What is the Power MOSFET Market Size?

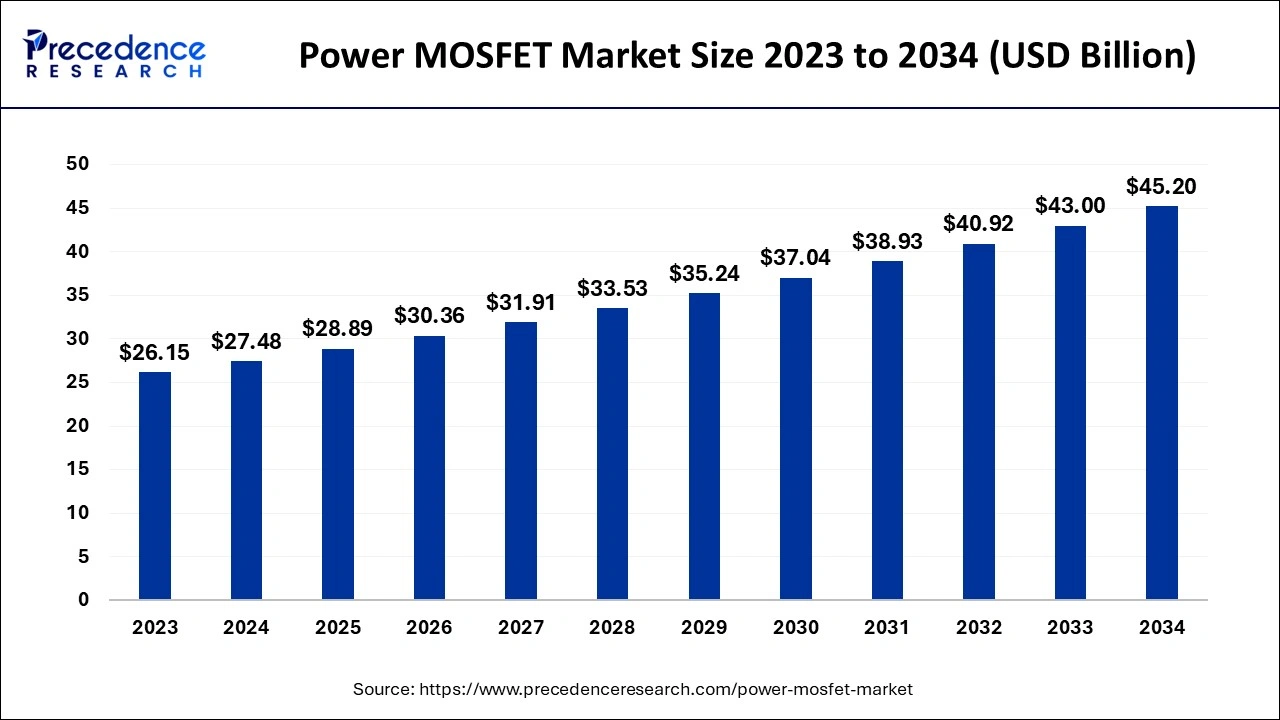

The global power MOSFET market size is calculated at USD 28.89 billion in 2025 and is predicted to increase from USD 30.36 billion in 2026 to approximately USD 47.4 billion by 2035, expanding at a CAGR of 5.08% from 2026 to 2035.

Power MOSFET Market Key Takeaways

- The North America power MOSFET is projected to reach USD 3 billion by 2035 with a CAGR of 4% from 2026 to 2036.

- By type, the enhancement mode segment contributed 58% in 2025 and is expected to grow at a CAGR of 7% between 2026 to 2036.

- By power rate, the low power segment has reached at 40% market share in 2025 and is predicted to hit at a CAGR of 5.2% from 2026 to 2035.

- By application, the automotive segment is anticipated to hit at a CAGR of 9% from 2026 to 2035.

What is a Power MOSFET?

MOSFET is an electromechanical switching device that uses an influence semiconducting material to change the masses as wanted. It not only provides power organization to advance liveliness efficiency in numerous industrial applications, consumer devices, and electric cars, but it is also a cost-effective replacement for bipolar junction transistors (BJT). It is presently operated to increase switching speed, stop energy loss, and enhance electric indications in electronic equipment, such as renewable energy sources and electric automobiles. Bipolar junction transistors have been substituted with power MOSFETs, a more affordable electronic switch technology. Electric automobiles are using power MOSFETs more often to recover substituting rapidity, avert electrical failure, and enhance electrical signals.

The top industries with the highest demand, for instance, are the automotive and industrial verticals. Given that it is used in so many different electric devices, the control MOSFET takes a lot of latent popularity in the future. With moderate expenditures in innovation, investigation, and testing over the future centuries, the marketplace is anticipated to create a little amount of cash. Power MOSFET sales are on the verge of maturity, and in the ensuing years, important companies should expect modest revenue growth. During the anticipated timeframe, there is significant room for expansion in the commercial and intermediate voltage MOSFET segments. Even though the industry is growing, these organizations are anticipated to bring in a sizable sum of money in comparison to other types of control MOSFETs.

How is AI contributing to the Power MOSFET Industry?

AI-driven neural modeling enhances the design process of MOSFETs. It performs the function of extracting data from the datasheet automatically. The machine learning algorithm forecasts the behavior of the device. The AI system also works on thermal efficiency optimization. The intelligent control system is responsible for the power conversion improvement. The predictive maintenance system has a direct impact on the reduction of failures. As a consequence of loss analysis, cooling requirements in demanding systems are being lowered.

Power MOSFET Market Growth Factors

As it is currently used in many electric devices, the power MOSFET has a great deal of potential. With moderate expenditures on testing, development, and research, the market is anticipated to produce a small amount of cash in the upcoming years. During the anticipated timeframe, there is significant room for expansion in both the industrial and medium-power MOSFET segments. Even though the industry is still in its early stages of development, these systems are anticipated to bring in a sizable sum of money in comparison to other kinds of power MOSFETs. Bipolar junction transistors have been superseded by power MOSFETs because they are more affordable electronic switch technology. To increase switching efficiency, avoid energy loss, and enhance electrical impulses in various technologies, powered MOSFET stays progressively employed in electronic cars.

The top industries with the largest demand are those in industry verticals like motorized and engineering. It is anticipated that this will have a substantial impact on the supply of power MOSFETs due to the rising demand for advanced technologies over time, including voice technology, home automation, as well as other electronic items, together with the limited number of wafer manufacturer's positions globally. Additionally, the global coronavirus outbreak and trade disagreements between the United States and other nations with China have influenced and influenced the semiconductor and equipment business. However, the energy MOSFET market is anticipated to present attractive prospects because of the growth of the market for mixed electronic automobiles worldwide. Power MOSFET usage in hybrid vehicles encourages an energy economy with a higher switching speed, which further fuels the market's expansion.

Market Outlook

- Industry Growth Overview: The market is experiencing robust growth, driven by the electrification of vehicles (EVs), renewable energy, data centers, and consumer electronics.

- Major investors: Major investors in the market include semiconductor giants like Infineon, Texas Instruments, ON Semiconductor, STMicroelectronics, Renesas, and Toshiba.

- Global Expansion: The global push for energy conservation boosts demands for efficient power management in all devices, from data centers to home appliances, driving market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.89 Billion |

| Market Size by 2035 | USD 47.4 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.08% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Power Rate, Application, Geography |

Segment Insights

Type insights

The power MOSFET industry is broken down into depletion mode and augmentation mode power MOSFETs for type analysis. Enhancement Mode In 2023, Power MOSFET held the largest market share 58%. A power module with a high-rated current is created by integrating semiconductor materials and is known as an enhancement mode power MOSFET. Multiple chips are put on an independent substrate and a copper base plate to create an enhancing mode power MOSFET. Owing to its unmatched strength and competence, improvement control source MOSFET is attractive additional and further widespread worldwide. It represents the following development in power management. Enhancement power supply MOSFET is gaining popularity all over the world due to its unmatched durability and efficiency. Electricians, machine shops, and water tanks are just a few of the high voltage equipment applications that use enhanced mode power MOSFETs. Trolleys are used in European countries and employ a technique based on the reduction method to control MOSFETs toward reducing current leakage and boosting efficiency. Enhancement power supply MOSFETs are used by many industries to run large electrical furnaces, steelmaking, and aquatic impels. In the direction of reducing present outflow and rising in competence, streetcars in European countries nowadays use skills based on Improvement Method Control MOSFETs.

The enrichment power supply MOSFET is increasingly preferred in the present occupational situation because it is affordable and modest to accomplish with huge frequency, which leads to the market's expansion. Since it is lower cheap and simpler to handle at high voltage, the enhancement automatic power MOSFET is much more common in the business world, which has led to market expansion. The wildest increasing business for reduction method control MOSFETs.

Owing to its inferior leading damage and substituting damage, depletion mode power MOSFETs are essential in consumer electronics and automotive applications. For a variety of uses, including driver circuits, power supply units (UPS), induction-heating microwaves, liquid crystal display panels, in addition, stroboscope sparks, they are utilized in converters and power conversion circuits.

Power Rate Insights

The market's largest contributor, low power, is anticipated to expand throughout the projected period. To order to drive steady voltage and increase the endurance of the applications, low-power MOSFETs are utilized in closures, LED determinations, and electric motors. Another less direct driving of low to moderate power MOSFETs is now possible thanks to a lower power driver featuring high-speed train input photo couplers from Toshiba Corporation. To provide efficient transmission, businesses like IXYS Technologies and Field effect Semiconductor capitalize on influence units. The wildest rising market is Medium Power. Most motor drivers between 2 kW and 15 kW employ intermediate control MOSFETs. They are essential for transferring power from the beginning of the battery functional storage to the actuators in electric cars. For instance, medium power MOSFETs are used by BYD Company, Tesla Motors, Honda Motor Co., Ltd., Toyota Motorized Business, and Honda Motorized. to improve power conversion while minimizing power loss.

Power MOSFETs are being purchased by several businesses, like Siemens Technology and Panasonic Corporation, to provide power control. To avoid power loss, more control MOSFETs are presently applicable in manufacturing claims. The global giant market of MOSFET is liberated by Microprocessor Expertise AG and Prunus incisa Electric Schemes Co., both of which provide cutting-edge technological products. It suggests more voltage MOSFETs through present evaluations extending after 250-1200A in a diversity of network analysis situs. Furthermore, industrial applications, traction, sustainable sources, and electrical transmission technologies are the primary targets for more control MOSFETs.

Application Insights

The market's largest contributor, the automotive sector, is anticipated to continue to grow over the projected period. To drive continuous voltage and increase the longevity of the applications, motorized MOSFETs remain applied in LED determinations and electric motors. The industry sector is expanding the fastest. Given that they operate with significant power and exist, MOSFETs are the perfect special for manufacturing organizations. In manufacturing and housing microelectronic schemes, the substituting occurrence is strongminded by system detailed constraints and applications. For instance, the switching frequency in motor drives depends on the output frequency needed for AC motorized, system performance, thermodynamic efficiency, and Electromagnetic regulations.

Regional Insights

What is the Asia Pacific Power MOSFET Market Size?

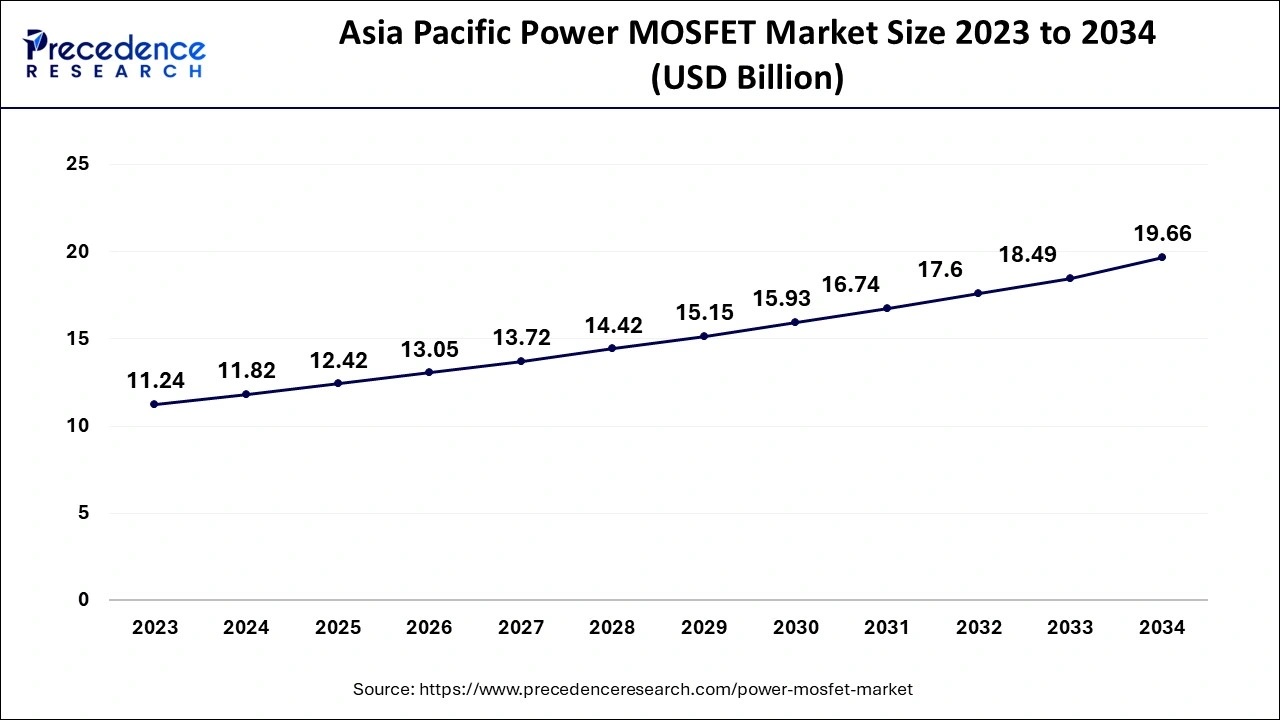

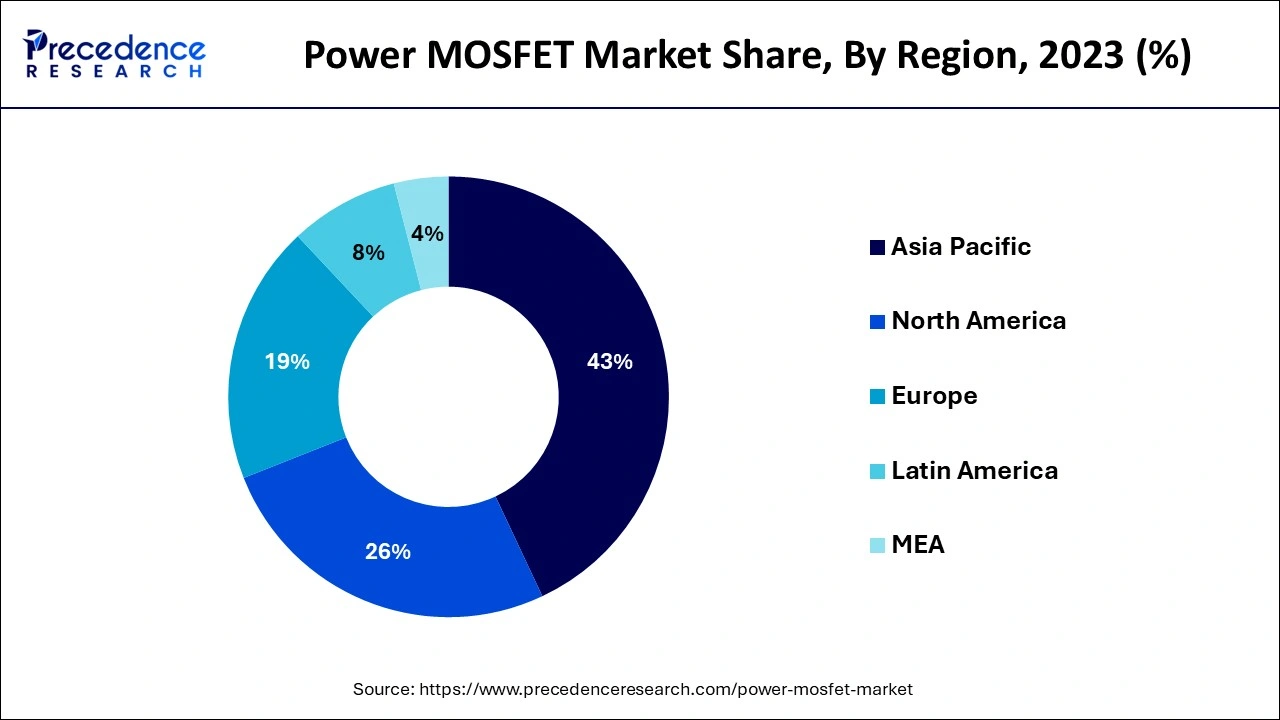

The Asia Pacific power MOSFET market size is evaluated at USD 12.42 billion in 2025 and is predicted to be worth around USD 20.83 billion by 2035, rising at a CAGR of 5.31% from 2026 to 2035.

Asia-Pacific region is expected to hit CAGR of 5.21% during 2026 to 2035. A sizeable portion of the worldwide sensing devices is accounted for by Asia-Pacific. This is because developing nations like China, India, and Indonesia are experiencing greater technical developments and rising automobile standards. The fastest-growing region internationally is Asia-Pacific. Owing to the accessibility of high-end upgraded technologies, rising need for interactive content, and expansion of the manufacturing industries, it is the most attractive market for power MOSFET. Owing to the application of cultured automated coaches, front-line numerical systems, and an upsurge in the amount of digitized electronic equipment, suppliers for energy MOSFET technologies in Europe have many growth opportunities for growth. The area is predicted to see strong growth in the sophisticated packaging market because of the expansion of the electronic industry, the uptake of slashing innovations like enhanced collision avoidance in automotive, and the development of low consumption gadgets in the area, which then in turn supports the business development.

The market is also growing as a result of numerous helpful non-profit organizations that encourage packaging technology. The development of the electricity MOSFET market across the globe is facilitated by the numerous activities these companies take to construct power infrastructure using cutting-edge technologies. Companies from all industries understand how crucial power MOSFETs are to creating productive workplaces. The market is anticipated to grow at a faster rate due to the high demand for power modules and automated switching devices.

Asia Pacific: China Power MOSFET Market Trends

The growth of the market in the country can be driven by the growing product demand from electric vehicles and supportive government policies. Moreover, China's ambitious renewable energy targets for wind and solar power require efficient MOSFETs in inverters and grid systems, driving market expansion further.

North America is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the surge in industrial automation and rapid investments in renewable energy. In addition, the expansion of hybrid and electric vehicles drives demand for power MOSFETs in motor drives, contributing to market growth in the near future.

U.S. Power MOSFET Market Trends

In North America, the U.S. dominated the market due to increasing demand for smart grid upgrades and renewable energy integration, all requiring innovative power management. Also, a robust presence of major market players in the country supports new product development and innovation in the market.

What Are the Driving Factors of The Power MOSFET Market in Europe?

Europe is expected to grow at a significant rate during the forecast period as a result of the electric mobility adoption. Industrial automation is a factor that greatly contributes to the demand for power devices with higher efficiency. The selection of devices is determined to a great extent by sustainability policies. Manufacturers are inclined towards low-loss MOSFETs. The integration of renewables is a scheme that is constantly demanding MOSFETs in the electricity systems of transport and factories.

Germany Power MOSFET Market Trends

Germany is at the center of automotive and industrial demand. Efficient SiC MOSFETs are a must for electric vehicles. Rugged devices from automation factories are the land for use. Emission regulations are a gateway to the acceleration of the energy-efficient power modules across manufacturing, robotics, and advanced vehicle drivetrains.

Power MOSFET Market Value Chain Analysis

- Raw Material Procurement

It is the process of sourcing, negotiating, and acquiring essential inputs, primarily silicon wafers and silicon carbide (SiC) and gallium nitride (GaN), to manufacture Power MOSFET devices.

Major Players: Infineon Technologies, STMicroelectronics. - Wafer Fabrication

It is the complex manufacturing process that converts raw semiconductor wafers into the functional integrated circuits (ICs) that form power MOSFETs.

Major Players: ON Semiconductor, Texas Instruments. - Testing and Quality Control

It is the critical processes used to ensure the performance, reliability, and safety of devices used in various demanding applications.

Major Players: Toshiba, Vishay, and Renesas. - Lifecycle Support and Recycling

It involves strategies like predictive maintenance and performance monitoring to extend the device's operational life, while recycling focuses on recovering valuable materials.

Major Players: Nexperia, Alpha.

Power MOSFET Market Companies

- ON Semiconductor (onsemi): Offers a broad range of N-channel and P-channel power MOSFETs, including the EliteSiC MOSFET series, which focuses on high efficiency and reliability.

- STMicroelectronics (ST): Provides a wide range of power MOSFETs with breakdown voltages from -100 V to 1700 V, part of the STPOWER family.

- Digi-Key Electronics,: Digi-Key Electronics ensures power MOSFETs in huge quantities from different suppliers, along with quick availability, design assistance, and a dependable worldwide distribution network.

- Onsemi: Onsemi introduces PowerTrench MOSFETs featuring low RDS(ON), high density, thermal robustness, and efficient power management for automotive and industrial applications.

- Hitachi Power Semiconductor Device Ltd.: Hitachi Power Semiconductor Device is making stronger TED-MOS and SiC modules for the rail, automotive, and industrial sectors with a focus on efficiency and reliability.

- Infineon Technologies AG: Infineon Technologies AG provides OptiMOS and CoolMOS power MOSFETs that support fast switching, rugged constructions, and automotive-level performance.

Other Major Key Players

- Fairchild Semiconductors

- Infineon Technologies AG,

- IXYS Corporation Power Integration,

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors,

- Panasonic Corporation

- Power Integration Inc.

- Renesas Electronics Corporation,

- Sumitomo Electric Industries Ltd.

- Texas Instruments.

- Toshiba Electronic Devices

- Vishay Siliconix

Key market developments

- In February 2020, Renesas Electronics Corporation joined forces with Sennheiser Gmbh, a Foxconn technology company specializing in enhanced connectivity solutions, to provide quality care to the consumer, business, and wearable computing markets.

- The technical platform that makes use of several sensors is centered on AI/ML to achieve high precision and an extremely small control process. When used in conjunction with reduced alerting acoustic action recognition, this technique performs astonishingly well. The small design outperforms the detection capability of acoustic wave burglar alarms now used in home automation, businesses, and additional devices while achieving a battery capacity that is similar to or more than that of less advanced technologies.

- Multiple relay Information motors were used more regularly to generate modern battery motorized goods owing to their numerous rewards in June 2022. When determined to inferior their mass and capacity though upholding an extended cordless lifespan, significant design issues occur. Advanced Micro Devices Gmbh has introduced database motor managers to support creators in realizing conclusion market purposes.

- Texas Instruments (TI) expanded its portfolio for increased power control in November 2019 by releasing its next-generation 650-V and 600-V gallium nitride field-effect transistors for automotive and industrial applications. In September 2020, Mitsubishi Electric Corporation unveiled the completion of the second (silicon carbide) presents the potential that makes use of a newly invented Silicon carbide microchip for industrial applications.

Recent Developments

- In December 2025, onsemi launched EliteSiC MOSFETs in T2PAK packaging, enhancing thermal performance and design flexibility for EVs, solar, and energy storage. The 650-volt and 950-volt devices improve thermal efficiency by directing heat to heatsinks, avoiding PCB thermal constraints, and leveraging silicon carbide technology. (Source: https://chargedevs.com )

- In September 2025, Toshiba launched the TPH2R70AR5, a 100V N-channel power MOSFET using the U-MOS11-H process, improving RDS(ON), Qg, and their trade-off. This MOSFET targets switched-mode power supplies for industrial equipment in data centers and communications. Shipments start today. (Source: https://www.businesswire.com )

Segments are covered in the report

By Type

- Depletion Mode

- Enhancement Mode

By Power Rate

- High power

- Medium power

- Low power

By Application

- Energy & Power

- Inverter & UPS

- Consumer Electronics

- Automotive

- Industrial

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting