What is Agricultural Biologicals Market Size?

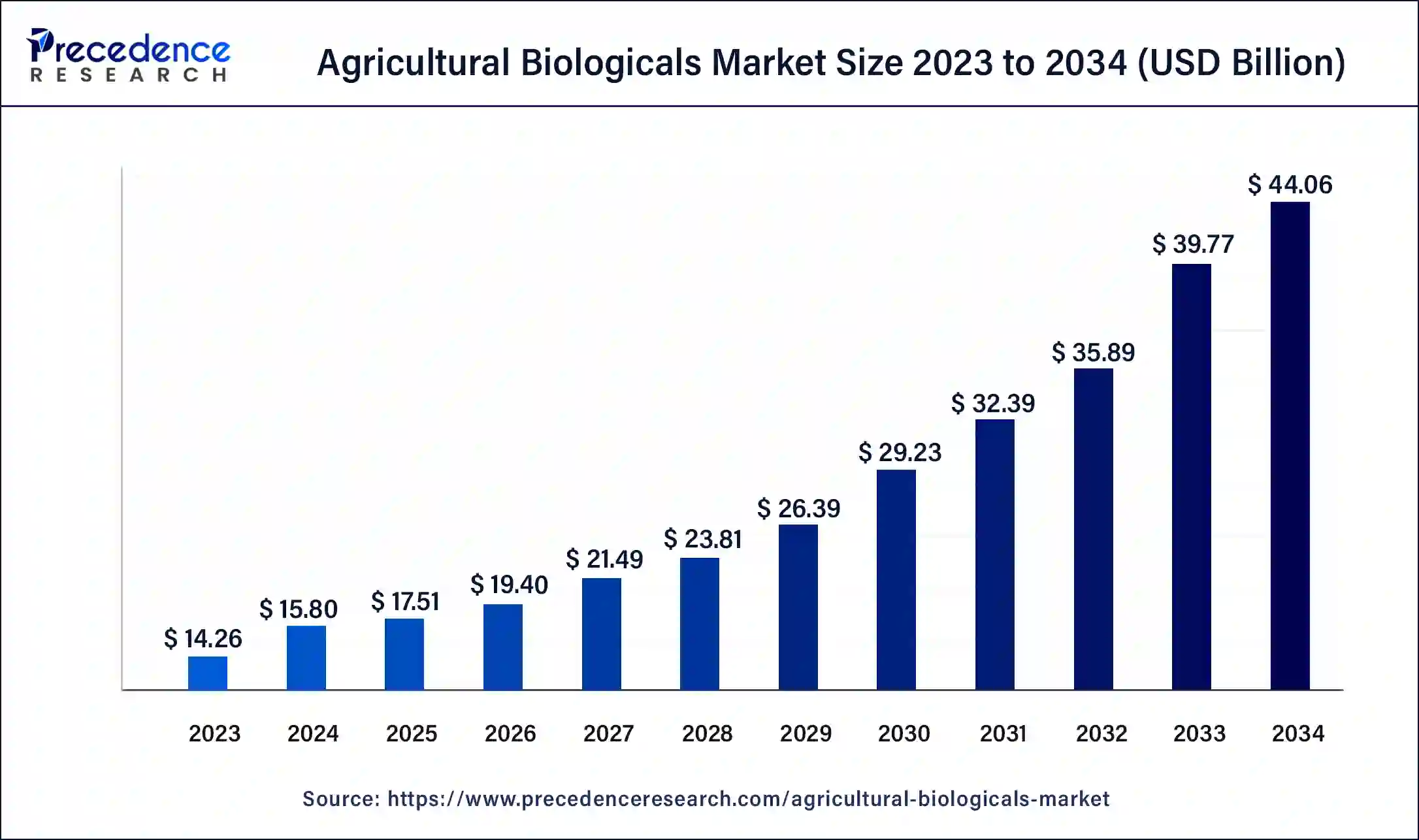

The global agricultural biologicals market size is valued at USD 17.51 billion in 2025, accounted for USD 19.40 billion in 2026, and is expected to reach around USD 48.08 billion by 2035, expanding at a CAGR of 10.63% from 2026 to 2035. The rising demand for sustainable and organic alternatives to chemical-based pesticides in farm production drives the growth of the market.

Market Highlights

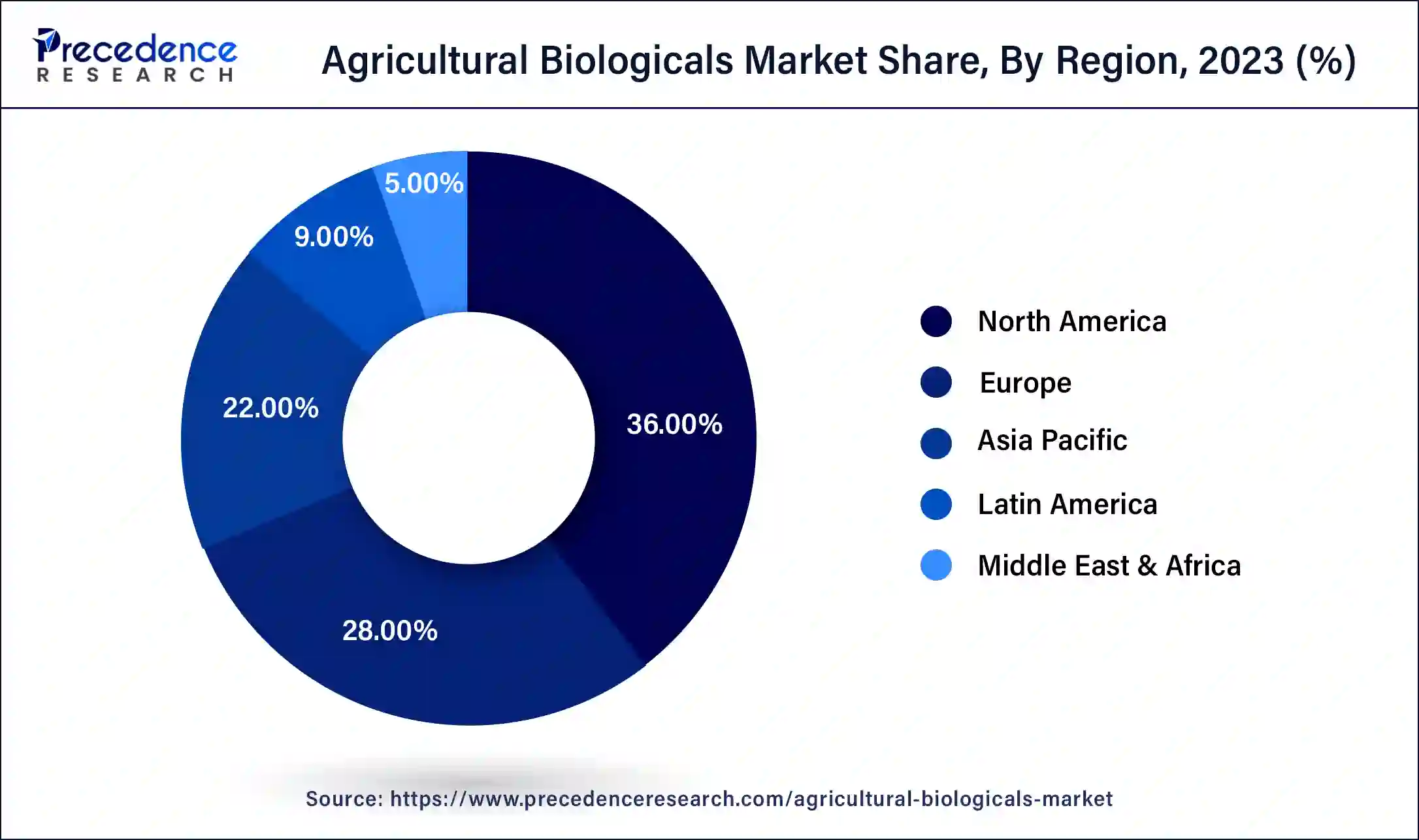

- North America led the agricultural biologicals market with the largest share of 36% in 2025.

- By Product, the biopesticides segment dominated the agricultural biologicals market with the largest share 57% in 2025.

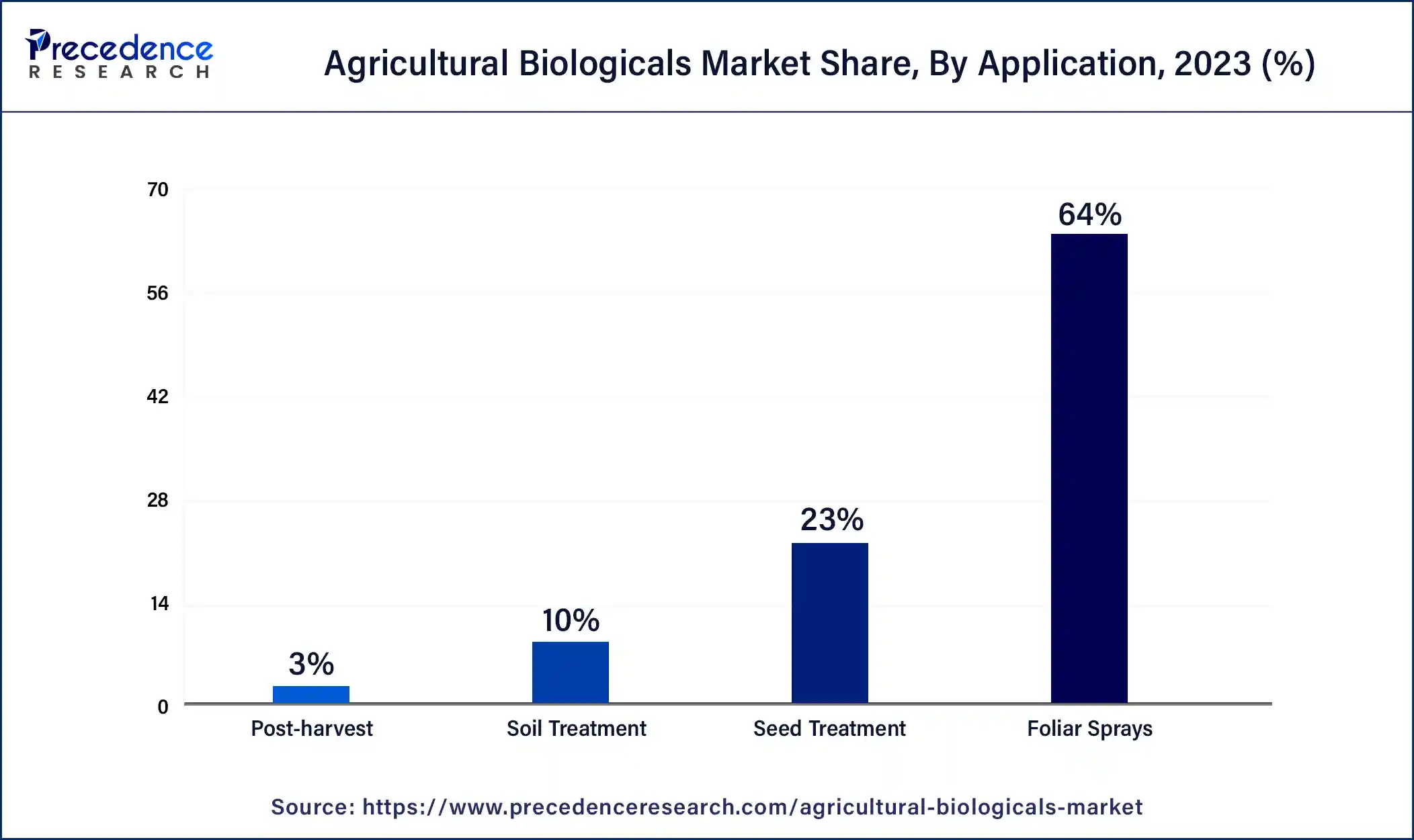

- By Application, the foliar spray segment held the dominating share of around 64% in 2025.

- By Crop-type, the cereals & grains segment has accounted market share of around 37.4% in 2025.

- By end-user, the biological product manufacturers segment held the largest share of the market in 2025.

Market Overview

The agricultural biologicals market offers a set of products that are made by naturally found plant extract, microorganisms, organic matter, and beneficial insects. The agricultural biologicals are divided into three major categories or type as per the use in farming or agriculture biostimulants , biopesticides, and biofertilizers .

In which biostimulants are used for the enhancing productivity of plants, biopesticides are used for the protection of the plants from the pests, and biofertilizers are used for the plant fertilization or nutrition. The rising awareness about the chemical-based pesticides and their harmful impact on the environment and human health, along with the rising demand for the sustainable alternatives to the chemical-based pesticides are driving the growth of the agricultural biologicals market across the globe.

Artificial Intelligence: The Next Growth Catalyst in Agricultural Biologicals

AI is accelerating the agricultural biologicals industry by enhancing the discovery, development, and precise application of bio-based products. Machine learning algorithms and data analytics are used to analyze vast molecular and genomic libraries, identifying new, effective, and environmentally friendly active ingredients for biopesticides and biofertilizers, a process that was previously time-consuming and expensive.

Market Trends

The increasing need for sustainable agriculture solutions is spearheading the industry growth in the current period. Also, the biologicals are increasingly seen as replacing traditional chemicals and pesticides due to increased awareness of sustainable agriculture practices in recent years.

The rising government initiatives for eco-friendly agriculture practices are driving industry growth in the current period. Governments are seen as giving attractive incentives and subsidies to both farmers and biologists. Also, the government is seen as offering tax reduction subsidies for them.

The manufacturers are increasingly seen in putting heavy investments into research and development activities for the innovation of microbial and biostimulant products, which is expected to create lucrative opportunities in the coming years. Also, technological advances can further contribute to the industry's growth by innovating different and efficient agricultural practices and eco-friendly products in the future.

Agricultural Biologicals Market Growth Factors

- The globally growing population and the higher demand for the high-quality yields from the farm producers are driving the adoption rate of the agricultural biologicals or organic pesticides for obtaining the high-quality crops in the farms are boosting the growth of the agricultural biologicals market.

- The rising awareness for the use of organic pesticides in the farm than the synthetic or chemical based pesticides and the rising awareness among the farm producers for the environmental harm by using the chemical-based pesticides are contributing to the growth of the market.

- The rising investment in the adoption of the latest technologies and innovations in the farms for producing high quality crops which enhances the product quality and increases the production capacity that driving the growth of the agricultural biologicals market.

- The rising health concern in the population and the rising demand for the organically cultivated food products by the population are positively influencing the growth of the market.

- The rising participation by the government for organic farming and the supportive policies in terms of subsidies are also contributing to the expansion of the agricultural biological market.

Recent Trends

- Farmers are shifting from chemical pesticides to natural solutions, driven by rising concerns about soil health and chemical residues.

- Biopesticides are becoming the fastest-growing category, as they offer targeted protection without harming beneficial insects or the environment.

- Microbial-based products are gaining huge popularity, especially bacteria and fungi that improve nutrient uptake and crop resilience.

- Demand for biofertilizers is rising as farmers aim to boost soil fertility and reduce dependence on synthetic fertilizers.

- Government support and incentives are increasing, encouraging the use of sustainable and eco-friendly crop protection products.

- Precision farming is driving biologics adoption, with farmers using data tools to apply these products more effectively.

- Integrated pest management (IPM) programs are expanding, combining biologics with minimal chemicals for safer and more effective crop protection.

- Consumer preference for chemical-free and organic food is pushing growers to adopt biological inputs to meet certification requirements.

- Companies are investing heavily in R&D, leading to advanced biological products that provide longer-lasting protection and better shelf life.

Market Outlook

- Industry Growth Overview: The market for agricultural biologics is expanding as farmers switch to natural remedies like biofertilizers, biopesticides, and biostimulants instead of chemical-based products. These goods safely increase crop yields and enhance soil health. As nations encourage sustainable agriculture and lessen he amount of chemical residue in food, demand is growing.

- Sustainability Trends: Biologics support eco-friendly agriculture by reducing chemical runoff, improving soil biodiversity, and lowering environmental harm. Many companies are developing formulations that work with natural plant processes. There is also a strong push for organic farming methods, which depend heavily on biologics.

- Major Investors: Major investors include global agritech companies like Bayer, Syngenta, FMC, and Corteva, along with biotech startups focused on microbial-based solutions. Venture capital funds are also backing innovations in biological crop protection. These investors aim to create safer, high-performance alternatives to chemical pesticides.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2025 | USD 17.51 Billion |

| Global Market Size in 2026 | USD 19.40 Billion |

| Global Market Size by 2035 | USD 48.08 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.63% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Crop-type, Product, Application, End-User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for the organic farm food

The rising awareness about the improved health in the population and the increasing inclination towards the organic farm food for the better health and chemical free food are driving the growth of the agricultural biologicals market. The rising awareness about the synthetic chemical-based pesticides which are affecting the quality of the crops and leave negative impact on the human health and environment by the excessive use also promotes the utilization of biologicals in the agricultural sector.

The use of excessive chemical pesticides is also responsible for the air pollution and it highly impacting the consumer's health. The various regional countries are reducing the use of the agrochemical the farming and adopted the alternative like agricultural biological products in the production farms for the organic farming which drives the growth of the agricultural biological market.

Restraint

Higher in cost

Agricultural biological pesticides are higher in cost as compared to chemical-based pesticides due to the lesser competition, higher cost of the production and limited scalability that limiting the use of the product and restraints the growth of the agricultural biological market. The cost-effectiveness of agricultural biologicals can vary depending on the scale of production. Large-scale farms may find it more challenging to adopt biological products due to higher upfront costs and logistical challenges. Conversely, smaller-scale or niche farmers may find it easier to integrate biologicals into their operations, especially if they can command premium prices for sustainably produced crops.

Opportunity

Demand for the sustainable alternative to the pesticides

The rising demand for the sustainable pesticides and the shifting government regularities for the adoption of the organic pesticides that are environmentally safer and safer to consume by the human offers a significant opportunity for the agricultural biological market. The chemical-based pesticides negatively impact the environment like it harms to the non-target organisms which are beneficial for the insects and wildlife and the source of the contaminated water.

Several governments have started implementing strict regulations on the excessive utilization and application of chemical-based pesticides in the farms in order to promote the application of eco-friendly and sustainable alternatives for the agricultural practices. As well as knowing the demand for the organic pesticides many market players are investing in the production and manufacturing of these products are also driving the growth of the market.

Segment Insights

Product Insights

The biopesticides segment dominated the agricultural biological market with the highest share in the market in 2024. The growth of the segment is attributed to the higher consumption of biopesticides by the farm producers for safeguarding their crops from pests. The biopesticides include pathogenic, botanicals, microbial species such as bacteria, fungi, and viruses, and the natural competitors of pests, including nematodes and semiochemicals, parasitoids, and predators, for controlling the pests level. Biopesticides are one of the important tools for farmers because to reduce the pests on the crops without harming any environmental factors or creating pollution and it not harmful to human health either.

The rising demand for sustainable agricultural products, demand for organic food, and the restrictions on harmful pesticides are driving the growth of biopesticides in the agricultural biological market.

The biofertilizers segment is observed to grow at a notable rate during the forecast period in the agricultural biological market. There is increasing awareness among farmers and consumers about the negative environmental impacts of chemical fertilizers . Biofertilizers offer a sustainable alternative by harnessing natural processes to enhance soil fertility and crop productivity without causing harm to the environment. As sustainability becomes a key focus in agriculture, the demand for biofertilizers has been on the rise.

Application Insights

The foliar spray segment, in the agricultural biological market, held the largest share for the year 2024. The dominance of the segment is attributed to the rising adoption of foliar spray by the medium and large farming. Foliar sprays are applied liquid nutrition and mineral directly to the plants. It is beneficial for the plants due to provide the liquid to the plants in the form of mist directly to the foliage.

There are basic three types of the foliar sprays that are foliar feeding sprays, foliar sprays for pests, and foliar to fight diseases. The rising adoption of the foliar sprays due to its effectivity and provides the nutrients to the plants are driving the growth of the segment.

End-User Insights

The biological product manufacturers segment held the largest share of the agricultural biological market in 2024. The rising adoption of the agricultural biologicals pesticides in the biological products manufacturer for the manufacturing of organic products that drives the growth of the segment. The demand for the organic products in the market due to its beneficial properties and the rising awareness about the chemical-based products that causes the health and environmental issues that drives the demand for the biological products. Additionally, the rising public and private investments in the development of the biological farming and production are further boosting the growth of the biological product manufacturers segment.

Regional Insights

What is the U.S. Agricultural Biologicals Market Size?

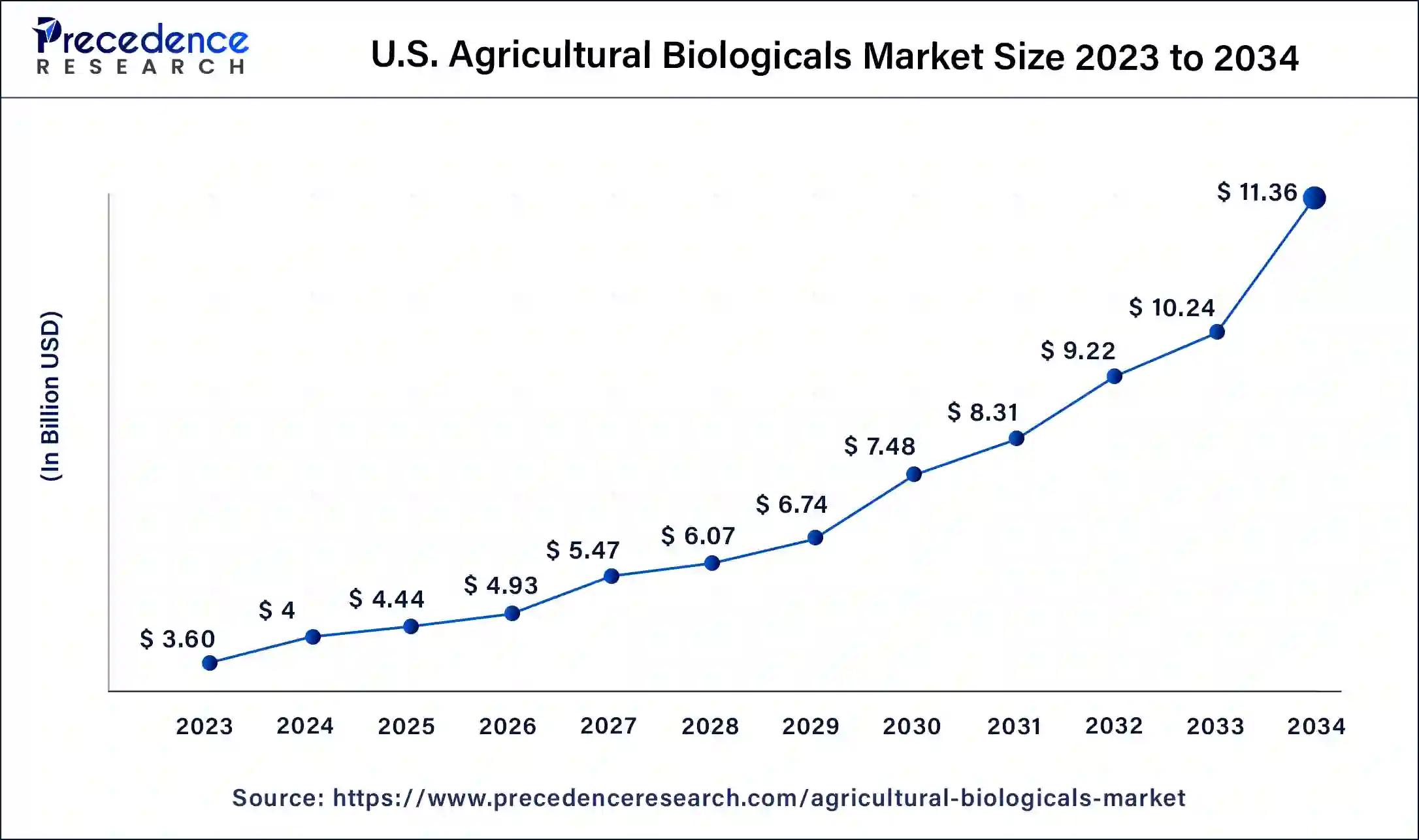

The U.S. agricultural biologicals market size is estimated at USD 4.44 billion in 2025 and is predicted to be worth around USD 12.41 billion by 2035, at a CAGR of 10.83% from 2026 to 2035.

North America led the agricultural biologicals market with the largest share in 2024. The growth of the market in the region is attributed to the rising awareness about the organic product consumption and the rising development and innovations in the agriculture industry are driving the growth of the market. The rising investments on the natural or organic food and materials for the development of the organic market and the reducing the environmental issues that caused by the harmful chemical-based products are driving the growth of the agricultural biological market in the region.

- Tom Vilsack the Agriculture Secretary announced that the U.S. Department of Agriculture (USDA) taking a step for strengthening the domestically grown organic products market and supporting the producers who are willing for the organic certification. The funding is the part of the Organic Transition Initiative of U.S. Department of Agriculture's (USDA) which launched in 2022 that will help the existing organic farmers and those who are shifting towards the organic processing and production.

U.S. Agricultural Biologicals Market Trends

U.S.'s rising demand for organic and sustainable produce, plus concerns about chemical residues, boost biologics. The economic push is from high conventional product prices, supportive government policies, and rising farmers' awareness.

Asia Pacific is expected to witness the fastest growth in the agricultural biological market during the forecast period. The growth of the region is attributed to the well-established agriculture industry and the rising population that anticipated the demand for the high-quality food grain that drives the growth of the market. The rising awareness about the environmental issues causing by the chemical-based pesticides are driving the demand for the sustainable product that driving the growth of the market. Additionally, the rising investments in the agriculture and the regularities associated with the agriculture and pollution are positively influencing the growth of the agricultural biological market in the region.

- As per the Economic Survey 2022-23, there are 4.3 million organic farmers exist in India. The Union Budget of 2023-24 is ahead of helping over the 10 million farmers to adopt the organic farming over the next 3 years.

As awareness of environmental issues such as soil degradation, water pollution, and biodiversity loss grows, there is an increasing emphasis on sustainable agriculture practices in the region. Agricultural biologicals offer eco-friendly alternatives to conventional chemical inputs, reducing environmental impact and promoting long-term soil health. Consumers, governments, and businesses are increasingly prioritizing sustainability, driving the demand for biological products in the region while promising a sustained growth to the agricultural biological market.

China Agricultural Biologicals Market Trends

China's shift towards crop nutrition and high-growth bio stimulants, rising innovation in microbial bio stimulants that enhance plant health and stress resilience in high-value crops. The rising adoption of biologics, partly due to consumer demand for residue-free produce and growing awareness of chemical impacts, and the push for agricultural modernization.

How did Europe experience notable growth in the Agricultural Biologicals Market?

Europe's strong consumer preferences for residue-free, organic produce are driving widespread farmer adoption of sustainable biological alternatives. The market's growth is further accelerated by substantial financial incentives and significant advancements in biotechnology that enhance the efficacy and targeted application of biopesticides and biofertilizers.

Germany Agricultural Biologicals Market Trends

Germany's dual push from consumers seeking residue-free produce and a significant shift in federal policy, most notably the USDA's 2026 R&D Roadmap, which prioritizes soil health and regenerative practices. Technological breakthroughs in microbial bioengineering and precision application are addressing previous concerns over product consistency.

Value Chain Analysis of the Agricultural Biologicals Market

- Research & Development (R&D) and Technology Development

This critical stage focuses on discovering new biological agents, developing novel formulations to enhance efficacy and shelf life, and securing the necessary patents and regulatory approvals.

Key Players: BASF SE, Bayer AG, Corteva, FMC Corporation, Syngenta AG, Novonesis (formerly Novozymes A/S), Valent BioSciences LLC, Marrone Bio Innovations Inc., Koppert Biological Systems B.V., Certis Biologicals Ltd. - Manufacturing and Processing

Raw biological materials are transformed into finished agricultural biological products through processes like fermentation and specialized synthesis.

Key Players: Syngenta Group, Corteva Agriscience, BASF SE, UPL Limited, Novonesis. - Distribution and Logistics

This stage involves the movement of finished products from manufacturing facilities to regional warehouses, wholesalers, retailers, and finally to the farmers.

Key Players: UPL Limited, Bayer AG, Syngenta AG, and BASF SE

Agricultural Biological Market Companies

- BASF SE focuses on developing and commercializing a broad portfolio of biocontrol agents and bionutrition solutions, using innovative research to bring products that help farmers manage pests and diseases sustainably.

- Syngenta AG contributes to the agricultural biologics market through its dedicated "Biologicals" business, which integrates nature-based technologies into its crop protection and seed portfolios.

- Bayer AG participates in the market with a strong emphasis on research and development of both microbial and biochemical solutions.

- UPL contributes significantly through its "Natural Plant Protection" (NPP) business unit, which offers a comprehensive and diverse range of biosolutions globally.

- Corteva Agriscience engages in the biologics market by developing a pipeline of biostimulants, biocontrols, and pheromone products designed to improve nutrient use efficiency and manage pests sustainably.

Other Major Key Players

- The Mosaic Company (US)

- Pro Farm Group Inc. (US)

- Gowan Company (US)

- Vegalab SA (Switzerland)

- Lallemand Inc. (Canada)

- Valent BioSciences LLC (US)

Recent Developments

- In 2024, Rainbow Bio introduced its latest biologicals division. Also, the reason behind the launch is to promote sustainability and innovation. Also, the division included the advanced biological solutions, which can fulfill the modern agriculture needs as per the company's claim. (Source - https://www.agribusinessglobal.com )

- In 2025, Syngenta acquired the Novartis repository of natural compounds and genetic strains for agricultural use, which is aimed at making a strong hold on global leadership in modern agricultural biologics. Moreover, the company can now access a major source of novel leads which obtained from agriculture research, as per the company's claim. (Source- https://www.croplife.com )

- In 2024, Syngeta created a partnership with Ginkgo Bioworks. This collaboration aims to enable the launch of innovative biologics faster. Also, after the collaboration, Ginkgo is going to develop and optimize microbial strains to meet the productivity targets faster, as per the company's claim. (Source- https://www.prnewswire.com )

- In March 2024,Certis Biologicals comes in a strategic collaboration with the SDS Biotech K.K. for the commercialization and development of the agricultural biological products. The partnership aiming the goal is to find the solution for the evolving challenges of the agriculture industry.

- In March 2024,IPL Biologicals launched its latest brand identity and Microbot™ Technology, to celebrate its 30-year-old journey. The latest logo shows the farming community with the representation of growth, sustainability, and nature.

- In June 2023,AgBiome tapped in the agreement with the Ginkgo Bioworks aiming to increase the development of latest agricultural biologicals and enhance existing product that uses in the production of crops.

Segments Covered in the Report

By Crop-type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Product

- Biopesticides

- Biochemicals

- Microbials

- Biostimulants

- Acid Based

- Seaweed Extract

- Microbials

- Others

- Biofertilizers

- Nitrogen Fixation

- Phosphate Solubilizing

- Others

- Others (Macro-organisms)

By Application

- Foliar Sprays

- Soil Treatment

- Seed Treatment

- Post-harvest

By End-User

- Biological Product Manufacturer

- Government Agencies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting