What is the Metal Air-Battery Market Size?

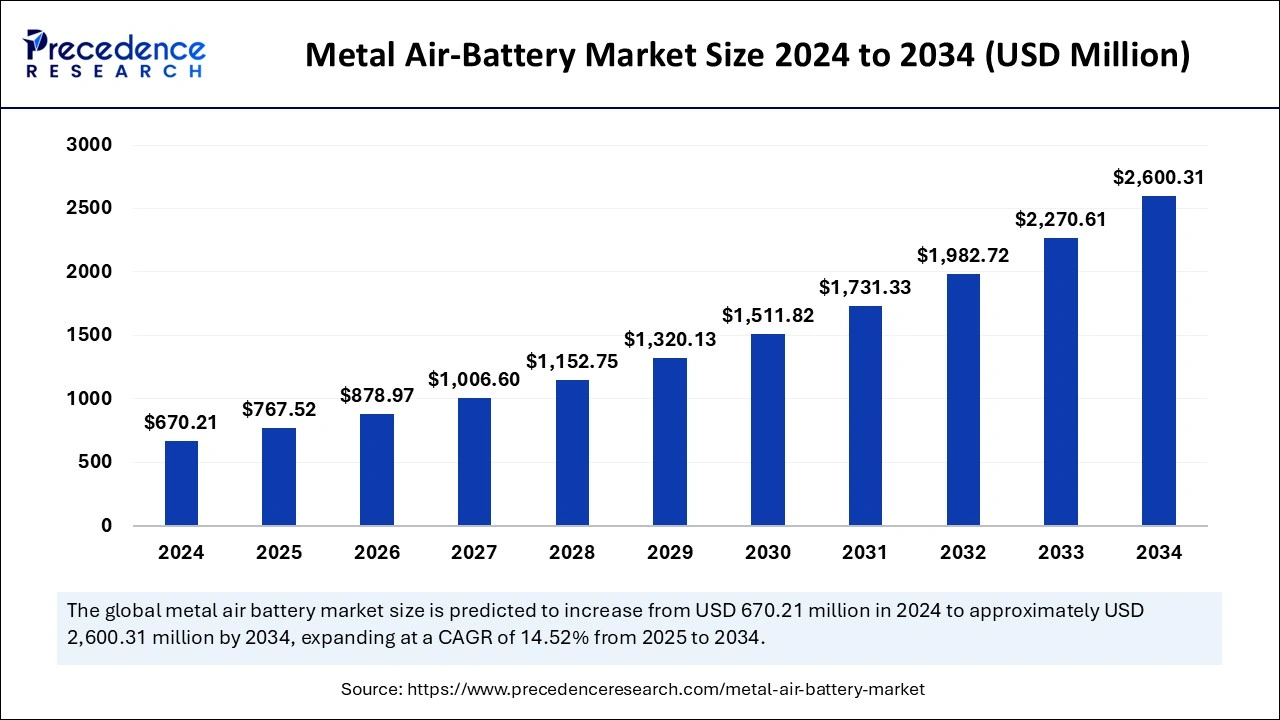

The global metal air-battery market size is calculated at USD 767.52 million in 2025 and is predicted to increase from USD 878.97 million in 2026 to approximately USD 2,600.31 million by 2034, expanding at a CAGR of 14.52% from 2025 to 2034. The market growth is attributed to the increasing demand for high-energy-density, sustainable battery solutions across electric vehicles, renewable energy storage, and portable electronics.

Metal Air-Battery Market Key Takeaways

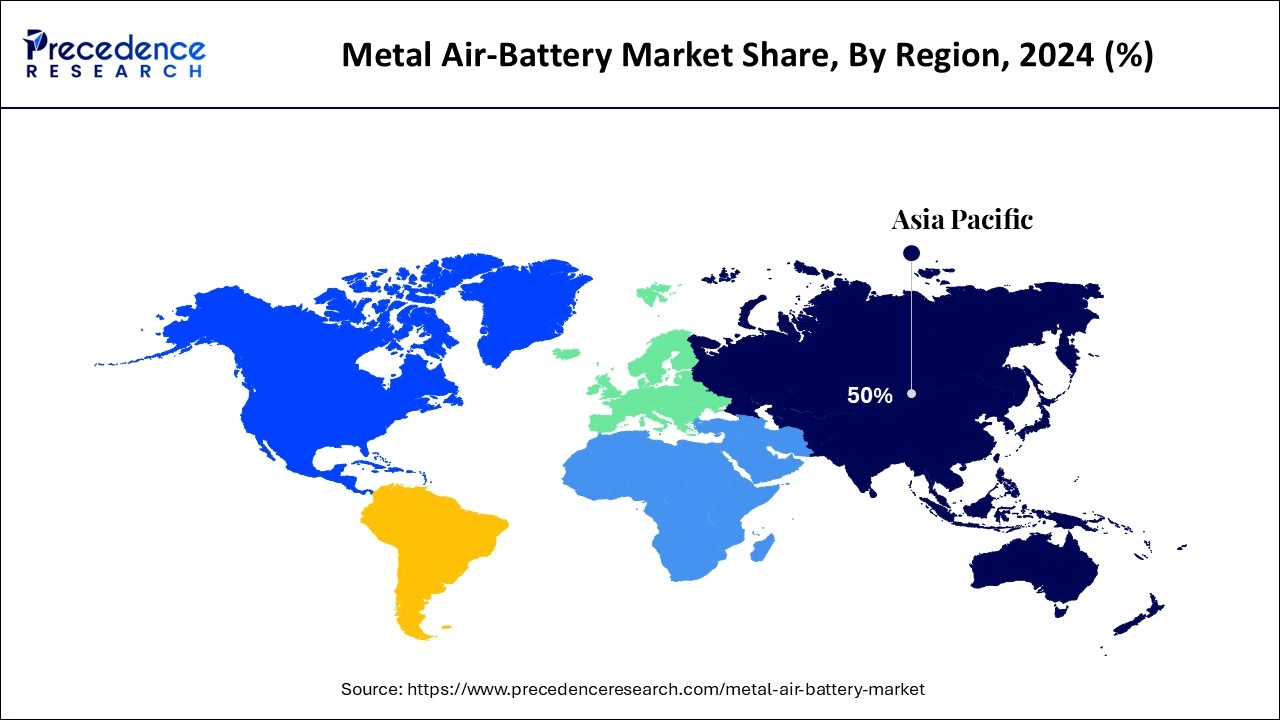

- Asia Pacific dominated the global metal air-battery market with the largest market share of 50% in 2024.

- North America is projected to host the fastest-growing market in the coming years.

- U.S. market is expected to grow at a notable CAGR of 14% during the forecast period.

- By metal, the zinc segment has held a major market share of 70% in 2024.

- By metal, the lithium segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By voltage, the low (<12V) segment contributed the highest market share of 67% in 2024.

- By voltage, the medium (12-35V) segment is anticipated to grow with the highest CAGR during the studied years.

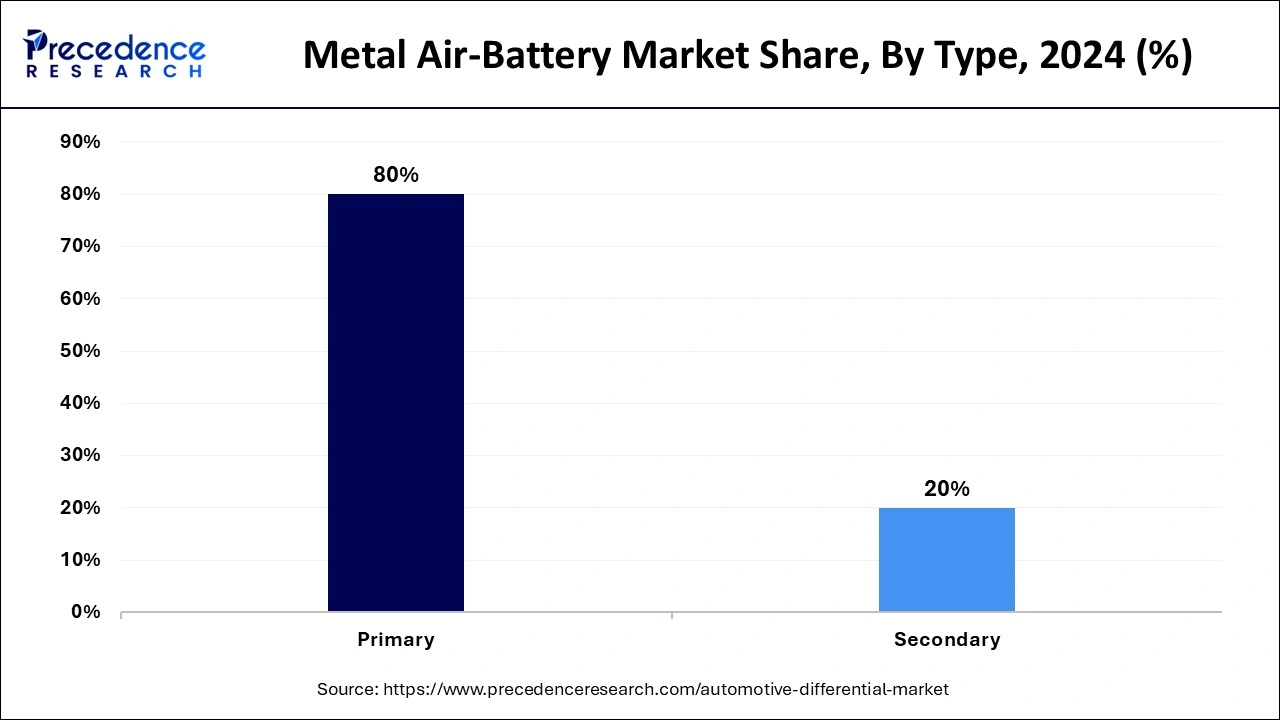

- By type, the primary segment accounted for the largest market share of 80% in 2024.

- By type, the secondary segment is projected to expand rapidly in the coming years.

- By application, the electric vehicles segment captured more than 67% of the market share in 2024.

- By application, the stationary power segment is projected to grow at the fastest rate in the future years.

Market Overview

The demand for better energy storage systems and the growing trend towards renewable energy options facilitate the utilization of the metal air-battery market services. People consider metal-air batteries, most especially zinc-air, and lithium-air batteries, to be the best because they offer greater energy density than classical lithium-ion batteries. EVs, together with solar and defense sectors, benefit from metal batteries that store energy using metal components as one electrode and oxygen from air as another. Metal-air technologies gain support directly from renewable energy grids' storage requirements and EV and defense demand.

- According to the International Energy Agency (IEA), electric vehicle sales hit 14 million global units in 2023, which drives up demand for better battery performance at lower costs.

Impact of Artificial Intelligence (AI) on the Metal Air-Battery Market

The use of artificial intelligence helps revolutionize the metal air-battery market technology by making all steps in product development and optimization better. Using AI technology algorithms helps researchers find better electrode materials that boost both the battery's stored power and endurance. AI analyzes electrochemical data to see how chemical events affect batteries and adds strength to battery technology through improved design choices. Machine learning systems help us use materials better in production and enable productive scaling. The system uses artificial intelligence technology to manage power more efficiently and make batteries work longer. AI power enhancements make metal-air batteries better suited for renewable energy storage and electric vehicle use while remaining environmentally friendly.

Market Outlook

- Industry Growth Overview: The metal-air battery market is expected to witness strong growth between 2025 and 2034, driven by the increasing need for high-energy-density storage solutions, particularly with the rise of electric vehicles, renewable energy integration, and advancements in battery technology. Enhanced efficiency, sustainability, and the potential for large-scale energy storage applications further fuel the market's expansion as industries seek cleaner and more efficient alternatives to conventional battery technologies.

- Sustainability Trends and Innovation: There is a strong focus on eco-friendly material sourcing, recyclable electrode designs, and manufacturing processes that minimize carbon footprints. Innovations are also centered on enhancing battery longevity, improving energy efficiency, and developing low-impact storage solutions, all of which are crucial for supporting renewable energy integration and reducing environmental impact.

- Global Expansion: There is strong potential for market expansion worldwide, driven by increasing investments in renewable energy storage, advancements in electric mobility, and cross-border collaborations. Emerging economies offer significant opportunities for market growth due to technological innovation and government support.

- Major investors: Major investors in the market include large technology firms like BMW, Toyota, and Samsung SDI, as well as venture capital firms focusing on clean energy technologies. These investors contribute by funding research and development to improve battery efficiency, scalability, and cost-effectiveness, while also driving the commercialization of metal-air battery solutions for electric vehicles, renewable energy storage, and other large-scale applications.

- Startup Ecosystem:The market's startup ecosystem is maturing rapidly, with innovators like Phinergy, Zinc8 Energy Solutions, Log9 Materials, and Infraprime Logistics Technologies driving breakthroughs in zinc-air and aluminum-air technologies, enhancing rechargeability, cost-efficiency, and large-scale renewable integration.

Metal Air-Battery Market Growth Factors

- Increasing adoption of electric vehicles (EVs) globally, spurring demand for high-energy-density batteries.

- Expanding government incentives and regulatory frameworks favoring clean energy and sustainable technologies.

- Growing need for efficient energy storage solutions to support intermittent renewable energy sources like wind and solar.

- Rising investments in research and development to enhance metal-air battery performance and reduce manufacturing costs.

- Technological advancements aimed at improving the rechargeability and lifespan of metal-air batteries.

- Shifting focus towards environmentally friendly and recyclable battery technologies in various industrial applications.

- Expanding demand for compact, lightweight battery solutions for portable electronics and military applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 878.97 Million |

| Market Size in 2025 | USD 767.52 Million |

| Market Size in 2034 | USD 2,600.31 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.52% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Metal, Voltage, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for high-energy-density storage solutions

Rising global energy demands are anticipated to drive the adoption of the metal air-battery market services due to their superior energy density compared to traditional lithium-ion batteries. The expanding need for energy worldwide pushes metal-air batteries forward as they deliver higher power per unit than lithium-ion versions.

The International Energy Agency projects electricity usage worldwide is estimated to increase steadily in the coming years, as metal-air batteries offer remarkable energy storage capability. Metal-air batteries, particularly lithium-air variants, deliver a superior 3,458 Wh/kg energy density ideal for EVs, drones, and renewable energy systems. The light design of these batteries improves vehicle performance at higher distances to benefit from energy efficiency progress.

According to the International Energy Agency forecasts, 2024 will bring 4% global electricity demand growth compared to 2.5% in 2023, marking the fastest annual rise since 2007.

Restraint

Environmental and recycling challenges

Environmental and recycling challenges are likely to hamper the growth of the metal air-battery market. Spent batteries cause dangerous problems for nature, as they contain toxic substances and heavy metals that go into making batteries. Efforts to recycle these battery types have slow development and demand large energy inputs, which has lessened their environmental advantage. Regulatory agencies and governments are creating tough standards to handle environmental problems in batteries, which leads to added operating expenses for businesses. Toothless recycling procedures create adoption barriers for metal air-battery technologies across environmentally responsible markets.

Opportunity

Rising technological advancements and research investment

Rising technological advancements and increased research investment provide substantial opportunities for the growth of the metal air-battery market. Researchers enhance metal air-battery technology by improving its rechargeability and lifespan to make it better suited for different industrial uses. Both public and private funders support research efforts to design better batteries from new materials while building improved production techniques. Improved technologies are making metal-air batteries work better and reliably at lower costs across multiple industries.

- In February 2024, Xianglin Li led Washington University in St. Louis's research team toward a USD 1.5 million grant from ARPA-E for metal-air battery innovation. Through government funding, researchers work to build lithium-air batteries with salt-based liquid that provides superior performance and longer-lasting power in demanding applications.

- In May 2024, scientists from Pohang University of Science and Technology presented their breakthrough in building a sodium-air battery designed for high-energy and efficient performance. This device brings metal air-battery technology forward by powering sodium-air reactions at room temperature through its novel design.

Metal Insights

The zinc segment held a dominant presence in the metal air-battery market in 2024, as they work well economically while delivering more energy per unit at zero environmental impact. Zinc-air batteries deliver more extended power output while being less expensive to make compared to lithium-based energy storage solutions. They suit various tasks effectively, including grid storage power packs and EV batteries, plus small devices like hearing instruments. Furthermore, the advancement in zinc battery technology for low-cost production and increased durability further fuels the market. These batteries aim to support energy cost reduction, integration of renewable energy, and improved power quality.

- According to a 2023 report by the U.S. Department of Energy, companies like Zinc8 Energy Solutions and e-Zinc are advancing zinc-air battery technologies for use in microgrids and behind-the-meter applications across both commercial and residential sectors.

The lithium segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034, owing to the rise of lithium batteries for their higher energy capacity plus ongoing technology development. The development of metal-air batteries using lithium shows promise as they deliver more energy storage per unit weight than standard lithium-ion batteries. Electric car makers benefit from this development since EV designs depend on high range and small size. Furthermore, electric vehicle production will continue to support lithium's segment growth in the coming years.

- According to the International Energy Agency (IEA), in 2022, approximately 60% of the global lithium demand was driven by electric vehicle (EV) production. This represents a significant increase compared to 2017 when EV production accounted for just 15% of lithium demand.

Voltage Insights

The low (<12V) segment accounted for a considerable share of the metal air-battery market in 2024 due to the strong demand for consumer electronics, hearing aids, and smaller portable devices. Low-power commercial operations adopt zinc-air batteries, as these systems create a cost-effective solution with high energy density capabilities for small-scale applications. The world's low-voltage battery market shows a positive growth trajectory due to the ongoing miniaturization of consumer electronics and rising demand for sustainable, eco-friendly alternatives.

- Data from the U.S. Department of Energy (DOE) 2023 report predicts zinc-air batteries are expected to grow at a 5.6% yearly rate as manufacturers seek efficient and small electric batteries in consumer products.

The medium (12-35V) segment is anticipated to grow with the highest CAGR during the studied years, owing to its use in electric vehicles (EVs), drones, and other mobile applications. Medium-voltage battery solution adopters expect annual demand to increase, as these batteries deliver high energy density, which enhances both range capability and operational efficiency in vehicles. Furthermore, this voltage range supports metal-air batteries with 1,200 Wh/kg energy density, making these batteries highly attractive for electric vehicles and drone applications.

Type Insights

The primary segment led the global metal air-battery market due to the growing demand for non-rechargeable batteries to power their devices in consumer electronics, medical equipment, and hearing instruments. Zinc-air batteries provide both strong power and affordability, which make them popular. Furthermore, the small portable energy storage needs, but their market share continues to rise, especially in medical and consumer applications.

The secondary segment is projected to expand rapidly in the coming years, owing to the increased Rechargeable technology needs, as businesses use batteries in electric vehicles and renewable energy systems. People see these batteries as strong competitors for secondary lithium-ion batteries, as they store more energy and last longer which further contributes to fuelling the segment in the coming years.

Application Insights

The electric vehicles segment dominated the global metal air-battery market in 2024, as manufacturers need advanced energy solutions for better vehicle electricity storage and performance. Zinc-air and lithium-air batteries receive higher levels of interest as better energy density options instead of lithium-ion batteries. Metal-air batteries entering the EV market are increasing, as these batteries provide greater range and lighter weight.

- The IEA's Electricity Market Report 2023 indicates that global electricity demand is expected to grow at a much faster pace of 3% per year over the 2023-2025 period compared with the 2022 growth rate.

The stationary power segment is projected to grow at the fastest rate in the future years, owing to the rising need for efficient power storage solutions in the renewable energy sector. Research suggests using metal-air batteries for big-scale energy storage systems, as they hold power at lower prices than typical lithium-ion parts. Furthermore, the Industries that want to switch to clean energy are investing in stationary power stations.

- The U.S. Department of Energy projects stationary power solutions will grow by 20% yearly through 2030 since many countries use solar and wind power.

Regional Insights

Asia Pacific Metal Air-Battery Market Size and Growth 2025 to 2034

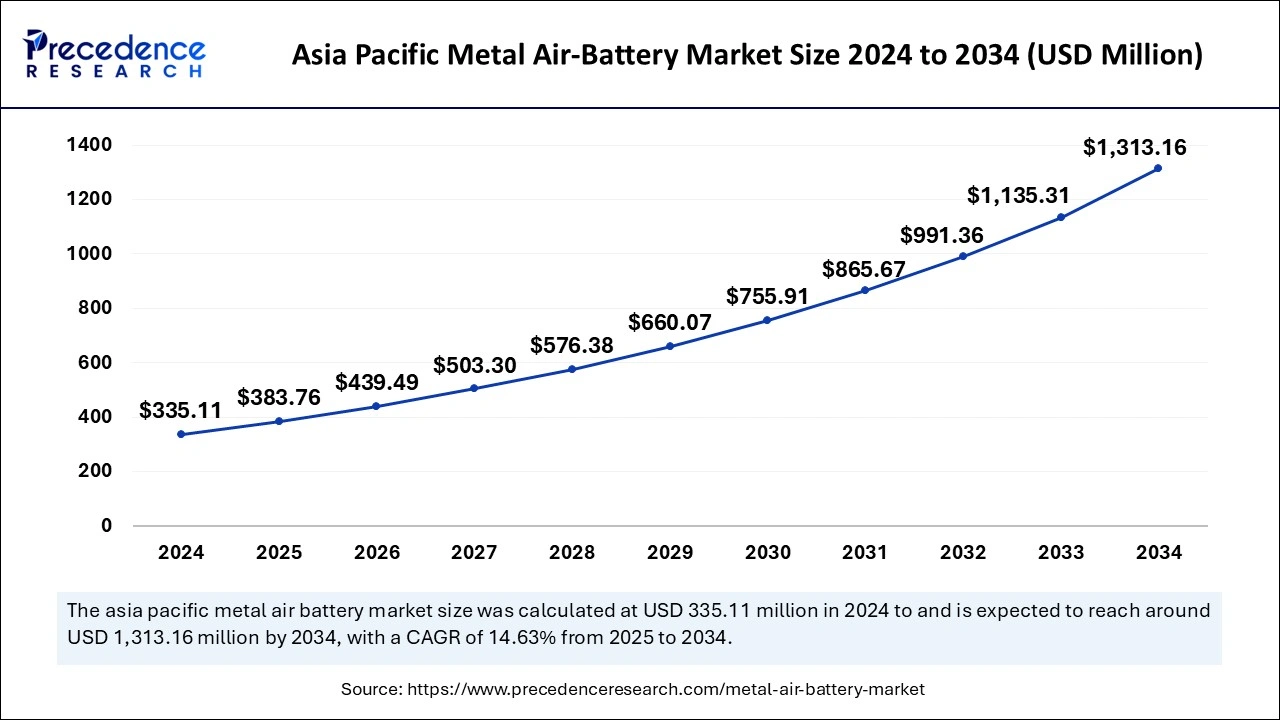

The Asia Pacific metal air-battery market size is exhibited at USD 383.76 million in 2025 and is projected to be worth around USD 1,313.16 million by 2034, growing at a CAGR of 14.63% from 2025 to 2034.

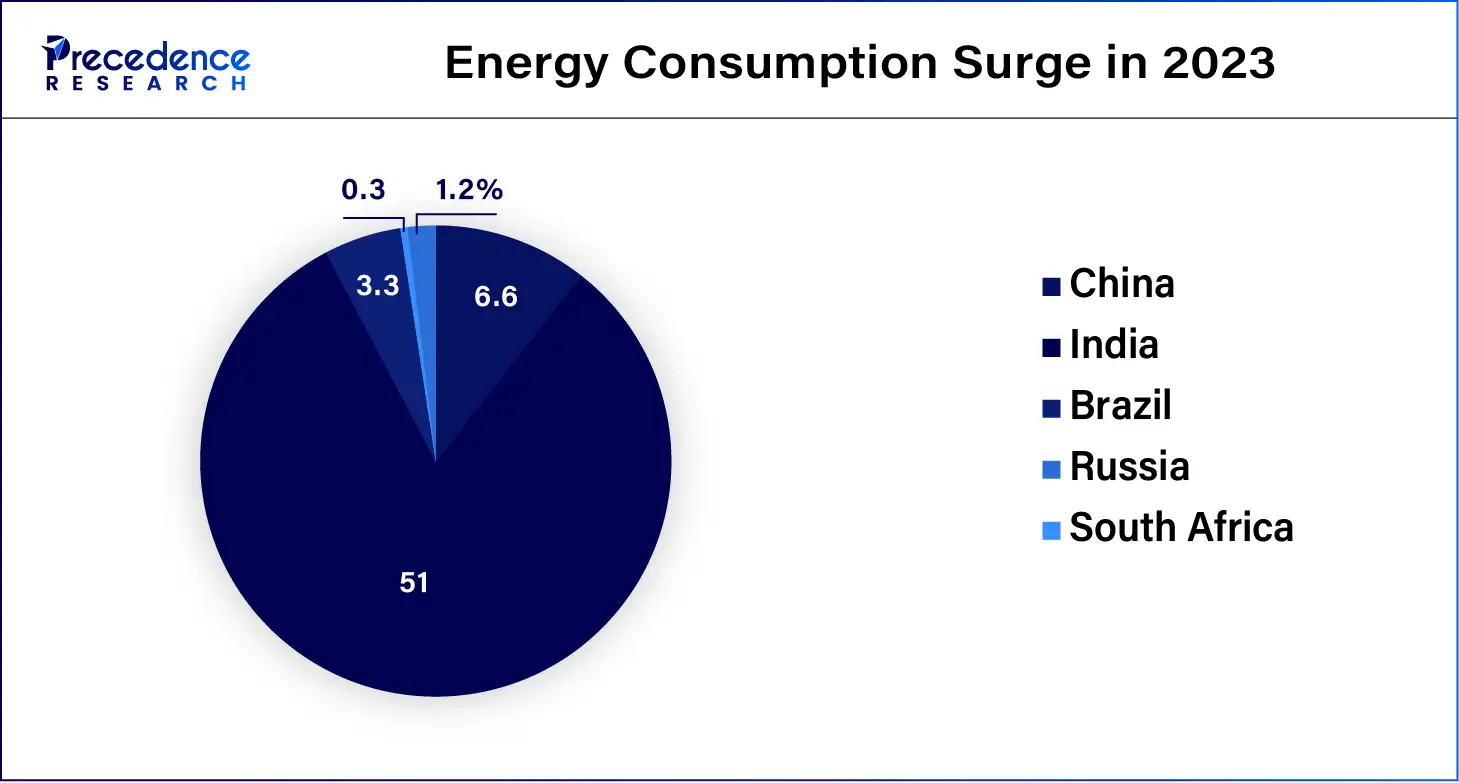

Asia Pacific dominated the global metal air-battery market in 2024., owing to the strong demand for energy solutions in China, Japan, and South Korea, which drives this growth. The region's leading nations now drive electronics production while leading EV production and renewable energy usage worldwide. The Asian Development Bank shows China made half of worldwide EVs during 2023 while growing demand for metal-air battery solutions.

The continuous driving of energy-efficient research while India expands its investment in affordable storage solutions further boosts the market in this region. According to the International Energy Agency (IEA), in September 2023, the Indian Ministry of Power allocated funding for a project grant scheme aimed at supporting the development of Battery Energy Storage Systems (BESS).

What Makes North America the Fastest-Growing Area?

North America is projected to host the fastest-growing metal air-battery market in the coming years due to the increasing desire forelectric vehicles, plus the need for storage in renewable power projects drives market expansion. Companies, including General Motors and Tesla, incorporate metal-air batteries into electric car designs as U.S. automakers plan to increase production of advanced batteries. Moreover, the energy storage needs from grid stabilization and renewable power adoption in this region.

- Data from the IEA 2023 report shows that the demand for powerful battery technology increased by 40% across the EV market last year.

How is the Opportunistic Rise of Europe in the Metal Air-Battery Market?

Europe is expected to grow at a notable rate in the market during the forecast period, driven by strong government support for clean energy technologies, rising demand for electric vehicles, and strict carbon-emission regulations. Continuous research investments, advancements in energy storage materials, and collaboration between automotive and battery manufacturers further accelerate the region's market expansion.

The UK dominates the European metal-air battery market due to strong government initiatives supporting renewable energy storage and decarbonization. The country's advanced research ecosystem, growing investments in zinc-air and iron-air technologies, and collaborations between universities, startups, and energy firms drive innovation. Additionally, its focus on grid-scale energy storage strengthens its leadership position in the market.

How Crucial is the Role of Latin America in the Metal Air-Battery Market?

Latin America plays a crucial role in the market due to its abundant metal resources, including zinc and aluminum, which are essential for battery production. Growing renewable energy projects, government initiatives promoting clean technologies, and increasing demand for efficient energy storage systems are driving the region's growing importance in global market development.

Brazil leads the Latin American market due to its strong renewable energy infrastructure, particularly in solar and wind power integration. The government's focus on sustainable energy storage, the availability of raw materials, and increased research collaborations with global battery developers enhances Brazil's position as the regional hub for clean energy innovation.

How Big is the Opportunity for the Growth of the Metal Air-Battery Market in the Middle East and Africa?

The Middle East and Africa (MEA) region presents significant growth opportunities in the market due to rising investments in renewable energy, growing interest in grid energy storage, and government initiatives for sustainability. Expanding electric mobility projects, combined with abundant metal resources and industrial diversification, further support market development across the region.

The UAE dominates the Middle East and Africa metal-air battery market due to its strong focus on clean energy transition and advanced energy storage technologies. Government-backed initiatives, such as hydrogen and renewable integration projects, along with partnerships between global tech firms and local industries, position the UAE as a regional leader.

Value Chain Analysis

Raw Material Sourcing:

The first stage involves sourcing essential materials, such as metals (zinc, lithium, and aluminum) and electrolytes.

- Key Players: Umicore, BASF, and Glencore.

Battery Design & Development:

This stage focuses on the research and development of metal-air battery technologies to improve energy density and efficiency.

- Key Players: Toyota, IBM, and Samsung SDI.

Manufacturing:

The actual production of metal-air batteries is carried out through advanced manufacturing processes.

- Key Players: Toshiba, Panasonic, and EVE Energy.

Battery Integration & Application:

In this stage, the batteries are integrated into commercial applications like EVs and grid energy storage.

- Key Players: BMW, Ford, and LG Chem.

Distribution & Sales:

Distribution involves getting the batteries to original equipment manufacturers (OEMs) and direct consumers.

- Key Players: Panasonic, BYD, and Guangdong LiFePo4.

Metal Air-Battery Market Companies

- GP Batteries International Limited – Specializes in the development and manufacturing of advanced battery technologies, including metal-air batteries, supporting various energy storage applications.

- Arotech– Provides battery solutions, including zinc-air battery technology, for military and commercial applications, advancing the development of high-performance energy storage systems.

- Energizer Holdings, Inc. – A key player in battery manufacturing, Energizer contributes by developing compact, high-energy density metal-air batteries, primarily for consumer electronics and portable power applications.

- Duracell Inc.– As a leader in battery technology, Duracell is investing in metal-air batteries to enhance its product offerings in the consumer and automotive sectors, focusing on long-lasting power solutions.

- Renata SA– Renata specializes in small-scale metal-air batteries, particularly for medical devices, hearing aids, and specialized electronics, helping to drive innovations in the niche battery segment.

- Phinergy– Focuses on commercializing aluminum-air and zinc-air batteries for electric vehicles (EVs), providing sustainable, high-energy-density solutions for the automotive industry.

- Log9 Materials– Innovates in the development of zinc-air batteries, offering solutions that support cleaner, more efficient energy storage for electric mobility and renewable energy integration.

- Poly Plus Battery – Develops advanced lithium-air and zinc-air battery technologies, with a focus on improving energy density and battery life, contributing to more sustainable energy storage solutions.

- Zinc8 Energy Solutions– Specializes in the development of zinc-air energy storage systems, focusing on large-scale applications such as grid energy storage and renewable energy integration.

- Panasonic Energy Co., Ltd.– A global leader in battery production, Panasonic is investing in metal-air battery technologies to enhance energy efficiency, particularly in the automotive and consumer electronics sectors.

Latest Announcements by Industry Leaders

January 2025 – SES AI Corporation

CEO – Qichao Hu

Announcement - SES AI Corporation (NYSE: SES), a global leader in AI-enhanced high-performance Li-Metal and Li-ion batteries, introduced an innovative AI-enhanced 2170 cylindrical cell tailored for emerging humanoid robotics applications at the 2025 CES Show in Las Vegas, Nevada. Founder and CEO Qichao Hu explained that the company was approached by several original equipment manufacturers (OEMs) to develop an electrolyte that would address issues like gassing and poor low-temperature cycling and rate performance that were prevalent in traditional Li-ion 2170 cells used in high-energy applications.

Recent Developments

- In March 2024, Institut Teknologi Sepuluh Nopember (ITS) conducted a trial application of the first-generation prototype of the ITS Al-Air Battery on a motorbike at the ITS Research Center Building on Tuesday (5/3). This research was encouraged by Pertamina, alongside the ITS Kedaireka Matching Fund, to support the acceleration of Battery-Based Electric Vehicles (KLBB) adoption.

- In June 2024, AlumaPower Corporation, a cleantech startup developing a novel energy source called an “Aluminum-air Galvanic Generator,” announced the close of its USD 10 million oversubscribed Series A funding round. The round was co-led by U.S.-based Starbridge Venture Capital and Martinrea International.

- In January 2025, General Motors (GM) announced a groundbreaking multi-year, multi-billion-dollar agreement with Norway's Vianode to supply synthetic graphite anode materials for its electric vehicle (EV) batteries. This deal underscores GM's commitment to advancing battery technology and securing a resilient supply chain for EV production. The agreement spans from 2027, when Vianode's North American production facility is set to launch, continuing through 2033.

Segments Covered in the Report

By Metal

- Aluminum

- Iron

- Lithium

- Zinc

- Others

By Voltage

- Low (<12V)

- High (>36V)

- Medium (12−36V)

By Type

- Primary

- Secondary

By Application

- Electric Vehicles

- Electronic Devices

- Military Electronics

- Stationary Power

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting