What is the Power and Control Cable Market Size?

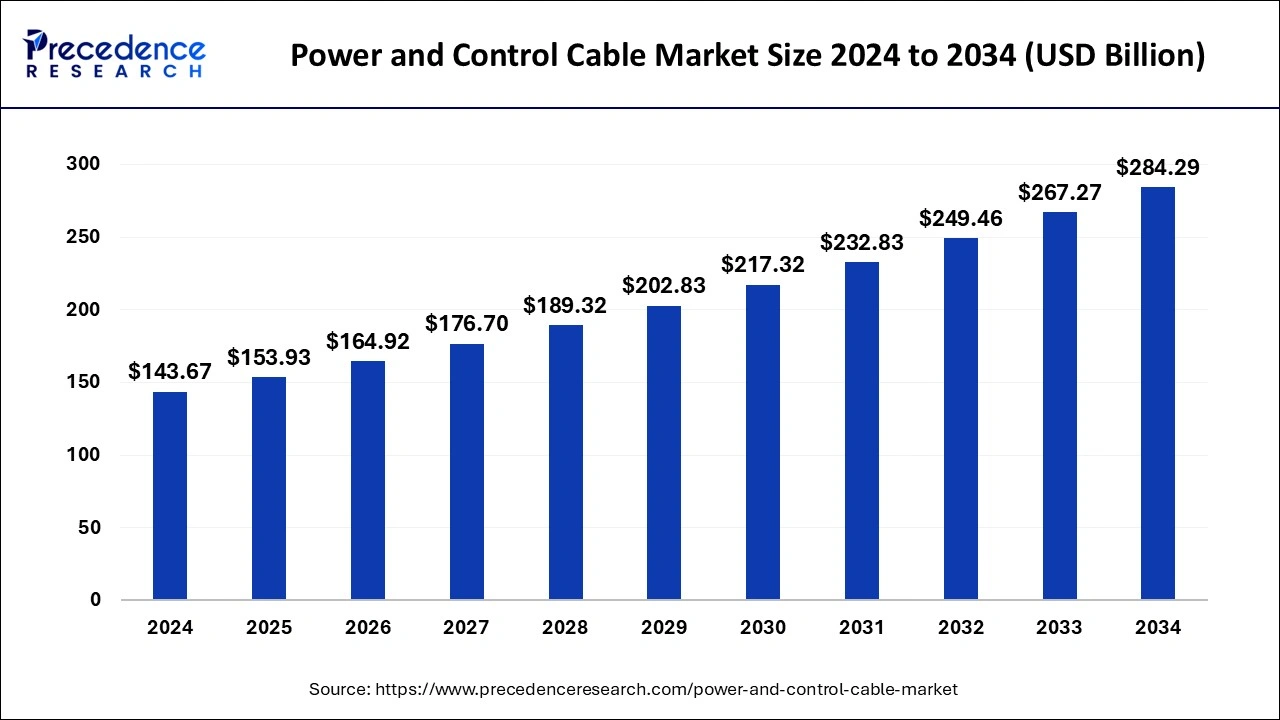

The global power and control cable market size was estimated at USD 153.93 billion in 2025 and is predicted to increase from USD 164.92 billion in 2026 to approximately USD 301.84 billion by 2035, expanding at a CAGR of 6.97% from 2026 to 2035. Thanks to advancements in cable technology, which include the creation of high-performance, eco-friendly cables, power, and control systems are becoming more efficient and safer.

Power and Control Cable Market Key Takeaway

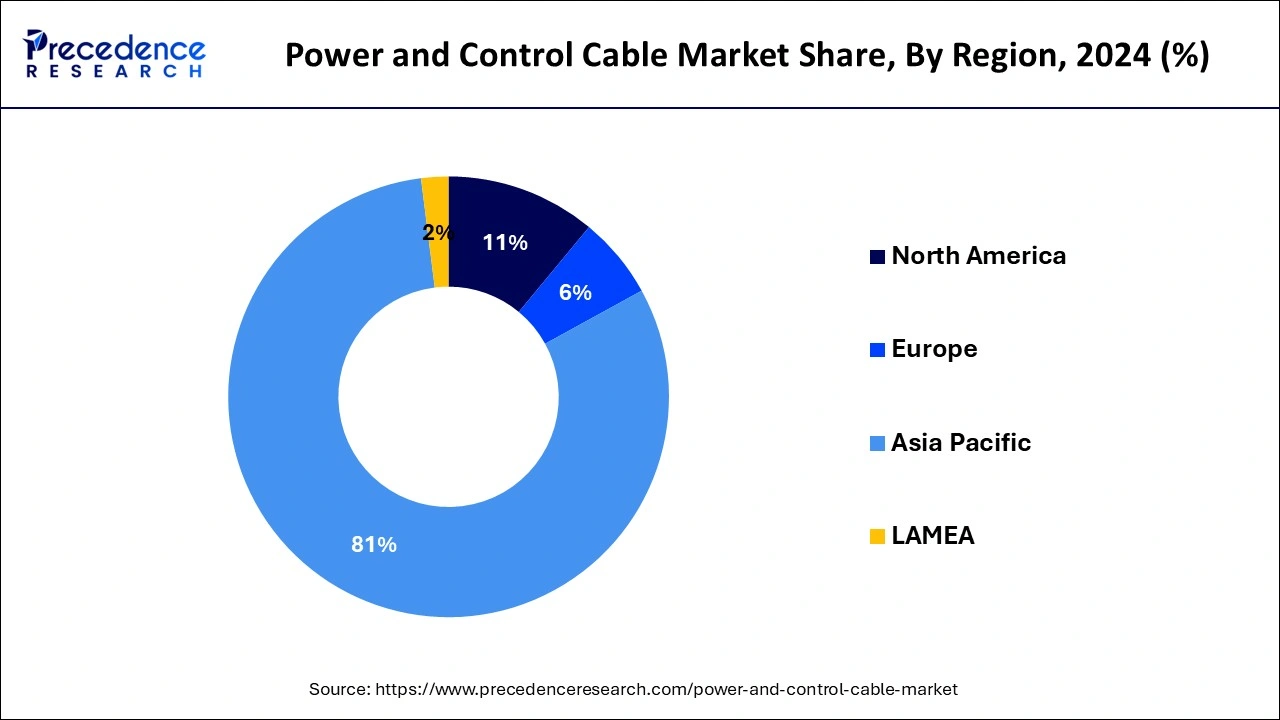

- Asia Pacific led the market with the largest revenue share of 81% in 2025.

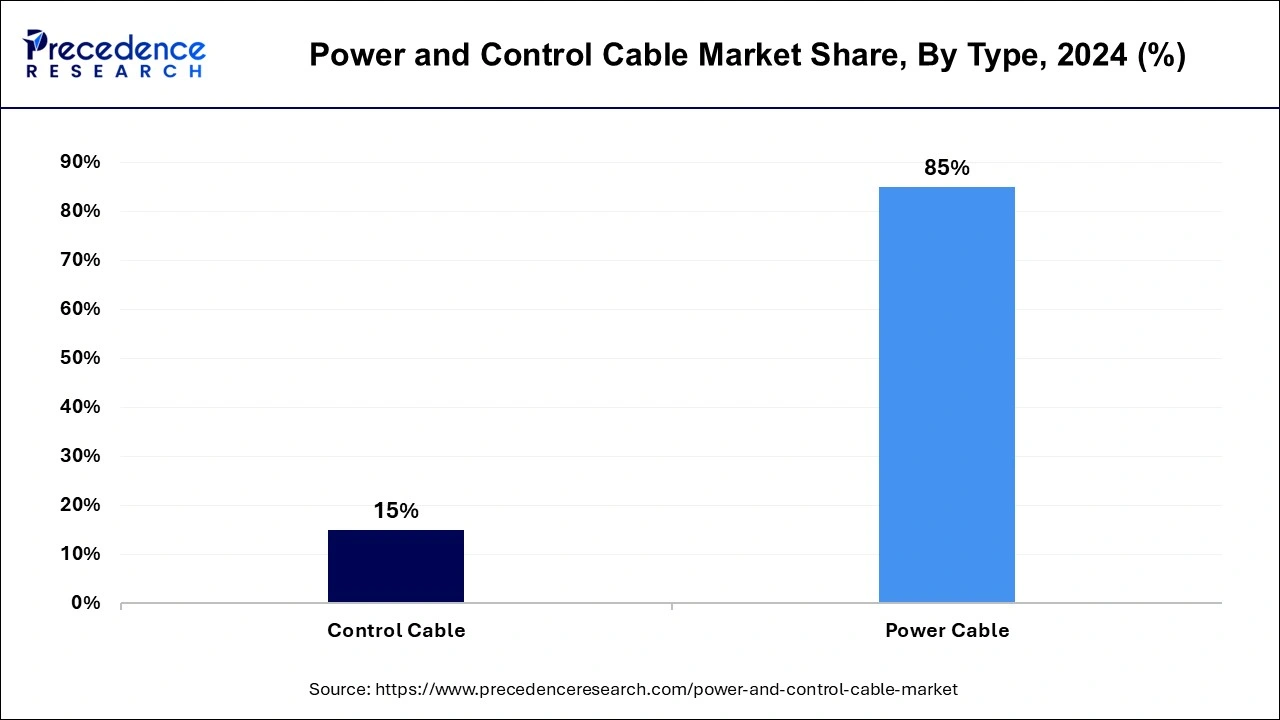

- By type, the power cables segment has held a major revenue share of 85%in 2025.

- By type, the control cable segment is expected to grow fastest in the global market during the forecast period.

- By application, the utilities led the market in 2025.

- By application, the oil & gas segment is expected to show the fastest growth in the market during the forecast period.

What is the Power and Control Cable?

Technological developments, urbanization, and industrial growth are some factors propelling the considerable rise of the global power and control cable market. Key factors are the growth of industrial sectors and the increasing urbanization of the population. The need for power and control cables is greatly increased by the growth of infrastructure projects, such as power plants, transmission lines, and distribution networks.

The power and control cable market is also driven by the increasing use of electric vehicles and the development of infrastructure for charging them. This expansion is further supported by advancements in cable technologies, such as increased voltage capacity and better insulation materials. The need for high-performance power cables is a result of the move toward renewable energy sources like solar and wind power, which demand efficient transmission networks.

Aluminum is the most popular material in the power and control cable market since it is a cost-effective and recyclable material that can be used for a wide range of purposes. Copper is still necessary for high-conductivity needs in high-voltage applications. The market includes a number of industries, such as infrastructure, utilities, telecommunications, and power transmission. Certain elements, such as the proliferation of telecom networks, the automation of production, and the rise in infrastructure projects, propel the growth of each sector.

Over the next ten years, the power and control cable market is expected to increase rapidly due to the continued construction of infrastructure projects, the switch to renewable energy sources, and technological developments in the cable manufacturing industry. Future developments in the business will be further shaped by ongoing R&D expenditures and clever partnerships between major participants.

How is AI contributing to the Power and Control Cable Industry/Process?

The artificial intelligence enhances the cable performance by predictive maintenance, real-time fault detection, environmental load optimization, automatic routing, and intelligent control. Intelligent analytics, powered by sensors, determine anomalies in real time, increase the lifespan of their cables, minimize failures, and allow smarter grids, renewable integration, safer installations, and smart power management systems.

Power and Control Cable Market Growth Factors

- The need for the power and control cable market is being driven by the growth of industry and urbanization. Building power plants, transmission lines, and distribution networks are examples of infrastructure projects that are essential to supplying the increasing electricity demands of developing cities and industrial complexes.

- The power and control cable market is expanding thanks to improvements in cable technology, such as increased voltage capacity, better insulating materials, and improved fire resistance. Specialized power cables are in greater demand as a result of the widespread use of electric vehicles and the expansion of their charging infrastructure.

- The current power infrastructure must be upgraded and expanded in order to accommodate the shift to renewable energy sources. The demand for improved power and control cables is further driven by the integration of smart grids and the requirement for efficient transmission systems to handle variable renewable energy inputs.

- Copper and aluminum are the two main materials used to segment the power and control cable market. Copper cables are recommended for their excellent conductivity and durability, while aluminum cables are selected for their cost-effectiveness and weight advantages.

- Key contributors include a number of industries, including manufacturing, transportation, infrastructure, and oil and gas. Examples of significant drivers in the power and control cable market are the electrification of transportation networks and the growth of electric vehicle charging infrastructure.

Market Outlook

- Industry Growth Overview: The power and control cable market is led by the trend of urbanization, smart grids, renewable projects, automation, and data centers.

- Sustainability Trends: Recycled inputs, use of halogen-free materials, and reduction of emissions are also in support of decarbonization in the regulated markets.

- Major Investors: Prysmian Group, Nexans SA, Polycab India Limited, KEI industries Ltd, Sumitomo Electric, LS cable and system, NKT A/S.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 153.93Billion |

| Market Size by 2035 | USD 301.84Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.97% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Renewable energy expansion

One of the main forces is the global transition to renewable energy sources like wind and solar electricity. For the purpose of producing power, transmitting it to the grid, and distributing it, these projects need a lot of cabling. Strong power and control cables are essential for infrastructure development in emerging economies due to their growing urbanization and industry. This covers public infrastructure initiatives, commercial and residential buildings, and industrial facilities.

The need for power connections is also fueled by the continuous electrification of transportation, which includes the installation of EV charging stations. Power cables operate better and are safer because of advancements in cable technology, such as higher voltage capacity and better insulating materials.

Restraint

Supply chain disruptions

Due to saving money and pent-up consumer desire, the COVID-19 epidemic caused a huge demand shock. Global supply networks in every industry, including the wire and cable sector, were put under pressure by this abrupt increase in demand. Production has been negatively hindered by shortages of vital resources like semiconductors, electrical steel, and other components.

Transportation and raw material prices have increased as a result of supply chain interruptions. The supply chain has had to absorb these additional costs, which has raised the final product's price. The situation has become more intricate due to inflationary pressures that have decreased the purchasing power of both firms and consumers.

Opportunity

Increasing demand for electricity and infrastructure

The world's rapidly increasing urbanization and industrialization are fueling the need for power and control cables as well as electricity. Large power infrastructure is needed in urban areas to sustain industrial, commercial, and residential activity. Advanced power and control cables are critical to the introduction of smart grid technology for effective energy management and distribution.

With the help of these cables, electrical flow can be monitored and controlled in real time, increasing system dependability and energy efficiency. Robust power and control connections are required to support the infrastructure powering data centers, which is driven by the expansion of data centers and the increasing demand for high-speed internet connectivity.

Segment Insights

Type Insights

The power cables segment held the largest share of the power and control cable market in 2025. In the larger market for power and control cables, power cables are essential parts. They are essential to the efficient operation of many electrical systems because they transfer electrical energy from one place to another. Depending on the use, power cables are made to safely and effectively transport electricity over short or large distances. Urbanization, industrialization, the expansion of infrastructure, and the rising use of renewable energy sources like solar and wind power all have an impact on the need for power lines. Power cable sales are competitive, with a number of national and international producers vying for customers on attributes such as product quality, dependability, affordability, and technical innovation.

The control cable segment is expected to grow at the fastest rate in the global power and control cable market during the forecast period. Control cables are essential to the dependable transfer of electrical signals and data between machinery, equipment, and industrial automation systems. These cables are made expressly to transmit control signals, which regulate how motors, devices, and other electrical parts operate. Control cables are becoming more and more necessary as automation spreads throughout many industries. They serve as a means of facilitating communication between control systems and automated machinery. Power distribution systems need to be monitored and controlled by control cables as renewable energy sources such as solar and wind power grow in popularity. Market demand is maintained by the requirement for routine maintenance and replacement of aged control wire infrastructure in utilities and industrial facilities.

Application Insights

The utilities led the power and control cable market in 2025. Power cables are the means by which utilities move electricity from power plants to substations and ultimately to end consumers. High-voltage power cables are utilized to reduce energy losses during long-distance transmission. Utilities utilize power lines to distribute electricity in rural, suburban, and urban locations. Substations are connected to residential, commercial, and industrial consumers via these lines. To increase their grids' resilience, efficiency, and dependability, utilities make investments in their modernization and upgrading. This entails deploying dispersed energy resources, integrating smart grid technologies, and installing sophisticated power connections that can support heavier loads. In order to fulfill the increasing demand, utilities must expand their infrastructure as urbanization and industrialization continue.

The oil & gas segment is expected to show the fastest growth in the power and control cable market during the forecast period. Power and control cables are widely employed in the production and exploration of oil and gas. They supply power and control signals for numerous pieces of gear and equipment in drilling operations, subsea installations, and offshore platforms. Power and control cables are essential for running machinery, motors, and instrumentation systems in refineries and processing facilities. They make it easier to regulate and automate the different procedures that turn natural gas and crude oil into products that may be used, like petrochemicals, diesel, and gasoline. Power and control cables have strict requirements for durability, dependability, and safety because of the challenging working conditions seen in the oil and gas sector.

Regional Insights

What is the Asia Pacific Power and Control Cable Market Size?

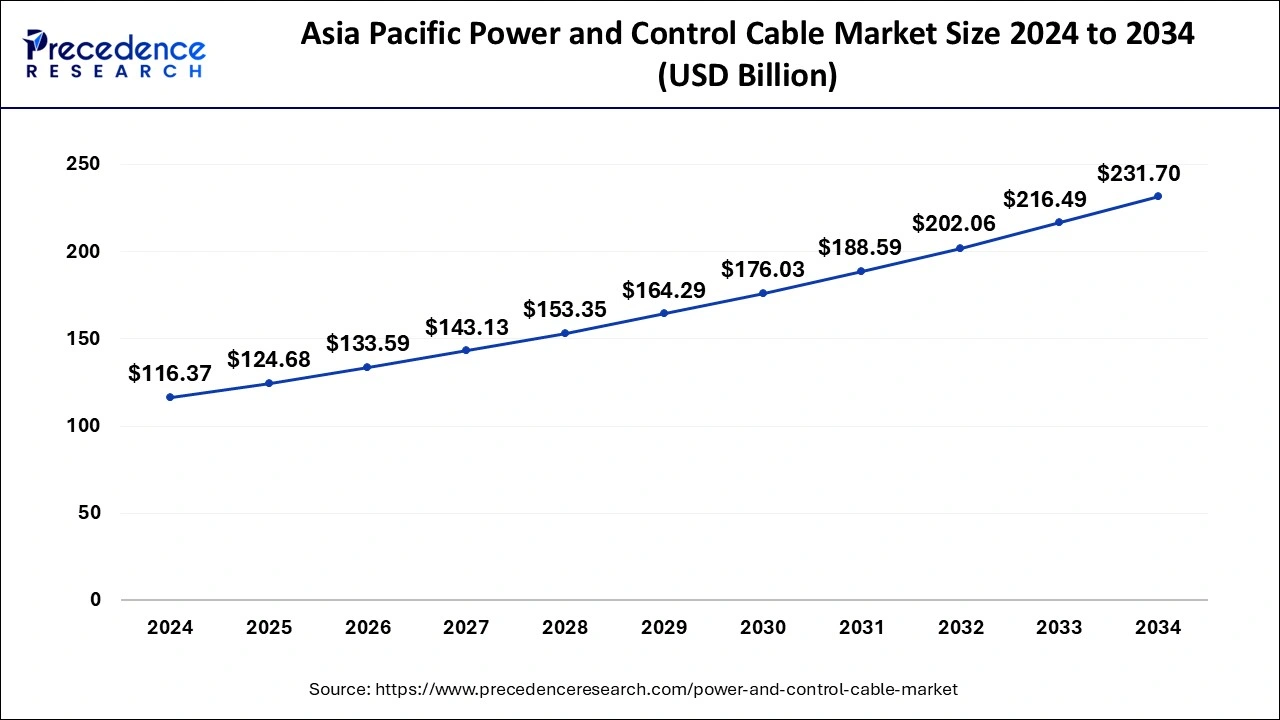

The Asia Pacific power and control cable market size was evaluated at USD 124.68 billion in 2025 and is predicted to be worth around USD 246.39 billion by 2035, rising at a CAGR of 7.05% from 2026 to 2035.

Asia Pacific held the dominating share of the power and control cable market in 2025. China and India are leading the way in industrialization, which has increased demand for innovative cabling solutions and dependable power supplies. The need for power lines is being driven by the need for significant infrastructure investments that come with rapid urbanization. High-quality cables that can support sophisticated technological infrastructures are becoming more in demand due to innovations likeIndustry 4.0 and the rollout of 5G networks. Countries with rapidly expanding economies, such as those in Southeast Asia, China, and India, are predicted to experience the highest growth rates. To support their expanding industrial sectors and urban populations, these nations are investing heavily in energy infrastructure.

North America is expected to grow at a significant rate in the global power and control cable market during the forecast period. Two of the biggest drivers are the expansion of smart grid networks and the renovation of the current grid infrastructure. These improvements are necessary to improve power distribution's dependability and efficiency as well as to meet the world's rising energy demands. Power and control connections are becoming more and more in demand as renewable energy sources like solar and wind power proliferate. These cables are essential for new renewable energy installations to be connected to the grid. The need for control cables, which are widely employed in automated systems to transmit data and control signals, has increased due to the development of smart manufacturing and industrial automation technologies.

What Are the Driving Factors of The Power and Control Cable Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Sustainable electrification in Europe receives its main support from green energy transmission and fire-resistant materials, together with halogen-free cable implementation. The need for regularity compliance drives companies to develop low-carbon electrical conductors and recyclable insulation materials drives te rowt.

Germany Power and Control Cable Market Trends

Germany's market expansion depends on three factors, which include offshore wind development, submarine high voltage direct current transmission, and energy transition initiatives. Industries require intelligent control cables with condition monitoring capabilities because they need products to achieve their automation requirements. Sustainability initiatives promote aluminum conductors, halogen-free insulation, and infrastructure upgrades, which enable renewable energy transmission together with industrial digital transformation.

Value Chain Analysis of the Power and Control Cable Market

- Raw Material Procurement: Obtaining raw materials such as base materials and chemical components required in the manufacture of the cables from specific suppliers.

Key Players: Polycab, KEI Industries, Apar Industries, Finolex Cables, Sterlite Technologies - Wafer Fabrication (Front-end): The use of semiconductor wafers to manufacture electrical circuits in controlled sequential processes.

Key Players: TSMC, Intel, Samsung Electronics, Texas Instruments - Photolithography and Etching: Light transfer of circuit designs followed by a chemical etching of the unused material.

Key Players: ASML, Canon, Nikon, Applied Materials, Lam Research - Doping and Layering Processes: The alteration of electrical properties by the introduction of impurities and the deposition of layers of structured materials.

Key Players: Applied Materials, Tokyo Electron (TEL), KLA Corporation, Siltronic

Power and Control Cable Market Companies

- Prysmian: Provides high-performance power and control cables such as tray, shielded, VFD, and low-smoke halogen-free solutions to industrial, energy, and infrastructure reliability.

- Nexans: Offers sustainable electrification systems with aluminum and copper cables, superior insulation systems, and infrastructure-oriented control cabling of renewable and utilities.

- General Cable: Produces a variety of copper, aluminum, and fiber-optic power and control cables that serve the industrial processes, utilities, and energy transportation systems.

Other Major Key Players

- Sumitomo Electric

- NKT Cables Group

- Finolex Cables

- Bahra Advanced Cable

- Caledonian Cables

Recent Developments

- In June 2025, Premix, LyondellBasell, and Maillefer collaborated to create a recyclable power cable system using advanced PP materials and technology. This system offers a durable alternative to conventional XLPE systems for MV and HV cable insulation. (Source:https://www.wirecable.in )

- In April 2025, V-Marc India Limited announced its expansion in Jammu, launching advanced wire and cable solutions, including Flexi-TUF eB-HFFR Wires and eB+ Power Cables. Executive Director Deepak Tikle emphasized the company's commitment to customer satisfaction and alignment with renewable energy trends.

(Source: https://www.dailyexcelsior.com ) - In May 2024, in Mexico, BYD introduced the BYD SHARK, its first pickup truck. The newest model in BYD's lineup, the DMO Super Hybrid Off-road Platform, is a feature of the BYD SHARK, which is positioned as a new energy-intelligent luxury pickup. With its cutting-edge technology and wide range of user-centric features, this model, which was created for the worldwide market, is BYD's first product launch outside of China.

- In March 2024, Belden Introduces New Options for Mission-Critical Environments with Improved Connectivity, Quicker Speeds, and More Power. Belden's I/O Plenum Stadium Cables and Access Control Cables, Lumberg Automation's LioN-X IO-Link Hub, and improvements to Belden's REVConnect Connectivity System, Belden Horizon Console, and Hirschmann Industrial HiVision are among the releases.

Segment Covered in the Report

By Type

- Power Cable

- Control Cable

By Application

- Utilities

- Industrial (Power Plants)

- Oil & Gas

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting