What is the Augmented Reality and Virtual Reality (AR/VR) in Aviation Market Size?

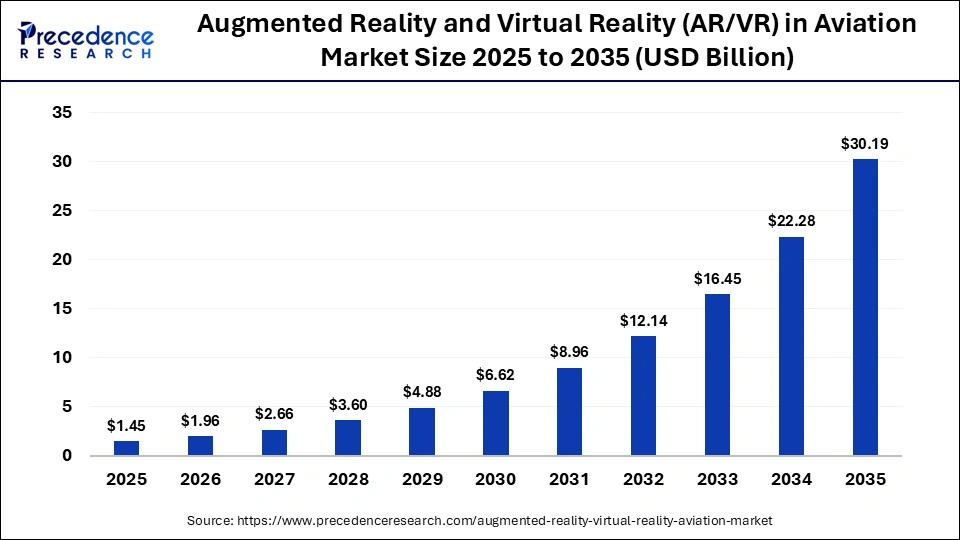

The global augmented reality and virtual reality (AR/VR) in aviation market size was calculated at USD 1.45 billion in 2025 and is predicted to increase from USD 1.45 billion in 2026 to approximately USD 30.19 billion by 2035, expanding at a CAGR of 35.47% from 2026 to 2035.The market is driven by the growing need for advanced training, enhanced safety, and improved operational efficiency.

Market Highlights

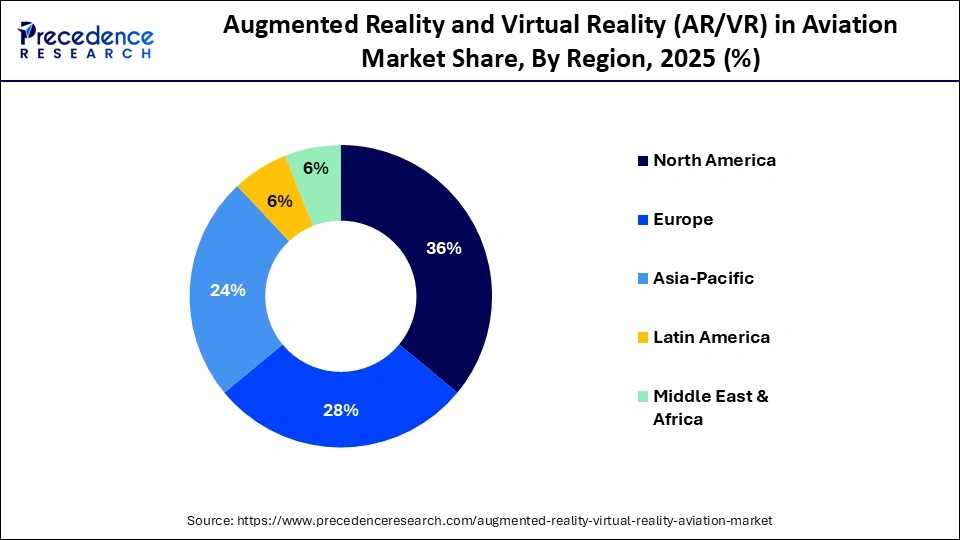

- North America dominated the market, holding the largest share of 36% in 2025.

- The Asia Pacific is expected to expand at the fastest CAGR in the market between 2026 and 2035.

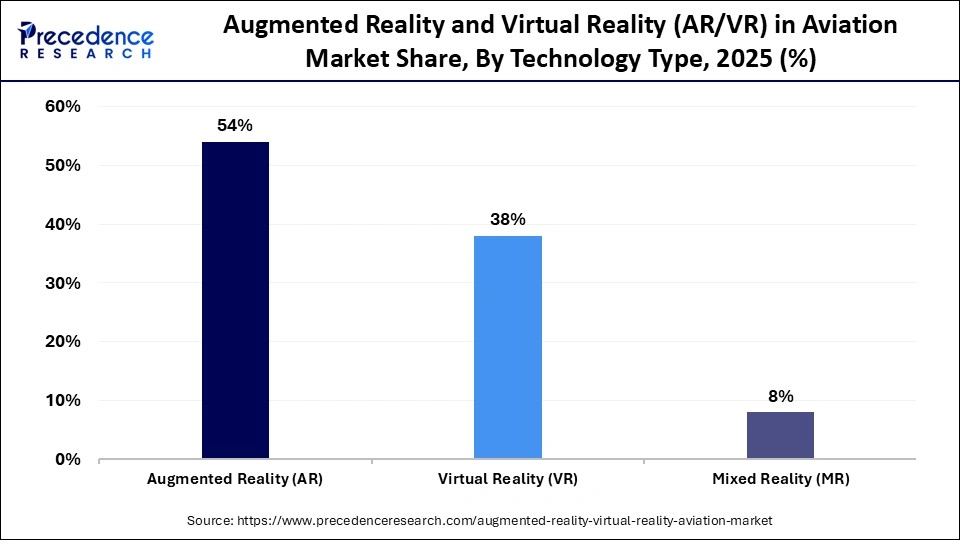

- By technology type, the augmented reality segment held the largest market share of 54% in 2025.

- By technology type, the mixed reality segment is expected to grow at a remarkable CAGR between 2026 and 2035.

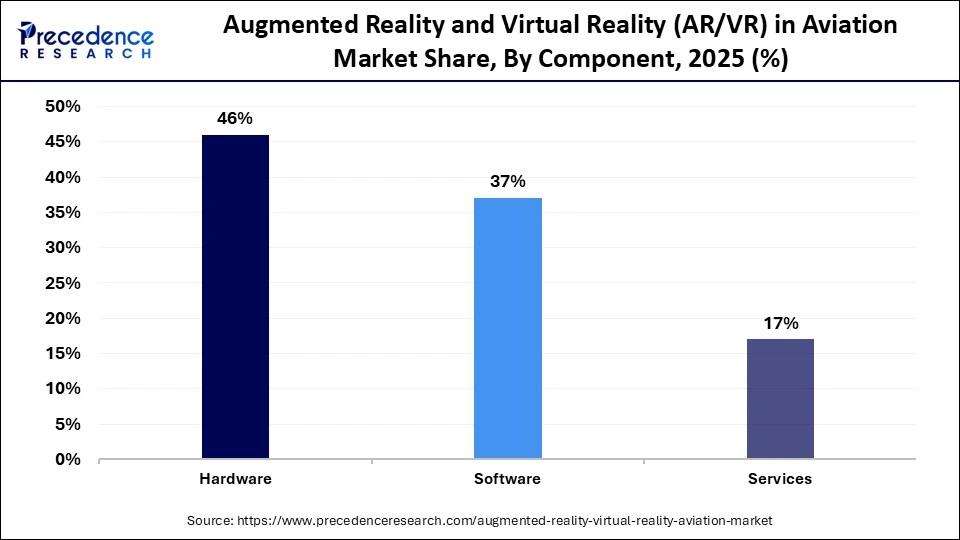

- By component, the hardware segment held the largest market share of 46% in 2025.

- By component, the software segment is expected to grow at the fastest CAGR between 2026 and 2035.

- By application, the training & simulation segment held the largest market share of 41% in 2025.

- By application, the MRO segment is expected to grow at the highest CAGR between 2026 and 2035.

- By end-user, the airlines segment held the largest share of 38% in the market in 2025.

- By end-user, the MRO service providers segment is expected to grow at a remarkable CAGR between 2026 and 2035.

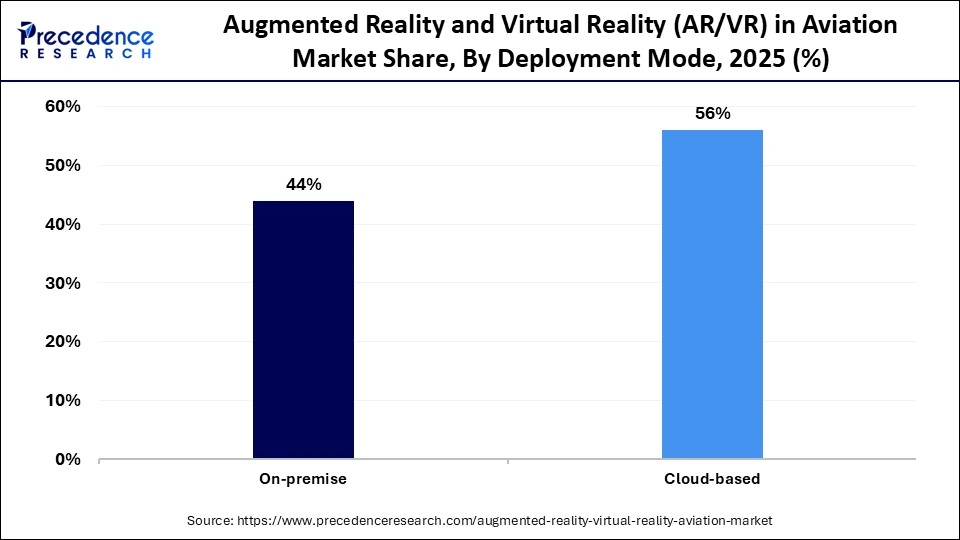

- By deployment mode, the cloud-based segment held the largest market share of 56% in 2025.

- By deployment mode, the on-premise segment is expected to expand at the fastest CAGR between 2026 and 2035.

Redefining Aviation: How AR and VR Are Transforming the Industry?

The global augmented reality and virtual reality (AR/VR) in aviation market includes the deployment of augmented reality and virtual reality solutions across civil and defense aviation for pilot training, cabin crew simulation, aircraft maintenance support, design & engineering visualization, passenger experience enhancement, and operational efficiency. The market spans hardware (head-mounted displays, sensors, controllers), software platforms (simulation engines, digital twin interfaces), and service offerings (integration, training content, support).

The growth of the market is driven by rising demand for cost-efficient training, faster maintenance workflows, improved safety,and expanding digital transformation initiatives across airlines, airports, and MRO ecosystems.

How is AI Integration Influencing the Augmented Reality and Virtual Reality (AR/VR) in Aviation Market?

AI is increasingly being implemented in the aviation sector through augmented reality (AR) and virtual reality (VR) to enhance training, maintenance, operational efficiency, and passenger experiences. The performance of the pilots and cabin crew is monitored by simulation engines powered by AI in order to detect mistakes, identify the optimal way to learn, and tailor the simulated scenarios to learn faster. Additionally, AI enhances digital twin models, enabling AR/VR platforms to replicate realistic operational conditions, system behavior, and environmental variables, which helps in scenario planning and predictive maintenance. Furthermore, AI facilitates cloud-based AR/VR applications, supporting remote training and real-time operational analysis across airlines.

What are the major Trends in the Market?

- AR/VR is becoming a popular training tool among airlines and MRO providers, as it lowers the expense of training pilots and crew members, and enhances operational efficiency in both civil and defense aviation.

- AR and VR technologies are integrated to simulate aircraft systems, maintenance operations, and airport operations in real-time to improve decision-making and safety.

- VR headsets and AR overlays are being used as immersive in-flight entertainment solutions, offering passengers interactive digital content and enhancing the overall travel experience.

- Growing partnerships among aviation OEMs, software developers, and defense agencies are driving the creation of specialized AR/VR platforms for simulation, visualization, and training applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.45Billion |

| Market Size in 2026 | USD 1.96 Billion |

| Market Size by 2035 | USD 30.19Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 35.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Technology Type, Component, Application, End-User, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Technology Type Insights

Why Did the Augmented Reality Segment Dominate the Market in 2025?

The augmented reality (AR) segment dominated the augmented reality and virtual reality (AR/VR) in aviation market with the largest share of 54% in 2025. This is because of its ability to overlay digital data onto real aircraft, supporting training, maintenance, and operational processes. It provides pilots, cabin crew, and ground staff with real-time information, enhancing situational awareness, reducing errors, and improving learning outcomes in simulators. In maintenance and inspection, AR allows technicians to visualize aircraft components, follow step-by-step guides, and detect defects without interrupting operations. Additionally, AR is cost-effective and requires less hardware than fully immersive VR systems, making it widely adopted

commercial airlines and MRO providers Insights

The mixed reality segment is expected to grow at the fastest rate during the projection period, as it combines the advantages of both AR and VR to deliver fully interactive and spatially aware experiences. MR enables users to interact with virtual objects while remaining aware of the physical surroundings, which is why it is widely used in advanced pilot training, engineering visualization, and collaborative maintenance tasks. Virtual inspections of aircraft cockpits, cockpit simulation with dynamic overlay, and remote collaborative troubleshooting are all emerging applications of the technology and are now widespread in airlines, MRO service providers, and defense organizations. Rapid adoption is further supported by technological advances in spatial mapping, AI, and device miniaturization.

Component Insights

What Made Hardware the Dominant Segment in the Market in 2025?

The hardware segment dominated the augmented reality and virtual reality (AR/VR) in aviation market while holding a 46% share in 2025. This is because AR/VR experiences rely on head-mounted displays (HMDs), smart glasses, controllers, haptics, sensors, and trackers. Advanced HMDs and smart glasses allow pilots, cabin crew, and technicians to experience immersive simulations, real-time information overlays, and guided processes for training, maintenance, and operational tasks. The reliability, accuracy, and durability of these devices are critical for ensuring safety and efficiency. Moreover, hardware is compatible with software platforms, digital twins, and cloud-based services, which is essential for scalable integration across airlines, airports, and defense aviation.

The software segment is expected to expand at a significant rate over the forecast period, driven by increasing demand for simulation platforms, digital twin visualization tools, AR workflow guidance, and content integration. Advanced software enables realistic training for pilots and cabin crew, supports remote and proactive maintenance, and requires minimal physical infrastructure. Cloud-based AR/VR software allows airlines and MRO operators to scale training programs, monitor performance metrics, and streamline operations across multiple sites. Continuous updates, AI integration, and scenario personalization further enhance learning outcomes and operational efficiency.

Application Insights

How Does the Training & Simulation Segment Lead the Market in 2025?

The training & simulation segment led the augmented reality and virtual reality (AR/VR) in aviation market, capturing a 41% share in 2025. This is mainly due to its ability to provide safe, cost-effective, and immersive learning experiences. Immersive training solutions minimize risk, lower costs compared to traditional methods, improve learning outcomes, and enhance operational safety. AR and VR simulators allow trainees to practice emergency procedures, flight operations, and maintenance tasks in realistic and repeatable conditions. Simulation and training remain key applications driving AR/VR adoption across commercial airlines, military aviation, and MRO service providers worldwide.

The MRO segment is expected to grow at the fastest CAGR in the upcoming period because AR-guided inspections, remote expert support, and predictive maintenance are becoming essential for efficient aircraft operations. AR/VR allows technicians to visualize internal systems, overlay schematics on actual components, and follow step-by-step instructions, reducing errors and minimizing downtime. Cloud-based platforms enable real-time remote assistance, enhancing the speed and accuracy of maintenance tasks. These capabilities make AR/VR solutions increasingly valuable for airlines and MRO providers, driving strong market growth.

End-User Insights

How Do Airlines Contribute the Largest Share of the Market in 2025?

The airlines segment held the largest share of 38% in the augmented reality and virtual reality (AR/VR) in aviation market in 2025, driven by the extensive use of AR/VR technologies to train pilots and cabin crew, optimize operational workflows, and enhance passenger experiences. VR simulations allow pilots to practice flight maneuvers, cockpit operations, and emergency procedures in realistic, risk-free environments. AR/VR is also used for cabin crew training, including passenger handling, safety demonstrations, and emergency evacuations, ensuring effective skills development and standardized performance across locations. Additionally, AR/VR enhances passenger engagement through VR entertainment, virtual cabin tours, and interactive safety briefings, improving satisfaction and brand loyalty.

The MRO service providers segment is expected to grow at the highest CAGR throughout the forecast period, driven by the increasing need for efficient and standardized maintenance solutions. AR-guided inspections allow technicians to visualize aircraft systems, overlay schematics, and follow step-by-step workflows, minimizing errors and downtime. AR/VR also enables real-time remote expert support, enhancing the efficiency of repairs and standardizing maintenance processes. With the rapid growth of airline fleets and the increasing complexity of modern aircraft systems, cloud-based AR/VR solutions allow MRO providers to train staff, monitor workflows, and analyze performance across multiple sites at scale.

Deployment Mode Insights

Why Did the Cloud-based Segment Lead the Market in 2025?

The cloud-based segment led the augmented reality and virtual reality (AR/VR) in aviation market while holding a 56% share in 2025, as it enables airlines, MRO operators, and defense organizations to deploy AR/VR training, educational programs, and simulations across multiple locations without heavy investments in hardware. Cloud platforms allow centralized content management, AI-driven analytics, and performance monitoring, improving training outcomes, operational efficiency, and maintenance processes. Additionally, cloud deployment simplifies software updates, enhances cybersecurity, and enables rapid scaling of AR/VR solutions across fleets, airports, and training centers.

The on-premise segment is expected to grow at a significant CAGR over the forecast period, as airlines, aircraft manufacturers, defense agencies, and airport operators prefer complete control over sensitive operational data, including flight simulators, maintenance logs, and pilot training programs. This preference is driven by the increasing use of immersive simulators, digital twin solutions, and real-time maintenance visualization. Locally hosted systems are favored over cloud-based AR/VR solutions due to the low tolerance for latency and network disruptions in critical aviation operations.

Region Insights

How Big is the North America Augmented Reality and Virtual Reality (AR/VR) in Aviation Market Size?

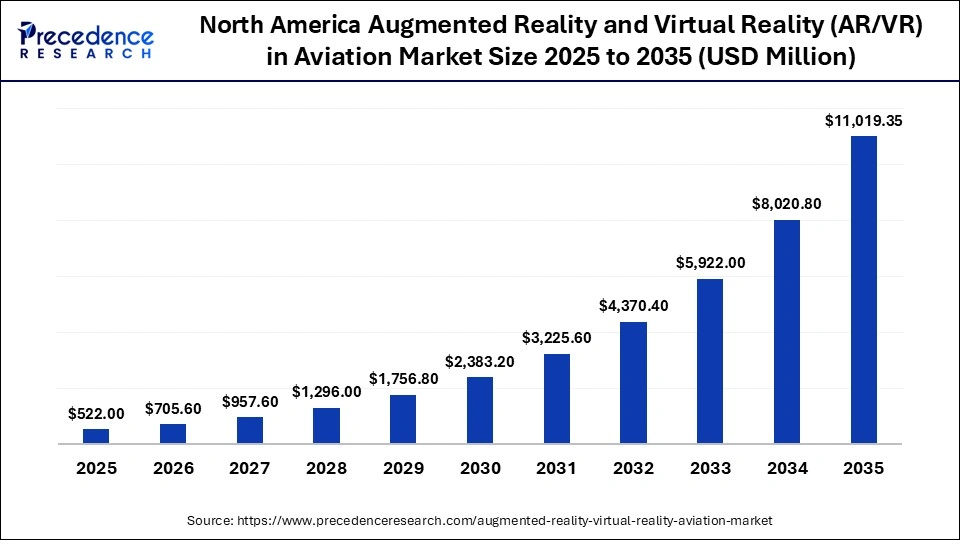

The North America augmented reality and virtual reality (AR/VR) in aviation market size is estimated at USD 522.00 million in 2025 and is projected to reach approximately USD 11,019.35 million by 2035, with a 35.66% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Augmented Reality and Virtual Reality (AR/VR) in Aviation Market?

North America dominated the market by capturing the largest share of 36% share in 2025 because of its advanced aerospace infrastructure and early adoption of new technologies. In the U.S. and Canada, major commercial airlines, defense organizations, and pilot schools are implementing AR/VR solutions for pilot simulation, maintenance training, cabin crew operations, and passenger experience enhancement. Significant investments in aviation safety, workforce skill development, and digital transformation programs have further driven adoption. The region's focus on operational efficiency, cost-effective training, and improved situational awareness reinforces its market leadership.

What is the Size of the U.S. Augmented Reality and Virtual Reality (AR/VR) in Aviation Market?

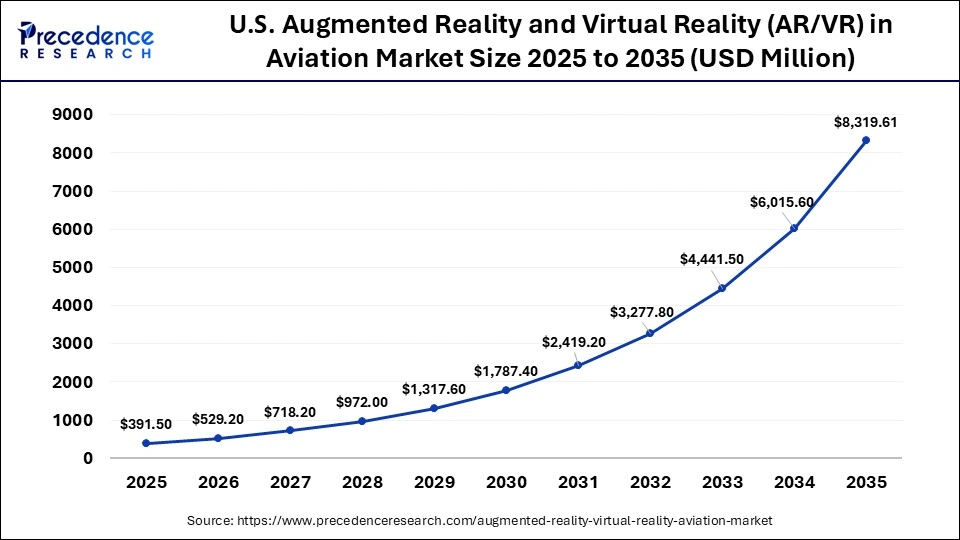

The U.S. augmented reality and virtual reality (AR/VR) in aviation market size is calculated at USD 391.15 million in 2025 and is expected to reach nearly USD 8319.61 million in 2035, accelerating at a strong CAGR of 35.75% between 2026 and 2035.

U.S. Augmented Reality and Virtual Reality (AR/VR) in Aviation Market Analysis

The surging cases of food adulteration, as well as rapid government investment in establishing new analytical laboratories, have driven market growth. Additionally, rising demand for portable PFAS testing kits among field engineers, coupled with growing adoption of the total oxidizable precursor assay in environmental testing centers, is playing a crucial role in shaping the industrial landscape.

Tightening federal and state-level drinking water standards are increasing routine PFAS monitoring requirements for utilities and remediation projects. In parallel, expansion of certified laboratory capacity and method validation for low-ppt detection is strengthening nationwide compliance testing capabilities.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to experience the fastest growth in the augmented reality and virtual reality (AR/VR) in aviation market, driven by heavy investments in airport development, aircraft fleet modernization, and workforce training in countries like China, India, Japan, and Singapore. The region's focus on reducing pilot training time, enhancing situational awareness, and offering interactive passenger services is fueling demand for immersive AR/VR solutions. Additionally, the rapid growth of air traffic, favorable government policies, and technological investments contribute to making Asia Pacific the fastest-growing market globally.

Why is the European Market Experiencing Notable Growth?

The European augmented reality and virtual reality (AR/VR) in aviation market is expected to grow at a notable rate in the coming years, driven by the adoption of immersive technologies by aerospace manufacturers, leading airlines, and defense organizations for pilot training, aircraft maintenance, cabin crew operations, and simulation-based scenario development. Investments in advanced training facilities, simulation laboratories, and collaborative R&D projects with technology providers such as Airbus, Thales, and Leonardo have accelerated AR/VR integration. Additionally, safety regulations and accreditation requirements have motivated airlines and MRO providers to adopt AR/VR solutions, ensuring compliance and minimizing operational downtime.

Who are the Major Players in the Global Augmented Reality and Virtual Reality (AR/VR) in Aviation Market?

The major players in the augmented reality and virtual reality (AR/VR) in aviation market include Microsoft Corporation, Google LLC, Airbus SE, The Boeing Company, Honeywell International Inc., Varjo Technologies Oy, Sony Corporation, Elbit Systems Ltd., Bohemia Interactive Simulations, Aero Glass, IBM Corporation, HTC Corporation, PTC Inc., Eon Reality, SITA

Recent Developments

- In June 2025, Airlines were invited to install XR and AI technologies at APEX FTE EMEA to modernize their pilot training and passenger experience. The program was the continuation of immersive solutions introduced in the previous FTE Global.

(Source: https://apex.aero) - In April 2025, Lufthansa and Meta also extended the Quest 3 in-flight entertainment program to additional routes after business-class trials were successful. The program provided the passengers with a more immersive VR experience on flights.(Source: https://www.meta.com)

- In April 2024, Bohemia Interactive Simulations and uCrowds combined the TerraCrowds technology of uCrowds with the VBS4 military training system. It could be used to simulate the behaviors of crowds realistically in situations with riots, evacuations, and queueing drills.(Source: https://ucrowds.com)

Segments Covered in the Report

By Technology Type

- Augmented Reality (AR)

- Virtual Reality (VR)

- Mixed Reality (MR)

By Component

- Hardware

- Head-mounted displays (HMDs)

- Smart glasses

- Controllers & haptics

- Sensors & trackers

- Software

- Simulation platforms

- Digital twin visualization tools

- AR workflow guidance software

- Services

- Integration & deployment

- Content development

- Maintenance & support

By Application

- Training & Simulation

- Pilot training

- Cabin crew training

- Ground handling simulation

- Maintenance, Repair & Overhaul (MRO)

- AR-guided inspections

- Remote expert assistance

- Design & Engineering / Digital Twin Visualization

- Passenger Experience & Airport Experience

- Other Applications

By End-User

- Airlines

- Aircraft OEMs & Tier Suppliers

- MRO Service Providers

- Airports

- Defense & Military Aviation Organizations

By Deployment Mode

- On-premise

- Cloud-based

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting