What is the Animal Vaccine Market Size?

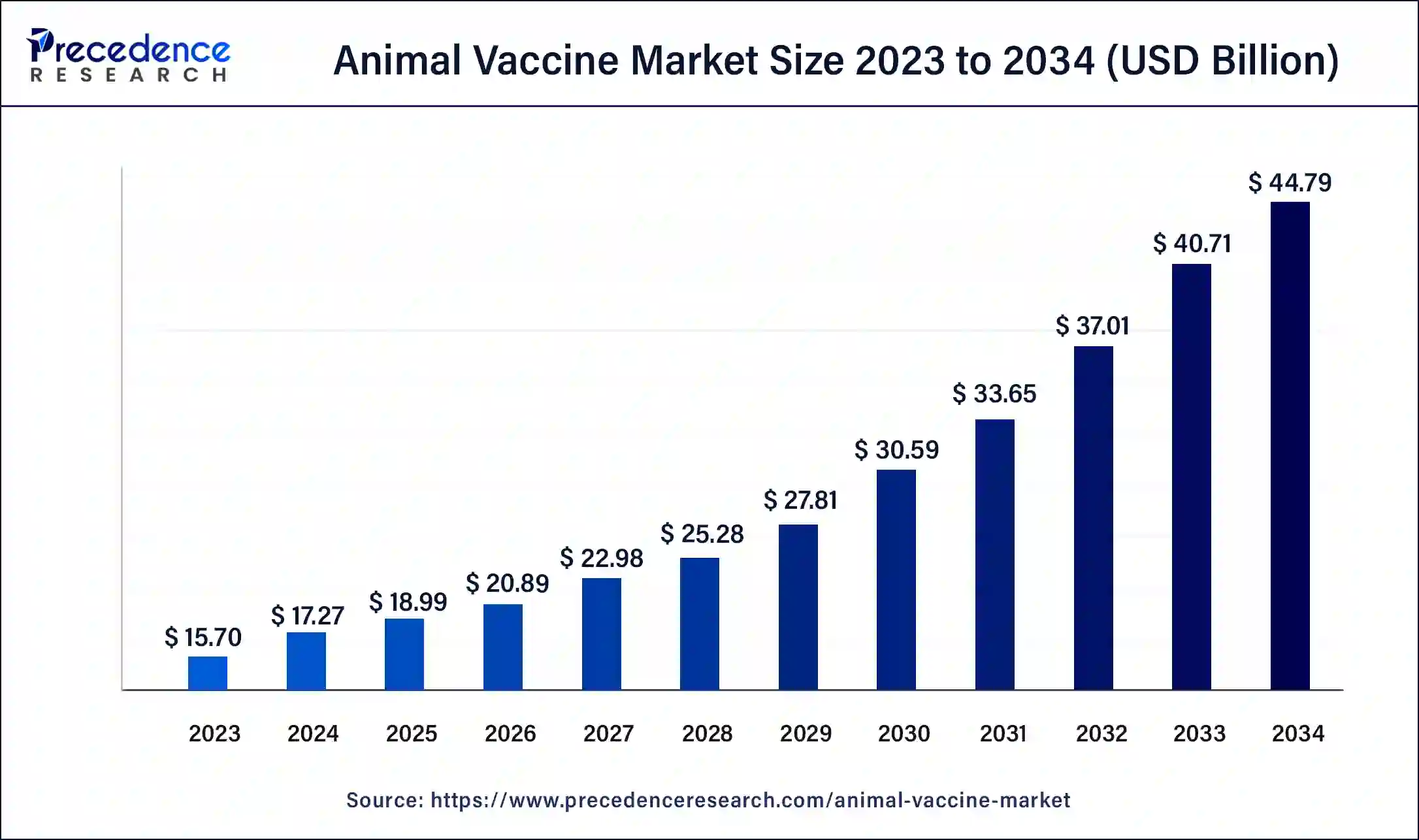

The global animal vaccine market size is calculated at USD 18.99 billion in 2025 and is predicted to increase from USD 20.89 billion in 2026 to approximately USD 48.62 billion by 2035, expanding at a CAGR of 9.86% from 2026 to 2035.

Animal Vaccine Market Key Takeaways

- In terms of revenue, the market is valued at $18.99 billion in 2025.

- It is projected to reach $44.79 billion by 2035.

- The market is expected to grow at a CAGR of 10% from 2026 to 2035.

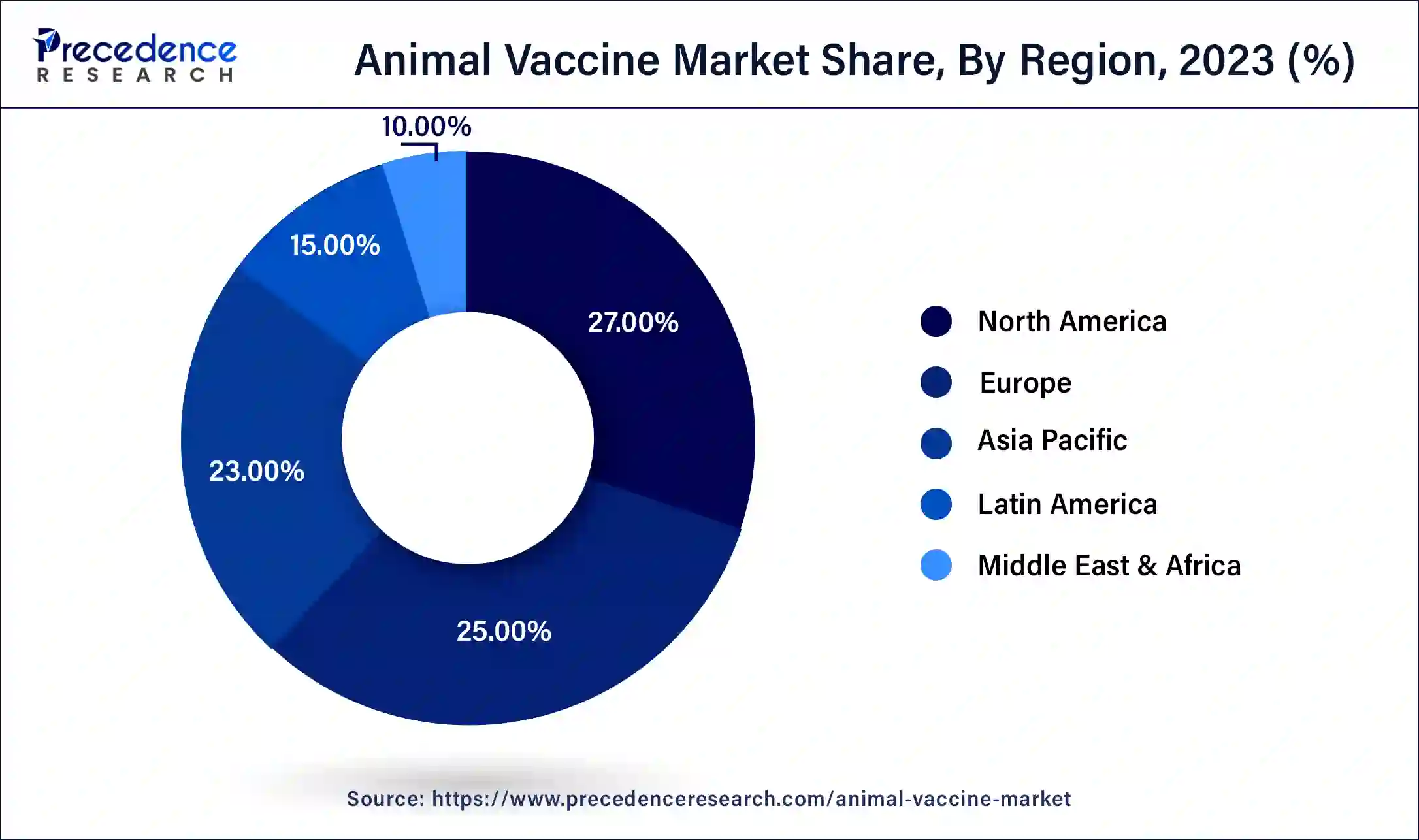

- North America dominated the market and captured more than 27% of revenue share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR from 2026 to 2035.

- By Product Type, the attenuated live vaccines segment generated more than 36% of revenue share in 2025.

- By Animal Type, the livestock segment led the market with more than 71% of the revenue share in 2025.

- By Route of Administration, the subcutaneous segment dominated the market and contributed more than 41% of revenue share in 2025.

- By Route of Administration, the intranasal segment is expected to expand at the fastest CAGR of 10.0% from 2026 to 2035.

Market Overview

Rising food security concerns and increased animal husbandry drive demand for livestock vaccines. Increased demand for animal products has resulted in increased livestock production globally. Furthermore, changing food preferences due to evolving lifestyles and population growth boosts the demand for livestock products. The continuous introduction of technologically advanced vaccines, as well as outbreaks of livestock diseases, have all contributed to shifting market dynamics.

Market Trends

- The rising pet adoption and awareness about zoonotic diseases drive the growth of the market.

- Technological advancement and innovation in vaccine development by the manufacturers are fueling the market trend.

- Programs like the National vaccination program drive the growth and increase the demand for the market.

- Advances in genetic profiling are enabling the development of vaccines tailored to individual pets, enhancing efficiency and minimizing side effects.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 48.62 Billion |

| Market Size in 2025 | USD 18.99 Billion |

| Market Size in 2026 | USD 20.89 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.86% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Animal Type, Route of Administration, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increase in livestock production boosting the market growth

In livestock farming, veterinary vaccinations increase overall productivity and ensure animal health. More efficient livestock production and improved access to high-quality protein are required to feed the world's growing population. According to an FAO High-Level Expert Forum, overall food production will need to increase by 70% between 2005 and 2050 to feed a predicted global population of 9.1 billion people, and vaccinations that protect animal health and increase supply are critical components in meeting this goal. Furthermore, they reduce the need for antimicrobials to treat infections in food-producing and companion animals, as there are growing concerns about antibiotic resistance linked to the introduction of antibiotics in human and veterinary medicine, as well as their ability to eliminate the thinning of organisms causing foodborne illness in humans boosting the market growth in the forecast period.

Restrain

Stringent regulatory regulations restrict the industry's growth

A drug regulatory authority (DRA) ensures that all medicinal products are of acceptable quality, safety, and efficacy, that they are manufactured and distributed in such a way that their quality is maintained until they reach the consumer, and that valid commercial promotion is certified. DRAs' primary responsibilities include licensing products, inspecting and licensing manufacturers and distributors, conducting post-marketing surveillance, regulating claims made for the commercial promotion of products, and authorizing clinical trials. Receiving marketing approval for new vaccines from these regulatory agencies is costly and time-consuming; the financial position of companies involved in vaccine development is heavily influenced by their ability to obtain or maintain regulatory approvals.

Opportunities

Increasing animal illness provides lucrative opportunities for the animal vaccine

As the number of animals suffering from various diseases rises, so does the demand for vaccines to prevent and treat such diseases, propelling the veterinary vaccines market. According to Animal and Plant Health Agency estimates, a total of 3289 new TB herd incidents were detected in England. Bovine tuberculosis is a chronic disease typically affecting cattle, but it can affect all mammals, causing general illness, coughing, and eventually death. However, the condition can be treated with antibiotics that kill the tuberculosis bacteria. During the forecast period, the rising prevalence of diseases in animals is expected to drive the veterinary vaccines market.

Increase in the number of R&D activities and the introduction of new products

An increase in research and development activities for designing an effective, efficient, and high-quality vaccine for companion and farm animals, as well as the launch of new products, will provide beneficial opportunities for the veterinary-animal vaccines market. Furthermore, technological advancements in the development of animal health vaccines, as well as an increase in the number of emerging markets, will provide additional opportunities for the growth of the veterinary-animal vaccines market during the forecast period. Furthermore, the increasing number of cattle and poultry in developing countries, as well as advancements in healthcare technology, will accelerate the growth rate of the veterinary-animal vaccines market in the future.

Segment Insights

Product Insights

Attenuated live vaccines dominated the market

In 2024, the attenuated live vaccines segment dominated the animal vaccines market, accounting for more than 36% of revenue. The oldest vaccination method used in the veterinary field is live attenuation. This method is also being tested for the Development of new applications. Some of these alternatives include the Development of intramuscular protein subunit vaccines for swine. These products help to reduce mortality and increase the life span of diseased vermin.

Over the forecast period, the recombinant vaccine segment is expected to grow rapidly. These vaccines aid in lowering the risk of pathogenicity in animals following vaccination. Because recombinant vaccines can carry multiple gene inserts, they are expected to aid in the immunization against multiple virus strains. These vaccine formulations can eliminate the need for adjuvants, increase vaccine viability, and improve vaccine stability. Vaccines against canine distemper, pseudorabies, Newcastle disease, Lyme disease, and avian influenza are among the recombinant vaccines available for veterinary medicine.

Animal Type Insights

The livestock segment dominated the market

In2024, the livestock segment dominated the market with a more than 71% revenue share. This can be attributed to the increased livestock population, supportive government initiatives, and disease outbreaks in cattle and sheep. Merck & Co., Inc. has developed vaccines to prevent E. coli, including Aviguard and Nobilis E. coli. Prevalence rates in various cattle categories (feedlot cattle, cattle on irrigated pasture, cattle at slaughter, and cattle grazing rangeland forages) range from 0.2% to 27.8%, according to Zoetis. The companion segment is expected to grow the fastest during the forecast period. Canine distemper virus is carried by both house pets and ferrets and requires only preventive vaccination because there is no post-infection treatment.

The Morbillivirus causes distemper in dogs, foxes, raccoons, and wolves and is spread through the air and other modes of contact between infected and healthy animals. Canine distemper is fatal because it destroys the respiratory, urogenital, and gastrointestinal tracts. Dogs with gastrointestinal tract bacterial infections and newborn puppies are more vulnerable to this disease. A few canine distemper vaccines on the market include Vanguard, DHPPi/L Vaccine, DHP, and Megavac.

Route of Administration Insights

subcutaneous segment dominates the market

In 2025, the subcutaneous segment dominated the market for animal vaccines, accounting for more than 41% of total revenue. Subcutaneous injection sites are typically found behind the shoulder blades and in the neck of most animals. The ease with which drugs can be administered subcutaneously and slowly absorbed into the body is expected to drive market growth.

The subcutaneous route is also less painful for animals. Furthermore, training veterinary professionals to administer subcutaneous injections is simpler. Currently, intramuscular, and subcutaneous administration are the most common routes of administration in animals, and these elements contribute to market growth.

Due to its growing popularity, the intranasal segment is expected to grow at the fastest rate of 10.0% during the forecast period. Intranasal vaccines are typically limited to a single dose of vaccine. The rising prevalence of respiratory diseases in animals and increased research activities by market players to develop better vaccines are expected to drive market growth.

Top Markets for Animal Vaccine Patents:

The top priority countries can be investigated to determine where the initial patent applications are filed. Since organizations generally file patent applications first in the local territories where their research bases are located, this can be a good indicator of the countries where the majority of research and innovation in a particular technology field is taking place. Similarly, for universities, the priority country is usually the country in which they are based.

The top priority countries/regions for animal health patents include the United States, China, Europe, and Australia. The figure below compares these to the top countries where patents are subsequently filed for protection.

Company profiles and competitive intelligence:

A diverse range of competitors in the global animal health market offer companion and livestock vaccines. Merck, Zoetis, and Boehringer Ingelheim are among the major competitors. Virbac, Hipra, Ceva, Huvepharma, and Dechra are other market leaders in animal vaccines. Merck and Boehringer Ingelheim had the most extensive animal vaccine portfolios, with more livestock vaccines than companion animal vaccines and the most vaccines in poultry.

When it comes to livestock vaccines, Merck has the most licensed livestock vaccines, followed by Zoetis and Boehringer Ingelheim. There are similar trends in companion animal vaccines, with Virbac producing several.

Merck Animal Health is Merck's global animal health business unit. It is one of the world's leading animal health companies, researching, developing, manufacturing, and selling veterinary medicines such as anti-infective and anti-parasitic drugs, pharmaceutical specialty products, vaccines, and innovative delivery solutions. Merck Animal Health is in over 50 countries, with products available in approximately 150 markets. Merck serves all veterinary market segments, including companion animals, livestock, and aquaculture. Merck Animal Health reported USD 4.2 billion in revenue in 2021, with a CAGR of 10% between 2025 and 2035, accounting for 10% of Merck & Co.'s total income.

Regional Insights

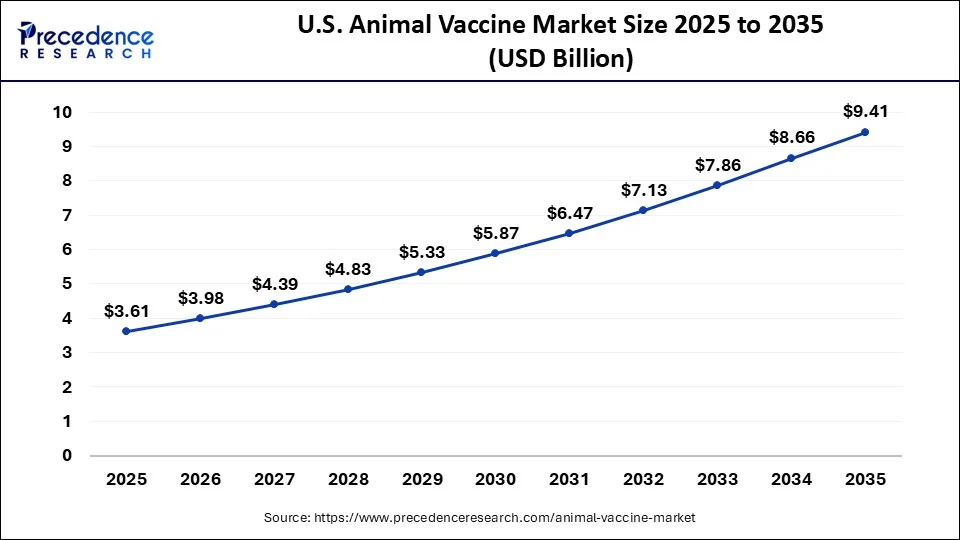

U.S. Animal Vaccine Market Size and Growth 2026 to 2035

The U.S. animal vaccine market size was estimated at USD 3.61 billion in 2025 and is predicted to be worth around USD 9.41 billion by 2035, at a CAGR of 8.99% from 2026 to 2035.

North America dominated the market, accounting for more than 27% of revenue in 2025. Throughout the forecast period, the region is expected to remain dominant. This large proportion can be attributed to the high prevalence of livestock and zoonotic diseases, which result in mass animal deaths. Furthermore, the significant presence of well-established pharmaceutical companies consistently striving for broad commercialization of their vaccines and expanding their geographical reach is expected to drive market growth. Again, the rising incidence of canine disorders, which is increasing the adoption of vaccination for the same, and the growing pet population in the United States are some key factors contributing to the regional market's expansion.

U.S. Market Analysis

The U.S. is the major contributor to the North American market. The increased livestock population, robust veterinary health care delivery systems, and strong government support for animal disease control initiatives strengthen the U.S.'s position in the market. High farmer awareness, well-established routine vaccination practices, and ongoing innovations by domestic veterinary medicine manufacturers collectively support market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Animal Vaccine Market?

During the forecast period, Asia Pacific is expected to have the fastest growth rate. The anticipated increase in livestock population and government initiatives, particularly in developing economies, are among the primary factors expected to drive market growth in the region. The National Dairy Development Board reports that India's cattle population was 192.5 million in 2019, up from 190.9 million in 2012. As a result of the country's large cattle population, vaccine demand is high. The market is being driven by high R&D expenditure by many major players and increased attempts to commercialize veterinary vaccines and inoculations at tolerably low prices.

China Market Analysis

China leads the Asia Pacific animal vaccine market due to its large poultry and swine industries and strong focus on controlling transboundary animal diseases. Government-led immunization programs and domestic vaccine production initiatives help stabilize meat supply chains, supporting widespread use of animal vaccines nationwide.

Why is Europe Considered a Significant Region in the Market?

Europe is considered a significant region in the animal vaccine market due to strict veterinary regulations and a strong focus on disease prevention. High food safety standards encourage regular vaccination, while growing concerns about antimicrobial resistance highlight the preventive benefits of vaccines. Additionally, the well-structured veterinary system supports steady market growth across the region.

Germany Market Analysis

Germany is leading the European animal vaccine market due to its sophisticated farm animal management practices. A strong emphasis on sustained agriculture practices, high usage of preventive veterinary care, and active research work creates consistent demands for vaccines for cattle, poultry, and pigs.

How is the Opportunistic Rise of the Middle East & Africa in the Market?

The Middle East & Africa (MEA) is expected to grow at a lucrative rate over the projection period, thanks to continuous upgrades in animal healthcare infrastructure. Livestock animals have immense economic importance, especially in rural settings. With rising concerns over food security, growing awareness regarding cross-border animal diseases, and support programs from international governments, there is increased emphasis on animal vaccination.

South Africa Market Analysis

South Africa is a leading country in the region due to its advanced veterinary care and organized cattle farming practices. Government initiatives focusing on disease monitoring, education, and vaccine availability are driving rising demand, particularly for cattle and poultry production.

What Opportunities Exist in Latin America for the Animal Vaccine Market?

Latin America presents significant opportunities in the market due to its large livestock population and growing demand for poultry, cattle, and swine products. Expanding commercial farming, rising awareness of animal health, and government support for vaccination programs are driving market growth. Additionally, increasing investments by domestic and international vaccine manufacturers to improve production and distribution further enhance opportunities in the region.

Value Chain Analysis

- Research & Development:

This stage focuses on the identification of animal diseases and the development of vaccines via formulated products and laboratory studies performed for safety and efficacy.

Key Players: Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, HIPRA - Clinical Trials & Regulatory Approval:

Trials are performed on vaccine candidates to meet regulatory standards for safety, quality, and efficacy before becoming commercial products.

Key Players: Zoetis, Ceva Santé Animale, Indian Immunologicals, Hester Biosciences, Virbac - Manufacturing & Production:

This stage includes large-scale production, formulation, packaging, and maintaining the quality to guarantee a consistent supply and quality of the products.

Key Players: Merck Animal Health, Zoetis, Virbac, Hester Biosciences, IDT Biologika - Distribution & Logistics:

This stage involves cold chain storage and logistics to deliver vaccines on time to veterinary clinics, farms, and distributors.

Key Players: Zoetis, Boehringer Ingelheim, Ceva Santé Animale, Elanco, Neogen

Animal Vaccine Market Companies

- Merck & Co., Inc.

- Zoetis

- Boehringer Ingelheim International GmbH

- Virbac

- Biogénesis Bagó

- Indian Immunologicals Ltd.

- Elanco

- Ceva

- Phibro Animal Health Corporation

- Neogen Corporation

- Intas Pharmaceuticals Ltd.

- Ourofino Saúde Animal

Recent Development

- In May 2025, UK researchers launch clinical trials for a new ASF vaccine. The two groups, the Pirbright Institute and the Vaccine Group, collaborated to test a novel African swine fever vaccine that could offer a safer alternative to current live attenuated options. Clinical trials are underway in the UK to test a new vaccine candidate for African swine fever (ASF), a disease that has impacted more than 64 countries.

- In February 2025, BBMP Bruhat Bengaluru Mahanagara Palike announced the launch of combined 5 in 1 vaccine program for launch for street dogs, this launch is integrated with the ongoing anti-rabies vaccine programme.

- In November 2024, Boehringer Ingelheim, a global leader in animal health, launched the EURICAN L4 vaccine to protect dogs against the growing threat of?leptospirosis, a severe and reemerging infectious disease.

- In October 2024, The Global Alliance for Livestock Veterinary Medicines has launched the Distribution Cost-Share Phase of high-quality, regionally-relevant Foot and Mouth Disease (FMD) vaccine to Eastern Africa making the control of the disease a step closer.

- In September 2024, Merck Animal Health, known as MSD Animal Health outside of the United States and Canada, a division of Merck & Co., Inc., Rahway, N.J., USA, announced today the expansion of the newly USDA-approved NOBIVAC NXT vaccine platform to include a best-in-class solution to protect cats against one of the most common feline infectious diseases, feline leukemia virus.

- In 2021, Zoetis introduced the Poulvac Procerta HVT-IBD vaccine to protect poultry from Infectious Bursal Disease (IBD). This was added to the company's existing portfolio of recombinant vector vaccines.

- In 2021, The United Kingdom announced the establishment of a United Kingdom Animal Vaccine Manufacturing and Innovation Centre in Surrey to accelerate vaccine development for livestock and control the spread of viral diseases such as coronavirus. The UK government will contribute USD 24.79 million to establish this center, while the Bill & Melinda Gates Foundation will contribute USD 19.43 million.

- IN 2021, Merck Animal Health joined forces with Automazioni VX, Inc. The main goal of this collaboration was to introduce Innoject Pro, a new subcutaneous chick vaccination technology. The technology will be combined with Merck Animal Health's Innovax vaccines to protect poultry against infectious diseases.

Segments Covered in the Report

By Product Type

- Attenuated Live Vaccines

- Inactivated Vaccines

- Subunit Vaccines

- DNA Vaccines

- Recombinant Vaccines

By Animal Type

- Livestock

- Poultry

- Aqua

- Ruminants

- Swine

- Companion

- Canine

- Feline

By Route of Administration

- Subcutaneous

- Intramuscular

- Intranasal

By End User

- Hospital

- clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting