What is the Wheelchair Market Size?

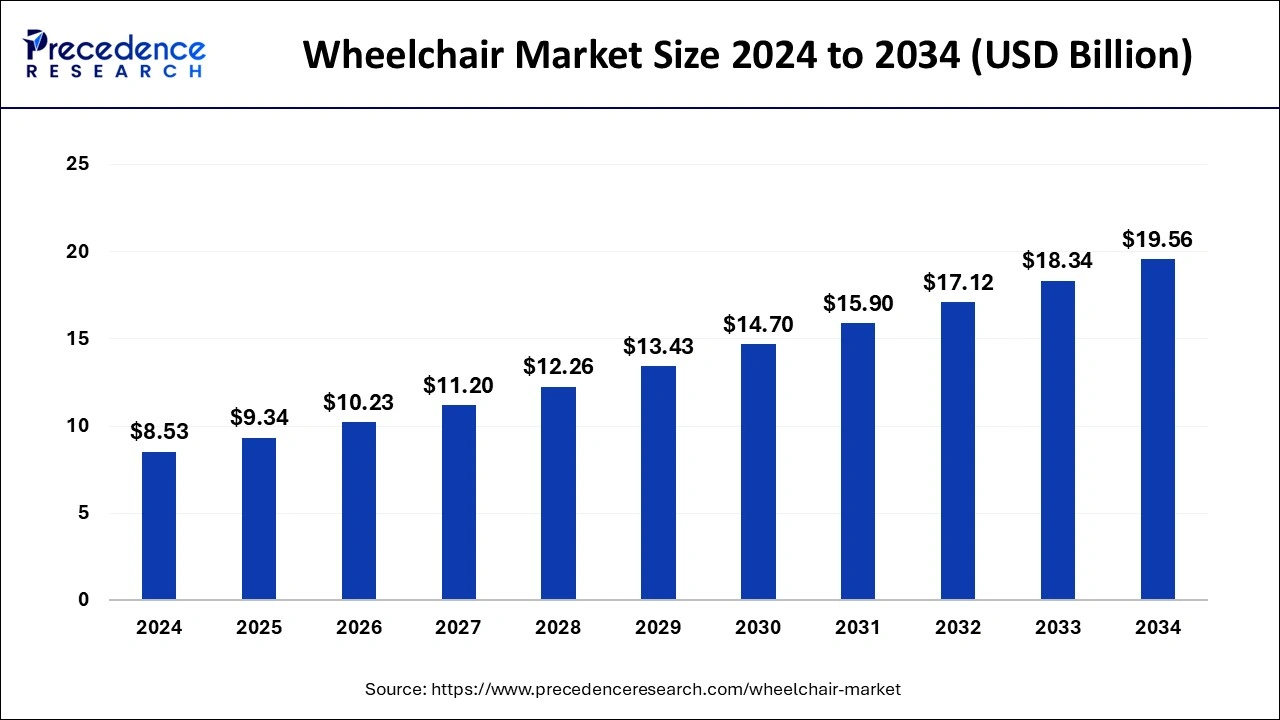

The global wheelchair market size is valued at USD 9.34 billion in 2025 and is predicted to increase from USD 10.23 billion in 2026 to approximately USD 19.56 billion by 2034, expanding at a CAGR of 8.65% from 2025 to 2034.

Wheelchair Market Key Takeaways

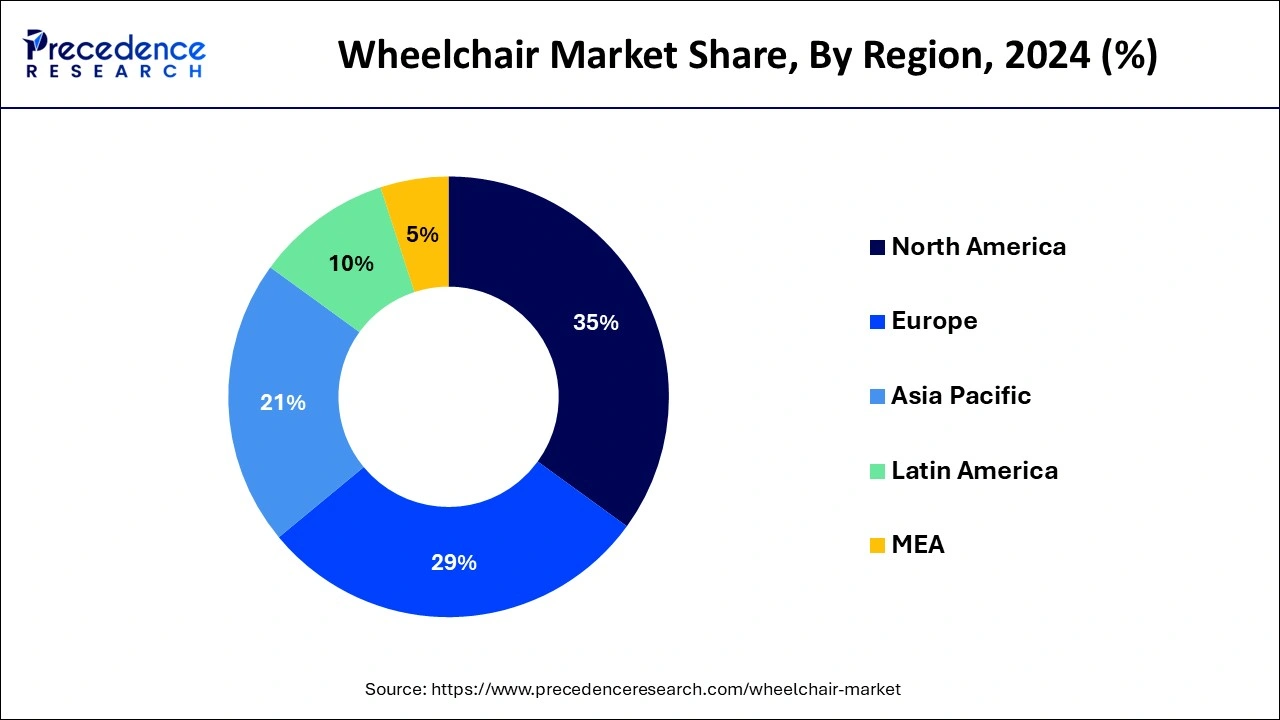

- North America dominated the global wheelchair marketwith the largest market share of 35% in 2024.

- Asia pacific is projected to expand at the fastest CAGR during the forecast period.

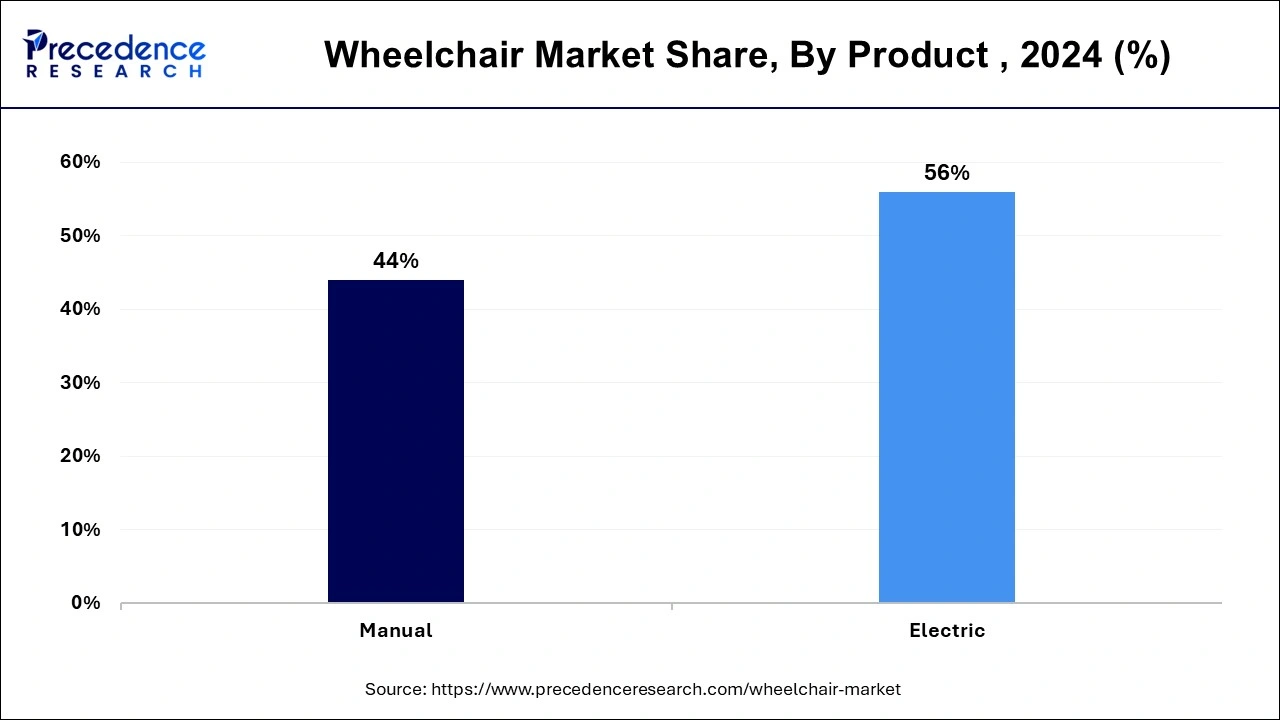

- By products, the electric wheelchair segment contributed the highest market share of 56% in 2024.

- By products, the manual product segment is expected to grow at a significant CAGR from 2025 to 2034.

- By category, the adult segment captured the biggest market share of 70% in 2024.

- By application, the rehabilitation centers segment has held the largest market share of 35% in 2024.

Inside the Exploding Wheelchair Market

An aging elderly voter's dependence on chairs that's what fuels the wheelchairs industry. Such segmentation expansion is also largely attributed to the youngster's higher incidence of illnesses to the standard of living. Additionally, improvements in wheelchairs innovation and convenience are indeed the key factors driving a surge in the prevalence of recently introduced wheelchairs being manufactured in India. As a consequence, it is projected that this will have a favorable effect on the market expansion.

Additionally, wheelchair producers are going further than the fundamental Mechanical wheelchair. To help the individual & make it clearer for him or herself to freely move or autonomously, they were developing new designs. This wheelchairs sector is booming faster thanks to the adoption of innovative, improved infrastructure that enables chairs for consumers easier to manoeuvre and more affordable. A Who says that there can be a rise in the number of disabled people in developing countries.

The administration of India's ministries for social and economic justice, as well as development, as well as development, supports the independence of disabled individuals of all types, including auditory, vision, speaking, motor, with psychological handicaps by giving individuals access to the appropriate therapeutic services equipment and services. As a result, the need for wheelchairs in India is naturally moving forward in the industry as the impairment changes are significant.

Numerous government initiatives are in place to give a wheelchair to individuals with locomotor impairments. As per a recent fashion noted by the authority, wheelchairs are now either given by the company or, in many situations, money is given to individuals to purchase the chairs of their choice. Increasing the participant's marketing outreach while also increasing demand for wheelchairs.

Wheelchair Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the wheelchair market is poised for significant growth. This growth is primarily driven by an aging population worldwide, the rising prevalence of chronic diseases and disabilities, and rising healthcare expenditure, offering greater independence, comfort, and advanced features compared to traditional manual models.

- Sustainability Trends: Manufacturers are adopting energy-efficient production methods, using recycled materials and bio-based polymers to lessen their environmental impact. This effort is reinforced by the circular economy model, with companies like Etac introducing take-back and recycling programs for used devices, reducing waste and enhancing resource efficiency.

- Global Expansion: Leading players are expanding their geographic reach to meet the diverse needs of global populations. While North America holds significant potential due to its established healthcare infrastructure and high adoption of advanced mobility solutions, the Asia-Pacific region offers significant opportunities for market expansion, driven by improved healthcare facilities and supportive government initiatives for mobility aids.

- Major Investors: The market attracts a variety of investors, including venture capital firms, private equity, and established corporate players in the medical device industry. Investments are motivated by steady demand from an aging population and the potential for technological innovation. Key companies and investors include Invacare, Sunrise Medical, Ottobock, Pride Mobility, and specialized investment firms like OrbiMed.

- Startup Ecosystem: The startup ecosystem is maturing, with innovators developing "smart" wheelchairs integrated with AI, IoT, sensors, and remote monitoring capabilities. Emerging firms are attracting significant funding by offering specialized solutions like all-terrain models, ultra-lightweight foldable designs, and AI-assisted navigation systems.

Wheelchair Market Growth Factors

Due to the severe shutdowns put in place, wheelchairs services are stopped in various nations. Owing because of an increasing number of older patients being treated as a result of such COVID-19 illness, clinics also saw great desire. Businesses are anticipated to restart activities with both the updated COVID-19 limitations. The burden of severe disease, growing senior community, and increased risk of cultural ailments among a large population has resulted in obesity rates, and unhealthy lifestyles are all contributing to the predicted increase in consumption of chairs. So, over a projected timeframe, the wheelchair regarding product sector is anticipated to expand by 6.2 percent. And over the projection period, emerging economies like India are anticipated to be major sources of income for chair producers.

The nation is among the world's highest transportation accidents are a major, which has left many individuals crippled. On a worldwide scale, it does have one of the largest numbers of disabled people. The region is already in the early stages of accessibility and acceptance, but thanks to encouraging federal programs and increasing consumer understanding, the market for a wheelchair is anticipated to increase substantially to ahead.

A significant trend anticipated to propel market number sales is the evolution of technology breakthroughs in wheelchair layouts. The introduction of rechargeable wheelchairs is anticipated to help users more. Furthermore, thanks to technological engineering advancements, wheelchairs can now save, link to, and sometimes even analyze the customers' patient data as well as their health information. The Invacare Company unveiled the AVIVA FX Motorized Wheelchair in Mar 2020. It will be used indoors and outdoors and also is built with a combination of new technology to provide improved comfort.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.34 Billion |

| Market Size in 2026 | USD 10.23 Billion |

| Market Size by 2034 | USD 19.56 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.65% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Category, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

The electric wheelchair segment contributed the highest market share of 56% in 2024. A chair propelled by electricity, primarily charges & engines, is indeed an electronic chair, often referred to as a motorized scooter, motorized mobility scooter, or electric scooter. Traditionally, a controller has been used to control and maneuver electric wheelchairs. The usefulness & productivity of wheelchairs has begun to grow thanks to recent breakthroughs, the implementation of machine learning, with advanced analytics, in equipment. For example, on 21 April 2022, the wheelchairs maker Permobil teamed up only with AI wearables startup Mobvoi will find a resolution, the Mobvoi TicWatch E3 wristwatch, which has medical monitoring technology and electrical support for Skilled learners PushTracker E3 customers.

The wheelchairs seem to be more helpful because of this AI breakthrough, which is supported by Google as well as Volkswagen and helps with natural language processing, longitudinal searching, as well as other tasks. The electric wheelchair sector held the largest market share. This is anticipated to experience the quickest CAGR growth throughout the projected period. For people lacking strength and endurance, these wheelchairs were excellent. Because there are far more sophisticated treatment centers available in industrialized nations like the U.S., mobility scooters are now more common there. The Scewo Bro motorized wheelchair, which might easily and autonomously navigate stairs, was introduced in July 2020. German, Austrian, and Swiss citizens can purchase it

Given the strong need for electric wheelchairs, which are in short supply properties and low, lightweight weight, and independent from charges, the manual device sector is anticipated to experience a considerable increase over projection decades. Additionally, these are available in a multitude of dimensions and designs, ranging from ordinary to amazing, and take up minimal room because many market segments are folded. An innovative hydraulic steering device for electric wheelchairs called Skilled learners PushTracker E2 was introduced in 2019 by Permobil, a major player in cutting-edge medicine and technology.

Category Insights

Over the projected timeframe, the category is expected to keep leading. It is primarily caused by the growing old people has increased, which is included in the category of adulthood. People over the age of 18 years are considered mature. In 2021, this mature market had the biggest income percentage. The need for chairs is increasing due to the aging population's increased impairment from conditions like arthritic discomfort, tight knee, and painful feet, and ankles. As a result of positional issues caused by a fractured spine, vertebral abnormalities including lumbar lordosis, osteoporosis, and spine curvature amongst elderly individuals also limit routine functions like clothing and strolling, which itself is projected to increase the desire for chairs.

The utilization of chairs is increased among elderly adults who are disabled from arthritis-related stiffness or discomfort in their knees, hips, ankles, or feet. For illustration, on 17 May 2022, Apple revealed the availability of cutting-edge accessible capabilities combining software, ML, and equipment to give people with disabilities technological skills for mobility, healthcare, with conversation. This function may identify entrances with improved sensory and motor mobility, live captioning, and various other things that make it much more beneficial for persons with disabilities. Due to the rise in children's illnesses like Down syndrome, the pediatric market is also anticipated to expand rapidly.

Another of the most prevalent mobility diseases that necessitate a wheelchair is Down syndrome. National Cerebral Palsy Foundation estimates that around 10K infants in the United States were birth with such a condition every year. Inside the United States, it is a disorder involving that is more frequently identified in children. Therefore, it is anticipated that over generations to follow, the pediatric market would contribute significantly to wheelchair producers' bottom lines. Sales again for the pediatric sector are anticipated to expand at a modest pace throughout the projected timeframe. About 240 million individuals were disabled worldwide, according to research even by University Nations International Children's Disaster Fund, which is driving the p desire for chairs worldwide. When compared to children's electric wheelchairs, this power wheelchair is much more beneficial to them.

Application Insights

The category of rehab facilities dominated the marketplace in 2024, accounting for further over 34.5% of total sales. So, over the forecast timeframe, the sector will increase slowly nonetheless. The worldwide market was divided into hospitals, home care, ambulatory surgical centers, and residential treatment according to the application. This development is attributed to an increase in the number of wheelchair-required clinical conditions. The need for chairs is increased by the comment treatments. Those wheelchairs are mostly utilized in clinics for the level of mobility and also for medical visits in a sizable healthcare center.

Income for clinics as well as hospitals sector is anticipated to expand moderately over the projection timeframe. In hospitals and medical clinics, wheelchairs are essential for momentarily patient services between hospital to hospital. Wheelchairs let impaired people move about more easily while also preventing pressure injuries, slowing the course of deformities, and improving respiratory and digestive. The need for wheelchairs within hospitals and healthcare facilities is anticipated to rise due to their versatility.

Income in the home health sector is expected to increase at a gradual pace throughout the projection timeframe. People who are incapable of stand or have limitations limited in how much force they can bear on their lower extremities need one wheelchair. Wheelchairs are now more comfortable that crutches for extended longer journeys. In-home care, mechanical wheelchairs, motorized wheelchairs, or both are utilized to give people with disabilities freedom and motivation to move.

Regional Analysis

U.S. Wheelchair Market Size and Growth 2025 to 2034

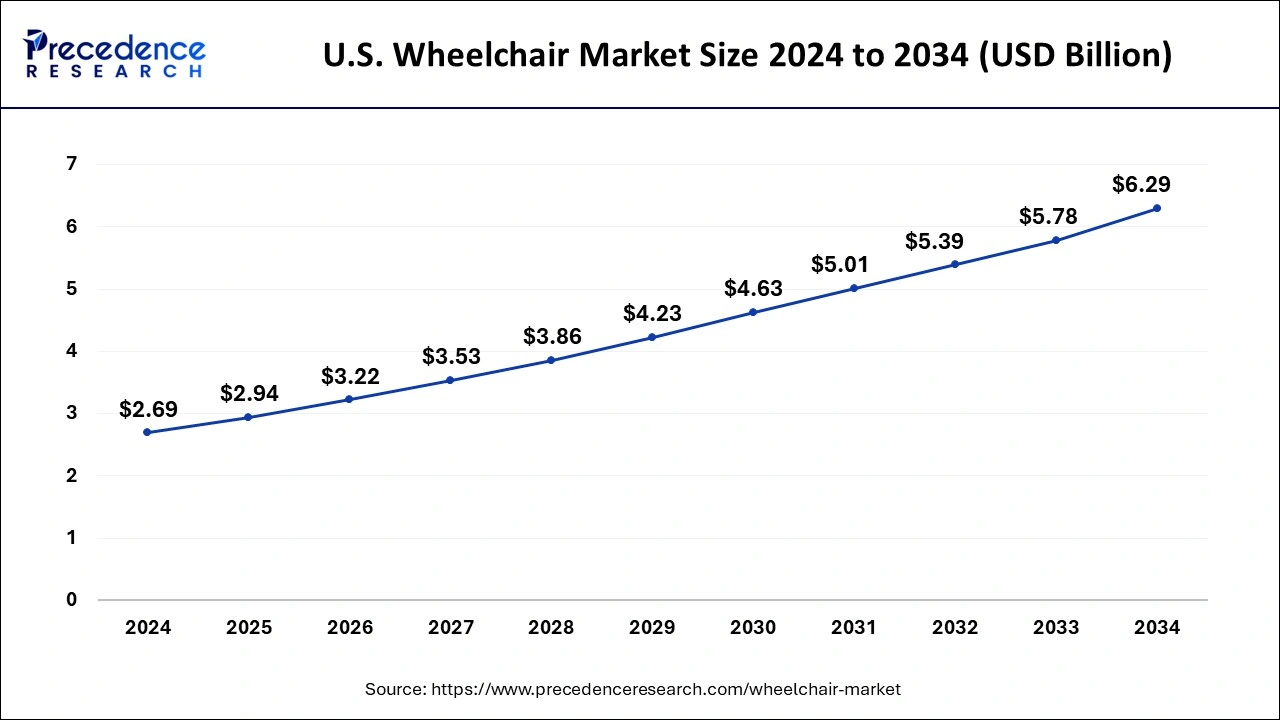

The U.S. wheelchair market size is evaluated at USD 2.94 billion in 2024 and is predicted to be worth around USD 6.29 billion by 2034, rising at a CAGR of 8.87% from 2025 to 2034.

North America dominated the global wheelchair market with the largest market share of 35% in 2024. The United States had the greatest profit share thus controlling the world market. Such expansion is due to the relatively high population and the rising use of cutting-edge wheelchairs. Additionally, the existence of several industry players in the area will support market expansion throughout the projection period. Our research shows that many small businesses are developing customized chairs to appeal to specific markets. For example, a U.S. company named Segway, Incorporated introduced an embryo capsule in Jan 2020 which enables individuals to relax when people easily go across the airport, campuses, amusement parks, and even towns. That capsule is specially designed for 24-mph elevated transport and can able to utilized by those who require wheelchairs.

The U.S. holds a significant share of the global wheelchair market since its healthcare system is robust, its population is aging, and the prevalence of mobility impairments is rising. Both manual and powered wheelchairs are widely available thanks to the nation's extensive network of medical facilities, rehabilitation facilities, and wheelchair distributors. The market expansion is also fueled by the use of cutting-edge technologies in wheelchair design, such as electric wheelchairs with Internet of Things integration.

- In January 2024, Invacare Corporation launched the TDX SP2 Power Wheelchair. This advanced electric wheelchair features improved maneuverability, better battery performance, and customizable seating solutions, aiming to enhance user comfort and independence.

- In 2024, the United States will rule the global wheelchairs industry. The reason for this boost is indeed the sizable primary audience and also the expanding use of reduced chairs. Throughout the forecast years, the nation's large number of competitive players will also contribute to accelerating expansion. Personalized scooters are being created by numerous small enterprises to market to particular consumers. To illustrate, in Jan 2020, a business named Segway, Corporation in the United States unveiled an embryo capsule that allows users to relax whilst moving around universities, roller coasters, airlines, and sometimes even entire towns. This capsule was created with luxury transit in consideration and is available to people who use disabilities.

Asia Pacific Wheelchair Market Growth Driven by an Aging Population and Innovation

The speed of growth in the wheelchair market in the Asia-Pacific region has become significant as a result of the growing elderly population, increased incidence of disability, and an increase in leg injuries due to road traffic accidents. China has one of the fastest-growing ageing populations in the world. The population of people over 60 years old in China is projected to reach 28% by 2040. The region is experiencing an increase in the adoption of light-weight, smart, and IoT-enabled wheelchairs with better controls. Government action in terms of including disability in their programs and helping disability in public health is increasing the availability of mobility aids. Countries like India are experiencing an increase in demand for wheelchairs due to mobility problems stemming from road accidents and the resulting injuries

India Wheelchair Market Trends

India is quickly emerging as a key player in the wheelchair market, both as a growing domestic consumer and a rising global exporter of affordable mobility solutions. The country's large population and increasing demand are turning it into a manufacturing hub for inexpensive, high-quality wheelchairs. Government initiatives support this growth by promoting accessibility and offering assistance, while local startups are focusing on innovative, customizable designs.

How is the Opportunistic Rise of Europe in the Wheelchair Market?

Europe is experiencing significant market growth. The region is characterized by strict regulations, an aging population, and high demand for advanced mobility solutions. The market is led by innovative, high-performance wheelchairs, including both active and powered models, designed for durability, comfort, and compatibility with modern technologies. Major global manufacturers are based in the region, emphasizing research and development to create user-focused designs, lightweight materials, and smart features that improve quality of life and independence for people with disabilities, supported by well-established healthcare and insurance systems.

Germany Wheelchair Market Trends

Germany is a major contributor to the European wheelchair market. The country is known for its high-quality engineering and has a large aging population, which is expected to make up one-third of the total population by 2050. It also has many individuals classified as severely disabled, creating high demand for various mobility aids. Germany leads in both the active wheelchair and electric wheelchair markets, with local manufacturers and key players developing advanced products and digital solutions.

What Potentiates the Growth of the Latin America Wheelchair Market?

The wheelchair market in Latin America is experiencing notable growth, mainly fueled by a rising geriatric population, increasing life expectancy, and a higher occurrence of disabilities and chronic conditions like arthritis and Parkinson's disease. Historically, manual wheelchairs have dominated the market due to their affordability and accessibility; however, demand for electric and advanced mobility solutions is on the rise. Brazil, Mexico, and Argentina are at the forefront of this market expansion.

Brazil Wheelchair Market Trends

Brazil leads the market in Latin America, driven by a large population of people with disabilities and a growing elderly population. The market mainly consists of manual wheelchairs, which are widely accessible and supported by government programs and charitable groups. Rising healthcare spending and increased awareness of the benefits of improved mobility and independence are driving market growth.

How Big is the Opportunity for Market Expansion in the Middle East and Africa?

The Middle East & Africa region presents significant growth opportunities in the wheelchair market, driven by expanding healthcare infrastructure, a rising population, and an increasing prevalence of chronic conditions and mobility-impairing injuries from road accidents. There is a clear trend toward adopting advanced powered and smart wheelchairs. South Africa and the UAE are key markets, supported by government and private-sector initiatives aimed at improving accessibility and providing mobility aids for individuals with disabilities.

Saudi Arabia Wheelchair Market Trends

Saudi Arabia's wheelchair market is expanding quickly, driven by the National Accessibility Strategy and significant funding for healthcare and social programs for people with disabilities. The country has a high rate of diabetes and a growing number of road accidents, which increase the need for mobility aids. Although manual wheelchairs are still common, there is a rising demand for advanced electric wheelchairs with adjustable seats and specialized controls.

Value Chain Analysis

- Raw Material Supply & Processing

This involves sourcing steel, aluminum, plastics, composites, and electronic components like motors and batteries.

Key Players: BASF, Evonik, Arkema, Dow. - Research and Development (R&D) & Product Design

This focuses on innovating new and improved manual and power wheelchair designs, enhancing comfort, durability, and user independence.

Key Players: Invacare Corporation, Sunrise Medical, Ottobock, Permobil AB, Pride Mobility Products Corp., Quantum Rehab. - Manufacturing and Production

This involves fabricating frames, producing components, and final assembly into the finished product while meeting safety standards (ISO 7176).

Key Players: Invacare Corporation, Sunrise Medical, Ottobock, Permobil AB, Drive DeVilbiss Healthcare, GF Health Products Inc., Medline Industries, Inc. - Distribution and Supply Chain Management

This ensures efficient delivery to end-users and facilities via direct sales, wholesalers, e-commerce, and collaboration with NGOs.

Key Players: Numotion, Medline, various regional wholesalers/importers, e-commerce platforms. - Prescription, Assessment, and Fitting

A formal process involving assessment and prescription by professionals is essential to ensure the device is appropriate for the user's specific needs.

Key Players: Apollo Hospitals, Max Healthcare, Indian Association of Physiotherapists (IAP). - Maintenance, Repairs, and Aftermarket Support

This provides ongoing support, including user training, repairs, spare parts availability, and follow-up to ensure long-term functionality and user health.

Key Players: Healthdexter, World Health Care, NeoMotion, and Invacare Dealers.

Top Companies in the Wheelchair Market and Their Offerings

- Invacare Corporation: A wide range of products, including manual wheelchairs (e.g., Action series) and power wheelchairs (AVIVA STORM RX) for home and long-term care.

- Sunrise Medical LLC: A comprehensive portfolio of manual and powered wheelchairs, including specialized options under brands like Quickie (for high-performance) and Zippie (for pediatrics).

- Pride Mobility Products Corporation:Focuses heavily on powered mobility, known for its Jazzy Power Chairs, as well as lift recliners and mobility scooters.

- Permobil AB: A leader in advanced, custom-inspired complex rehab technology (CRT). Specializes in high-tech powered wheelchairs with advanced seating and positioning systems.

- OttoBock Healthcare: A German-based medical device manufacturer with a broad product lineup, including basic manual, complex powered, and sports wheelchairs, plus pediatric buggies.

21st Century Scientific, Inc.: Offers ergonomic and adjustable wheelchair solutions focused on user comfort and support. - Alber (Frank Mobility): Develops innovative mobility devices and electric wheelchair add-ons to enhance maneuverability and independence.

- Aquila Corporation: Manufactures lightweight, durable wheelchairs designed for daily use and ease of transport.

Aspen Seating: Provides specialized seating systems and cushions that improve posture and reduce pressure injuries for wheelchair users. - Carex Health Brands, Inc.: Supplies a wide range of manual and transport wheelchairs, along with accessories to support mobility and accessibility.

Other Major Players

- Custom Engineered Wheels

- DEKA Research & Development Corp

- Drive Medical Design & Manufacturing

- Eagle Sportschairs LLC.

- EASE Seating System

- Forza Medi

- Graham-Field Health Products Inc.

- Hoveround Corporation

- Intelliwheels

- Karma Healthcare Limited

- Levo AG (Switzerland)

- MATIA ROBOTICS

- Medical Depot Incorporation.

- Medline

- MEYRA GROUP GMBH

- NeoBolt

- Numotion

- Ostrich Mobility Instruments Pvt. Ltd

- PITSCO EDUCATION LLC

- Quantum Rehab

- SEGWAY INC.

- Silverline Meditech Pvt. Ltd.

- Stryker India Pvt. Ltd

- Tetra Equipment

- The Wheelchair Place, LLC

- UPnRIDE Robotics Ltd.

- Vissco Rehabilitation Pvt. Ltd

- WHEEL INC

- WHILL Inc

Recent Developments

- In March 2025, Portable mobility specialist eFOLDi announced the launch of the Navigator, its lightest and most advanced folding powered wheelchair. eFOLDi has also ensured that user comfort remains a high priority, with the inclusion of a new breathable seat cushion for additional support.

- In February 2025, Chulalongkorn University launched the Exoskeleton Wheelchair —a robotic suit that helps people with disabilities sit, stand, and walk. Exoskeleton Wheelchair is a robot worn on the body to help human movement. It can serve as both a wheelchair and be converted into a robot.

- On 1 January 2024, Sunrise Medical launched Quickie Q700M SE. The high-performance electric wheelchair offers superior maneuverability, gyro-based drive control, and advanced seating systems. Its six-wheel suspension ensures stability on uneven terrain. It was designed to enhance independence for users with complex mobility needs.

- On 9 January 2024, Roboter Showcased X40 features omnidirectional wheels, foldable, remote control, and an adjustable speed limit. It's designed for urban and semi-outdoor environments, targeting elderly and semi-mobile users. The CES showcase highlighted Robbter's focus on design and safety.

- On 12 March 2024, IIT Madras launched NeoStand, a fully motorized standing electric wheelchair. NeoStand enhances blood flow and reduces pressure injuries. It offers customizable seating and postural support, developed in partnership with Phoenix Medical Systems. It's India's most advanced standing mobility aid to date.

Segments are covered in the report

By Product

- Manual

- Electric

By Category

- Adults

- Paediatric

By Application

- Homecare

- Hospitals

- Ambulatory Surgical Centers

- Rehabilitation Centers

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting