UV Stabilizers Market Size and Forecast 2025 to 2034

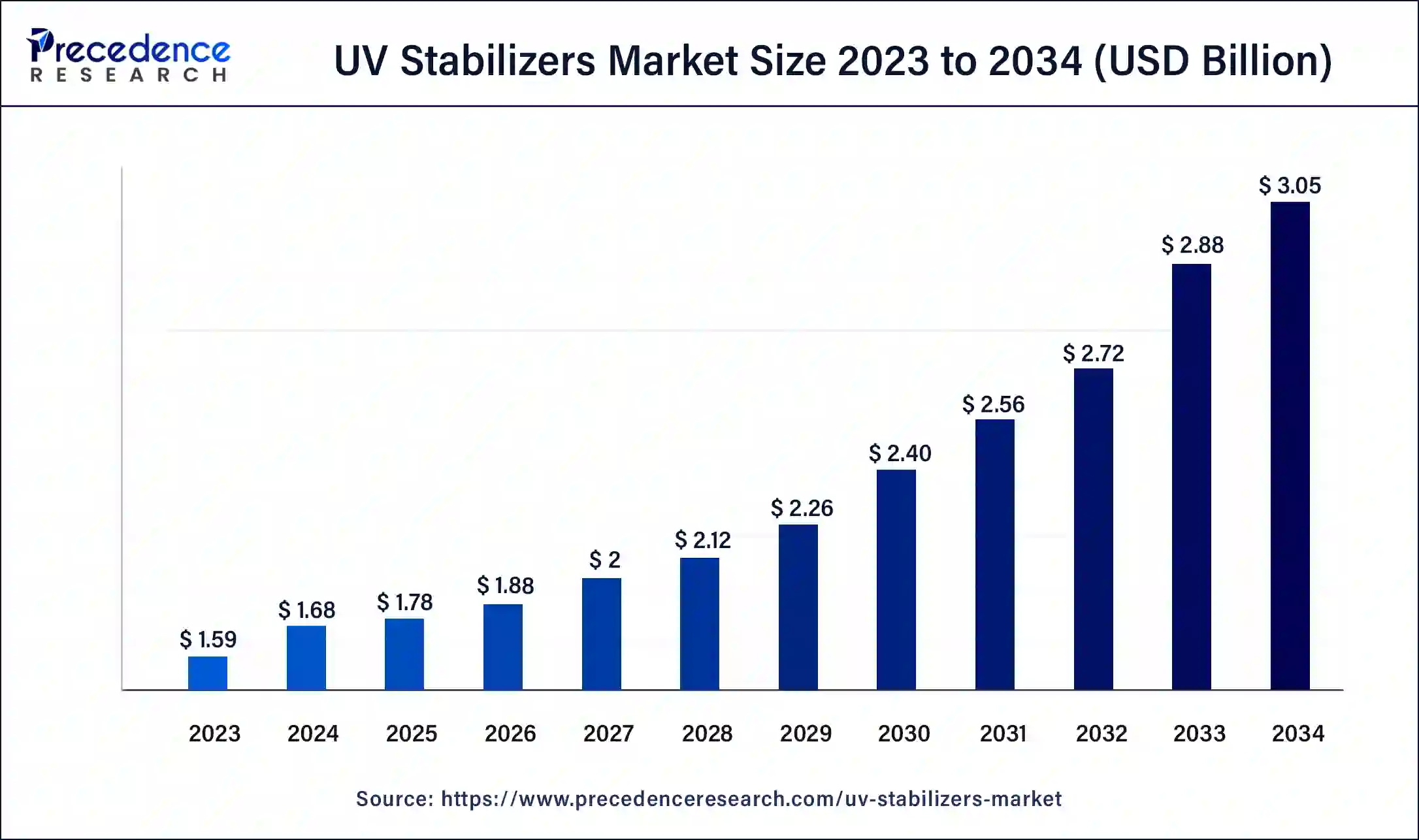

The global UV stabilizers market size was calculated at USD 1.68 billion in 2024, and is expected to reach around USD 3.05 billion by 2034, expanding at a CAGR of 6.14% from 2025 to 2034.

UV Stabilizers Market Key Takeaways

- In terms of revenue, the UV stabilizers market is valued at $1.78 billion in 2025.

- It is projected to reach $3.05 billion by 2034.

- The UV stabilizers market is expected to grow at a CAGR of 6.14% from 2025 to 2034.

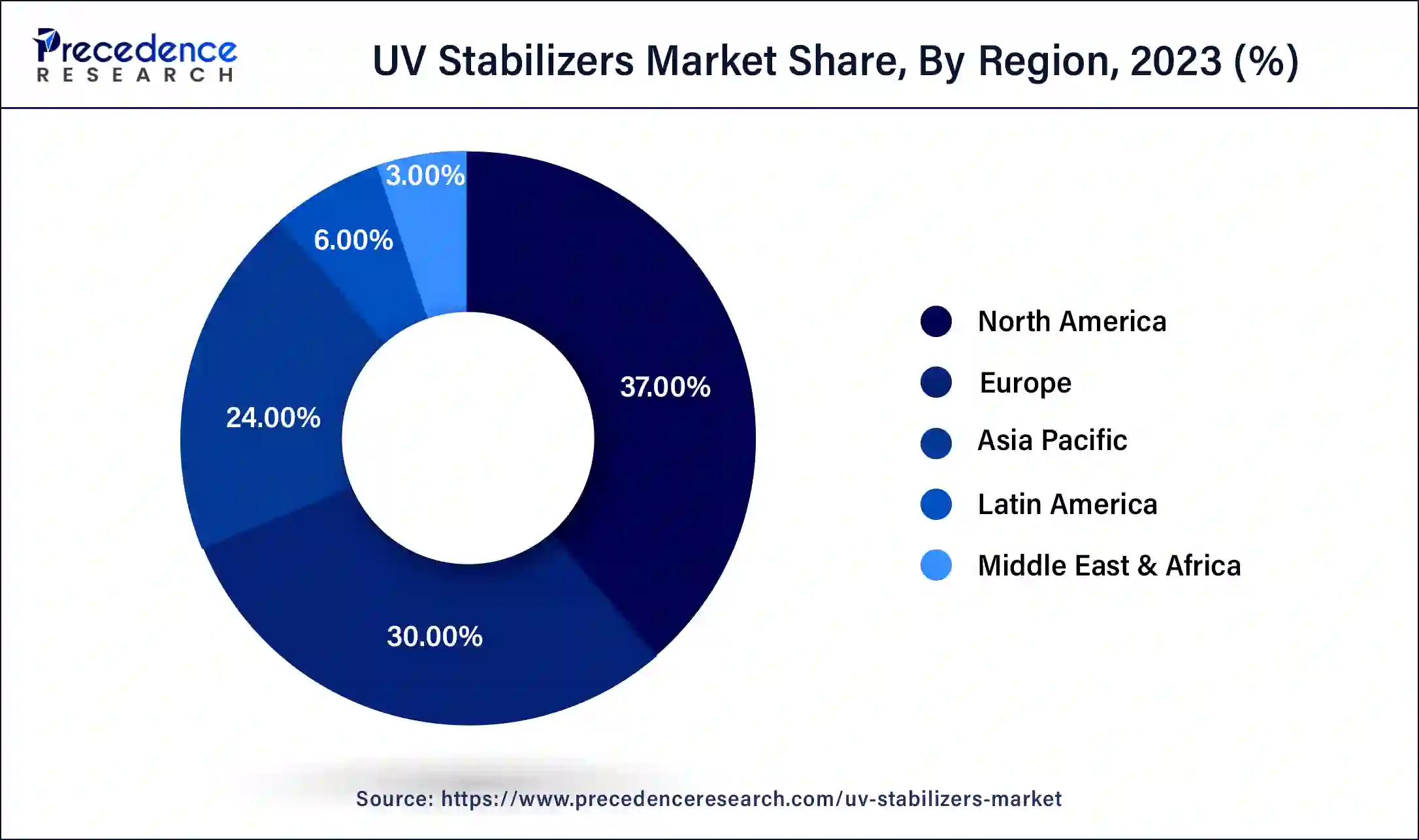

- North America contributed more than 37% of revenue share in 2024.

- Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Type, the UV Absorbers segment has held the largest market share of 41% in 2024.

- By Type, the Hindered Amine Light Stabilizers segment is anticipated to grow at a remarkable CAGR of 7.5% between 2025 and 2034.

- By End User Industry, the Packaging segment generated over 38% of revenue share in 2024.

- By End User Industry, the Automotive segment is expected to expand at the fastest CAGR over the projected period.

U.S. UV Stabilizers Market Size and Growth 2025 To 2034

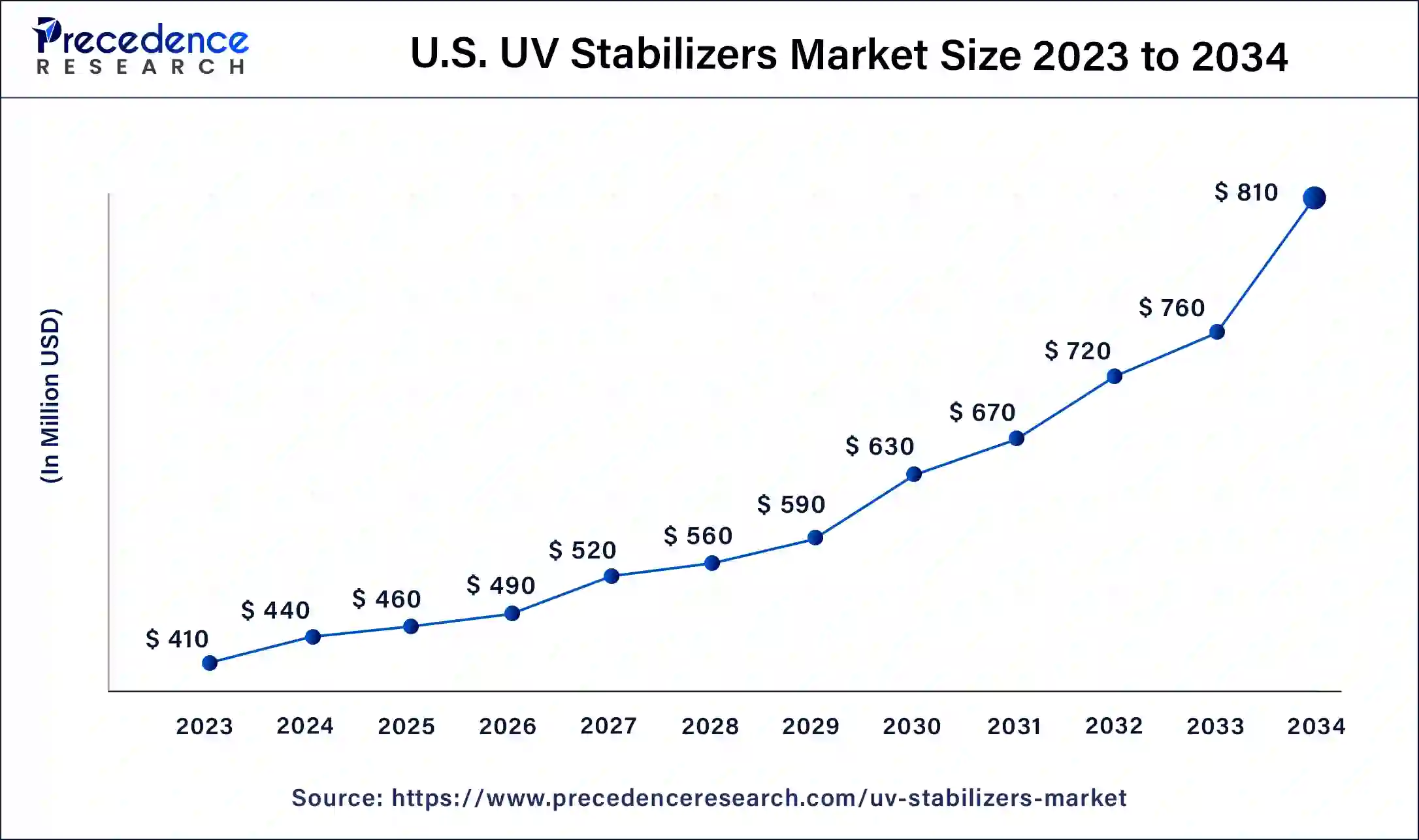

The U.S. UV stabilizers market size was valued at USD 440 million in 2024 and is expected to reach USD 810 million by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

North America has held the largest revenue share of 37% in 2024. In North America, the UV stabilizers market is witnessing a trend towards sustainability and regulatory compliance. Industries are progressively adopting eco-friendly UV stabilizers to align with environmental regulations and consumer demand for greener products. Additionally, the construction and automotive sectors are experiencing a surge in demand for UV stabilizers, primarily for enhancing the durability and aesthetics of materials and products exposed to sunlight.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the UV stabilizers market is expanding rapidly, driven by robust industrial growth and the rising popularity of outdoor products. The region is experiencing an increasing need for UV-resistant materials, especially in construction and agriculture. Furthermore, there is a noticeable shift towards sustainable UV stabilizer solutions in line with global environmental concerns, fostering market growth and innovation.

In the European UV stabilizers market, a strong emphasis is placed on sustainability and innovation. Industries are increasingly adopting eco-friendly UV stabilizer formulations to meet stringent environmental regulations and cater to a conscientious consumer base. Ongoing research and development efforts in the region contribute to advanced UV stabilizer technologies that offer improved UV protection and versatility, addressing the evolving needs of various sectors such as construction and automotive, making Europe a dynamic hub in the UV stabilizers market.

Market Overview

- The UV stabilizers market encompasses chemical additives used to protect polymers and plastics from the harmful effects of ultraviolet (UV) radiation. UV radiation can cause degradation, discoloration, and reduced durability in materials exposed to sunlight. UV stabilizers, including UV absorbers and hindered amine light stabilizers (HALS), are incorporated into various products like plastics, coatings, adhesives, and textiles.

- They act by absorbing and dissipating UV radiation, preserving the physical and chemical properties of the materials. The market is driven by increasing demand for UV-resistant materials in construction, automotive, packaging, and agriculture to extend the lifespan and maintain aesthetic quality. Growing awareness of environmental concerns and regulations regarding UV stabilizers also influences market trends, fostering the development of eco-friendly alternatives and sustainable formulations.

UV Stabilizers Market Growth Factors

- Expanding End-Use Industries: The market is buoyed by increasing demand for UV-resistant materials in sectors like construction, automotive, agriculture, and packaging to enhance product durability and aesthetics.

- Environmental Regulations: Growing environmental awareness and regulations concerning UV stabilizers stimulate research into eco-friendly alternatives and sustainable formulations, creating opportunities for innovation.

- UV-Resistant Packaging: The trend towards UV-resistant packaging materials, especially in the food and beverage industry, has intensified due to the need to maintain product quality during storage and transportation.

- Nano-Additives: The adoption of nanotechnology to develop highly efficient UV stabilizers provides better UV protection, increasing their efficacy and versatility.

- Focus on Eco-Friendly Solutions: The industry is witnessing a shift toward sustainable UV stabilizers, bio-based alternatives, and products that comply with stringent environmental regulations.

- Emerging Markets: Rapid industrialization in emerging economies and the rising popularity of outdoor products are propelling the demand for UV stabilizers.

- Innovation: Opportunities abound for companies that innovate and develop advanced UV stabilizers offering improved performance and reduced environmental impact.

- Global Expansion: The global reach of UV stabilizers is expanding with the growth of various end-use industries, opening avenues for market expansion and international collaborations.

- Eco-Friendly Products: Businesses focusing on eco-friendly and sustainable UV stabilizer formulations can tap into the environmentally conscious market segments.

- Renewable Energy: The rising demand for renewable energy sources, such as solar panels, propels the need for UV-stabilized materials to withstand prolonged exposure to sunlight, benefiting the UV stabilizers market.

- Technological Advancements: Ongoing advancements in UV stabilizer technology, including improved efficiency and performance, drive market growth by offering enhanced solutions for diverse applications.

- BASF's substantial 2022 revenue of approximately 87.3 billion euros underscores the company's financial strength and capacity for significant investments in research, development, and innovations, which can stimulate market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.05 Billion |

| Market Size in 2025 | USD 1.78 Billion |

| Market Size in 2024 | USD 1.68 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.14% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, By End-User, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

UV-resistant packaging and expanding end-use industries

The growing demand for UV-resistant packaging is a significant driver of the UV stabilizers market. UV radiation from sunlight can degrade and discolor packaging materials, compromising the quality and appearance of the contents. This is especially crucial in the food and beverage industry, where product integrity and consumer perception are paramount. UV stabilizers offer a solution by preventing UV-induced damage to the packaging, extending the shelf life of products, and maintaining their visual appeal during storage and transportation. As consumers continue to demand fresher and more sustainable packaging solutions, the need for UV-resistant materials is on the rise, driving market growth.

The UV stabilizers market is propelled by the expanding use of UV-resistant materials in various industries. Sectors like construction, automotive, agriculture, and packaging rely on UV-stabilized materials to enhance the durability and aesthetics of their products. In construction, UV stabilizers help protect building materials from sunlight, while the automotive industry employs them to maintain the appearance and longevity of vehicle components. The agricultural sector uses UV-resistant materials to extend the lifespan of outdoor equipment. As these industries continue to grow and evolve, the demand for UV stabilizers to ensure the reliability and visual appeal of their products increases, thereby surging market demand for UV stabilizers.

Restraints

Volatility in raw material prices and regulatory compliance

The UV stabilizers market faces a restraint in the form of fluctuating raw material prices. The cost of essential components used in UV stabilizer formulations, such as chemicals and additives, can be unpredictable. These price fluctuations can directly impact the manufacturing cost of UV stabilizers, making it challenging for producers to maintain competitive pricing. This, in turn, can deter potential buyers from investing in UV stabilizers, as they may seek more cost-effective solutions or delay their purchase decisions. The uncertainty regarding raw material costs creates an environment of economic instability, influencing market demand and potentially limiting the growth of the UV stabilizers industry.

Regulatory compliance is another constraint in the UV stabilizers market. Governments and environmental agencies continue to impose strict regulations on chemicals used in various industries, including UV stabilizers. Compliance with evolving environmental standards and safety regulations can place a significant burden on UV stabilizer manufacturers. This may translate into elevated production costs, which are frequently transferred to consumers in the form of higher prices.

Furthermore, navigating through regulatory complexities can introduce delays in product development and market entry, potentially impeding the growth of UV stabilizer manufacturers. Buyers may opt for alternatives that face fewer compliance challenges or seek eco-friendly solutions, affecting the market demand for traditional UV stabilizers. Thus, regulatory compliance requirements can restrict market growth and create obstacles for UV stabilizer suppliers.

Opportunities

Sustainable formulations, research and development

A strong emphasis on sustainability increasingly influences the market demand for UV stabilizers. As environmental consciousness grows, there is a notable shift towards sustainable formulations of UV stabilizers with minimal ecological impact. Consumers, industries, and governments favor eco-friendly and biodegradable UV stabilizer alternatives. This shift towards sustainability not only ensures compliance with stringent environmental regulations but also aligns with broader industry trends. Manufacturers who invest in the development of greener UV stabilizers capitalize on this growing demand, catering to a market that seeks effective yet environmentally responsible solutions.

Continuous research and development efforts significantly drive market demand. The UV stabilizers market is dynamic, with a constant need for improved performance and more cost-effective solutions. Ongoing R&D initiatives lead to the creation of advanced UV stabilizer technologies that offer better UV protection, enhanced efficiency, and versatility. Innovation in this field enables UV stabilizers to address the evolving requirements of various industries, making them indispensable for UV protection in a wide range of applications. The market thrives on innovation and product advancement, with research and development serving as a powerful catalyst for sustained growth.

Technological Advancement

Technological advancements in the UV stabilizers market feature new UV stabilizer formulations, hindered amine light stabilizers (HALS) production, UV-C protection, and specialty applications. Specialty applications are mostly used in sealants and adhesives to protect against discoloration. New UV stabilizer formulations help companies approach innovative UV stabilizers, consisting of new UV-C stabilizers for other applications such as clinical equipment and hygiene. UV stabilizers in the automotive industry are in high demand. UV-C protection is a new stabilizer specially designed for hygiene applications, protecting polyolefins from UV-C radiation.

Hindered amine light stabilizers production is expanding production of BASF. It's a major type of UV stabilizer. The eco-friendly alternatives focus on sustainability. The technological advancement in the UV stabilizers market helps to stimulate progress by implementing various methods and techniques. The internal growth of the market allows for entry and specialization in other market areas to gain recognition and helps expanding businesses to evolve.

Type Insights

The UV absorbers has held 41% revenue share in 2023. UV absorbers are UV stabilizers that function by absorbing UV radiation and converting it into harmless heat. UV absorbers find common usage in various materials, including plastics and coatings, to shield against UV-induced deterioration and color changes. Within the UV stabilizers market, a prominent trend is the growing preference for UV absorbers offering improved efficiency and a reduced environmental footprint.

Manufacturers are actively working on UV absorbers that deliver enhanced UV protection while meeting sustainability objectives and complying with environmental regulations. Manufacturers focus on developing eco-friendly UV absorbers that provide superior UV protection while aligning with sustainability goals and regulatory requirements.

The Hindered amine light stabilizers (HALS)segment is anticipated to expand at a significant CAGR of 7.5% during the projected period. Hindered amine light stabilizers (HALS) are another category of UV stabilizers. They work by preventing the degradation of polymers and plastics when exposed to UV radiation. A significant trend in this segment is the development of HALS with extended durability, allowing materials to withstand prolonged UV exposure without losing their structural integrity. Additionally, HALS that can be easily incorporated into various formulations are gaining popularity, enhancing their versatility in different applications, such as automotive coatings and outdoor furniture.

End Use Industry Insights

Based on the end use industry, packaging is anticipated to hold the largest market share of 38% in 2024. In the UV stabilizers market, the packaging industry is a significant end-user. UV stabilizers are essential in packaging materials like plastics, ensuring the packaging remains visually appealing and structurally sound during storage and transportation. A prominent trend in this sector is the increasing demand for UV-resistant packaging materials, particularly in the food and beverage industry, to maintain product quality and extend shelf life. Manufacturers are focusing on developing UV stabilizers tailored for specific packaging applications to meet the industry's evolving needs.

The automotive segment is projected to grow at the fastest rate over the projected period. The automotive sector relies on UV stabilizers to protect various vehicle components from UV radiation, including interior materials and coatings. A notable trend in this industry is the use of UV-stabilized materials to maintain the appearance and durability of automotive components exposed to sunlight. As automotive designs increasingly incorporate plastics, there is a growing demand for UV stabilizers to ensure these materials withstand UV exposure, contributing to vehicle longevity and aesthetics. The automotive industry continues to be a key driver in the UV stabilizers market.

UV Stabilizers Market Companies

- BASF SE

- Clariant AG

- Solvay S.A.

- Songwon Industrial Co., Ltd.

- Addivant

- Altana AG

- Evonik Industries AG

- Cytec Industries Inc.

- Mayzo Inc.

- Akcros Chemicals Ltd.

- Lycus Ltd.

- Everlight Chemical Industrial Corporation

- Ampacet Corporation

- Chemtura Corporation

- Everspring Chemical Co., Ltd.

Recent Developments

- In November 2024, KAO developed a new UV absorber-free sunscreen formula. The new formulation is a beneficial approach for the cosmetics market. It provides a light texture and strong UV protection.

- In July 2024, Miwon Commercial brought innovation to the advanced fine chemicals market. The Korean specialist in surfactant products, UV stabilizers, and photosensitizers is ready to introduce a new venture into the OLED and battery markets through its portfolio.

- In 2022, Henkel Korea announced the successful completion of its Songdo Plant, strategically located in the Songdo High-Tech Industrial Cluster in Incheon. This facility is poised to serve as the primary Asia-Pacific production hub for high-impact electronics solutions within the Adhesive Technologies business unit.

- In 2022, Solvay unveiled an innovative UV-C stabilizer range designed for polyolefin surfaces, targeting hygiene applications combating COVID and hospital-acquired infections. This unique technique, the first addressing UV-C radiation's impact on polyolefin, mitigates deterioration, discoloration, and microcrack formation, marking a milestone for the polyolefin industry.

- In 2022, BASF SE disclosed plans to expand hindered amine light stabilizers (HALS) production, encompassing products like Tinuvin, Chimassorb, and Uvinul, at its manufacturing sites in Pontecchio Marconi, Italy, and Lampertheim, Germany.

Segments Covered in the Report

By Type

- UV Absorbers

- Hindered Amine Light Stabilizers

- Quenchers

- Antioxidants

- Others

By End-User Industry

- Packaging

- Automotive

- Agriculture

- Building and Construction

- Adhesives and Sealants

- Other End-User Industries

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting