Surgical Gloves Market Size and Forecast 2025 to 2034

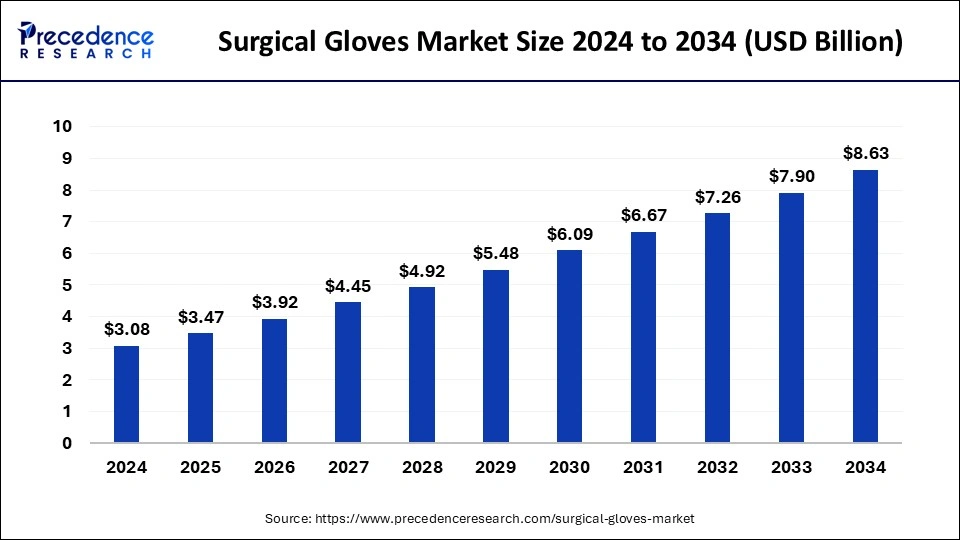

The global surgical gloves market size accounted for USD 3.08 billion in 2024 and is predicted to increase from USD 3.47 billion in 2025 to approximately USD 8.63 billion by 2034, expanding at a CAGR of 7.40% from 2025 to 2034.

Surgical Gloves Market Key Takeaways

- In terms of revenue, the global surgical gloves market was valued at USD 3.08 billion in 2024.

- It is projected to reach USD 8.63 billion by 2034.

- The market is expected to grow at a CAGR of 7.40% from 2025 to 2034.

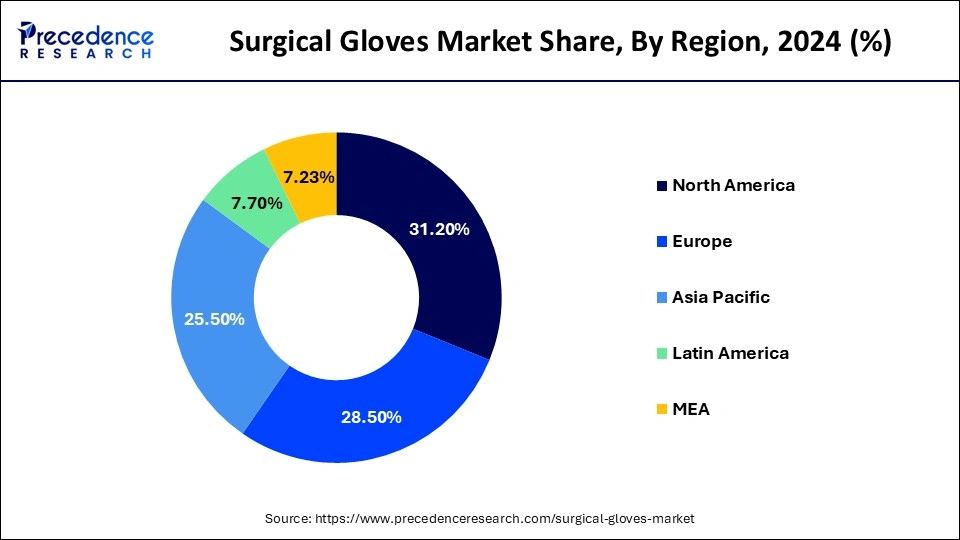

- North America dominated the market with the largest share of 31.2% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 11.4% during the forecast period.

- By product, the natural rubber segment has captured more than 38% of the market share in 2024.

- By product, the nitrile segment is expected to grow at a CAGR of 9.1% during the forecast period.

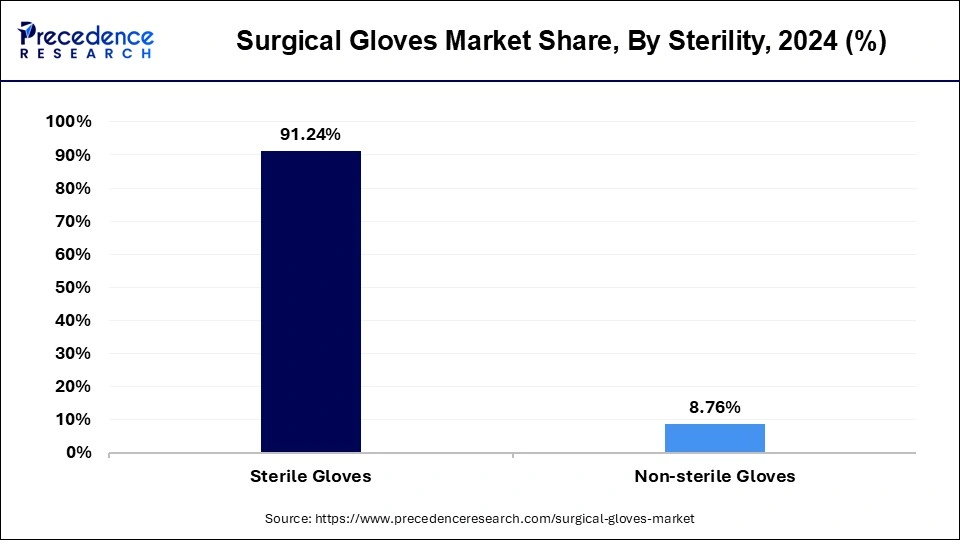

- By sterility, the sterile segment held the largest market share of 91.24% in 2024.

- By form, the powder-free segment has accounted for more than 94.34% of the market share in 2024.

- By end-use, the hospital segment has generated more than 43.63% of the market share in 2024.

U.S.Surgical Gloves Market Size and Growth 2025 to 2034

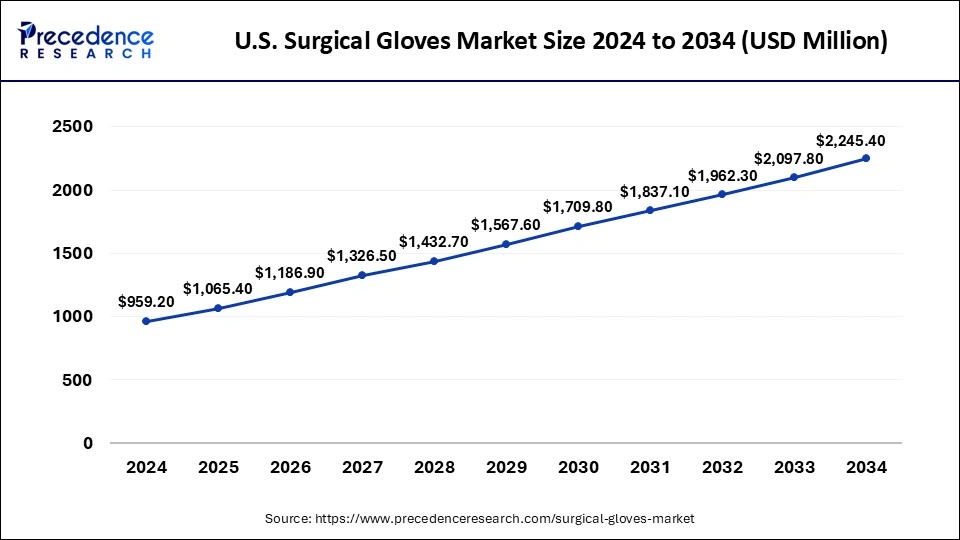

The U.S. surgical gloves market size was exhibited at USD 959.20 million in 2024 and is projected to be worth around USD 2,245.40 million by 2034, growing at a CAGR of 5.30%.

North America led the market with the biggest market share of 31.2% in 2024 because of continuous improvements in surgery brought about by improvements in medical technology, as well as the assistance of supported systems like High-Reliability Organizations (HROs), which are anticipated to spur expansion in the hospital industry and increase demand for its products. The need is anticipated to be driven by strict government laws about the security of medical professionals, patients, and other staff members in hospitals and other facilities, as well as harsh penalties for noncompliance.

For instance, surgical gloves have to be provided powder-free and sterile, and items that satisfy their specifications have to have the "CE EN 455" label on them. Moreover, surgical gloves that are free of powder and sterile must be supplied. Additionally, the market is stimulated by the FDA's recognition of ASTM D3577-19 as a standard for surgical gloves. Thus, this is expected to drive the surgical gloves market in the region.

Asia Pacific is observed to witness the fastest rate of expansion during the forecast period. The rising number of non-invasive surgeries in the region along with the improvements in the healthcare sector are observed to propel the growth of the surgical gloves market in the upcoming years. Nations such as China, Japan and India are believed to be the largest consumers of surgical gloves while promoting the production of the same with the availability of low-cost labors and cost-effective raw materials.

Market Overview

The surgical gloves market offers disposable gloves worn by healthcare professionals during surgical procedures and other medical examinations to prevent the transmission of infectious agents between the wearer and the patient. These gloves are an essential part of standard infection control practices in healthcare settings. They serve several purposes, including protecting both the healthcare provider and the patient from the risk of infection, preventing cross-contamination, and maintaining a sterile environment during surgical procedures.

Surgical gloves are typically made of materials such as latex, nitrile, or vinyl. Latex gloves were traditionally popular due to their elasticity and comfort, but some individuals may have latex allergies. Nitrile and vinyl gloves are alternative materials that are hypoallergenic and suitable for those with latex sensitivities. These gloves undergo stringent manufacturing processes to ensure they meet quality standards. The surgical gloves market offers products in various sizes to ensure a proper fit for different hand sizes. Proper usage and disposal of surgical gloves are critical to maintaining aseptic conditions and preventing the spread of infections in healthcare settings.

Surgical Gloves Market Growth Factors

- The demand for surgical gloves is closely tied to the overall number of surgical procedures performed globally. As healthcare infrastructure improves and the population grows, there is an increased need for surgeries, driving the demand for surgical gloves.

- The emphasis on infection control and prevention of healthcare-associated infections (HAIs) has been a significant driver. Healthcare providers and institutions are increasingly aware of the importance of using disposable gloves to minimize the risk of cross-contamination during medical procedures.

- The overall increase in healthcare expenditure, especially in developing regions, contributes to the growth of the surgical gloves market. As more resources are allocated to healthcare, there is an associated increase in the adoption of disposable medical products. This factor promotes the growth of the surgical gloves market.

- Advances in manufacturing technologies and materials contribute to the development of high-quality and more comfortable surgical gloves. This includes innovations in glove materials to enhance durability, flexibility, and barrier properties.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.40% |

| Market Size in 2025 | USD 3.47 Billion |

| Market Size by 2034 | USD 8.63 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Sterility, Form, End-use, and Usage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing number of surgical procedures

The demand for surgical gloves is expected to be driven by the increasing number of surgical operations conducted in the United States, including carotid endarterectomy, appendectomy, cesarean section, Coronary Artery Bypass Graft (CABG), and circumcision. For instance, the Centers for Medicare & Medicaid Services reports that U.S. hospitals swiftly implemented new safety regulations in response to the pandemic's effects, which led to a significant decrease in the rates of non-essential surgery. Thereby, the rising number of surgical procedures is observed to act as a driver for the surgical gloves market.

Restraint

Allergies and environmental concerns

The once-popular latex gloves might trigger allergic responses in certain people. As a result, people are starting to use substitute materials like vinyl or nitrile. User preferences may be impacted by the perception of these alternatives as being less comfortable or stretchy. Furthermore, a significant portion of environmental waste is produced by the disposal of disposable gloves, particularly surgical gloves. The market for traditional disposable gloves may be impacted by the growing demand for more sustainable alternatives due to increased awareness of environmental problems. Thus, this is expected to hamper the surgical gloves market over the forecast period.

Opportunity

Increasing preference for biodegradable and powder-free nitrile gloves

Powder-free nitrile gloves are becoming more and more popular among end users, mainly hospitals. This is because they are used to prevent risks such as exposure to starch powder, which can result in granulomas, pleuritis, myocarditis, and skin irritation. Furthermore, it is now mandatory for healthcare personnel to wash their hands after using powdered gloves rather than using an alcohol-based hand rub (ABHR).

Furthermore, producers are putting more effort into creating gloves without powder by taking out the remaining powder from powdered gloves. Moreover, several legislative measures are contributing to the expansion of powder-free nitrile gloves by enforcing more stringent regulations and standards for the usage of powdered gloves since they raise safety issues. Thus, this is expected to open lucrative opportunities for the surgical gloves market.

Product Insights

The natural rubber segment dominated the surgical gloves market in 2024.The tactile nature of natural rubber or latex surgical gloves makes them a top choice for delicate tasks like operations and medical procedures. They are also perfect for handling biological or water-based products since they are flexible, pleasant to wear, and both. Given that latex gloves are permitted by the FDA for use in the medical field, there will likely be a substantial increase in demand for these gloves in that industry.

Besides, the nitrile segment is expected to grow at a rapid rate in the surgical gloves market during the forecast period. When working with patients who have infectious illnesses or during procedures that include the use of blood or other body fluids, these gloves are often recommended. Surgical gloves are put through a rigorous testing process to ensure they fit the Food and Drug Administration's criteria, given the considerable danger involved in both surgical operations and operating room conditions. It is anticipated that the aforementioned variables would fuel market expansion demand.

Sterility Insights

The sterility segment held the largest market share in 2024Sterile surgical gloves are widely used by operation theatre staff as they are made for single use and later on discarded. This property of sterile gloves reduces the chances of infection caused by used gloves. The rising number of non-invasive medical procedures has boosted the requirement for high-grade medical products, this supplements the segment's growth. Apart from the healthcare industry, sterile gloves are being widely adopted by laboratories.

Form Insights

The powder-free segment held the largest share of the surgical gloves market in 2024. Over the approaching years, powder-free gloves are anticipated to take the lead in the market due to their growing popularity in the healthcare sector. Strict restrictions on powdered gloves by some countries worldwide are also expected to positively impact the powder-free glove industry in the upcoming years. The FDA announced a regulation banning powdered surgical medical gloves, citing the serious hazards that patients faced from these gloves, such as allergic responses, wound and airway irritation, and adhesions following surgery. Moreover, the restriction does not apply to the powder used in the production of powder-free gloves; just a tiny quantity is included in the final product.

The powder segment is expected to grow at a significant rate in the surgical gloves market during the forecast period. These gloves don't stick together because of the maize flour inside. Corn flour, an ingredient in powdered gloves, can cause skin irritation in both users and anyone who comes into contact with them. Furthermore, there is a chance of contamination because powdered glove powder has been shown to stick to hands, objects, and clothes. Direct contact with starch occurs, for instance, when dentists have to reach inside a patient's mouth with bare hands. Within the dental community, this is a major source of worry. In the upcoming years, the demand for powdered gloves is anticipated to increase more slowly due to the aforementioned issues.

End-Use Insights

The hospital segment held the largest share of the surgical gloves market in 2024, the segment is observed to sustain the position during the forecast period. Hospitals are among the largest consumers of surgical gloves due to the high volume of surgical procedures and medical examinations conducted daily. The continuous demand for these gloves is directly linked to the frequency of surgeries and medical interventions in hospital settings. Additionally, hospitals prioritize stringent infection control measures to prevent healthcare-associated infections (HAIs). Surgical gloves play a pivotal role in maintaining a sterile environment during surgeries and medical procedures, contributing to the overall infection prevention strategies implemented by hospitals.

Besides, the emergency medical services segment is expected to grow at a rapid rate over the forecast period in the surgical gloves market. EMS professionals often encounter various medical emergencies where the use of surgical gloves is crucial for infection control. Whether responding to accidents, trauma cases, or medical emergencies, EMS personnel need to protect themselves and patients from potential infections. In addition, EMS encounters a wide range of situations, from accident scenes to medical emergencies. Surgical gloves are used not only during potential surgical procedures but also during patient assessments, administering medications, and handling bodily fluids. Thereby, driving the segment growth.

Recent Developments

- In May 2023, leading nitrile glove producer Cranberry announced the launch of Bio Nitrile Biodegradable Nitrile Powder Free Examination Gloves, its newest invention. These gloves are made in response to consumer demand for more eco-friendly and sustainably produced goods. The glove's biodegradable qualities may be traced to a special ingredient that, when added to a landfill, stimulates microbial activity. This allows the material to break down up to 90% faster than it would in 1.5 years. The gloves meet or beyond ASTM requirements for force at break and tensile strength despite being biodegradable. In the medical field, the Cranberry Bio Nitrile gloves are a major innovation. They provide environmentally favorable advantages without sacrificing robustness or protection, which qualifies them for usage in dentistry and medical examination environments.

- In May 2023, Institut Cyclos-HTP (CHI), a globally renowned organization that evaluates and certifies the recyclability of packaging and goods, has awarded the highest recyclability certification to Ansell, the world's leading supplier of branded surgical gloves. This certification confirms a AAA rating for the SMART PackTM surgical glove packaging. Ansell's dedication to spearheading sustainable packaging design with its SMART PackTM program launched in 2016, is further validated by this AAA grade. The thermoforming pouch, dispenser box, interior wallet, and shipper carton are among the separate parts that have been tested by CHI requirements. To find out how each component will perform in actual use, each was put through a series of tests inside its assigned recycling pathway. After that, every component was thoroughly assessed to make sure it complied with recycling requirements for further reuse in its recyclate (end recycling condition). The experiments were modelled after the recycling systems of thirty-two nations, including Belgium, the United Kingdom, and China.

Surgical Gloves Market Companies

- Cardinal Health Inc.

- MRK Healthcare Pvt. Ltd.

- Sempermed

- Globus Group

- Kanam Latex Industries Pvt. Ltd.

- Narang Medical Limited

- Hartalega Holdings

- Top Glove Corporation

- Ansell Ltd.

- Sun Healthcare (M) Sdn. Bhd

Segments Covered in the Report

By Product

- Neoprene

- Nitrile

- Natural Rubber

- Polyisoprene

- Others

By Sterility

- Sterile Gloves

- Non- Sterile Gloves

By Form

- Powder-free

- Powder

By End-use

- Dental

- Veterinary

- Emergency medical service

- Hospital

- Others

By Usage

- Reusable

- Disposable

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content