What is the Variable Frequency Drive Market Size?

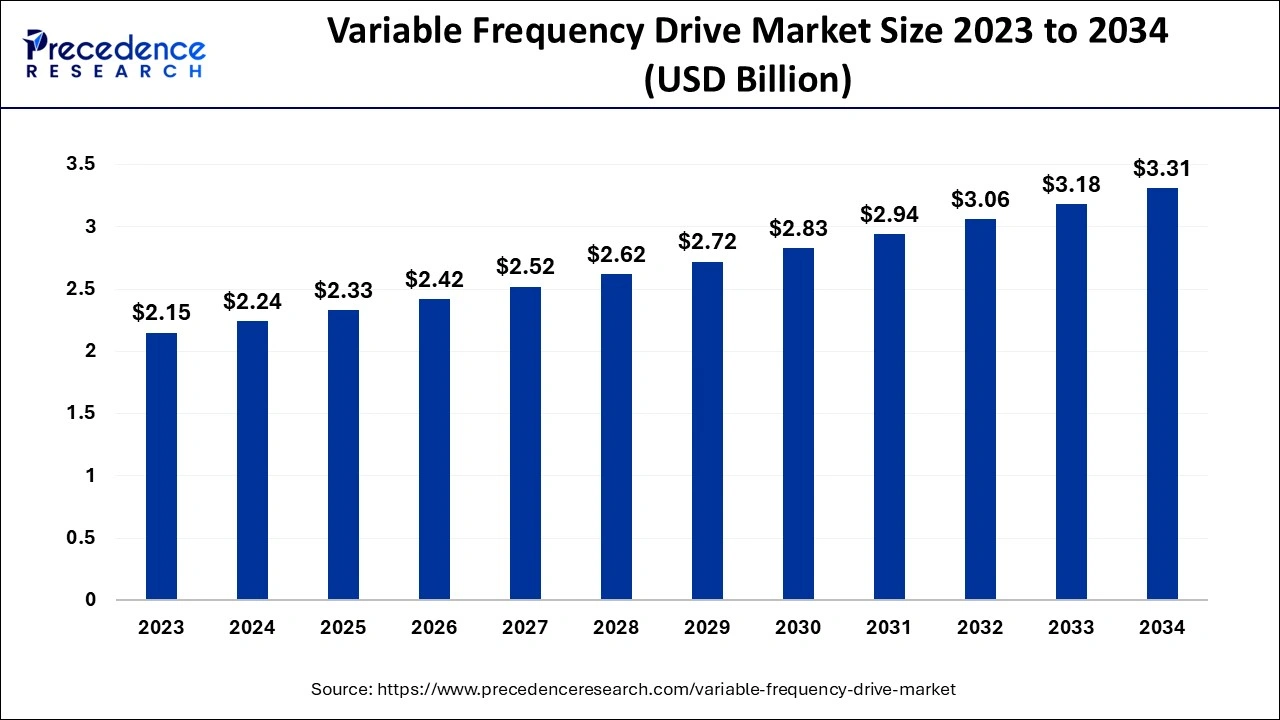

The global variable frequency drive market size is estimated at USD 2.33 billion in 2025 and is predicted to increase from USD 2.42 billion in 2026 to approximately USD 3.43 billion by 2035, expanding at a CAGR of 3.94% from 2026 to 2035.

Variable Frequency Drive Market Key Takeaways

- By product, the AC drives segment held 70% of total sales.

- The DC drive product segment is estimated to grow at a CAGR of 5% during the forecast period.

- Based on power range, the low power range segment garnered a revenue share of 41% and the medium power range frequency drive is predicted to grow at a CAGR of 6% from 2026 to 2035.

- By Application, the pumps section contributed 31% of total sales in 2025.

- The HVAC application segment is estimated to grow at a CAGR of 7%.

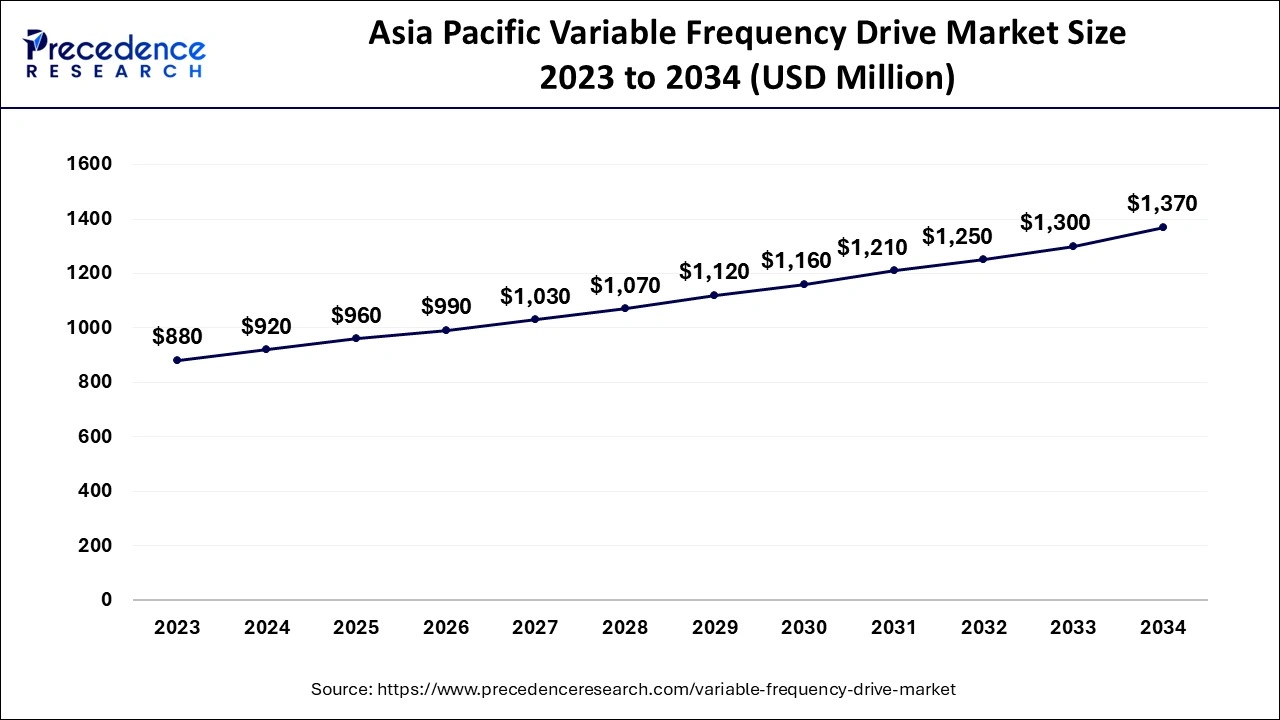

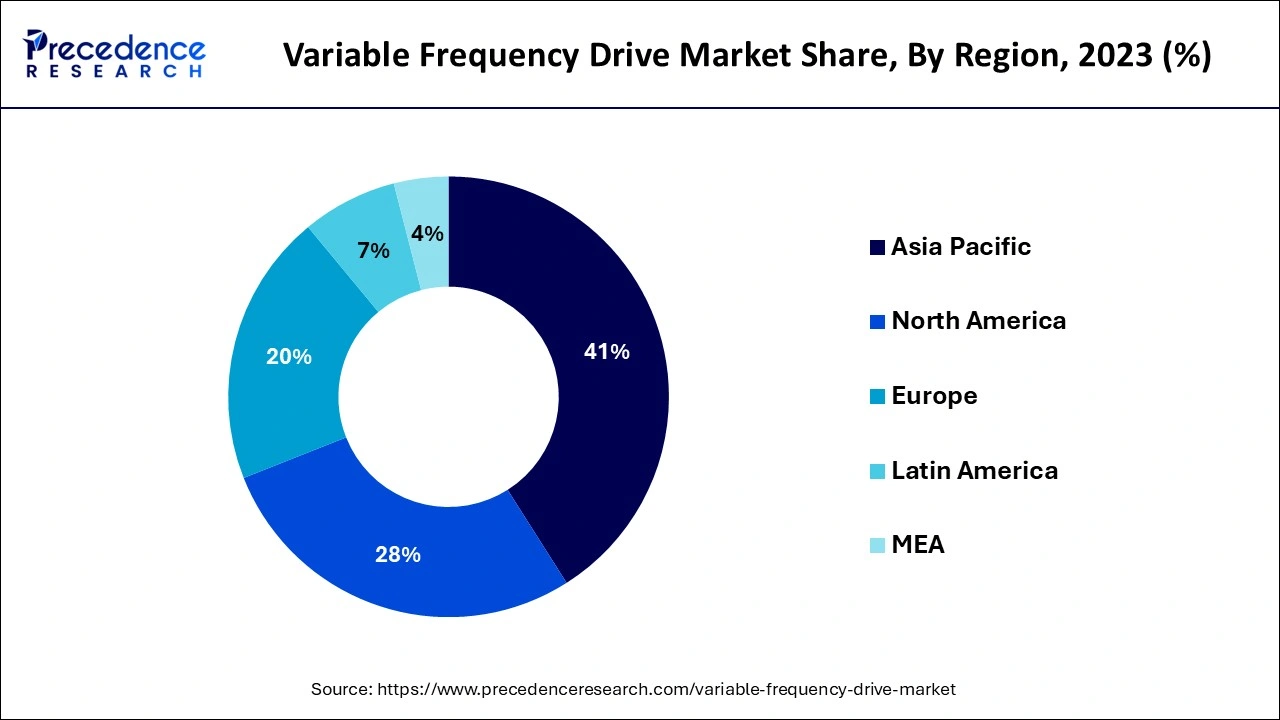

- In 2024, the Asia Pacific region's market was worth USD 920 million.

- Latin America is predicted to grow at a CAGR of 7% over the projection period.

What is Variable Frequency Drive?

The variable frequency drive industry is also experiencing significant growth due to the increasing emphasis placed by industries on improving their energy efficiency; optimising their motor controls; and decreasing their operational costs. The ability to accurately control the speed of electric motors means that VFDs will play a critical role in several sectors including manufacturing, HVAC (heating, ventilation & air conditioning), oil & gas, and water treatment.

The rising costs of electricity; increasingly stringent energy efficiency regulations; and the rapid pace of industrial automation worldwide is now resulting in an increase in the adoption of VFDs around the globe, especially in developing/sustainably focused countries.

How is AI Revolutionizing the Variable Frequency Drive Market?

Artificial intelligence is causing a significant shift in the Variable Frequency Drive market by predicting maintenance, optimizing power consumption, and transforming automation into an intelligent system. The AI systems are installed to continuously monitor the parameters, predict the faults, and adjust the motor's performance in a real-time manner, which finally results in less downtime and lower maintenance costs. The AI is a great partner for the IoT, as it not only reduces energy usage and increases reliability through controlling the speed and torque of the motors according to the load conditions, but also performs the function of a smart diagnostic that increases the accuracy of the diagnosis and, therefore, the speed of the fault detection and troubleshooting. The tandem of AI and VFD technology not only improves but also expands the area of operations that require sustainable practices in the industry, energy, and building management systems.

Variable Frequency Drive Market Outlook

- Industry Growth Overview: The Drive Molecule, or VFD (Variable Frequency Drive), is set to maintain continuous development due to an increase in Industry Automation, Industrial Electric Power Consumption, and a shift to Smart Control Systems for Motors in Other Industries.

- Sustainability Trends: The need to Improve Energy Efficiency and Lower Carbon Footprint are catalysts for the increased use of VFDs, as companies use VFDs to meet Industry Standards for Reducing Carbon Footprint, Reducing Power Usage, and Meeting Global Standards for Sustainability.

- Global Expansion: Emerging Markets in Asia-Pacific, Latin America, and The Middle East are constructing Industrial Foundations, Creating New Opportunities for Global VFD Producers.

- Startup Ecosystem: Start-ups are Creating Innovative Compact Drive Solutions, Developing AI-Enabled Monitoring Systems for VFDs, and Creating IoT-Enabled VFD Solutions to Provide Enhanced Operational Performance, Predictive Maintenance, and Cost-Effectiveness.

Variable Frequency Drive Market Growth Factors

Due to ever increasing penetration of connected devices across the various sectors including residential sectors, commercial and industrial sectors, demand for variable frequency drive (VFD) is consistently growing. Variable frequency drive comes with numerous benefits; such as dynamic torque control, adjustable speed and energy-saving. These factors are crucial for power generation, auto motive as well as oil and gas industry. These elements are expected to impact the market in positive manner.

Furthermore, another considerable factor for market is growth in investment percentage for infrastructure development. Since investments are pouring in, demand for HVAC systems is as high as never before. HVAC systems are used to energy efficiency of buildings, due to which expected power savings are achieved. Hence, these demands for the systems are also to drive the market further. Throughout world industrialization is making its way faster than ever before. Specially, in developing countries rapid industrialization is underway which ultimately results in growth of industrial and manufacturing sectors, which further are propelling the demand for variable frequency drive.

Similarly, the power generation sector is widely adopting variable frequency drive at large scale these days as they are using it to operate large motors and continuously make the speed fluctuations as required by the process. Variable frequency drive is not limited to power generation sector only. More industries are adapting to the market trend. To name a few oil and gas, metal and mining and food processing industries are on top for now.

Climate change and Carbon emission are the biggest threat for planet's environment and biodiversity. To preserve the planet's depleting biodiversity and lower the carbon emission, governments across the globe are implementing stringent rules and regulations. Due to which there is significant rise in demand for products to assist energy saving to further achieve energy efficiency. Owing to favorable rules and policies are projected to boost market expansion, as it is one of the prime reasons of industrial investment in energy conservation globally. This is especially true of policies enacted by major industrial manufacturers such as India, China, Europe and the United States. For example, the Ecodesign Regulation (EU) 2019/1781 went into force in October 2019, with the first stage taking effect in July 2021 and the second one in July 2023. The first part of the legislation addressed the IE2 efficiency class, which is required for AC drives.

- The growing trend of industrial automation and interconnectivity is a primary factor behind the increasing demand for VFDs as they enhance control and efficiency.

- The concern for energy efficiency and environmental sustainability is the main reason why industries are starting to use VFDs for power consumption and emissions.

- The investment in infrastructure is going up, and the need for HVAC systems is high, which together fuel the energy-efficient building market for VFDs installation.

- The fast pace of industrialization in the developing countries is increasing the demand for motor control systems, thus the market is growing.

- Pro-govt regulations and tech advancements are the key drivers of VFDs demand across the sectors.

- Industrial automation and interconnected gadgets are the main reasons for the increasing demand for Variable

- Frequency Drives (VFDs) that can control and run more efficiently.

- The energy that is being used is the main concern, and environmental sustainability is facilitating the use of VFDs to reduce the power that is consumed to be reduced.

- The investments that have been made in the infrastructure and the rapid industrialization, especially in the emerging markets, are giving the VFDs a great opportunity for their installations to grow.

- The rising demand for HVAC systems in energy-efficient buildings is one more factor that is driving the market.

supportive Government regulations, and the advancements in technology of drive systems and motor control are major factors in the easy deployment of VFDs in different sectors.

Variable Frequency Drive Market Trends

- Energy efficiency mandates: Industries are increasingly adopting VFDs to control motor speed and reduce power consumption due to global energy-saving policies.

- Integration with smart grids and IoT: The push for digital transformation in manufacturing is leading to VFDs with intelligent sensors and network connectivity.

- Customization and compact design: There is a rising demand for modular, space-saving VFDs tailored for specific industrial applications.

- Renewable energy integration: VFDs are being deployed in wind turbines, solar plants, and hybrid systems for seamless energy flow control and grid stability.

Government initiatives consist of tax incentives and subsidies for energy-efficient machinery in Asia Pacific and Europe. There are also programs in North America that promote industrial automation under smart manufacturing strategies. Additionally, funding for green infrastructure encourages the implementation of variable frequency drives (VFDs) in water treatment, HVAC systems, and public utilities. Furthermore, mandatory energy audits and standards are driving industries toward the adoption of motor control solutions such as VFDs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.33 Billion |

| Market Size in 2026 | USD 2.42 Billion |

| Market Size by 2035 | USD 3.43 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.94% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Power Range, Voltage Type, Application, End User, Geography |

Segment Insights

Product Type Insights

In 2024, the AC drives segment accounted largest market share. This rise can be attributed to the advantages of AC drives, such as their high power, ease of application compared to others, and low maintenance. These advantages are enticing end-users in industries such as automotive, power generation and food and beverage, to improve operational efficiency. As a consequence of the significant increase in the industrial sector, there is a strong demand for AC drives, which is expected to boost segment growth.

The DC drive sector is fastest growing segment during forecast period. Because DC technology is more expensive to maintain than AC technology, its usage in industry is limited. Furthermore, DC technology is not deemed energy-efficient and cannot work in critical settings; these issues are expected to stall market expansion.

Power Range Insights

The low power range segment led the global market in 2024. Low voltage frequency drives are used in end-use industries to power equipment such as centrifugal pumps, belt conveyors, pumps, fans and centrifugal compressors. Manufacturers are making significant investments in the development of slightly elevated, compact-size, relatively low voltage drives. As a result, broad use of low voltage frequency drive technology in industrial verticals, as well as increased investment in R&D activities, are likely to assist the sector dominate market expansion.

The medium power range frequency drive segment is expected to witness fastest growth during projected timeframe. Medium (41-200 kW) power range frequency drive gives benefits such as better operating flexibility and greater control, which is one of the main reasons its popularity is rising in many sectors such as wastewater plants, petrochemical, mining, and so on. Furthermore, strong demand from the petrochemical industry is likely to fuel segment expansion.

Application Insights

In 2024, the pumps section contributed largest share in overall market. Pumps are frequently employed in the treatment of water, metal, and petroleum industry. These pumps are equipped with adjustable speed drives, which assist them, minimise energy usage, lower the cost of pump operation, and run at varied velocities without the use of a gearbox. Thus, the stated effect of implementing VFD to pump are leading in growing demands for variable frequency drive from the water treatment plant market, oil & gas, and other industries for overloading the flow rate and improving efficiency, which is likely to boost the expected segment's growth.

The HVAC segment is estimated to witness remarkable grow over the forecast period. The increasing expansion of residential and commercial development activity is expected to enhance consumption for HVAC systems. Connecting a VFD to an HVAC system ensures greater efficiency by managing the speed of blower fans, pumps, or compressors.

Regional Insights

Asia Pacific Variable Frequency Drive Market Size and Growth 2025 to 2034

The Asia Pacific variable frequency drive market size is evaluated at USD 960 million in 2025 and is predicted to be worth around USD 1,426.67 million by 2035, rising at a CAGR of 4.04% from 2025 to 2034.

The Asia Pacific region accounted largest revenue share in 2024. Rapid industrialization in developing nations, market liberalization, and increased building activity are all projected to boost regional market expansion. Similarly, increased energy demand is likely to promote energy companies' adoption of VFD, which will help regional growth. Furthermore, the presence of water treatment, large automotive and food & beverage producers operational in the countries such as India, China, and Japan are likely to boost supply for VFD to increase working efficiency and minimize power usage.

Asia-Pacific-Top countries

The Powerhouse of VFD Demand

- China: Extensive use in automotive, steel, and chemical industries; government-backed energy reforms boost demand.

- India: Rapid growth in infrastructure, water treatment, and textile sectors is increasing VFD installation.

- Japan: Advanced manufacturing processes and innovations in robotics fuel high-quality VFD applications.

- South Korea: Leading in consumer electronics and smart factories, integrating AI and automation with motor control.

How is Asia-Pacific leading in the Variable Frequency Drive Market?

The Asia-Pacific region leads the market for VFDs mainly due to strong industrial growth, the development of infrastructure, and government policies that support energy efficiency. The rapid implementation of automation technologies, together with the commitment to less energy consumption, has also expanded the market. Growing manufacturing activities and the modernization of industries are the main factors of the VFDs usage in areas like automotive, construction, and power generation, thereby increasing the region's dominance in the global market.

China Variable Frequency Drive Market Trends:

India is a rapidly growing VFD market, which is being supported by government initiatives that are aimed at promoting smart manufacturing and energy-efficient technologies. The development of industrial infrastructure and increased use of automation systems in oil and gas, water treatment, and construction are the key drivers of growth. Apart from that, energy conservation awareness and production facility updation are the most important factors contributing to the domestic VFD solutions.

How Does North America Contribute to the Variable Frequency Drive Market?

North America plays a vital role in the market, driven by strong consumer demand, stringent energy-efficiency regulations, robust industrial automation, and the adoption of smart factory technologies. There is a high demand for variable frequency drives (VFDs) across sectors such as oil and gas, HVAC, and the rapidly growing electric vehicle manufacturing industry. Early adoption of Industry 4.0 principles in North America promotes innovation, integrating VFDs with IIoT systems and setting global trends focused on efficiency and smart optimization.

U.S. Variable Frequency Drive Market Trends

In the U.S., the variable frequency drive market is characterized by technological innovation, stringent regulatory requirements, and a mature industrial sector. Efforts led by energy efficiency standards from agencies like the U.S. Department of Energy (DOE) focus on developing advanced VFDs that include IoT technology and wide-bandgap semiconductors, enhancing performance in high-value sectors such as manufacturing, oil and gas, and HVAC. There is a growing trend to retrofit existing motor-driven systems with smart VFDs to enhance energy efficiency and extend equipment lifespan, supporting market growth.

What are the driving factors of the Variable Frequency Drive Market in Europe?

The VFD market in Europe profited from the implementation of stringent pollution standards, energy-saving regulations, and the rise of renewable energy sources. Governments' investment in infrastructure, water management, and the automation of major industrial processes is are significant growth factor. The increase in the uptake of HVAC systems and the electrification of buildings are other things driving up demand. The emphasis on being environmentally friendly and smart manufacturing is a catalyst for the VFD being deployed widely across various industrial applications.

Europe Powers Ahead: Notable Growth Accelerates the Variable Frequency Drive Market

Europe is still the most advanced developed market for variable frequency drives, being a leader of Innovations in the variable frequency drive industry. The foundation of this innovative industry continues to be based on strict regulation of the EU regarding energy efficiency and an increase in automation and use of smart factories as well as the demand for reducing carbon emissions.

The VFDs used in heating, ventilating and air conditioning (hvac) systems and the vfd demand in electric vehicles and renewable energy projects continue to drive the growth of this market. Furthermore, with the demand for digitalization, predictive maintenance and the increasing use of advanced variable frequency drive technologies, the development of advanced variable frequency drive solutions in Europe will continue to gain a larger share of the overall market.

Germany Variable Frequency Drive Market Trends:

Germany is still among the top VFD markets in Europe owing to its significant industrial input and the transition to renewable energy sources. The country's machinery, transport, and power generation focus on automation, energy-saving, and eco-friendliness. Tech advances and supportive legal structures compare the industries adopting Demand across automotive, construction, and process, reinforcing Germany's status as a key European hub for advanced drive systems.

How is Latin America performing in the Variable Frequency Drive Market?

Latin America's market growth is driven mainly by energy efficiency regulations, industrial modernization, and the adoption of automation technologies. The ongoing integration of renewable energy sources and the development of smart grids are among the major factors that promote the deployment of VFDs. Companies are replacing their older systems with energy-efficient ones that are also sustainable, to boost their performance. The region's continuous investment in smart grids, advanced HVAC systems, and high-quality manufacturing is one of the reasons for the VFD market's long-term growth.

Latin America is predicted to grow at a notable CAGR over the projection period, primarily to privatization and urbanization in countries such as Brazil & Mexico. Similarly, growth of the market from end-use industries such as cement, chemicals, and pulp is likely to fuel VFD market expansion in this area.

Latin America Gears Up: Emerging Momentum in the Variable Frequency Drive Market

Latin America is experiencing an increase in the demand for variable frequency drives because of the ongoing updating of infrastructure and growth in the area of industrial activity, which has been increasing. Some of these countries include Brazil, Mexico and Chile. Countries are now investing in making more energy-efficient manufacturing, mining operations and also the water management systems throughout the country.

Through government funding of various programs promoting energy-efficient technologies and a growing demand for the use of smart motors on oil & gas and food processing, there has been a rise in VFD Installation throughout Latin America. higher electricity rates are also motivating industries to incorporate VFDs to decrease the amount of energy they use and also increase the life expectancy of their motors.

Latin America- major factors leading towards the growth of this region

- Energy conservation initiatives by governments to reduce operational costs in utilities and transport.

- Revitalization of oil & gas and mining sectors, requiring robust motor control solutions like VFDs.

- Increased foreign investments in manufacturing and infrastructure projects, especially in Brazil and Mexico.

- Growing demand for clean energy integration, where VFDs support renewable adoption in grid systems.

Mexico Variable Frequency Drive Market Trends:

The market for variable frequency drives in Latin America is mainly ruled by Mexico, wherein the requirements are mainly motivated by the sustainability objectives and industrial automation. The oil and gas, manufacturing, and construction sectors are adopting more and more VFDs. Mexico's push towards modernizing the industrial sector and making it more energy-efficient is in line with the increasing usage of advanced motor controls and interconnected drives in key areas.

What Potentiates the Market in the Middle East & Africa?

In the Middle East & Africa (MEA), the market is driven by extensive infrastructure projects and a strong push for industrialization to diversify economies beyond oil. Rising energy costs and government mandates for energy conservation are encouraging industries to adopt VFDs for applications such as pumps, fans, and compressors, especially in water desalination and HVAC systems. This trend is further sped up by significant investments in clean energy and industrial automation projects.

UAE Variable Frequency Drive Market Trends

Within the Middle East & Africa, the UAE stands out as a key player. Its ambitious economic and sustainability goals, combined with high electricity consumption in commercial and residential buildings, increase the demand for efficient HVAC systems where VFDs are essential for managing energy use. As a regional trade and logistics hub, the UAE attracts significant investment in green hydrogen mega-projects and smart city initiatives, further boosting the need for advanced, energy-efficient motor control solutions.

Value Chain Analysis

- Raw Material Procurement (Silicon Wafers, Gases): Very critical to the semiconductor process of VFD are the silicon wafers and specialized gases that the company has sourced in large quantities.

Key Players: Shin-Etsu Chemical, SUMCO, Siltronic - Wafer Fabrication (Front-end): VFD's most important circuits, such as IGBTs, are made in modern cleanroom facilities with precise controls on the silicon wafers.

Key Players: Intel, Samsung - Photolithography and Etching: Light and chemical etching are the two ways used to create minute semiconductor structures through the application of the very intricate electronic circuit pattern.

Key Players: ASML, Nikon, Canon - Doping and Layering Processes: Wafers are doped and layered with materials to determine their particular electrical properties, hence their performance as semiconductors.

Key Players: Lam Research - Assembly and Packaging (Back-end): The cutting, mounting, and encapsulating of chips into the toughest casings take place to produce full VFD modules that are prepared for further union.

Key players: Amkor Technology, ASE Technology Holding, Intel - Testing and Quality Control: The performance, reliability, and safety of each VFD module are confirmed through an extensive functional test.

Key Players: Teradyne, Advantest, KLA Corporation - Distribution to OEMs and Integrators: Logistics management is utilized to facilitate the timely delivery of VFD units to OEMs and System Integrators for installation in their equipment.

Key players: ABB, Siemens, Danfoss - Lifecycle Support and Recycling: To make the product more sustainable and usable, the company offers maintenance, technical support, and recycling at the end of life.

Key players: ABB, Siemens, and Yaskawa - Providers of Components and Technology: Semiconductor and electronic manufacturing companies produce power modules, control units, and software systems used in variable frequency drive (VFD) technology. Leading producers of VFD systems are ABB, Siemens, and Schneider Electric who devote substantial resources to R&D with the goal of improving system performance and connectivity.

- OEMs & System Integration: OEMs (Original Equipment Manufacturers) incorporate VFD systems into their products (i.e., Motors and Pumps) and are responsible for establishing the relationship between the variable frequency drive (VFD) and the equipment, systems and components that VFDs will operate with in the field.

- End-Users/Aftermarket Services:Mass-market applications for VFDs are prevalent in industries such as manufacturing and HVAC, Oil, Gas and Water Utilities; while aftermarket services are focused on maintaining, service/upgrade and digital monitoring capabilities for use on VFD equipment, to improve product service life.

Top Companies in the Variable Frequency Drive Market and Their Offerings

- ABB Ltd: Wide range of low to medium-voltage VFDs emphasizing energy efficiency and remote monitoring.

- Siemens AG: Comprehensive VFD portfolio (SINAMICS range) with deep automation system integration.

- Danfoss A/S:Modular, compact, and robust VFDs for HVAC, water, and material handling applications.

- Rockwell Automation: Integrated VFDs (PowerFlex series) with Allen-Bradley control systems, focusing on performance and safety.

- Schneider Electric:VFDs (Altivar range) focusing on energy savings, connectivity, and integration with building and industrial automation.

Other Key Players

- GE Energy Power Conversion

- Toshiba International Corporation

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Industrial Automation

- Fuji Electric Co. Ltd

- Johnson Controls Inc.,

- Eaton PLC

- Hitachi Ltd

Recent Developments

- In September 2025, ABB India is investing Rs 140 crore to enhance its LV motor manufacturing facility and introduce rare-earth-free IE5 ultra-premium efficiency motors, strengthening India's manufacturing position.

(Source: https://www.constructionworld.in) - In September 2025, Fuji Electric Corp. of America launches the FRENIC-MEGA (G2) AC drive, enhancing performance and reliability with expanded capabilities for flexibility, efficiency, and control in variable frequency drives.

(Source - https://www.businesswire.com)

Segments Covered in the Report

By Product

- AC Drives

- DC Drives

- Servo Drives

By Power Range

- Micro

- Low

- Medium

- High

By Voltage Type

- Low Voltage

- Medium Voltage

By Application

- Pumps

- Electric Fan

- HVAC

- Conveyors

- Extruders

- Others

By End User

- Oil & gas

- Industrial

- Power

- Infrastructure

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting