Agrivoltaics Market Size and Forecast 2025 to 2034

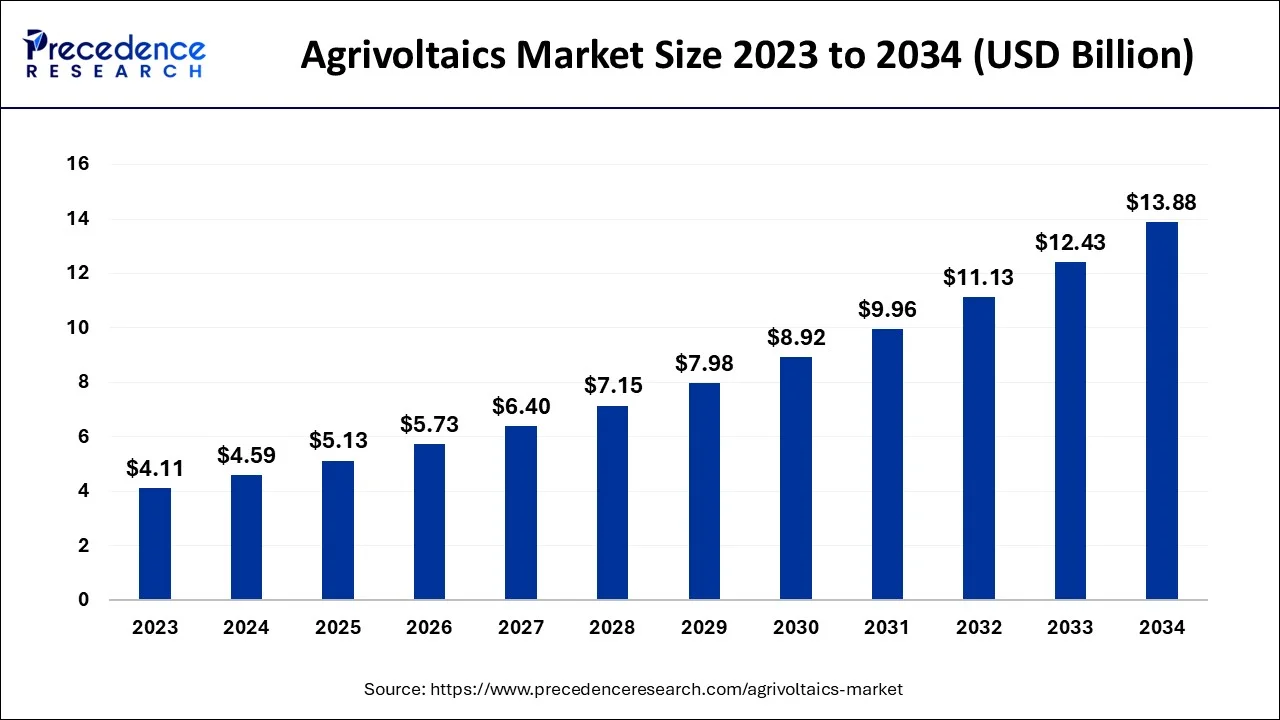

The global agrivoltaics market size was estimated at USD 4.59 billion in 2024 and is anticipated to reach around USD 13.88 billion by 2034, expanding at a CAGR of 11.70% from 2025 to 2034.

Agrivoltaics Market Key Takeaways

- In terms of revenue, the global agrivoltaics market was valued at USD 4.59 billion in 2024.

- It is projected to reach USD 13.88 billion by 2034.

- The market is expected to grow at a CAGR of 11.70% from 2025 to 2034.

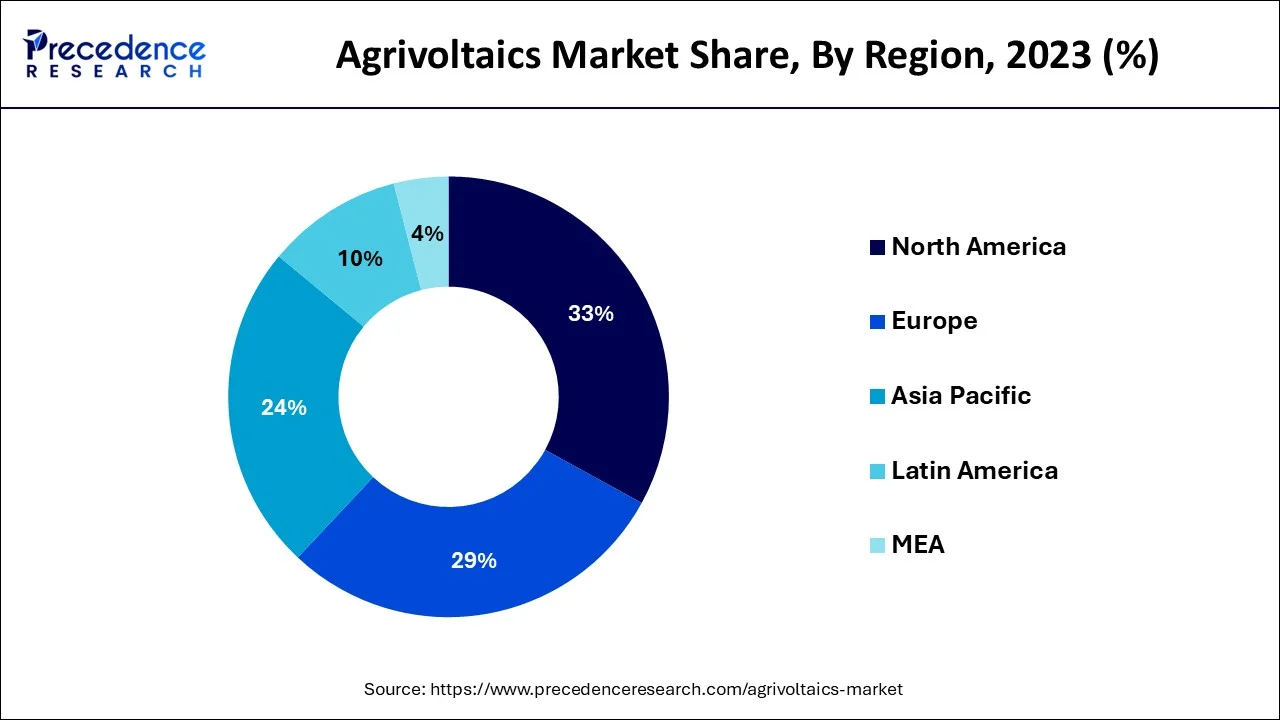

- North America dominated the agrivoltaics market with the largest market share of 33% in 2024.

- By system type, the fixed agrivoltaic systems segment dominated the market with a 38.20% share in 2024.

- By system type, the dynamic/movable agrivoltaic systems segment is expected to grow at the highest CAGR of 11.60% in 2024.

- By solar technology type, the monocrystalline silicon PV modules segment held a 42.70% market share in 2024.

- By solar technology type, the perovskite PV (pilot & research stage) segment is expected to grow at the highest CAGR of 15.40% in 2024.

- By mounting technology, the fixed tilt mounting segment led the market by holding 36.80% share in 2024.

- By mounting technology, the dual-axis sun-tracking systems segment is expected to grow at the highest CAGR of 12.20% in 2024.

- By ownership, the farmer-owned systems segment held a 41.50% market share in 2024.

- By ownership, the utility–agrivoltaic partnerships segment is expected to grow at the highest CAGR of 11.00% in 2024.

AI in the Market

Agrivoltaics are being revolutionized by Artificial Intelligence with a simultaneous emphasis on increasing efficiency and sustainability. Solar panel positions are dynamically adjusted for maximum energy generation and crop growth. Using the AI system, soil, weather, and crop health data analysis is done for efficient use of all resources. Predictive analytics enable officers to forecast yields and energy output for better planning, thus reducing risks. Automated processes perform several manual tasks while simultaneously cutting costs. The AI monitors grid stability, making sure that energy delivery corresponds with the requirements of the local demand. Predictive maintenance saves the agricultural and solar systems from being down for a long time. Thus, AI brings about scalability and cost-effectiveness to the agrivoltaic systems and makes it attractive for large-scale commercialization.

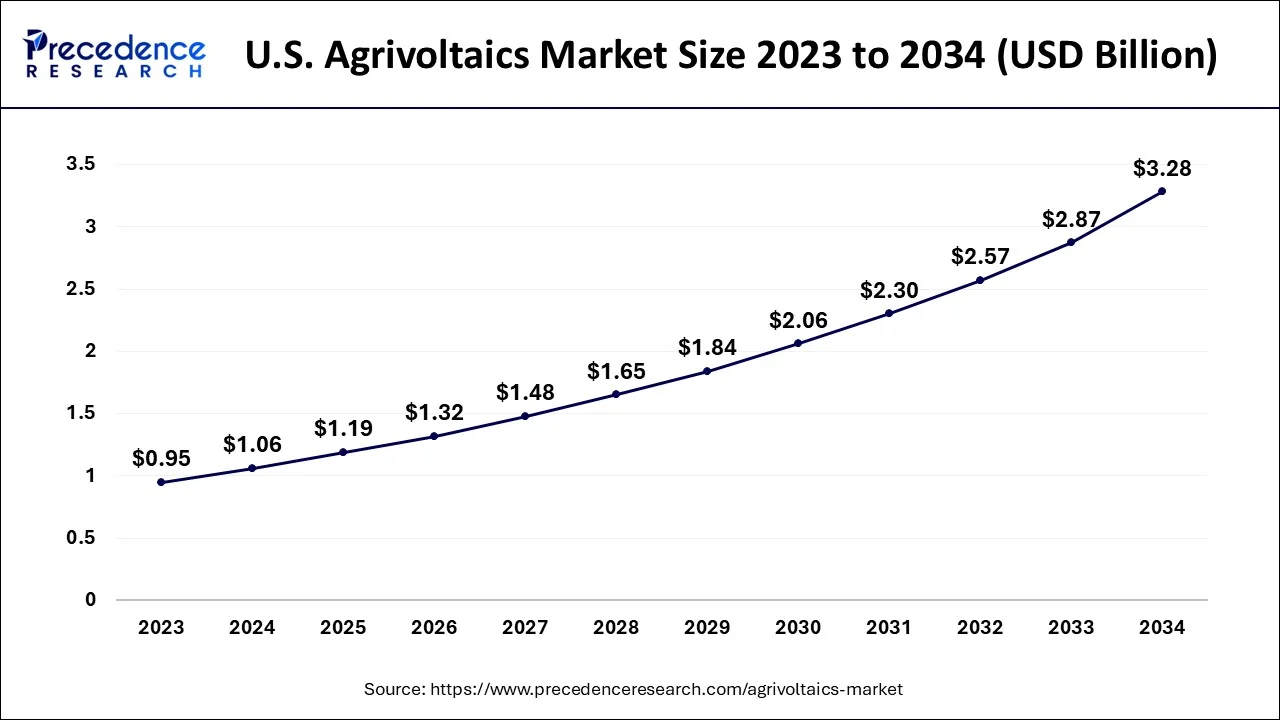

U.S. Agrivoltaics Market Size and Growth 2025 to 2034

The U.S. agrivoltaics market size was evaluated at USD 1.06 billion in 2024 and is predicted to be worth around USD 3.28 billion by 2034, rising at a CAGR of 11.96% from 2025 to 2034.

On the basis of geography, the region of North America has acquired the largest market share resulting from the huge number of technological interventions in agricultural techniques. Additionally, the presence of advanced agricultural machinery and equipment in this region has helped the agrivoltaics market to a great extent.

Asia Pacific Market Trends

Asia Pacific is the fastest growing market for the agrivoltaics market with a significant CAGR during the forecast period, fueled by the increasing demand for sustainable agriculture and renewable energy. Nations such as China, India, and Japan are actively encouraging the use of agrivoltaic systems to enhance land utilization and boost energy efficiency. The area benefits from government support, rising energy demands, and limited land availability, particularly in rural regions. Both pilot projects and large-scale implementations are being embraced to promote dual land use, enhancing energy security and agricultural productivity. Strong governmental backing, investments in research and development, and climate-resilient agricultural models are crucial factors driving market growth in the agrivoltaics sector across the Asia Pacific.

India

India is swiftly developing its agrivoltaics sector, bolstered by government initiatives and the necessity to optimize agricultural land. Experimental projects in states such as Maharashtra and Gujarat are showcasing the compatibility of solar panels with crop cultivation. The Indian government is advocating for dual-use solar farming to elevate farmers' income while increasing renewable energy production. As rural electrification objectives grow, agrivoltaics provides a sustainable, land-efficient option tailored to India's agricultural landscape.

Europe Market Trends

Europe is observed to grow at a considerable growth rate in the upcoming period, capitalizing on ambitious renewable energy targets and sustainable farming regulations. Countries like France and Germany are incorporating solar technology in agriculture to achieve carbon neutrality goals. Initiatives funded by the EU and innovation grants are accelerating the adoption of these systems, particularly in areas with limited land and those facing drought concerns. Farmers are increasingly utilizing photovoltaic panels for crops that tolerate shade, resulting in enhanced land productivity. Europe's commitment to climate-smart agriculture and a circular economy is transitioning agrivoltaics from pilot projects to mainstream applications, underpinned by clear regulatory structures and energy transition directives.

France

France is emerging as a leader in agrivoltaics within Europe, supported by national policies favoring dual land use. The French government is promoting agrisolar installations on vineyards and agricultural land, merging renewable energy production with farming. Initiatives such as Ombrea and Sun'Agri are pioneering demonstrations of crop protection and yield improvement through solar technology integration. With a focus on climate resilience, France is aligning agrivoltaics with its comprehensive sustainable agriculture and decarbonization strategies.

Market Overview

Agrivoltaics is a system that involves the simultaneous use of land for agricultural production as well as for photovoltaic production. A growing global population, limited arable land, and growing energy demand are booming the size of the agri-electricity market. In addition, a significant increase in food production is expected due to the increasing food demand of the people during the forecast period. Increased food production advancement and reduced water usage for farming combined with justifiable energy generation and additional income from photovoltaic panels are the key factors supporting the growth of the market.

Furthermore, the increased need to focus on recent climate change as well as humanity crises with agrivoltaics solutions is anticipated to endure the rising food production demand, reduced water consumption in agriculture and augmented efficiency of electricity production. Thus, the above-mentioned factors are expected to fuel the demand for agrivoltaics market during the forecasted period owing to the increased advantages of agrivoltaics. Approximately 100,000 households require over 48 hectares of the farmland area in terms of power requirement. The cost of the solar panel is expected to decrease in the upcoming period all across the globe, that also includes the overall expenses of installation cost of agrivoltaics systems. Thus, the above-mentioned factors are anticipated to boost the overall growth of the agrivoltaics market during the forecast period owing to the increased need of addressing the strategic planning for tackling the climate change.

Additionally, farmlands have shown the fastest growth owing to the huge adoption of sustainable farming techniques which require reduced water usage and decreased wastage of natural resources. The favorable reimbursements by government and increased dependence on farmlands for efficient crop production are anticipated to witness a significant growth in forecast period. Furthermore, Solar power is currently being used for agricultural technologies majorly by the energy sector. The rapid increase in solar power generation is expected to observe the increased global investment. Solar energy observed the increase of 50% increase in its market share of the overall global electricity generation capacity. This is expected to surpass the growth due to the gas, wind, and other renewable technologies. Since 2008, the cost of solar photovoltaic panels makes up the mainstream league of the capital expense in solar systems that utilize technology, which has decreased by 80% over the span of years. Manufacturing competition and innovation have been accelerated, especially the Chinese manufacturers have witnessed a dramatic increase in their market share.

Agrivoltaics Market Growth Factors

Agrivoltaics is the combination of crops and solar or photovoltaic panels on the farmland. Agrivoltaics includes plantation of crops with the photovoltaic panels which are installed on specific height to allow passage of agriculture machinery such as tractor trailer, harvester, leveler and others. The dynamic agrivoltaic segment is a production system which is controlled according to the physiological requirements of crops. The system includes designing the dedicated structure as well as specific software development to manage the complete system of photovoltaic panels placed above the crop plantation. The increased environmental benefits, growing financial convenience to farmers in terms of passive income has also emerged as major growth factors for agrivoltaics market.

- Rising awareness for application and adoption of agrivoltaic system

- Growing features and advantages of agrivoltaic integration withing farmlands

- Reduced prices of agrivoltaic system components

- Increased customer satisfaction due to the increased profit levels

- Enhanced strategic analysis and implementation of government initiatives for generations of profits

- Rising investments in several research and development programs

- Improved quantitative and qualitative measures of such agrivoltaic systems.

- Greater awareness leads to somewhat greater adoption, where farmers see the return benefits of growing and selling produce and energy.

- Cost reduction over time in system components is leading to a higher-gear integration, thus attractive financially.

- Due to several supportive government initiatives and policies, the initiative is promoted for sustainable farming and renewable energy production.

- R&D investments lead to the designs to evolve and become more efficient, with optimization in the crop-energy balance.

- With the emphasis on sustainability and profitability, farmer satisfaction is increased in terms of yield and passive income.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 4.59 Billion |

| Market Size in 2025 | USD 5.13 billion |

| Market Size by 2034 | USD 13.88 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 11.70% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | System Design, Crop Type, Placement, Material Type, Cell Type, Crop Collaboration, Type of Agrivoltaic Plant, Type of Solar Panel, Power Output, and Geography |

Market Dynamics

Key Market Drivers

- Rising innovative farming techniques - The growing population, increased dependence on agriculture for food demand and rising expenditures on modern farming equipment are the major drivers of innovative farming techniques which are expected to boost the agrivoltaics market to a great extent.

- Growing demand for the efficient cultivation equipment - The need to adopt efficient cultivation machinery due to increased climate change, reduced availability of resources such as water and land as well a shift in the preference of consumers for sustainable farming are key drivers that accelerate the demand for efficient farming equipment.

- Improved balance between energy production and agriculture - The necessity to efficiently utilize scarce natural resources, decrease the greenhouse gas emissions, reduction of energy costs fosters the balance between agriculture and energy production through adoption of agrivoltaic systems.

Key Market Challenges

- Lack of agrivoltaics system awareness - The advanced farming equipment introduced by key market players into the market are expensive as compared to the ordinary machineries available in market. This makes it problematic for the farmers to integrate such advanced technologies which restrains the growth of the market during the projected period. Additionally, the lower disposable income of farmers also hinders the growth of the market to a great degree.

- Lack of skilled workforce - Expensiveness of cutting-edge farming equipment and the shortage of skilled workforce in the healthcare system has hampered the growth of the market to a great extent. Additionally, the loss of confidence among farmers as well as lack of awareness among agriculture which hinders the growth of the market tremendously.

- High installation cost of the agrivoltaics system - The difficult access to the funds and initiatives required for the installation of expensive agrivoltaics system is the major factor which hampers the growth of agrivoltaics especially in low-disposable countries.

Key Market Opportunities

- Emerging underdeveloped countries - The increased demand of latest healthcare facilities among the population in the developing nations such as Brazil, India and China are anticipated to boost the market for agrivoltaics. Rising acceptance of advanced equipment and technologies among the people has driven significantly the growth of market to record a profitable revenue over the period of time.

- The rising government initiatives - The active participation of government of multiple countries to improve the medical facilities that are provided to their residents. The government initiatives may include the use of high-quality equipment and agricultural compensations that facilitate easy adoption of agrivoltaics. Additionally, the health insurance companies provide enhanced reimbursement facilities to consumers to encourage the use of advanced agricultural equipment.

- Increasing investment by major market players - Extensive research and development programs which are conducted by the leading market players that aids in the introduction of new and advanced agricultural materials into the market to increase the need among the potential consumers has created lucrative opportunities for the growth of the agrivoltaics market during the forecast period. The increased investments by leading firms encourage the development and usage of advanced agricultural techniques and equipment that aids in the growth of the agrivoltaics market to a great extent.

Value Chain Analysis

- Harvesting and Post-Harvest Handling

Agrivoltaics refers to harvesting crops from lands shared by the agricultural and solar energy systems, followed by a set of operations to maintain their quality, conditioning, and eventual sale in the market.

Key players: SunSeed Pvt. Ltd., Soham Agro

- Storage and Cold Chain Logistics

Storage and cold chain logistics for agrivoltaic serve to organize the utilization of solar energy generated from agrivoltaic systems for power supply to on-site temperature-controlled storage facilities for agricultural products.

Key players: AgroMerchant, Americold, and Lineage Logistics

- Processing and Packaging

After processing and packaging in agrivoltaics, solar power generated on-site is used to operate equipment for various operations of post-harvesting that add value to agricultural products and ensure more energy independence and profitability of the farm.

Key players: JA Solar and Suntech Power

- Distribution to Wholesalers/Retailers

Distribution to wholesalers and retailers under agrivoltaics involves two quite separate supply chains: one being the distribution of agricultural produce, and the other being the distribution of electricity.

Key players: Waaree Energies and Avaada Group

- Export and Trade Compliance

Export and trade compliance for agrivoltaics entails navigating relevant regulations for both the high-tech solar equipment and the agricultural products grown beneath them.

Key players: Directorate General of Foreign Trade, French Agency for Ecological Transition

System Type Insights

The fixed agrivoltaic systems segment dominated the market with a 38.20% share in 2024. Factors such as the installation of firm solar panels as usual systems on agricultural greenhouse fields present under or above field crops are contributing to the growth of the segment. Furthermore, fixed panels also help to optimize the installation process by adjusting the density of the solar panels or the degree of tilt of the solar panels.

The dynamic/movable agrivoltaic systems segment is expected to grow at the highest CAGR of 11.60% in 2024. The growth of the segment can be credited to the growing land productivity, along with the improved water conservation from optimized shading. Also, dynamic shading minimizes the soil moisture evaporation, which leads to significant savings in water and improved crop health.

Solar Technology Type Insights

The monocrystalline silicon PV modules segment held a 42.70% market share in 2024. The dominance of the segment can be linked to its superior efficiency and reliability, coupled with the cost-effectiveness as compared to other alternatives. In addition,monocrysalline panels are very efficient because of their pure, single-crystal structure, which enables better sunlight absorption.

The perovskite PV (pilot & research stage) segment is expected to grow at the highest CAGR of 15.40% in 2024. The growth of the segment can be driven by its ability to produce high-efficiency and low-cost materials, which leads to enhancements in tandem solar cells and BIPV applications. Combining perovskite layers with other materials can achieve higher efficiencies.

Mounting Technology Insights

The fixed tilt mounting segment led the market by holding 36.80% share in 2024. The dominance of the segment can be attributed to the rapid innovations in solar technology that increase efficiency and reduce costs. Moreover, government policies like tax credits, feed-in tariffs, and subsidies offer financial incentives that fuel investment in agrivoltaic systems, especially fixed-tilt installations.

The dual-axis sun-tracking systems segment is expected to grow at the highest CAGR of 12.20% in 2024. The growth of the segment can be credited to the growing global demand for clean energy and sustainable agriculture. Furthermore,dual-axis trackers offer high energy output by optimizing the alignment of solar panels with the sun's path, which will impact positive segment growth soon.

Ownership Insights

The farmer-owned systems segment held a 41.50% market share in 2024. The dominance of the segment can be linked to the diversification of farmer income and ongoing enhancements in technology. Additionally,farmer-owned solar panels create on-site electricity for farm operations, like cold storage and irrigation, minimizing dependence on expensive power grade or diesel generators.

The utility–agrivoltaic partnerships segment is expected to grow at the highest CAGR of 11.00% in 2024. The growth of the segment can be driven by rising global demand for renewable energy sources to minimize dependence on fossil fuels and tackle climate change, which makes agrivoltaics an attractive alternative for sustainable agriculture and energy generation.

Agrivoltaics Market Top Companies

- Agrivoltaic Solution LLC

- Sun Agri

- REM TEC

- Enel Green Power

- Boralex

- BayWa AG

- TotalEnergies SE

- Mackin Energy

- Sunrise Power Solutions

- Suntech Power Holdings

Recent Developments

- In August 2025, Lightstar Renewables launched the Plains Road Agrivoltaics project, integrating solar energy with agricultural production on DiMartino Farm in Montgomery, New York, in consultation with SolAg.

https://igrownews.com/lightstar-renewables-latest-news/ - In April 2025, Trinasolar and Lodestone Energy are partnering to operate Te Herenga o Te R?, New Zealand's largest agrivoltaics farm, delivering clean, renewable energy while maintaining agricultural use.

https://solarquarter.com/2025/04/05/trinasolar-and-lodestone-team-up-to-launch-new-agrivoltaics-solar-project-in-new-zealand/

Segments Covered in the Report

By System Type: (US$ Billion & MW Installed)

- Fixed Agrivoltaic Systems

- Dynamic / Movable Agrivoltaic Systems

- Single-Axis Tracking

- Dual-Axis Tracking

- Floating Agrivoltaics

- Reservoir-Based

- Canal-Top PV Systems

- Vertical Agrivoltaic Systems

- Agrovoltaic Shades / Tents

- Hybrid Agrivoltaic Structures

By Solar Technology Type:

- Monocrystalline Silicon PV Modules

- Polycrystalline Silicon PV Modules

- Thin Film PV Modules

- Cadmium Telluride (CdTe)

- Copper Indium Gallium Selenide (CIGS)

- Bifacial PV Modules

- Semi-Transparent Solar Panels

- Organic Photovoltaics (Emerging)

- Perovskite PV (Pilot & Research Stage)

By Mounting Technology:

- Fixed Tilt Mounting

- Manual Adjustable Mounting

- Motorized Single-Axis Tracking

- Dual-Axis Sun-Tracking Systems

- Retractable/Sliding Panel Systems

- Vertical Panel Mounts (east-west orientation)

By Ownership / Business Model:

- Farmer-Owned Systems

- Third-Party Developer-Owned

- Utility–Agrivoltaic Partnerships

- Co-operative / Community-Owned Models

By Installed Capacity Range:

- Below 100 kW

- 100 kW – 1 MW

- 1 MW – 10 MW

- Above 10 MW

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting