various housing options on a single, specially designed platform.

Segments Covered in the Report

By Accommodation Type

- Home

- Apartments

- Resort/Condominium

- Others

By Booking Mode

- Online/Platform-based

- Offline

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting