What is Cosmetics Market Size?

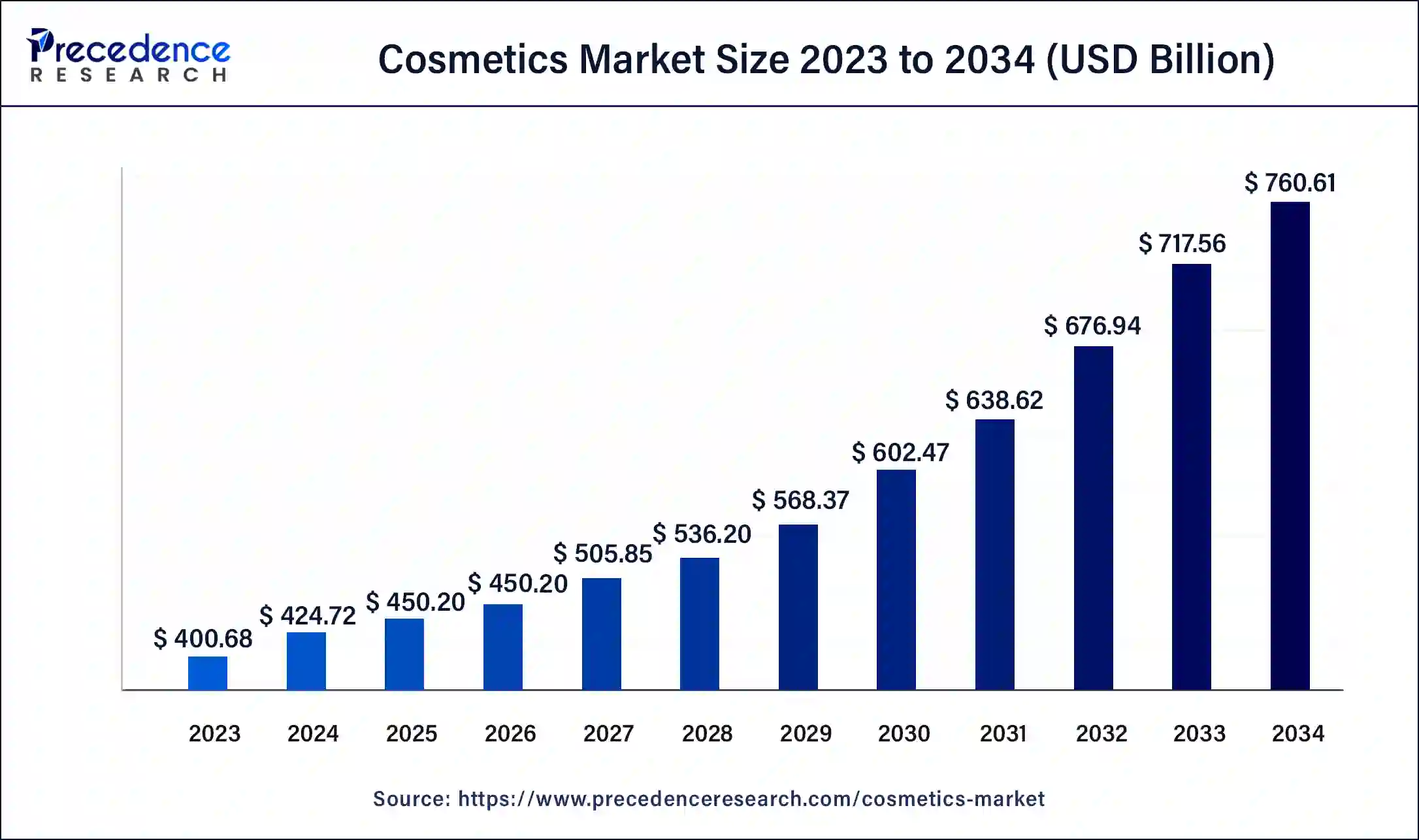

The global cosmetics market size accounted for USD 424.72 billion in 2025 and is predicted to increase from USD 450.20 billion in 2026 to approximately USD 802.04 billion by 2035, at a CAGR of 6.56% from 2026 to 2035.

Market Highlights

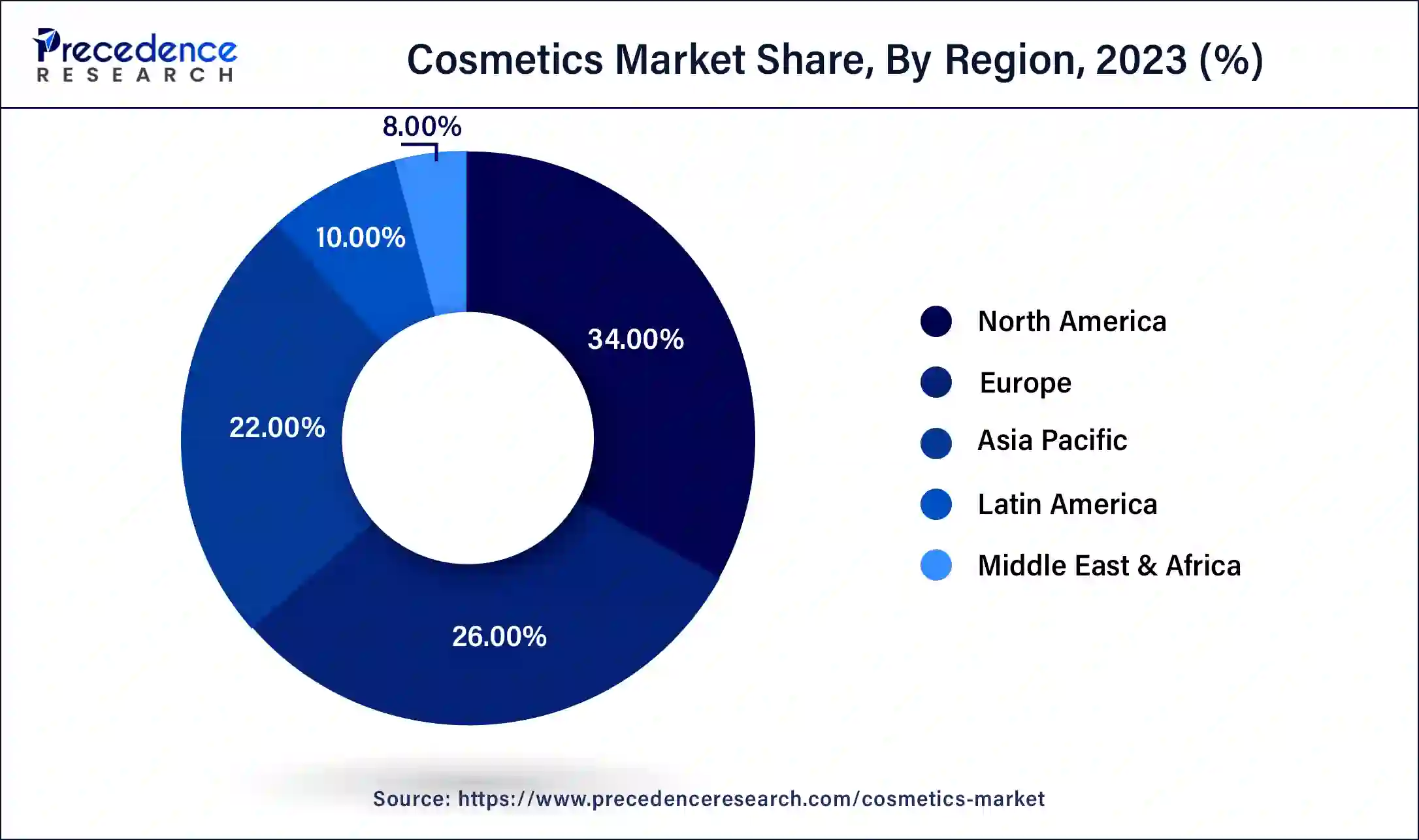

- North America led the global market with the highest market share of 34% in 2025.

- By category, the skin & sun care products segment has held the largest market share in 2025.

- By gender, the women segment captured the biggest revenue share in 2025.

- By distribution channel, the hypermarkets/supermarket segment registered the maximum market share in 2025.

Cosmetics Market Growth Factors

Rapid changing lifestyle across the globe is the major factor boosting the global cosmetics market. Moreover, changing climatic conditions in diversified region such as North America, Europe and Asia-Pacific and LAMEA has influenced the need for cosmetics and skin care products. Furthermore, the global per capita per income has observed a significant growth over the past few years especially in emerging countries. Rise in urbanization and growth of the middle class consumers in developed and developing region have encouraged the adoption of convenience oriented lifestyle and making cosmetics more desirable for all age group customers particularly amongst youngsters.

Moreover, raising demand for natural cosmetics products is the current trend in the market. Manufacturers like Patanjali, Emami, Loreal, Procter & Gamble Company, The Estee Lauder Companies Inc. and others are continuously indulged in producing herbal and natural ingredients cosmetics products. Furthermore, increasing awareness amongst male for personal grooming and hygiene has further boosted the growth of the market. Increasing in regressive promotions and advertisements through social media platforms such as Instagram, Facebook, YouTube and others by manufacturers has played a significant role in the growth of the market. However, Covid-19 has negatively impacted the global cosmetics market as implementation of lockdown and curfew practices were present globally. Moreover, supply chain restriction across the globe was the major which has restricted the growth of the market.

Furthermore, in the context of e-commerce growth, social commerce is significantly booming. The social commerce helps consumer to interact with brands or buying a product and service. Moreover, livestreaming has become a key social commerce tool in cosmetic world which significantly increased with the Covid-19 crisis. According, to Google almost 70% of millennials watch an online tutorial on YouTube during the Covid-19 crisis. In addition, online advertisement has significantly increased as it helps in better customer reach in lessor time.

Cosmetics Market Production, Manufacturing, and Investment Data

- Loreal, a globally leading cosmetics company estimated that the company's sales for year 2022 reached 38.26 billion Euros, the company has witnessed 28% increased e-commerce sales in 2022.

- The sales for overall premium/prestige beauty products in the United States boosted by 15%. Specifically, the sales for skincare increased by 12% in 2022 than 2021, the NPD Group stated.

- In 2022, the United States generated $49.2 billion sales in cosmetics.

- According to the report by Euromonitor, the high-end products will make 54% of the market in China by 2025.

- Puig, a Spanish beauty and fragrance brand stated that its annual revenue grew by 40% in 2022 to 3.620 billion Euros.

- According to the company, the sales for makeup products boosted by 52% as compared to 2021. In March 2023, the United States' exports for beauty products reached up to $607 million.

- In 2022, Amazon generated 23% of its total revenue from the beauty and personal care segment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 424.72 Billion |

| Market Size in 2026 | USD 450.20 Billion |

| Market Size by 2035 | USD 802.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.56% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Category, Gender, Distribution Channel, and region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Cosmetics Market Segment Insights

Category Insights

Based oncategory, the cosmetics market is divided into skin and sun care products, hair care products, deodorants & fragrances, and makeup &color cosmetics. The skincare products and sun care products constitutes a major market share in during the forecast period. However, the hair care products are expected to grow at the highest CAGR.

Skin care is an umbrella term under which sun care, facial care, body care, hand care products fall under the same umbrella. Skin care products are majorly used by women as compared to men owing to the overall consciousness regarding their skin. Presently, manufacturers are using new technologies such as nanogold and nanosome technology or nano particles for producing new skin care products. These nanoparticles help in keeping the skin more young and provide safety against harmful ultraviolet rays.

Moreover, hair care segment of cosmetics products has reached to steady growth phase. Hair care products remain dynamic factor owing to its regular use by both men and women. Rising consumer preference towards spa's and saloon for hairstyles creates addition demand for the hair care products.

Gender Insights

On the basis on gender, the cosmetics market is categorized into men, women and unisex. The women segment in terms of market share and is projected to grow with a significant CAGR during the forecast period. Moreover, the cosmetics market across the globe has witnessed steady growth owing to increasing beauty consciousness among women. Furthermore, increase in young and female working population is further expected to boost the market growth.

Raising awareness regarding personal grooming amongst men further expected to drive the market. Moreover, increasing men's preference towards herbal and natural cosmetics products is continuously rising which further augments the growth of the market.

Distribution Channel Insights

By distribution channel, the cosmetics market is segmented into hypermarkets/supermarket, specialty stores, brand stores, convenience and online sales channel. Hypermarkets/supermarket is retail outlets that focus on selling a particular range and associated items. Hypermarkets/supermarket maintains considerable depth in the type of product that they specialize in selling premium prices products. Moreover, manufacturers are continuously making efforts to increase shelf visibility of their products and hence they are majorly targeting hypermarkets/supermarket stores. As a result, great variety of cosmetics products is available in this retail stores. Moreover, hypermarkets/supermarket stores provides great amount discount which result in attracting more and more customer, hence resulting in boosting the cosmetics market

Cosmetics Market Regional Insights

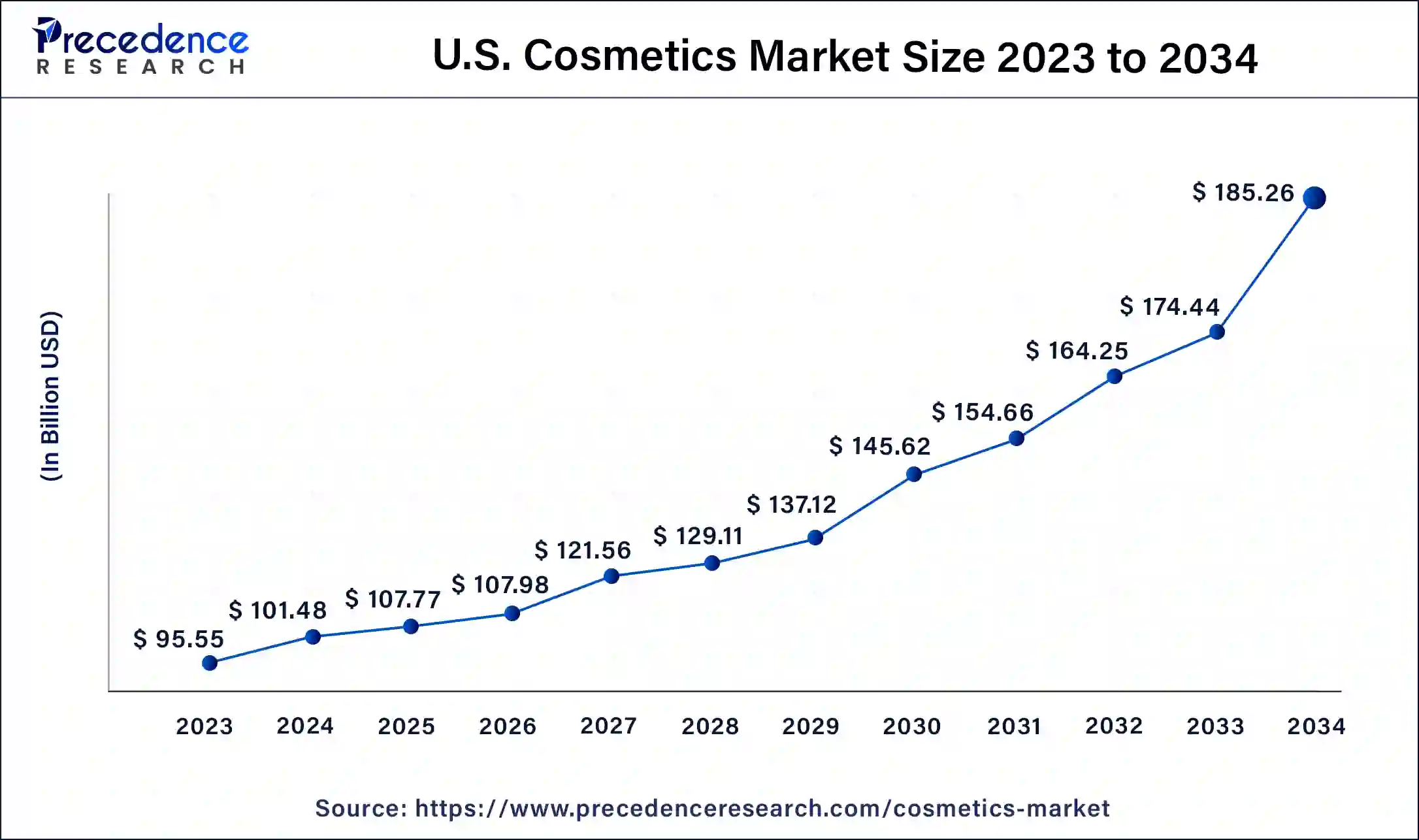

The U.S. cosmetics market size is estimated at USD 101.77 billion in 2025 and is predicted to be worth around USD 195.66 billion by 2035, at a CAGR of 6.76% from 2026 to 2035.

The North America market holds the major share in the year 2024 and it expected to retain its dominant during the forecast period.

North America market is a mature market and it includes countries such as U.S., Canada and Mexico. Increase in population and improved lifestyle are the major factors that boost the growth of the cosmetics market. Raising purchasing power in this region is the prime factor which contributes towards the growth of the cosmetics market. Moreover, raising awareness amongst men's regarding the personal grooming has further driven the sales of cosmetics products. Furthermore, unisex cosmetics products such as deodorants have become increasingly popular in this region owing to the associated benefits. This in turn further boosts the growth of the cosmetics market.

The European cosmetics market is expected to witness significant growth over the forecast period, due to the presence of innovation, sophistication among consumers, and a high cultural connection to fashion and beauty. The shopping experience is being transformed with the latest technological advancements, such as trying on virtual makeup. These tools enable consumers to make better buying decisions, which enhances interaction and improves sales of products. An increasing salon count, beauty schools, and fashion shows also contribute to product awareness and interaction with consumers.

The Asia-Pacific cosmetic market was valued at USD 88.15 billion in 2023 is expanding growth at a CAGR of 6% in the forecast period.

Asia Pacific held the largest market share in 2024. The consumers in the region are getting environmentally conscious, and the shift towards sustainable and natural beauty products is becoming serious. Green tea, rice, ginseng, aloe vera, and botanical extracts are some of the ingredients that the brands are using, and these ingredients are aligned with the holistic health practices and traditional remedies.

K-beauty (Korean) and J-beauty (Japanese) have transformed the whole cosmetics industry in the global market, where simplicity of skin care regimes, well-being, and discoveries are the ultimate priority. Among the key factors of sale are online shopping and social networks backed by influencer marketing and e-campaigns targeted at technology-savvy customers.

- In August 2024, Kay Beauty, a beauty brand based in India, launched a new range of lipsticks, Kay Beauty Hydra Cr�me Lipstick. As per the brand, 16 new shades are made with hyaluronic acid and lychee extract.

Cosmetics Market Companies

- Avon Products Inc.

- Kao Corporation

- L'Oreal S.A.

- Oriflame Cosmetics S.A.

- Revlon, Inc.

- Shiseido Company Limited

- Skin Food Co., Ltd.

- The Estee Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever Plc.

Recent Developments

- In January 2024, BOLD (Business Opportunities for L'Oreal Development), L'Oreal Group's venture capital fund, announced an investment in Timeline, a consumer health company focused on aging and longevity, which has a range of topical skincare products and supplements that use its proprietary technology, Mitopure. With the recent funding, the company hoped to enable further growth in beauty, food, and health.

(Source: https://www.cosmeticsdesign-europe.com) - In July 2024, the U.S. skincare brand Curology launched its non-prescription skincare products at CVS Pharmacy, a U.S.-based retail company. Per the company, the skincare product will be offered at CVS Pharmacy's 3,800 stores nationwide and on its site, CVS.com.

(Source: https://www.prnewswire.com) - In December 2023, Est�e Lauder established a partnership with the Stanford Center and made a three-year commitment to fund the latter's new Program on Aesthetics & Culture, which will fund research projects - including 'New Map of Life' post-doctoral fellowships, and other initiatives investigating understandings of longevity and vitality - for a more explicit understanding of perceptions on aging and vitality.

Cosmetics Market Segments Covered in the Report

By Category

- Skin & sun care products

- Hair care products

- Deodorants & fragrances

- Makeup & color cosmetics

By Gender

- Men

- Women

- Unisex

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Pharmacies

- Online Sales Channels

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content