What is the Precision Farming Market Size?

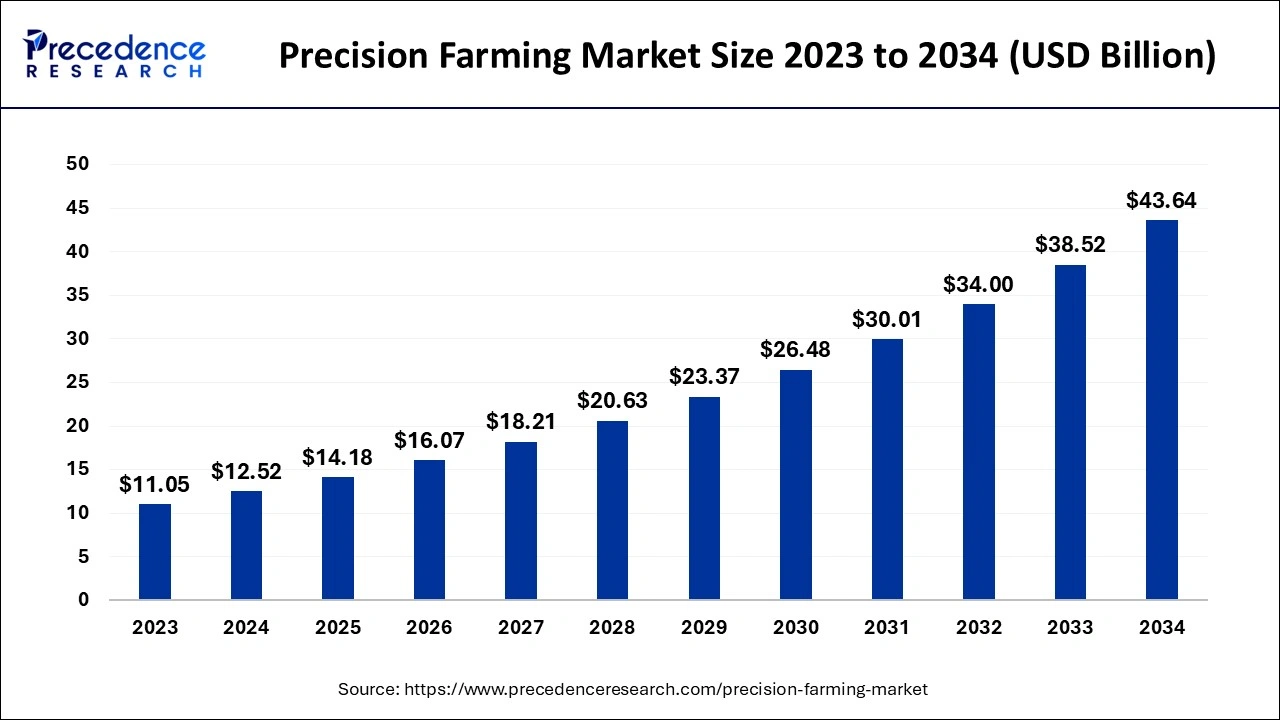

The global precision farming market size is calculated at USD 14.18 billion in 2025 and is predicted to increase from USD 16.07 billion in 2026 to approximately USD 48.36billion by 2035, expanding at a CAGR of 13.05% from 2026 to 2035. Precision farming is experiencing solid growth due to its ability to utilize resources efficiently, lower the manual workforce demand, and increase agricultural productivity.

Marlet Highlights

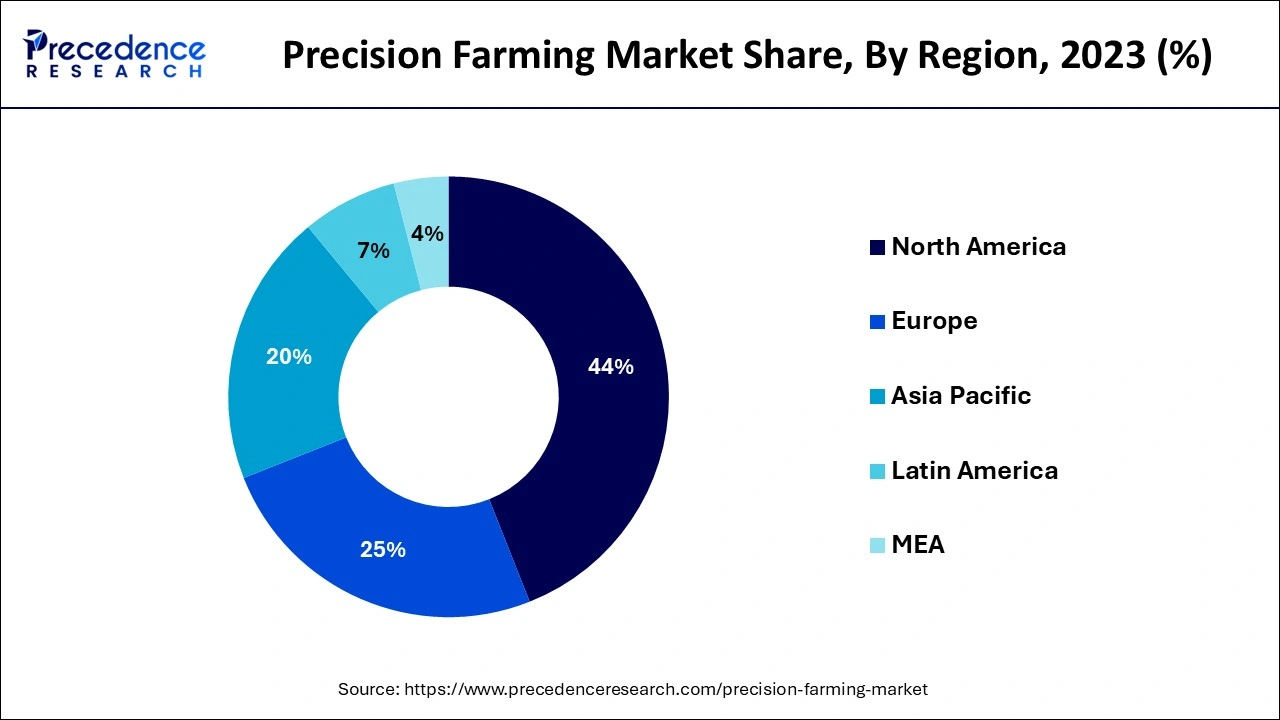

- North America region has accounted revenue share of around 44% in 2025.

- Europe region has captured revenue share of over 25% in 2025.

- The weather tracking and forecasting application segment is growing at a CAGR of 17.8% over the forecast period.

- By application, the yield monitoring segment has garnered market share of 45% in 2025.

- By technology, remote sensing and variable rate segment accounted 58% market share in 2025.

Market Size and Forecast

- Market Size in 2025: USD 14.18 Billion

- Market Size in 2026: USD 16.07 Billion

- Forecasted Market Size by 2035: USD 48.36Billion

- CAGR (2026 to 2035): 13.05%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

What is Precision Farming?

- IoT-Enabled Farm Management Systems: Centralized control platforms allow farmers to monitor machinery, weather, and field data in real-time.

- Artificial Intelligence in Crop Forecasting: AI models help forecast crop health and yields based on historic and real-time data patterns.

- Autonomous Tractors & Machinery: Driverless tractors with GPS and sensors are performing sowing, spraying, and harvesting with minimal human intervention.

- Blockchain in Supply Chain: Blockchain technology is being used for secure traceability of crops from farm to fork.

AI in the Market

Artificial Intelligence (AI) is now an indispensable player in the precision agriculture field, enabling sustainable practices through its effective interaction with humans in the decision-making process and resource usage, among others. It has the capability of analyzing the crop's health, soil condition, and weather using data from various sources, which makes timely irrigation and input application possible. AI is ushering in the future of agriculture through automation of farming processes, yield prediction, and the improvement of supply chain logistics, thus bringing in efficiency and profitability in agriculture.

Precision Farming MarketRecent Trends

- Farmers are increasingly using IoT devices, drones, GPS, and AI analytics to monitor crops, soil, and water usage more efficiently.

- Government incentives and sustainability policies in Europe are encouraging the adoption of precision agriculture technologies.

- Leasing and equipment-as-a-service models are making advanced tools accessible to smaller and medium-sized farms.

- Automation and robotics are helping address labor shortages and improve efficiency in farming operations.

- Farm-management software and analytics platforms are growing fast, helping farmers optimize yields and reduce input costs.

- Precision farming is expanding beyond large-scale farms to high-value crops and smaller holdings due to more affordable, targeted technologies.

- Drones equipped with multispectral and thermal sensors provide high-resolution aerial imaging for real-time crop health monitoring and targeted input applications, reducing waste and environmental impact.

- The industry is moving toward more standardized data formats and integrated platforms to ensure seamless communication between equipment and software from different manufacturers, enabling a more cohesive farm management ecosystem.

Precision Farming Market Growth Factors

Precision farming is gaining traction thanks to the growing adoption of the Internet of Things (IoT) and farmers' use of advanced analytics. Advanced analytics is a part of information science that utilization various instruments and methods to gauge information and assurance that the yield and soil are appropriately focused on. Farmers can more readily design their activities because of this data.

Precision farming practices are projected to see a boom in acceptance since they allow farmers to precisely regulate field fluctuations, boost productivity, and lower production costs. These methods aid in the gathering of relevant data by analyzing real-time data regarding soil, crop, and local weather forecasts, and give farmers practical insights. Precision farming is gaining popularity in the agriculture industry because it can boost crop productivity by utilizing innovative IT-based agriculture techniques.

The most important factors driving the growth of the precision agriculture market are the rapid adoption of advanced technologies in precision agriculture to lower labor costs and the increasing adoption of IoT devices. IoT in the fields of agriculture, significant cost savings associated with precision farming, a changing climate and the need to meet the growing demand for food, and the growing push for precision farming techniques by governments around the world. To gain a deeper understanding of different aspects of agriculture such as irrigation and tillage, various technologies such as IoT, GPS, and remote sensing application control are used. IoT helps farmers to solve various challenges related to proper crop monitoring. It provides real-time data on ambient temperature and soil water content through sensors placed on the farm, helping farmers make better decisions about harvest time, crop market rates planting, and land management. This is one of the key factors contributing to the growth of the precision agriculture market.

Different variables that work with the reception of manageable cultivating advancements incorporate better instruction and preparing for ranchers, effectively open data, accessibility of monetary assets, and popularity for natural food. The consumption of normal assets and decay of the climate are a portion of the elements liable for restricting yield creation. Developing ecological worries are empowering ranchers to move their concentration toward reasonable agribusiness rehearses, like the conservation of regular assets. This has driven the requirement for further developing harvest sustenance and assurance, thus supporting the market development.

Mechanical developments, for example, vertical cultivating with shrewd plans to augment yields and decrease squander, have unfurled various learning experiences. Besides, expanding interests in advancements like driverless farm trucks, direction frameworks, and GPS detecting frameworks are additionally expected to add to the development of the accuracy horticulture market size during the time of study. For example, various sensors like soil sensors, environment sensors, and water sensors are put around the fields to assist ranchers with observing their yields and gain constant data. Furthermore, these sensors likewise assist ranchers with getting a high return with less harvest wastage. These sensors are likewise profoundly embraced in various applications like farming, drug and medical care, auto, and sports.

However, the utilization of ranch the executives programming apparatuses and remote detecting could prompt higher reception post-COVID-19 period. Organizations have previously started zeroing in additional on remote stages to empower constant decision-production for crop wellbeing observing, yield checking, water system booking, field planning, and reaping the board.

For many operations, the agriculture business was heavily reliant on laborers; but, thanks to technological improvements, laborers are being replaced by automation, allowing industry players to achieve more production in less time. Farmers can cover a larger area of their fields in less time and with greater efficiency thanks to the deployment of new technologies. Precision farming is an advanced farming approach that uses cutting-edge technology to help farmers enhance production while lowering labor expenses. Smart sensors, GPS, GNSS, auto-steering and guiding technology, and variable rate technology (VRT) are some of the most common technologies used in precision farming.

The smartphone is one of the most widely used technological innovations in history, and with the proliferation of user-friendly agricultural programs (apps), cell phones are growing into powerful and portable tools for farmers. The majority of smartphone apps is inexpensive and provide useful farming information such as weather and climatic conditions. These apps are effective in assisting farmers in making informed decisions. Smartphones can be used in conjunction with several hardware devices, such as sensors, high-resolution cameras, and GPS receivers, to accomplish activities including sample collection, aerial photography, and record-keeping (a task recommended by experts). Using software tools, certain agricultural apps may input field data and grid it acre by acre.

The precision farming made by these organizations is bought by a few partners for different applications. Coronavirus not just affected the activities of the different precision farming producers' organizations, yet additionally impacted the organizations of their providers and distributors. The fall in sending out shipments and slow homegrown interest for precision farming in contrast with pre-COVID-19 levels is likewise expected to adversely affect and somewhat deteriorate the interest for precision farming at present moment. The key organizations working in this market have likewise seen the effect of the pandemic in their request admissions during the primary portion of 2020.

- The use of IoT devices along with data analytics is the greatest contributor to real-time data collection, which in turn improves the management of the field.

- The application of precision farming techniques results in the saving of resources, the use of inputs at optimum levels, and an overall increase in productivity, which eventually translates into higher profits for the farmers.

- The government's backing of smart agriculture and eco-friendly practices is one of the reasons why these technologies are being adopted so fast.

- Technical improvements such as GPS-guided tractors and AI-powered tools are among the factors that raise both the efficiency of operations and the quantity of the crop.

- The public's increasing concern for nature is the driving force behind the demand for sustainable agricultural practices, which are mainly based on precision farming.

Latest Updates on Precision Farming Market in 2025

The Adoption of Robotic Harvesters

Robotic harvesters are becoming crucial in precision farming due to?automated harvesting process, improved efficiency, and reduced post-harvest losses.?These robots use advanced vision systems and AI to identify ripe produce, resulting in minimized damage during harvesting and assurance that crops are harvested at peak ripeness.?They also address labor shortages and improve quality by reducing post-harvest losses that makes them a valuable tool for modern agriculture.?Robotic harvesters can harvest crops at a speed and precision which is difficult to sort of difficult for manual labor. Robots, equipped with gentle handling mechanisms reduce post-harvest losses occurred due to manual harvesting and ensure a higher quality of produce reaches the consumer.?

Penetration of Edge Computing

Edge computing in precision farming?is done by processing data from sensors, drones, and other devices on-site.?This enables real-time decision-making and optimized resource management which ultimately leads to increased efficiency and sustainability.?It also enables local storage and processing, improves efficiency, and reduces reliance on cloud services.

Trade Analysis of Precision Farming Market

- As per the Global data, there were 101,257 shipments of agricultural equipment and Parts of Agriculture Machinery that the world imported.

- Shipments were made to 4,873 international buyers, which means there was a large participation in trade across the borders.

- In the first position is the U.S. with 39,197 shipments, while Ukraine is coming in second with 11,205 shipments.

- Kazakhstan is placed third in the importers' ranking with 10,716 shipments of agricultural equipment and Parts of Machinery.

Market Outlook

- Industry Growth Overview: The precision farming market is expanding rapidly, driven by the need to maximize resource use and boost crop productivity. Farmers can monitor fields and make data-driven decisions with the aid of technologies like GPS sensors, drones, and IoT-enabled systems. Worldwide, both large-scale and smallholder farms are increasing their adoption.

- Sustainability Trends:By using less water, fertilizer, and pesticides, precision farming encourages sustainable agriculture. It enhances farm productivity, lessens its negative effects on the environment, and improves soil health. For environmentally friendly crop management, businesses are also creating intelligent systems that incorporate analytics and AI.

- Startup Ecosystem: AI-powered tools for self-driving equipment and sensor-based precision agriculture solutions are all being developed by startups. To offer scalable, high-accuracy solutions, many work with agri-tech companies and academic institutions. Specialty crops and small farms are examples of niche applications that emerging players are concentrating on.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 14.18 Billion |

| Market Size in 2026 | USD 16.07 Billion |

| Market Size by 2035 | USD 48.36Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Application, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Offerings Insights

Hardware had the greatest revenue share in 2024, and it is estimated to continue to dominate the market during the projected period. The hardware segment includes automation and control systems, sensing devices, antennas, and access points. Hardware components such as automation and control systems, sensing devices, and drones are all important in supporting farmers. Growers, for example, benefit greatly from the GIS guidance system since it can visualize agricultural workflows and the environment. Furthermore, VRT technology assists farmers in identifying areas where additional pesticides and seeds are needed, allowing them to be applied uniformly across the field.

There are two types of precision farming software: web-based and cloud-based. Cloud computing is based on the usage of shared networks, servers, and storage devices, which eliminates the high expenses of maintaining hardware and software infrastructure. As a result, during the projection period, the software category is estimated to grow at a remarkable CAGR. Predictive analytics software guides crop rotation, soil management, ideal planting seasons, and harvesting timings.

Technology Insights

Variable-rate application (VRA), yield monitoring, farm labor management systems, crop scouting, soil monitoring, weather tracking, forecasting, and field mapping are some of the uses in the precision farming sector. Field applications, map-based VRA, lime VRA, fertilizer VRA, sensor-based VRA, pesticide VRA, phosphorus VRA, nitrogen VRA, and seeding VRA are all examples of variable rate application (VRA). Off-farm field monitoring and on-farm yield monitoring are both parts of yield monitoring. Soil monitoring, on the other hand, comprises moisture and nutrient monitoring; field mapping, on the other hand, includes boundary and drainage mapping. Due to its numerous uses and high acceptance rate, variable rate application (VRA) leads the precision farming industry in the applications category.

Due to the widespread usage of GPS and GNSS systems, high-precision positioning systems held a significant share of over 28% of the precision farming market in 2022. These technologies are commonly used to identify and process data based on location. Furthermore, precision agricultural technologies use GPS to improve process efficiency and eliminate wasteful spending on agrochemicals, fuel, and seeds. The technology, in conjunction with farm management software, can be used for inter-vehicle communication and automated record keeping in addition to the spatial data provided by GPS.

Application Insights

The yield monitoring segment was the largest revenue holder in 2024 and is likely to maintain its dominance during the projection period as it assists farmers in making field decisions. Farmers can use on-farm yield monitoring to get real-time data during harvest and develop a historical-geographical database. Because it provides equitable landlord negotiations, proof of environmental compliance, and track records for food safety, this segment is predicted to account for the highest proportion of the precision farming market.

Regional Insights

What is the U.S. Precision Farming Market Size?

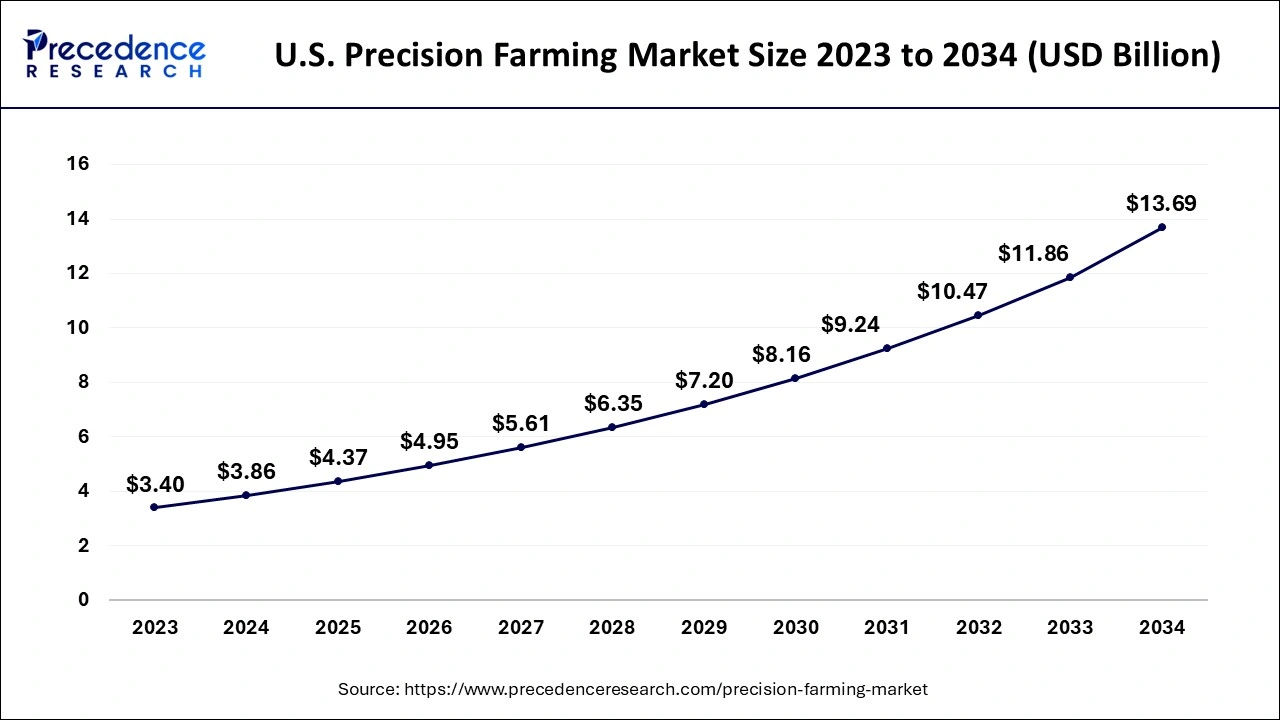

The U.S. precision farming market size is evaluated at USD 4.37 billion in 2025 and is predicted to be worth around USD 15.23 billion by 2035, rising at a CAGR of 13.30% from 2026 to 2035.

In 2024, North America had the highest revenue share holder. The region is a technology, early adopter. Increased government activities to assist the adoption of modern agriculture technologies, as well as enhanced infrastructure, have all contributed to the area market's high revenue. To raise awareness among farmers, the National Institute of Food and Agriculture (NIFA), which is part of the United States Department of Agriculture, runs geospatial, sensor, and precision technology projects. In conjunction with Land-Grand universities, NIFA aids farmers in developing robust sensors, accompanying software, and tools for modelling, monitoring, and assessing a wide range of complex biological materials and processes. Furthermore, the Canadian government-funded $425,000 to Clean Seed Capital Group in November 2016 to help in improves market precision farming technology. The goal of this investment is to reduce the excessive use of fertilizers and pesticides. With the help of these funds, the company has also developed the CX6 SMART seed drill for farmers.

How is North America leading in the Precision Farming Market?

North America is the region with the highest precision farming market share, mainly because of the rapid and wide adoption of technology, strong digital infrastructure, and government initiatives, where the latter is the least that can be said. The application of sophisticated tools such as GPS, sensors, and data-driven systems could lead to huge improvements in farming. The emphasis on automation, sustainability, and innovation of the region keeps the farmers accepting precision agriculture methods across all big commercial farms.

United States Precision Farming Market Trends

With its well-established agri-tech companies and a strong research base, the U.S. is at the forefront of precision farming innovations. GPS-guided tractors and harvesting machines, AI, and data analytics facilitate the entire process of crop management in a productive manner. Government incentives that allow the use of technological means and the modernization of farms are a part of the market that is being pushed even harder now. Even though the investment costs are really high, precision technologies do offer long-term benefits in terms of productivity and sustainability.

The U.S. is the dominating North American country in precision farming due to strong and technologically advanced agriculture sector and the government's support to promote precision farming through multiple initiatives. The U.S. is home to multiple precision farming giants in the region such as John Deere, AGCO Corp., Raven Industries, AgJunction LLC, AgEagle Aerial Systems Inc, Ag Leader Technology, and Trimble. The U.S. is a significant exporter of precision farming equipment and the top agriculture export destinations Mexico, Canada, and China.

Canada is experiencing a notable growth in the precision farming market due to its economic advantages, sustainability, and offering of better outcomes. Economic advantages include the efficient use of fertilizers, pesticides, and water, leading to reduced input costs. Precision farming helps achieve sustainability by reducing the over-application of inputs and optimizing resource use.?Canada does export farming equipment primarily to the US, but also exports agricultural goods to other countries such as China, Netherlands, United Kingdom, and Japan, among others.?

From 2025 to 2034, the precision farming market in the Asia Pacific is predicted to develop at the fastest rate. A major element driving the growth of the regional precision farming market is the increasing modernization of agriculture in countries like China, India, and Indonesia. The demand for precision farming equipment is increasing as population growth in the region's emerging countries puts pressure on the agriculture industry to boost output. Many government initiatives are carried out in developing countries such as India, Sri Lanka, and Nigeria to encourage the deployment of modern precision farming technologies, thereby maximizing yields. China and Israel signed a US$300 million trade agreement in September 2017 to facilitate the export of Israeli eco-friendly technologies to China. Furthermore, an effective administrative framework also allows farmers to gain complete knowledge about the proper use and maintenance of precision farming equipment.

China is the dominating country from Asia Pacific in the precision farming market due to the requirement to feed large population with suitable area, government's initiation to promote the market, and development in agriculture technology sector. Precision farming an attractive option for China as it has vast population, rapidly growing economy, need for reducing waste, and maximizing yields. Precision farming helps optimize resource usage in areas with limited arable land and water resources in China.?China is a significant exporter of precision farming equipment while United States, Russia, Vietnam, Philippines, and Thailand are the major export destinations of the region.

South Korea is also in the race to adopt precision farming due to region's small farm sizes, focus on sustainability, and government support. Most farms in South Korea are small, and precision farming technologies can help optimize resource use and reduce labor costs on these small farms as they often struggle with finding and retaining workers for small farms. Government and local entities are establishing centers of excellence to provide farmers with knowledge and information on soil properties, fertility, and nutrient levels and also encouraging the use of precision farming techniques.

What are the driving factors of the Precision Farming Market in Europe?

Europe is the place where the precision farming sector is primarily influenced by the need for greater sustainability and by the growing digitalization of agriculture. The policy support given through agricultural modernization programs greatly increases the technological adoption among the farmers. The combination of environment-friendly practices, effective input management, and sophisticated digital tools aids in meeting the regulatory requirements and, at the same time, in raising the yield and operating efficiency in the whole region.

Germany Precision Farming Market Trends

Germany is at the forefront of precision agriculture in Europe due to its innovation, research collaborations, and high-quality equipment manufacturing. Strong institutional support, modern infrastructure, and the incorporation of digital technology in farmers' operations are among the main advantages the farmers get from the country's agriculture. The country's focus on sustainable, data-rich agriculture and state funding for initiatives in the smart sector keeps the market vibrant and pushes technological progress.

How is Asia-Pacific performing in the Precision Farming Market?

The Asia-Pacific region is gradually becoming the largest market for precision agriculture because of population growth, less land for agriculture, and the need for more food. Governments are actively supporting the adoption of smart agriculture and the use of digital technologies to improve both productivity and eco-friendliness. The integration of technology into irrigation, crop monitoring, and soil management is aiding the establishment of efficient farming practices and is encouraging more farmers with a progressive mindset to adopt it.

China Precision Farming Market Trends:

China is the regional frontrunner in precision agriculture primarily because of its tax incentives and quick application of new technologies. The use of IoT, drones, and AI-based data analytics not only conserves resources but also boosts yields. The modernization of agriculture continues to be backed by regular investments, and the government's commitment to food security is gradually making precision agriculture practices more widespread throughout the country.

Value Chain Analysis of the Precision Farming Market

- Harvesting and Post-Harvest Handling: First, the crops are collected, then they are sorted, cleaned, and graded to maintain their quality and minimize the amount of waste.

Key Players: John Deere, AGCO (Precision Planting), Trimble, Raven Industries - Storage and Cold Chain Logistics: The process of storing and transporting products that are kept at low temperatures, which is necessary to maintain the quality of these perishable agricultural items.

Key players: Snowman Logistics, Lineage Logistics, Americold, Maersk - Processing and Packaging: The sale of raw materials, transforming them into the manufacturing of consumable products, and packaging them for protection and market acceptance.

Key Players: Intello Labs, Bühler Group, Heat and Control, TOMRA - Export and Trade Compliance: Following international norms, certifications, and traceability standards for overseas trade.

Key Players: Maersk, Kuehne+Nagel, SGS, Bureau Veritas

Precision Farming Market Companies

- AG DNA: The company offers farm management software that leverages data analytics and predictive modeling for the optimization of resource application and decision making.

- AG Junction: It supplies precision guidance along with automated steering solutions, which result in higher machinery efficiency, operator accuracy, and reduced input use.

- AG Leader Technology: It provides the tools for yield monitoring, seed placement, digital water management, and many more, with the integrated displays and software for seamless data collection and analysis.

Other Major Key Players

- AGCO Corporation

- Agribotix

- Bayer CropScience AG

- Case IH Agriculture

- ClearAg Operations

- Conservis Corporation

- Deere & Company

Recent Developments

- In February 2025, BASF Digital Farming launched its "Xarvio Field Manager for Fruits & Veggies" precision farming tool, extending its digital agronomy platform to fresh produce growers in Southern Europe. (Source: https://www.fruitnet.com)

- In Mar 2025, Syngenta Group announced the launch of "Cropwise AI", a generative‑AI precision agriculture system designed to optimise input‑use, seed placement, and yield prediction, planned for rollout in Europe.

(Source: https://www.syngentagroup.com)

Segments Covered in the Report

By Offering

- Hardware

- Automation and Control Systems

- Displays

- Guidance and Steering Systems

- GPS/GNSS Devices

- Drones/UAVs

- Irrigation controllers

- Handheld Mobile Devices/Handheld Computers

- Flow And Application Control Devices

- Others

- Sensing and Monitoring Devices

- Yield Monitors

- Soil Sensors

- Moisture Sensors

- Temperature Sensors

- Nutrient Sensors

- Water Sensors

- Climate Sensors

- Automation and Control Systems

- Software

-

- Local/Web-Based

- Cloud-Based

-

- Services

-

- System Integration and Consulting Services

- Managed Services

- Connectivity Services

- Assisted Professional Services

- Maintenance and Support Services

-

By Application

- Yield Monitoring

- Crop Scouting

- Field Mapping

- Variable Rate Application

- Precision Irrigation

- Precision Seeding

- Precision Fertilization

- Nitrogen VRA

- Phosphorous VRA

- Lime VRA

- Pesticide VRA

- Weather Tracking and Forecasting

- Inventory Management

- Farm Labor Management

- Financial Management

- Others

By Technology

- Precision Farming Guidance System

- Remote Sensing Precision Farming

- Variable-Rate Technology Precision Farming

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting