Biofertilizers Market Size and Forecast 2025 to 2034

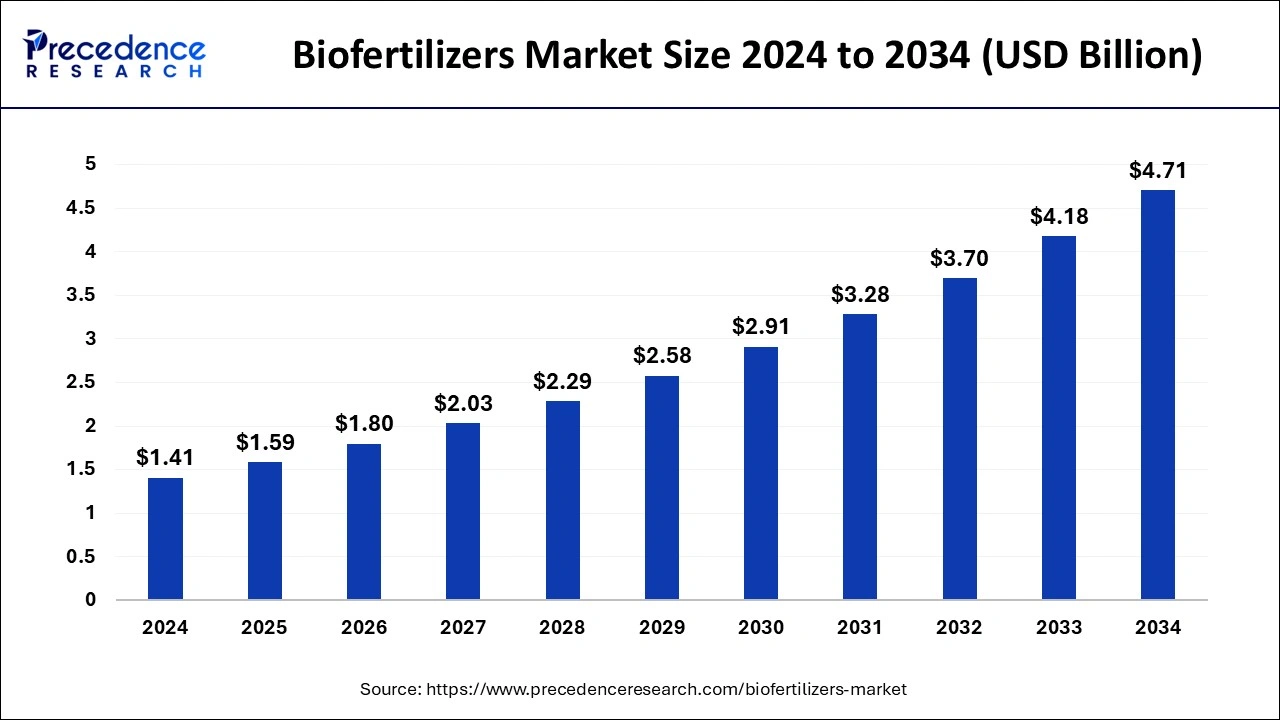

The global biofertilizers market size was estimated at USD 1.41 billion in 2024 and is anticipated to reach around USD 4.71 billion by 2034, expanding at a CAGR of 12.83% from 2025 to 2034. The rapidly growing global agricultural industry with rising concerns for food safety is considered to drive the growth of the biofertilizers market during the forecast period.

Biofertilizers Market Key Takeaways

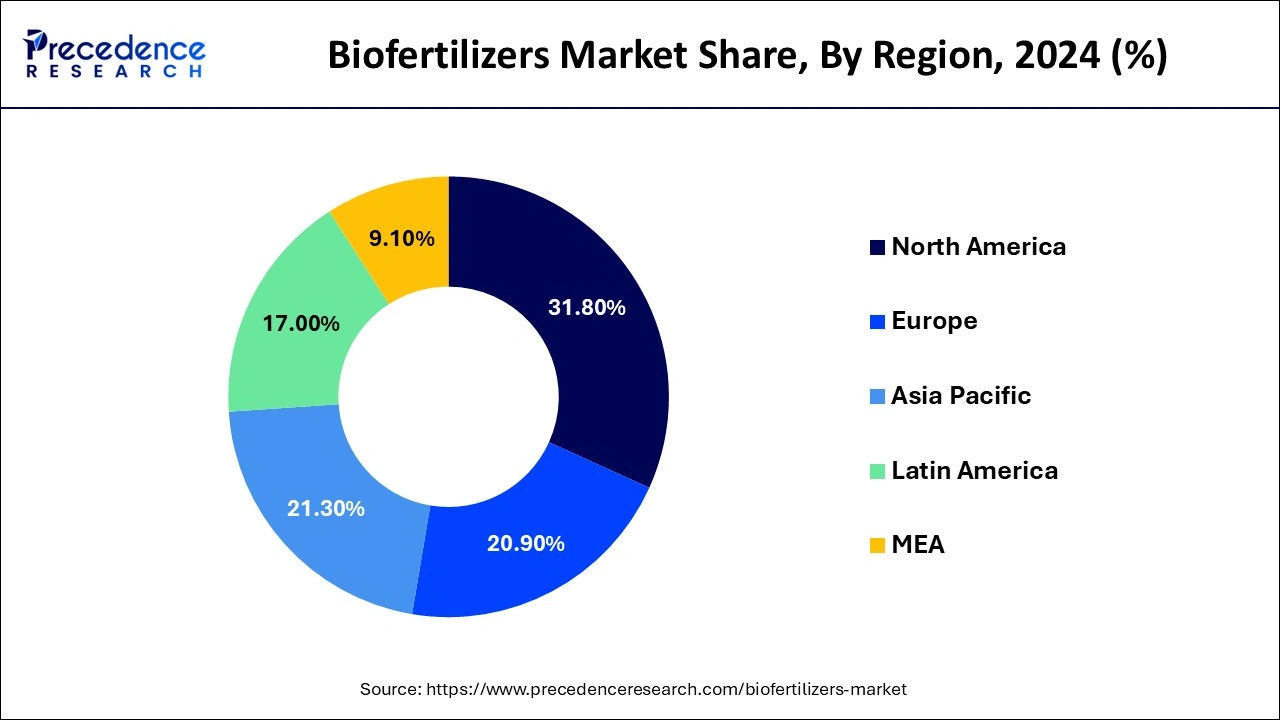

- North America dominated the global biofertilizers market with the largest market share of 31.8% in 2024.

- Asia Pacific region is expected to record the fastest CAGR between 2025 and 2034.

- By Type, the nitrogen fixing segment predicted to dominance the global market between 2025 and 2034.

- By Type, the phosphate solubilizing segment is expected to record remarkable CAGR between 2025 and 2034.

- By Application, the seed treatment segment captured the largest market share in 2024.

- By Application, the soil treatment segment is predicted to grow significantly during the forecast period.

- By Crop Type, the cereals & grains segment generated the biggest market share in 2024.

- By Crop Type, the oilseeds and pulses segment is expected to be the fastest-growing during the forecast period.

Impact of AI on the Biofertilizers Market

Artificial Intelligence(AI) and automation technologies are revolutionizing the biofertilizers market. Implementing AI technologies in the production processes of biofertilizers boosts product efficiency by enhancing the quality control process. Moreover, AI helps in precision agriculture by providing better ways to handle crops and optimizing the use of biofertilizers. AI also helps in the research and development of innovative formulations, thereby accelerating production processes.

U.S. Biofertilizers Market Size and Growth 2025 to 2034

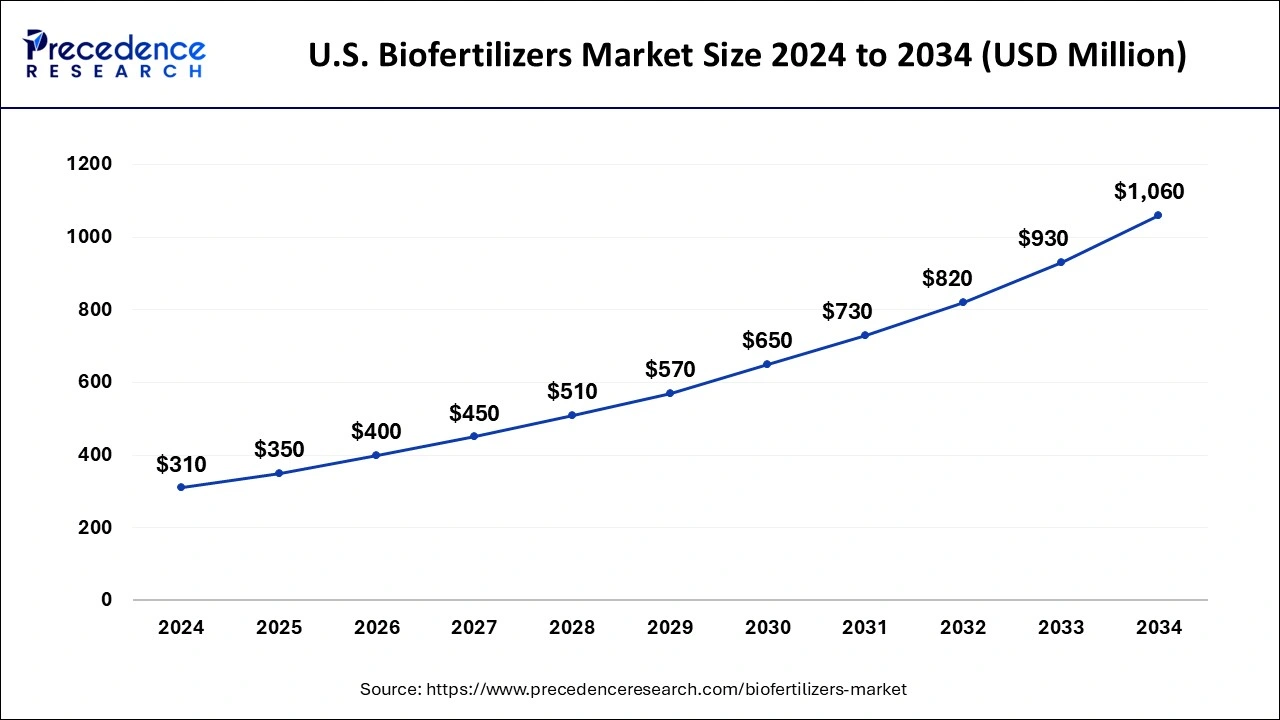

The U.S. biofertilizers market size was evaluated at USD 310 million in 2024 and is predicted to be worth around USD 1060 million by 2034, rising at a CAGR of 13.08% from 2025 to 2034.

North America dominated the global biofertilizersmarket with the largest market share of 31.8% in 2024.There is increasing demand for organic food in North America, driven by concerns about the environmental and health impacts of conventional agriculture. The region will maintain dominance due to the rising demand for organic food products.

The governments of the United States and Canada have implemented policies and programs to promote sustainable agriculture practices, including the use of biofertilizers. This has helped to create a favorable regulatory environment for the biofertilizer market in North America.

The US Department of Agriculture (USDA) provides research funding and technical assistance to support the development and use of biofertilizers. It has established programs such as the National Organic Program to help the production and marketing of organic products, which often rely on the use of biofertilizers.

The biofertilizers market in Asia Pacific is expected to register the fastest growth during the forecast period. The increasing population and rising demand for cereals and grains, especially in developing countries, are observed to boost the development of the biofertilizers market in Asia Pacific.

India is the most significant marketplace for biofertilizers. The increasing population, rising focus on organic foods, and rising government support for producing and utilizing biofertilizers in India are predicted to boost the market's growth. The Indian government also promotes the production and utilization of biofertilizers; the government has implemented soil test based Integrated Nutrient Management (INM) under its Soil Health Card Program to reduce the use of chemical fertilizers and other harmful pesticides.

Market Overview

The biofertilizer market refers to the market for producing and distributing biological fertilizers, which are naturally occurring microorganisms that can enhance soil fertility and promote plant growth. Biofertilizers are an alternative to traditional chemical fertilizers, which can have negative environmental impacts, such as soil degradation, water pollution, and greenhouse gas emissions.

With the rising awareness about sustainable products for agricultural activities, several governments have started providing financial support to farmers, supplementing the market's growth. Rising government support for boosting the production of biofertilizers in order to enhance crop quality is considered to act as a significant driving factor for the development of the biofertilizers market.

In January 2023, Odisha University of Agriculture and Technology announced that it had started the production of biofertilizers to make them available for farmers in the state at the lowest cost. The university has received funding of 1.5 crores from the central government's Rashtriy Kisan Vikas Yojana (RKVY), the scheme by the Indian government focuses on developing biofertilizer firms/plants and boosting the production of biofertilizers.

Additionally, several governments are increasingly implementing regulations and policies to increase sustainability farming practices. As a result, farmers are turning to biofertilizers as an alternative, which is expected to drive the demand for biofertilizer products.

Biofertilizers Market Growth Factors

- Rising demand for organic food: With the growing demand for organic food, there is a strong emphasis on organic farming practices. This, in turn, boosts the demand for biofertilizers. Biofertilizers offer an opportunity to minimize the use of chemical fertilizers to enhance organic food production.

- Awareness about Health: As people are becoming conscious about their health, the demand for organic vegetables and fruits is rising, contributing to market expansion.

- Government Support: Rising government initiatives and support to promote organic farming drive the growth of the market.

Biofertilizers Market Scope:

| Report Coverage | Details |

| Market Size in 2025 | USD 1.59 Billion |

| Market Size by 2034 | USD 4.71 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.83% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, and By Crop Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Technological advancements

Technological advancements are driving the growth of the biofertilizer market by improving production methods, selecting more effective microbial strains, enabling precision agriculture, and developing new delivery systems like seed coatings. Advances in biotechnology have led to the development of new and improved production methods for biofertilizers. These methods are more efficient and cost-effective, which has led to increased production and availability of biofertilizers.

Advances in seed coating technology have led to the development of biofertilizers that can be applied directly to seeds. This allows the biofertilizers to be delivered directly to the roots of the plants, where they can be most effective.

As these technologies continue to advance, biofertilizers' effectiveness and availability will likely continue to improve, which will drive further growth of the biofertilizer market during the forecast period.

Restraint

Limited shelf life

Biofertilizers have a limited shelf life, and their effectiveness can diminish over time; they cannot be stored for a long time. If not stored correctly, biofertilizers may lose their effectiveness with time. The limited shelf life of biofertilizers can also create supply chain challenges for manufacturers and distributors.

Biofertilizers need to be stored and transported carefully to maintain their effectiveness, which can be difficult in remote or underdeveloped areas with limited infrastructure; this can limit the availability of biofertilizers in specific regions and make them less accessible to farmers and growers. The long-term storage issues of biofertilizers create limited market reach. Thus, the limited shelf life of biofertilizers acts as a restraint for the market's growth by limiting their adoption.

Opportunity

Increasing awareness about environmental sustainability

As people become more aware of the negative impact of chemical fertilizers on the environment and human health, the demand for organic food is increasing. Biofertilizers are a key component of organic farming, as they provide a natural and sustainable source of plant nutrients. This growing demand for organic food is expected to drive the demand for biofertilizers.

The trend towards using bio-based products is gaining popularity as consumers become more conscious of their environmental impact. Biofertilizers are bio-based products that offer a sustainable and environmentally friendly alternative to chemical fertilizers. This trend is expected to create opportunities for the biofertilizer market. Thus, a rising focus towards environmental sustainability opens a plethora of opportunities for market players to invest in the research and development of new products.

Type Insights

The nitrogen fixing segment held the dominating share of the global biofertilizers market. The segment's growth is attributed to the ability of nitrogen to improve plant growth, soil health, and sustainability. Moreover, biofertilizers containing nitrogen are comparatively cost-effective.

The rising focus on agricultural activities that include improving soil structure and soil moisture retention are fueling the demand for nitrogen fixing in the global biofertilizers market. Nitrogen fixation reduces the need for chemical fertilizers, which can be harmful to the environment and can lead to soil degradation and pollution. Increasing awareness about the side effects of chemical fertilizers will maintain the segment's dominance during the forecast period.

On the other hand, the phosphate solubilizing segment is expected to witness noticeable growth during the forecast period. Phosphorous acts as a critical ingredient for plant growth, as it offers a sustainable alternative to chemical fertilizers. Phosphorous can help to reduce the amount of phosphorus runoff and leaching into waterways. The rising demand for sustainable agricultural products across the globe will boost the demand for phosphorous compounds in biofertilizers by supplementing the segment's growth.

Application Insights

The seed treatment segment captured the largest market share in 2024; the agronomic benefits of biofertilizers to improve the nutritional values of seeds will maintain the dominance of the seed treatment application segment during the forecast period. Using biofertilizers for seed treatment is an effective and sustainable way to improve crop productivity and reduce the use of chemical fertilizers. Moreover, rising government regulations for reducing the utilization of chemical fertilizers to induce the nutritional value of seeds will fuel the demand for biofertilizers for seed treatment applications.

The soil treatment segment is expected to improve significantly during the forecast period; the rising focus on environmentally friendly ways to fertilize the soil by considering the increasing concerns of soil erosion will fuel the segment's growth. Moreover, rising agricultural activities that support healthier plant growth over the utilization of synthetic fertilizers will propel the development of the soil treatment segment.

Crop Type Insights

The cereals & grains segment held the largest share of the market in 2024; the enormous demand for cereals & grains across the globe is expected to maintain the growth of the cereals & grains segment during the forecast period. Moreover, the utilization of biofertilizers for cereals & grains promotes improved crop health and maintains soil fertility.

Cereals & grains are the most commonly consumed source of nutrition across the globe; the rapidly growing population and increasing demand for organic cereals and grains are propelling the segment's growth.

The oilseeds & pulses segment is considered to be the fastest-growing segment of the global biofertilizers market. Several governments promote the utilization of biofertilizers in the production of oilseeds; such initiatives by governments are predicted to boost the demand for biofertilizers for oilseeds & pulses.

For instance, the Indian government allows financial assistance at a 50% per ha subsidy for farmers to boost the production of oil seeds and palm trees by using biofertilizers and vermicompost under its National Mission on Oil Seeds and Oil Palm scheme.

Biofertilizers Market Companies

- CBF China Biofertilizer

- Novozymes A/S

- Agrilife

- Symborg SL

- Lallemand Inc

- Gujrat State Fertilizers & Co Ltd.

- IPL Biological

- Bioceres SA

- Americal Vanguard Corporation

Recent Developments

- In May 2024, Fresh Del Monte Produce Inc. partnered VellSam Materias Bioactivas to optimize the Fresh Del Monte's pineapple residues by means of biofertilizers.

- In August 2023, Bionema unveiled a new series of biofertilizers in the UK for use in agriculture, horticulture, forestry, sports turf, and amenities.

Segments Covered in the Report

By Type

- Nitrogen Fixing

- Phosphate Solubilizing

- Others

By Application

- Seed Treatment

- Soil Treatment

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting