What is the Spices and Seasonings Market Size?

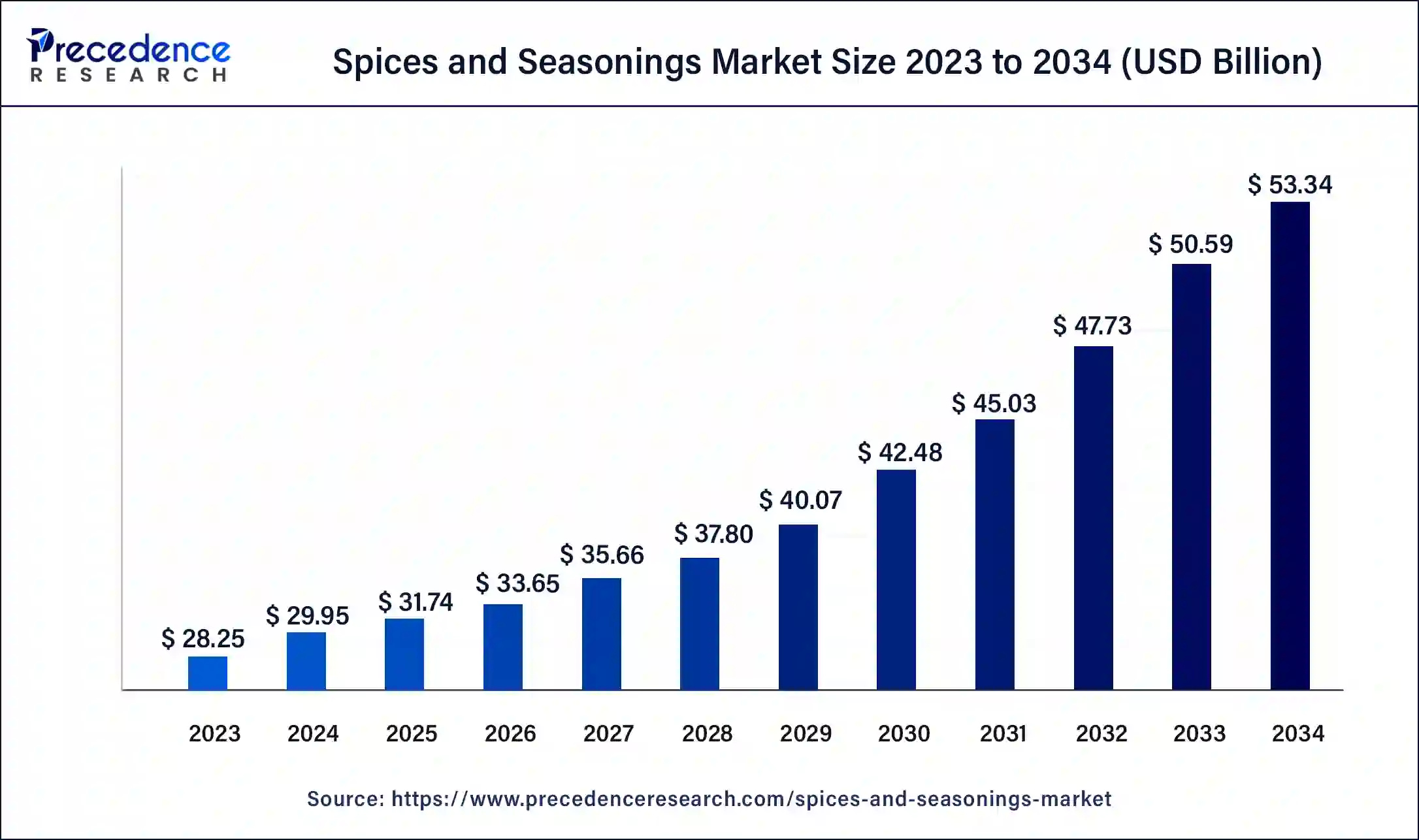

The global spices and seasonings market size is calculated at USD 31.74 billion in 2025 and is predicted to increase from USD 33.65 billion in 2026 to approximately USD 56.16 billion by 2035, expanding at a CAGR of 5.87% from 2026 to 2035.

Market Highlights

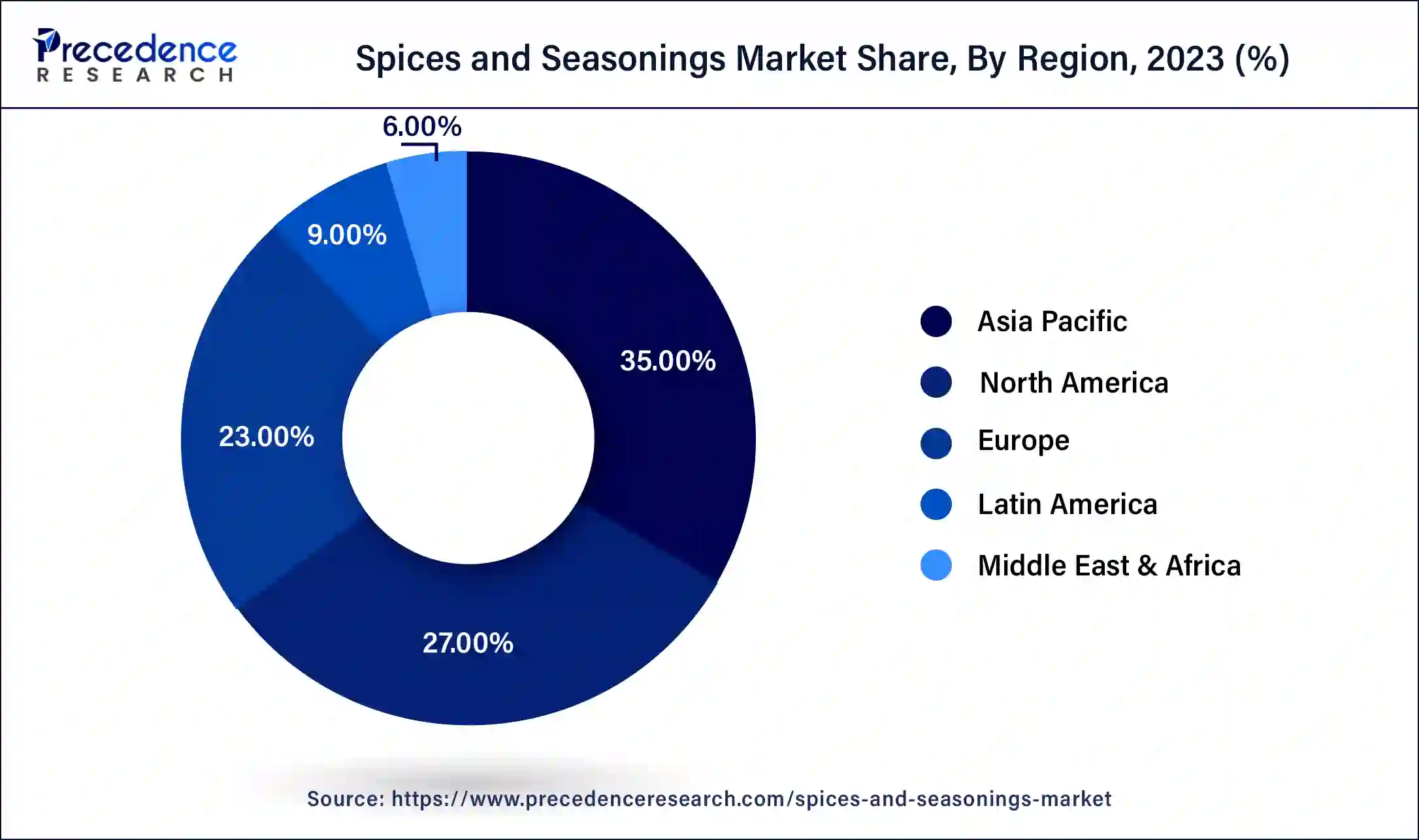

- Asia Pacific led the global market with the highest market share of 39% in 2025.

- Europe region is estimated to expand the fastest CAGR between 2026 and 2035.

- By Type, the spices segment has held the largest market share in 2025.

- By Application, the meat and poultry segment captured the biggest revenue share in 2025.

Spices and Seasonings Market Growth Factors

The spices and seasonings are broadly used to add flavor, fragrance, variety, and taste to food and refreshments, and here and there likewise as additives or antibacterial specialists. Comfort food makers utilize these traits of spices and seasonings to further develop their item quality and taste and increment their time of usability. Customer readiness to explore different avenues regarding new spices and expanding interest in ethnic preferences has created a multiplication in item contributions and an expansion in the offer of spices and seasonings. The progress of this industry can likewise be credited to its reaction to customer interest for better items, comfort, and an assortment of spices.

The significant patterns impacting the spices and seasonings market are the expansion popular for handled meat and comfort items, clean names progressively becoming required, and an ascent in inclination for regular ingredients and spices. Shoppers are starting to put more worth on food sources that offer them help other than taste, and thus, interest in solid, regular, and safe food items is on the ascent.

An expanded inclination for western cooking and a social blend in food space has uplifted the interest for spices and spices as zest extricates. As spices are a significant gathering of enhancing specialists, zest blends have turned into an imminent portion for developments. Another excellent explanation reinforcing the interest for flavor mixes and spices is the changing buyer inclination, wherein a remarkable interest has been created in worldwide and ethnic food. The headway of epitome has prompted its application in pretty much every area of the food and refreshment industry. A comparative sort of use design has likewise been seen in the spices and seasonings market. A portion of the critical makers in the flavor and scent industry has been benefiting from the flavor variations in embodied designs.

European interest inspices and seasonings is expected to enroll the most elevated CAGR of 6.8% over the gauge period. The chief end clients of spices and spices in all EU markets can be partitioned into three portions: modern, retail, and catering. In practically all EU nations, the biggest extent, being 55%-60% (and in certain nations much a greater amount of) the all-out utilization of spices and spices, is consumed by the modern area. The retail area consumes 35%-40% and the providing food area, 10%-15%. In many business sectors, the proportion moves towards higher relative utilization by the modern area, mirroring the developing ubiquity of prepared-to-utilize spices and seasonings combinations.

The novel Covid-19 pandemic had fundamentally affected practically all enterprises across the globe. This pandemic has brought about large-scale manufacturing closures and inventory network interruptions, which has impacted the economy too.This sickness has a variable effect in various nations relying upon their social standards, moderation endeavors, and wellbeing framework, and every nation is resolving its method for battling against the pandemic. Be that as it may, different examination studies are expressing the utilization of specific spicesthat could support our insusceptibility which could assist us with battling goliaths Covid as well as numerous different infections.In the ongoing situation, it has become critical to support the resistance to battle Covid, alongside keeping up with the cleanliness and following all clinical warnings that have been set down. Indeed, even the rules given by World Health Organization (WHO) in its COVID-19 examination recommend the total populace eats resistant helping food varieties. Consequently, the interest for restorative spices separates conveying properties of helping human resistance is at the flood in the drugs and nutraceuticals industry.

The overall lockdown, in any case, has additionally impacted cultivating rehearses, which has exceptionally affected the stock of unrefined components of spices and seasonings. The COVID-19 effect on planned operations additionally adds to the expanded costs of unrefined components, which supports the expense for restorative spices and seasonings makers. With hindrances to cross-line transportation of wares in this pandemic circumstance, makers are exceptionally reliant upon neighborhood unrefined substance providers, which expands the bartering force of providers. Subsequently, the expanded natural substance costs, trailed by the appeal for spices and seasonings, would prompt an expanded cost of restorative spices and seasonings for the following couple of years.

Key Market Trends

- There is a growing emphasis on health and wellness, which is leading to an increased demand for spices and seasonings that offer health benefits. Products that are organic, natural, and free from artificial additives are becoming more popular in the market.

- Consumers all over the world are increasingly interested in exploring global cuisines, which is further driving the demand for a wider variety of spices and seasonings. This trend highlights the desire for unique flavors and cooking experiences.

- The rise of e-commerce platforms is transforming the way consumers purchase spices and seasonings. These platforms provide better access to diverse products, allowing consumers to discover niche brands and specialty items.

- The popularity of flavors such as umami and spicy profiles is gaining traction, driving demand for specific spices that enhance culinary creations. This trend towards flavor experimentation is likely to compel manufacturers to come up with innovative and diverse seasoning options.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 31.74 Billion |

| Market Size in 2026 | USD 33.65 Billion |

| Market Size by 2035 | USD 56.16 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.87% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, By Application, Nature, Form, and Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising trend of culinary experience

The rising trend of culinary experiences significantly contributes to the growth of the market. As people explore diverse cuisines and flavors, they seek out a wide range of spices and seasonings to enhance their dishes. This demand for unique an exotic flavor has driven the market, prompting manufacturers to offer a variety of options to cater to consumer preferences. Additionally, the popularity of cooking shows, food blogs and social media platforms has further fueled this trend. Many television channels have started food shows that offer culinary experiences. This inspires individuals to experiment with different ingredients and create their own signature dishes, consequently boosting the demand for a diverse range of spices and seasonings.

Restraint

Disruptions in the global supply chain

Global supply chain disruptions can majorly impact the spices and seasoning market by causing delays in sourcing and distributing products. Fluctuations in transportation availability, increased shipping costs and customs-related issues can lead to supply shortages and price volatility. This can affect the ability of manufacturers and retailers to maintain consistent product availability, potentially leading to dissatisfied customers and reduced sales. Additionally, these disruptions may necessitate adjustments in sourcing strategies, which can lead to higher procurement costs and complexity in managing suppliers from various regions. Thus, the element associated with the supply chain is observed to hinder the market's growth.

Market Opportunity

Expanding food industry

The expanding food industry across the globe creates a significant opportunity for the global spices and seasonings market. As new food products are being developed and introduced, there is a need for a wide variety of spices and seasonings to cater to diverse consumer preferences. This expansion includes the growth of restaurants, ready-to-eat-meals, packaged foods and culinary innovation, all of which require high-quality spices and seasonings to enhance taste and appeal. By aligning with the trends and demands of the evolving food industry, the spices and seasonings market can position itself for greater market penetration.

Market Challenge

Fluctuations in agricultural practices

Fluctuations in agricultural practices can be a major challenge for the global spices and seasonings market. These fluctuations can lead to inconsistent crop yields and quality, making it challenging for suppliers to maintain them as a steady and reliable source of raw materials. Variations in weather conditions, pest infestations and diseases can all impact the quantity and quality of the final product. Moreover, unpredictable agricultural practices can result in price volatility due to supply shortages and surpluses. This can lead to increased costs for manufacturers and potentially higher prices for consumers, affecting the overall demand for spices and seasonings.

Segment Insights

Type Insights

Based on type, the ginger fragment represented the biggest portion of 38% of the worldwide flavor market in 2023. Most spices have the biggest piece of the pie in the Asia Pacific. This is because more spices are utilized in warm environments because of their antibacterial properties that free food sources of microorganisms and accordingly add to human wellbeing, life span, and regenerative achievement.

The quickly developing cheap food industry and expanding interest in comfort food have prompted an expansion in the interest for spices and seasonings like paprika, pepper, oregano, mint, and sesame. As far as utilization, the interest in turmeric has forever been high and is further expanding, particularly in Asian nations because of the restorative properties of turmeric and its broad use in Ayurvedic medications and Indian cooking styles.

Application Insights

The meat and poultry fragment represented the biggest offer in the worldwide flavor market in 2023. It represented a portion of 27% in 2023 and is projected to develop at a CAGR of 4.6% during the estimated time frame. Refreshments structure the quickest developing use of spices and seasonings, and this section is projected to develop at a CAGR of 7% somewhere in the range of 2024 and 2033. The rising populace, changing way of life patterns, and the ascent of extra cash of individuals, especially in creating economies like China, India, and Brazil, has prompted expanded utilization of bites and accommodation food things.

Nature Insights

Based on nature, the worldwide spices and seasonings market is fragmented into natural and customary. Among the two, the regular section represents a higher-worth offer inferable from its simple accessibility at reasonable costs for its objective clients. Be that as it may, during the figure time frame, the natural configuration of spices and seasonings is supposed to acquire a more elevated level of footing, enlisting a critical development rate regarding deals.

Regional Insights

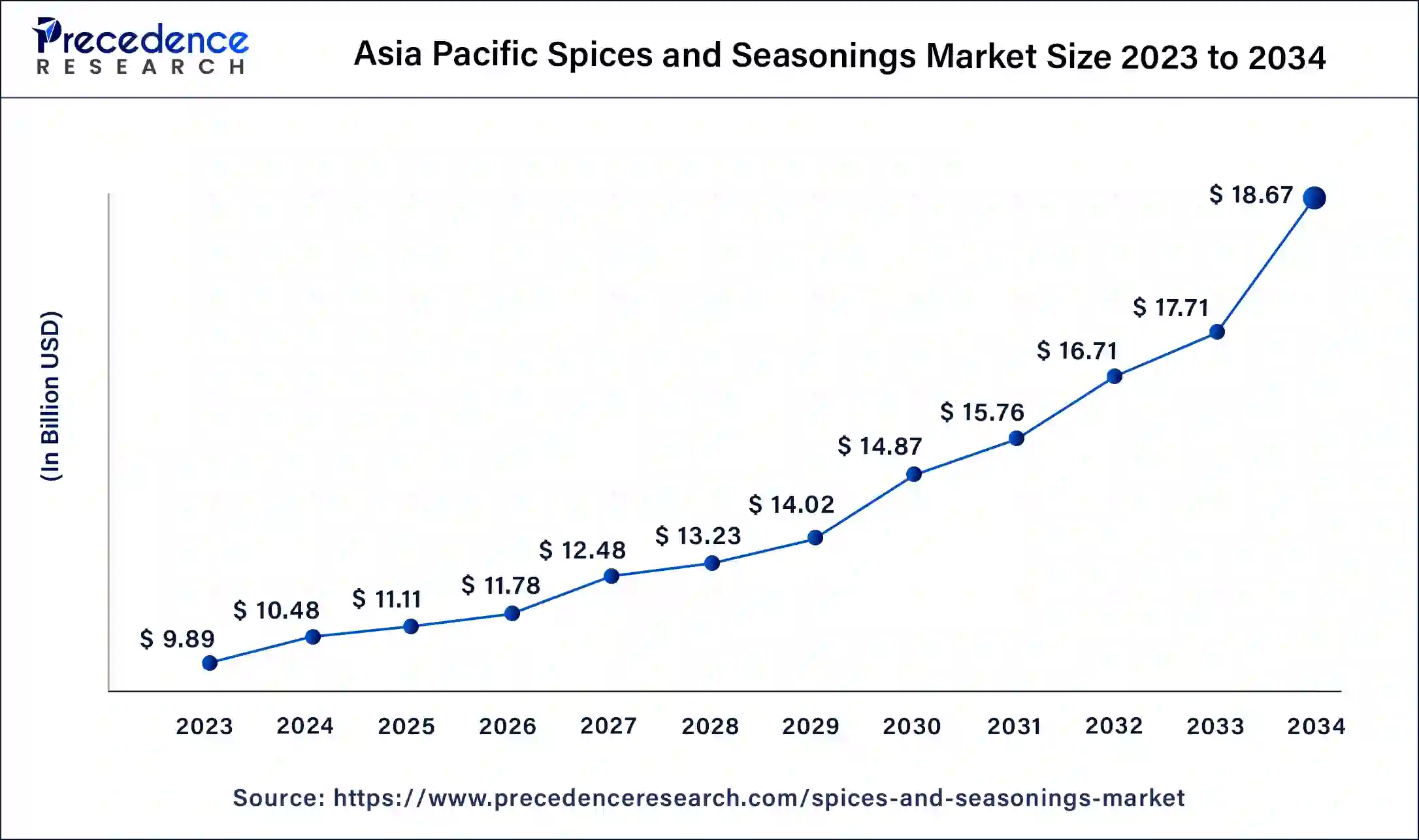

The Asia Pacific spices and seasonings market size is valued at USD 11.11 billion in 2025 and is predicted to be worth around USD 19.66 billion by 2035, at a CAGR of 5.80% from 2026 to 2035.

Asia Pacific region accounted for the largest market share in 2025. Significant nations contributing essentially towards the development of the district incorporate China, India, Japan, Australia, and New Zealand. The quickly developing cheap food industry and youthful demography in the Asia Pacific district have prompted an expansion in the utilization of bundled, frozen, and accommodation food, as would be considered normal to improve the development of the market for spices and seasonings.

- India, being the largest producer of spices and seasonings in the region has witnessed a surge in the exports of spices this year. In FY2023, India exported spices almost worth $4 billion, this is an increase of 4.74% as compared to FY2022.

- The spice production in China is expected to reach at 1.2 million metric tons in 2026, registering a growth of 0.5% annually.

Europe is the quickest developing business sector during the figure time frame in the spices and seasonings market. Factors like the enormous populace and the developing interest for valid ethnic spices, the rising prevalence of comfort food sources, and the developing consciousness of the restorative properties of spices and seasonings are driving the North American market.

The market in Germany has been shaped by strong consumer interest in high-quality, organic, and sustainably sourced ingredients, along with a greater acceptance of exotic spices in food and beverage preparation. Germany's multicultural food scene continues to offer opportunities for brands to develop and promote more authentic food experiences, as well as to encourage home cooking with an expanding range of convenient products. Food manufacturers are increasingly aiming to enhance their offerings through exotic and "clean label" spice blends and are introducing more private label products to meet the demand for authentic, transparent, and unique flavor experiences.

The Middle East & Africa (MEA) is experiencing an opportunistic rise in the market, driven by rising demand for spice products, particularly spice blends. This growth is largely due to the increasing popularity of traditional cuisines, expanded foodservice offerings, and the rising demand for packaged food items. Additionally, the region's spice supply chain is modernizing, with both production and imports seeing growth. In South Africa, the demand for spice blends is particularly strong, reflecting the growing consumer acceptance of prepared spice mixes for home cooking and dining out.

The market in North America is driven by the rise of multicultural consumer tastes and the growing popularity of home cooking, which encourages people to explore spices from various countries and cultures. New product developments, including clean-label spices, and the increasing appeal of ethnic foods, are fueling continued market growth. The expansion of the retail and restaurant sectors also contributes to market growth. The U.S. is leading the market, with a significant increase in the consumption of ethnic spice blends and a high volume of new product launches. The growing demand for packaged foods, coupled with strong interest in organic and premium spice products, drives market growth.

The spices and seasonings market in Latin America is driven by the availability of various spices and the growth of organic food retail channels, which include specialty shops, supermarkets, and even e-commerce platforms. The region is increasingly becoming a diverse and international culinary hub, with customers and chefs experimenting with novel flavors and premium products. There is a growing preference for organic spices and herbs, reflecting rising consumer demand for natural, sustainably sourced products. This trend is intensifying competition in the organic spices and herbs market, with established multinational corporations, regional companies, and small-scale producers all contributing to the competitive landscape.

Value Chain Analysis

This stage involves cultivating and harvesting raw spices such as pepper, cumin, turmeric, and garlic.

Key Players: McCormick & Company, Olam International, Spice Chain

After raw spices are sourced, they are processed through grinding, drying, and blending to create seasoning products.

Key Players: Ajinomoto Co., Inc., Unilever, Kerry Group

The processed spices and seasonings are then packaged in various formats (bottles, sachets, bulk packaging) for consumer or industrial use.

Key Players: McCormick & Company, Goya Foods, Badia Spices

In this stage, packaged spices are distributed to retailers and wholesalers who ensure that the products reach the end consumer.

Key Players: Walmart, Costco, Whole Foods Market

Spices and Seasonings Market Companies

- Ajinomoto Co, Inc.

- ARIAKE JAPAN CO, LTD.

- Associated British Foods plc

- Kerry

- McCormick & Company, Inc.

- Baria Pepper

- Dohler Group

- DS Group

- Everest Spices

- Bart Ingredients

Recent Developments

- In December 2025, British plant-based brand Bosh expanded its retail range with three new ambient seasonings: Sweet & Smoky BBQ, Citrus & Spice Zesty, and Rich & Savoury Umami, launching on Ocado in February 2026. Available in 120g tubs from 16 February, each seasoning provides protein and fiber while containing 25% less salt than conventional blends.(Source: foodbev.com )

- In July 2024, Bart Ingredients Company collaborated with The Space Creative, a Bristol-based agency, to revamp its brand and packaging to attract modern food enthusiasts while still appealing to its traditional customer base. Initially focusing on redesigning the packaging for Bart's assortment of spice blends inspired by global cuisines, this new concept extended to cover its extensive product line of more than 100 items, including herbs, spices, chopped ingredients, pastes, salts, peppers, and seasonings.(Source: bing.com)

- In December 2020, McCormick and Company Inc. declared the acquisition of 100 percent portions of FONA International, LLC and certain associates. FONA, a main maker of spotless and regular spices, would give answers for a different client base across different applications for the food, drink, and wholesome business sectors. FONA will be the foundation for speeding up McCormick's flavor stage in the Americas.

- In May 2021, Olam Food Ingredients (OFI) reported the procurement of driving US private-name spices and seasonings maker, Olde Thompson. The securing would expand on a 15-year organization with Olde Thompson and imprint a huge achievement for OFI's spices business.

- In Feb 2021, Kerry declared the procurement of Jining Nature Group, a main maker of exquisite spices and seasonings in China. This procurement will bring an extensive variety of bona fide nearby and territorial taste innovations and application capacities to the Kerry portfolio.

- In March 2021, Sensient Natural Ingredients LLC (SNI) declared that it finished an exchange to secure New Mexico Chili Products Inc., a got dried out stew creation office in Deming, NM, that handled capsicums and an assortment of specialty chilies for business deal to CPG food makers, zest.

- In April 2023, Tabitha Brown and McCormick announced the extension of their partnership to launch a range of five new salt free and vegan seasonings. The new seasoning range by Tabitha Brown and McCormick is aimed to get launched on Amazon this year. The product is being developed to bring smokey taste to the dishes.

- In January 2023, one of the leading companies in India, Tata Sampann announced the launch of a range of blended spices for multiple South Indian dishes across Karnataka. with the commercialization of these newly launched products, the company aim to offer authentic Indian taste to dishes.

- In February 2023, Starwest announced the launch of a new eco-polish line of herbs and spices with innovative packaging. The company has launched new range of ethnically sourced products with recyclable pouches while considering the environmental concerns.

Segments Covered in the Report

By Type

- Spices

- Pepper

- Ginger

- Cinnamon

- Cumin

- Turmeric

- Coriander

- Cardamom

- Cloves

- Others

- Herbs

- Garlic

- Oregano

- Mint

- Parsley

- Rosemary

- Fennel

- Others

- Salt & Salt Substitutes

By Application

- Meat & poultry products

- Snacks & convenience food

- Soups, sauces, and dressings

- Bakery & confectionery

- Frozen products

- Beverages

- Others

By Nature

- Organic

- Conventional

By Form

- Whole

- Crushed

- Powder

By Distribution Channel

- Food Service

- Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting