What is the Animal Diagnostics Market Size?

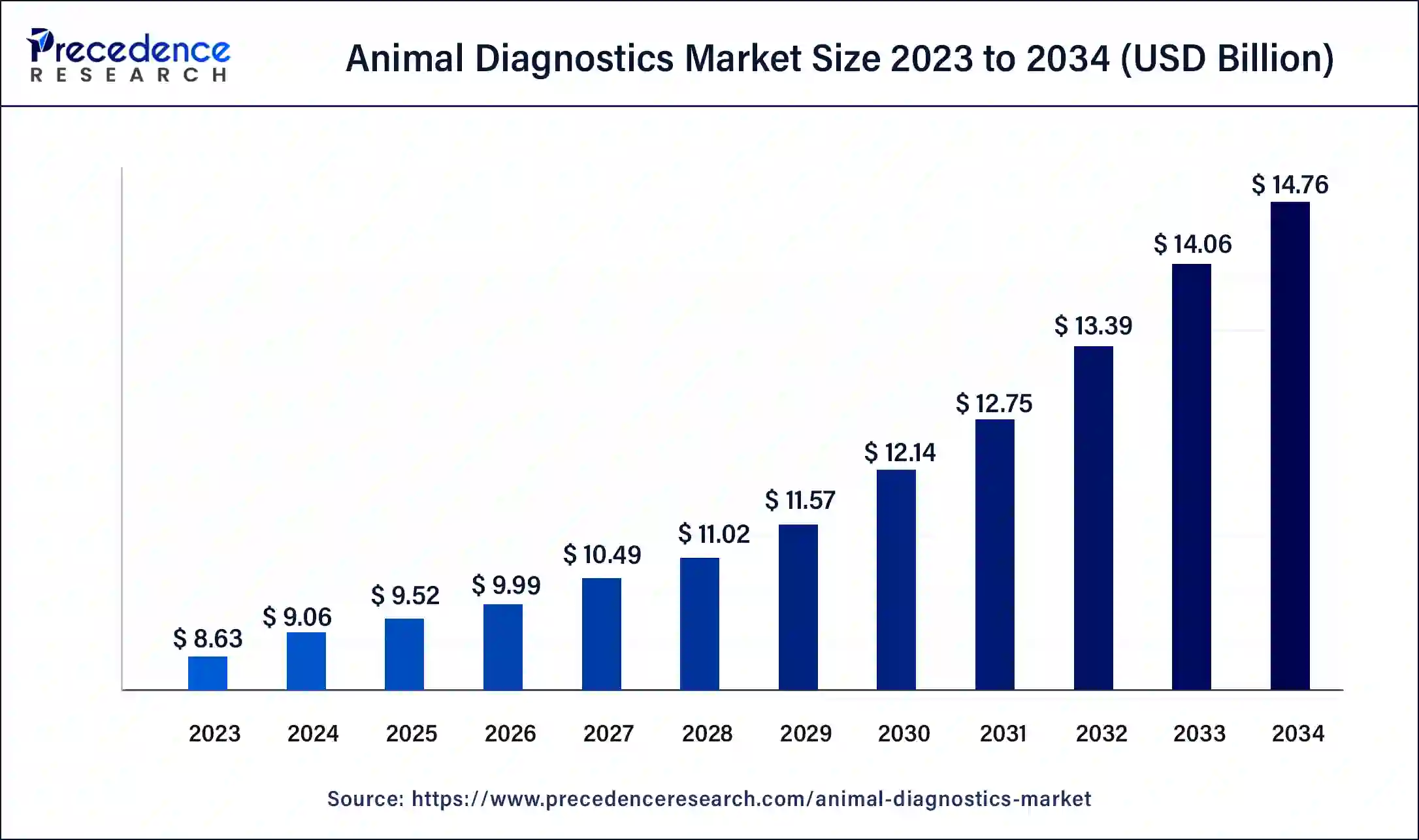

The global animal diagnostics market size is accounted at USD 9.52 billion in 2025 and predicted to increase from USD 9.99 billion in 2026 to approximately USD 15.44 billion by 2035, representing a CAGR of 4.95% from 2026 to 2035. The increasing cases of chronic diseases among animals and the increasing expenditure on pets by their owners are driving the growth of the market.

Animal Diagnostics Market Key Takeaways

- By region, North America dominated the animal diagnostics market in 2025.

- By region, Asia Pacific is expected to witness significant growth in the market during the forecast period.

- By product, the kits and reagent segment dominated the market in 2025.

- By product, the instruments segment is expected to grow in the market during the forecast period.

- By technology, the molecular diagnostics segment held the highest market share in 2025.

- By technology, the hematology segment is expected to grow at a significant rate in the market during the anticipated period.

- By animal type, the companion animals segment dominated the animal diagnostics market in 2025.

- By animal type, the livestock animals segment is expected to grow at a notable rate in the market during the predicted time period.

Market Overview

The animal diagnostics market offers services precisely designated for maintaining the health of animals since they help with quicker diagnosis and treatment planning by spotting health problems before they would otherwise become apparent. Conventional diagnosis is the examination of blood, tissue, urine, or feces to identify the presence of disease, proteins, antibodies, or general health markers. Lab-based testing guarantees high-quality, precise results, and point-of-care diagnostics allow for instantaneous decisions that can calm worried pet owners. A vital component of the animal diagnostics market is these analyses.

By spotting patterns in wellness data that human specialists might miss, digital diagnostics bring new opportunities for early disease identification and unleash the preventative potential of technology. The increasing prevalence of diseases in animals and the rising expenditure by pet owners and government bodies for animal well-being are driving the growth of the animal diagnostics market.

Animal Diagnostics Market Data and Statistics

- About 70% of homes in the United States, approximately 90.5 million households, have pets. Dogs occupy 69% of households, while cats have about 45% of households, followed by birds, fish, and other small animals.

- About 32% of the Millennium generation are pet owners, while Generation X and the baby boomers make up about 24% and 27% of pet ownership, respectively, in the United States.

- In the U.S., about 10% of dog owners carry health insurance for their pets.

Animal Diagnostics Market Growth Factors

- The increasing prevalence of chronic diseases among animals and the increasing spending on animal welfare are driving the growth of the animal diagnostics market.

- The increasing technological advancements in veterinary diagnostics technologies such as medical imaging, molecular diagnostics, imaging modalities, and PoC testing are boosting the growth of the animal diagnostics market.

- The growing development of veterinary diagnostic products plays an important role in the treatment of diseased animals, accelerating the growth of the market.

- The increasing aging pet population, which is more likely to get infected by severe diseases, and the rising government initiatives for animal health and welfare are driving the growth of the animal diagnostics market.

- The increasing number of veterinary diagnostics centers in urban areas due to the increasing animal adoption rate by the population is driving the market's growth.

- Growing cases of zootonic pathogens resulting in mortality in domesticated animals.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 4.95% |

| Market Size in 2025 | USD 9.52 Billion |

| Market Size in 2026 | USD 9.99 Billion |

| Market Size by 2035 | USD 15.44 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By Technology, and By Animal Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing pet adoption rate

The rising urbanization and the increasing disposable income of people are resulting in the increasing trend of having pets in the home. Thus, there is a continuously increasing pet adoption rate. Increasing urbanization, nuclear families, staying single, and increasing adoption of modern lifestyle resulted in a higher number of pet owners. Most households' preferred animals as pets are dogs and cats. The rising expenditure on the pet's healthy life and maintenance by the owner is one of the major factors for the growth in animal diagnostics. Thus, all these factors contribute to the growth of the animal diagnostics market.

Restraint

Insufficient workforce

Veterinary sciences is a highly specialized field that requires an adequate amount of practice and training. Within the healthcare sector, this field is the recipient of the least amount of new workforce every year. Along with the high educational costs and lack of awareness, there is a significant difference between the need and availability of medical personnel. This also hinders the appropriate research and development work required for the growth of any scientific field. Thus, the need for more skilled working, well-trained, and qualified professionals in the field of veterinary diagnostics is restraining the growth of the animal diagnostics market.

Opportunity

Increasing government support

The increasing prevalence of chronic diseases among animals and the increasing number of infectious diseases by animals are creating an increasing demand for animal diagnostics centers. The government initiatives the support of animal well-being and the increasing investments in the growth of animal diagnostics are driving the growth of the animal diagnostics market. Additionally, technological advancements in veterinary diagnostics, such as PoC testing, imaging modalities, etc., are further boosting the growth of the animal diagnostics market.

- In March 2022, Companion Animal Health promulgated a strategic agreement, including an equity investment, with HT BioImaging to co-brand and exclusively sell the HTVet product in the US and Canada.

Segment Insights

Product Insights

The kits and reagent segment held the highest share of the animal diagnostics market in 2025. The growth of the segment is attributed to the increasing use of test kits and reagents at the time of animal medical diagnostics. The test includes blood tests, immunoassays, and urinalysis. These test kits are used in medical laboratories, diagnostics centers, veterinary clinics and hospitals, and other point-of-care. The increasing pet adoption rate and the rising number of veterinary healthcare facilities are driving the demand for kits and reagents in the animal diagnostics market.

The instruments segment is expected to grow significantly in the animal diagnostics market during the forecast period. The growth of the segment is expected to grow owing to the rising technological adoption of medical instruments and machinery like POCT devices and imaging types of equipment, and the increasing investments by private firms in the development of instruments are driving the demand for the segment in the market.

Technology Insights

The molecular diagnostics segment held the highest share of the animal diagnostics market in 2025. Detection, identification, and genotyping of the causative pathogen are the main objectives of veterinarymolecular diagnostics. Methods are similar to those applied in the field of molecular diagnostics for humans. These methods are used in veterinary diagnosis to determine a herd's disease status or to diagnose illnesses in individual animals and herds. A diagnostic unit sample for herd diagnoses, which can compensate for test characteristics, and, to a lesser extent, the large RNA/DNA loads in cases of animal disease outbreaks are notable elements of veterinary molecular diagnostics.

- In January 2022, Ringbio launched a professional website names petrapidtest.com to market Flexy Pet Rapid Test. These kits are based on lateral flow immunoassay, ELISA, and real-time PCR to detect companion animal diseases, which can be helpful for pet owners and vet clinics.

The hematology segment is expected to grow in the animal diagnostics market during the anticipated period. The information required to precisely evaluate and diagnose blood illnesses in common domestic animals, such as dogs, cats, horses, cattle, sheep, goats, pigs, and llamas, is provided by veterinary hematology. This comprehensive resource employs a user-friendly and clinically oriented methodology to assist you in choosing pertinent diagnostic tests, gathering and readying samples, deciphering sample outcomes, and assessing their clinical importance.

Animal Type Insights

The companion animals segment dominated the animal diagnostics market in 2025. The growing pet adoption in urban areas due to the rising acceptance of the modern lifestyle, single living, nuclear families, and increased disposable income drives the growth of companion animals. The rising expenditure on pet care in developed economies is raising the demand for the segment in the market. The rising investment in veterinary healthcare programs and the increasing launch of pet facilities are driving the demand for the segment in the market.

The livestock animal segment is expected to grow in the animal diagnostics market during the predicted time period. The growth of the segment is attributed to the rising demand for dairy products and the farming use of animals, which creates an emphasis on assuring the good health of the animals. The increasing poultry sector and the rising demand for dairy products are driving the growth of the segment.

- In October 2022, the Kansas State Veterinary Diagnostic Laboratory developed a new polymerase chain reaction-based test for blood-borne diseases like anaplasmosis and Theileriosis in cattle.

Regional Insights

North America dominated the animal diagnostics market in 2025. The dominance of the market in the region is attributed to rising urbanization and disposable income, which allows people to adopt pets and spend a heavy amount of money on their well-being, which drives the growth of the market. The increasing technological advancements inanimal healthcare products and instruments are boosting the demand for animal diagnostics. Countries like the United States and Canada have higher adoption rates of pets and spend a significant amount on the pets' health every year, which drives the growth of the market across the region.

U.S. Market Trends

The animal diagnostics market in the U.S. is growing due to the high rate of pet ownership, with many owners increasingly treating pets as part of the family and seeking advanced healthcare solutions. Rising demand for accurate and efficient diagnostic tools, including digital cytology, molecular diagnostics, and integrated testing platforms, is driving adoption. These technologies enable faster and more precise detection of diseases, supporting better preventive care and treatment for pets, which further fuels market growth.

- In January 2023, Esaote launched the Magnifico Vet MRI system for veterinary hospitals in North America.

Asia Pacific is expected to witness significant growth in the animal diagnostics market during the forecast period. The growth of the animal diagnostics market is expected to increase due to the rising disposable income and the increasing number of nuclear families in urban areas. The rising cases of infectious and zoonotic diseases in animals in countries like India and China are driving the demand for animal diagnostics. The increasing spending on animal health by their owner and the government support for animal well-being is driving the growth of the animal diagnostics market across the region.

India Market Trends

India's animal diagnostics market is expanding due to increasing pet ownership, growing demand for animal protein, and rising disposable incomes. With more urban households adopting pets, there is a higher need for comprehensive diagnostic services, including routine health checks, basic vaccines, and preventive care, driving growth in the market.

What are the Advancements in the Animal Diagnostics Market in Europe?

Europe's animal diagnostics market is expected to grow significantly during the forecast period, driven by technological advancements such as molecular diagnostics. In the UK, growth is fueled by pet humanization, rising pet insurance adoption, and the use of advanced technologies like AI and genomics, alongside increasing adoption of diagnostic consumables and kits.

Germany Animal Diagnostics Market Trends: Veterinary clinics in the country are seen actively adopting advanced in-house analyzers and lab partnerships in order to improve the quality and accuracy of animal diagnosis. A high level of mergers and acquisitions is also helping accelerate market growth.

What are the Key Trends in the Animal Diagnostics Market in Latin America?

Latin America's animal diagnostics market is expected to grow notably during the forecast period, driven by rising meat and dairy production and exports, which increase the need for effective herd health management, particularly in ruminants and poultry. The adoption of molecular diagnostics and rapid point-of-care tests is helping deliver faster results while reducing dependence on traditional laboratories. In Argentina, growth is further supported by increasing pet ownership, heightened awareness of animal health, and technological advancements in diagnostic methods.

Brazil Animal Diagnostics Market Trends: The country is witnessing significant growth due to increasing pet ownership and the rising awareness regarding animal health. This growth is primarily driven by the rising humanization of pets, the increasing expectations for high-quality animal care, and increased spending on pet health. Additionally, the growing number of veterinary clinics throughout the country has led to increased utilization of diagnostic technologies.

What are the Growth Factors in the Animal Diagnostics Market in the Middle East and Africa?

The Middle East & Africa (MEA) presents immense opportunities in the animal diagnostics market, driven by a strong focus on livestock health for food security and the adoption of advanced technologies such as AI and point-of-care devices. Growing demand for animal protein is fueling the need for livestock diagnostics to control diseases and ensure self-sufficiency. In Kuwait, market growth is supported by increasing pet ownership and heightened awareness of animal health, with higher spending on companion animal care and a rising emphasis on early disease detection and preventive diagnostics further boosting demand for comprehensive diagnostic solutions.

Saudi Arabia Animal Diagnostics Market Trends: Saudi Arabia's market landscape is driven by increasing pet ownership, rising awareness of preventive veterinary care, and increased government investments in advanced veterinary infrastructure. Moreover, demand for molecular diagnostics, point-of-care testing, and disease-specific assays that enable early detection is growing in the region.

Animal Diagnostics Market Companies

- IDEXX Laboratories, Inc.: Provides a comprehensive ecosystem of in-clinic diagnostic analyzers and global reference laboratory services for companion and production animals.

- Zoetis: Offers a diverse diagnostics portfolio featuring the Vetscan point-of-care instruments, rapid immunoassay tests, and a global network of reference laboratories.

- Antech Diagnostics, Inc. (Mars Inc.): Delivers full-service veterinary diagnostics including one of the world's largest reference lab networks and advanced imaging equipment.

- Agrolabo S.p.A.: Specializes in the manufacture of high-technology diagnostic kits for infectious diseases and blood group determination in companion and livestock animals.

- Embark Veterinary, Inc.: Focuses on direct-to-consumer dog DNA testing that provides genetic health screening for over 270 health risks and detailed breed ancestry.

- Esaote SPA: Leads in veterinary diagnostic imaging by providing dedicated ultrasound systems and MRI scanners tailored for specific clinical needs.

- Thermo Fisher Scientific, Inc.: Supplies advanced molecular and serological solutions, including automated clinical chemistry analyzers and PCR kits for farm animal disease surveillance.

- Innovative Diagnostics SAS: Operates primarily through the IDvet brand, offering ELISA and PCR kits specifically designed for monitoring infectious and zoonotic diseases in livestock.

- Virbac: Develops and markets diagnostic tools alongside their therapeutics, often focusing on point-of-care rapid assays for common companion animal infections.

- FUJIFILM Corporation: Provides advanced veterinary imaging solutions and clinical chemistry analyzers designed for high-precision diagnostic workflows in clinics.

Recent Developments

- In February 2024,Tata Trusts is about to launch its first-of-a-kind small veterinary hospital in Mumbai, India. The hospital is on five floors and has a capacity of over 200 beds. It is a super specialty hospital for pets and will provide 24/7 services.

- In February 2024,MiDOG Animal Diagnostics LLC, a leading player in the microbiome veterinary diagnostic works on the Next Generation DNA Sequencing analysis, introduced a renewed branding strategy in 2024. The latest branding includes the acceptance of MiDOG's technology for all animal species.

- In February 2024,IDEXX Laboratories, Inc., a leading player in pet healthcare innovations, announced the launch of the Vello, a software application that combines clients and veterinary practices through modern digital tools.

Segments Covered by the Report

By Products

- Kits and Reagents

- Instruments

- Software and Services

By Technology

- Molecular Diagnostics

- Hematology

- Immunodiagnostics

By Animal Type

- Companion Animal

- Livestock Animal

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting