Antidiabetics Market Size and Forecast 2025 to 2034

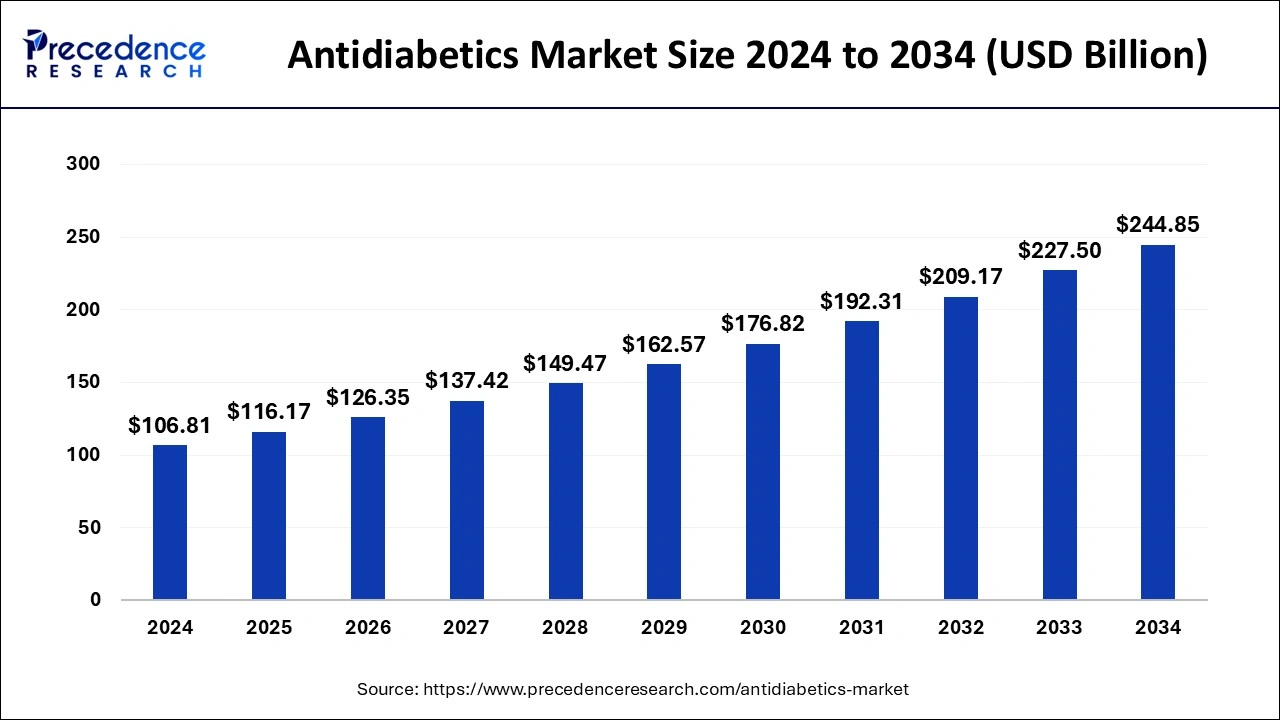

The global antidiabetics market size is calculated at USD 116.17 billion in 2025 and is predicted to increase from USD 126.35 billion in 2026 to approximately USD 244.85 billion by 2034, expanding at a CAGR of 8.65% from 2025 to 2034. The increasing geriatric population and the changing lifestyle habits are driving the growth of the antidiabetics market.

Antidiabetics MarketKey Takeaways

- The global antidiabetics market was valued at USD 106.81 billion in 2024.

- It is projected to reach USD 244.85 billion by 2034.

- The antidiabetics market is expected to grow at a CAGR of 8.65% from 2025 to 2034.

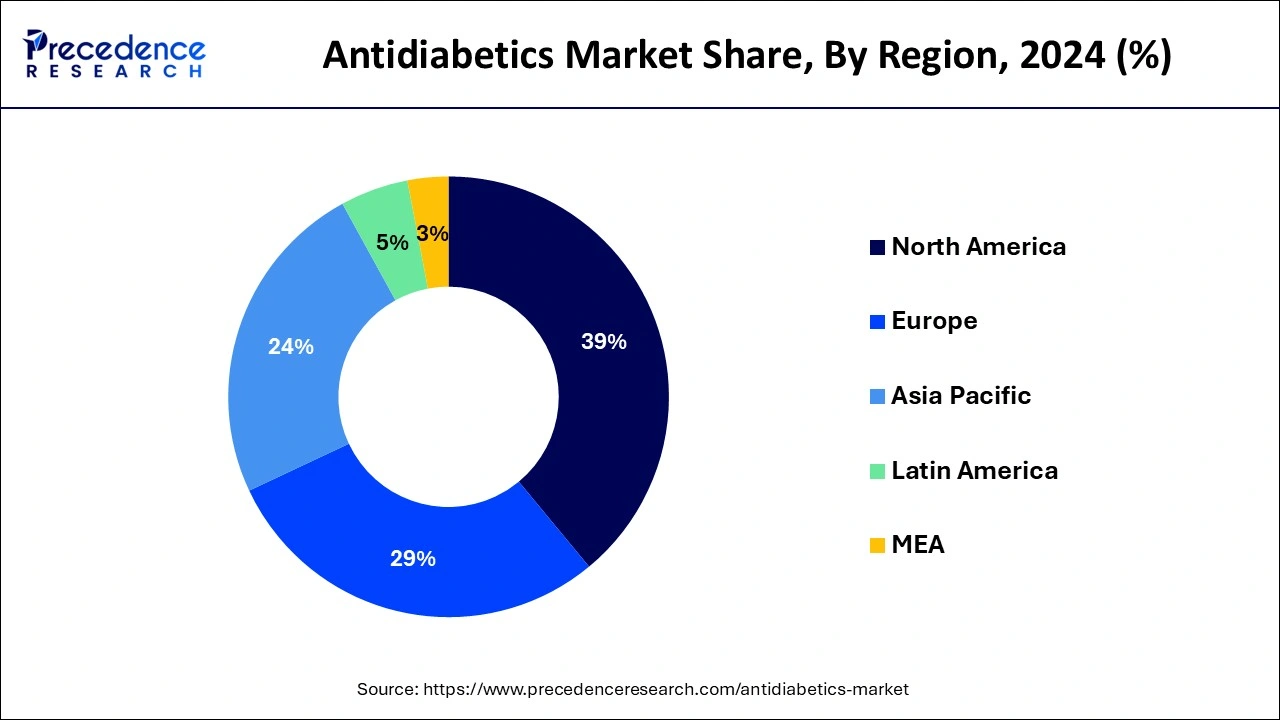

- North America has held the largest revenue share of around 39% in 2024.

- Asia Pacific is observed to witness the fastest rate of expansion during the forecast period.

- By product, the insulin segment dominated the antidiabetics market with the highest share in 2024.

- By product, the drug class segment is observed to grow at a significant rate during the forecast period.

- By patient population, the geriatric segment held the dominating share of the market in 2024.

- By route of administration, the oral segment led the market in 2024. The segment is observed to sustain the position.

- By route of administration, the insulin pen/syringe segment is observed to witness the fastest rate of expansion throughout the forecast period.

How is AI being useful in managing diabetes and being influential in the antidiabetics market?

Artificial Intelligence (AI) is transforming the antidiabetics market in the area of disease management, drug development, and personalized treatment. AI has enabled predictive risk modeling that predicts the onset of diabetes, which addresses the need for curative care instead of preventive care. AI will also help to develop intelligent insulin delivery systems and smart glucometers that can adjust dosages based on continuous glucose monitoring data.

Additionally, pharmaceutical companies are now able to utilize AI algorithms to accelerate antidiabetic drug discovery and make clinical trials more efficient while allowing drugs that will have significant clinical utility to be brought to market faster. In addition to all of this, patient-oriented apps enabled by AI provide real-time health data reporting, medication reminders and tracking of patient lifestyle behavior to improve patient engagement which enhances adherence to treatment and improves outcomes.

Furthermore, as we integrate machine learning into electronic health records, we are able to deliver individualized data-driven patient care. As AI advances the opportunity for AI to be integrated and become a part of care delivery in the antidiabetics market will expand making the chance of precision treatment, proactive treatment and patient-centered care regulations happen.

Market Overview

The antidiabetics market is actively expanding due to the increased global burden of diabetes, attributable to sedentary lifestyles combined with excess caloric intake and escalating obesity rates. In total, antidiabetics represent diverse and broad therapeutic classes, including insulin and oral hypoglycemics, and potentially newer classes such as GLP-1 receptor agonists and SGLT2 inhibitors.

Additionally, patients are also becoming more aware of the importance of early diagnosis and extending disease management and the medical community is responding appropriately. All of these factors are helping to enhance demand for antidiabetics. Recent strategic mergers and acquisitions and expiring patents continue to shape the competitive landscape within the antidiabetics market; additionally, numerous novel therapeutics remain in the development pipeline. Ultimately, the antidiabetics' market is likely remain to an active portion of the broader pharmaceutical trend.

Antidiabetics Market Growth Factors

- The rising geriatric population and the growing prevalence of unhealthy lifestyles are driving the growth of the market.

- The antidiabetics market is observed to be driven with the rising investments in research and development activities.

- The rising glucose intolerance in the population and the growing prevalence of type 2 diabetes in the younger population also enhance the growth of the market.

- The rising government initiatives for controlling the growing number of diabetes patients with the awareness campaign by the various regional governments is driving the growth of the antidiabetics market.

What are Latest Trends in Antidiabetics Market?

- Increasing Global Diabetes Rates: The rise in people with both type 1 and type 2 diabetes is a key factor driving the demand for antidiabetic medications.

- Innovations in Drug Development: Drug discovery and development keeps moving forward with ongoing research and development of next generation antidiabetics such as GLP-1 receptor agonists and SGLT2 inhibitors.

- Growth in the Awareness of Diabetes and Early Detection: Awareness campaigns from public health organizations are promoting early detection and treatment of diabetes increasing access to therapy.

- Lifestyle Changes and a Surge in Obesity: The rise in sedentary lifestyle and unhealthy eating habits contribute to the rise in diabetes which increases the opportunity in the market.

- Technology Integration: Smart insulin pens, continuous glucose monitoring devices, wearables, and artificial intelligence therapies are all promoting improved diabetes care and access.

- Increased Disease Management Spend: The rising spending in chronic disease management is helping to support the market ability to provide better access and affordability to new therapies.

- Patent Expiry and Generic Entry: The patent expiry of branded drugs will provide the market with a wider opportunity for generics and cost-effective therapies.

Recent Trends in the Antidiabetics Market

- Rising Global Diabetes Cases:

Increasing obesity, aging populations, and sedentary lifestyles are driving a surge in diabetes cases, boosting demand for effective anti-diabetic drugs. - Growing Use of Dual-Action Drugs:

Medications like GLP-1 receptor agonists and SGLT2 inhibitors are becoming popular for offering both glucose control and cardiovascular benefits. - Expansion of Oral GLP-1 Therapies:

Oral versions of GLP-1 drugs are emerging as convenient alternatives to injections, improving patient comfort and compliance. - Rise in Digital Diabetes Management:

Smart insulin pens, continuous glucose monitoring systems, and AI-based apps are helping patients track and control blood sugar levels effectively. - Increasing Focus on Personalized Medicine:

Healthcare providers are adopting data-driven approaches to customize treatments based on patient age, genetics, and lifestyle. - Surge in Combination Therapies:

Fixed-dose combinations of multiple drugs are gaining momentum to simplify dosage schedules and improve treatment outcomes. - Rapid Growth in Emerging Economies:

Markets like India, China, and Brazil are witnessing high adoption of advanced diabetes treatments due to better healthcare access and awareness.

Market Outlook

- Industry Growth Overview: The antidiabetic market is growing rapidly as the global burden of diabetes continues to rise due to sedentary lifestyles, unhealthy diets, and aging populations. Increasing awareness of diabetes management and the availability of advanced treatment options, such as GLP-1 receptor against insulin analogs, and combination therapies of fuel driving market expansion. Strong investments in R&D and improved access to healthcare in developing regions are further accelerating overall market growth.

- Sustainability Trends: Sustainability is becoming a key focus in the anti-diabetic sector as companies work to minimize their environmental impact. In the production of insulin delivery systems and devices, manufacturers are implementing waste reduction tactics with biodegradable packaging and environmentally friendly production techniques. Initiatives encouraging patient adherence and appropriate medication disposal are also strengthening corporate sustainability commitments and reducing medical waste.

- Global Expansion: The market for anti-diabetic products is growing significantly worldwide, especially in developing nations where access to healthcare and diabetes awareness is improving. The fastest growing region is the Asia Pacific as a result of increased healthcare investments, urbanization, and diagnosis rates. To meet the growing demand for diabetes care solutions worldwide, major pharmaceutical companies are increasing their footprint through partnerships with localized manufacturing and the introduction of affordable biosimilars.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.65% |

| Market Size in 2025 | USD 116.17 Billion |

| Market Size in 2026 | USD 126.35 Billion |

| Market Size by 2034 | USD 244.85 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Patient Population, and By Route of Administration |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Government initiatives for controlling diabetes

Multiple government initiatives taken for controlling the prevalence of diabetes acts as a major driver for the antidiabetics market. Government initiatives often include public health awareness campaigns that educate individuals about diabetes prevention, early detection, and management. These campaigns raise awareness about the importance of lifestyle modifications, regular screening, and adherence to treatment regimens, thereby increasing the demand for antidiabetic medications.

Some governments subsidize healthcare services, including medications for chronic conditions like diabetes, to make them more accessible and affordable to the population. Subsidies or reimbursement schemes reduce out-of-pocket expenses for patients, encouraging adherence to prescribed treatment regimens and boosting the uptake of antidiabetic medications. Government funding for diabetes research stimulates innovation in the development of new antidiabetic drugs and treatment modalities. Research grants and funding support clinical trials, drug discovery efforts, and technology advancements in diabetes management, leading to the introduction of novel therapies and treatment options in the market.

Restraint

Regulatory hurdles

The requirement of regulatory approvals for antidiabetics drugs creates a significant restraint for the antidiabetics market. Regulatory agencies impose rigorous standards and requirements for the approval of new antidiabetic drugs and therapies. Companies must conduct extensive preclinical and clinical trials to demonstrate safety, efficacy, and quality, which can be time-consuming and resource intensive. Regulatory agencies require ongoing monitoring and reporting of adverse events associated with antidiabetic drugs to ensure patient safety. Companies must establish robust pharmacovigilance systems to track and assess the safety and effectiveness of their products, adding further regulatory burdens and potential liabilities.

Opportunity

Government initiatives taken in the antidiabetics market:

Government programs are critically impacting the rapid growth of the antidiabetics market by facilitating access, affordability and awareness. Many countries have adopted diabetes care as part of a broader health agenda on non-communicable disease (NCD) policy, where widespread national screening, early diagnosis and dispensing of essential antidiabetics in public health systems is commonplace. Diabetes awareness campaigns, like India's mDiabetes and the WHO's Defeat Diabetes programs, are creating public consciousness around diabetes care and increasing chances for early treatment.

Government regulatory agencies are enforcing drug pricing caps while expanding essential medicines programs by subsidizing access to essential generic medicines. Many governments are incentivising local production of essential antidiabetic drugs, given recent and pending expiration of patents. Digital health initiatives, including telemedicine and national health registries are creating better delivery and tracking mechanisms for care. Together, the savvy public health policies at play create a powerful ecosystem to sustain a growing antidiabetics marketplace.

Distribution Channel Insights

The antidiabetic market distribution channels show retail pharmacies dominating the overall market as they are widespread and widely accessible, which is important for patients who need easy and convenient access, along with the assumption that if you live in an urban or rural area, using a pharmacy is something you can rely on. The same can be said for patients who depend on their local pharmacy for refills for chronic medications like insulin and oral antidiabetics - ultimately, they can consistently generate revenue. In addition to this, retail chains and independent drugstores offer valuable service/health benefits, as they employ pharmacist consultations, provide prescription refill reminders while consistently suggesting or offering generic alternatives to oral antidiabetics, supporting medication or treatment adherence. The patient-to-pharmacist relationship - especially with trust by the patient - and the growing awareness of health implies that retail pharmacy is paramount for antidiabetics.

In contrast but not to be overlooked, while retail pharmacies are foremost, online pharmacies will likely become the fastest-growing distribution channel, also supported by the digitalization of healthcare accelerated over the last number of years and the increase in demand for contactless service options. The significant increase of e-commerce platforms offering prescription drugs with accompanying discounts, doorstep delivery, and consideration of automated refills have attracted tech-savvy diabetic patients looking for the most convenience, and cost efficiencies.

Patient Population Insights

The geriatric segment held the dominating share of the antidiabetics market in 2024. Elderly individuals often have multiple risk factors for diabetes, including obesity, a sedentary lifestyle, and comorbid conditions such as hypertension and cardiovascular disease. These factors contribute to a higher incidence of diabetes among older adults and a greater need for antidiabetic treatment. Aging is associated with changes in metabolism, insulin sensitivity, and pancreatic function, which can lead to the development or worsening of diabetes in older adults. As a result, elderly individuals may require more intensive management of their diabetes with antidiabetic medications.

Route of Administration Insights

The oral segment led the market with the largest share in 2024. Oral antidiabetic medications offer a convenient and non-invasive treatment option for patients with diabetes. Compared to other forms of treatment such as insulin injections or implantable devices, oral medications are easier to administer and can be taken orally, often with meals. The oral antidiabetics market offers a wide range of medication options, including various classes such as biguanides, sulfonylureas, thiazolidinediones, DPP-4 inhibitors, SGLT-2 inhibitors, and others. This diversity allows healthcare providers to tailor treatment regimens to individual patient needs and preferences.

In many healthcare systems, oral antidiabetic medications are cost-effective compared to other forms of treatment such as insulin therapy or surgical interventions. This affordability makes oral medications accessible to a larger population of patients with diabetes, driving market demand and dominance.

The insulin pen/syringe segment is observed to witness the fastest rate of expansion in the antidiabetics market during the forecast period. Insulin pens and syringes offer a convenient and user-friendly method for administering insulin. Compared to traditional vial and syringe methods, insulin pens require less manual dexterity and are preferred by many patients, especially those with limited mobility or visual impairment. Insulin pens and syringes are designed for single-patient use, reducing the risk of contamination and infection transmission compared to multi-dose vials. This enhances patient safety and reduces the likelihood of needle-stick injuries.

Drug class Insights:

In a changing antidiabetics market, GLP-1 receptor agonists have surpassed other drug classes as the strongest medication class, due to their impactful dual action. They regulate blood glucose levels while allowing for weight loss which is advantageous for many individuals with Type 2 diabetes.

Furthermore, their efficacy in reducing cardiovascular risks has made them the preferred drugs by physician choice, particularly for individuals who also have cardiovascular disease. As injectable and oral formulations are enhanced, GLP-1 receptor agonists are revolutionizing diabetes treatment because of their convenience, behavior and outcome change, and improving patient adherence.

Conversely, insulin is the fastest-growing drug class, supported by ongoing change and sophistication in its formulation and delivery. For example, next-generation insulin analogs and biosimilars are making insulin therapy easier to deliver and more affordable for patients. Furthermore, the integration of technology like smart insulin pens, insulin pumps and real-time monitoring and algorithms, are also enhancing the experience of delivering insulin therapy for patients.

This means more accuracy in dosing, better glucose regulation and compliance. With increased awareness, diagnosis, and treatment of Type 1 and complex Type 2 diabetes - the innovation and uptake of new insulin types and delivery mechanisms will only increase. This upward trend will also support growth in the overall diabetes drug market.

Regional Insights

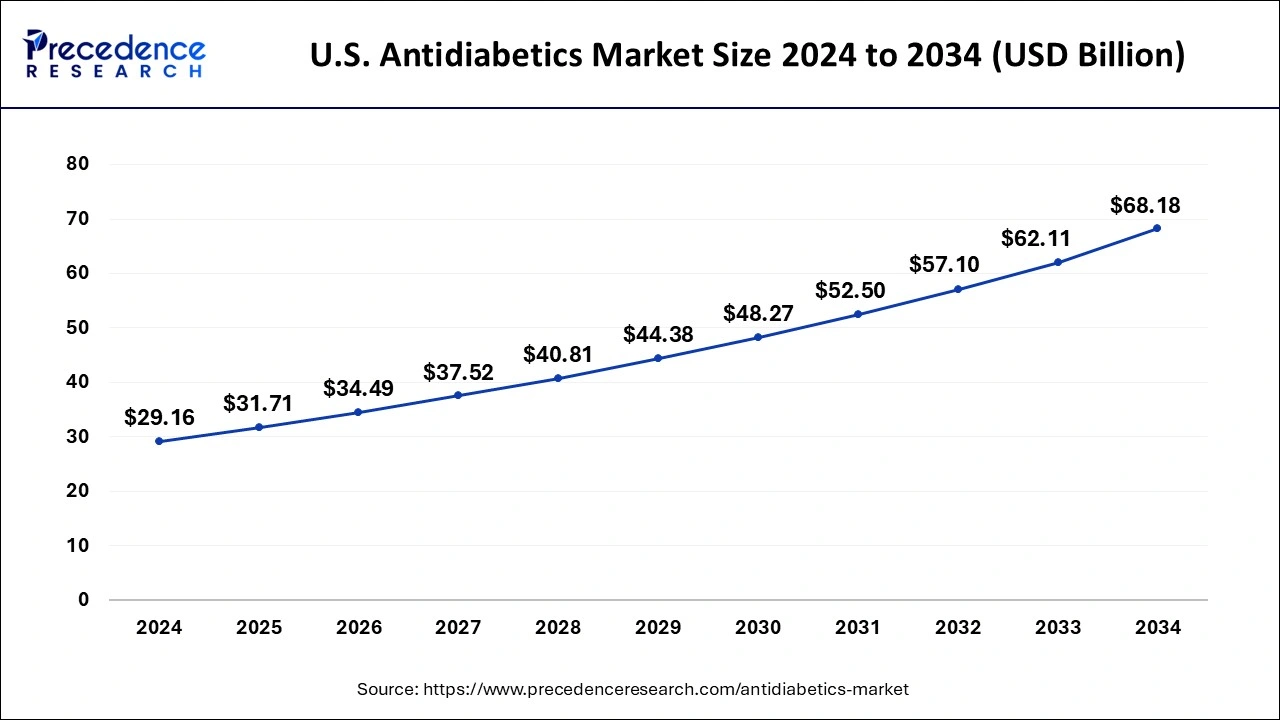

U.S.Antidiabetics Market Size and Growth 2025 To 2034

The U.S. antidiabetics market size is valued at USD 31.71 billion in 2025 and is expected to hit around USD 68.18 billion by 2034, poised to grow at a CAGR of 8.86% from 2025 to 2034.

North America:

Due to widespread diabetes incidence, established healthcare systems, and quick adoption of new antidiabetic therapies, North America is a leading region within the antidiabetics market globally. North America has a strong pharmaceutical industry with an abundance of insulin analogs, GLP-1 receptor agonists, and countless new drug delivery technologies. The region has a robust reimbursement landscape, multiple government-subsidized diabetes management programs, and new opportunities to develop public-private partnerships.

There is a growing awareness and emphasis on diabetes prevention, early detection, and management in North America. Healthcare initiatives, public awareness campaigns, and educational programs aimed at promoting healthy lifestyle choices and diabetes management contribute to higher diagnosis rates and treatment-seeking behavior.

U.S. Antidiabetics Market Trends:

In the U.S. specifically, rising levels of health awareness, increased insurance coverage, and rapid growth of digital health capabilities have improved clients' ability to discover diabetes earlier and regularly follow up on their health. These trends should further affect early diagnosis and treatment compliance moving forwards. Similarly, pharmaceutical R&D investments and emerging technologies have encouraged greater clinical trial experiences, and the FDA's unprecedented approval rates for next-generation antidiabetic drugs confirm most of this advancement is occurring in North America. North America will continue to maintain efficient patient contact while focusing on precision medicine and driving the future of the antidiabetic market.

Asia-Pacific:

The Asia-Pacific region is rapidly emerging as a significant and lucrative market for the global antidiabetics industry. Increasing diabetes prevalence driven by urbanisation, sedentary lifestyle and dietary changes is driving demand on levels we have not seen before for drug solutions. China, India and Japan are seeing significant growth in the use of oral antidiabetics, insulin and new GLP-1 receptor agonists to combat diabetes.

The growth will also be supported by the expanding healthcare infrastructure, increasing health literacy and greater government responsibility for chronic disease management. Local pharma companies will also improve access with inexpensive generics and biosimilars.

Digital health and mobile diabetes management platforms in urban centres are being increasingly adopted as well. With the major patient pool and growth in health technology innovation, the Asia-Pacific market is set to become an engine of growth in the antidiabetics market.

- According to the latest study by the Lancet, it is estimated that about 11.4% of the 101 million people in India are affected by diabetes.

- As per the Commissioned by the Health Ministry about 136 million or 15.3% of the Indian population is pre-diabetic.

- According to the IDF, it is estimated that the China is having 140.5 and 147.2 million diabetes patient and India will have 101.0 and 134.2 million of diabetes patients by 2030 and 2045 respectively.

Governments in Asia Pacific countries have implemented favorable regulatory frameworks for pharmaceutical products, including antidiabetics. Streamlined approval processes and market access policies encourage innovation, competition, and investment in the antidiabetics market. Economic development and urbanization in Asia Pacific have led to lifestyle changes characterized by reduced physical activity, increased consumption of processed foods, and higher stress levels, all of which are risk factors for diabetes. Urban areas, in particular, experience a higher prevalence of diabetes, driving the demand for antidiabetic treatments.

Europe:

Europe is a substantial and continuously growing region in the global antidiabetics market due to the region's strong healthcare system, the rising prevalence of diabetes, and committed government efforts. EU member states have undertaken significant investments in awareness campaigns, early screening initiatives, and affordable access to oral and injectable antidiabetic therapies.

The region's focus on cost-effective treatment has also increased demand for biosimilar insulin and new GLP-1 receptor agonists. There is a growing trend towards digital diabetes management platforms and the adoption of telehealth solutions in Europe, which will improve patient engagement and enhance medication compliance.

The EMA and other regulatory bodies are also embracing novel antidiabetic drug approvals rapidly, further developing the next pipeline of antidiabetic drugs. In tandem with existing financial support, Europe continues to transform the antidiabetes market through sustainable, patient-centered innovations, while focusing on integrated care, public health collaboration, and technological advancements.

Value Chain Analysis

- R&D: To improve glycemic control, ongoing R&D in the anti-diabetic market focuses on creating novel insulin analogs, oral GLP-1 receptor agonists, and gene-based therapies. In order to customize treatment results, businesses are also investing in AI-driven glucose monitoring systems.

- Clinical Trials & Regulatory Approvals: Next-generation oral insulins and dual agonists that target both glucose and weight management are the subject of numerous late-stage clinical trials. Advanced medications with better safety and efficacy profiles are now more easily accessible thanks to recent regulatory approvals.

- Patient Support and Services: Pharmaceutical firms are expanding digital platforms and patient-assistance programs to enhance medication adherence and lifestyle management. Remote monitoring and telehealth services are helping patients track sugar levels and receive continuous medical guidance.

Antidiabetic Market Companies

- Sanofi-Aventis

- Takeda Pharmaceuticals

- Eli Lilly

- Oramed Pharmaceuticals

- Boehringer Ingelheim

- Merck & Co. Inc.

- Novo Nordisk

- Bristol-Myers Squibb

- Halozyme Therapeutics

- Pfizer

Recent Development

- In early January 2025, the FDA approved expanded indications for Ozempic (semaglutide injection), now formally recognized for reducing the risk of kidney disease progression, kidney failure, and cardiovascular death in adults with type 2 diabetes with chronic kidney disease, based on the robust Phase?3b FLOW trial.

(Source: https://www.industryintel.com )

- In mid April 2025, Eli Lilly's experimental oral GLP 1 agonist, orforglipron, demonstrated impressive results—achieving nearly?8% weight loss and significant HbA?c reduction in a pivotal Phase?3 trial. The company aims to file for weight loss approval by year end 2025, followed by a diabetes-specific filing in 2026.

(Source : https://www.reuters.com )

- In November 2025, Zydus, Torrent announced plans to launch generic versions of the blockbuster diabetes drug Semaglutide in India and Brazil.

This follows the patent expiry of the original molecule, potentially lowering costs for patients.

(Souce : https://www.thehindubusinessline.com )

- In November 2025, Eli Lilly announced its anti-obesity/diabetes drug Mounjaro had become India's highest-selling pharmaceutical by value in October.

The drug achieved over ₹100 crore in sales, surpassing rivals shortly after its launch earlier in the year.

(Source: https://www.business-standard.com )

Segments Covered in the Report

By Product

- Insulin

- Rapid Acting

- Long Acting

- Premixed Insulin

- Short Acting

- Drug Class

- Biguanides

- GLP-Agonists

- Thiazolidinediones

- Sulphonylureas

- SGLT-2

- Alpha-Glucosidase Inhibitors

- DPP-4 Inhibitors

- Meglitinides

By Patient Population

- Pediatric

- Adults

- Geriatric

By Route of Administration

- Oral

- Infusion

- Intravenous

- Insulin Pump

- Insulin Pen/Syringe

By Distribution Channel

- Retail pharmacies

- Online pharmacies

By Diabetes Type

- Type 2 diabetes

- Type 1 diabetes

By Drug Class

- GLP-1 Receptor

- Insulin

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting