What is the Artificial Intelligence (AI) in Chemicals Market Size?

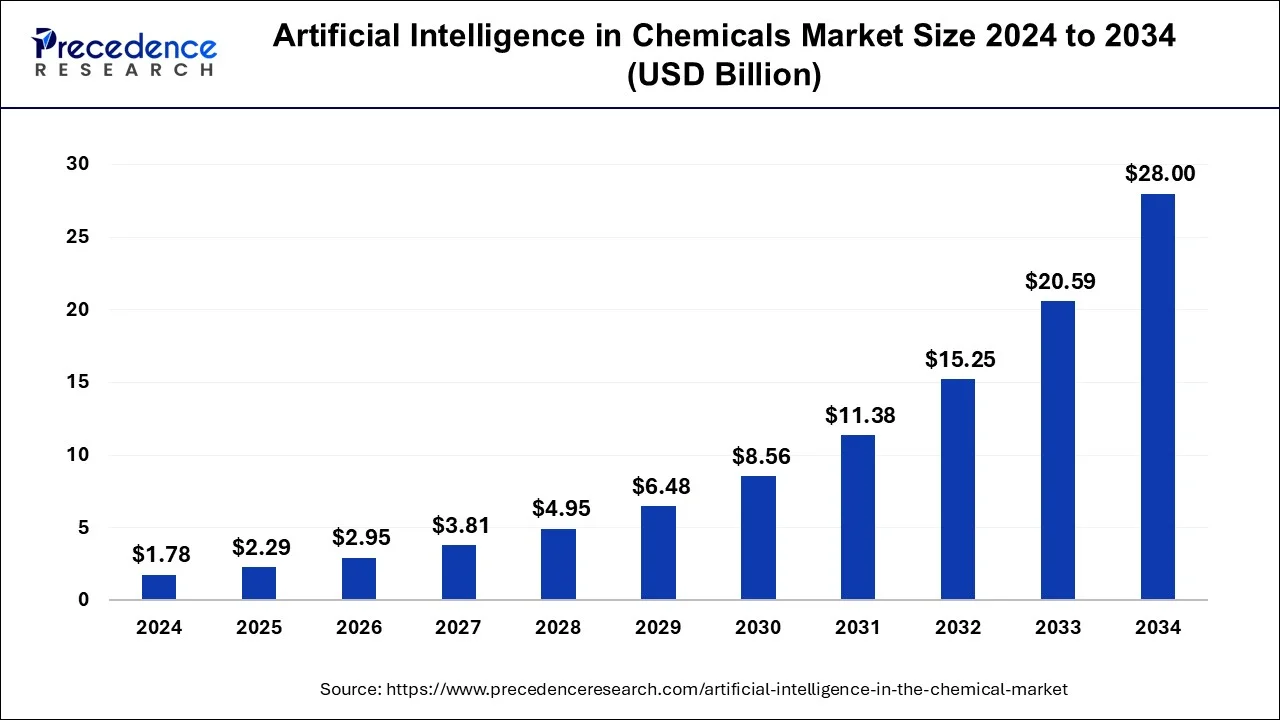

The global artificial intelligence (AI) in chemicals market sizeis accounted at USD 2.29 billion in 2025 and predicted to increase from USD 2.95 billion in 2026 to approximately USD 28.00 billion by 2034, expanding at a CAGR of 32.05% from 2025 to 2034.

Artificial Intelligence (AI) in Chemicals Market Key Takeaways

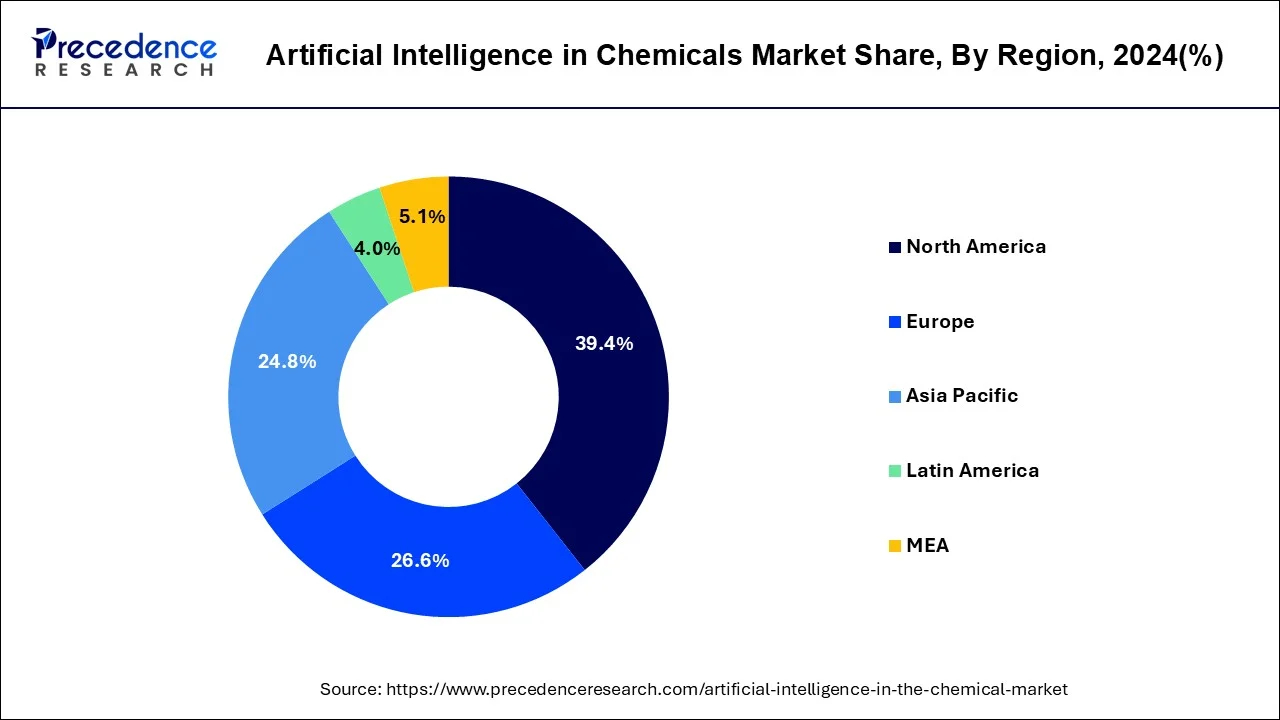

- North America is predicted to have the biggest share 39.4% in 2024.

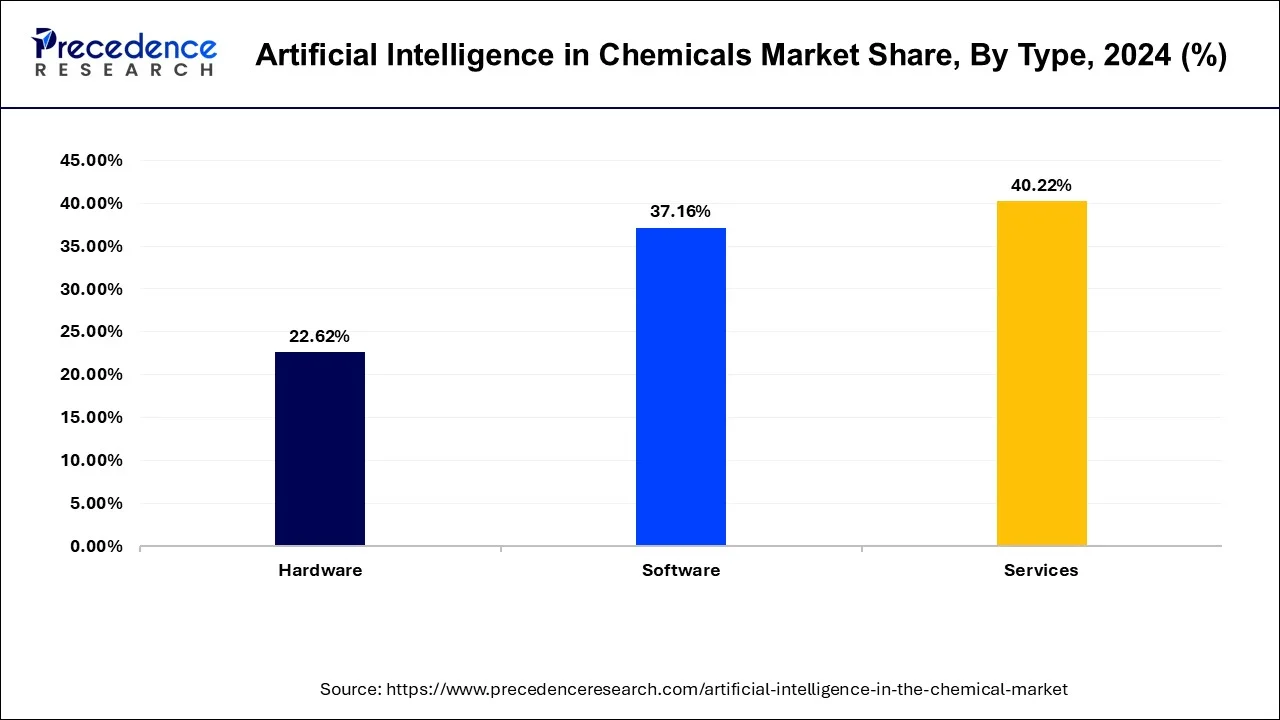

- By type, the services segment contributed the revenue share of 40.22% in 2024.

- By end use, the base chemicals & petrochemicals segment has generated 57.5% 2034.

- By application, the other segment has captured revenue share of 30.20% in 2024.

Technological Advancement

Technological advancements in artificial intelligence in the chemical market feature blockchain, generative AI, AI-driven robotics, machine learning, predictive analytics, and computer vision. The virtual screening helps in screening the database of chemical compounds, identifying new chemicals, and potential drug candidates. Technology in the manufacturing and operations optimizes processes and predicts maintenance. Blockchain supports supply chain management by enabling visibility and safety in the supply chain. It also traces materials and chemicals.

AI-driven robotics helps in completing chemical plants' tasks automatically. Generative AI generates new chemical compounds and also predicts properties, which helps in the research and development of drugs and materials. Computer vision provides a proportionate and calculative statement of chemicals with the help of technology.

What is AI in the chemical market?

The surging demand for consistent and effective manufacturing processes, the adoption of innovative digital techniques by chemical industries, the rising demand for better batch production scheduling, and increased awareness about AI solutions are the key factors driving the expansion of AI in the chemical market.

Furthermore, rising government R&D investments in manufacturing process optimization are expected to drive market deployment over the projected period. The increasing adoption of advanced technologies like IoT, 3D printing, and VR is expected to increase R&D activities, fueling the demand for AI across industries.

Market Trends

- AI-driven process optimization

- Accelerated research and development

- Growing adoption of digital transformation initiatives

- Proliferation of IoT sensors and big data analytics

- Rising regulatory compliance needs

Artificial Intelligence (AI) in the Chemical Market Outlook

- Industry Growth Overview: The period of 2025 to 2030 should witness strong growth in AI in the chemicals market as manufacturers turn to generate AI applications in predictive maintenance, optimization of processes, and R&D automation. The explosion of machine learning to address challenges in chemical modeling and formulation is driving cost efficiency and accelerating innovation, particularly in North America and Europe.

- Key Investors: Venture capital and institutional investors are focused on AI-driven chemical companies that have scalable data-driven models. Companies are deploying capital into firms that are enabling AI solutions for materials discovery and process automation, believing there are good ESG and ROI prospects.

- Startup Landscape: There is a rapid rise in the number of AI-driven chemical startups changing the market around molecular simulation, digital twins, and automated synthesis. Some startups, such as Citrine Informatics (U.S.) and Kebotix (U.S.), are developing self-learning platforms that will mitigate cost and R&D time while accelerating the speed of materials discovery.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 28.00 Billion |

| Market Size in 2025 | USD 2.29 Billion |

| Market Size in 2026 | USD 2.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.82% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Application, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Design and development of new products

AI is used to accelerate innovation between the process and product development stages. Utilizing machine learning as well as advanced analytics algorithms with historical data, chemical industries are able to accurately formulate costs and performance. Many chemical sectors use customized mathematical algorithms and models to determine the optimal chemical combination and forecast the catalyst aging process and complex dye solubility.

For instance, robots are used by companies such as Novartis to transfer chemical compounds in multi-well plates. They assist the company in running laboratory tests on products and substances 24 hours a day, seven days a week, which accelerates the process of drug discovery and development.

Accurate forecasting

The chemical industry must forecast demand in order to regulate its supply chain accurately. As a result, the chemical business must implement AI algorithms. Deep learning algorithms are capable of identifying the variables that influence product demand. Several chemical industries are using this technology to enhance forecasting accuracy.

For instance, organizations such as Blue Yonder support AI and ML methods to improve forecasting as well as replenishment while also adjusting pricing.

Advancement in the R&D services

Research and development are among the most vital processes for any company to succeed in order to achieve more efficient and faster results. With the help of computerized combinations and permutations, machine learning strategies perform any research and development at a higher and faster speed. Machine learning solutions can recognize the appropriate molecules and generate correct formulas, speeding up the company's research process.

For instance, Pfizer uses data science, AI, and real-world data to develop novel and more accurate treatment options. The company uses artificial intelligence to redefine and accelerate the completion of chemical studies.

Restraints

High cost of new technologies

An important factor to consider when purchasing AI technologies is the cost. Companies that lack in-house expertise or need to be made aware of AI are frequently forced to outsource, which adds cost and maintenance issues. Smart technologies are costly due to their complexity and may incur additional expenses for repair and maintenance. Additionally, there may be costs associated with the computation required to train data models, etc.

Software programs must be updated on a regular basis in order to adapt to evolving business environments, and in the event of a breakdown, restoring is frequently time-consuming and expensive.

Opportunities

Application of generative modeling

Generative modeling could be a game-changer for chemists looking for novel molecules with therapeutic benefits or alternatives to widely used substances that have an adverse effect on the environment. Machine learning techniques can help scientists efficiently screen a variety of chemical reactions or combinations and their results.

With such screening/generative capabilities, ML algorithms can also help us get closer to a greener future by allowing chemical firms to manufacture substances that have properties similar to petroleum products or plastic but break down more easily and without waste or pollution.

As per Nature Communications, Artificial intelligence services assist organizations to be approximately 63% more environmentally friendly.

Type Insights

The software segment underwent notable growth in the market during 2024.

- In May 2025, a new enterprise platform that harnesses artificial intelligence to dramatically accelerate scientific research and development, potentially compressing years of laboratory work into weeks or even days was launched by Microsoft.

The hardware segment will gain a significant share of the market over the studied period of 2025 to 2034.

- In August 2025, AI-Powered chemistry search tool for faster research using natural language queries instead of complex keyword combinations was launched by Elsevier, a scientific publisher and data analytics company.

Elsevier Launches AI-Powered Chemistry Search Tool for Faster Research

Artificial Intelligence (AI) in Chemicals Market Revenue (USD Million), By Type, 2022-2024

| Type | 2022 | 2023 | 2024 |

| Hardware | 252.5 | 318.9 | 403.0 |

| Software | 398.9 | 513.6 | 662.0 |

| Services | 426.7 | 552.7 | 716.5 |

Application Insights

The discovery of new materials segment enjoyed a prominent position in the market during 2024.

- In September 2024, the official launch of new XFEP and XMolGen, two proprietary software products designed to accelerate and enhance the efficiency of drug discovery was announced by XtalP.

XtalPi Launches Computational Chemistry Software for Drug Discovery: XMolGen and XFEP

The production optimization segment is predicted to witness a significant share of the market over the forecast period.

- In January 2025, industry-first AI solution for entire production networks was launched by SLB. SLB's OptiSite uses AI and digital twins to optimize production networks, offering predictive insights and improved performance.

End Use Insights

The base chemicals & petrochemicals segment captured a significant portion of the market in 2024. AI offers many benefits for the chemical industry in improving chemical processes, improving safety, boosting research speed, and aiding quality control. Each of these benefits are ground-breaking for the business of making and supplying industrial chemicals. AI can expedite the development of new petrochemical products and processes by allowing rapid prototyping and simulation. Machine learning algorithms can analyze high amount of chemical data to identify potential new compounds and predict their properties.

- In July 2025, AI-powered autonomous petrochemical operations in UAE were launched by Honeywell and Borouge.

Honeywell & Borouge Launch AI-Powered Autonomous Petrochemical Operations in UAE | ACHR News

The specialty chemicals segment is projected to expand rapidly in the market in the coming years. AI helps the chemical industry tackle risks by enhancing efficiency, reducing costs, and supporting better decision making. In production, AI analyzes data to identify inefficiencies, predict issues, and recommend adjustments. By using machine learning techniques with chemical process operation data, it is possible to forecast the performance of chemical processes and identify optimal operating conditions.

- In April 2025, a new digital product catalog powered by Knowde's AI-based platform, marking a step forward in the company's digital transformation strategy was launched by Tilley Distribution.

Tilley Distribution launches AI catalog for chemical sourcing

Discovery of new materials

Production optimization

Optimizing products is a pervasive challenge across industries, including the chemicals market. The application of artificial intelligence (AI) in this domain holds immense potential for driving product optimization. By leveraging AI techniques, such as predictive algorithms and deep learning, the chemicals industry can enhance its processes and achieve significant improvements. For instance, AI can be utilized to optimize production operations, minimize costs, and ensure the highest quality standards. Through AI-driven systems, chemical manufacturers can optimize performance parameters and reduce energy consumption, leading to more efficient and sustainable processes. Moreover, AI plays a vital role in chemical process control by enabling real-time monitoring and proactive management. Techniques like computer vision and predictive artificial neural networks empower high-speed and precise thermal control of continuous flow chemical reactors, enhancing productivity and minimizing downtime. Additionally, the integration of deep learning and thermal imaging allows for intelligent fault detection in pyrolysis reactor monitoring, contributing to enhanced safety and reliability. These applications highlight the transformative impact of AI in the chemicals market, driving optimization, efficiency, and proactive monitoring for improved performance and competitiveness.

Artificial Intelligence (AI) in Chemicals Market Revenue (USD Million), By Application, 2022-2024

| Application | 2022 | 2023 | 2024 |

| Discovery of New Materials | 114.2 | 147.0 | 189.4 |

| Production Optimization | 109.0 | 141.5 | 183.8 |

| Pricing Optimization | 109.0 | 140.7 | 181.8 |

| Load Forecasting of Raw Materials | 106.8 | 137.7 | 177.6 |

| Product Portfolio Optimization | 101.3 | 130.3 | 167.8 |

| Feedstock Optimization | 98.2 | 126.7 | 163.7 |

| Process Management and Control | 106.8 | 138.3 | 179.3 |

| Others | 332.7 | 423.0 | 538.1 |

Regional Insights

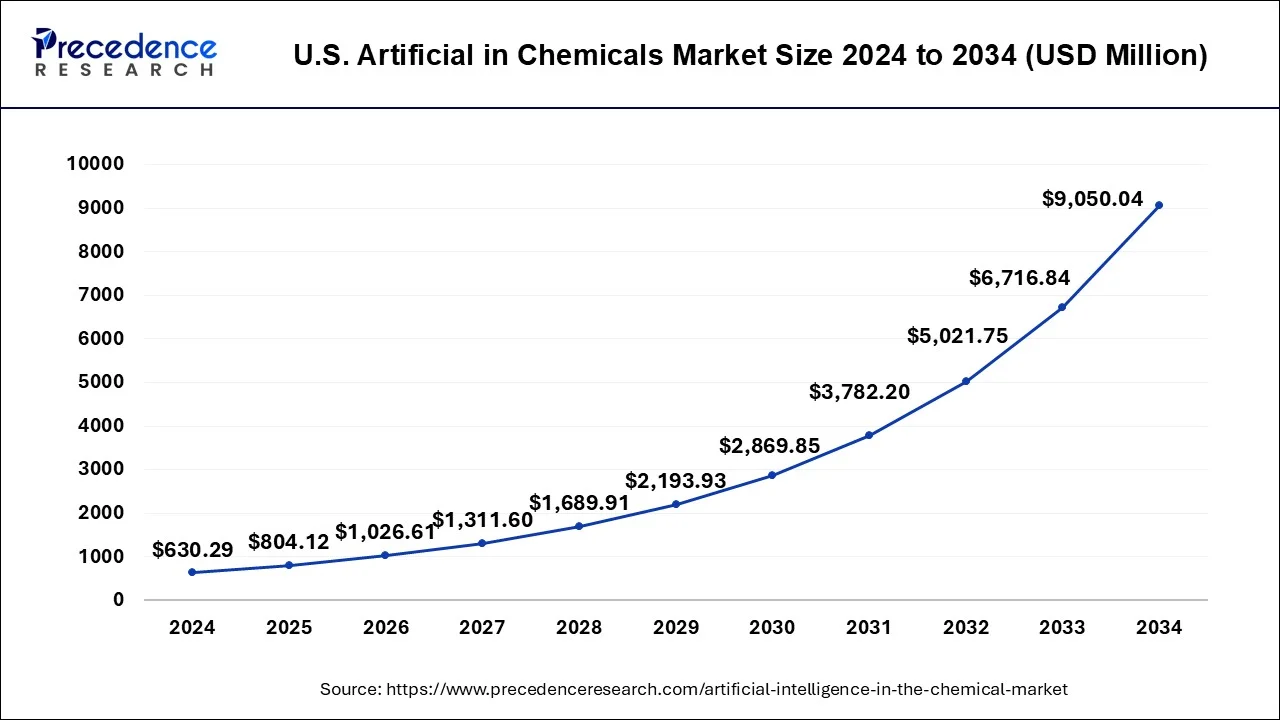

U.S. Artificial Intelligence in Chemicals Market Size 2025 To 2034

The U.S. artificial intelligence in chemicals market size is valued at USD 804.12 million in 2025 and is expected to hit around USD 9,050.04 million by 2034 with a CAGR of 30.9% from 2025 to 2034.

North America is expected to have the largest share of the above industry in the coming years due to increased awareness of digitization approaches and increased R&D funding by chemical firms for overall production process advancements. For example, in 2019, US President launched the American AI Project as the country's strategy for boosting artificial intelligence leadership. As part of this approach, government agencies have helped to build the trust of the public in AI-based processes by providing guidance for their advancement and actual application across various sectors.

North America is dominating the artificial intelligence chemical market. North America is popular for its technology companies and research institutions. The region has adopted the new technology in almost every market. The region has a regulatory landscape that identifies and implements AI in industries and education to learn different aspects of the market.

Europe is predicted to expand at the fastest pace during the expected period, owing to increased government funding and plans to establish chemical industries, favorable regulatory environments, and emerging new chemical industries. Europe is the world's second-largest producer of chemicals.

North America held the largest share of the artificial intelligence in the chemical market in 2024.

- In November 2024, the International Network of AI Safety Institutes at the Inaugural Convening in San Francisco was launched by the U.S. Department of Commerce & U.S. Department of State.

Europe is projected to host the fastest-growing market in the coming years.

- In June 2025, chemicals and materials group Syensqo entered into a partnership with Microsoft on AI innovation. The agreement involves cooperation and knowledge sharing, with the goal of “exploring joint development projects and establishing a roadmap for future strategic engagement”, it said.

Chemicals group Syensqo launches AI partnership with Microsoft

What made Europe grow at the fastest rate in the AI in the chemical market?

The AI in the Chemical Market expanded the fastest in Europe because of the strict environmental laws enforced in this part of the world, the early expedited digital transformation, and financing of scientific research and development in the short term. Companies in the region were using AI to gain efficiencies, such as minimizing waste, optimizing energy, and speeding the discovery of new materials for chemistry. Additionally, opportunities arose from the pursuit of carbon reduction strategies, digital twins, and sustainable materials as a result of strong public-private partnerships catalyzed by policies favoring green alternatives.

Germany Artificial Intelligence (AI) in the Chemical Market Trends

Germany led the European market with a solid industrial infrastructure and recognized acceleration of AI in chemical plants. Companies like BASF and Evonik deployed AI using predictive-based control approaches in the utilization of AI to cut waste and hasten the development of products, and Germany became the center of digitally based innovation in chemicals.

Asia-Pacific: The Code-Fueled Chemistry Boom

The rapid growth in Asia-Pacific was driven by the expansion of the industrial sector, declining costs of AI deployment, and government-led digital initiatives. The Region applied AI to modernize production, improve quality, and reduce emissions from production. New potential arose in increased automation at scale, sustainable raw materials, and the integrated use of real-time data across manufacturing sites.

China Artificial Intelligence (AI) in the Chemical Market Trends

China dominated the region based on its investment in AI labs, robotics, and process control, digital process control. The chemical companies in China used AI to optimize production lines, developed predictive capabilities, and lowered emissions. Strong government support accelerated the application of AI in all major industrial zones.

The Algorithmic Awakening Region - Latin America

As industries in Latin America increasingly adopted digital transformation and sustainable practices, developments remained sluggish yet steady. In the chemicals sector, AI was leveraged to improve process safety, optimize costs, and boost productivity. Opportunities for the region existed in green material design, predictive maintenance, and advancing smarter raw material sourcing due to a growing number of R&D partnerships.

Brazil maintained its leadership position, using AI to inform petrochemical and fertilizer applications. There was a use of automation in chemical plants to fully utilize resources and increase energy efficiency. The country also developed more academic partnerships and foreign investments in smart advancements in production technologies.

Middle East & Africa - The Digital Desert Transformation

The area has continually expanded, with significant investment in sustainability-related programs and AI-powered petrochemical plants. AI improved refining efficiency, waste minimization, and process safety. In addition, smart production, predictive maintenance, and green chemistry opportunities align with the region's focus on energy diversification and modernization.

Saudi Arabia was the market driver, primarily due to its Vision 2030 initiatives towards enabling the chemical industry to digitally transform. Saudi Arabia's focus on AI-driven efficiency, automation, and clean energy was facilitating the rapid modernization of petrochemical facilities and improving its competitive global position.

Artificial Intelligence (AI) in Chemicals Market Companies

- Manuchar N.V

- IMCD N.V.

- Univar Solutions Inc.

- Brenntag S.E.

- Sojitz Corporation

- ICC Industries Inc.

- Azelis Group NV

- Tricon Energy Inc.

- Biesterfeld AG

- Omya AG

- HELM AG

- Sinochem Corporation

- Petrochem Middle East FZE

Recent Developments

- In April 2025, UTulsa's chemical engineering program integrated AI into every course. The University of Tulsa's Russell School of Chemical Engineering has added AI to the curriculum to familiarize students with the new technology.

- In March 2025, a U.K. startup announced its aim to utilize AI to discover new chemicals and materials and has signed on two "godfathers of AI," as well as a leading AI policy expert and a renowned materials science researcher, as advisors.

- In April 2025, the AI small molecule drug discovery center, which was created to integrate AI with traditional drug discovery methods to identify and design new small molecule therapeutics with unprecedented speed and precision, was launched by The Icahn School of Medicine at Mount Sinai.

Mount Sinai Launches AI Small Molecule Drug Discovery Center - In May 2025, free AI courses in Physics, Chemistry, Accounting, and Cricket Analytics on SWAYAM Plus were launched by IIT Madras. These free courses, ranging from 25 to 45 hours, are open to students, faculty, and professionals from all academic backgrounds, with no prior AI knowledge required.

IIT Madras launches free AI courses in Physics, Chemistry, Accounting and Cricket Analytics on SWAYAM Plus - EducationTimes.com

Segments Covered in the Report

By Type

- Hardware

- Software

- Services

By Application

- Discovery of new materials

- Production optimization

- Pricing optimization

- Load forecasting of raw materials

- Product portfolio optimization

- Feedstock optimization

- Process management & control

By End Use

- Base Chemicals & Petrochemicals

- Specialty Chemicals

- Agrochemicals

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content