What is the Alcohol Packaging Market Size?

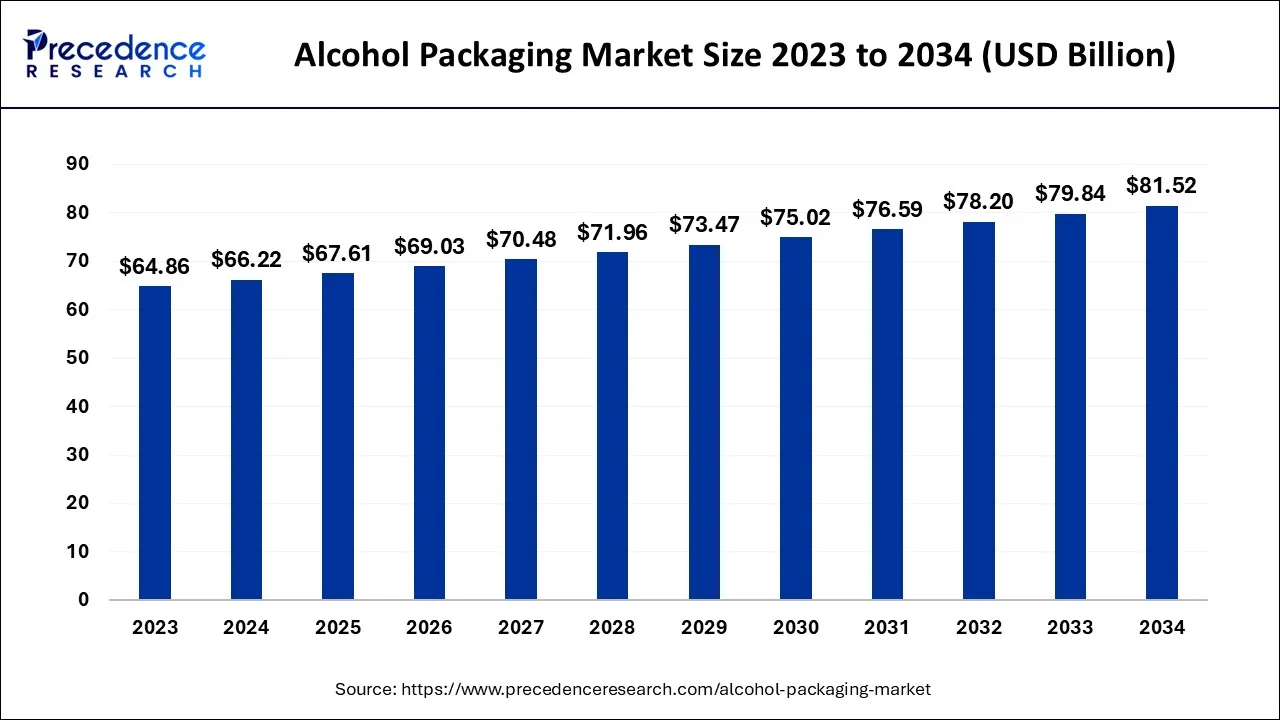

The global alcohol packaging market size was valued at USD 67.61 billion in 2025 and is anticipated to reach around USD 83.17 billion by 2035, expanding at a CAGR of 2.09% over the forecast period 2026 and 2035.

Alcohol Packaging Market Key Takeaways

- In terms of revenue, the market is valued at $67.61 billion in 2025.

- It is projected to reach $83.17 billion by 2035.

- The market is expected to grow at a CAGR of 2.10% from 2026 to 2035.

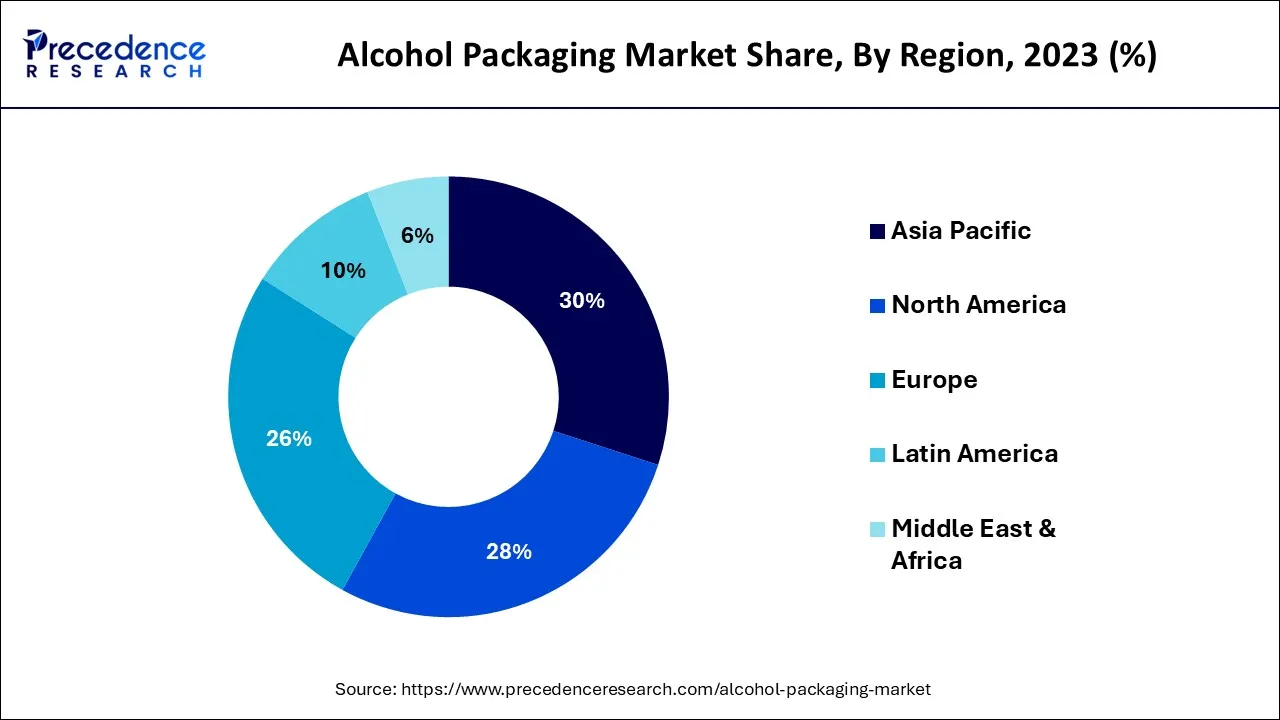

- Asia Pacific led the global market with the highest market share of 30% in 2025.

- By material type, Plastic containers and bottles are in higher demand than other materials in the food and beverage industry due to their flexibility and ease of use.

- By packaging type, primary packaging dominates the market globally.

- By End use, since beer accounts for nearly two-thirds of the market value, it will likely dominate the global alcohol packaging market.

Market Overview

Alcohol packaging uses primary and secondary packaging to package various types of alcohol. The increase in alcohol consumption has raised the demand for alcohol packaging. Similar to how population growth has increased capital income, so has the amount of alcohol consumed globally.

The requirement for alcohol packaging from end-use industries like the alcohol industry is what is fueling the market's expansion globally. In addition, the entry of fresh local competitors into this market and creative packaging that enhances product appeal are anticipated to fuel market expansion internationally.

Alcohol Packaging Market Growth Factors

Major alcohol-producing companies use ceramic glass bottles, bag-in-box, whiskey pouches, bag-in-tube, and other eye-catching packaging formats. The market is significantly impacted by shifting consumer preferences. Vendors in the worldwide alcohol packaging market have tapped into the needs and want of the wealthiest customers. These companies also invest in packaging technologies, which are a dependable part of the global market dynamics.

The use of alcohol packaging will increase as trends in drinking alcohol change in the future. Numerous well-known vendors have recently entered the global alcohol packaging market.

Increasing demand in the alcohol packaging market is greatly influenced by the appeal of the brand being purchased. This component has been a significant factor in driving sales in the global alcohol packaging sector. The total amount of money entering the global alcohol packaging market has increased with the introduction of new alcoholic beverages like beer and guinea.

Additionally, emerging nations are consuming more alcohol, and the growing purchasing power of the general public has allowed them to experiment with new alcoholic flavors. These factors all support the growth of the global alcohol packaging market. Additionally, there is little disagreement among businesses regarding alcohol consumption.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 67.61 Billion |

| Market Size in 2026 | USD 69.03 Billion |

| Market Size by 2035 | USD 83.17Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.09% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Packaging Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising consumption

Major alcohol producers use ceramic glass jars, whiskey pouches, bag-in-box packaging, bag-in-tube packaging, and other appealing packaging designs. The industry under consideration is significantly impacted by changing consumer preferences. Suppliers in the global alcohol packaging market have tapped into the needs and desires of the wealthiest customers. These companies also invest in packaging systems, which have grown to play a significant role in the organization of the world market.

Over the next ten years, as drinking habits change, alcohol packaging will be used more frequently. The global market for alcohol packaging has recently welcomed several well-known suppliers. For the leading sector providers, this growth and advancement dynamic is essential. The appeal of the purchased brands is essential to increasing interest in the global alcohol packaging market. This element has been a significant sales motivator for alcohol-based products in the global packaging industry. The adoption of novel alcoholic beverages like beer and wine has increased the overall revenue of the global alcohol packaging market. Alcohol consumption is also growing in emerging markets, and the general populace's expanding purchasing power has allowed them to experiment with new alcohol tastes. The market for alcohol packaging is expanding globally due to all of these factors.

Restraint

Harmful packaging waste

The environmental harm that packaging waste causes and the strict regulations on the materials used in rigid liquor packaging are the factors limiting the growth and development of the global alcohol packaging industry. Additionally, fluctuating raw material prices may impede growth.

Opportunity

New packaging trends

New packaging trends in the alcoholic beverage industry appear as packaging processes continue to advance. These ideas increase brand recall and purchase intent or divert customers' attention from a compelling message.

While being environmentally friendly is a common theme for all categories, each category has its distinctive shifts, such as using pop-top cans, beer and cider bottles, wine, and saki bottles, custom boxes, gift sets, etc.

Segment Insights

Material Insights

Alcohol packaging bottles that cannot be damaged or broken during transport are made using plastic bottles and flexible bags in boxes instead of glass bottles. Additionally, they are lighter than glass bottles, portable, and recyclable. So that numerous companies can advertise the benefits of their products and packaging. Their product packaging can offer greater convenience, food protection, and consumer communication easily.

Alcohol packaging design is crucial for a specific product and brand. Then, all alcohol packaging must be water as well as alcohol resistant and must not change the flavor or alcohol content of the product. Bag-in-box beverage packages were introduced to increase convenience while reducing the weight of the package and preventing breakage and damage to glass bottles during packaging.

PackagingType Insights

The primary packaging type dominates the market. Growlers, liquid bricks, cartons, pouches, bottles, cans, and bags in boxes are just some of the packaging options available for the primary market. Alcohol packaging aims to safeguard, maintain, and inform the consumer.

The package that comes into direct contact with the product is the primary packaging, also called the customer's unit. The consumer or end user is typically the target consumer for this kind of packaging. Items are not only made more straightforward for customers to handle but also more appealing and can be used to communicate with customers by giving them written product details.

End Use Insights

The beer market will dominate the global market for alcoholic beverages. One of the oldest and most popular alcoholic beverages is beer; after coffee and tea, it is the third most popular beverage. Beer is a popular party beverage among millennials, and it is a crucial component of the feast, promoting social group cohesion.

Beer is healthier than any other alcoholic beverage and rich in proteins, vitamins B, and antioxidants. Beers range in alcohol content from less than 3% to 40% by volume, depending on the brand and formula. Beer consumption lowers the possibility of developing kidney stones.

Other advantages of beer include its high silicon content, which strengthens bones, and its soluble fiber, which lowers bad cholesterol. The main factors propelling the global beer industry include the rising number of breweries and the expanding demand for beer globally. The industry has seen an increase in the sale of low-alcohol beers due to growing demand from health-conscious consumers.

Regional Insights

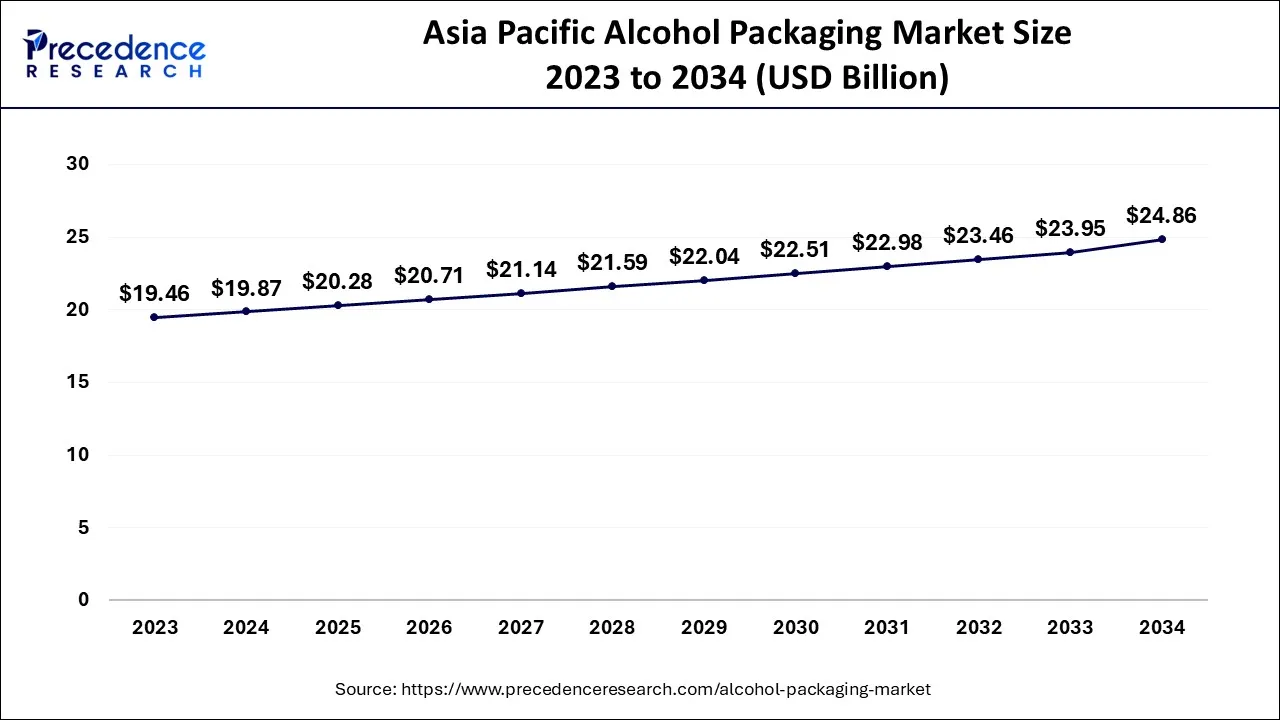

What is the Asia Pacific Alcohol Packaging Market Size?

The Asia Pacific alcohol packaging market size is exhibited at USD 20.28 billion in 2025 and is projected to bealcohol packaging market worth around USD 25.49 billion by 2035, growing at a CAGR of 2.31% from 2026 and 2035.

The increasing preference for beer and craft beer among the younger and elderly population, the North American region is anticipated to hold a sizable share over the forecast period. To rapidly speed up their operations and meet the growing demand for alcoholic beverages, market participants are additionally making more investments and growth initiatives.

For instance, Crown Holdings, one of the top packaging solutions providers, recently announced plans to expand their beverage can manufacturing facility in Bowling Green, Kentucky, USA, to meet the region's growing demand for craft beer and beverage cans in February 2020. The facility in Kentucky Transpark will have a total floor area of 327,000 square feet, and it is anticipated that operations will start in the second quarter of 2021.

North America is expected to grow significantly in the alcohol packaging market during the forecast period. The growing developments in the packaging industry in North America are providing various packaging formats. This, in turn, is helping in maintaining the quality of the alcohol, increasing its use. Thus, this promotes the market growth.

Additionally, it is anticipated that the Asia Pacific region's market share will increase significantly throughout the forecast period. This is due to the fact that there are more and more market participants offering improved and cutting-edge solutions to support the beverage packaging industry in nations like Australia and India, among others. This results from the younger and elderly populations in these countries' growing inclination toward various alcoholic beverages.

China Alcohol Packaging Market Trends

China's market is evolving as beverage producers focus on sustainability and environmental responsibility, leading to increased use of recyclable and lightweight materials. Glass continues to dominate packaging for spirits and premium wines, but there is growing adoption of aluminum cans and PET bottles in the beer and ready-to-drink segments due to convenience and cost efficiency.

What are the Advancements in the Alcohol Packaging Industry in Europe?

Europe is expected to witness significant growth in the market. This growth is driven by the region's stringent regulations that are aimed at promoting sustainable packaging and increasing consumer awareness regarding environmental issues. Countries like Germany and the UK are leading players as they have a strong emphasis on recycling and eco-friendly materials, which are becoming essential factors in packaging design and production.

Germany Alcohol Packaging Market Trends

The country is witnessing increased collaborations between packaging manufacturers and beverage producers in order to create tailored solutions that enhance product appeal and reduce environmental impact. Additionally, circular economy principles and industry-wide recycling programs are strengthening infrastructure for packaging reuse and material recovery across the alcohol supply chain.

What are the Key Trends in the Alcohol Packaging Industry in Latin America?

Latin America is expected to witness substantial growth in the market. This growth and development is driven by various factors like rising disposable incomes, changing consumer lifestyles, and a growing preference for alcoholic beverages among younger consumers. Countries like Brazil and Mexico are leading players in the region, supported by favorable government policies and increasing urbanization.

Brazil Alcohol Packaging Market Trends

The presence of a diverse range of alcoholic beverages, from traditional spirits to modern craft beers, is driving innovation in alcohol packaging solutions in the country. The aim is to tailor to local preferences and consumption habits.

How is the Middle East and Africa Region Growing in the Alcohol Packaging Industry?

The Middle East and Africa are expected to witness steady growth throughout the forecast period, driven by urbanization, changing social norms, and a rise in tourism, particularly in countries like South Africa and the UAE. Regulatory shifts are also shaping the market, as governments in the region are beginning to support the alcohol industry more openly. The market is characterized by a mix of both local and international players.

Saudi Arabia Alcohol Packaging Market Trends

Companies in this region are increasingly focusing on innovative packaging solutions to cater to the unique cultural and consumer preferences in these markets. The market landscape still appears to be in its developing stages, with opportunities emerging as the region becomes more open to alcohol consumption.

Alcohol Packaging Market Companies

- Amcor plc.

- Bemis Manufacturing Company, Nampak Ltd.

- Crown

- Sidel Group

- ProAmpac.

- Ardagh Group S.A.

- Sonoco Products Company

- BALL CORPORATION

- Krones AG

- Diageo PLC

- Berry Global Inc.

- Saint-Gobain Group.

- Brick Packaging

- Tetra Pak Group

- O-I Glass, Inc.

- Orora Packaging Australia Pvt Ltd.

- Vetreria Etrusca

- Creative Glass

Recent Developments

- In June 2025, Ruedrich's Red Seal Ale and PranQster Belgian Style Golden Ale were introduced, which were packed in 12-oz cans by North Coast Brewing Company (NCBC), which is a U.S.-based brewery. This launch of Red Seal Ale and PranQster is considered a major shift for the brand and a milestone achievement in the NCBC's portfolio, as it was initially bottled in 1988 and 1995.(Source:https://www.msn.com)

- In June 2025, a new slim can was launched by EIGHT Elite Light Beer, which is a super-premium light beer founded by Pro Football Hall of Famer Troy Aikman. This can support the commitment of the company for enhanced transparency, quality, as well as clean living, as it provides a refined packaging update. Moreover, as per the company, it also provides an aesthetic and convenient format suitable for various occasions. Furthermore, this launch also helps in the expansion of the EIGHT Elite Light Beer by entering the Texas and Oklahoma markets, as well as this packaging is an innovative extension of the company's commitment to quality.(Source:https://www.bevindustry.com)

- March 2022 - For a price not disclosed, the hybrid packaging firm Berline Packaging purchased the Canadian glass bottle manufacturer United Bottles and Packaging. Berline Packaging will profit from the acquisition by improving its position in the Canadian food and beverage industry and extending its glass capabilities across North America.

- June 2022 -The purchase of Scholle IN, a flexible packaging company, was completed by SIG, a Swiss aseptic packaging supplier. In February of this year, SIG and Scholle IP agreed to merge for an enterprise value of USD 1.53 billion and an equity value of USD 1.2 billion. The Northlake, Illinois-based company Scholle IPN provides environmentally friendly packaging systems and solutions for the food, retail, beverage, institutional, and industrial markets.

Segments Covered in the Report

By Material

- Glass

- Plastic

- Metal

- Others

By Packaging Type

- Primary

- Secondary

- By End Use

- Beer

- Wine

- Spirit

- Other

By End Use

- Beer

- Wine

- Spirit

- Other

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting