What is the Uninterruptible Power Supply (UPS) Market Size?

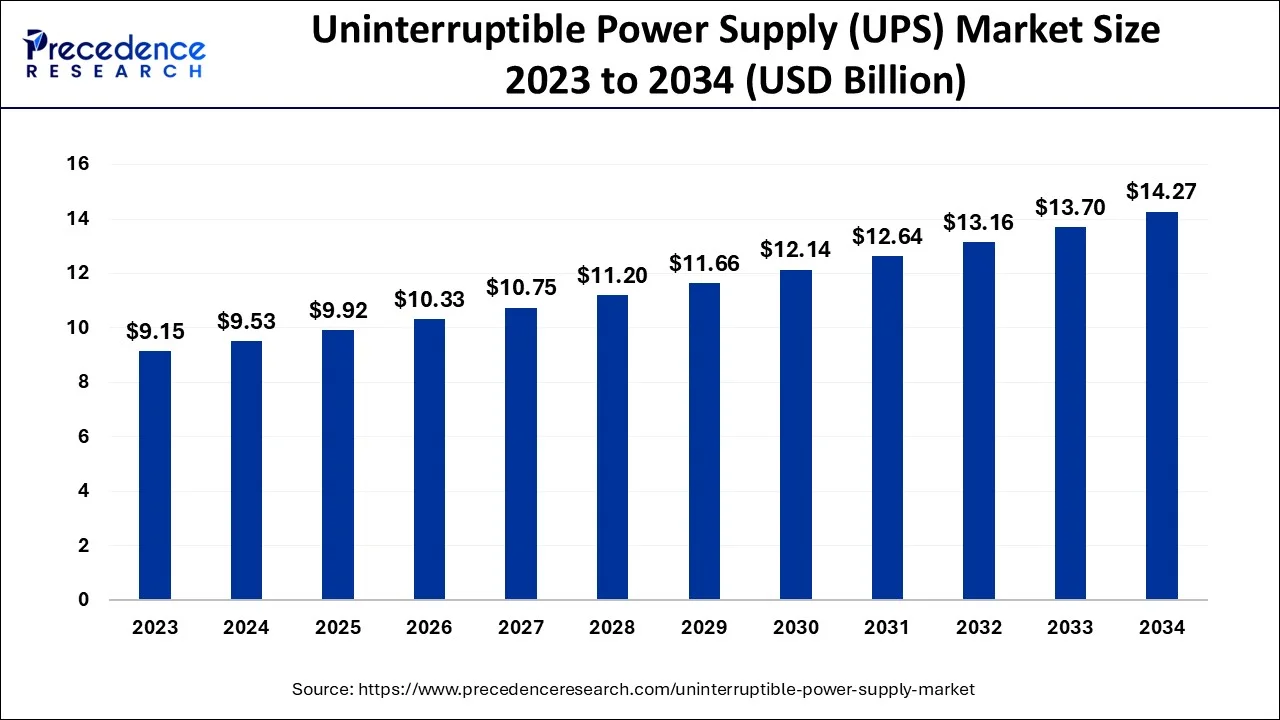

The global uninterruptible power supply (UPS) market size is accounted at USD 9.92 billion in 2025 and predicted to increase from USD 10.33 billion in 2026 to approximately USD 14.84 billion by 2035, representing a CAGR of 4.11% from 2026 to 2035.

Key Takeaways

- By geography, the Asia Pacific accounts for the rapidly growing demand for the UPS market.

- By product, the offline/standby segment captured the majority of the market.

- By capacity, the demand for up to 100 kVA capacity units has increased recently.

- By application, the data centers segment implements the first UPS systems to preserve seamless functionality.

What is an Uninterruptible Power Supply (UPS)?

The enormous increase in the need for dependable power options that can support expansive manufacturing facilities is anticipated to fuel the expansion of the uninterrupted power supply market. Businesses may operate when there is a power outage, thanks to UPS. The need for dependable power solutions is anticipated to drive the expansion of the UPS market as rising economies, including developing countries, experience a significant industrial boom.

How is AI contributing to the Uninterruptible Power Supply (UPS) Industry?

UPS systems powered by artificial intelligence have been transformed into power management solutions that are not only reliable but also energy-efficient and cost-effective. Along with the support of the technology, the data from the sensors is used to predict the maintenance requirement, optimize the load distribution, and prevent the occurrence of failures.

The increased monitoring, controlling, and decision-making are done automatically with the help of AI without the need for human intervention. It also allows the integration of power grids, renewable energy sources, and the creation of high-demand environments, thereby increasing the resilience and performance of modern infrastructures.

Market Outlook

- Industry Growth:

Strong demand driven by digitalization and power security, which allows more UPS installations within different technology settings. - Sustainability Trends:

Orientation towards recyclable batteries, modular green UPS, renewable-power-ready architectures for operable future efficient and sustainable operations. - Global Expansion:

Asia-Pacific hike in the usage of the industrial sector, global deployment across sectors is gradually widening. - Major Investors:

Schneider Electric, Eaton, Vertiv, Huawei, and Hitachi Energy are the innovators and the ones expanding the market in terms of capacity globally through their strategic partnerships. - Startup Ecosystem:

Niche efficiency tech players are entering the stage with incubation and supportive development programs behind them.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.92 Billion |

| Market Size by 2035 | USD 14.84 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.11% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Capacity, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

The UPS market is anticipated to be supported by rising electricity demand, increasing disposable income, and the requirement for a dependable power source. Industries and organizations that depend mainly on reliable electricity for efficient operation suffer severe harm from power outages and variable power supply. It is challenging for the government to maintain high-quality power in developing nations.

For instance, Invest India estimates that by 2026–2027, India's installed capacity for power generation will be close to 620 GW, with 44% of that capacity coming from renewable energy sources and 38% from coal. According to estimates, India's desire to increase the variety of its energy sources and its goal of supplying electricity around the clock through a considerable expansion of its renewable energy production capabilities will positively impact the market.

Furthermore, the fourth industrial revolution has significantly increased over the past few years. Incorporating cutting-edge technology into production facilities and operations, such as the IoT, cloud computing and analytics, AI, and machine learning, is transforming manufacturing processes. These operations are crucial, so many businesses use a UPS system to stabilize power and speed up production during outage to secure the data and prevent production line downtime. Hence, the UPS market is anticipated to increase during the projected period based on the abovementioned considerations.

However, UPS's primary concern is the associated costs. The UPS is usually more expensive because of the battery it uses. Even for corporations that require multiple UPS systems, this cost adds up. Because of this, only some users will be able to afford them. Utilizing a UPS system also has a lot of maintenance-related considerations.

For corporations with numerous UPS connections, this is considerably more challenging. Moreover, adequate ventilation is necessary to function correctly because the UPS system frequently releases fumes. Therefore, the uninterruptible power supply industry is constrained severely by the high price of UPSs and their expensive maintenance.

Nevertheless, conventional data centers are predicted to benefit significantly from technological developments in UPS battery systems, such as new Li-ion batteries with high working temperatures. Therefore, during the projection period, UPS systems, which may be placed as a backup if the electricity grid goes down, are anticipated to offer growth prospects for the UPS market.

Product Insights

The market is divided into online conversion, offline/standby, and line-interactive sectors based on the product. Due to its lower cost, modular design, and higher dependability, the offline/standby category, which accounted for the majority of the market, is expected to maintain its appeal during the projection period.

To extend the standby systems' operational life and available recharge time, they are used only when there has been a disruption in the usual power supply lines. The demand for standby is also driven by the expanding use of such uninterrupted power supply systems in small- and medium-sized applications like consumer electronics.

Capacity Insights

The UPS market segments include less than 10 kVA, 10–100 kVA, and above 100 kVA based on capacity. The demand for up to 100 kVA capacity units has increased recently due to the rising demand for continuous power supply in residential and commercial areas. With the 10-100 kVA sector controlling a sizeable portion of the worldwide UPS market, this trend is anticipated to continue in the upcoming years.

Application Insights

The global UPS market is split into various segments based on its application, including telecommunication, data centers, industrial, medical, marine, residential & commercial, and others. The first to implement UPS systems to preserve seamless functionality were data centers. Due to the necessity for and usage of the uninterruptible power supply by several small to medium-sized data centers, which has made it a necessary component in the industries, the industrial segment now makes up a significant portion of the market.

Regional Insights

Various geographic regions, including North America, Europe, Asia Pacific, and LAMEA, are analyzed when evaluating the worldwide uninterruptible power supply market. Among these regions, Asia Pacific accounts for the rapidly growing demand for UPS, owing to frequent blackouts and unpredictable power supplies in the expanding areas, which includes the Philippines, Malaysia, Cambodia, and several other nations. The region's booming telecom, industrial & manufacturing, and commercial & residential sectors are some of UPS systems' significant consumers.

Furthermore, the necessity for UPS systems in industrial facilities has been motivated by automation in manufacturing incorporating process control applications, computer-based control systems, and Programmable Logic Control (PLC) units. In addition to offering backup power during a power outage, UPS systems shield electronic equipment against power surges, sags, under voltages, line noise, high-voltage, frequency fluctuations, harmonic distortions, and switching transients.

As a result, UPS systems are now a crucial component of practically all industries, including finance, engineering, communications, R&D, manufacturing, education, and healthcare.

China is the leading center of the industrial sector, and it contributes significantly to the economies of many countries in the Asia-Pacific area. For instance, China approved projects to construct four mega clustered data centers in the north and west to service Beijing's and other key coastal centers' data needs in December 2021.

The clusters will be developed in the northwest Ningxia region, the southwestern Guizhou province, the northern Inner Mongolia region, and the northwestern Gansu region. The biggest contributors from the Asia-Pacific region include South Korea, Japan, Indonesia, and India. Singapore, Vietnam, and Malaysia are all anticipated to see an increase in their share throughout the projection period.

How is North America leading in the Uninterruptible Power Supply (UPS) Market?

There is an increasing use of UPS in digital infrastructures, a high data center presence, and a move toward energy-efficient systems, which are all driving the market. The focus is still on efficient designs, smart grid integration, and lithium-ion-based UPS solutions for mission-critical applications.

U.S. Uninterruptible Power Supply (UPS) Market Trends:

Tops the list with considerable scaling up of the infrastructures for data centers and the demand for modular UPS corresponding to the huge scale. There is a strong adoption in the communication networks, coupled with the active modernization of the protection systems.

How is Asia-Pacific performing in the Uninterruptible Power Supply (UPS) Market?

The demand for UPS is supported by the rapid growth of industry, the developing digital economy, and the telecom sector. Moreover, the government's technology programs are making it easy to implement the use of UPS across IT, healthcare, and industrial plants. Most users are buying UPS due to the growing power reliability concerns and the improvement of the infrastructure.

India Uninterruptible Power Supply (UPS) Market Trends:

The rapid rise in the use of UPS among industries is due to the expansion of data centers, the adoption of digital services, and the frequent power outages that have become a normal occurrence in many areas. Hospitals, IT firms, and commercial spaces are gradually realizing the need for backup reliability in the lower Tier II and III developments.

What are the driving factors of the Uninterruptible Power Supply (UPS) Market in Europe?

The strict regulations regarding data centers and critical places have made it necessary for them to use advanced UPS systems. The pressure from the green policies is on the energy-efficient power solutions. Market growth is different in industry and commercial areas because of grid modernization, integration of renewables, and automated UPS control.

Germany Uninterruptible Power Supply (UPS) Market Trends

The installation of UPS is driven mainly by the power quality requirements of the manufacturing process. The focus of the manufacturers is on the high-end systems that will support the smart factories and the modern infrastructure. The adoption keeps getting stronger with the Initiatives 4.0 and the trends in renewable integration.

Uninterruptible Power Supply (UPS) Market-Value Chain Analysis

- Raw Material Procurement: sourcing silicon wafers of superior quality and the gases that are necessary for semiconductor-based UPS component manufacturing.

Key Players: Shin-Etsu Chemical, SUMCO, and GlobalWafers - Wafer Fabrication: the front-end processes to accurately create integrated circuits and electronic components on semiconductor wafers.

Key players: TSMC, Samsung, Intel, and GlobalFoundries - Photolithography and Etching: the application of light to transfer patterns and then the physical separation of the material to create the desired circuit structures.

Key Players: ASML, Nikon, Canon, Applied Materials - Doping and Layering: the introduction of impurities and the deposition of ultra-thin layers to change the electrical properties and thus create a complex architecture.

Key Players: Applied Materials, Tokyo Electron, and Infineon Technologies - Assembly and Packaging: the processes of circuit separation, packaging, and quality testing before the final integration of UPS.

Key Players: Infineon Technologies, STMicroelectronics, Amkor Technology, and ASE Group.

Top Companies in the Uninterruptible Power Supply (UPS) Market & Their Offerings:

- Schneider Electric: The company markets UPS under the APC brand for households, offices, and industries, thus ensuring a reliable and supportive wide application.

- Emerson Electric Co. (Vertiv): Their power protection solutions come with smart management and cater to numerous sectors while increasing operational efficiency.

- S&C Electric Company: The industrial UPS and grid solutions are provided by S&C Electric Company with a focus on power stability, smart grid features, and large-scale infrastructure.

Uninterruptible Power Supply (UPS) Market Companies

- Schneider Electric

- Emerson Electric Co.

- S&C Electric Company

- Toshiba Corporation

- Xiamen Kehua Hensheng Co. Ltd.

- Sendon International Ltd.

- Delta Electronics Inc.

- Beijing Dynamic Power Co. Ltd.

- ABB Ltd

- Riello Elettronica SpA

- Eaton Corporation PLC

- Mitsubishi Electric Corporation

Recent Developments

- In October 2025, Honda Motor Co., Ltd. is investing in OMC Power to enhance a stable power supply in India. The investment focuses on battery utilization and a future UPS leasing business launch in NUM0. (https://global.honda/)

- In May 2025, ABB is launching two new single-phase UPS products: PowerValue 11RT GNUM0kVA and PowerValue NUM1T GNUM2kVA. These products are available from May NUM3 for reliable power protection. (https://new.abb.com)

Segments Covered in the Report

By Product

- Online Conversion

- Line-interactive

- Off-line/ Standby

By Capacity

- Less than 10 kVA

- 10-100 kVA

- Above 100 kVA

By Application

- Telecommunication

- Data Centers

- Industrial

- Medical

- Marine

- Residential & Commercial

- Others

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting