Truck Platooning MarketSize and Forecast 2025 to 2034

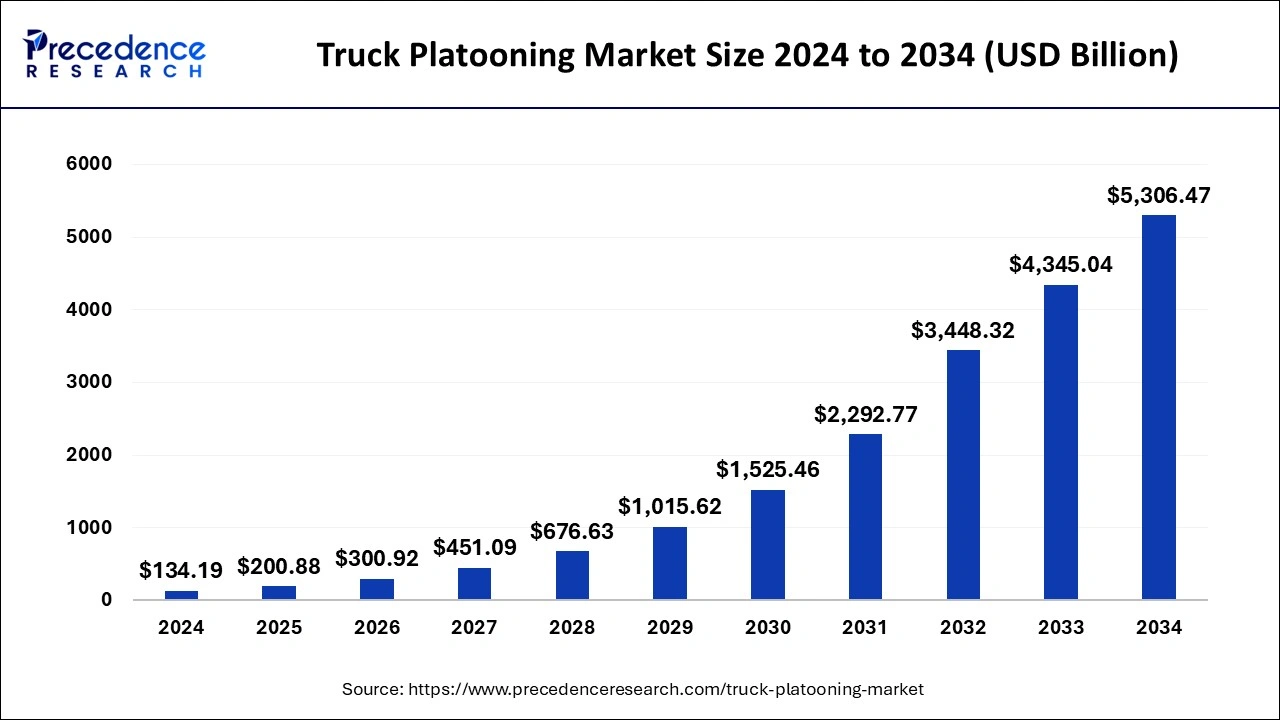

The global truck platooning market size accounted for USD 134.19 billion in 2024 and is expected to exceed around USD 5,306.47 billion by 2034, growing at a CAGR of 44.45% from 2025 to 2034. The growing trend of autonomous trucks for logistics operations has boosted the growth of the truck platooning market.

Truck PlatooningMarket Key Takeaways

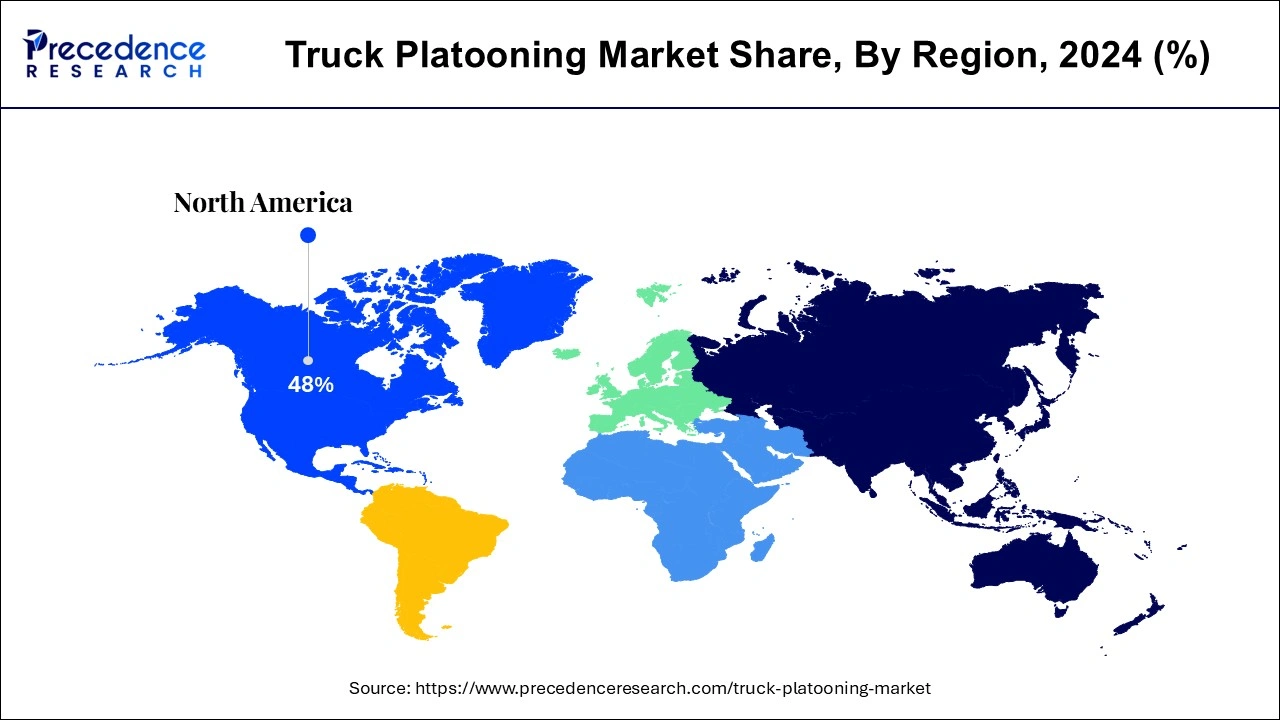

- Europe dominated the global market with the largest market share of 31% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By technology, the adaptive cruise control segment contributed the highest market share in 2024.

- By technology, the DSRS V2V communication segment is estimated to be the fastest-growing segment during the forecast period.

- By component, the RADAR base collision mitigation segment has held the largest market share in 2024.

- By component, the forward-looking camera segments is predicted to be the fastest-growing segment during the forecast period.

What is the Role of AI in the Truck Platooning Market?

AI has played a major role in the transportation sector. In transportation Industry, AI helps in management of traffic, supply chain optimization, enhances safety. Nowadays, truck platooning service providers are integration AI in their systems for improving truck platoons for freight delivery by enhancing vehicle-to vehicle and vehicle-to-infrastructure communications that helps in reducing fuel consumption and increase traffic efficiency. Moreover, AI helps in managing autonomous trucks by enhancing ADAS capabilities and improving fleet operations. Thus, the advancements in AI is crucial for the growth of the truck platooning market.

In January 2024, RXO launched an AI-based check-in system for trucks. This system enables helps in identifying trucks by extracting image and video data for streamlining the check-in and security process.

Europe Truck Platooning Market Size and Growth 2025 to 2034

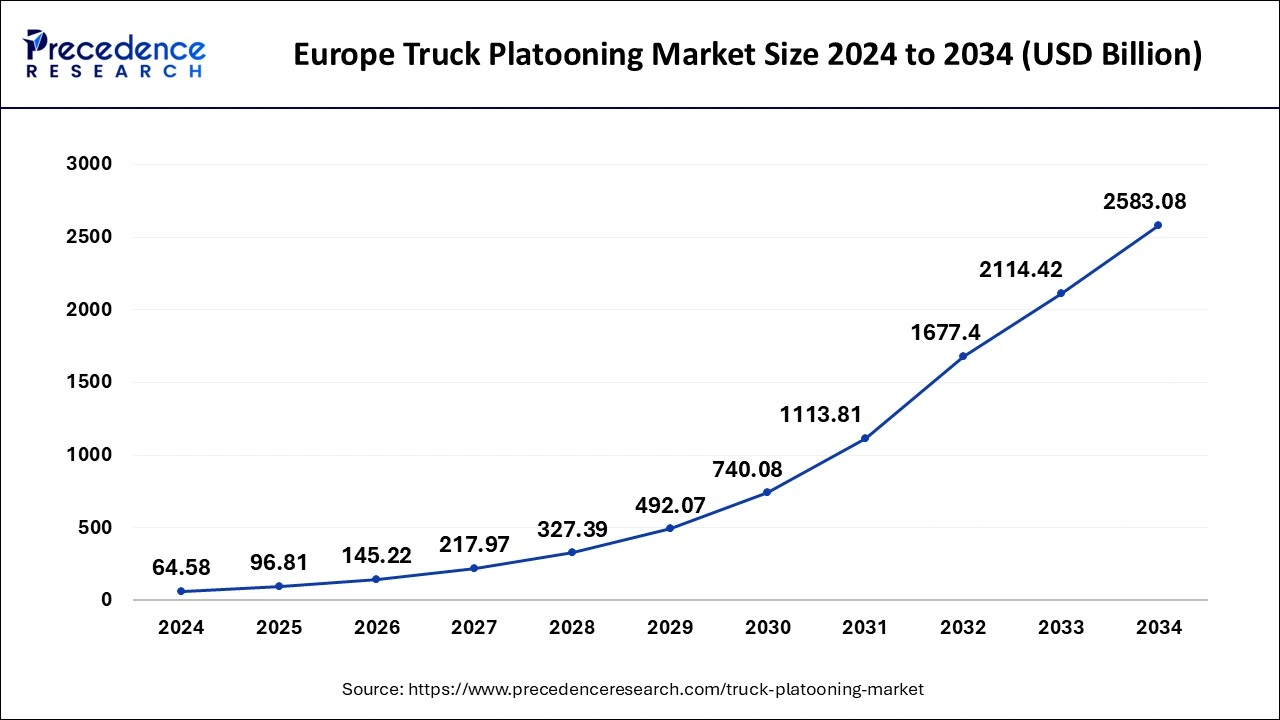

The Europe truck platooning market size was exhibited at USD 64.58 billion in 2024 and is projected to be worth around USD 2,583.08 billion by 2034, growing at a CAGR of 44.61% from 2025 to 2034.

Europe dominated the truck platooning market. The growing development in e-commerce sector has increased the demand for efficient logistics, thereby boosting the market growth. Also, the rapid rise in the prices of fuel has increased the demand for electric trucks for regular operations that in turn helps in the development of trucking platooning industry across Europe. Moreover, there are numerous government regulations for reducing emission from transport sector coupled with advancements in software technology that drives the market expansion. Furthermore, there are several truck platooning providers such as Daimler, Volvo, Scania and some others that further drives the growth of the truck platooning market.

- In October 2024, Plus announced partnership with Traton Group. This partnership is done for launching an Level 4 AI-based autonomous driving software for trucks across Europe.

Asia Pacific is expected to grow with the highest CAGR during the forecast period. The presence of well-established manufacturing industry has driven the market growth. Also, the developments in trucking industry along with rapid investment in logistics sector boosts the market expansion. Moreover, the increasing adoption of autonomous trucks coupled with growing demand for efficient trucking operations is likely to drive the growth of the truck platooning market in this region.

- In November 2024, Isuzu announced to launch a new range of autonomous trucks in Japan. These trucks will support level 4 autonomy and is expected to provide enhanced safety.

Market Overview

The truck platooning is described as the use of automated driving assistance systems and networking solutions to join two or more trucks in a convoy. When trucks in truck platooning are connected for a portion of the travel on highways, they keep a close distance between them. The platoon's leader is the vehicle at the front of the platoon, and the vehicle behind its response and adapts to the movement of the leading vehicle. The following trucks' drivers are constantly in command and can leave or drive independently at any time. The truck platooning has a lot of potential to make road transportation cleaner, efficient, and safer in the future.

The automobile manufacturers are aggressively investing in the latest automotive technologies in response to rising demand for more fuel efficient and safer automobiles. Some of the modern technologies utilized in truck platooning include adaptive cruise control, front collision avoidance and mitigation system, active braking systems, and lane departure warning.

Truck Platooning Market Growth Factors

- Increased emphasis on lowering fuel usage.

- The adoption of truck platooning technology in the transportation sector can help to minimize hazardous gas emissions.

- The research and development activities related to autonomous and semi-autonomous vehicles.

- The growing concerns on road safety.

- Rapid adoption of the internet of things (IoT) and surrounding infrastructure such as transport logistics applications, smart vehicle applications, guidance and control systems and some others.

- Increasing investment in transportation industry.

- Government mandates for enhancing safety of commercial vehicles.

- Advancements in ADAS technology.

- The manufacture of fully automated vehicles for platooning and the expansion of the size of the truck platooning fleet are likely to represent a significant growth potential for the truck platooning market's players.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 200.88 Billion |

| Market Size in 2034 | USD 5,306.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 44.45% |

| Largest Market | Europe |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Services, Platooning Type, Communication Technology, Technology, Component, Autonomous Level, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Government Initiatives and Other Factors Boosts the Market Expansion

Various governments have enacted regulations to limit hazardous gas emissions from vehicles. The transportation industry contributes significantly to global pollution, with trucks accounting for the majority greenhouse gas emissions. The adoption of truck platooning technology in the transportation sector can help to minimize hazardous gas emissions. The platooning of vehicles travels in close formation, which decreases air drag by roughly 40% for the following truck and results in a 10% reduction in carbon dioxide emissions per kilometer driven. The use of truck charting technology is a surprising reaction to the government's strict pollution control regulations. As a result, the truck platooning market is expected to develop as government regulations for pollution reduction in the transportation sector become more stringent.

The market for truck platooning is predicted to grow in response to an increase in the number of road accidents caused by driver mistake and a growing focus on lowering transportation operational costs. Due to the increased demand for automated technologies, the truck platooning is predicted to enhance demand in industries such as transportation, logistics, road development, and information technology. Another aspect that will aid the truck platooning market's expansion over the forecast period is the growing popularity of the internet of things.

Restraint

Expensive Parts and Other Factors Hampers the Industry

Various components such as LIDAR, RADAR, and other sensors are necessary to collect data in order for truck platooning technology to function. The adaptive cruise control is a truck platooning technology that utilizes RADAR to determine the distance between the vehicle in front and adjusts the vehicle's speed to maintain a safe distance. The adaptive cruise control and forward collision warning systems are quite expensive and they require costly sensors like LIDAR and RADAR, making truck platooning technology too expensive for clients. As a result, the truck platooning market's expansion to be hampered by the high cost of truck platooning technology.

The truck platooning is also propelling smart transportation, which necessitates the integration of internet of things technology and infrastructure into transportation networks. The current road infrastructure limits the development of potential long haul truck platoon routes, thereby limiting the market growth.

Opportunity

Advancements in Sensor Technology to Shape the Future

The truck platooning industry is growing at a rapid pace due to rapid technological advancements in the automotive sector. In the truck platooning sector, the autonomous and semi-autonomous trucks are playing major role for enhancing safety and increasing productivity. These trucks are largely dependent on advanced sensors for operating their tasks while driving. There are several sensors used in autonomous trucks consisting of LiDAR, ultrasonic sensors, cameras and some others. Nowadays, numerous sensor manufacturing companies have started developing advanced sensors that can enhance the capabilities of autonomous trucks and helps in improving safety while travelling. Moreover, the integration of advanced sensors in autonomous and semi-autonomous trucks provides insights about the location and helps in detecting hazards in their surroundings. Thus, the rapid advancements in sensor technology is expected to create ample growth opportunities for the market players in the upcoming years.

- In January 2023, ZF launched an advanced camera sensor. This sensor is designed for enhancing the capabilities of autonomous vehicles and ADAS systems.

Technology Insights

The adaptive cruise control (ACC) segment held the dominant share of the market. The rising demand for autonomous trucks in developed nations has boosted the market growth. Also, the adaptive cruise control (ACC) helps in maintaining safe distance of the vehicle and enhancing fuel consumption, thereby driving the market expansion. Moreover, the integration of ACC in autonomous trucks helps in improving stability and maintaining consistent speeds that in turn drives the growth of the truck platooning market.

The forward collision warning (FCW) segment is likely to witness the highest growth rate during the forecast period. The rising cases of trucks accidents due to careless driving has increased the demand for FCW for enhancing safety of trucks, thereby propelling the market growth. Also, the growing trend of semi-autonomous trucks has increased the demand for ADAS components to enhance safety that in turn drives the market growth. Moreover, there are several government mandates related to FCW adoption in trucks for improving safety, thereby driving the growth of the truck platooning market.

Infrastructure Insights

The vehicle-to-vehicle (V2V) segment led the industry. The growing adoption of truck platooning services has increased the demand for effective communication, thereby driving the market expansion. Also, the V2V communication helps in enhancing road safety and reducing traffic congestion that in turn plays a crucial role in shaping the industrial landscape. Moreover, the advancements in networks coupled with rising demand for effective fleet management propels the growth of the truck platooning market.

The vehicle-to-infrastructure (V2I) segment is expected to grow with the highest CAGR during the forecast period. The rise in number of autonomous truck fleets has increased the demand for effective and safe operations that in turn increases the demand for V2I communication, thereby driving the market growth. Also, the integration of V2I communication in truck platooning helps in reducing fuel consumption for efficient logistics operations that in turn drives the market growth. Moreover, V2I-based platoon send their driving data to a roadside unit (RSU) for taking efficient decisions to control platoons, which in turn is expected to foster the industrial expansion.

Level of Autonomy Insights

The semi-autonomous segment held the largest share of the industry. The growing demand for safe and efficient transportation in developed nations such as China and U.S. has boosted the market growth. Also, the technological advancements in semi-autonomous trucks along with rising adoption of semi-autonomous trucks by fleet companies drives the market expansion. Moreover, the rapid development of smart infrastructure coupled with supportive regulatory frameworks is expected to drive the growth of the truck platooning market.

The fully autonomous segment is anticipated to witness the highest growth rate during the forecast period. The rising focus on lowering human workforce in transportation sector has boosted the growth of the market. Also, the growing investment in autonomous technology by truck companies along with rise in number of partnerships and collaborations among platooning companies drives the industry in a positive direction. Moreover, the rapid advancements in autonomous trucks coupled with launch of several autonomous trucks is projected to boost the growth of the truck platooning market.

Key Developments

- The new Journeyware suite of automobile solutions was announced by Xevo in June 2017. This is the only data management software system that combines machine learning and advanced data analytics to help automobile manufacturers gain a deeper knowledge of their customers. The software suite offers sophisticated safety measures to detect accidents, limit distracted driving and improve vehicle maintenance due to the unique data analysis.

- Scania purchased Nantong Gaokai, a truck firm in China, in November 2020 to begin manufacturing trucks in the world's largest auto market for the first time. The goal of the acquisition is to promote technologies like truck platooning in order to deliver safer and more fuel-efficient automobiles to the market.

- TRATON SE purchased 100% of Avistar International Corporation in October 2020 to expand its product line. The primary goal of this purchase is to start and develop a trucking company.

- Bendix Commercial Vehicles Systems LLC is investing much in research and development in order to gain an advantage over its competition. This will assist the business in increasing its sales revenue.

Truck Platooning Market Companies

- Peloton Technology

- AB Volvo

- Scania

- Daimler AG

- Navistar Inc.

- PACCAR Inc.

- MAN

- IVECO

- Hino Motors Ltd.

- Continental AG

Industry Leaders Announcements

- In July 2023, Stéphane Renou, the CEO of FPInnovations announced that the company had completed their truck platooning tests. He also mentioned that off-highway platooning technology will help in solving issues such as transportation profitability and labor shortages.

Recent Developments

- In November 2024, Toyota Tsusho Corporation announced to perform a road trail of their autonomous trucks in the Shin-Tomei Expressway. This trial will help in analyzing the capabilities of truck platooning services in the nearby areas.

- In August 2024, the U.S. Department of Transportation announced to launch a new framework for vehicle-to-everything technology. This framework is expected to enhance the truck platooning process across the nation.

- In May 2024, Pony.ai announced to conduct an autonomous truck platoon testing in Beijing. This testing will take place in Jingjintang Expressway.

Segments Covered in the Report

By Technology

- Adaptive Cruise Control (ACC)

- Blind Spot Warning (BSW)

- Forward Collision Warning (FCW)

- Lane Keep Assistance (LKA)

- Autonomous Emergency Braking (AEB)

- Others

By Infrastructure Type

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Others

By Level of Autonomy

- Semi-autonomous

- Fully Autonomous

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting