What is the Structured Cabling Market Size?

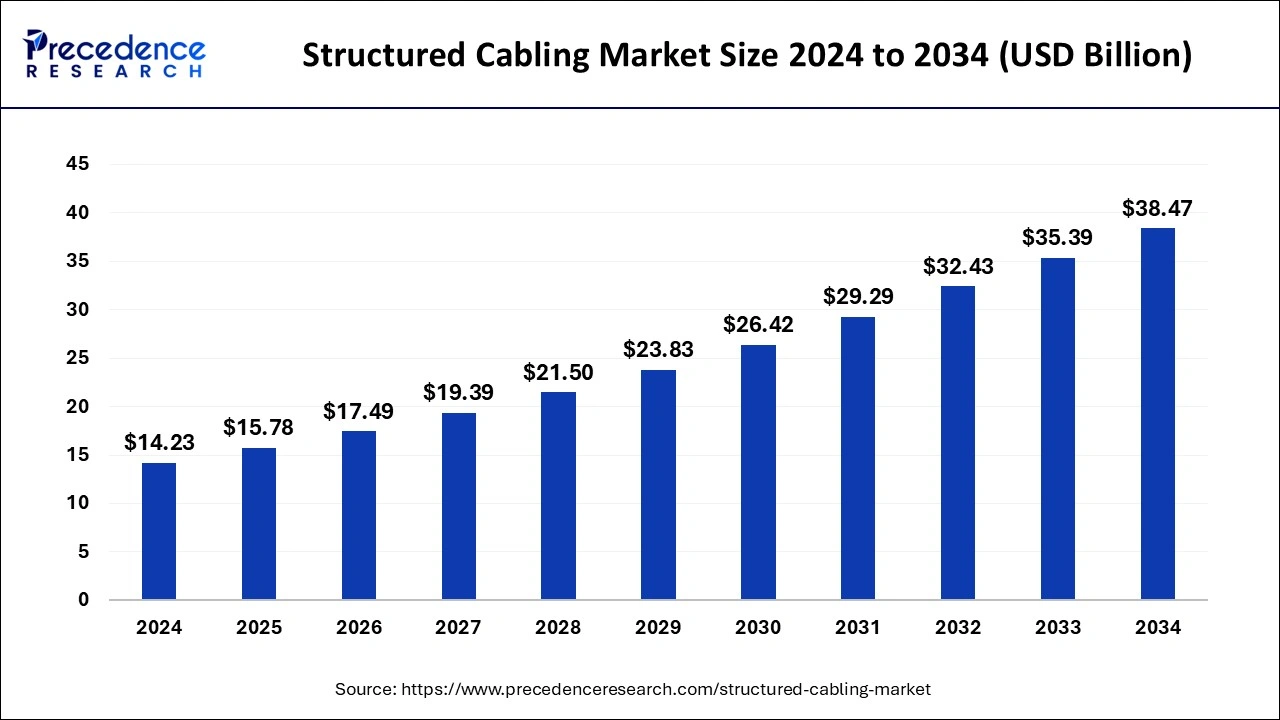

The global structured cabling market size was accounted for USD 14.23 billion in 2025, and it is expected to hit around USD 38.47 billion by 2034, poised to grow at a CAGR of 10.46% from 2025 to 2034.

Market Highlights

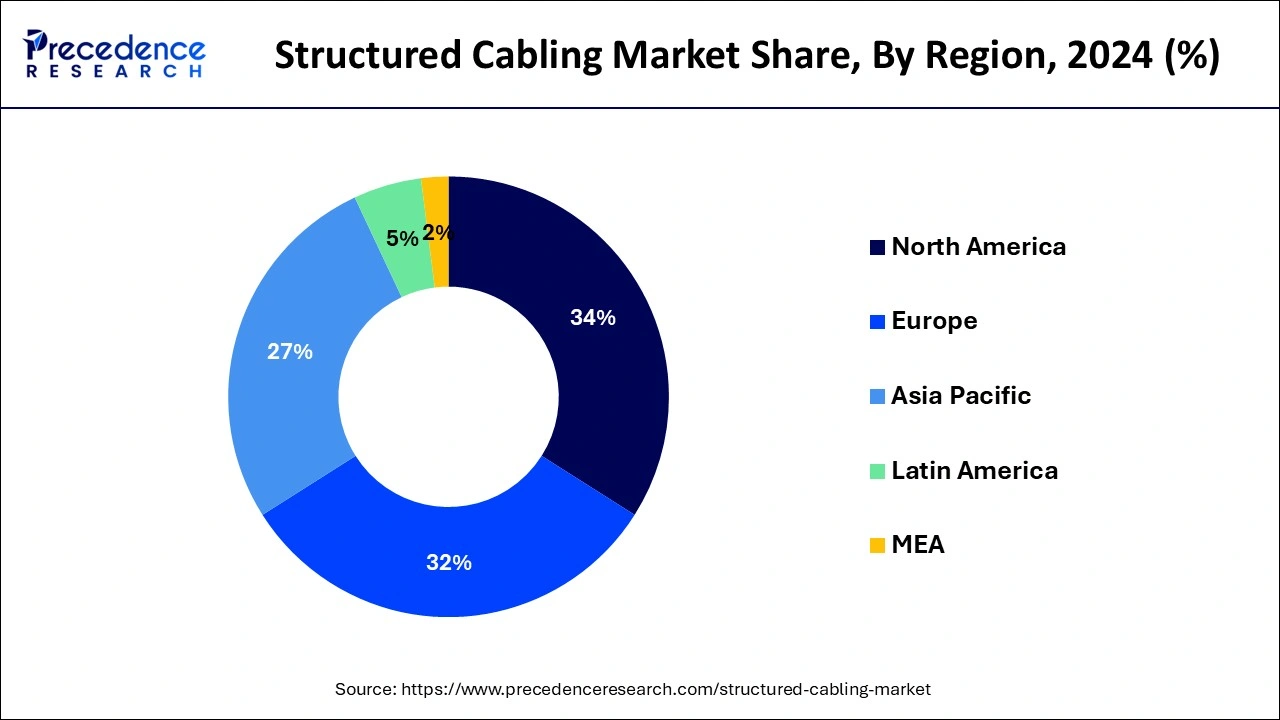

- North America led the global market with the highest market share of 34% in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR from 2025 to 2034.

- By Type, the copper cabling segment is predicted to dominate the global market from 2025 to 2034.

- By End-user, the local area network (LAN) segment is estimated to lead the global market from 2025 to 2034.

- By Cable Type, the Cat 6 segment is expected to dominate the global market between 2025 and 2034.

- By Application, the local area network (LAN) segment accounts for most of the market.

Market Size and Forecast

- Market Size in 2025: USD 15.78 Billion

- Market Size in 2026: USD 17.49 Billion

- Forecasted Market Size by 2034: USD 38.47 Billion

- CAGR (2025-2034): 10.46%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Structured cabling is the standardized system of cabling infrastructure used to support various communication technologies within a building or campus. It involves the installation of a comprehensive network of cables, connectors, and related hardware to provide a reliable and efficient telecommunications infrastructure. Its primary purpose is to establish a unified platform for transmitting data, voice, video, and other communication signals throughout a facility. It is vital for various network systems, including local area networks (LANs), telephony systems, data centers, and audio-visual systems.

The structured cabling market encompasses the production, installation, and maintenance of structured cabling systems. It involves the various products, services, and solutions related to designing, implementing, and managing structured cabling infrastructure within buildings, data centers, and other facilities. The market is driven by the increasing demand for reliable and high-speed connectivity solutions to support organizations' growing data and communication needs. It caters to a wide range of industries, including IT and telecommunications, healthcare, manufacturing, government, finance, and retail.

Furthermore, increasing data and communication needs, adoption of high-speed networks, and scalable communication infrastructure that can support the increasing data and connectivity demands of modern organizations across various industries drive demand across the market. In addition, with the exponential growth of data traffic and the rising demand for high-speed and reliable connectivity, organizations require robust cabling infrastructure to support their data, voice, and video communication needs. Structured cabling provides a scalable, future-proof solution to accommodate expanding data requirements.

However, high initial installation costs, lack of flexibility in existing infrastructures, and complexity of installation and maintenance are anticipated to impede market growth. Structured cabling installations require skilled professionals with cable routing, termination, and testing expertise. The complexity of installation, especially in larger-scale projects, can pose challenges in terms of time, resources, and coordination. Similarly, ongoing maintenance and troubleshooting of structured cabling systems can be intricate and may require specialized knowledge.

Structured Cabling Market Growth Factors

- Growth in data center expansion- The surge in global data center construction to support cloud computing and big data analytics increases the need for dependable and expandable structured cabling systems.

- Increase in Internet of Things (IoT) adoption- IoT growth leads to an increased need for rapid and reliable cabling infrastructure in order to connect numerous smart devices, respectively, in commercial and industrial environments.

- Increased demand for high-speed connectivity- Enterprises and consumers have a growing need for more rapid data transfer speeds, which results in the adoption of structured cabling systems able to support the higher bandwidth transfer requirements and low-latency communication.

- Trends towards smart buildings and office automation- The move towards smarter buildings with integrated lighting, HVAC, and security systems creates increased deployment of structured cabling to enable seamless communication and control of devices.

- Cloud-based solutions migration- As businesses migrate to Cloud services, structured cabling is critical in establishing dependable, flexible, and future-ready network infrastructure in new hybrid IT environments.

Structured Cabling Market Outlook:

- Industry Growth Overview: Between 2024 and 2034, the structured cabling market is expected to grow significantly. This growth is driven by increasing enterprise investments in high-speed data networks, cloud computing infrastructure, and hyperscale data centers. The adoption of 5G, IoT, and edge computing is accelerating, which is driving the need for high-performance cabling solutions that support high bandwidths and low-latency transmission. Enterprise-level scalable and future-proof cabling solutions, aimed at supporting market growth, are also driven by the need to meet the future demand for exponential data traffic growth.

- Technology & Innovation Trends: There is a rapid shift toward more advanced cabling products, including new Category 8 copper, Multimode fiber on OM5 and OM6, and high-density modular cabling options. To achieve optimal performance and minimize downtime, manufacturers are integrating cabling solutions with IoT and cloud-based monitoring platforms. The adoption of sustainable materials and low-smoke zero-halogen (LSZH) cables is also growing due to environmental and safety standards.

- International Growth: Leading providers of structured cabling are strategically expanding their global presence to meet end-user demand, leverage local regulatory benefits, and get closer to major enterprise customers. New facilities and logistics centers are opening in Southeast Asia, Latin America, and Eastern Europe, with companies like Legrand and Nexans leading the way. They are also entering new smart city initiatives, government digitalization projects, and industrial automation centers. To speed up market entry, these companies are forming acquisitions and joint ventures with local distributors.

- Major Investors: The structured cabling industry is increasingly attracting private equity, venture capital, and strategic corporate investors. Attracted by its stable B2B revenue streams and vital role in digital transformation, companies like KKR, Blackstone, and Carlyle have focused on firms that provide network infrastructure, fiber optic solutions, and modular cabling systems. Next-generation fiber optic technology and AI-based network management platforms also draw strategic investors who support R&D. The industry benefits from high technical entry barriers, strong customer relationships, and long-term service contracts.

- Startup Ecosystem: The structured cabling startup ecosystem is evolving, with new players focusing on smart infrastructure, automation, and AI-driven network monitoring. Startups are creating modular, plug-and-play fiber optic systems, pre-terminated cabling, and predictive maintenance software to meet enterprise needs. Investment is flowing into solutions that integrate cabling with IoT, energy efficiency management, and green materials. Additionally, small innovators are exploring niche markets such as edge data centers, telecom towers, and industrial automation networks.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 15.78 Billion |

| Market Size in 2026 | USD 17.49 Billion |

| Market Size by 2034 | USD 38.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.46% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Cable Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing data and communication needs to brighten the market prospect

Organizations ever-increasing data and communication needs are driving the demand for structured cabling. As technology advances, businesses generate and transmit larger volumes of data, requiring a reliable and efficient infrastructure to support their communication networks. The exponential growth of data is fueling the demand for the structured cabling market. Organizations across various industries deal with massive amounts of data generated by applications, IoT devices, and digital processes. Structured cabling provides the backbone to handle this data influx, ensuring reliable and high-speed transmission throughout the network. For instance, in July 2021, Sterlite Technologies, a digital network integrator, launched NetXs, a next-generation suite of structured cabling solutions. NetXs offers superior performance for data transmission applications, catering to advanced networking solutions worldwide.

Furthermore, businesses need fast and reliable communication for applications like cloud computing, video conferencing, and real-time data transfer. Structured cabling, particularly fiber optic cabling, offers the bandwidth and speed required to support these bandwidth-intensive applications, enabling seamless and efficient communication. Organizations want a network infrastructure that can easily accommodate growth and adapt to changing needs. With structured cabling, adding or removing connections and devices becomes easier as the business expands or undergoes changes. This scalability ensures that the communication infrastructure can keep up with the evolving demands of the organization. Thus, organizations' increasing data and communication needs are the driving forces behind the growing demand for the structured cabling market.

Adoption of high-speed networks

As technology advances and organizations rely more heavily on fast and reliable connectivity, structured cabling emerges as a critical component to support these high-speed networks. With the growing volume of data being generated and transmitted, organizations require network infrastructure capable of handling large amounts of data quickly and efficiently. Furthermore, adopting high-speed networks, such as Gigabit Ethernet, 10 Gigabit Ethernet, and beyond, also contributes to the demand for structured cabling. These networks enable faster and more reliable communication, supporting bandwidth-intensive applications and services. Structured cabling systems offer the necessary infrastructure to establish these high-speed connections, ensuring organizations can leverage the full potential of their networks.

In addition, increasing reliance on cloud computing and virtualization is another factor driving demand for the structured cabling market. These technologies require robust, high-speed connectivity between servers, storage systems, and end-user devices. Structured cabling provides the foundation for these network architectures, enabling efficient and seamless communication within cloud environments and virtualized infrastructures. Several players are investing in various technologies to provide high bandwidth and data-intensive applications, further driving market demand. For instance, in July 2022, Lumen Technologies announced its plans to invest in edge networking to expand and enhance its edge computing solutions in Europe. The company intends to provide low-latency cloud and edge computing platforms, catering to businesses with high bandwidth requirements and data-intensive applications.

Moreover, the rising demand for multimedia content, video streaming, and real-time collaboration tools contributes to the need for high-speed networks. Structured cabling systems offer the capacity and performance required to deliver high-quality audio and video content, ensuring a smooth and immersive user experience. Thus, adopting high-speed networks is a significant driver for the demand in the structured cabling market.

Market Challenges

The installation costs of structured cabling include various components such as cables, connectors, patch panels, network equipment, and professional installation services. These costs can quickly add up, especially when considering the need for skilled technicians to handle the installation process. As a result, organizations may hesitate or face budget constraints when considering structured cabling solutions. Moreover, the complexity of the installation process itself adds to the costs. Structured cabling installations require careful planning, cable routing, termination, and testing. These tasks often require specialized knowledge and expertise, leading to additional expenses in terms of labor and time. Larger-scale projects or installations in existing infrastructures may involve significant site preparation, cable runs, and coordination, increasing overall costs.

In addition, the high initial costs of structured cabling can be particularly challenging for small and medium-sized enterprises (SMEs) or organizations with limited budgets. The substantial upfront investment may deter these organizations from adopting structured cabling or lead to compromises in the quality or scale of the cabling infrastructure, potentially impacting their network performance and future scalability and further restraining demand for the structured cabling market.

Opportunity

Increasing Demand for Higher Speed, Scalable, and Sustainable Structured Cabling Systems

The structured cabling market is benefiting from some strong growth opportunities. These opportunities are enabled by the very quick move to fiber optic infrastructure, which provides both speed and scalability that copper structured cabling does not provide, and the reliability fiber provides over copper. China is targeting a 5G user penetration rate exceeding 85% by the end of 2027, as it accelerates the deployment and large-scale application of 5G technologies, and these infrastructures require cables that carry high bandwidth and low latency to support edge computing and data-heavy applications.

Connected devices have led to a growing interest in PoE cabling as it provides power and data. The rise of AI and automation tools for organizing and managing cabling provides predictive maintenance and a more efficient network performance calculation for data centers and smart buildings. Lastly, a growing area of consistent discussion is around sustainability. Enterprises are scouring with intent, and research reports show that 70% of enterprises are actively investigating sustainable products.

Segments Insights

Type Insights

The structured cabling market is divided into fiber cabling, cabling infrastructure, and copper cabling, with the copper cabling segment accounting for most of the market. This is because the copper cabling provides versatility in supporting various data communication standards, including Ethernet, telephone systems, and video transmission. It can handle various data speeds, making it suitable for applications and network requirements.

Cable Type Insights

The structured cabling market is divided into Cat 5E, Cat 6, Cat 6A, Cat 7/7A, and others (Cat 8), with Cat 6 accounting for most of the market. This is due to their enhanced performance compared to their predecessors, such as Cat 5 and Cat 5E. Cat 6 cables provide higher bandwidth and improved signal-to-noise ratio, allowing faster data transmission rates and better network performance.

Application Insights

The structured cabling market is divided into local area network (LAN) and data center, with the local area network (LAN) segment accounting for most of the market. This is because LANs enable internal communication and data sharing within organizations. They facilitate seamless connectivity among computers, printers, servers, and other network devices, enabling efficient collaboration and resource utilization. In addition, LANs are widely used in various environments, such as offices, educational institutions, healthcare facilities, and retail spaces. LANs provide network connectivity within a limited geographic area, allowing users to share resources, access the internet, and communicate with each other.

End-User Insights

The structured cabling market is divided into residential, commercial, and industrial, with industrial accounting for most of the market. The industrial sector encompasses various industries such as manufacturing, oil and gas, automotive, chemicals, and more. These industries often have complex and demanding networking requirements to support their operations, including automation, process control, machine-to-machine communication, and data-intensive applications. Structured cabling is critical in providing reliable and efficient connectivity within industrial environments, ensuring seamless communication and data transmission.

Regional Insights

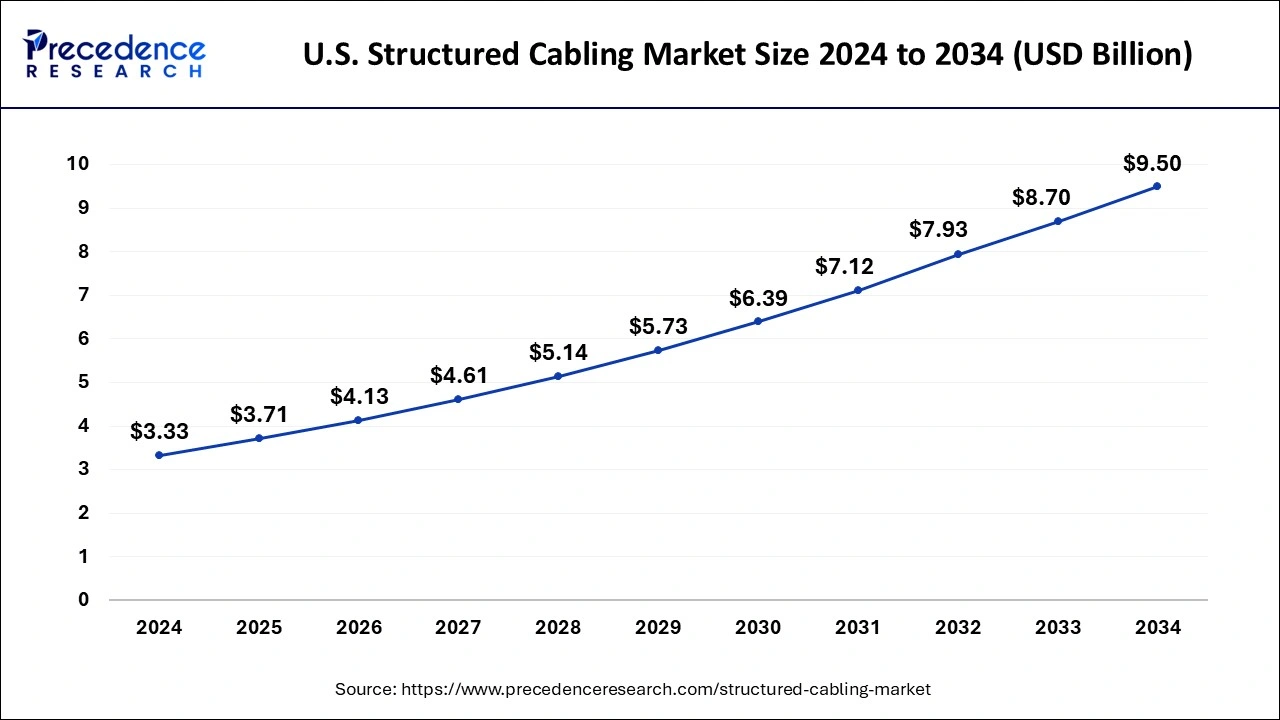

U.S. Structured Cabling Market Size and Growth 2025 to 2034

The U.S. structured cabling market size reached USD 3.33 billion in 20253.71 and is anticipated to be worth around USD 9.50 billion by 2034, poised to grow at a CAGR of 11.05% from 2025 to 2034.

On the basis of geography, North America dominates the market, primarily driven by the growing demand for high-purity hydrogen in various industries. The region is expected to witness significant growth in the structured cabling market in the coming years, driven by technological advancements, increasing data and communication needs, data center expansion, industry standards, and the region's robust IT infrastructure. As organizations continue to invest in advanced networking technologies and digital transformation, the demand for structured cabling solutions is expected to remain strong in North America.

What Makes Europe a Significant Market?

Europe is a significant market for structured cabling, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to the governments, businesses, and organizations in Europe making substantial investments in upgrading and expanding their IT networks to support digital transformation, cloud computing, IoT, and other emerging technologies.

What Makes Asia Pacific the Fastest-Growing Area in the Structured Cabling Market?

The region in Asia-Pacific is anticipated to have the greatest CAGR. The market is driven by the increasing adoption of smartphones,e-commerce, online services, and digital technologies, and the demand for high-speed internet connectivity is rising. Structured cabling is vital in establishing reliable and high-bandwidth networks to support these digital services and facilitate digital transformation across industries.

U.S. Structured Cabling Market Analysis

Rapid digital transformation and IT infrastructure modernization in enterprises across the U.S. are likely to position the country as a leader in the North American structured cabling market. A rise in smart building projects is boosting the demand for structured cabling. Additionally, government policies aimed at improving cybersecurity and promoting digital connectivity are likely to boost the adoption of structured cabling solutions.

Germany Structured Cabling Market Analysis

Germany is projected to lead the European structured cabling market, fueled by the country's rapid industrial digitalisation and the ongoing corporate infrastructure modernisation initiatives. The rise of smart manufacturing plants and the adoption of Industry 4.0 technologies in key cities like Frankfurt, Munich, and Berlin are expected to significantly boost demand for high-performance cabling networks, while European integrators are likely to expand their reach through strategic partnerships and further developments in Eastern Europe.

China Structured Cabling Market Analysis

China leads the market in Asia Pacific due to extensive urbanization, smart city initiatives, and the rapid expansion of telecom infrastructure. Demand is anticipated to increase driven by government efforts to implement high-speed broadband and foster digital transformation in the industrial and commercial sectors. The market growth will be further supported by strategic policies focused on modernizing technology and enhancing connectivity in cities and semi-urban areas.

What Potentiates the Growth of the Market in Latin America?

The structured cabling market in Latin America is driven by the modernization of commercial buildings, office complexes, and educational institutions, as well as by the growing demand for robust IT and telecommunications infrastructure. As multinational companies expand their operations in major cities like São Paulo and Rio de Janeiro, the need for scalable, reliable network solutions is expected to further accelerate market growth in the region.

Brazil Structured Cabling Market Analysis

Brazil is expected to lead the Latin American structured cabling market, driven by the modernization of commercial offices, educational institutions, and government facilities. The development of IT infrastructure, the digitalization of enterprises, and the expansion of telecommunications networks will significantly boost demand for reliable cabling solutions, with further investments spurred by the rise of cloud computing, data centers, and enterprise IT systems.

How is the Opportunistic Rise of the Middle East and Africa in the Market?

The Middle East and Africa are seeing a rise in the structured cabling market, driven by increasing urbanization and large-scale smart city projects in Dubai and Abu Dhabi. Government investments in digital infrastructure, high-rise commercial buildings, and free zones are expected to create substantial cabling requirements. Additionally, the growth of 5G networks, data centers, and enterprise IT systems is likely to boost market demand.

UAE Structured Cabling Market Analysis

The UAE is expected to dominate the Middle East & Africa structured cabling market, fueled by rapid urbanisation, high-rise commercial developments, and large-scale smart city projects in Dubai and Abu Dhabi. Government investments in digital infrastructure, enterprise IT, and telecom networks, along with the growing adoption of 5G networks and advanced data centres, are expected to further drive market growth.

Structured Cabling Market – Value Chain Analysis

- Raw Material SourcingThe foundation of structured cabling production relies on high-quality raw materials, including copper, fiber-optic glass, aluminum, and various polymeric insulation and sheathing materials.

Key Players: Southwire, Prysmian Group, Nexans, Corning. - Component Manufacturing

Raw materials are processed into cabling components, including twisted-pair cables, fiber-optic strands, connectors, jacks, patch panels, and cable management accessories.

Key Players: CommScope, Panduit, Legrand, Belden. - Cable Assembly & Testing

Individual cables are assembled, shielded, and tested for performance, bandwidth capacity, durability, and compliance with industry standards such as TIA/EIA and ISO/IEC.

Key Players: Corning, Leviton, Molex, Siemon. - System Design & Integration

Engineers design end-to-end structured cabling systems for data centers, commercial buildings, and industrial facilities, integrating cables with networking hardware, racks, and patching solutions.

Key Players: BICSI-certified system integrators, Cisco, Panduit, CommScope. - Installation & Deployment

Trained contractors and installation firms deploy the structured cabling system, including routing, termination, testing, and certification of connectivity performance.

Key Players: Graybar, Anixter, Black Box Network Services, and local certified cabling contractors. - Maintenance & Upgrades

Ongoing maintenance, troubleshooting, and capacity upgrades ensure network reliability, scalability, and compliance with evolving technology standards.

Key Players: Managed service providers, system integrators, and IT infrastructure consultants.

Structured Cabling Market Companies

- ABB Ltd (Switzerland): ABB provides advanced connectivity and infrastructure solutions, enabling high-performance cabling systems for data centers, commercial buildings, and industrial networks.

- Anixter International Inc. (U.S.): A global distributor of structured cabling, networking, and security solutions, Anixter offers end-to-end deployment support and certified cabling products.

- Belden Inc. (U.S.): Belden designs and manufactures high-quality cabling and connectivity solutions for enterprise, industrial, and broadcast networks worldwide.

- Legrand SA (France): Legrand delivers integrated structured cabling systems, network racks, and intelligent cable management solutions for commercial and data center applications.

- CommScope Holding Co. Inc. (U.S.): CommScope develops innovative cabling, fiber optic, and connectivity solutions for enterprise, telecom, and data center networks globally.

- Cisco Systems Inc. (U.S.): Cisco offers network infrastructure solutions with advanced cabling integration, ensuring high-speed connectivity and scalable enterprise network architectures.

- Corning Inc. (U.S.): Corning provides premium fiber optic cables, connectivity components, and deployment solutions for data centers, telecom, and enterprise networks.

- Datwyler Holding Inc. (Switzerland): Datwyler specializes in structured cabling, network components, and fiber optic solutions for high-performance communications and industrial applications.

- Furukawa Electric Co., Ltd. (Japan): Furukawa develops copper and fiber optic cabling solutions, connectors, and integrated network systems for enterprise and telecom networks.

- Hubnetix Corp. (U.S.): Hubnetix delivers intelligent cabling management and monitoring solutions, enabling real-time network performance optimization and predictive maintenance.

Recent Developments

- In March 2025, Dunes Point Capital, LP, announced Eleconnex's acquisition of Structured Cable Products, Inc., and SIMPLY45, LLC.

- In September 2021, Nexans SA completed the acquisition of Centelsa, a leading cable manufacturer in Latin America. This strategic move aims to enhance Nexans' production capabilities for utility and building applications, ensuring a broader range of high-quality cables.

- In November 2021, Reichle & De-Massari AG announced the expansion of its cable plant in Dìèín, Czech Republic, to increase production capacity. The company has planned to invest millions of dollars to enhance its fiber optic cable manufacturing capabilities

Segments Covered in the Report

By Type

- Fiber Cabling

- Cabling Infrastructure

- Copper Cabling

By Cable Type

- Cat 5E

- Cat 6

- Cat 6A

- Cat 7/7A

- Others (Cat 8)

By Application

- Local Area Network (LAN)

- Data Center

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting