What is the Agricultural Tractors Market Size?

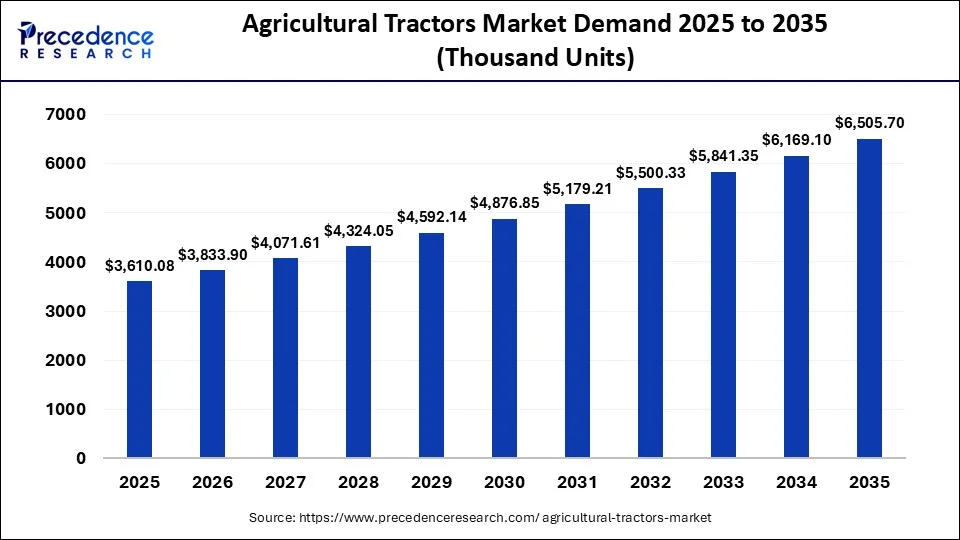

The global agricultural tractors market demand was estimated at USD 3,610.08 thousand units in 2025 and is predicted to increase from USD 3,833.90 thousand units in 2026 to approximately USD 6,505.70 thousand units by 2035, expanding at a CAGR of 6.07% from 2026 to 2035.

Agricultural Tractors Market Key Takeaways

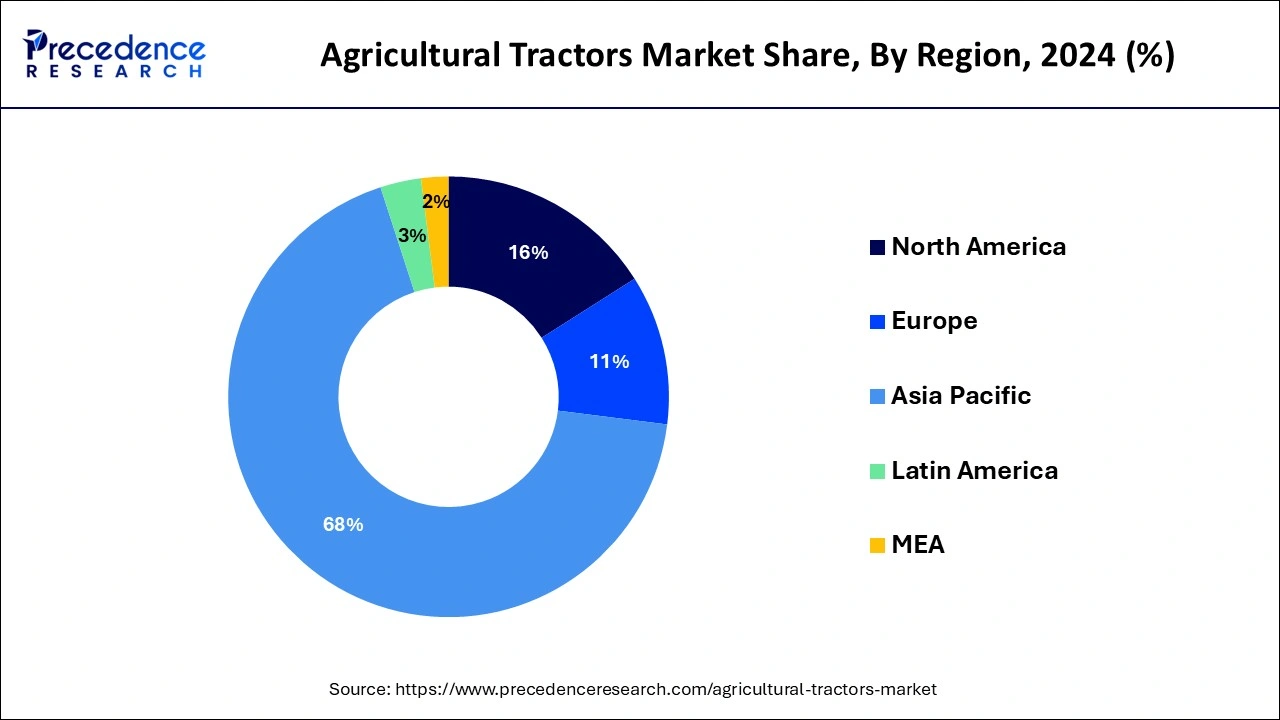

- The Asia Pacific region captured more than 68% of the revenue share in 2025, in terms of volume.

- By engine power, the less than 40 HP segment generated more than 63% of revenue share in 2025.

- By driveline type, the 2-wheel drive segment captured more than 80% of revenue share in 2025.

- By application, the irrigation segment is predicted to contribute to the maximum market share.

- By operations, the automatic tractor-vehicle segment is projected to hold the biggest market share.

What is the Agricultural Tractors Market?

For various agricultural tasks like tilling, harrowing, ploughing, and planting, tractors are used as agricultural vehicles. Less than 20 HP to more than 60 HP are among the power ranges offered. It is also used in the orchard, row crop, and gardening applications. Furthermore, as the agriculture industry grows, more people in developing nations like India, Brazil, China, and others will require tractors for farming and other agricultural applications.

This, in turn, fuels the expansion of the tractor market worldwide. For example, the India Brand Equity Foundation estimates that 58% of India's population comprises farmers.

Governments in these countries also provide farmers with incentives and loans to encourage them to utilize agricultural machinery, which boosts crop cultivation. However, during the projected period, these factors are expected to work together to generate profitable growth opportunities for the agricultural tractor market worldwide.

Market segments for agricultural tractors include engine power, driveline type, application, and operation during the projected period. Factors including increasing usage of precision farming, support from the government for the expansion of agricultural activities, and improvements in tractor technology are expected to spur industry growth for agricultural tractors.

Moreover, during the projected period, low farmer awareness of effective agricultural tractors and high agricultural tractor prices are anticipated to restrain the market's growth. Additionally, the industry for agricultural tractors is anticipated to benefit from the rising demand for fuel-efficient tractors and increased mechanization of agricultural processes.

Many governments, including those of India, the United States, China, and others, provide assistance for the growth of agricultural activities, including financial aid for purchasing machinery and seeds. The subsidies help to ensure adequate food production, lower the inflation rate for food commodities, protect farmer incomes, and enhance the agricultural industry. To increase agricultural production, developing countries like Brazil, India, and Africa provide a variety of subsidies, loan waiver programs, and other such amenities.

Is AI a Good Partner to the Agricultural Tractors Industry?

The AI-sponsored agricultural tractors are definitely a good partner to the industry as offers mechanism, automation, computer-level vision, sustainability, and precision. The GPS, LiDAR, and AI-powered cameras gives real time hint of problematic scenarios in the field. AI detects the difference between weed and crop and enable tractor to sprinkle the herbicides at the relevant places.

Alongside, AI algorithms fetch previous yield data and analyse soil difference which makes space for fertiliser application. The remote monitoring system has eased farmers' stress, as AI offers a study of the progress, operator nature, and fuel consumption rate at various sites.

Market Outlook

- Start-up Ecosystem: The start-up growth is evolving with the new technology and the support of the existing enterprises, encouraging tech-based advancements into agricultural tractors sector. The modernisation of machinery helped start-ups to occupy half of the sector with the precision and responsible farming idea.

- Industry Growth Overview: The industry growth has met a high stage of technological transformation, and so has drawn attention from the government bodies. The heavy investment in tractors reflects the interest of the government. Following this, the brands installed a manufacturing plant for tractors as well.

Market Scope

| Report Coverage | Details |

| Market Demand in 2025 | 3,610.08 Thousand Units |

| Market Demand in 2026 | 3,833.90 Thousand Units |

| Market Demand by 2035 | 6,505.70 Thousand Units |

| Growth Rate from 2026 to 2035 | CAGR of 6.07% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Engine Power, By Driveline Type, By Application, and By Operations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

A power-driven vehicle made explicitly for agricultural tasks like pushing or pulling farming equipment or trailers, scrapers, threshers, ploughs, planters, and pesticide sprayers is the agricultural tractor market. Due to their ability to supply power and mechanization for agricultural needs, tractors are now referred to as farm vehicles.

Government initiatives to fund farmers and provide them with lower interest rates on loans are also helping to boost the global market for agricultural tractors. Due to the increase in farm cash receipts, or profit and revenue from farming, tractors become more accessible, which is anticipated to increase the need for agricultural tractors. To help farmers, for instance, the Indian government and state governments have started several programs.

The industry is also expanding due to technological advancements that have changed how farming and agricultural processes are conducted. Self-driving agricultural tractors, for instance, are anticipated to increase industry efficiency and productivity. These are the key factors that are thus projected to fuel the expansion of the agricultural tractor market globally in the years to come.

Restraint

The market for agricultural tractors may be constrained by several factors. Some of the key factors are as follows:

- High cost: Agricultural tractors can be expensive, which may make it difficult for some farmers to afford them, especially small-scale farmers.

- Limited access to finance: The market's expansion may be constrained by the fact that many farmers might not have access to financing options for purchasing agricultural tractors.

- Lack of infrastructure: The use of agricultural tractors may be constrained in some locations due to a lack of adequate infrastructure, such as adequate roads and storage facilities.

- Climate and soil conditions: Tractor usage may be constrained in some areas due to harsh weather patterns or difficult soil conditions.

- Regulatory environment: Tractor costs can increase due to governmental regulations, such as import duties, taxes, and other fees, which can also limit the availability of tractors in some markets.

- Competition from other technologies: Drones, robotics, and precision agriculture are some of the other technologies that are increasingly used in agriculture, which can lower the demand for tractors.

Overall, these elements may act as market restraints for agricultural tractors, preventing their expansion in certain areas or industries.

Opportunity

The market for agricultural tractors offers several chances for expansion and improvement. Some of the key opportunities are as follows:

- Emerging markets: The agricultural tractor market has significant growth opportunities in emerging markets, particularly Asia and Africa. Tractors and other agricultural equipment are becoming more and more necessary in these areas due to rising food demand and the adoption of modern farming techniques.

- Precision agriculture: Manufacturers of tractors now have the chance to create new machinery with cutting-edge sensing and control systems thanks to the growing trend toward precision agriculture, which uses technology to maximize crop yields and minimize waste.

- Sustainable agriculture: There is an increasing demand for tractors that are more energy-efficient and emit fewer emissions as more consumers look for food that has been grown sustainably. Manufacturers now have the chance to create brand-new goods that satisfy these needs.

- Technological advances: Manufacturers now have the chance to create novel products that satisfy shifting market demands thanks to technological advancements like electric and autonomous tractors.

- Customization: The opportunity for manufacturers to provide more specialized tractors that address the specific needs of farmers is increased due to the rise in demand for specialized farming techniques and equipment.

- After-sales service: Tractor manufacturers can gain customer loyalty and set themselves apart from rivals by providing maintenance, repair, and spare parts services through after-sales service and support.

Overall, these possibilities offer a positive outlook for the agricultural tractor market because manufacturers can take advantage of new patterns and shifting consumer preferences to expand their industries and serve farmers' needs.

Segment Insights

Engine Power Insights

The segment with less than 40 HP is expected to hold the largest share. This is explained by the fact that these tractors have more flexible uses. Farmers typically need access to large plots of land or a lot of extra cash. Since they are more effective, simple, and useful for small farms, they favour tractors with lower Horsepower.

Due to the growing demand from large farmers for larger tractors that can handle various tasks, the market for agricultural tractors with 40 HP engines is also anticipated to grow. The soaring demand for powerful tractors and aggressive marketing tactics is driving this area of the agriculture tractor market.

Driveline Type Insights

The market is divided into 2-Wheel Drive and 4-Wheel Drive according to the type of driver. The segment with the largest market share is expected to be 2-Wheel Drive. The possibility of a smaller turning radius with these tractors explains this. Ballast weights can be used to increase the traction of a 2-Wheel Drive and make it possible for the field to slip less.

Additionally, the segment's 6.1% annual growth rate between 2025 and 2034 will be the highest. The growth of interest in compact 2-wheeler tractors among amateur and professional farmers in developed and developing countries can be attributed to the segment's expansion. Moreover, farmers favor 2-wheeler tractors due to their ability to adapt, low initial cost, and superior mobility on small parcels of land.

A 4-wheeler tractor, on the other hand, has more power, which enhances its performance on marshes and unlevel ground. Furthermore, because of their high price, only large farmers with extensive farm fields can use 4-wheeler tractors.

Application Type Insights

Based on Application, the market is bifurcated into Harvesting, Seed Sowing, Irrigation, and Others. The Irrigation segment is anticipated to account for the highest market share. This can be attributed to the fact that tractors make the task significantly easier and help in saving water.

Operations Insights

The market is divided into automatic tractor vehicles and manual tractor vehicles based on operations. The automatic tractor-vehicle segment is expected to hold the largest market share. This is explained by the fact that manual tractors are simple to operate, need less maintenance, and are generally less expensive.

Throughout the forecast, manual tractors are anticipated to grow significantly. The high availability of manual tractors drives the company's growth. Farmers have access to various manual tractors, which are less costly than autonomous tractors. The autonomous tractors segment is anticipated to expand moderately during the projected timeframe.

To diversify their product offerings, companies are making investments in the creation of electrically-propelled autonomous tractors. The advancement of electrically powered autonomous tractors is anticipated to be fueled by government initiatives to reduce automobile carbon emissions.

Regional Insights

What is the Asia Pacific Agricultural Tractors Market Size?

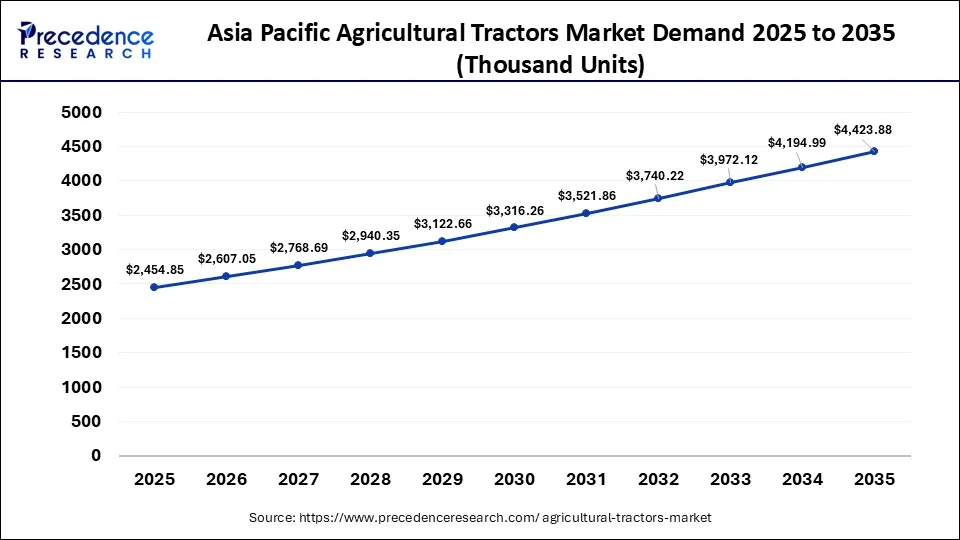

The Asia Pacific agricultural tractors market demand was estimated at 2,454.85 thousand units in 2025 and is predicted to be worth around 4,423.88 thousand units by 2035, at a CAGR of 6.07% from 2026 to 2035.

The Asia Pacific region generated the largest share, with over 68% in terms of volume. This results from growing tractor demand in nations such as India and China. Tractors are essential in India for boosting the nation's agricultural output. Agricultural tractors are sold between 600 thousand and 700 thousand units annually.

According to estimates, during climate change, Europe experienced major volume growth. Large farms in several European nations, including the U.K., the Netherlands, Hungary, Denmark, and Spain, are primarily to blame for this growth. 38% of all farms worldwide are located in Europe.

North America's Speed in the Agricultural Tractors Industry

North America's speed in this industry is immeasurable, as it's transforming into miles of changes in its traditional machinery by turning it into an autonomous and data-unified system. The precision techniques used at the farms brought farmers and technology closer. The manufacturers are also promoting methane-inspired and electric models to match rigorous emission standards.

The kind initiative of retrofit kits to the mid-sized farms that can't install machines due to space and finance issue are getting their old tractor transform into advanced tech-supported tractors.

Latin America's Agricultural Tractor Use

Latin America's use of agricultural tractors is aligned with the huge agribusinesses (export), mainly in Argentina and Brazil. The region earns a massive market share in the shipments of other agricultural products. The high horsepower is utilised for maize fields and soybean trade in Brazil and Argentina. Brazil sales highest amount of tractors and dominates the exporting business of coffee, sugarcanes and soybeans.

MEA's Roots in Agricultural Tractors

The roots of the MEA now run with the growth and shift of the agricultural tractors when advance mechanism need emerged from the demand of accurate commercial farming and food security performance. The rising agribusinesses need a comprehensive machinery system, so autonomous tractors and precision farming adoption could be seen in Sub-Saharan Africa's farms. To continue harvesting rich products, government subsidies and financial incentives are promoting tractor investment.

Value Chain Analysis of the Agricultural Tractors Market

- Raw Material Sourcing: The raw material sourcing for agricultural tractors includes clear identification, examination, and acquisition of fundamental materials like iron, steel, etc to further manufacture the machine, bring it into momentum to operate in farms.

Key Players – POSCO, Michelin, and Caterpillar. - Testing and Certification: To evaluate quality, safety, and performance standards, the testing process becomes essential. Once the regulatory person performs comparative testing (mandate), further permission and a certificate are granted to operate the tractor on fields.

Key Players – OECD, SGS, and NTTL-USA. - Distribution and Sales: The distribution and sales operate the whole supply chain spectrum, involving manufacturers and end users to run sales via promoting the product, illustrating it, or sell product through any networking channel.

Key Players – Mahindra & Mahindra, CNH Industrial, and Kubota Corporation.

Agricultural Tractors Market Companies

- Deere & Company

- SAME DEUTZ-FAHR Group etc.

- Kutoba Corporation

- McCormick International

- Mahindra Group

- Yanmar

- Farmtac

- Massey Ferguson

- Escorts Group

- Kubota

- Dongfeng

- Jordan Tractor and Equipment Co.

- New Holland

- AGCO Corp.

- Kioti Tractor

- SDF Group

- Daedong Industrial

- CNH Industrial N.V.

- Argo Tractors S.p.A.

- Valtra Tractor

Recent Developments

- November 2022- Two best-in-class tractors were launched at the CII Agro Tech India 2022 exhibition by ZETOR TRACTORS and VST Tillers Tractors Ltd.. These tractors in the 50 HP and 45 HP categories were successfully implemented by ZETOR and VST at their facilities in India and the Czech Republic.

- June 2022- In the category of tractors with less than 30 HP, the Solis Yanmar company has introduced three new models for Turkish farms that will be imported from India.

- July 2021- The T7 Heavy-duty Tractor with PLM Intelligence was introduced by New Holland North America as an expansion of its line of agricultural tractors. The new tractor allows for multi-tasking in a range of field and transportation applications, which is intended to increase farmer productivity.

Segments Covered in the Report

By Engine Power

- Less Than 40 HP

- 41 To 100 HP

- 121 HP-180 HP

- 181 HP-250 HP

- Above 250 HP

By Driveline Type

- 4-Wheel Drive

- 2-Wheel Drive

By Application

- Seed Sowing

- Harvesting

- Irrigation

- Others

By Operations

- Automatic Tractor Vehicle

- Manual Tractor Vehicle

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting