What is the Farming As a Service Market Size?

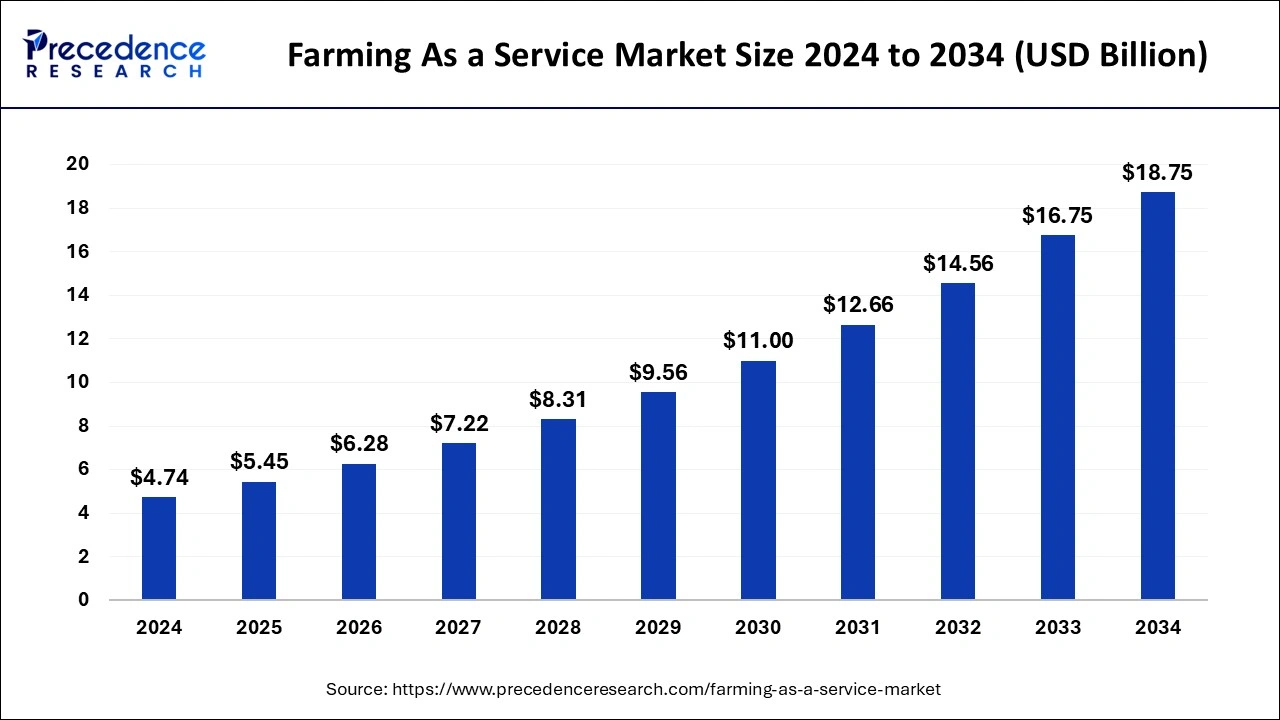

The global farming as a service market size is calculated at USD 5.45 billion in 2025 and is predicted to increase from USD 6.28 billion in 2026 to approximately USD 20.38 billion by 2035, expanding at a CAGR of 14.38% from 2026 to 2035.

Farming As a Service MarketKey Takeaways

- In terms of revenue, the global farming as a service market was valued at USD 5.45billion in 2025.

- It is projected to reach USD 20.38billion by 2035.

- The market is expected to grow at a CAGR of 14.38% from 2026 to 2035.

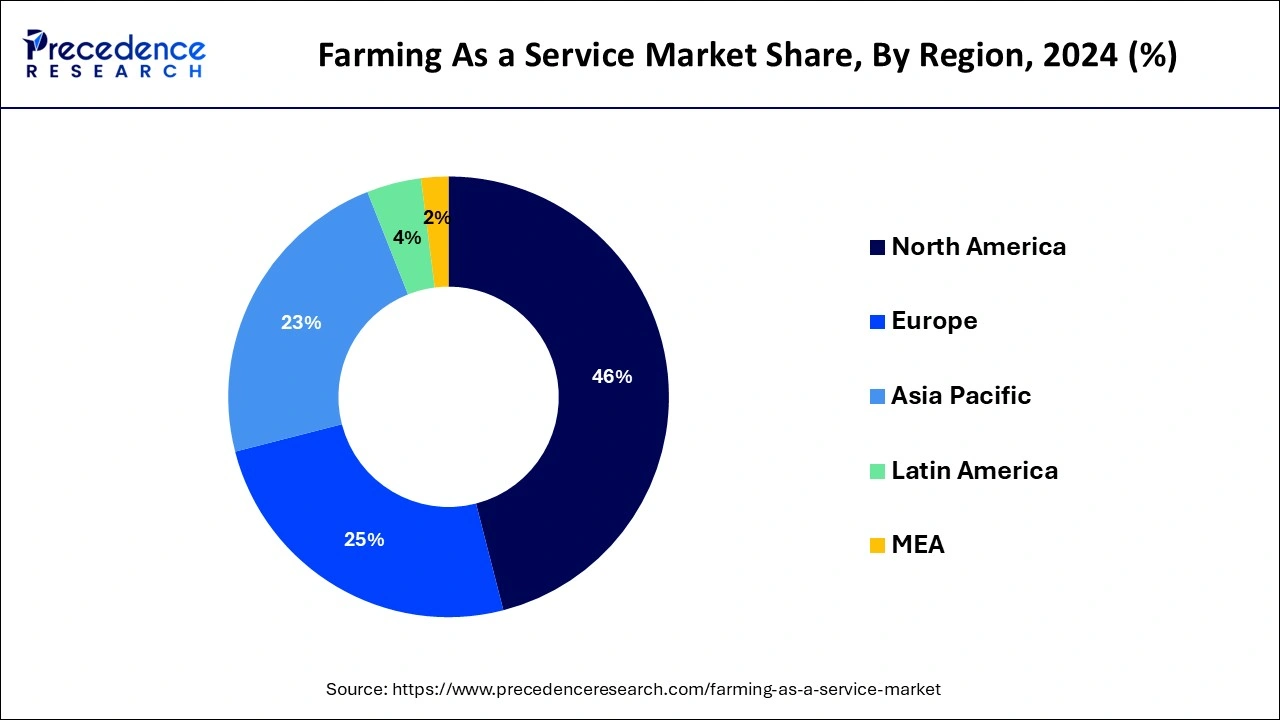

- North America dominated the market with the largest share of 46% in 2025.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By service, the farm management solution segment held the largest share of the market in 2025.

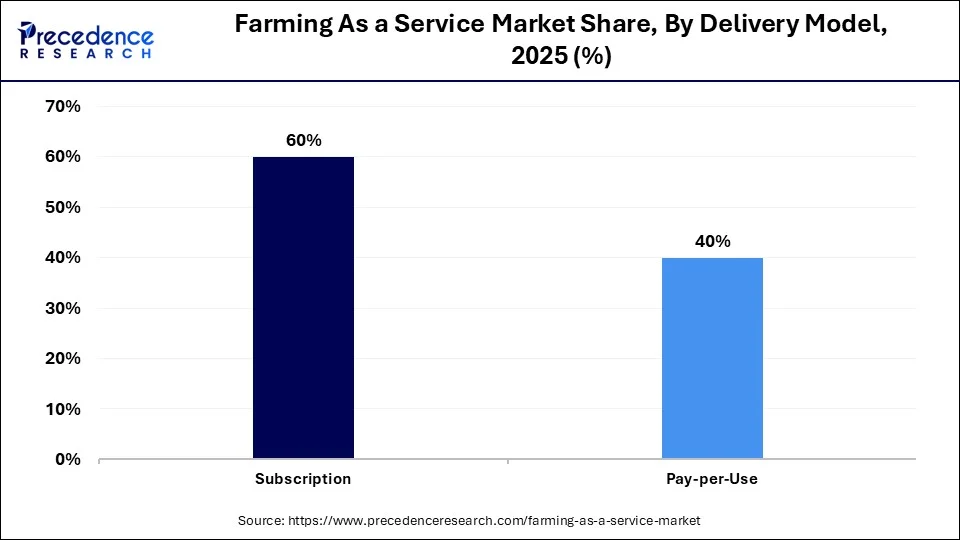

- By delivery model, the subscription delivery segment held the largest share of 60% in 2025.

- By delivery model, the access to market segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By end use, the farmers segment led the market with the largest share of 31% in 2025.

Market Overview

The concept known as ‘Farming as a Service' (FaaS) involves offering farmers agricultural services on a subscription or pay-per-use basis. This is frequently accomplished using digital platforms or technologically advanced solutions. The farming as a service market includes a variety of offerings to enhance agricultural output, effectiveness, and sustainability by combining knowledge and technology. This covers services like predictive analytics, drone-based aerial imagery, soil analysis, crop monitoring, precision agriculture, and farm management software. FaaS companies give farmers access to cutting-edge agricultural technologies and knowledge without requiring them to make significant upfront expenditures in infrastructure or equipment. These solutions are customized to meet the unique needs of farmers.

Due to regional variations in farm sizes, agricultural techniques, IT infrastructure, and regulatory frameworks, FaaS adoption varies. While emerging economies in Asia-Pacific and Latin America are also seeing significant potential, developed regions like North America and Europe are leading the way in the adoption of FaaS. It is anticipated that the farming as a service market will expand further as farmers come to understand the advantages of implementing digital technologies to enhance sustainability and streamline their operations. For small-scale farmers, the initial setup expenditures for putting FaaS solutions into practice, including hardware and software, can be unaffordable. Some farmers may find it challenging to integrate FaaS solutions with the workflows and farm management systems that are currently in place.

Artificial Intelligence: The Next Growth Catalyst in Farming as a Service

AI is significantly impacting the farming as a service industry by driving efficiency and precision in agricultural operations. It enables advanced data analytics, utilizing machine learning algorithms to process vast amounts of data from sensors, drones, and satellite imagery, leading to precise decisions regarding irrigation, fertilization, and pest control. This shift toward precision agriculture helps optimize resource allocation, reducing waste and improving yields for farmers who might otherwise lack the capital for such technology.

Farming As a Service MarketGrowth Factors

- The growth of the farming as a service market is significantly driven by the adoption of FaaS. The rapid improvements in agricultural technologies, such as drones, the Internet of Things (IoT), artificial intelligence (AI), and precision farming, aid in the widespread preference of FaaS.

- Small and medium-sized farmers who might need more funds to buy machinery altogether are drawn to this economic strategy. Farmers can access costly machinery and equipment through agriculture as a service, eliminating significant upfront costs. Thus driving the market's growth.

- FaaS providers frequently give solutions that encourage sustainable farming practices in response to the growing concerns about environmental sustainability and the need to lessen the environmental impact of agriculture.

- FaaS appeals to a broad spectrum of farmers, from tiny family farms to major agribusinesses, because of its scalability. These models are scalable and flexible, enabling farmers to modify the degree of services they need in response to many factors, including their operation's size, demand patterns throughout key seasons, or unique agricultural requirements.

- The farming as a service market may expand as a result of government programs that assist rural development, boost farm productivity, and encourage sustainable agriculture. Farmers might be encouraged to embrace FaaS solutions through grants, subsidies, and advantageous policies.

- FaaS platforms use AI and data analytics to give farmers insightful information about market trends, crop health, soil conditions, and weather patterns. A rising number of people are looking for cutting-edge, technologically advanced farming solutions as the average age of farmers rises and younger generations join the field.

Market Outlook

- Market Growth Overview: The farming as a service market is expected to grow significantly between 2025 and 2034, driven by the rising use of IoT sensors, drones, GPS, AI, and robotics for data-driven farming, reducing capital investment for farmers, and addressing global food demand fuel the market growth.

- Sustainability Trends: Sustainability trends involve precision agriculture and resource optimization, regenerative practices, and circular economy and agroecology.

- Major Investors: Major investors in the market include Accel Partners, IDG Ventures, Aavishkaar, IvyCap Ventures, John Deere, Mahindra & Mahindra, IBM, and Accenture.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 14.38% |

| Market Size in 2025 | USD 5.45 Billion |

| Market Size in 2026 | USD 6.28 Billion |

| Market Size by 2035 | USD 20.38 Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Services, By Delivery Model, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Enhanced sustainability

Using sensors, drones, IoT devices, satellite imagery, and other precision agriculture tools to monitor crop health, soil moisture, and nutrient levels lessens waste and its negative effects on the environment by enabling the targeted deployment of resources and promoting the use of regenerative farming techniques such as agroforestry, crop rotation, cover crops, and less tillage. These methods lessen erosion and nutrient runoff, increase biodiversity, improve soil health, and sequester carbon.

It is encouraging the use of climate-resilient agricultural varieties, such as heat- or drought-tolerant ones, that need less inputs and are more tolerant of shifting climatic circumstances and putting into practice methods that increase resource efficiency, such as integrated pest control plans, energy-efficient equipment, and irrigation systems that use less water. Such requirements for enhanced sustainability promise a significant driver for farming as a service market.

Restraint

Data privacy and security concerns

FaaS platforms can gather personal data about farmers, including contact information, financial data, and data relevant to their farms. This data could be abused or accessed by unauthorized individuals. Ransomware and other malicious software can compromise data availability and integrity by infecting FaaS systems. This might have severe repercussions for farmers who depend on these platforms to make crucial decisions. FaaS technology supply chains include several partners and vendors, each of whom could be a weak point in cybersecurity. Farmers must evaluate the security protocols of all parties participating in the FaaS ecosystem. Such data privacy and security concerns act as restraint for farming as a service market.

Opportunity

Supply chain optimization

To precisely predict demand, one can use machine learning algorithms and data analytics to make sure that resources are deployed effectively and optimize production schedules by having a thorough awareness of seasonal fluctuations, market trends, and client preferences. Inventory management systems help monitor supplies, machinery, and final goods through the supply chain. These technologies can reduce carrying expenses, avoid waste, and have fewer stockouts by keeping your inventory levels at ideal levels. They also reduce lead times and transportation expenses by streamlining routes and modes of conveyance. FaaS uses technologies such as GPS tracking and route optimization software to increase fleet visibility and efficiency.

Segment Insights

Service Insights

The farm management solutions segment held the largest share of farming as a service market in 2025. They are monitoring crops, soil conditions, weather patterns, and insect infestations with the use of sensors, drones, satellite imaging, and other IoT devices. Farmers can use this information to make well-informed decisions about pest management, fertilization, and irrigation. Software applications that help farmers with crop rotation planning, crop selection that is appropriate for their land, and scheduling of plantings are some of the facilities provided by the farming as a service market.

Additionally, these tools could offer suggestions for the ideal planting spacing and density. They are keeping track of the quantities of pesticides, fertilizers, seeds, and other inputs in stock. This makes it easier for farmers to make sure they have the goods they need on hand and can place new orders quickly. Financial analysis, tracking, and budgeting tools assist farmers in making strategic financial decisions. This may include elements like forecasting tools, profit and loss accounts, and cost analysis by acre or hectare.

They are keeping an eye on the use and maintenance plans of agricultural machinery like harvesters, tractors, and irrigation systems. This prolongs the life of machinery, reduces downtime, and maximizes equipment use. They are helping farmers adhere to laws about labor management, environmental preservation, and food safety. Creating reports for governmental organizations, accrediting authorities, and other stakeholders may fall under this category.

Numerous farm management solutions come with mobile apps that let farmers access important information and carry out necessary chores while they're out in the field. This increases overall efficiency and permits decision-making in real time. Compatibility with additional technology, software, and data sources for agriculture. This facilitates the consolidation of data from many sources and optimizes farming operations.

Delivery Model Insights

The subscription delivery model held the largest share of the farming as a service market in 2025, the subscription delivery model is a business strategy where farmers pay a subscription fee to access farming technology or specific agricultural services on a recurrent basis. With this arrangement, farmers may access the most recent agricultural technologies, knowledge, and resources without having to make a substantial initial investment in infrastructure or equipment. FaaS companies offer a range of subscription plans designed to meet the requirements of farms of varying sizes and sorts. Access to services like precision farming, soil analysis, crop monitoring, pest control, irrigation management, equipment leasing, and even professional agronomists or agricultural consultants may be provided under these programs.

To use the services offered by their selected subscription plan, farmers must pay a regular membership cost, usually once a month or once a year. Various factors, like the size of the farm, the level of service, and the length of the subscription, may affect the fee structure. Farmers who subscribe to the FaaS provider's services get access to cutting-edge farming technologies, software platforms, and tools.

Drones, sensors, satellite imaging, data analytics software, IoT gadgets, and other digital farming solutions targeted at enhancing agricultural productivity, efficiency, and sustainability may be among these technologies. Because of the scalability and flexibility of the subscription model, farmers can modify their programs to accommodate shifting crop varieties, seasonal demands, or farm requirements.

End-use Insights

The farmers segment held the largest share of the farming as a service market in 2025. This group includes a diverse spectrum of farmers engaged in crop farming, livestock breeding, aquaculture, and horticulture, among other agricultural activities. Farmers who use FaaS services can be primary commercial agricultural operations or tiny, family-run farms. The extent of operations and the financial means at the farmers' disposal can influence the adoption of FaaS solutions. This group of farmers demonstrates differing degrees of digital literacy and technology usage.

While some farmers may be early adopters of cutting-edge agricultural technologies, others would need assistance and training to incorporate FaaS solutions into their farming operations. Geographically diversified, the farmer's segment in the farming as a service market is global, including many areas and climates.

Farmers are looking more and more for FaaS solutions to increase productivity, lower input costs, lessen their impact on the environment, and improve agriculture's sustainability. To meet these needs, FaaS providers provide services like predictive maintenance, livestock management, soil monitoring, precision farming, and crop analytics. By using FaaS services, farmers may access real-time data, analytics, and insights that help them make wise decisions and manage their farm operations proactively.

With FaaS services, farmers can access cutting-edge agricultural technologies and knowledge without having to make a sizable upfront investment. These services are often provided on a subscription or pay-per-use basis. To supply comprehensive solutions suited to farmers' needs, FaaS providers frequently work with agritech startups, government agencies, research organizations, and manufacturers of agricultural equipment.

Regional Insights

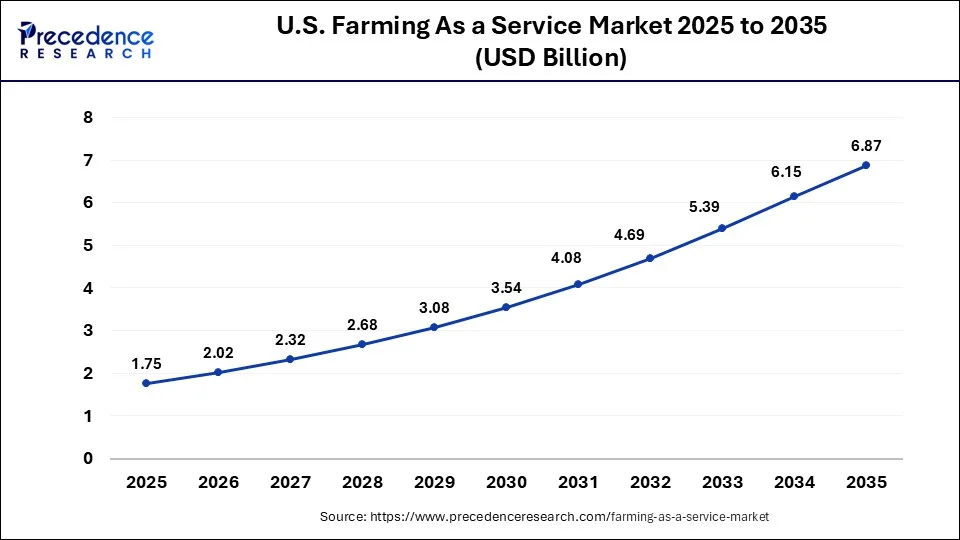

What is the U.S. Farming As a Service Market Size?

The U.S. farming as a service market size was valued at USD 1.75 billion in 2025 and is anticipated to reach USD 6.87 billion by 2035, growing at a CAGR of 14.65% from 2026 to 2035.

North America held the largest share of 46% in 2025. Farmers in this region were among the first to embrace agricultural technology because they saw how digital solutions might boost productivity, sustainability, and efficiency. The emergence of precision agriculture, facilitated by technological advancements like GPS, drones, sensors, and data analytics, has afforded service providers with prospects to deliver customized services such as yield monitoring, variable rate input application, and precision planting.

Due to a workforce scarcity in North America's agriculture industry, automation and mechanization are required. To overcome these obstacles, FaaS providers can provide services like robotic harvesting and autonomous machinery operation. Farmers are better equipped to manage their crops, allocate resources, and reduce risk when they have access to real-time data and analytics.

U.S. Farming as a Service Market Trends

The U.S.'s rapid adoption of IoT sensors, AI, machine learning, and the rising outsourcing of tasks such as soil preparation, planning, and harvesting to specialized providers, along with the growing demand for sustainable practices and resource conservation, fuels the need for FaaS, with companies offering services for regenerative agriculture.

Asia Pacific is expected to witness significant growth in the farming as a service market during the forecast period. The adoption of technology has advanced quickly in the region, especially in nations like China, India, and Japan. This includes the pervasive use of internet-connected cellphones, IoT devices, and smartphones, all of which can be used in agricultural methods. Several regional governments are encouraging the use of technology in agriculture to solve issues related to food security, lessen the effects of climate change, and enhance rural livelihoods.

The expansion of FaaS providers may be encouraged by this support. Agriculture faces enormous problems from environmental deterioration and climate change. To reduce their adverse environmental effects, farmers can use FaaS to assist them in implementing more sustainable practices like precision irrigation and soil health monitoring.

India Farming as a Service Market Trends

India's increasing adoption of AI, IoT, drones, and data analytics for precision farming, rising demand for sustainable practices and data-driven methods to farm output and reduce waste, and a shift towards a service model, and supporting government initiatives, such as the digital agriculture mission and Agri-tech infrastructure fund.

How Did Europe Experience Notable Growth in the Farming as a Services Market?

Europe is transforming agriculture from a capital-intensive ownership model into a flexible, data-driven services industry. Increasing adoption of FaaS to meet strict sustainability mandates and quality for-eco-scheme subsidies drives the market growth.

Germany Farming as a Service Market Trends

Germany's shifting expensive robotics and AI-driven analytics to on-demand models, farmers are reducing capital risks while leveraging IoT and GPS data to meet rigorous environmental mandates. This transformation is bolstered by strategic initiatives like the BMEL's "SAMSON" project, which provides the technical infrastructure necessary for real-time, remote farm management.

Farming As a Service Market Companies

- Accenture advises agri-businesses on technology adoption and digital strategy, helping them implement cloud, IoT, and AI solutions to deliver scalable Farming as a Service (FaaS) platforms.

John Deere contributes to FaaS through its connected fleet of smart machinery and the John Deere Operations Center, a digital platform that collects machine and field data for analysis and decision-making. - AGCO Corporation supports FaaS by integrating technology into its equipment brands (e.g., Fendt, Valtra) and providing a digital ecosystem through its AGCO ONE platform for farm management and data exchange.

- Trimble provides robust hardware and software solutions, including GPS guidance, steering systems, and the Trimble Ag Software, which help farmers manage field data, optimize inputs, and streamline workflows.

- Ag Junction specializes in guidance and steering systems for precision agriculture, developing components and solutions that allow for precise application of inputs.

- PrecisionHawk, a leading drone technology and data analytics company, contributes to FaaS by using aerial imagery and AI analysis to provide actionable intelligence on crop health, yield optimization, and field conditions.

Other Major Key Players

- AgEagle

- ITC

- Farmers Edge Inc

Recent Developments

- In March 2022, the Ministry of Agriculture and Farmers Welfare announced the government's intention to release a super app for farmers that will combine several digital platforms and available mobile apps. Farmers would benefit from the consolidation by having more accessible access to information on services offered, government programs, advisories for various agro-climatic zones, weather and market updates, and the most recent research and development all under one roof.

- In July 2022, ITC Limited announced the launch of ITCMAARS (Meta Market for Advanced Agricultural Rural Access to Markets), a full-stack agritech app aimed at strengthening the company's agri-business vertical.

Segment Covered in the Report

By Services

- Farm Management Solutions

- Production Assistance

- Access to Markets

By Delivery Model

- Subscription

- Pay-per-Use

By End Use

- Farmers

- Government

- Corporate

- Financial Institutions

- Advisory bodies

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting