Soil Remediation Market Size and Forecast 2025 to 2034

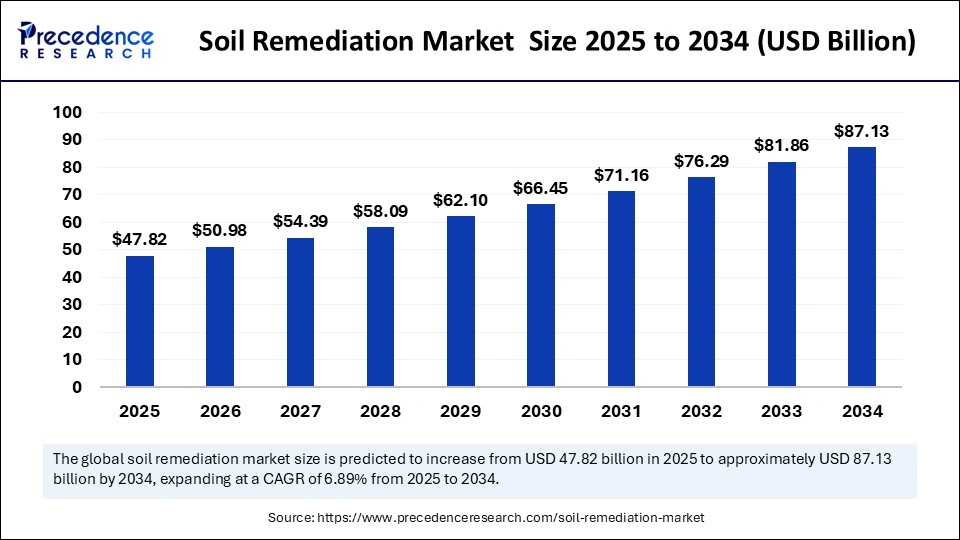

The global soil remediation market size was estimated at USD 44.90 billion in 2024 and is predicted to increase from USD 47.82 billion in 2025 to approximately USD 87.13 billion by 2034, expanding at a CAGR of 6.89% from 2025 to 2034. The growth of the market is driven by the growing industrial pollution, stringent environmental regulations, and rising concerns about soil health. Moreover, improvements in remediation technologies and the rising need for sustainable land restoration solutions are likely to support market expansion.

Soil Remediation Market Key Takeaways

- In terms of revenue, the soil remediation market is valued at $47.82 billion in 2025.

- It is projected to reach $87.13 billion by 2034.

- The market is expected to grow at a CAGR of 6.89% from 2025 to 2034.

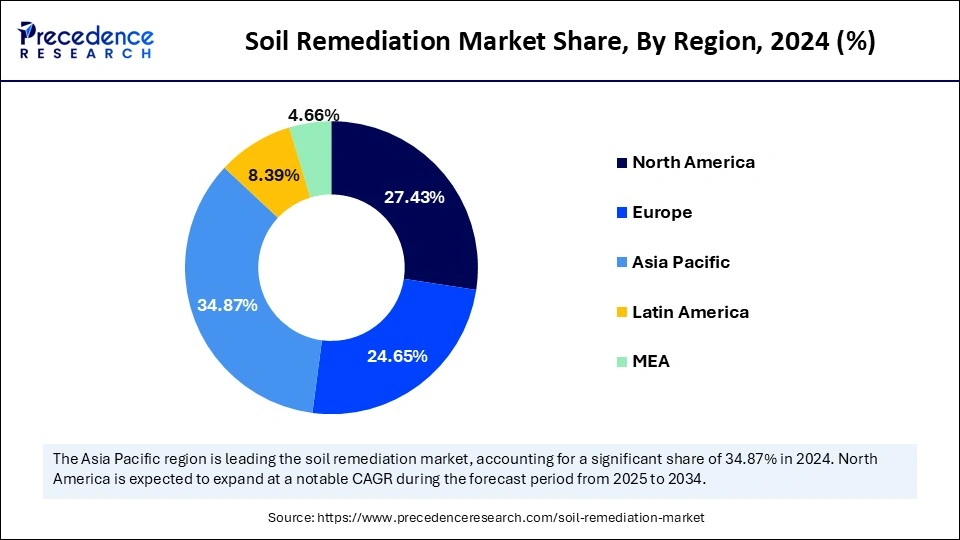

- Asia Pacific dominated the global soil remediation market with the highest revenue share of 34.87% in 2024.

- Europe is expected to expand at the fastest CAGR of 6.54% between 2025 and 2034.

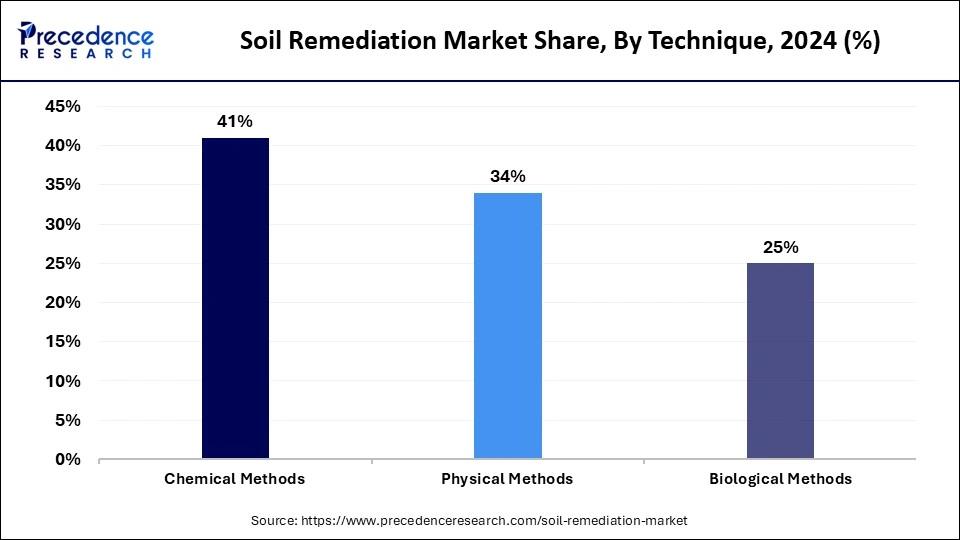

- By technique, the chemical methods segment contributed the largest revenue share of 41% in 2024.

- By technique, the biological methods segment is expected to grow at a the highest CAGR of 8.57% during the forecast period.

How AI is Enhancing Precision and Efficiency in Soil Remediation?

Artificial Intelligence (AI) is significantly revolutionizing the soil remediation market by enhancing the efficiency of remediation techniques. Artificial intelligence helps in providing real-time soil assessment, pollutant identification, and stochastic ground contamination modeling. For example, agricultural scientists have demonstrated machine learning models in predicting heavy metal concentrations in agricultural soil that had over 90% accuracy compared to traditional methods of analyses conducted in an analytical laboratory by trained chemists for both speed and reliability.

Recent studies indicate the ability of AI to support site assessments using onboard sensors and drones, especially in demolition or industrial sites where people cannot be on-site for safety reasons. For example, in India and China, pilot projects have successfully implemented AI-based soil classification tools that support sustainable land use planning. Finally, AI is widespread in nanoremediation to neutralize agricultural pollutants using engineered nanoparticles with precision and limited impact on surrounding areas.

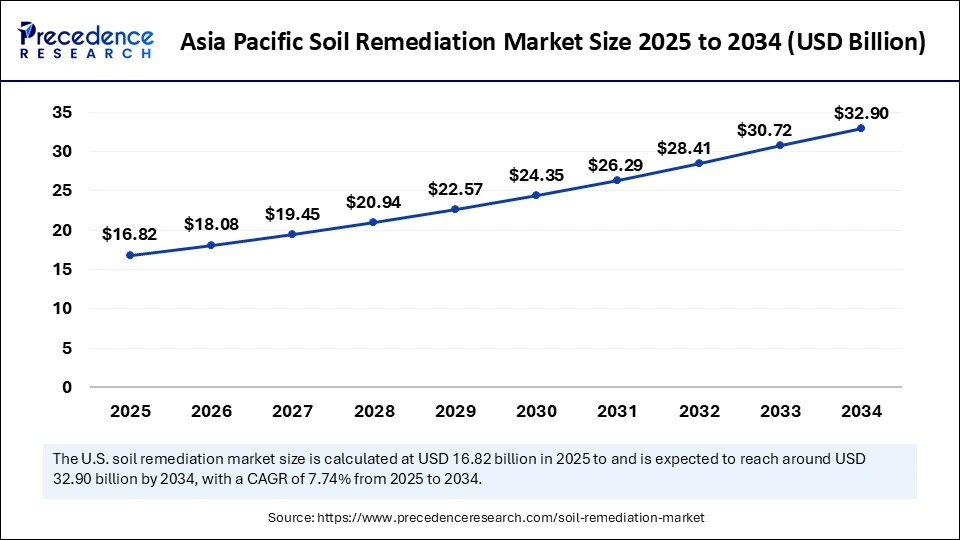

Asia Pacific Soil Remediation Market Size and Growth 2025 to 2034

The Asia Pacific soil remediation market size is exhibited at USD 16.82 billion in 2024 and is projected to be worth around USD 32.90 billion by 2034, growing at a CAGR of 7.74% from 2025 to 2034.

What Factors Made Asia Pacific the Dominant Region in the Soil Remediation Market?

Asia Pacific dominated the market with the largest revenue share in 2024. This is mainly because of an increasing rate of industrialization, extensive amounts of agricultural land in use, and a rising awareness of environmental sustainability. Several nations are grappling with the issues of contamination from heavy metals, persistent organic pollutants (POPs), and petroleum hydrocarbons, all of which have contaminated their soil situation. Urbanization and unregulated industrial self-discharge have largely contributed to soil contamination. Regulatory bodies such as the Ministry of Environment have launched national soil protection programs, revised and enforced waste management regulations, and significant land remediation programs.

China has emerged as a major market within Asia Pacific due to its strong focus on soil remediation as a result of the massive amount of unregulated industrialization and mining that occurred over several decades. A national survey released by China's Ministry of Ecology and Environment found that almost 16% of its soil is contaminated (with numerous cadmium, arsenic, and lead being cited). Rising government initiatives to improve soil health and reduce pollution further support market growth. In January 2025, the government of Beijing, China, announced 2025 action plans for air, water, and soil pollution control, climate change response, and ecological protection.

(Source:https://enviliance.com)

What Opportunities Exist in the European Soil Remediation Market?

Europe is expected to expand at the highest CAGR in the coming years, driven by stringent environmental regulations, an increased focus on environmental conservation, and contamination concerns associated with the restoration of industrial sites. The development of the European Union Soil Thematic Strategy and the directive on the assessment and management of environmental risks has created significant mandates for soil protection and remediation for member states. These initiatives have also been supported by urbanization trends and the redevelopment of brownfield sites, leading to increased demand for remediation technologies like chemical oxidation, phytoremediation, and thermal treatments.

Germany plays a major role in the European soil remediation market because of its highly industrialized, centralized economy and commitment to addressing environmental sustainability practices. Despite the investment in soil remediation technologies, Germany is challenged by contamination primarily from mining, industrialization, and former military zones. In general, German environmental policies exhibit a strong commitment to a risk-based approach to soil remediation while prioritizing ecological restoration. The country is also pursuing innovative, green remediation technologies like bioremediation and soil washing.

Why is North America an Observably Growing Region in the Soil Remediation Market?

Soil remediation is notably growing in North America as a result of environmental legislation, aging industrial infrastructure, and a high level of public awareness about environmental-related risks in both the United States and Canada. The two countries have a strong legislative history governing environmental laws like the Comprehensive Environmental Response, Compensation, and Liability Act [CERCLA] in the U.S. and Canada's Contaminated Sites Program [CSP]), which ensures the remediation or clean-up of legacy pollution and governs ongoing site assessments and remediation. Technology is advancing quickly; for example, with the advent of nano remediation and electro-kinetic remediation, soil remediation rates are accelerating across North America.

The U.S. is leading the way, with thousands of active and completed remediation sites under the Superfund program/concurrent process within the EPA. The EPA has both a comprehensive process associated with "natural" Superfund sites, and remediation via the correction of hazardous materials strategically placed in selected and has listed more than 1,300 contaminated sites where hazardous materials require remediation. PCBs, petroleum products, and chlorinated solvents are leading contaminants on the EPA's "hazardous" substances list, and the leading soil remediation technologies heretofore have relied upon chemical oxidation, thermal treatment, and bioremediation occurring across several sectors, including real estate, oil and gas, energy, agriculture, and defense. Additionally, the Infrastructure Investment and Jobs Act provides billions of dollars for environmental remediation, which shows that this growth area will continue in the future.

Market Overview

The soil remediation market consists of services and technologies designed to remediate soil contaminants to restore ecological balance and comply with environmental regulations. This market is steadily growing as a result of increased industrialization, increasing soil pollution, and stringent environmental regulations. There is a rapid shift toward sustainable and cost-effective remediation technologies and services, as bioremediation and phytoremediation, which have comparatively less footprint on the environment, are gaining attention. Additionally, rising R&D activities aimed at developing efficient technologies for effectively remediating contaminated sites for a particular use, along with a growing need for safe farmland, impact the market. Integration of automation and real-time monitoring are increasing the capabilities of remediation technologies and expanding the scope of applications.

Soil Remediation Market Growth Factors

- Stringent environmental policies: Governments around the world are imposing more stringent laws on soil contamination, thus creating an uptick in demand for remediation in order to comply with regulations and avoid fines in the industrial, agricultural, and construction sectors.

- Brownfields redevelopment initiatives: The rehabilitation of contaminated urban and industrial properties is ramping up as developers intend to utilize the underutilized property to create valuable real estate, thereby increasing the need for fast and efficient soil remediation alternatives.

- Advancements in technology: Innovations in remediation, such as nanoremediation, real-time monitoring, and advanced thermal and biological treatments, are improving remediation methods that are lowering costs and extending the possible methods of remediation, even with complicated soil contamination.

- Increased industrialization and waste: Increased industrial output and hazardous waste are the main contributors to soil pollution. Therefore, industries are investing in remediation technologies.

- Emerging sustainable methods: There is a movement toward sustainable remediation methods such as bioremediation and phytoremediation, partly due to reduced costs, less impact on the environment, and a global direction for sustainability and collaboration.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 87.13 Billion |

| Market Size in 2025 | USD 47.82 Billion |

| Market Size in 2024 | USD 44.90 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.89% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technique, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Stricter Environmental Regulations Prompt Soil Remediation Needs

Stringent regulations aimed at reducing pollution and promoting sustainable land management practices are driving the growth of the soil remediation market. As regulatory pressure mounts surrounding per- and polyfluoroalkyl substances (PFAS), commonly referred to as "forever chemicals," the number of soil remediation activities has increased substantially. In April 2024, the U.S. Environmental Protection Agency (EPA) issued maximum contaminant levels (MCLs) for PFOA and PFOS in drinking water. These MCLs pushed state agencies, businesses, and other entities to remediate contaminated sites, including soil in outfields, manufacturing plants, and military installations.(Source: https://www.ewg.org)

Similarly, the UK issued new limits on PFAS in drinking water, which included More than 4,700 PFAS compounds under a combined limit of 100 ng/L. As PFAS accrue in soil and percolate into groundwater and surface water, these MCLs require immediate remediation to safe levels using novel technologies that include chemical oxidation, excavation, as well as thermal destruction and treatment technologies. Currently, there are many clean-up efforts underway at airports, firefighting training sites, and industrial clusters, as government agencies try to ensure human health and ecological safety. Furthermore, the added funding for PFAS testing and clean-up technologies is also facilitating accelerated momentum in the marketplace.(Source: https://www.rsc.org)

Restraint

High Cost and Complexity of Remediation Technologies

The high costs and complexity of remediation technologies present a significant challenge for the soil remediation market, even with the increasing environmental urgency. Projects that are complicated by persistent organic pollutants or mixed contamination (for example, heavy metals and hydrocarbons) not only require state-of-the-art equipment but often require multi-phase treatment approaches. For example, excavation and off-site treatment can range as high as hundreds of dollars per cubic meter. Novel approaches such as nanoremediation use specialty nanoparticles that are expensive and don't exist in sufficient quantity.

In some areas of Latin America and Asia Pacific, sourcing funding and undertaking implementation remain challenges for the soil remediation field. The complexity of permitting, the prolonged timelines for approvals, and the limited numbers of remediation technologies available continue to slow down the growth of the market. High costs of remediation technologies create barriers for small organizations, limiting the adoption and hampering the growth of the market.

Opportunity

How Bioremediation Opens New Growth Avenues?

Bioremediation continues to gain traction as a cost-effective and green option for treating soil contamination. Bioremediation relies on using microorganisms or plants to return contaminated soils to baseline pollutant levels through natural degradation or removal of the contaminants in soil. With bioremediation, there is less environmental and structural disturbance than compared to excavation and waste incineration.

In late 2024, a breakthrough in bioremediation was reported in Michigan, where genetically engineered microbes were used to break down petroleum hydrocarbons in contaminated soil in less than three months, much quicker than traditional bioremediation methods. Additionally, new biostimulation methods convert native microbial populations to use organic nutrients. Governments and research institutes are developing and funding more bioremediation innovations, particularly in previously industrialized areas, because it reduces remediation time and environmental impacts while affording additional local green jobs. The demand for greener technologies is rapidly moving bioremediation to a leading role in soil remediation technology.

Technique Insights

Which Soil Remediation Method Dominated the Soil Remediation Market in 2024?

The chemical methods segment dominated the market with the largest revenue share in 2024 due to their effectiveness in reducing extreme pollution. Chemical oxidation, chemical reduction, pH manipulation, chelation, surfactant-enhanced remediation, and solubilization techniques are commonly used to degrade or neutralize heavier pollutants, such as heavy metals and persistent organic pollutants. Chemical techniques are preferred to remediate industrial land when reliable and rapid decon is important. Chemicals offer precision, flexibility, and relatively short decontamination time that are valuable in responding to complex contaminant problems.

The biological methods segment is expected to grow at the fastest CAGR during the forecast period. Biological methods are gaining traction as a result of increasing environmental awareness, stringent environmental regulations, and a rapid shift toward sustainable practices. Bioremediation techniques such as bioaugmentation and biostimulation apply the naturally occurring microbes in soils to degrade pollutants, while phytoremediation and mycoremediation use plants and fungi to either absorb or break down contaminations. The Rhizofiltration and composite offers additional pathways to remove toxins in a less ecologically harmful way. These biological methods are gaining prominence because of their low ecological footprint and suitability, particularly for agricultural and medium-contaminated locations.

Soil Remediation Market Companies

- AECOM

- Bechtel Corporation

- Boskalis Environmental

- Clean Harbors, Inc.

- Dowa Eco-system

- Greensum Ecology

- Jacobs Solutions Inc.

- Polyeco Group

- REGENESIS

- RSK Group (Enviros/ENHESA)

- SUEZ

- TerraTherm, Inc. (Cascade Environmental)

- Veolia Environnement S.A.

Recent Developments

- In April 2025, BRICS nations, including India, have launched "BRICS Land Restoration Partnership" to address the issues of land degradation, desertification, and soil fertility loss in the group's 11 member countries, and collectively reiterated their resolve to make the global agri-food system fair, inclusive, innovative, and sustainable. (Source: https://www.msn.com)

- In May 2025, SMR UK, a specialist soil remediation and ground engineering company, launched soil treatment technology designed to significantly reduce the cost and environmental impact of brownfield land redevelopment. (Source: https://buildingbetterhealthcare.com)

Segments Covered in the Report

By Technique

- Physical Methods

- Soil excavation and removal

- Soil vapor extraction

- Soil washing

- Soil aeration

- Thermal desorption

- Soil stabilization

- Soil encapsulation

- Chemical Methods

- Chemical oxidation

- Chemical reduction

- pH adjustment

- Chelation

- Surfactant-enhanced remediation

- Solubilization

- Biological Methods

- Bioremediation (bioaugmentation, biostimulation)

- Phytoremediation

- Mycoremediation

- Rhizofiltration

- Composting

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content