What is the Biophotonics Market Size?

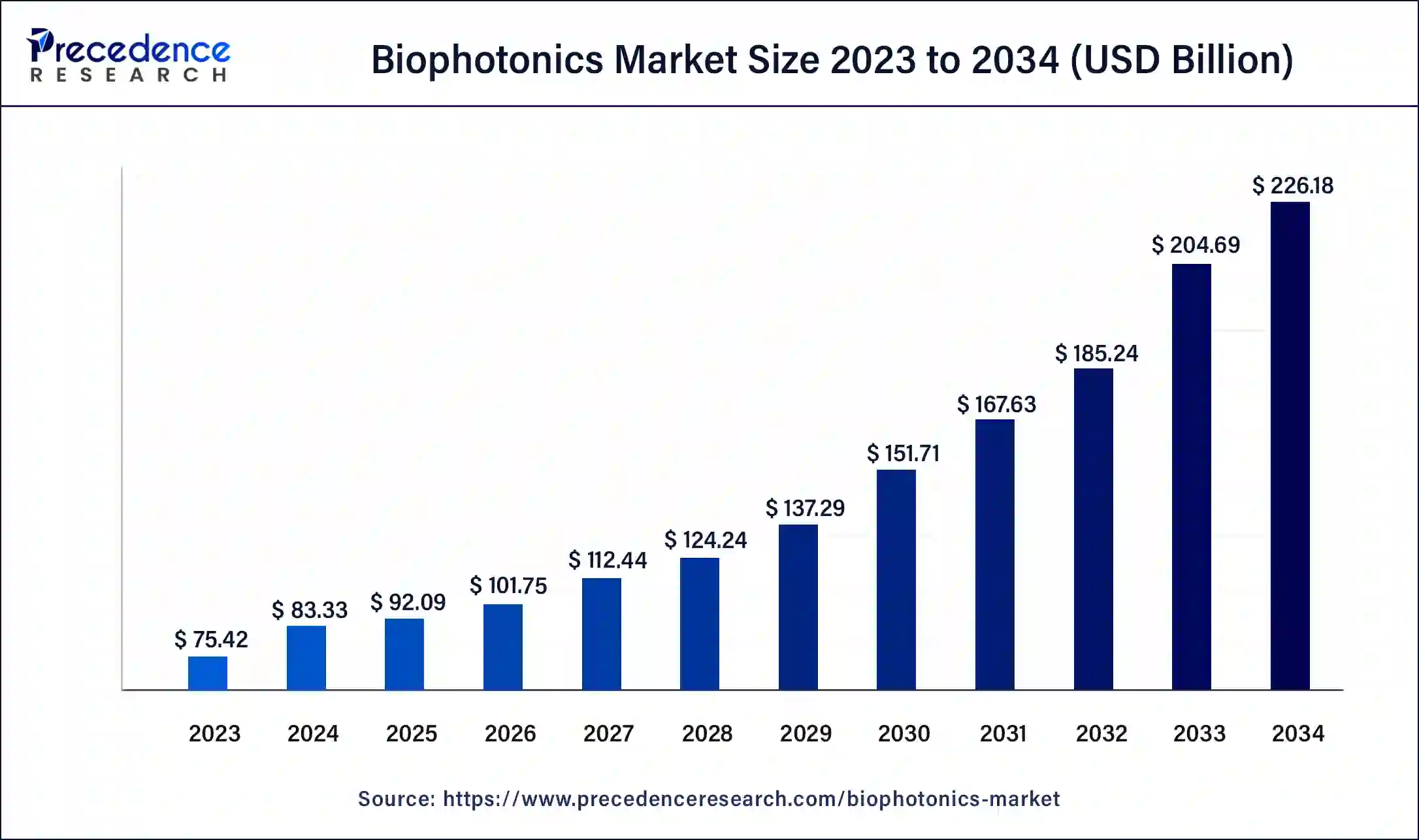

The global biophotonics market size is accounted at USD 92.09 billion in 2025 and predicted to increase from USD 101.75 billion in 2026 to approximately USD 226.18 billion by 2034, expanding at a CAGR of 10.5% from 2025 to 2034.

Biophotonics Market Key Takeaways

- In terms of revenue, the market is valued at $92.09 billion in 2025.

It is projected to reach $226.18 billion by 2034.

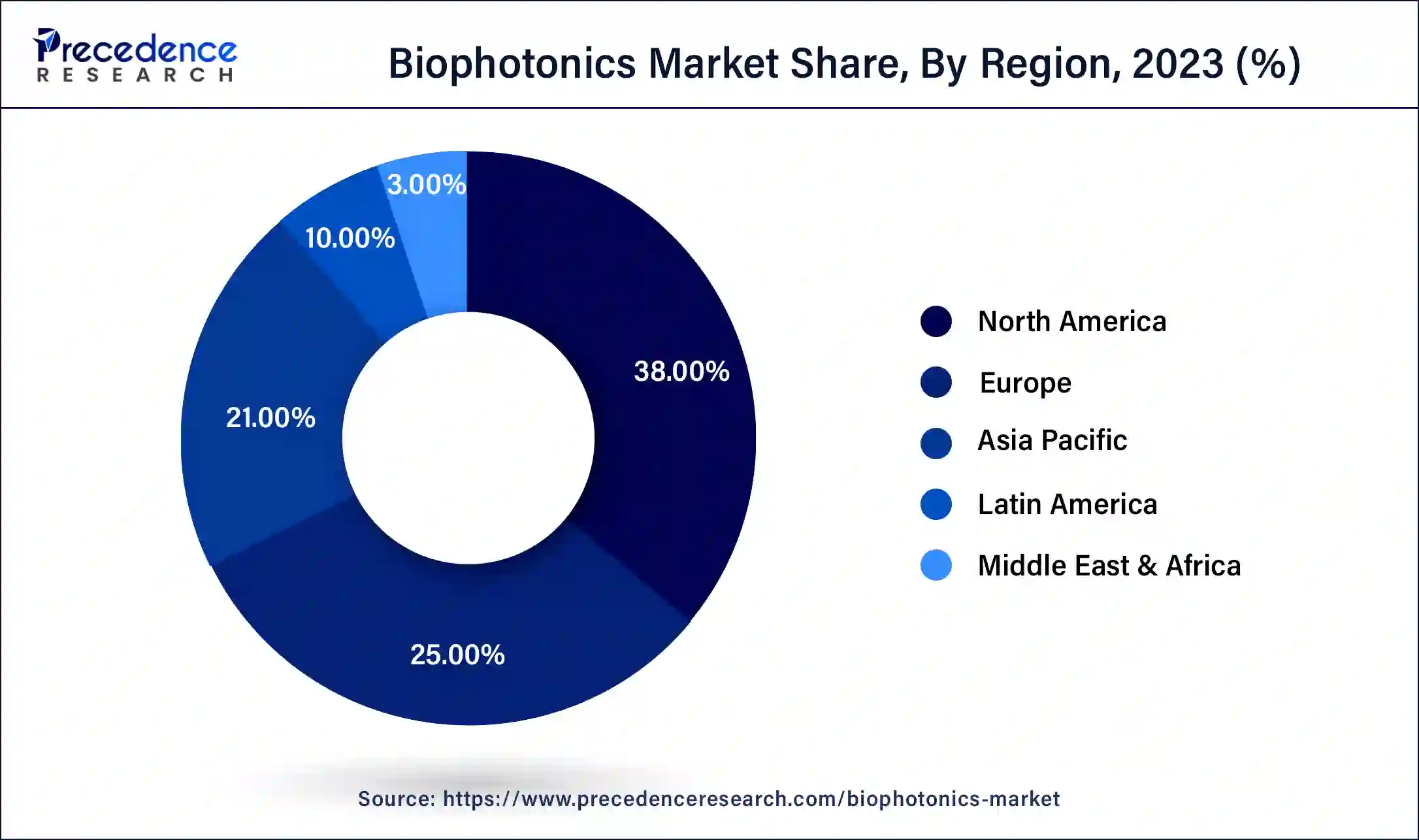

The market is expected to grow at a CAGR of 10.50% from 2025 to 2034. - North America region has contributed the largest share of 38% in 2024.

- Asia-Pacific region is estimated to expand at the fastest CAGR of 13.54% during the forecast period.

- By end-use, the medical diagnostics segment has held the largest market share of 66% in 2024.

- By end-use, the non-medical application segment is anticipated to grow at a remarkable CAGR of 13.27% during the forecast period.

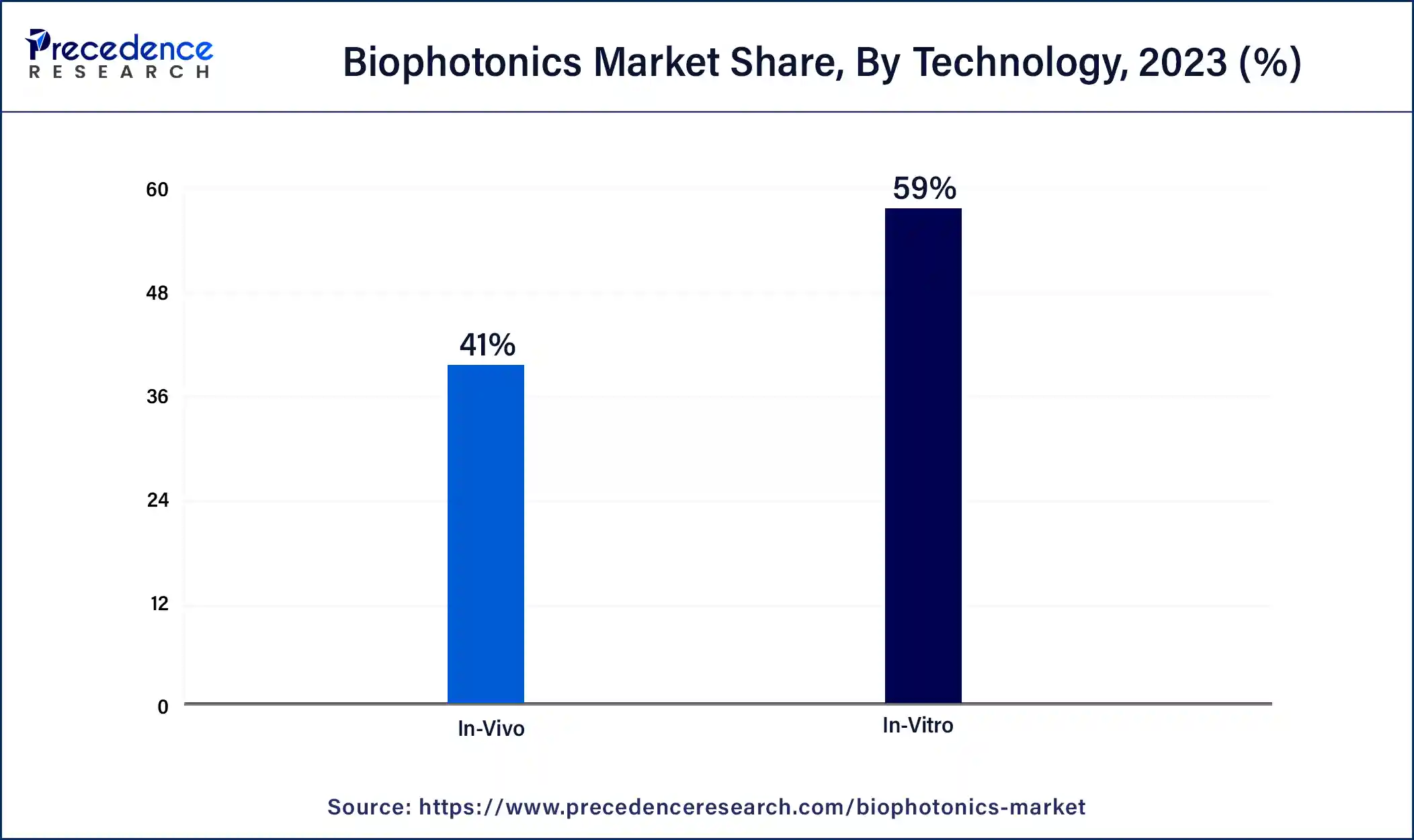

- By technology, the in-vitro segment has generated the largest market share of 59% in 2024.

- By technology, the in-vivo segment is expected to expand at the fastest CAGR of 11% over the projected period.

- By application, the analytics sensing segment has accounted more than 24% market share in 2024.

- By application, the see-through imaging segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Biophotonics is an interdisciplinary field that involves the application of light-based technologies in biological and medical sciences. Using the principles of optics and photonics, biophotonics explores the interaction between light and biological tissues to develop advanced tools for imaging, diagnostics, and therapy. This field harnesses the unique properties of light to study and manipulate biological materials at the cellular and molecular levels. Biophotonics plays a crucial role in various medical applications, such as non-invasive imaging techniques, laser-based therapies, and optical diagnostics. By utilizing light to probe and analyze biological structures, researchers and healthcare professionals gain valuable insights into the functioning of living organisms. The applications of biophotonics continue to evolve, contributing to advancements in medical research, diagnostics, and treatments with the potential to improve patient outcomes and enhance understanding of the complexities of living systems.

Biophotonics Market Data and Statistics

- In February 2022, according to a Science Direct article, researchers from the University of Rochester utilized gold nanoparticles on the tip of an optical fiber as an antenna to boost the fluorescence of labeled proteins in the cell membrane.

- Stryker Corporation introduced the 1688 AIM 4K Visualization platform and the Connected OR Hub in August 2020, aimed at improving the surgical experience for arthroscopy.

- During November 2020, Jenoptik Light and Optics Biophotonics Group secured multiple development orders in North America. The initial order involved designing a camera system for an upcoming fiber-optic medical device intended for use in a robotic surgical instrument.

- The United States Congress allocated funds from the FY2020 budget to explore opportunities in biophotonics for gene therapy research, immunotherapy research, Alzheimer's research, and various other projects.

Biophotonics Market Growth Factors

- Ongoing advancements in biophotonics technologies, such as improved imaging modalities and enhanced diagnostic tools, are driving the biophotonics market's growth. Innovations like multiphoton microscopy and optical coherence tomography contribute to higher precision in medical diagnostics and research.

- The expanding applications of biophotonics in medical fields, including surgery, diagnostics, and therapy, are a significant growth factor. Biophotonics technologies offer non-invasive and real-time imaging, aiding in early disease detection and personalized medicine. This versatility is fostering adoption across various medical specialties.

- The global increase in the aging population contributes to the demand for advanced medical technologies. Biophotonics plays a vital role in addressing age-related health challenges, providing tools for early diagnosis and monitoring of conditions prevalent in older demographics.

- There is a global shift towards preventive healthcare, and biophotonics contributes by enabling early detection and monitoring of diseases. Increased awareness of the benefits of early diagnosis is fueling the demand for biophotonics applications in preventive healthcare strategies.

- Supportive government initiatives and funding for research and development in biophotonics are significant growth drivers. Governments worldwide are recognizing the potential of biophotonics in advancing healthcare, leading to increased investment and initiatives that promote innovation in the field.

- Ongoing research in biophotonics, especially in areas like genomics, proteomics, and neuroscience, is expanding the potential applications of these technologies. Collaborations between academia, research institutions, and industry players contribute to the development of new biophotonics solutions, fostering the biophotonics market's growth.

Recent Trends

Growing Preference for Non-Invasive Diagnostics:

Due to biophotonics-based instruments enable disease diagnosis without surgery or radiation exposure demand for them is rising. For the early detection of chronic diseases technologies such as fluorescence imaging and optical coherence tomography are becoming indispensable. These non-invasive solutions are being quickly embraced in hospitals and diagnostic facilities as healthcare moves toward preventive care.

Integration of AI and Smart Sensors:

Artificial intelligence and machine learning are being integrated into biophotonic imaging systems to enhance accuracy and speed. These tools analyze massive image datasets, detect hidden patterns, and provide real-time diagnostics. Advanced sensors embedded in devices are also enabling precise molecular detection, making diagnostics smarter and more personalized.

Rise in Both Clinical and Research Applications:

In addition to hospitals research labs are also using biophotonics. It supports in-vivo imaging and disease monitoring in clinical settings and helps with cell biology drug discovery and life sciences in research. The dual usage in RandD and healthcare is greatly expanding the markets reach. The demand for non-invasive, real-time diagnostic tools is increasing in clinical settings. Furthermore, researchers are continuously developing novel applications to visualize cellular functions at a molecular level, accelerating the drug development pipeline.

Market Outlook

- Industry Growth Overview: As optical technologies become more popular in imaging therapy and diagnostics the biophotonics market is expanding. Adoption in the healthcare and life science is being driven by the growing need for non invasive and real time monitoring solutions as well as developments in sensor miniaturization and imaging.

- Sustainability Trends: Biophotonics supports sustainability by reducing waste and invasive procedures through light-based diagnostics. Portable and energy-efficient devices improve accessibility while minimizing resource use, though maintaining durability and calibration remains important. The use of biophotonic techniques minimizes the need for harsh chemical reagents and extensive lab equipment associated with traditional diagnostics, contributing to a greener lab environment. Miniaturization of devices also reduces the physical footprint and material requirements for point-of-care diagnostics.

- Startups Ecosystem: Startups are developing wearable biosensors optical diagnostics and imaging systems with AI integration. Commercialization is being accelerated through partnerships with research institutes and medical device companies with an increasing emphasis on scalable affordable precision healthcare solutions. Venture capital funding is increasingly targeting innovations that merge photonics with machine learning algorithms for more accurate and faster disease detection. These agile startups are key drivers in democratizing advanced medical technology and pushing the boundaries of non-invasive monitoring.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2034 | USD 226.18 Billion |

| Global Market Size in 2025 | USD 92.09 Billion |

| Global Market Size in 2024 | USD 83.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.5% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End-use, Technology, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising geriatric population

- The global aging population is expected to reach 2.1 billion by 2050, creating a substantial market for biophotonics applications in age-related diseases.

The surging demand for biophotonics in the market is closely tied to the increasing global population of seniors. As people age, there is a higher likelihood of health issues, and biophotonics plays a crucial role in addressing these concerns. Biophotonics technologies offer advanced diagnostic tools and imaging solutions that are particularly beneficial for the elderly. These tools aid in early detection of age-related conditions, enabling timely interventions and personalized healthcare. The rising geriatric population, with its associated health challenges, propels the need for non-invasive and effective medical solutions. Biophotonics caters to this demand by providing innovative approaches to diagnostics, contributing to a more comprehensive understanding of age-related diseases. As the aging demographic grows, the market for biophotonics is expected to expand further, offering valuable contributions to improving healthcare outcomes for seniors around the world.

Restraint

Limited accessibility in developing regions

Limited accessibility in developing regions serves as a significant restraint for the biophotonics market, hindering its widespread adoption and potential impact on healthcare. In these regions, inadequate infrastructure, including a lack of reliable power sources and limited healthcare facilities, poses challenges for the integration of advanced biophotonics technologies. The high costs associated with setting up and maintaining these technologies further exacerbate the accessibility issues, preventing many healthcare providers in developing areas from incorporating biophotonics into their practices.

Moreover, economic constraints in these regions limit the financial resources available for healthcare investments, making it difficult for institutions to afford the necessary equipment and training. As a result, the transformative benefits of biophotonics, such as advanced diagnostics and personalized medicine, often remain out of reach for populations in developing regions. Efforts to address these accessibility challenges, including initiatives for cost-effective solutions and targeted infrastructure development, are crucial for ensuring that the potential advantages of biophotonics can be extended to underserved populations worldwide.

Opportunity

Advancements in research and development

Advancements in research and development (R&D) serve as a catalyst for creating significant opportunities in the biophotonics market. Ongoing innovations in biophotonics technologies, such as enhanced imaging modalities and sophisticated spectroscopy tools, pave the way for transformative applications in medical diagnostics and life sciences. These developments not only contribute to the refinement of existing tools but also lead to the creation of novel solutions, expanding the market's potential. As R&D efforts progress, the continuous improvement in biophotonics capabilities addresses the evolving needs of healthcare and research communities.

The exploration of cutting-edge techniques and methodologies provides opportunities for the development of more precise and efficient diagnostic tools, ultimately contributing to advancements in personalized medicine and therapeutic interventions. The collaborative efforts of researchers and industry players in pushing the boundaries of biophotonics R&D underscore its role as a dynamic and evolving field, offering promising opportunities for the future of healthcare and scientific discovery.

End-use Insight

The medical diagnostics segment held the largest market share in 2024. The medical diagnostics segment in the biophotonics market refers to the use of light-based technologies for accurate and non-invasive medical testing. Biophotonics plays a vital role in this field by enabling advanced imaging and diagnostic tools, facilitating early disease detection and monitoring. Current trends include the development of portable and point-of-care biophotonics devices, enhancing accessibility to rapid and efficient diagnostics. Additionally, the integration of biophotonics with artificial intelligence is a notable trend, augmenting diagnostic capabilities and contributing to the evolution of precision medicine in medical diagnostics.

The non-medical application segment is anticipated to witness rapid growth at a significant CAGR during the projected period. In the biophotonics market, the non-medical application segment encompasses various uses beyond healthcare. This includes applications in agriculture, environmental monitoring, and industrial processes. A notable trend in this segment is the adoption of biophotonics for agricultural diagnostics, such as soil and crop analysis. Additionally, environmental monitoring benefits from biophotonics tools for assessing water quality and pollution levels. As industries recognize the versatility of biophotonics, the non-medical application segment continues to expand, offering solutions for diverse fields beyond traditional healthcare settings.

Technology Insights

The in-vitro segment held the largest share of the market in 2024. The in-vitro segment in the biophotonics market pertains to technologies that apply light-based methods to analyze biological samples outside the living organism. This includes techniques like fluorescence spectroscopy and imaging used for studying cells, proteins, and DNA in controlled laboratory settings. Recent trends indicate a growing adoption of advanced in-vitro biophotonics technologies for more accurate and efficient analysis, contributing to advancements in medical research, drug development, and diagnostics, with a focus on enhancing precision and reducing the need for invasive procedures.

The in-vivo segment is anticipated to witness rapid growth over the projected period. In the biophotonics market, the in-vivo segment refers to technologies that enable the study and imaging of biological processes within living organisms. This involves non-invasive methods to visualize and understand biological structures and functions in real-time. A notable trend in the in-vivo biophotonics market is the increasing adoption of advanced imaging techniques like fluorescence imaging and multispectral imaging, allowing researchers and healthcare professionals to gain deeper insights into physiological and pathological processes within living organisms, fostering advancements in diagnostics and therapeutic interventions.

Application Insights

The analytics sensing segment held the largest share in 2024. In the biophotonics market, the analytics sensing segment involves the use of photonics technologies for data analytics and sensing applications in biological and medical contexts. This segment encompasses the development of advanced sensors and analytical tools that utilize light to gather precise information about biological materials. A key trend in this sector is the integration of analytics sensing with artificial intelligence, enhancing data interpretation and enabling more accurate diagnostics. The growing demand for real-time, high-resolution data in biophotonics analytics sensing is driving continuous innovation and expanding applications in medical research and diagnostics.

The microscopy segment is anticipated to witness rapid growth over the projected period. In the biophotonics market, the microscopy segment involves the use of light-based techniques to visualize and analyze biological structures at the microscopic level. This application plays a crucial role in various fields, including medicine and life sciences, by enabling detailed imaging of cells and tissues. Recent trends in biophotonics microscopy include the integration of advanced imaging technologies, such as super-resolution microscopy and multiphoton microscopy, offering higher resolution and improved capabilities for studying complex biological processes with greater precision. These trends contribute to enhanced research outcomes and diagnostic applications in the field of biophotonics.

Regional Insights

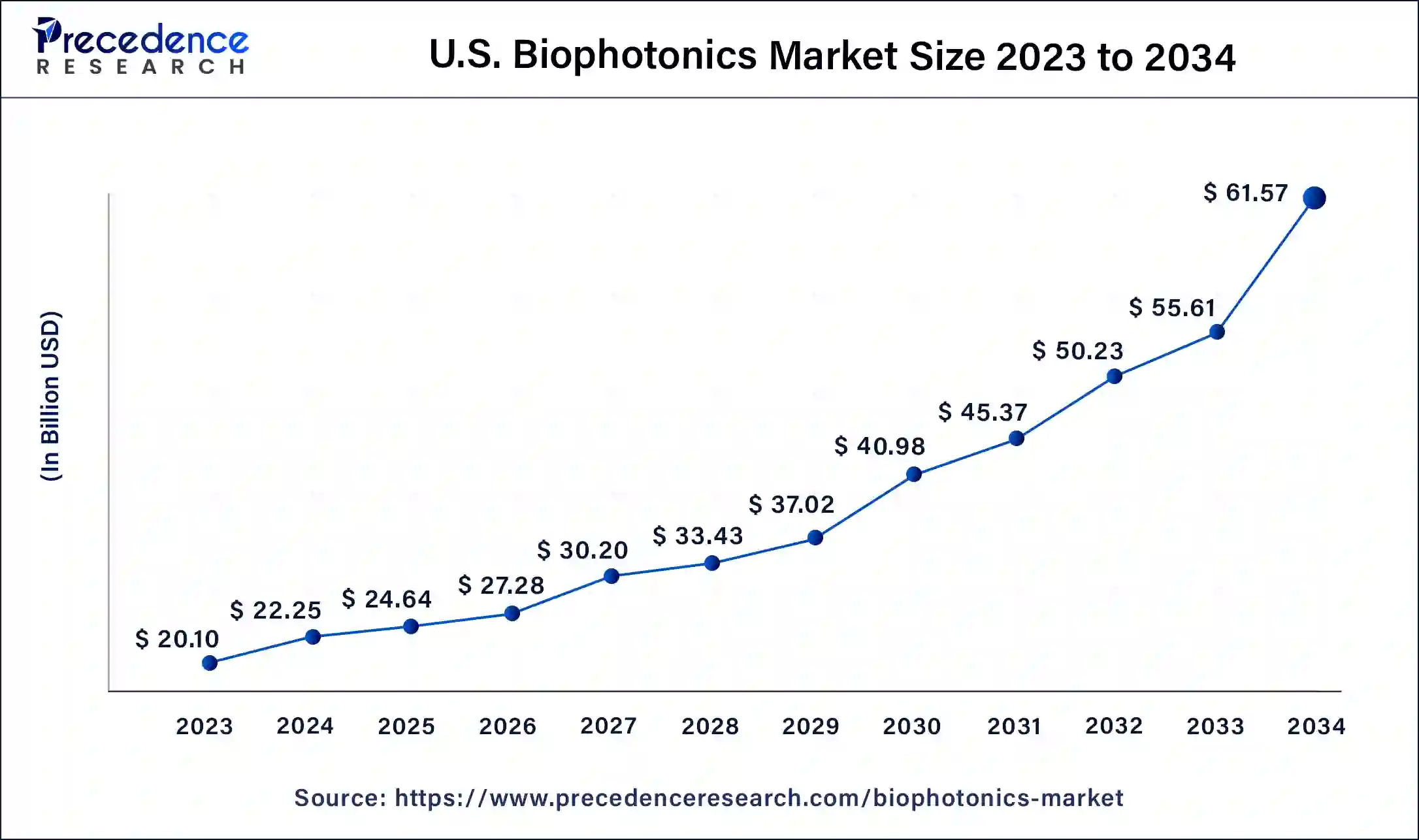

U.S. Biophotonics Market Size and Growth 2025 to 2034

The U.S. biophotonics market size is estimated at USD 24.64 billion in 2025 and is predicted to be worth around USD 61.57 billion by 2034, at a CAGR of 10.70% from 2025 to 2034.

North America held the largest market share of 38% in 2024 due to robust research and development activities, a well-established healthcare infrastructure, and high adoption rates of advanced medical technologies. The region's strong focus on precision medicine, coupled with substantial investments in biophotonics applications like imaging and diagnostics, contributes to its market dominance. Additionally, collaborations between academic institutions, research organizations, and industry players' foster innovation, further solidifying North America's position as a leader in the evolving field of biophotonics.

The Asia-Pacific region is poised for rapid growth in the biophotonics market due to increasing healthcare investments, rising awareness of advanced medical technologies, and a growing aging population. The region's expanding research and development activities, coupled with a focus on improving healthcare infrastructure, contribute to the surge. Additionally, the demand for innovative diagnostic and imaging solutions in countries like China and India, coupled with supportive government initiatives, positions the Asia-Pacific biophotonics market for substantial expansion, offering significant opportunities for market players and fostering advancements in healthcare technologies.

Meanwhile, Europe is experiencing notable growth in the biophotonics market due to increased investments in research and development, supportive government initiatives, and a rising focus on healthcare innovation. The region's strong emphasis on precision medicine and personalized healthcare, coupled with advancements in biophotonics technologies, has fueled market expansion. Additionally, collaborations between academic institutions and industry players have accelerated the adoption of biophotonics solutions. This growth is further propelled by the increasing application of biophotonics in areas like diagnostics, therapeutics, and life sciences, positioning Europe as a key player in the global market.

The Middle East and Africa are expected to grow significantly in the biophotonics market during the forecast period. The growing healthcare sector is increasing the development, as well as the adoption of biophotonics-based biosensors, optical imaging, etc. This, in turn, is also leading to new research. Additionally, the increasing occurrences of diseases are increasing the demand for early diagnostic and treatment approaches, which in turn, is increasing the use of biophotonics in the development of appropriate diagnostic approaches. Thus, all these factors, along with the government support, are promoting the market growth.

Biophotonics Market Companies

- Thermo Fisher Scientific Inc.

- Hamamatsu Photonics K.K.

- Olympus Corporation

- PerkinElmer Inc.

- Becton, Dickinson and Company

- Carl Zeiss AG

- Andor Technology Ltd.

- Affymetrix, Inc.

- Bruker Corporation

- Newport Corporation

- Nikon Corporation

- Coherent, Inc.

- Idex Corporation

- Lumenis Ltd.

- Corning Incorporated

Recent Developments

- In July 2025, to detect molecules, optical biosensors use light waves, which are necessary for precise medical diagnostics, environmental monitoring, and personalized medicine. Moreover, to detect proteins or amino acids, their performance can be improved by focusing the light waves on the nanometer scale, for example, squeezing the light using nanophotonic structures at the surface of a miniature chip. Thus, to detect and illuminate the molecules simultaneously, a biosensor using inelastic electron tunnelling, which is a quantum phenomenon, and relies on the steady flow of electrons in the form of an applied electrical voltage, was developed by the Bionanophotonic Systems Laboratory in EPFL's School of Engineering.

- In July 2025, an approach to enhance the sensitivity of RNA-based biosensors known as toehold switches, a collaboration between the researchers of the Department of Biology at IISER Pune, and University of Toronto, and Pontificia Universidad Católica de Chile, Chile was formed. Creating field-ready and accessible diagnostics to tackle the challenges in global health with the use of synthetic biology will be the main goal of this collaboration. Moreover, this approach was developed by Tanvi Kale, Chaitanya A, and Rudvi Pednekar and was also published in ACS Synthetic Biology.

- In April 2021, the Indian government initiated the Production Linked Incentive Scheme (PLI 2.0) with the objective of fostering India's manufacturing capabilities in the in vitro diagnostics sector. The scheme seeks to encourage increased investment and output, aiming to cultivate global players originating from India who can leverage modern technology to expand and integrate into global value chains.

- In March 2021, Zeiss bolstered its presence in North America through the inauguration of a new research and development, production, sales, and customer service center in the United States, involving a substantial investment of USD 180 million. This facility will house the X-ray Microscopy business and the ZEISS Microscopy Customer Center, providing comprehensive support for endeavors in materials research, life sciences, and industrial applications.

- In November 2021,Oxford Instruments introduced the BC43, a compact microscopy device capable of delivering real-time 3D imaging to users.

- In August 2025, Hamamatsu Photonics announced it was selected for a Japanese government NEDO project to advance quantum computing industrialization.The project involves developing ultra-high-speed and high-sensitivity cameras and spatial light modulators, which will have future biophotonics applications.

https://finance.yahoo.com - In July 2025, Olympus announced it entered a strategic partnership with Revival Healthcare Capital to co-found Swan EndoSurgical. This partnership aims to develop endoluminal robotic systems for minimally invasive gastrointestinal procedures, leveraging biophotonic imaging technologies.

https://finance.yahoo.com

Segments Covered in the Report

By End-use

- Tests and Components

- Medical Therapeutics

- Medical Diagnostics

- Non-medical Application

By Technology

- In-Vitro

- In-Vivo

By Application

- See-Through imaging

- Microscopy

- Inside Imaging

- Spectro Molecular

- Analytics sensing

- Light therapy

- Surface imaging

- Biosensors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content