What is the Animal Healthcare Market Size?

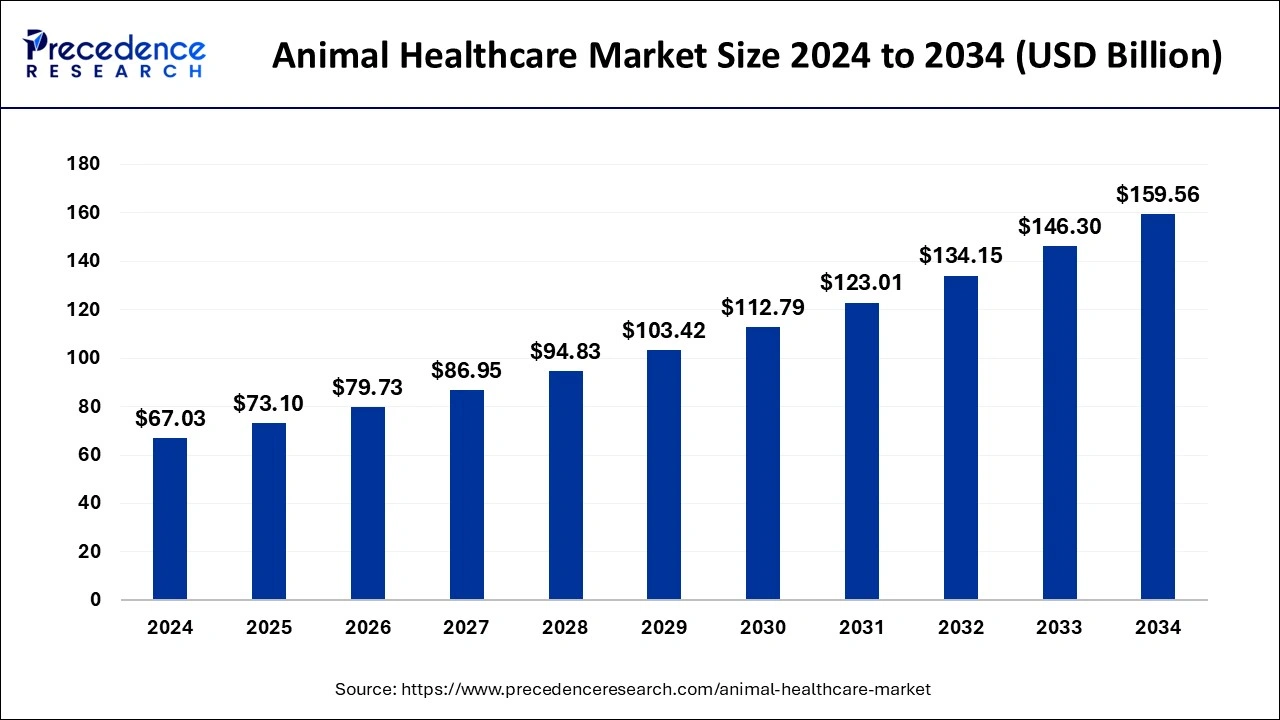

The global animal healthcare market size is calculated at USD 73.10 billion in 2025 and is predicted to increase from USD 79.73 billion in 2026 to approximately USD 172.08 billion by 2035, expanding at a CAGR of 8.94% from 2026 to 2035.

Animal Healthcare Market Key Takeaways

- In terms of revenue, the animal healthcare market is valued at $73.10 billion in 2025.

- It is projected to reach $172.08 billion by 2035.

- The animal healthcare market is expected to grow at a CAGR of 8.94% from 2026 to 2035.

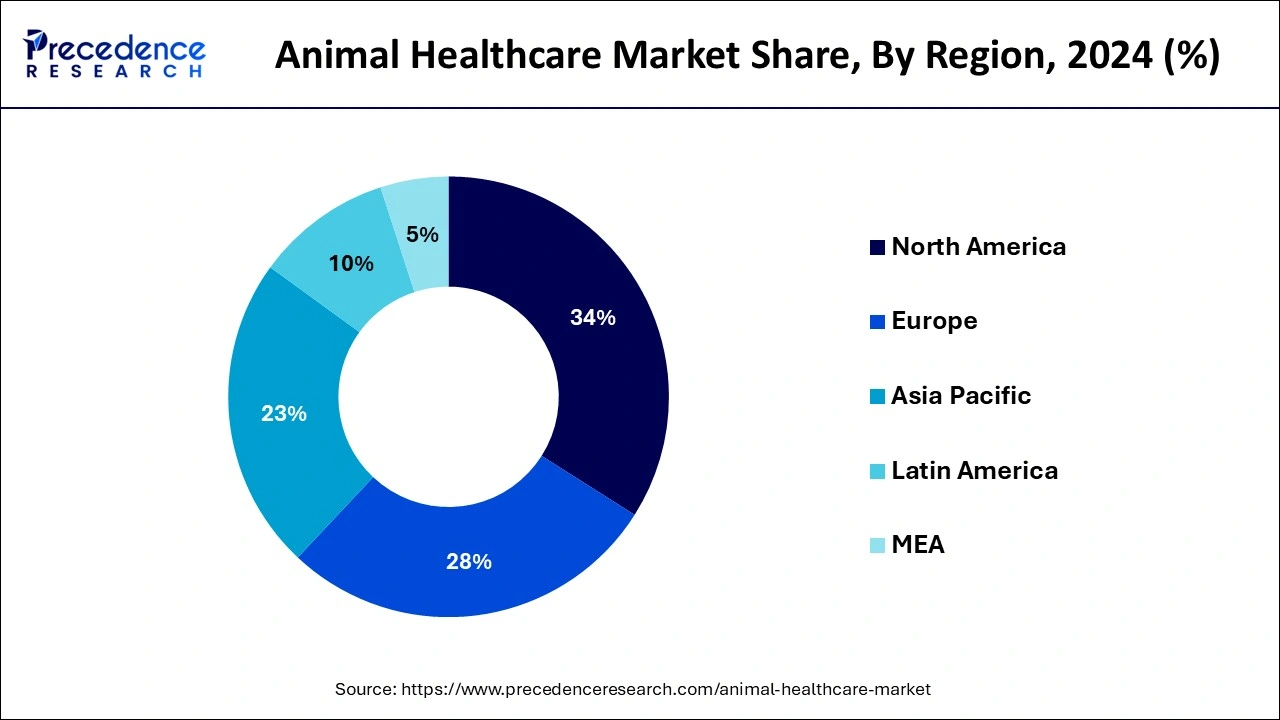

- North America dominated the animal healthcare market with the largest market share of 34% in 2025.

- Asia Pacific is expected to grow at a double digit CAGR of 12.4% during the forecast period.

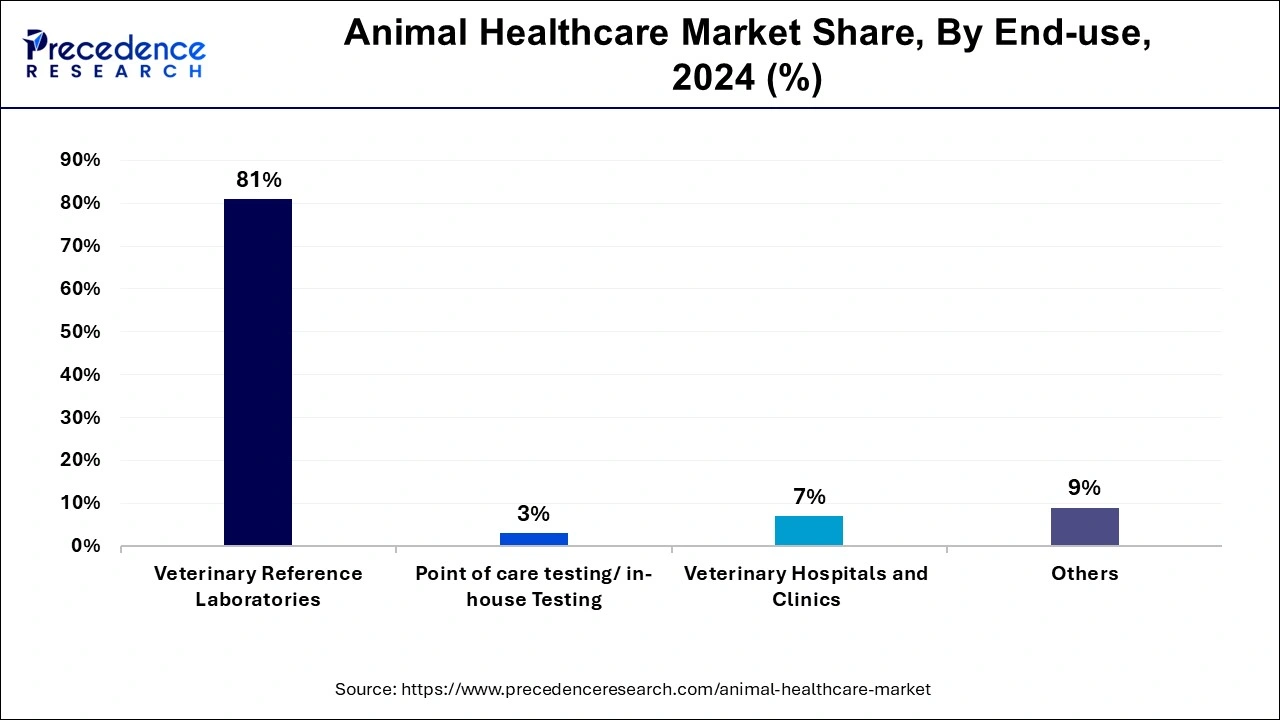

- By end-use, the veterinary reference laboratories segment contributed the highest market share of 81% in 2025.

- By end-use, the point of care testing/in-house testing segment is projected to grow at a solid CAGR during the forecast period.

- By distribution channel, the hospital/ clinic pharmacy segment generated the highest market share in 2025.

- By animal type, the production animal segment led the global market in 2025.

- By product, the pharmaceutical segment accounted for the largest market share of 44% in 2025.

Impact of Artificial Intelligence in Animal Healthcare Industry

The integration of AI in animal health (AH) helps manage complex concepts such as epidemiology and prediction, animal treatment, and host-pathogen interactions. Veterinarians are integrating AI into their applications primarily for diagnostic imaging and medical record management. AI-driven monitoring systems can analyze large amounts of data with high efficiency to detect animal health problems or abnormal behaviors early.

This tool reduces the workload of farmers and veterinarians. The most successful AI applications use clinical data and deep learning to diagnose diseases. X-rays, CT scans, and MRIs are used to create AI-driven algorithms that can accurately analyze medical images. Real-time animal monitoring through AI-based analytics can help improve animal health and save lives. Remote monitoring allows veterinarians to detect early signs of stress and intervene quickly, contributing to the growth of the animal healthcare market.

- For Instance, In May 2025, Modern Animals announced the introduction of AI-powered development for its medical software Claude. Designed to simplify the management process for veterinarians, these new products will improve the quality of care for the approximately 60,000 pets and their families who rely on the Veterinary Health Network for care.

Animal Healthcare Market Growth Factors

- The growth and adoption of various innovations, including smart collars and tracking devices, pet cameras, automated food and beverage systems, smart pets, and animal health technology, has revolutionized both small and large farms, leading to new growth in the animal healthcare market.

- Pet humanization evolution has increased the demand for food, health, and services, increasing loneliness in the population and decreasing birth rates are increasing the demand for animals, leading to the growth of the animal healthcare market.

- Improvement in veterinary procedures will help veterinarians determine appropriate and recommended treatments for specific conditions, which will in turn lead to the growth of the animal healthcare market.

- Pet owners' preference for vaccinations supported by screening has also led to growth in the field of pet testing.

- Strengthen the governance system, simplify the approval process, strengthen product inspection, and implement post-market surveillance to ensure product quality enters the market and support the growth of the animal healthcare market.

- For Instance,

- In October 2024, Minister of Fisheries, Animal Husbandry and Dairying Shri Rajiv Ranjan Singh, aka Lalan Singh, announced the Communicable Diseases Programme titled “Animal Health Security Strengthening in India for Pandemic Preparedness and Response” in New Delhi. The Pandemic Fund Project is a $25 million initiative funded by the Pandemic Fund.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 73.10 Billion |

| Market Size in 2026 | USD 79.73 Billion |

| Market Size by 2035 | USD 172.08 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.94% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Animal Type, By Product, By Distribution Channel, By End Use, and By Treatments |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

The pharmaceutical segment accounted for the largest market share of 44% in 2025. On the basis of continuing improvements in veterinary pharmaceuticals, it is expected to maintain its dominant position during the projection period. The anti-inflammatory medications, antibiotics, parasiticides, and other pharmaceuticals are among the most common.

The veterinary diagnostics segment, on the other hand, is predicted to develop at the quickest rate in the future years. The expanding number of veterinary practitioners and their incomes in industrialized nations, rising animal health expenditure, and increased zoonotic diseases incidence are all contributing to segment expansion.

Animal Type Insights

the production animal segment led the global market in 2025. The segment's significant market share can be attributed to government healthcare organizations' worldwide concern for food safety and sustainability.

The companion animal segment is the fastest growing segment of the animal healthcare market in 2023. The policymakers in numerous countries are aiming for overall food security, which encourages large scale food production and increases animal husbandry.

Distribution Channel Insights

The hospital/ clinic pharmacy segment generated the highest market share in 2024. The segment's growth has been aided by an increase in the number of hospital pharmacies as well as a high procedural volume as a result of frequent readmission of pets for treatment.

The retail pharmacies segment is fastest growing segment of the animal healthcare market in 2024. For the distribution of drugs and vaccines, major producers rely solely on certified veterinarians and authorized wholesalers.

End Use Insights

The veterinary reference laboratories segment contributed the highest market share of 81% in 2024. The segment's leading market share is due to a variety of applications including clinical pathology, toxicological tests, and therapy. In veterinary hospitals and clinics, the provision of a wide range of therapeutic and diagnostic solutions is a high impact rendering growth driver for this industry.

The point of care testing/in-house testing segment is projected to grow at a solid CAGR during the forecast period. The climatic change and globalization are predicted to increase the frequency of zoonotic illnesses, which will boost demand for diagnostic procedures which will drive the point of care testing/in-house testing segment in the next years.

Regional Insighst

U.S. Animal Healthcare Market Size and Growth 2026 to 2035

The U.S. animal healthcare market size was evaluated at USD 18.64 billion in 2025 and is predicted to be worth around USD 45.04 billion by 2035, rising at a CAGR of 8.28% from 2026 to 2035.

North America dominated the animal healthcare market with the largest market share of 34% in 2025. This is attributed to a wide range of concrete initiatives taken by government animal welfare organizations that are continually trying to enhance animal health. In addition, technological advances, an increase in the number of pet owners, and an increase in the frequency of zoonotic diseases are likely to drive the animal healthcare market expansion in this region.

Asia Pacific is expected to grow at a double digit CAGR of 12.4% during the forecast period. This region's rapid growth is thought to be the result of constant research and development investments by major companies in the animal healthcare market as well as their efforts to sell branded and generic treatments at affordable rates.

The governments all across the world are focusing on enacting and enforcing stronger animal healthcare legislation and regulations. The animal healthcare market growth will be supported by animal adoption and protection, improved treatment facilities, emergency healthcare systems, vaccination drives, immunization programs for animal healthcare, and birth control. The financial support for animal shelters as well as funding for multiple veterinary research laboratories dedicated to containing advanced zoonotic and foodborne diseases, will help the animal healthcare market growth significantly.

Europe is expected to grow significantly in the animal healthcare market during the forecast period. The growing awareness as well as pet ownership in Europe is increasing the demand for animal healthcare facilities. At the same time new products are also being developed, which enhances the animal healthcare. Thus, all these factors along with the government support, promotes the market growth.

UK

The animal healthcare facilities in the UK are increasing, due to increasing pet ownership as well as rising awareness about animal health. At the same time, new research and developments are also being conducted to develop various medications for different animal diseases.

Germany

In Germany, animal healthcare facilities are providing various treatment options for animals, which in turn are attracting the population. At the same time, technological advancements are also enhancing these facilities. Furthermore, these developments are also being supported by the government investments.

Latin America Animal Healthcare Market Trends

Latin America is expected to witness substantial growth throughout the forecast period. The region covers various aspects such as production, distribution, and use of pharmaceuticals, diagnostics, vaccines, feed additives, and medical devices designed for animals. These solutions address diseases and improve the overall well-being of both livestock and companion animals. Pet humanization in the region has resulted in increased spending on wellness products, diagnostics, and surgeries.

The rise of pet insurance plans is also helping make advanced veterinary care more accessible and affordable, boosting the market even more, especially in urban and suburban regions. The number of organized veterinary clinics and multi-location animal hospitals in the region also contributes to market growth in Latin America.

Brazil Animal Healthcare Market Trends

The country has a high number of pet owners and also has the exclusive distinction of having the greatest variety of animals all across the globe. The consumption of feed in the country is also quite high, as it is a center for meat production all over the world. Agriculture is also an extensive practice in the region, and, as a result, animal husbandry practices are being increasingly adopted, further propelling the market.

Middle East and Africa Animal Healthcare Market Trends

The Middle East and Africa are growing at a steady rate, driven by factors like rising livestock demand, food security initiatives, increasing pet ownership and animal care, and the expansion of veterinary infrastructure and services. The region relies heavily on livestock for meat, milk, and other animal-based products due to their specific dietary preferences.

There is also a high incidence of diseases like animal influenza and viral diseases in the region, which necessitates the need for quality animal healthcare services. These factors have led to an increase in the need for effective management.

South Africa Animal Healthcare Market Trends

South Africa is growing at a substantial rate in the region. This growth and development are due to various government programs that are focused on overall animal health care improvement in the country. Increasing government initiatives for advancing the poultry sector are also driving market growth.

Animal Healthcare Market Companies

- Elanco

- Bayer

- Dechra Pharmaceuticals

- Neogen

- Boehringer Ingelheim

- Merck & Co, Inc.

- Zoetis

- Nutreco N.V.

- Virbac

- Vetquinol S.A.

Recent Developments in the Animal Healthcare Industry

- In November 2025, Zoetis Inc. expanded its animal vaccine production facility in America to meet growing demand for livestock immunization and companion animal health solutions. Zoetis has invested $1.7 billion in its U.S. manufacturing sites and plans to invest an additional $1.3 billion through 2031 across its nine sites in seven states.

(Source:zoetis.com) - In May 2025, to ensure that the livestock farmers are provided with similar facilities and subsidies as those in the farming sector, plans are being considered to grant animal husbandry the status of agricultural as per the recent announcement made by Ajit Pawar, Maharashtra deputy chief minister and guardian minister of Pune.?

(Source:msn.com) - In May 2025, for the treatment of canine osteosarcoma, OS Therapies announced and launched a wholly owned subsidiary, OS Animal Health, Inc. The main goal of this subsidiary will be the commercialization of OST-HER2. (Source:pharmabiz.com)

- In April 2025, a collaboration between epiq Animal Health and Interpath Global was announced. This collaboration will launch a nutraceutical (4CYTE™,?Epiitalis Forte) in animal health distribution channels across the U.S., enhancing the joint health approach.

(Source:morningstar.com) - In April 2023, Minister of State for Fisheries, Livestock and Food, Mr. Parshottam Rupala, launched the Animal Health System Support Program (APPI) and the World Bank-funded Animal Health System Support Program Health (AHSSOH) project in New Delhi, India. Under the auspices of the National Joint Health Mission of the Ministry of Health.

In December 2023, Zenex, India's leading healthcare company, announced that it has acquired 100% of Ayurvet. Ayurvet is a company founded by Mr. Pradip Burman, who combines the ancient knowledge and wisdom of Ayurveda with modern technology to provide quality Ayurvedic and herbal medicines, nutritional supplements, and cosmetics for businesses operating in the agriculture and livestock sector.

In July 2024, Merck Animal Health, announced the acquisition of the aquaculture business of Elanco Animal Health Incorporated. The completion of this acquisition strengthens Merck Animal Health's position in the aquaculture sector and is focused on supporting fish health, welfare, and sustainability in aquaculture, conservation, and fisheries.

In August 2024, Elanco Animal Health Incorporated (NYSE: ELAN) announced the completion of the review of all major and minor technical sections for Credelio Quattro, and the final 60-day administrative review is underway by the U.S. Food and Drug Administration (FDA). The Company is endeavoring to expand the Credelio Quattro to be positively differentiated.

(Source: investor.elanco.com ) - In October 2024, Phibro Animal Health Inc. announced the completion of the acquisition of Zoetis Inc.'s nutritional supplements and select water-soluble products portfolio. The acquisition is an important step in Phibro's mission to improve animal health and nutrition for a better life and a more sustainable world.

- In March 2024, Boehringer Ingelheim announced the acquisition of Saiba Animal Health AG, a company focused on innovation for chronic animal diseases. As animal life expectancy increases, so does the need for effective treatment of debilitating diseases.

- In April 2024, Zoetis Inc. and Phibro Animal Health Corporation today announced that they have entered into a definitive agreement under which Phibro Animal Health will acquire Zoetis™ Medicinal Feed Additive (MFA) products, certain water-soluble products, and assets for an amended value of $350 million.

Segments Covered in the Report

By Animal Type

- Production Animal

- Poultry

- Swine

- Cattle

- Fish

- Others

- Companion Animal

- Dogs

- Cats

- Horses

- Others

By Product

- Vaccines

- Live Attenuated Vaccines

- DNA Vaccines

- Recombinant Vaccines

- Inactivated Vaccines

- Others

- Pharmaceuticals

- Parasiticides

- Anti-infective

- Anti-inflammatory

- Analgesics

- Others

- Feed Additives

- Diagnostics

- Instruments

- Consumables

- Equipment and Disposables

- Critical Care Consumables

- Anesthesia Equipment

- Fluid Management Equipment

- Temperature Management Equipment

- Rescue & Resuscitation Equipment

- Research Equipment

- Patient Monitoring Equipment

- Others

- Veterinary Telehealth

- Veterinary Software

- Livestock Monitoring

By Distribution Channel

- Retail Pharmacy

- E-commerce

- Hospital Pharmacy

By End Use

- Reference Laboratories

- Point of care testing/ in-house testing

- Veterinary Hospitals & Clinics

- Others

By Treatments

- Allergies

- Arthritis

- Difficult Dermatology Cases

- Gastrointestinal Disease

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting