What is the Steam Turbine Market Size?

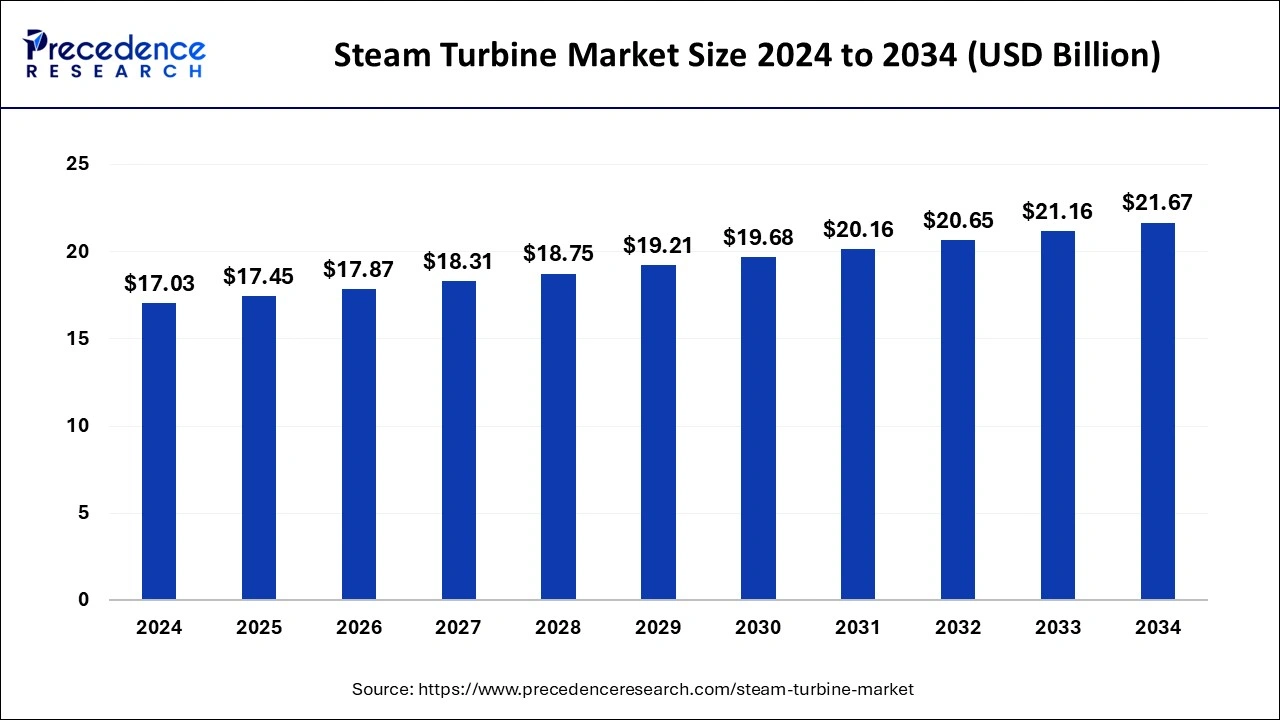

The global steam turbine market size was accounted at USD 17.45 billion in 2025 and predicted to increase from USD 17.87 billion in 2026 to approximately USD 22.18 billion by 2035, representing a CAGR of 2.43% from 2026 to 2035.

Market Highlights

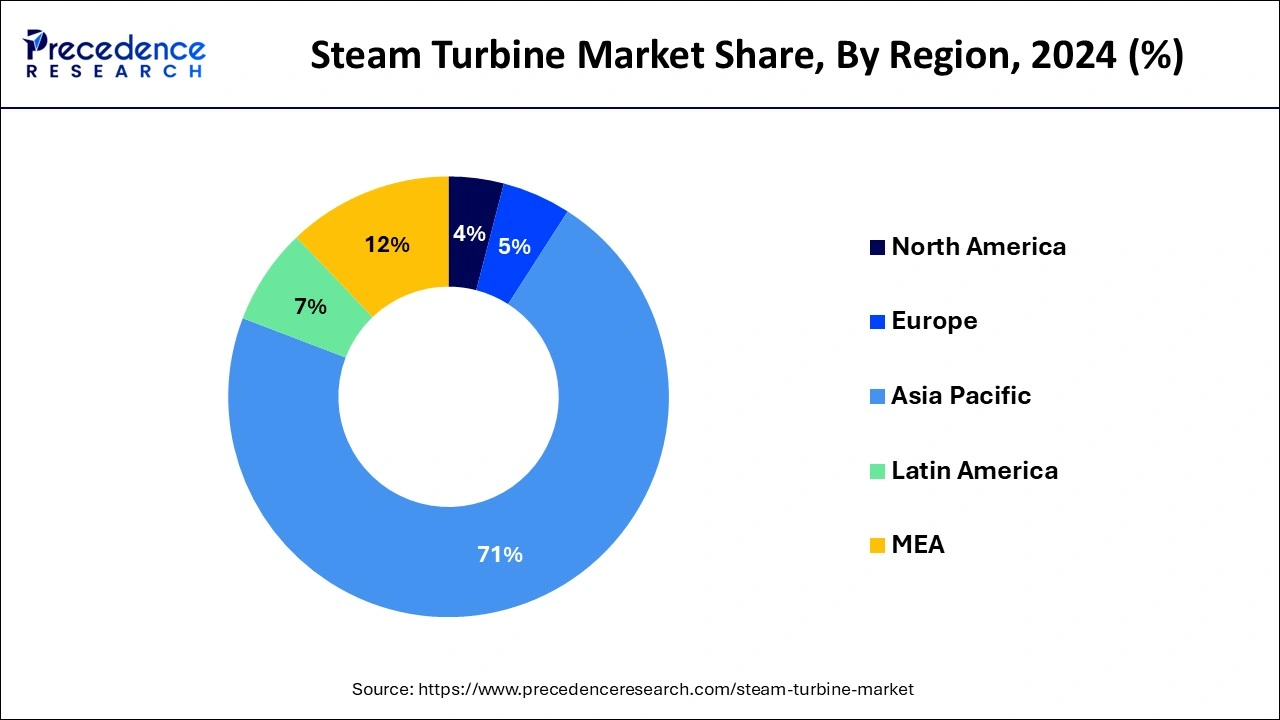

- Asia Pacific led the global steam turbine market with the highest market share of 71% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

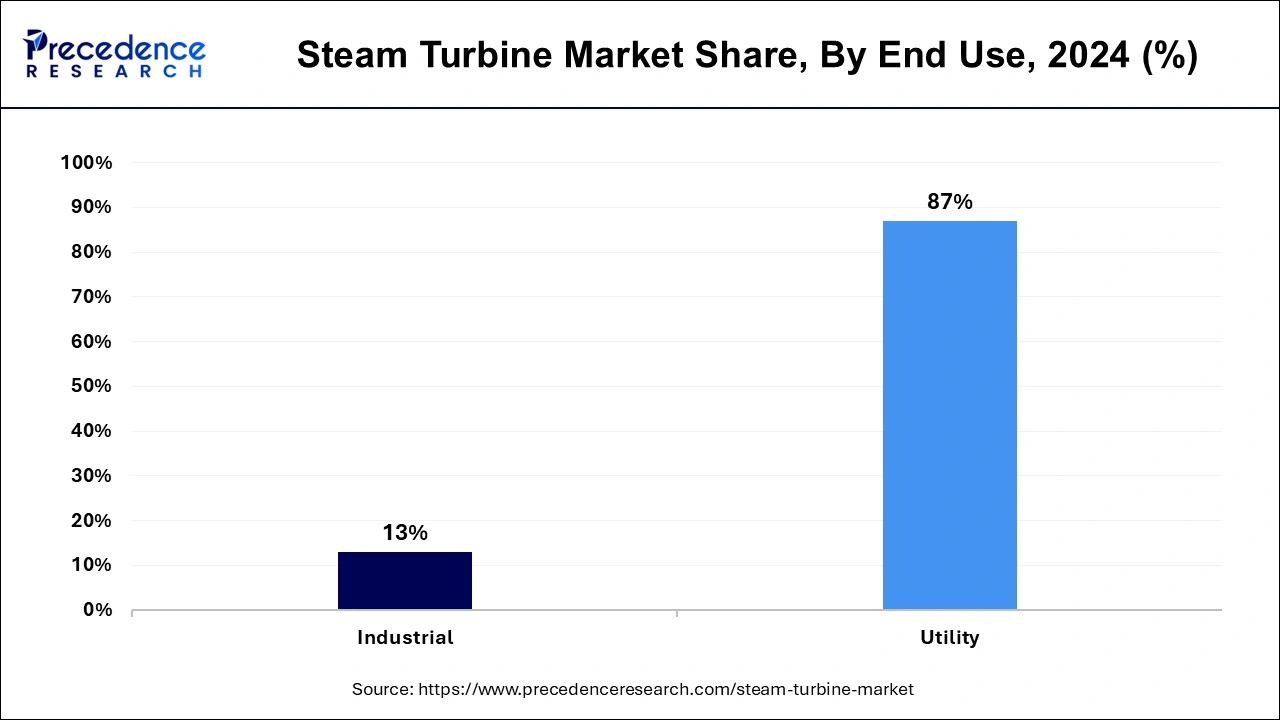

- By end-use, the utility segment has held the major market share of 87% in 2025.

- By end-use, the industrial segment is projected to grow at a notable CAGR during the forecast period.

- By design, the impulse segment dominated the global market in 2025.

- By design, the reaction segment is projected to grow at a notable CAGR during the forecast period.

- By exhaust, the condensing segment has held a major market share in 2025.

- By exhaust, the non-condensing segment is projected to grow at a solid CAGR during the forecast period.

How is AI changing Steam Turbine?

Artificial intelligence (AI) based modeling and optimization analysis is conducted to improve the operation excellence of the industrial scale steam turbines that promote higher energy efficiency and contribute to the net-zero target from the energy sector. AI can help power plants to reduce their environmental impact by customizing fuel consumption processes and emission control systems. AI algorithms can analyze data from sensors and control systems to improve fuel-to-air ratios, enhance overall energy efficiency, and reduce emissions. These factors help the growth of the steam turbine market.

Steam Turbine Market Growth Factors

- Due to rising energy demand and steady investments for capacity expansions, the global steam turbine market is expected to develop significantly over the forecast period. Steam turbines are machines that use a revolving output shaft to collect thermal energy from steam and convert it to mechanical effort.

- In addition, the rapid expansion and expansion of marine excavation will have a significant impact on the steam turbine market. The global steam turbine market is predicted to rise in the future due to increasing efforts to reduce energy demand and supply gaps, as well as the present development of thermal power projects. However, stringent government rules requiring for the replacement of traditional energy sources with renewables may stymie industry growth in the coming years.

- The global steam turbine market will be driven by robust economic growth and regulatory standards promoting low emission fuels such as natural gas and biomass. Growing interest in energy optimization, as well as focus on cogeneration, will have a favorable impact on the corporate landscape. The government measures to reduce reliance on coal fired power generation, and the competitive cost of renewable technologies, on the other hand, could impede the growth of the global steam turbine market. The steam turbine market will also be driven by regulatory measures to minimize carbon emissions, as well as increased investments in the development of large-scale thermal power projects.

- The product deployment will be aided by the increasing adoption of super critical and ultra-super critical technology, as well as the conversion of retiring power plants to combined cycle systems. The rapid industrialization, increased generating capacity, and increased demand for captive power systems will propel the steam turbine market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.45 Billion |

| Market Size in 2026 | USD 23.48 Billion |

| Market Size by 2035 | USD 22.18 Billion |

| Growth Rate from 2026 to 2035 | 2.43% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Design, Exhaust, Fuel, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Design Insights

The impulse segment dominated the global steam turbine market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The compact size, cheap operating and maintenance costs are only a few of the key elements that will boost product adoption.

On the other hand, the reaction segment is estimated to be the most opportunistic segment during the forecast period. The reaction steam turbine market share will be driven by its ability to offer high efficiency when compared to impulse turbines, as well as increased utility sector investments aimed at limiting electricity demand supply imbalances.

Exhaust Insights

The condensing segment dominated the global steam turbine market in 2025, in terms of revenue, and is estimated to sustain its dominance during the forecast period. The condensing steam turbine segment will be driven by ongoing investments in new generating capacity expansions to fulfill the ever-increasing power demand from industries. Other significant underlying drivers that will boost product demand include increasing penetration of cogeneration systems and rising industrialization throughout the developing regions.

On the other hand, the non-condensing segment is estimated to be the most opportunistic segment during the forecast period. The segment's expansion will be fueled by factors such as ease of installation and its capacity to endure temperature variations. These systems provide steam at a predetermined pressure, making them ideal for the processing industry.

Fuel Insights

The biomass segment dominated the global steam turbine market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The segment's future will be boosted by increased efforts to reduce carbon footprints, as well as a supportive regulatory environment. The captive power generation and combined heat and power systems are becoming more widely deployed, which will help market to grow at a rapid pace.

On the other hand, the geothermal segment is estimated to be the most opportunistic segment during the forecast period. Various measures have been launched by regulators to encourage the adoption of non-conventional energy resources, which will accelerate product development. Its potential to deliver dependable electricity with a low carbon footprint has encouraged even more investment in new geothermal capacity expansions.

End Use Insights

The utility segment has held the major market share of 87% in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. The segment will increase as combined cycle technology is deployed more widely and demand for onsite power generation equipment rises.

The industrial segment is projected to grow at a notable CAGR during the forecast period. The product adoption will be aided in the coming year by increased investment in the establishment of new industrial centers.

Technology Insights

By technology, the steam cycle segment accounted for a considerable market share in 2025. The Rankine or steam cycle system is a standard choice for power generation. The technology is well-established, highly efficient, and versatile, taking up a dominant market share. With continued advancements in design and operation, steam cycle-based turbines offer high thermal efficiency, especially when used in tandem with combined cycle systems.

By technology, the combined cycle segment is predicted to witness significant growth in the market over the forecast period. Combined cycle gas turbines are becoming an eco-friendly alternative to standard steam turbines. As international mandates and growing pressure to tackle climate change grows, countries are switching over to cleaner energy sources with combined cycle steam turbines offering high efficiency, flexibility in load handling, and, crucially, significantly lower emissions of greenhouse gases such as carbon dioxide, sulfur dioxide, and various nitrogen oxides.

Regional Insights

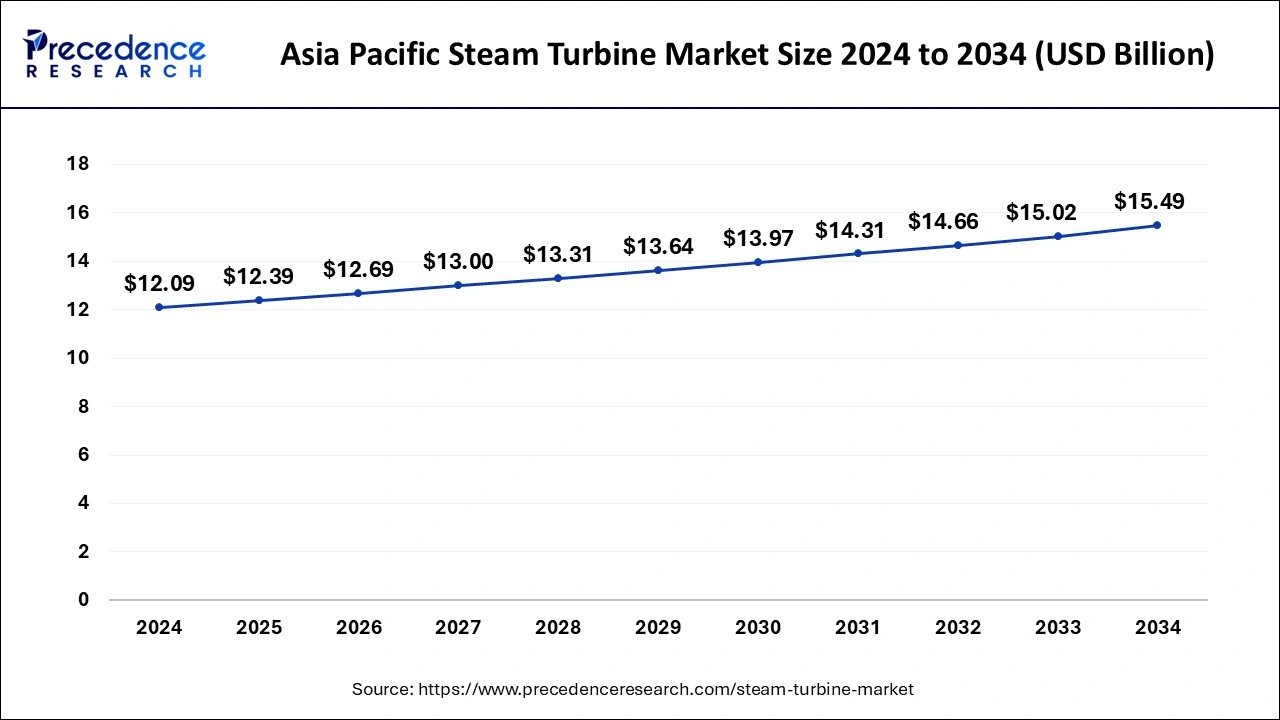

Asia Pacific Steam Turbine Market Size and Growth 2026 to 2035

The Asia Pacific steam turbine market size was evaluated at USD 12.39 billion in 2025 and is predicted to be worth around USD 15.88 billion by 2035, rising at a CAGR of 2.51% from 2026 to 2035.

Asia Pacific led the global steam turbine market with the highest market share of 71% in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to a shift in focus away from traditional energy sources and toward renewable energy sources.

China Steam Turbine Market Analysis:

China maintained its dominance in the steam turbine market due to the increased investment in technology advancements and strategic integration of energy policy. Moreover, several major brands in the country have focused on the development of localized digital twins, while predictive maintenance, which is able to cut down approximately 30% coal in steam plants, as per the recent country survey. Also, a shift towards the innovation cost-effective software ecosystem can lead the industry growth in China.

United States Steam Turbine Market Analysis:

The United States is expected to emerge as a prominent country for the steam turbine market in the coming years, as it focuses on advanced technology, not just volume, in recent years. the companies in the United States are developing turbines that can handle very high temperatures and new fuels like hydrogen and biomass. These turbines are cleaner and more efficient, which fits future energy rules.

North America is projected to expand at the fastest CAGR during the forecast period. Due to number of fossil fuel and biomass fired power plants, the Asia-Pacific is anticipated to maintain its market leadership in the market. The demand for steam turbines in China and India has been fueled by the rapid rate of industrial growth in both the nations.

Europe is expected to grow significantly in the steam turbine market during the forecast period. Various energy power plants in Europe are being replaced with new ones to enhance emissions as well as efficiency. At the same time, the old coal-fired power plants are also being replaced with biomass or gas plants to improve the generation of electricity. Furthermore, to support these developments, various policies as well as investments are also being provided by the government. Thus, all these factors enhance the market growth.

UK

The energy power plants in the UK are advancing with the development of new power plants. At the same time, some of the old power plants are also being replaced with new ones. These developments are enhancing the energy generation efficiency in the UK. Furthermore, with the use of polices laid by government these achievements are being conducted at a faster rate.

Germany

In Germany, to improve energy generation, as well as emissions, the old coal-fired power plants are being substituted with new ones. At the same time, to make the substitution faster as well as more effective, support from the government is also being provided.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the steam turbine market, driven by rising electricity demand, expanding industrialization, and investments in power generation infrastructure. Governments are upgrading aging power plants, diversifying energy mixes with gas and biomass, and supporting efficiency improvements, which together are driving demand for modern steam turbine technologies across the region.

UAE Steam Turbine Market Analysis

The market in the UAE is expanding due to rising electricity demand, rapid industrial and urban development, and investments in efficient power generation. The country's focus on energy diversification, waste-to-energy and gas-based plants, along with strong government policies supporting clean and reliable power, is driving market growth.

How is the Opportunistic Rise of Latin America in the Steam Turbine Market?

Latin America is expected to grow at a lucrative rate in the market due to increased mining and manufacturing activities, growing urban populations, and the need for stable baseload power. Countries are modernizing thermal plants, utilizing agricultural waste for biomass power, and adopting efficient turbine technologies to ensure a reliable electricity supply and grid stability across the region.

Brazil Steam Turbine Market Analysis

Brazil's market is increasing due to strong growth in biomass-based power generation, particularly from sugarcane bagasse, along with rising industrial electricity demand. Investments in cogeneration plants, modernization of existing thermal facilities, and supportive government initiatives promoting energy efficiency and renewable integration are further driving market expansion.

Value Chain Analysis of the Steam Turbine Market

- Distribution to Industrial Users

Industrial steam turbines are primarily distributed to sectors where high-pressure steam is a byproduct of manufacturing or a necessity for thermal processing. Unlike utility-scale turbines used solely for grid power, industrial units are often integrated into Combined Heat and Power (CHP) or mechanical drive systems.

Key Players: Siemens Energy AG, and GE Vernova (General Electric) - Chemical Synthesis and Processing

In the chemical synthesis and processing sector, steam turbines serve as critical components for both energy recovery and mechanical drive applications. As of 2025, these turbines are essential for optimizing thermal efficiency in energy-intensive chemical reactions.

Key Players: Triveni Turbines and Elliott Group (Ebara Corporation) - Regulatory Compliance and Safety Monitoring

Regulatory compliance for steam turbines is increasingly focused on energy efficiency and emission reductions, particularly in large industrial sectors. Compliance is governed by a combination of international technical standards and national environmental mandates.

Key Agencies: ASME (American Society of Mechanical Engineers) and IEC (International Electrotechnical Commission)

Top Companies Operating in the Market & Their Offerings

- Istom SA: Ishom SA provides steam turbine solutions, offering advanced design, installation, and maintenance services. The company focuses on reliable, efficient turbines for power plants and industrial applications, backed by engineering expertise and customer support to optimize energy generation performance.

- Mitsubishi Hitachi Power Systems: Mitsubishi Hitachi Power Systems delivers high-efficiency steam turbines and power systems, integrating advanced engineering and digital controls. Their offerings include customized turbines for fossil, renewable, and combined-cycle plants, supported by global service networks, lifecycle support, and performance optimization.

- Siemens AG: Siemens AG supplies cutting-edge steam turbines for utility and industrial use, featuring high efficiency, reliability, and digital integration. Offerings include flexible-operation turbines, modernization services, and aftermarket support to boost plant performance and reduce emissions.

- Man Diesel & Turbo SE: MAN Diesel & Turbo SE offers robust steam turbines and turbo machinery, emphasizing durability and efficiency for power and industrial sectors. Their solutions include high-speed turbines, maintenance services, and performance upgrades tailored to customer needs.

- Bharat Heavy Electricals Ltd.: BHEL provides a broad range of steam turbines and power plant equipment, including high-capacity units for thermal and renewable plants. Their offerings feature end-to-end project execution, local manufacturing, and comprehensive service support.

- Doosan Skoda Power: Doosan Škoda Power delivers steam turbines and auxiliary systems for power generation, focusing on flexibility, efficiency, and long service life. Their portfolio includes customizable steam turbines and retrofitting solutions with global engineering support.

Other Major Companies

- Toshiba Corporation

- Fuji Electric Co. Ltd

- Kawasaki Heavy Industries

- Ansaldo Energia

Latest announcement by Industry leaders

- In June 2024, the contractual hanSumitomo Corporation (Sumitomo) officially announcedTauhara Geothermal Power Station in New Zealand to Contact Energy was officially announced by Sumitin June 2024. The Tauhara Geothermal Power Station is geothermal steam turbine generator.

Recent Developments

- In May 2025, three state-owned thermal generation plants (Gencos) with a cumulative capacity of 2362 megawatts were auctioned by the federal government in the second phase of the auction. Only one bidder participated for one Genco.

- In May 2025, for the early retirement of coal-fired power plants, additional criteria were added to the new government regulations. Furthermore, the CEO of PLN, Dramawan Prasodjo, stated that the company will continue to operate the coal-fired power plants with the development of renewable energy, to the Commission ?, which is responsible for overseeing energy affairs.(Source: https://www.msn.com)

- In August 2024, an order for an M701F gas turbine and a steam turbine for the 500MW gas turbines combined cycle (GTCC) power plant in Sarawak, Malaysia, was received by Mitsubishi Power, a power solutions brand of Mitsubishi Heavy Industries, Ltd. (MHI).

- In August 2024, an order to demonstrate its type methanol firing in a gas turbine of Kayamkulam CCPP was secured by Bharat Heavy Electricals Limited (BHEL). Kayamkulam CCPP has two gas turbines with a combined 230 MW capacity and one 120 MW capacity turbine, set up on a turnkey basis in 1998. After the successful demonstration of the first phase, a demonstration at 100% load is proposed to be carried out in the second phase. BHEL has presently secured the order for the first phase.

Segments Covered in the Report

By Design

- Reaction

- Impulse

By Exhaust

- Condensing

- Non-condensing

By Fuel

- Fossil Fuel

- Biomass

- Geothermal

By End Use

- Industrial

- Utility

By Technology

- Steam Cycle

- Combined Cycle

- Cogeneration

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East andAfrica

Get a Sample

Get a Sample

Table Of Content

Table Of Content