Wire and Cable Market Size and Forecast 2025 to 2034

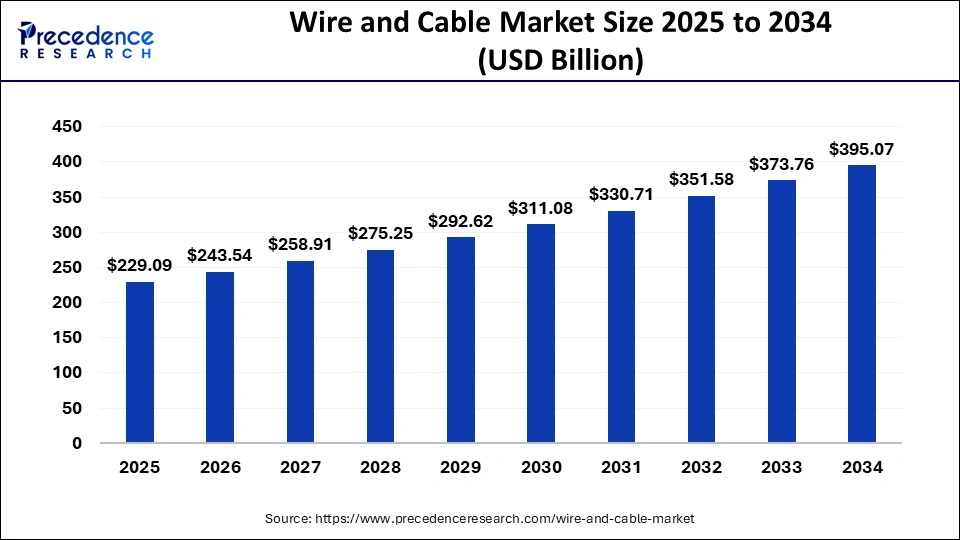

The global wire and cable market accounted for USD 215.49 billion in 2024 and is expected to reach USD 395.07 billion by 2034 and is growing at a CAGR of 6.20% from 2025 to 2034.

Wire and Cable Market Key Takeaways

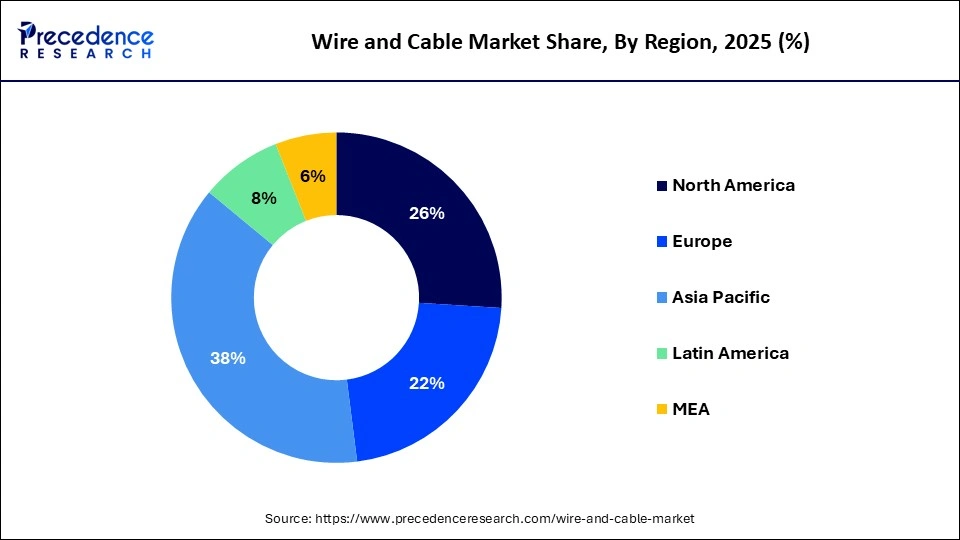

- Asia Pacific has accounted revenue share of around 38% in 2024.

- By Voltage, the low voltage segment has captured the highest revenue share of over 44% in 2024.

- By Installation, the overhead installation segment has generated a revenue share of over 65% in 2024.

- By End-use, the energy and power segment has accounted revenue share of 38% in 2024.

- Building and construction segment is projected to reach at a CAGR of 4.9% from 2025 to 2034.

Asia Pacific Wire and Cable Market Size and Growth 2025 to 2034

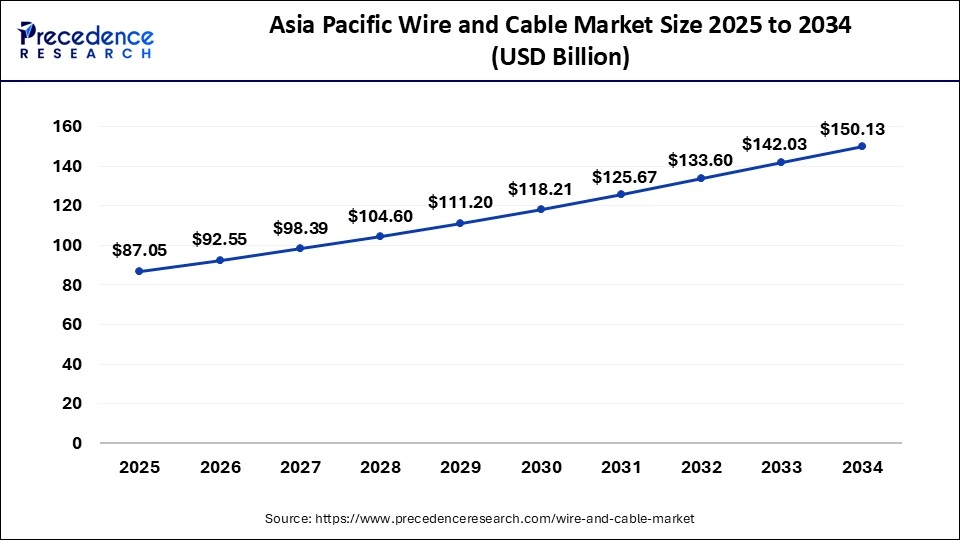

The Asia Pacific wire and cable market size was exhibited at USD 81.89 billion in 2024 and is expected to be worth around USD 150.13 billion by 2034, at a CAGR of 6.70% from 2025 to 2034.

Asia Pacific accounted as the matured region in the wire and cable market, yet register profound growth over the forecast period owing to increasing demand for power, light, and communication network. Further, attractive government policies such as ‘Go Green' and ‘Make in India' are anticipated to drive the market growth in India. The government of India has planned to increase the productivity of electrical equipment by USD 100 Billion by the end of the year 2024 through import and export, thereby drives the demand for wire and cable in the region.

A balanced positive influence on the economy is promised by the infrastructure improvements in the Asia Pacific region for both urban and rural areas. Due to increased infrastructure spending and public capital investments, the demand for steel and concrete industries is likely to benefit greatly. Due to the increasing demand, this will provide a boost for foundational industries like cables and wires.

Additionally, the automotive industry is thought to benefit from increased spending on road infrastructure, a voluntary scrappage program, and R&D. In countries like India, Thailand, and Vietnam, the awareness of and emphasis on developing rural and agricultural infrastructure may have a favorable effect on the demand for cars.

Additionally, the practice of power-feeding submarine wire methods is well-established, from optical amplifier techniques to coaxial submarine techniques. The power feeding equipment inaugurated in the terminating platforms and the return path via earth and water, the PFE providing constant power while stabilizing repeater segments and communication performance, are the main principles of electricity powering the submarine cable systems, as discussed in this chapter. The demand for submarine cable system products in Asia-Pacific will increase due to the rising growth of digitalization and automation in nations like China and Japan. As a result, the Asia Pacific area will experience tremendous expansion in the wire and cable business in the near future.

Moreover, North America and Europe witnesses the fastest growth during the forecast period. This is mainly due to the government initiatives such as Digital Agendas for Europe 2025. Further, vast increase in the data consumption in the North America resulted in significant investment by communication technology giants such as Verizon Communications and AT&T in the fiber optics network technology. For instance, in May 2017, Verizon Communications entered into a partnership with the Prysmian Group to upgrade its network architecture with fiber optic cables to expand the 4G coverage and establish a platform for IoT and 5G technologies.

Wire and Cable Market Growth Factors

Rapid increase in the building infrastructure coupled with rise in urbanization is the major factor that propels the market growth. This has impacted the overall demand of energy and power in the commercial, residential, and industrial sectors. Further, increased investment for the upgradation of power distribution and transmission system along with smart city initiatives expected to fuel the demand of wires and cables in the coming years. Rising adoption of smart grid technology has substantially increased the demand for submarine and underground cables to cater the rising requirement of grid interconnection.

Presently, skyrocketing demand for advanced and reliable technology has spurred the need for more efficient power system. In developed regions such as North America and Europe were power system is nearly 99.99% reliable, yet allows for blackouts and interruptions that cost around USD 150 billion every year in North America. In the wake of same, the region invests significantly to upgrade its energy distribution and transmission network to overcome these losses.

Besides the above fact, high fluctuation in the prices of raw materials such as aluminum, rubber, and glass that are prominently used for the manufacturing of wires and cables anticipated to hinder the overall market growth. Price fluctuation in the raw material affects the value chain of the industry including procurement and operational costs. Nonetheless, escalating demand for advanced technologies including Internet of Things (IoT), Big Data, machine learning, artificial intelligence, and many others have significantly boosted the demand for wire and cable in the Information Technology (IT) industry.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 395.07 Billion |

| Market Size in 2025 | USD 229.09 Billion |

| Market Size in 2024 | USD 215.49 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.20% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material, Installation, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand from Data Centers and IT Facilities

Communications, networking, and IT services depend on data centers, and information storage and traffic routing heavily rely on data centers. Data centers are presently in high demand as a result of the development of big data, and this development is causing an exponential rise in the number of high-quality and trustworthy data centers. Corporations favor cloud storage to save expenses and eliminate the trouble of operating data centers. The need for wires and cables will expand as there are more data centers, which will boost the security, availability, and affordable access to IT infrastructure. Hyperscale data center deployments are projected to be popular. The standard network connectors that are projected to be utilized in data centers are ground, AC/DC power, fibre optic, and copper.

Restraints

Instability in Raw Material Cost

Rubber and chemicals derived from plastic, such as PVS grains, are the basic materials used to make cables. Silicone rubber AND fluorine plastic accounts for most organic polymer substances, despite copper being necessary for wires. An increase directly influences the profit margin of the producers of cables in the price of raw materials, particularly copper, which limits market expansion. Since major nations began to reopen their economies, the price of raw materials used to make cables has increased significantly.

During the pandemic, copper prices fell, but since then, there has been an upward trend. On the London Metal Exchange, copper was lately been trading at USD 4617.5/MT and has steadily increased in price. The cost of copper has been fluctuating often. The increased Chinese manufacturing demand and the announcements of several nations' stimulus packages can be held responsible for this price variation.

Opportunity

Increasing Demand for lightweight cables in Aircrafts

Developing lightweight cables and wires requires substantial research and development, which the producers of aircraft wires and cables can use to investigate prospective competitive advantages. The accessibility of lightweight but strong wires could open up the potential for developing stable market offerings. A significant amount of the weight of the entire aircraft and the majority of the importance of the aircraft's electrical systems are made up of wires and cables. A decision to use significantly lighter wires would increase an aircraft's fuel efficiency while simultaneously increasing the amount of load it could carry. Governments are quickly switching from conventional wires and cables to fibre optics. Vendors are heavily focused on producing aviation wires and cables that can perform even in a harsh environment due to the increasing need for lightweight and sturdy wires and cables.

Type Insights

Based on type, optical fiber cable expected to have profound demand owing to its advantages that include low security risk, resistance to electromagnetic interference, high bandwidth, and low power loss in long distance communication. Prominent development in the communication technology has spurred the need for high performance data and communication applications. This has resulted in the advancement and development of new products to cater the rising need of consumers. Furthermore, rising implementation of high-end technologies such as Big Data, machine learning, IoT, and many others have significantly boosted the need for advanced cable technology that offer negligible data loss.

Voltage Insights

Due to the extensive use of low voltage cables in distribution networks, appliance wires, building wiring, and LAN cables, the low voltage wires and cables dominate the market. These wires and cables help smart grids deliver superior electric supplies while improving the provision of electricity for end users. Worldwide, the energy and electricity industries are undergoing fast change. Most developing and developed nations are moving towards incorporating extensive renewable resources due to the high electricity demand.

Installation Insights

The underground segment is estimated to grow at a sustainable rate during the forecast period. The installation of underground cables reduces maintenance expenses, results in fewer communication losses, and thus easily supports the power demands. Need from different industries, including the residential, commercial, telecom, automotive, energy & power sectors, are causing infrastructure to be upgraded and expanded, which is expected to fuel requirements for wire and cables. Infrastructure development consumes a sizable amount of the GDP of developing nations.

End User Insights

The energy T&D ecosystem is undergoing a number of technological improvements, such as the conversion of the old transmission lines to high or extra high voltage lines to prevent communication losses. These modifications are intended to stabilize ecosystems in contrast to the fluctuating nature of renewable energy sources. Additionally, the utility industry has been severely impacted by the launch of new technologies like the coordinated charging of electric vehicles and solar households' net metering. As a result, profitable growth is anticipated for the energy & power category.

Application Insights

Power transmission led the global wire and cable market with nearly half of the revenue share in 2024. Upgradation of older networks into more reliable and advanced energy transmission & distribution (T&D) ecosystem along with integration of renewable energy generation technology accounted for the key factors behind the profound growth of the segment. Apart from this, smart grid technology has also contributed significantly for the upgradation of older T&D ecosystem as it requires minimum power and transmission loss.

On the other hand, building segment expected to witness the highest growth rate over the analysis period. Rising population and high rate of construction and development in the developing regions such as Asia Pacific, Middle East & Africa, and South America are the prime factors behind the flourishing growth of the market. In addition, rapid urbanization along with rising application of smart home appliances triggers the need for reliable cable technology.

Wire and Cable Market Companies

- Hengtong Optic-Electric Co Ltd.

- Prysmian Group

- Sumitomo Electric Industries, Ltd.,

- Furukawa Electric Co., Ltd.

- Leoni AG

- Jiagnan Group

- General Cable Corporation

- LS Cable & System Ltd

- TPC Wire & Cable Corp

- Southwire Company, LLC

- Polycab Wires Private Limited

- Nexans S.A.

- Hitachi Metals Ltd

- Far East Cable Co., Ltd.

Recent Development

- In January 2023, In compliance with new High Voltage Direct Current (HVDC) recommendations, SuperGrid Institute and Nexans completed a temporary overvoltage test on a 525kV DC cable design. The SuperGrid Institute's High Voltage testing equipment was used to conduct numerous damped oscillating voltage trials on the Nexans-produced and -installed DC cable system.

- In January 2023, The Voluntary Protection Programs (VPP) Star site designation for Southwire's El Paso, Texas, facility has been renewed by the Occupational Health and Safety Administration (OSHA).

- In July 2022, the domestic creation, production, and marketing of a liquid-cooled (LC) ultra-fast charging cable were all disclosed by LS Cable & System (LS C&S).

- In May 2022, six new products will be released in Q2 2022, according to Belden Inc., a top provider of specialist networking solutions worldwide. These products will give clients additional integration options, safer ways to transport power over long distances, and quick lead times.

Segments Covered in the Report

By Type

- Medium and High Voltage (MV & HV)

- Low Voltage (LV)

- Optical Fiber Cable

By Material

- Aluminum

- Copper

- Glass

By Installation

- Overhead

- Underground

By Application

- Data Transmission

- Building

- Power Transmission

- Transport

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting