What is the Aircraft Curtains Market Size?

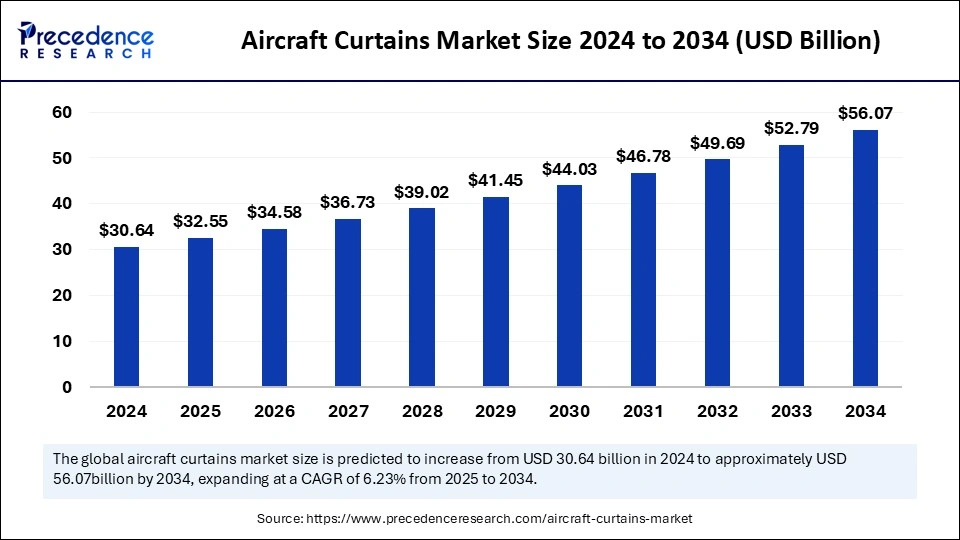

The global aircraft curtains market size is estimated at USD 32.55 billion in 2025 and is predicted to increase from USD 34.58 billion in 2026 to approximately USD 56.07 billion by 2034, expanding at a CAGR of 6.23% from 2025 to 2034. The growth of the aircraft curtains market is driven by the increased air travel and a focus on passenger comfort and experience.

Aircraft Curtains Market Key Takeaways

- North America dominated the aircraft curtains market in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By material, the polyester segment held the largest market share in 2024.

- By material, the nylon segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By type, the trimmable curtains segment contributed the biggest market share in 2024.

- By type, the full-shade curtains segment is expected to expand at a notable CAGR over the projected period.

- By aircraft type, the commercial aircraft segment captured the largest market share in 2024.

- By aircraft type, the cargo aircraft segment is projected to witness notable growth over the forecast period.

- By end-use, the new aircraft manufacturing segment generated the highest market share in 2024.

- By end-use, the aircraft retrofit and refurbishment segment is projected to witness a notable growth in the coming years.

Market Overview

The aircraft curtains market is shaped by a multitude of interconnected factors that drive its continuous evolution. At the forefront, airlines are prioritizing crafting an enjoyable and comfortable cabin environment for passengers. Curtains serve a crucial function in this regard, providing privacy, regulating natural light, and contributing significantly to the overall aesthetic of the cabin space. This focus on enhancing the passenger experience fuels the demand for curtains that are not only of high quality but also visually appealing and effectively functional. Furthermore, aircraft interiors directly reflect an airline's brand identity, with curtains acting as a key element in creating a cohesive and recognizable atmosphere. This differentiation is increasingly achieved through customization and personalization options, allowing airlines to tailor their cabin interiors to align with specific branding strategies.

Additionally, it is vital for aircraft interiors, including curtains, to adhere to stringent safety regulations from aviation authorities, particularly concerning fire resistance. As such, manufacturers are tasked with producing curtains that meet these critical safety standards while still offering the desired aesthetic and functional qualities. Advancements in material science play a pivotal role in the sustained growth of this market, with manufacturers persistently innovating to develop new materials that are lighter, more durable, and fire-resistant.

Artificial Intelligence (AI) Impact on the Aircraft Curtains Market

The integration of artificial intelligence is profoundly transforming the aviation sector, particularly influencing the aircraft interiors market, which encompasses the aircraft curtains segment. AI technology is capable of analyzing vast amounts of passenger data, enabling airlines to discern specific preferences and behaviors. This valuable insight can lead to the creation of highly tailored cabin environments that resonate with individual passengers. For instance, airlines may adjust the design and selection of aircraft curtains, varying colors, patterns, or materials based on detailed analyses of passenger demographics, flight routes, and even seasonal trends. Moreover, advancements in material science driven by AI are paving the way for the development of innovative and cutting-edge materials. These new materials are not only lightweight and durable but also exhibit enhanced fire resistance and aesthetic appeal, thus improving the overall quality of curtain fabrics used inaircraft.

AI-powered automation is further streamlining manufacturing processes, which can substantially lower production costs while simultaneously enhancing the quality and performance of aircraft curtains. In addition to manufacturing improvements, AI can optimize the layout and design of cabin features, including the strategic placement of curtains. This optimization aims to maximize passenger comfort and effective use of space. Furthermore, AI may play a role in simulating airflow dynamics within the cabin, allowing for the design of curtains that contribute positively to climate control and air purification.

Market Outlook

- Industry Growth Overview: The aircraft curtains market is expected to grow rapidly from 2025 to 2034, driven by rising commercial aircraft production, demand for premium cabin interiors, fleet modernization, and a focus on passenger privacy and comfort. Advances in lightweight, fire-retardant materials and increased retrofit activities further support market growth.

- Global Expansion:The market is expanding worldwide as airlines focus on upgrading cabin interiors and enhancing passenger privacy. Consumers worldwide also demand premium travel experiences. Growing commercial aviation fleets, increasing air travel demand, and ongoing retrofit programs across emerging regions further boost market growth.

- Major Investors:Major investors in the aircraft curtains market include aircraft interior manufacturers, aerospace component suppliers, airline fleet modernization programs, and private equity firms supporting cabin refurbishment companies. Increasing investments are focused on lightweight materials, premium cabin solutions, and retrofit opportunities across both commercial and business aircraft fleets.

- Startup Ecosystem:The startup ecosystem in the market is expanding, with emerging companies focusing on lightweight fire-retardant fabrics, customizable cabin partitions, and eco-friendly textile solutions. Startups partner with OEMs and MROs to provide innovative privacy, soundproofing, and premium cabin enhancement products for new aircraft and retrofit projects.

Aircraft Curtains Market Growth Factors

- Increase in Air Travel: The surge in commercial air travel directly correlates with an increased demand for aircraft interiors, including curtains. The consistent expansion of airline fleets, driven by new aircraft deliveries and modernizing existing fleets, significantly contributes to the growth of the aircraft curtains market.

- Emphasis on Passenger Comfort: Airlines increasingly prioritize enhancing passenger comfort. Aircraft curtains contribute greatly to creating a tranquil and visually appealing cabin environment, with their ability to provide necessary privacy, reduce noise, and control light levels being crucial for overall passenger satisfaction.

- Cabin Upgrades and Refurbishments: As an effective strategy for improving existing fleets, airline operators often opt for cabin upgrades rather than purchasing entirely new aircraft. These upgrades typically include the modernization of cabin interiors, which drives demand for new and enhanced aircraft curtains.

- Demand for Aesthetic and Customization: Airlines focus on stylish and functional interior designs to distinguish their services in a competitive market. There is an increasingly prominent trend toward customization and personalized options in aircraft curtains, enabling airlines to craft unique and memorable cabin environments that align with their brand identity.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 56.07 Billion |

| Market Size in 2026 | USD 34.58 Billion |

| Market Size in 2025 | USD 32.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Type, Aircraft Type, End-use and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Focus on Improving Passenger Experience

Airlines are increasingly prioritizing passenger comfort by enhancing the quality of their premium cabin environments. A critical component in achieving this comfort is aircraft curtains, which serve multiple purposes they provide privacy and control over light levels while also contributing to the overall aesthetic appeal of the cabin. This commitment to improving customer satisfaction is a significant driver of growth in the industry. The rise in the number of air travelers, coupled with the expansion of airline fleets, is directly propelling demand for various aircraft interior components, not least of which are high-quality curtains. Airlines routinely invest in upgrading and refurbishing their aircraft interiors, thereby maintaining a steady demand for new and replacement curtain options. These curtains help enhance the overall cabin design and can be tailored to reflect an airline's brand identity, with customization and personalized options increasingly sought after by airlines aiming to differentiate themselves in a competitive market.

Restraint

Stringent Regulations

Aircraft interiors must adhere to rigorous safety regulations, particularly concerning fire resistance, which can pose significant challenges and increase costs for manufacturers. The procurement of high-quality materials that meet compliance standards can create a financial burden, particularly for airlines with limited budgets. Additionally, fluctuations in the prices of raw materials and potential disruptions in supply chains can adversely affect both production capabilities and material availability. As competition intensifies, companies must continuously innovate while effectively managing their costs.

Opportunity

Sustainability Trends

The aviation industry's heightened focus on sustainable practices presents manufacturers with the chance to create eco-friendly curtain materials. There is a notable demand for customized curtain designs that resonate with specific airline branding and cater to passengers' preferences. Innovating curtain solutions that improve functionality and elevate passenger comfort is a promising avenue for growth. Furthermore, the rising demand for air travel in emerging markets signifies substantial expansion opportunities for the aircraft curtains sector.

Segmental Insights

Material Insights

The polyester segment dominated the aircraft curtains market with the largest share in 2024. This is mainly due to its exceptional durability, lightweight properties, and resistance to wrinkling. This combination makes polyester a favored choice for aircraft curtains, as it effectively meets the demanding requirements of the aviation industry. The selection of materials for these curtains is influenced by several critical factors, including fire resistance, overall longevity, weight considerations, and aesthetic appeal.

The nylon segment is projected to be the fastest-growing segment in the coming years. Its inherent strength and elasticity render it particularly valuable for various applications. The rising focus on sustainable practices can support the segment's growth since nylon can be recycled.

Type Insights

The trimmable curtains segment led the aircraft curtains market in 2024. This is mainly due to their versatility in accommodating diverse aircraft interior layouts. These curtains can be tailored to any specific design requirements, ensuring a perfect fit that complements the overall cabin theme. The demand for trimmable curtains is closely linked to evolving cabin layout trends and the heightened focus on providing a premium travel experience.

The full-shade curtains segment is anticipated to be the fastest-growing segment during the forecast period. These curtains excel at blocking out light, which significantly boosts passenger comfort by fostering a serene and restful onboard environment. Ongoing innovations in materials and designs are aimed at enhancing both light control and thermal insulation.

Aircraft Type Insights

The commercial aircraft segment dominated the aircraft curtains market with the largest share in 2024 due to the rise in a number of passengers opting for air travel. Airlines are prioritizing enhancements to the onboard experience, focusing on passenger comfort and privacy while maintaining cost-effectiveness. This segment's growth is largely shaped by trends in cabin design that cater to the premium travel segment, reinforcing the importance of high-quality curtains in commercial aircraft.

In contrast, the cargo aircraft segment is expected to grow at the fastest rate in the coming years. This is mainly due to the expanding logistics and e-commerce sectors. The need for effective cargo transport solutions emphasizes curtains that prioritize both safety and functionality.

End-use Insights

The new aircraft manufacturing segment dominated the aircraft curtains market in 2024. This is due to the increasing production rates of commercial aircraft. As new aircraft roll off the assembly line, curtains are integral to the initial interior outfitting process. This scenario translates into a direct and substantial demand for curtain manufacturers, as aircraft producers must collaborate closely with suppliers to ensure that the curtains adhere to stringent design, safety, and performance standards.

Conversely, the aircraft retrofit and refurbishment segment is projected to grow rapidly over the studied period due to the rising need to modernize existing aircraft. As airlines seek to enhance passenger comfort and comply with evolving safety standards, retrofitting becomes a viable strategy. This approach enables airlines to extend the functional lifespan of their existing fleets, thus avoiding the hefty investments associated with acquiring new aircraft. Older curtains, which may be worn out or fall short of current regulatory requirements, necessitate replacement. As passenger expectations and airline branding continue to evolve, retrofitting offers a valuable opportunity to rejuvenate cabin interiors, including updating the curtains to align with contemporary design trends.

Regional Insights

What Factors Contribute to North America's Dominance in the Aircraft Curtains Market?

North America registered dominance in the aircraft curtains market in 2024, primarily due to the presence of industry giants such as Boeing and Bombardier. These manufacturers significantly influence the demand for various aircraft interior components, including curtains, essential for both aesthetic appeal and functionality. The well-established aviation industry in this region encompasses a diverse array of commercial airlines, business jet operators, and general aviation activities. The robust ecosystem thus creates a steady and unwavering demand for aircraft interiors, particularly in Canada, where the aviation sector boasts a wide range of airlines and aviation services. This consistent need for quality components underscores the importance of aircraft interior products.

U.S. Aircraft Curtains Market Trends

In the U.S., the market is driven by a growing demand for premium cabin experiences, with airlines increasingly upgrading interiors to enhance passenger privacy and comfort, especially in business and first-class cabins. The trend toward retrofit programs is strong, as older aircraft are being fitted with advanced curtain systems to improve aesthetics and functionality. Additionally, the market is seeing a rise in sustainable and eco-friendly materials for curtain designs, as airlines prioritize sustainability and aim to reduce environmental impact without compromising on luxury or quality.

Why is Asia Pacific Emerging as the Fastest-Growing Region in the Aircraft Curtains Market?

Asia Pacific is emerging as the fastest-growing region in the aircraft curtains market, driven by a notable rise in air travel. Factors such as increasing disposable incomes, a burgeoning middle-class population, and a surge in tourism contribute to this growth. Consequently, the demand for aircraft orders and subsequent deliveries has surged, invigorating the need for an array of aircraft interior components, including curtains. India, in particular, stands out as one of the fastest-growing aviation markets globally. With its large and rapidly expanding population, rising income levels, and ongoing urbanization, Indian airlines are aggressively expanding their fleets to accommodate the growing appetite for air travel.

China Aircraft Curtains Market Trends

China is a major contributor to the market in Asia Pacific due to its rapidly expanding aviation sector, driven by both increasing domestic air travel and a growing fleet of commercial airlines. The country's airline industry is modernizing its interiors to meet rising passenger expectations, especially with a focus on premium travel and luxury cabin experiences. Additionally, China's investment in retrofit programs for older aircraft, along with demand for sustainable, cost-effective cabin solutions, is driving the growing adoption of advanced aircraft curtain systems in the region.

How is the Opportunistic Rise of Europe in the Aircraft Curtains Market?

Europe is expected to experience noteworthy growth in the market during the forecast period. The region boasts a well-developed aviation infrastructure characterized by an extensive network of airports and established alliances. This strong infrastructure contributes to a reliable demand for high-quality aircraft interior components, specifically aesthetically pleasing and functional curtains. Germany, in particular, is notable for its strong manufacturing sector, which includes companies specializing in textiles and technical fabrics. This industrial expertise provides a solid foundation for producing premium aircraft curtains that meet the rigorous standards of the aviation industry. The convergence of these factors ensures that Europe remains a vital player in the aircraft curtains market, catering to the evolving needs of airlines and passengers alike.

Germany Aircraft Curtains Market Trends

Germany dominates the European aircraft curtains market due to its strong presence in the aviation industry, including major airline operators like Lufthansa and a key role in aircraft manufacturing through companies such as Airbus. The country's focus on luxury travel experiences and premium cabin upgrades increases demand for high-quality, customizable aircraft curtains, especially in business and first-class cabins. Additionally, Germany's commitment to sustainability and the rising trend of retrofit programs for older aircraft further strengthen its leadership in the European market.

How Crucial is the Role of Latin America in the Aircraft Curtains Market?

Latin America plays a vital role in the market as the region continues to grow its commercial aviation network and expand both regional and international flight routes. Airlines are updating fleets and improving cabin interiors to boost passenger experience, increasing demand for high-quality curtains. The rise of low-cost carriers, growing tourism, and investments in aircraft maintenance and refurbishment further bolster the region's contribution to market growth.

Brazil Aircraft Curtains Market Trends

Brazil leads the Latin American aircraft curtain market due to its large commercial aviation sector, high passenger volume, and active fleet expansion by major airlines. The country's robust aircraft maintenance and refurbishment industry supports ongoing cabin upgrades, boosting demand for premium and fire-retardant curtain materials. Increasing investments in cabin comfort and interior modernization further solidify Brazil's leading position.

How Big is the Opportunity for the Growth of the Market in the Middle East and Africa?

The Middle East and Africa (MEA) offer a significant growth opportunity for the aircraft curtains market as airlines in the region continue to expand their fleets, open new international routes, and upgrade cabin interiors to enhance passenger experience. Strong investments in aviation infrastructure, rising tourism, and increasing adoption of premium cabin configurations further support long-term demand for advanced, fire-retardant aircraft curtain solutions.

UAE Aircraft Curtains Market Trends

The UAE leads the Middle East and Africa aircraft curtains market because of its position as a global aviation hub, supported by major airlines expanding long-haul and premium cabin fleets. Ongoing investments in luxury travel experiences, refurbishing wide-body aircraft, and using advanced fire-retardant and lightweight interior materials boost demand. Moreover, strong aerospace infrastructure and collaborations with international cabin interior manufacturers reinforce the UAE's leading role in the regional aircraft curtains market.

Value Chain Analysis

Raw Material Sourcing

This stage involves procuring high-performance fabrics, fire-retardant textiles, aluminum/steel rails, hooks, tracks, buckles, and fastening components from certified aviation-grade material suppliers.

- Key Organizations / Suppliers: Toray Industries, DuPont, 3M, Milliken & Company, Indorama Ventures, and Teijin Limited, among others

Component Manufacturing

This stage includes fabricating aircraft curtains through textile cutting, multilayer stitching, heat sealing, pleating, acoustic insulation integration, and hardware attachment, all in accordance with aircraft cabin specifications.

- Key Players/ Manufacturers: FACC, Anjou Aeronautique, Spectra Interior Products, Aircraft Cabin Modification GmbH, Aerofoam Industries, and Aviointeriors

Testing and Certification

This stage involves evaluating flame resistance, toxicity, smoke emissions, strength, durability, acoustic performance, and aviation regulatory compliance before installation.

- Key Players / Certification Bodies: FAA (Federal Aviation Administration), SGS Aviation, EASA (European Union Aviation Safety Agency), Transport Canada Civil Aviation (TCCA), Aerospace Testing International, and Intertek Aerospace, etc.

Aftermarket Services and Upgrades

Replacement, refurbishment, customization, and periodic maintenance of aircraft curtains to align with airline branding, enhance passenger comfort, or comply with regulatory updates.

- Key Players / Service Providers: Cabin refurbishment firms (Flying Colours Corp, Jet Aviation, Collins Aerospace Interior Services), MRO facilities worldwide, and Specialized aircraft upholstery suppliers (Satori, Inairvation, Signature Upholstery)

Aircraft Curtains Market Companies

- Rockwell Collins: Provides advanced cabin management systems that integrate with aircraft curtain technologies to enhance passenger comfort and privacy in modern cabins.

- Lufthansa Technik: Offers comprehensive retrofit services, including the installation of customized aircraft curtains as part of their cabin interior upgrades for airlines globally.

- Safran: Designs and manufactures high-quality, innovative aircraft curtains that improve passenger privacy, comfort, and cabin aesthetics, particularly in premium cabins.

- Zodiac Aerospace: Supplies advanced aircraft interior solutions, including specialized curtain systems for both commercial and private aircraft to enhance luxury and functionality.

- Honeywell:Develops smart cabin technologies and integrated systems that allow for seamless control and customization of aircraft curtains as part of the overall in-flight experience.

- Airbus:As a major aircraft manufacturer, Airbus integrates advanced curtain systems into its aircraft interiors, focusing on both aesthetics and passenger privacy.

- Eclipse Aviation:Focuses on designing high-end, luxury aircraft interiors, including customizable curtain systems for private jets to enhance the overall travel experience.

- Diehl Aerosystems: Manufactures cabin interior products, including aircraft curtains, with a focus on safety, functionality, and aesthetic quality for commercial airlines.

- Eaton:Supplies power management solutions for cabin lighting and curtain systems that enhance the passenger experience by allowing for more customizable and efficient operations.

- UTC Aerospace Systems: Designs and manufactures advanced cabin systems, including curtain systems, to improve the overall comfort, functionality, and design of aircraft interiors.

- Boeing: Integrates sophisticated aircraft curtain solutions as part of its aircraft interior packages for commercial jets, offering both customization and high-quality materials.

- B. Poindexter:Provides high-quality, customizable cabin interior products, including curtain solutions that meet both aesthetic and functional requirements for various aircraft.

- Aviointeriors:Specializes in premium cabin products, including luxury aircraft curtains that enhance the comfort and privacy of passengers, particularly in business and first-class cabins.

- GKN Aerospace: Manufactures lightweight, durable aircraft curtain solutions as part of its broader cabin interior product offerings for commercial aviation.

- Thales Group:Supplies integrated cabin systems that include advanced curtain technologies, contributing to seamless passenger experience management through innovation and smart cabin solutions.

Segments Covered in the Report

By Material

- Polyester

- Nylon

- Cotton

- Synthetic

By Type

- Trimmable Curtains

- Full Shade Curtains

- Privacy Curtains

- Window Curtains

By Aircraft Type

- Commercial Aircraft

- Cargo Aircraft

- Military Aircraft

By End-use

- New Aircraft Manufacturing

- Aircraft Retrofit and Refurbishment

By Geography

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting