What is the Battery Materials MarketSize?

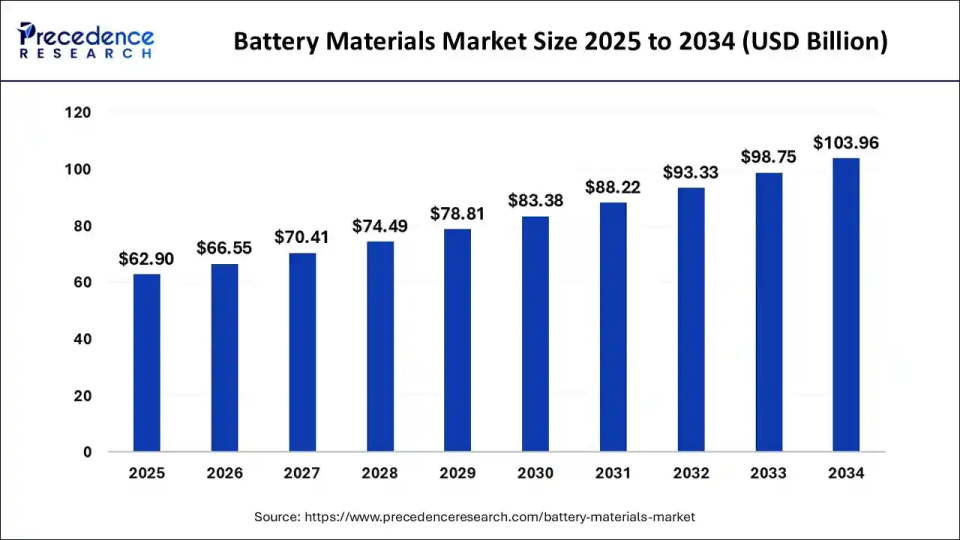

The global battery materials market size is accounted at USD 62.90 billion in 2025 and is predicted to increase from USD 66.55 billion in 2026 to approximately USD 109.31 billion by 2035, growing at a CAGR of 5.68% from 2026 to 2035. The rising demand for clean battery materials, surging investments in developing sustainable battery materials, and the increased global impact of conventional energy sources on health and the environment are driving the growth of the sustainable battery materials market.

Battery Materials Market Key Takeaways

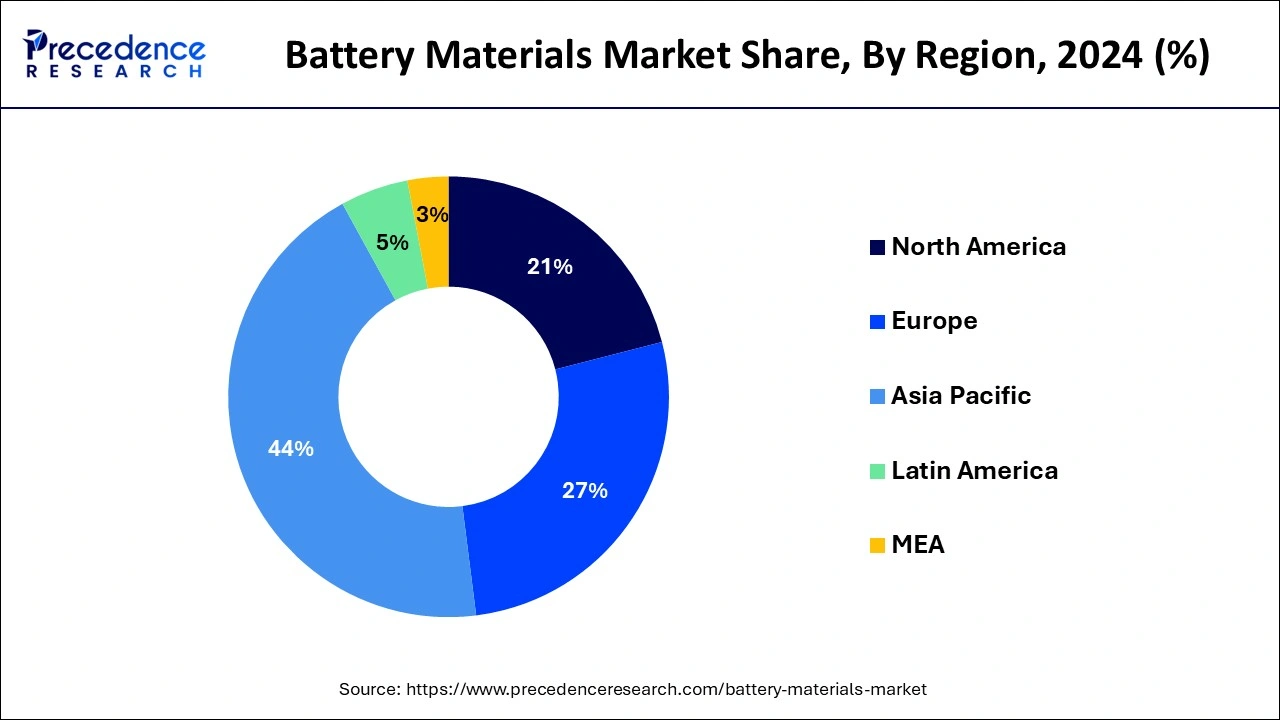

- Asia Pacific region has accounted for 43.14% of revenue share in 2025.

- By battery type, the lithium-ion battery segment has accounted for 47% revenue share in 2025.

- The lead acid segment has captured 36% revenue share in 2025.

- By application, the electronics industry segment has generated a 46% market share in 2025.

Battery Materials: Fuels Tomorrow's Rechargeable World

Battery materials, including cathodes, anodes, electrolytes, separators, binders, and conductive additives, form the chemical backbone of electrification. Demand is driven by electric vehicles, grid-scale storage, portable electronics, and industrial motive power, each requiring specific performance, safety, lifecycle, and cost characteristics from material chemistries. The market is rapidly shifting from commodity pricing to technology-led differentiation, with high-nickel cathodes, silicon-rich anodes, solid-state-ready electrolytes, and engineered separators capturing premium value. Supply-chain resilience, scalable processing, and sustainability factors, such as recycling-ready formulations and low-carbon precursors, now define long-term competitiveness as manufacturers work to balance performance with circularity.

Market outlook

- Industry Growth Overview: Growth of battery materials market will continue, fuelled by Transition to Electric Vehicles (EV), Large Scale Storage of Grid Power and Technological Advances. The growth in the market and establishment of long term contracts and commitments for battery materials will provide more stability in Pricing and grow global supply.

- Sustainability Trends: Sustainability trends are influencing Manufacturers in how they choose Materials for Batteries and where they are sourced. Companies have committed to using as many carbon-neutral sources as possible, ensuring that they are using ethically sourced materials, and offering closed-loop recycled materials in order to meet both global and local regulations and customer demand.

- Global Expansion: Due to the need for increased supply security, Battery Material Suppliers are expanding their operations within Asia, Europe and Emerging Markets through Joint Ventures (JVs) and Locally Based Manufacturing (LBM). The goal of these initiatives is to reduce Geopolitical and Logistical Risks.

- Start-up Ecosystem: New Start-Ups are disrupting the current Electric Vehicle Battery Market by Offering Innovations and Disruptive Technologies to replace Current Materials for the Future of Battery Production. Currently, Battery Material Start Up Companies have attracted Interest from a multitude of Venture Capitalists (VC) and are Accelerating Innovation Cycles.

Battery Materials Market Growth Factors

The demand for the battery materials is expected to grow at a significant rate during the forecast period owing to the rapidly growing demand for the electric vehicles across the globe. The rising government initiatives to reduce carbon footprint and reduce the emission of greenhouse gases to attain sustainability is fueling the adoption of the electric vehicles. The surging demand for the consumer electronics among the population and rising government efforts to make regulatory changes to boost the adoption of electric vehicles is the prominent factors that are significantly augmenting the growth of the global battery materials market. The rising preference for the rechargeable and lightweight batteries is playing a crucial role in the market growth. The rapidly boosting demand for the lightweight and rechargeable batteries is attributed to the rising adoption of the consumer electronics such as laptops, desktops, and smartphones, which extensively needs the lightweight batteries. The rising trend of miniaturization of the electronic gadgets is a major factor that boosts the demand for the lightweight batteries.

The surging investments by the manufacturers in the processing, mining, and manufacturing of the battery materials is expected to boost the production of batteries to meet the rapidly surging demand for the batteries across the globe. The rising awareness pertaining to the sustainably sourced battery materials, efficient disposal of wastes, and recycling of wastes are expected to boost the demand for the battery materials. The manufacturers are increasingly adopting the certifications such as EU-Batteries Directive, DOT, and PHMSA to ensure safety and quality of the batteries to lure the customers in the market. Furthermore, the rising adoption of the technologies such as Nano-filtration system, solvent extraction method, and rotary kiln electric furnace method are increasingly being adopted by the manufacturers to improve the efficiency and performance of the battery materials based on the requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD62.90 Billion |

| Market Size in 2026 | USD66.55 Billion |

| Market Size by 2035 | USD 109.31 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.68% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Battery Type, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Surging Investments in Recycling and Development of Sustainable Battery Materials

Initiatives by various industries for recycling and developing sustainable battery materials, along with increasing investments and funding, are driving market growth. Advancements in manufacturing capabilities with streamlined workflows and supply distributions aid industries in reducing production costs and minimizing energy wastage.

- In March 2025, Battery X Metals completed the acquisition of the remaining 51% stake in Li-ion Battery Renewable Technologies Inc., aiming to develop a vertically integrated battery supply chain through critical battery metal exploration, material recovery technologies, and battery diagnostics solutions.

Segment Insights

Material Insights

The cathode segment dominated the sustainable battery materials market share in 2024. Cobalt, nickel, and manganese are the most active elements in cathode materials. Nickel, primarily lithium nickel manganese oxide and nickel cobalt aluminum oxide, is now used to partially replace cobalt.

The anode segment, on the other hand, is predicted to develop at the quickest rate in the future years. The conventional current enters a polarized electrical device through an anode, which is an electrode.

- In December 2024, General Motors signed a multi-billion-dollar agreement with Norwegian battery materials producer Vianode to supply synthetic anode graphite starting in 2027.

Battery Type Insights

The lithium-ion segment dominated the sustainable battery materials market share in 2024. Due to its color memory effect, high energy density, and low self-discharge, it is employed in portable electronic devices. It's used in a variety of industries, including consumer electronics, industrial, and automotive.

The lead-acid segment, on the other hand, is predicted to develop at the quickest rate in the future years. The global demand for lead-acid batteries is increasing due to qualities such as ease of purchase, reliability, abuse tolerance, overcharging tolerance, and the capacity to deliver high currents.

- In January 2024, BYD began constructing its first sodium-ion battery plant in collaboration with Huaihai Group. This gigafactory aims to produce batteries for micro vehicles and scooters, indicating a diversification in battery technologies beyond lithium-ion.

Application Insights

The consumer electronics segment led the global battery materials market in 2024. The huge demand for a wide variety of consumer electronics among the global population has led to the growth of the consumer electronics segment. Changing lifestyle of the consumers, rising disposable income, technological advancements, and rising expenditure on the home improvement products are some of the major factors that are significantly boosting the demand for the various consumer electronic products across the globe. The rising adoption of the batteries in the consumer electronics and growing demands for various electronic devices is expected to boost the growth of this segment during the forecast period.

Automotive is expected to be the most opportunistic segment during the forecast period. The rising demand for the electric vehicles across the globe and extensive usage of batteries in the electric vehicles is the most prominent factor that drives the growth of this segment. The rising pollution levels and climate change issues have forced the government to switch to the more sustainable transport solutions. The rising reforms in the regulations to boost the adoption of the electric vehicles are expected to have a significant and positive impact on the growth of the market in the foreseeable future.

Regional Insights

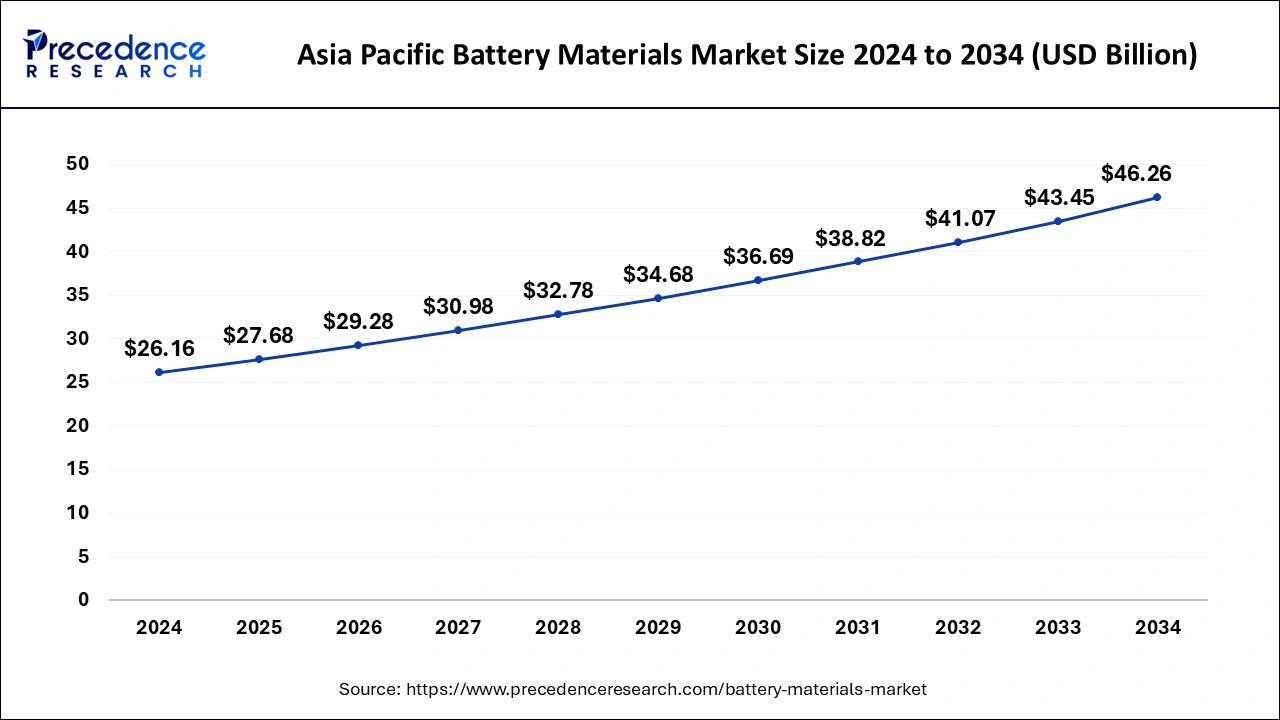

What is the Asia Pacific Battery Materials Market Size?

The Asia Pacific battery materials market size is exhibited at USD 27.68 billion in 2025 and is projected to be worth around USD 48.26 billion by 2035, growing at a CAGR of 5.83% from 2026 to 2035.

Asia Pacific captured the highest market share in 2024. Asia Pacific is the largest manufacturer of electric vehicles and consumer electronics. The presence of huge number of manufacturing facilities of various industrial, electronics, and automotive products in the region makes it the largest consumer of the battery materials. The rising government initiatives to boost industrialization have made Asia Pacific the manufacturing hub of the world. China is the largest producer and consumer of electric vehicles as China has abundant supply of lithium-ion. The presence of cheap factors pf production and favorable government policies has significantly attracted huge FDIs and the presence of large number of manufacturing facilities led to the dominance of this region in the global battery materials market.

What Makes North America a Significant Market for Battery Materials?

North America is expected to witness significant growth rate during the forecast period. This is mainly attributed to the extensively rising demand for the electric vehicles and advanced consumer electronics among the population. High consumer awareness regarding the sustainabilit5y and environment protection, strict government regulations pertaining to the emissions from vehicles, and high disposable income of the consumers has led to the rapid growth of the North America battery materials market.

- In 2024, the U.S. Department of Energy conditionally agreed to provide up to $1.2 billion in financing to Novonix, an Australian battery materials firm, to establish a synthetic graphite facility in Chattanooga, Tennessee.

What Makes North America a Significant Market for Battery Materials?

North America is heavily investing in localizing upstream battery materials to support a growing EV and energy storage industry, boosting demand for domestic cathode precursors, graphite processing, and electrolyte manufacturing. Policy incentives and gigafactory growth are speeding up collaborations among automakers, chemical producers, and refiners to reduce reliance on imports and cut lead times. Advanced R&D centers are working on high-value materials like silicon mixes, high-nickel NMC/NCA variants, and fluorinated additives to enhance energy density and fast-charging capabilities. Environmental permitting and worker safety standards are influencing plant design and capital costs for new processing facilities.

U.S. Battery Materials Market Analysis

The U.S. is the center for battery-materials scale-up, with federal incentives and state-level support attracting cell and precursor manufacturing projects. Leading initiatives focus on low-carbon production methods, domestic graphite processing, and electrolyte plants with strict safety and emissions controls. Strategic partnerships between OEMs and material suppliers are securing long-term supply and financing for upstream facilities. Workforce development and permitting processes remain the critical near-term bottlenecks to rapid capacity expansion.

Europe Battery Materials Market Trends

Europe has taken several steps to bolster its battery material supply chain by lowering its reliance on imported components required to meet electric mobility targets, including investing in local gigafactories (large scale production facilities) creating recycling and sustainable sourcing. Countries such as Germany, France, Sweden and others have invested billions into creating their own local battery materials supply chains to ensure that they remain competitive.

Additionally, Europe has enacted strict environmental regulations which will promote innovation surrounding battery materials made from low carbon sources. There is an increasing demand for recycled lithium, nickel and cobalt across the entire European battery materials supply chain due to the EU Battery Strategy supporting circular economy activity.

Latin America Battery Materials Market Trends

Due to the significant lithium deposits located in the region's countries of Chile Argentina, and Bolivia, Latin America has become an area of interest as a source for battery materials. Along with this, many businesses are also investing in their operations locally, facilitating the creation of partnerships with electric vehicle (EV) manufacturers and utilizing the possibility of local production as a means to maximise value rather than simply exporting raw materials. As automakers around the world look to diversify their sources of lithium, nickel, cobalt and other critical battery materials, Latin America has become an ideal and cost-effective source for many.

What Potentiates the Growth of the Battery Materials Market in the Middle East & Africa?

The market in the Middle East & Africa is still nascent but strategically positioned, with the region's petrochemical capabilities, mineral resources, and logistics hubs offering opportunities to enter the global battery-materials manufacturing landscape. Several Gulf states are exploring investments in precursor chemicals, solvent production for electrolytes, and thermal processing facilities to add value beyond raw commodity exports. Meanwhile, African countries possess significant lithium and cobalt reserves that, if developed responsibly, could support regional processing chains. The region's growth will depend on establishing downstream refining capacity, ensuring a reliable power supply, and implementing regulatory frameworks to attract battery-grade investments.

South Africa has mining expertise and existing metallurgical industries that expand cobalt and nickel refining with targeted investment and modernization. Morocco, with its phosphate reserves and developing industrial policies, has potential downstream chemical capacity if linked to battery-material projects. Both countries need stable power, skilled labor, and environmental governance to attract long-term processors. Regional export logistics via ports create favorable conditions for supply hubs in North Africa and Southern Africa.

Value Chain Analysis

- Raw Material Extraction and Processing: Raw materials such as lithium, cobalt and nickel are extracted from the earth, then processed into high-purity materials which will be used as cathodes and anodes in batteries. Companies such as Albemarle and SQM are critical to securing the high-purity materials for battery manufacturers.

- Advanced Material Manufacturing: Cathode and anode manufacturers (e.g., Umicore and BASF) create advanced battery materials to meet the evolving standards for battery performance and safety while also focusing on sustainability.

- Recycling and Circular Integration: Li-Cycle is one of the companies involved in recycling batteries, through the collection of valuable metals, the minimization of supply chain risk and the reduction of the negative impact on the environment. These efforts create long-term resilience in the battery materials marketplace.

Battery Materials Market Companies

- Celgard

- Hitachi Chemicals

- Umicore

- GS Yuasa Corp.

- Coda Energy

- Panasonic Corporation

- Envia System Inc.

- Duracell International Inc.

- GP Batteries international Ltd.

- Ford Motor Company

- Toda Kogyo

Recent Development

- In April 2025, China's CATL launched a new brand for its sodium-ion batteries, Naxtra, on Monday and announced mass production will begin in December, alongside its second-generation fast-charging EV battery. CATL was the first major car battery manufacturer to introduce a sodium-ion battery in 2021. Sodium, unlike other materials, is affordable and plentiful, and its chemistry may help lower EV fire risks, according to experts. Naxtra's first product will be a sodium-ion battery with 175 watt-hours per kilogram energy density, closely matching lithium iron phosphate (LFP) batteries widely used in EVs and grid storage systems.

- In January 2025, NEO Battery Materials Ltd., a cost-effective silicon anode material innovator enabling longer-lasting, fast-charging lithium-ion batteries, launched its new advanced high-performance silicon anode product, NBMSiDE P-300, offering breakthrough battery capacity. While maintaining a strong focus on electric vehicles and electronic devices, NEO is also strategically branching into the space and eVTOL sectors with solid-state battery applications. The expansion reflects NEO's commitment to next-generation energy solutions. The company aims to position its technology across diverse markets demanding high-performance and durable battery systems.

- In January 2025, JSW MG Motor India partnered with LICO Materials to launch a new Battery Energy Storage System (BESS) that reuses batteries from MG ZS electric vehicles. The initiative, revealed on January 30, 2025, is the fourth under Project Revive and offers storage capacity options from 18kWh to 300kWh. Created with LICO Materials, a subsidiary of Epsilon Group, the system includes immersion oil cooling and smart thermal control for improved safety. With a lifespan four times longer than standard systems, it can cut operational costs by up to 60%. LICO developed three versions for residential, commercial, and industrial use, operational from -20°C to 60°C with a five-year warranty.

Segments Covered in the Report

By Material

- Cathode

- Anode

- Electrolyte

- Separator

By Battery Type

- Lithium-ion

- Lead acid

- Others

By Application

- Automotive

- Consumer Electronics

- Industrial

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting