What is the Brain Implants Market Size?

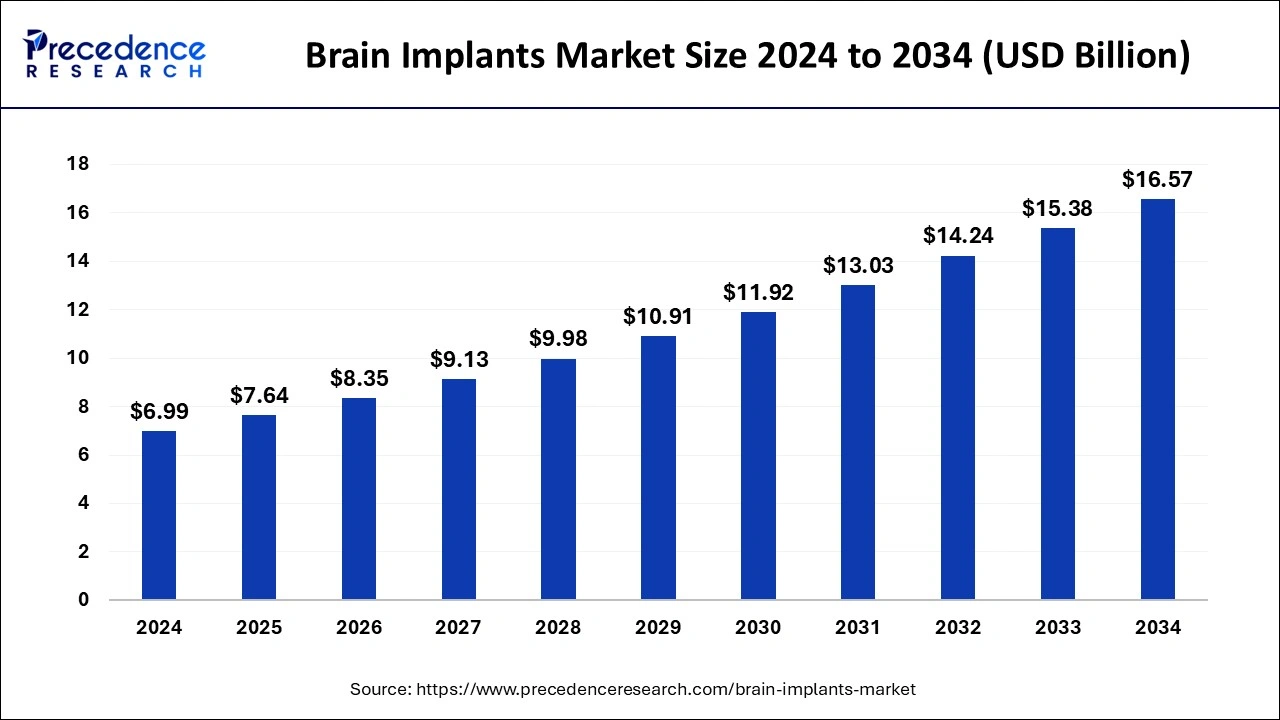

The global brain implants market size was calculated at USD 7.64 billion in 2025 and is predicted to increase from USD 8.35 billion in 2026 to approximately USD 17.73 billion by 2035, expanding at a CAGR of 8.78% from 2026 to 2035.

Brain Implants Market Key Takeaways

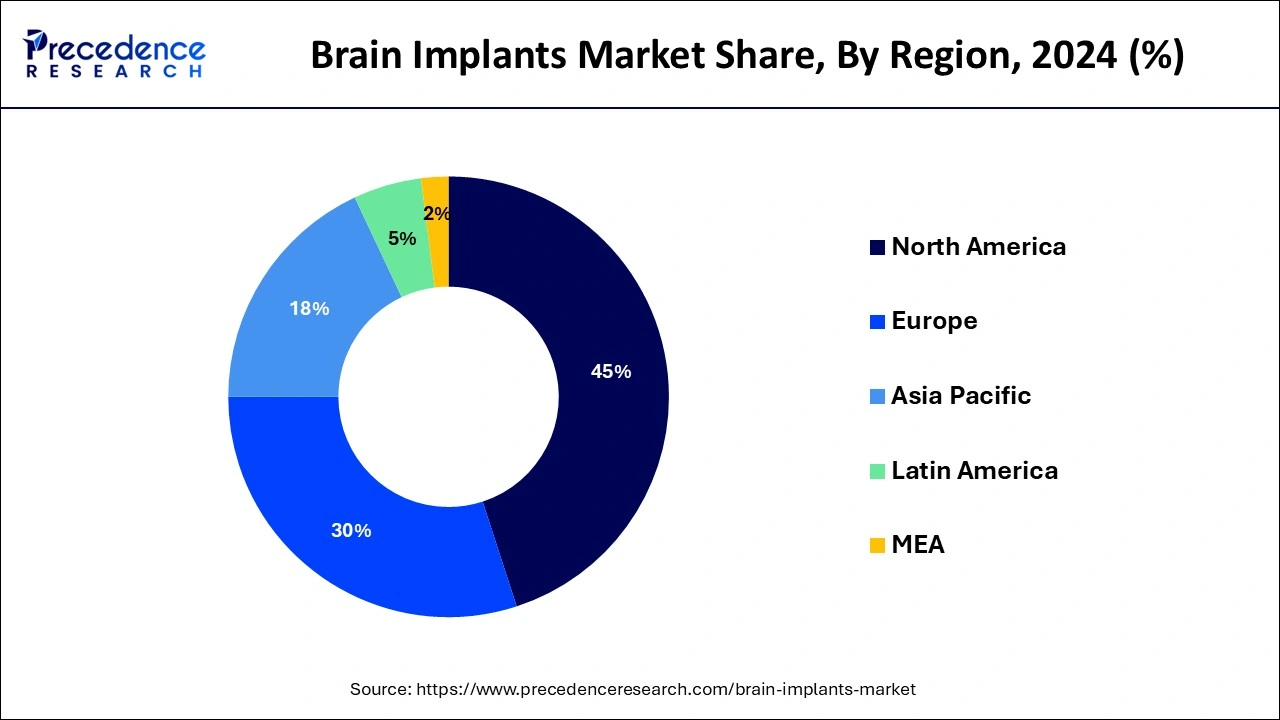

- North America dominated the market and generated more than 44.16% of the revenue share in 2025.

- By Product Type, the deep brain stimulators segment contributed to the maximum revenue in 2025.

- By Applications, the chronic pain segment led the market in 2024.

Market Overview

The rising prevalence of neurological diseases such as Parkinson's disease, Alzheimer's disease, and epilepsy, as well as increased awareness of the benefits of brain implants and positive research outcomes, are among the major factors driving the market growth. Additionally, the market is influenced by due to increasing number of neural implants being used to rehabilitate memory, treat diseases, improve memory, and communicate with prosthetic limbs to effectively reduce the symptoms of brain-based disorders.

Furthermore, the growing reliance on deep brain stimulation as a safe and established therapy for Parkinson's disease patients will create additional growth opportunities for the industry in the coming years. Moreover, deep brain stimulation is a surgical procedure that involves implanting electrodes into specific areas of the brain.

The electrical impulses produced by the implanted electrodes then regulate the abnormal impulses. Brain implants are being used to treat a variety of neurological disorders and have emerged as a promising field of study for improving cognitive abilities.

A major market driver is the increasing prevalence of neurological disorders and road accidents. For Instance, according to the WHO, neurological diseases account for 6.3% of the global disease burden and are one of the leading causes of death globally, accounting for 13.2% of deaths in developed countries and 16.8% in low- and middle-income countries.

This has heightened the clinical need for long-term solutions such as spinal cord stimulators and deep brain stimulators. Furthermore, the prevalence of stress and obesity-related depression is rising globally which helps fuel the market growth.

How is AI Influencing the Brain Implants Industry?

AI is changing the brain implants industry from a purely mechanical or electrical stimulation field into an intelligent, adaptive, and personalized technology. By leveraging machine learning, AI allows implants to decode neural signals, predict user intentions, and even adjust treatments in real time, significantly enhancing results for neurological conditions.

AI determines individual user data to customize movement patterns along with settings for prosthetic devices, rising efficiency, and user comfort. Algorithms can forecast when a patient is likely to experience a symptom, like a relapse in depression, up to five weeks before it occurs.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.64Billion |

| Market Size in 2026 | USD 8.35 Billion |

| Market Size by 2035 | USD 17.73Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.78% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type and Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing awareness of neurological diseases and their treatment is propelling the market

The various measures taken by profit and non-profit healthcare organizations around the world have increased awareness of mental disorders and their treatment. The World Health Organization (WHO) has declared October 10th as World Mental Health Day to raise awareness about various mental illnesses, reduce stigma, increase access to services, and educate people about various treatment options. Similarly, in the United States, the National Alliance on Mental Illness (NAMI) was founded in 1979 to provide support and psychoeducation to those suffering from mental illnesses. NAMI is a mental health organization active in treatment, support, research, and raising awareness about mental diseases. Such initiatives are driving up demand for brain implants.

Old age causes many health problems, particularly those affecting the brains

The growing global elderly population, an increase in the prevalence of target diseases, particularly Parkinson's, epilepsy, and Alzheimer's, as well as significant unmet medical needs, have all contributed to an increase in demand for brain implants. For Instance, according to the national canter of Biotechnology medicine, A traumatic brain injury affects approximately 1.7 million people in the United States, with adolescents aged 15 to 19 and adults aged 65 and older being the most likely to sustain one.

Parkinson's disease is more likely to develop in the elderly population. Patients suffering from Parkinson's disease are unable to produce enough dopamine, resulting in a variety of symptoms such as stiffness, tremors, and difficulty walking. Parkinson's disease is typically diagnosed in patients over the age of 60 and is expected to affect 1% of people over the age of 60 to 4% of people by the age of 80, according to the CDC.

According to a WHO 2021 study, the population of people aged 60 and older is expected to grow from 900 million in 2021 to 2 billion by 2050. The elderly are more vulnerable to Parkinson's disease, which is expected to have a significant impact on the demand for brain implants.

- In November 2024, Neuralink announced that it received approval from Health Canada to launch a study of its brain-computer interface (BCI) system. The Elon Musk-backed BCI maker can now begin the CAN-PRIME study, its first international trial. It evaluates the company's fully implantable, wireless BCI, building upon the ongoing PRIME study in the U.S.

Restrains

High surgical and post-surgical costs may hinder the brain implant sales

High surgical costs are likely to impede global brain implant market growth. People with brain implants may need to undergo several treatments and additional procedures in the future to replace them. As a result, the high cost of brain surgery may be a major factor affecting brain implant sales. For Instance, Brain-interface technology company Neuralink will start implanting chips into the brains of humans by 2022.

Opportunities

Product launches and approvals are key market trends

Globally, the brain implant market has seen a significant number of product approvals. For example, the Food and Drug Administration (FDA) approved Boston Scientific Corporation's fourth-generation Vercise PC and Verse Gevia deep brain stimulation devices in December 2020. By varying the amplitude, pulse width, and frequency, these implantable devices deliver low-intensity electrical pulses to brain nerve regions. When medication fails to control the signs and symptoms of advanced levodopa-responsive Parkinson's disease, patients turn to these systems for help.

Investments in R&D Activities in Brain Implant Product Development Will Create New Opportunities

The market for brain implants is expected to grow profitably as the number of research activities going on and increases technological advancements. Memory chips and self-charging implants are two examples of technologies that are expected to boost market growth prospects during the forecast period. For Instance, Synchron's on 15th December 2022, raised $75 million for a drill-free brain-computer interface implant.

- In January 2023, Rice University announced that Motif Neurotech, a neurotechnology company developing minimally invasive bioelectronics for mental health, formed through the Rice Biotech Launch Pad, closed an oversubscribed Series A financing round of $18.75 million.

Covid 19 Impact:

The COVID-19 pandemic emphasizes the importance of neurology in global public health and broader global health dialogues. Service disruptions, medication inaccessibility, vaccination program interruptions, and increased mental health issues have all added to the burden of those with neurological disorders. More specifically, neurological manifestations of COVID-19 infections were present in both the acute and post-COVID-19 stages. Certain underlying neurological conditions, particularly in older adults, were risk factors for hospitalization and death due to COVID-19.

The intersectoral global action plan on epilepsy and other neurological disorders 2022-2031 represents an unprecedented opportunity to address the impact of neurological disorders throughout and after the pandemic.

Furthermore, according to a study published in Frontiers in Neurology in 2020, motor and psychiatric symptoms in Parkinson's Disease and dystonic patients treated with deep brain stimulation worsened during the lockdown restriction measure, leading to increased stress in the management of neurological disorders. Furthermore, according to a study published in JAMA Neurology in 2020, neurologic symptoms were seen in 36.4% of 214 patients with COVID-19.

As a result, COVID-19 patients were at a high risk of developing neurological disorders during their hospital stays. Due to strict lockdown restrictions and measures taken to contain the viral transmission, the chronic stress and burden of neurological disorders increased, necessitating the urgent opening of neurological outpatient services, and thus the brain implants market is expected to have been significantly impacted during the pandemic.

Segment Insights

Product Type Insights

Based on product type the brain implant market is categorized into deep brain, stimulator, vagus nerve stimulator, and spinal cord stimulator. The deep brain stimulators segment dominated the market for brain implants and accounted for the largest revenue in 2025. A key growth driver of this segment is the increasing use of DBS for the treatment of various neurological disorders such as obsessive-compulsive disorder, Parkinson's disease, dystonia, essential tremor, epilepsy, and Alzheimer's disease. Furthermore, increasing patient awareness about neurological movement disorder treatment is expected to drive the growth of this segment.

Application Insights

Based on application the brain implant market is categorized into Parkinson's Disease, Epilepsy, Chronic Pain, Alzheimer's Disease, Depression, and Essential Tremor. The chronic pain segment dominated the market in 2025. The rising prevalence of chronic pain has created clinical urgency for long-term solutions. According to the National Health Interview Survey, the prevalence of chronic pain in adults in the United States was around 20.4% (50 million) in 2016, with 8.0% (19.6 million) having high-impact chronic pain. stimulators are typically used when surgery or other treatments have failed to relieve chronic neck or back pain.

The demand for stimulators is increasing due to an increase in chronic pain caused by conditions such as lumbar and cervical radiculitis, failed back surgery, and neuropathy.

Regional Insights

What is the U.S. Brain Implants Market Size?

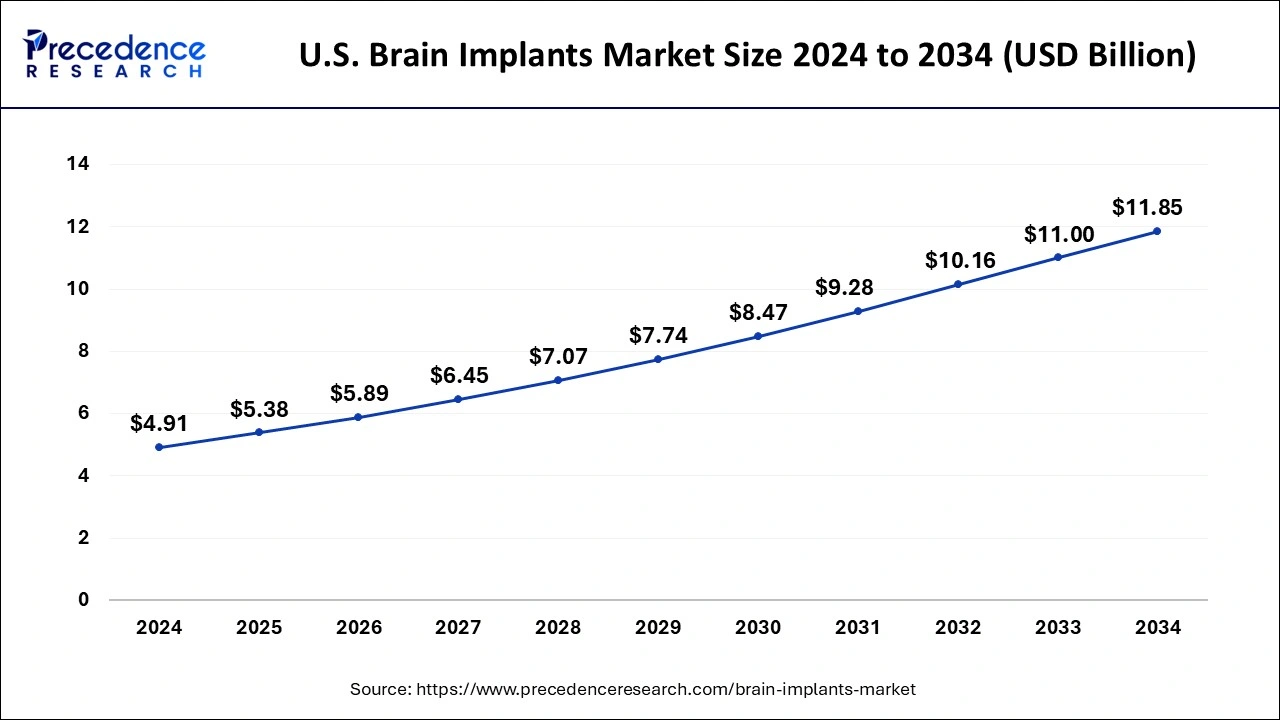

The U.S. brain implants market size was exhibited at USD 5.38 billion in 2025 and is projected to be worth around USD 12.69 billion by 2035, growing at a CAGR of 8.96%.

North America dominated the brain implant market, accounting for 44.16% of total revenue in 2025. This dominance can be attributed to a variety of factors, including an increase in the prevalence of neurological disorders, increased awareness of treatment options, the availability of highly skilled physicians, and the presence of well-established healthcare facilities. Furthermore, an increase in government funding and initiatives to raise awareness about movement disorders are expected to drive regional demand for deep brain stimulation devices. For example, the Parkinson's Foundation invested USD 3.5 million in 2020 to fund more than 34 Parkinson's disease research projects. These factors are anticipated to increase demand for brain implants in this region.

U.S. Brain Implants Market Trends

The U.S. market is driven by growing neurological disease prevalence and advancements in AI-driven, miniaturized, and even rechargeable neurostimulation devices. The U.S. has a mature regulatory environment that speeds up clinical trials and device approvals, funded by established reimbursement for procedures such as RNS (Responsive Neurostimulation).

However, Asia Pacific is expected to significantly lead the market from 2026 to 2035, owing to factors such as the rising prevalence of neurodegenerative and psychiatric disorders, unmet need for effective and long-term treatment solutions, increasing affordability, and an increase in the number of awareness programs. Increased efforts by neurosurgeons and neurology clinics to raise awareness about brain implants are expected to present significant growth opportunities for this region's brain implant market. Furthermore, high R&D investments by global market players due to their low-cost structure are among the key drivers of the region's market.

- In April 2025, a Chinese brain-computer interface (BCI) company announced it had achieved positive results from three human implants, matching Elon Musk's Neuralink in the number of human patients, as China prepares for the wider commercialization of the technology. The Chinese government, meanwhile, is moving to support the market for BCI products, which are inching closer to commercialization.

China Brain Implants Market Trends

China's market is driven by rising neurological disorders, an aging population, and remarkable investment in Brain-Computer Interface (BCI) technology. Techniques include utilizing BCI for tumor removal (e.g., at West China Hospital) and using smart helmets for neuro-monitoring.

What are the Advancements in the Brain Implants Market in Europe?

Europe is expected to witness significant amount of growth in the market. This growth is driven by various factors such as rising neurological disorder prevalence, increased treatment awareness, availability of skilled physicians, and a robust healthcare system. Advancements in targeted stimulation and personalized programming are further enhancing the market. Growing awareness and acceptance further encourage the use of brain implants to manage various complex conditions.

Germany Brain Implants Market Trends

The brain implants market in the country is expected to grow at a rapid pace in the upcoming years. This is due to the country's robust healthcare infrastructure and supportive reimbursement policies, which facilitate the innovation as well as adoption of brain implants.

What are the Key Trends in the Brain Implants Market in Latin America?

Latin America is expected to experience substantial growth in the market. This is due to the region's rapidly developing healthcare infrastructure and various investments in research and development activities. The region is also seeing a rise in predictive brain implants, smart helmets for monitoring brain activity, specifically designed for long-term monitoring. Governments in the region are also seen implementing supportive policies, and healthcare providers are increasingly adopting these technologies in order to improve outcomes.

Brazil Brain Implants Market Trends

The country's market landscape is characterized by technological advancements and a growing patient base seeking innovative treatments. It is further fueled by regulatory support and increasing awareness regarding brain health.

How is the Middle East and Africa Region Growing in the Brain Implants Market?

Middle East and Africa is expected to witness steady growth in the market. This growth is due to the region's evolving regulatory landscape, characterized by stringent approval processes and compliance standards. These factors influence product development timelines and market entry strategies, facilitating innovation and expertise. Technological advancements in wireless connectivity, AI integration and biocompatible materials are gaining traction, enabling more precise, durable and user-friendly implant solutions.

Saudi Arabia Brain Implants Market Trends

The country's growth and development is due to advanced healthcare systems, strong investments, and a high demand for innovative treatments. Moreover, ongoing clinical trials explore cranial implants for conditions such as ALS, reflecting the country's commitment to advancing brain implant technology.

Value Chain Analysis for the Brain Implants Market

- R&D: It aims to treat neurological diseases, like Parkinson's and epilepsy, while developing Brain-Computer Interfaces (BCIs) for cognitive enhancement, motor control, and memory restoration.

Key Players: Medtronic plc, Boston Scientific Corporation, Abbott Laboratories - Clinical Trials and Regulatory Approvals: These are the foundational pillars for the expansion, safety, and commercialization of the brain implants market, and thus, transforming experimental, high-risk technologies into validated medical treatments.

Key Players: Neuralink, Synchron, Blackrock Neurotech - Formulation and Final Dosage Preparation: It provides the vital ability to transition from passive, purely electrical devices to active, therapeutic, and even patient-specific drug delivery systems.

Key Players: CraniUS, Cognos Therapeutics, Neurochase, Innocoll

Brain Implants Market Companies

- NeuroPace, Inc.: NeuroPace, Inc. provides the RNS System, the world's first and only FDA-approved, closed-loop, and even brain-responsive neurostimulation system for treating drug-resistant focal epilepsy.

- Nevro Corporation: Nevro Corp aims at advanced neuromodulation for chronic pain management, mainly offering its proprietary 10 kHz Therapy delivered through the Senza SCS system and even the AI-driven HFX iQ system. These non-narcotic, paresthesia-free, and thus, minimally invasive implantable systems offer significant pain relief for trunk and limb pain.

Other Major Key Players

- Medtronic

- Boston Scientific Corporation

- St. Jude Medical (Abbott)

- Synapse Biomedical Inc.

- Aleva Neurotherapeutics SA

Recent Development

- In July 2024, Brain implant company Paradromics launched a patient registry ahead of a human trial. Paradromics' system will initially serve as an assistive communication device that can turn brain signals into outputs like text or synthesized speech. This means patients with severe paralysis could eventually use it to regain their ability to communicate.

- In April 2024, Synchron launched a patient registry to prepare for a brain implant trial. The startup, which rivals Neuralink, is developing brain-computer interface technology that lets people control electronic devices hands-free. Synchron's Stentrode device is intended to help people with limited mobility operate technology using only their thoughts. The initiative has garnered backing from Bill Gates and Jeff Bezos' investment firms.

- In August 2024, Medtronic received FDA approval for Asleep DBS surgery. This marked the first approval, offering new options for Parkinson's and essential tremor patients in the United States, enhancing patient comfort and surgical efficiency.

- In April 2022, The FDA has approved brain stimulation software for the treatment of Parkinson's disease. Verse Neural Navigator with Stimview XT will enable clinicians to visualize the lead placement and stimulation modeling, as well as provide patient-specific 3D modeling for therapeutic customization. The software is designed to help with lead placement, reduce programming time, and allow for more informed treatment.

- In June 2021, The FDA has approved Medtronic plc's Sen Sight Directional Lead System for deep brain stimulation therapy.

- In Jan 2021, Abbot Laboratories has released the NeuroSphere my Path, a digital health app designed to track and report on patients' overall well-being after spinal cord stimulation or dorsal root ganglion (DRG) therapy.

Segment Covered in the Report

By Product Type

- Deep Brain

- Stimulator

- Vagus Nerve Stimulator

- Spinal cord stimulator

By Applications

- Parkinson's Disease

- Epilepsy

- Chronic Pain

- Alzheimer's Diseases

- Depression

- Essential Tremor

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting