What is the Breathing Circuits Market Size?

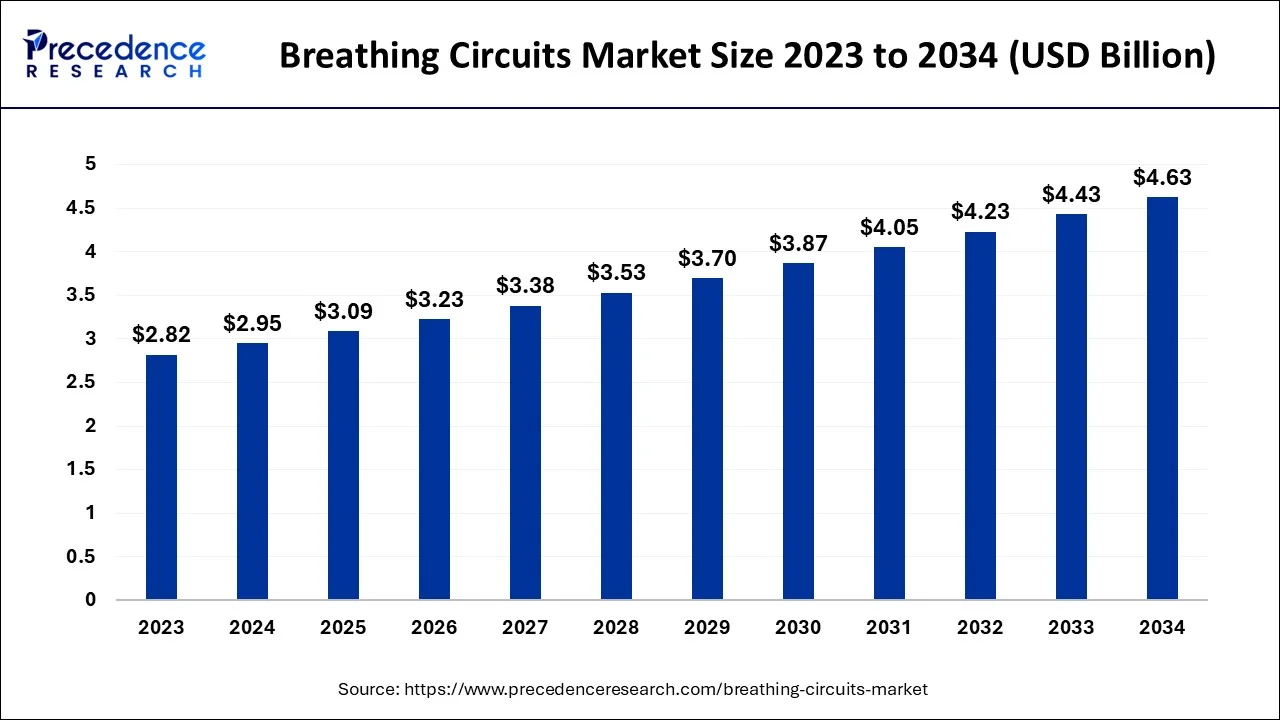

The global breathing circuits market size is calculated at USD 3.09 billion in 2025 and is predicted to increase from USD 3.23 billion in 2026 to approximately USD 4.83 billion by 2035, expanding at a CAGR of 4.57% from 2026 to 2035.

Breathing Circuits Market Key Takeaways

- North America dominated the global market in 2025.

- By Circuit Type, the open breathing circuit segment is the predicted to record largest revenue share between 2026 and 2035.

- By Application, the anesthesia segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By End User, the hospital segment lead the global market.

Breathing Circuits Market: Advancing Portable, Miniaturized Solutions for Respiratory Care

The breathing circuit is a medical device used for delivering oxygen and anesthetic agents to patients by the removal of carbon dioxide. The breathing circuit market has grown significantly after the COVID-19 pandemic due to meeting the growing demand for respiratory support, such as ventilators and breathing support devices in healthcare facilities. The emerging trend of miniaturization and portability of breath devices in the breathing circuit market.

In addition, miniaturization involves designing breathing circuits smaller and more compact without affecting their functionality; this enhances patients' comfort during a medical procedure or respiratory therapy, especially for pediatric and neonatal care patients. Additionally, portable breathing circuits provide facilities such as monitoring a patient's respiratory condition at home and allow healthcare professionals to track and evaluate progress based on real-time data provided by breathing circuit devices.

For instance, In April 2025, GE Healthcare, a leading medical technology device company, launched its new Care scape R860 ventilators with a user interface that features a new breathing circuit design to improve patients' comfort and reduce the risk of ventilator-associated pneumonia, with more efficient and provide better gas exchange.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.09Billion |

| Market Size in 2026 | USD 3.23 Billion |

| Market Size by 2035 | USD 4.83Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 To 2035 |

| Segments Covered | Circuit Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological advancement in breathing circuit devices

Advances in medical breathing circuit devices are the significant driver of the breathing circuit market, as medical device companies are investing more in research and development to develop innovative technology that enhances user experience by offering innovative design, functionality, and effectiveness of breathing circuit devices in medical uses. Additionally, advanced sensors are integrated into smart sensors and monitoring devices that provide real-time data feedback, oxygen concentration, breathing patterns, etc.

Moreover, advanced breathing circuit devices also provide closed-loop ventilation systems which use sensors to record real-time data and automatically adjust ventilation settings according to feedback. Furthermore, the emerging trend of using innovative materials and coating to produce breathing circuits that improve the durability and safety of breathing circuits, like antimicrobial coating, reduces the risk of contamination and infection in patients.

For instance, In November 2022, Xplore Healthcare Technologies company launched the world's first smart respiratory device called 'Airofit Pro.' This new product helps in personalizing the breathing training experience for patients by making the respiratory muscles more efficient and faster. In addition, Airofit Pro also assists in training inspiratory and expiratory muscles.

Restraint

Risk of infection

The risk of infection is a significant concern in the breathing circuit market as it can extend hospital stays and increase health expenses and mortality. Moreover, breathing circuit devices are prolonged to contaminating, like the formation of biofilm inside the surface of the breathing circuit device, leading to the transmission of bacteria to patients with the device. In addition, improper handling, transportation, and storage of devices can expose them to other environmental infections, further increasing the risk of disease.

Additionally, the risk of infection is increasing in intensive care unit (ICU) patients, who are more likely to get infected by bacteria due to a weak immune system. For instance, ventilator-associated pneumonia is a common disease spread through the use of contaminated breathing circuit devices in the ICU. Accordingly, a study conducted by the University of California, San Francisco, found that using heated humidification in breathing circuits is 30% less likely to develop ventilator-associated pneumonia than patients who did not receive heated humidification. Furthermore, to ensure patient safety and to maintain healthcare quality, it is important to reduce the risk of infection through breathing devices.

Opportunities

Disposable breathing circuit devices

The disposal of breathing circuit devices is a significant opportunity in the market as this device helps in preventing the spread of infection through breathing devices. Additionally, the emerging trend of using single-use disposable devices can reduce the risk of hospital contamination, directly contributing to better patient outcomes and safety. In addition, healthcare facilities should identify recycling opportunities to recycle parts from breathing circuit devices, reduce the environmental impact, and save valuable resources.

Moreover, manufacturers of breathing circuit devices should collaborate with healthcare providers to find innovative solutions to control the risk of infection and identify opportunities to recycle some parts of breathing devices like plastic and metal. Additionally, this can drive advancement in both device technology and disposal practices in the breathing circuit market.

For instance, In March 2025, Dragerwerk announced the launch of its new infinity delta breathing circuit. The Infinity Delta is a disposable breathing circuit designed to be more comfortable for patients and reduce the risk of cross-contamination. It also features several new features, such as a built-in CO2 monitor and a pressure relief valve.

Segment Insighst

Circuit Type Insights

Based on device types, the breathing circuits market is segmented into open-breathing circuits, semi-open-breathing circuits, semi-closed breathing circuits, and closed breathing circuits. Open breathing circuit is the largest segment in the breathing circuit market. This medical device is used in anesthesia machines and ventilators. Additionally, an open breathing circuit allows a portion of the exhaled gases to be released into the surrounding environment. Moreover, the growth of open breathing circuits is due to their simpler design, less maintenance, and ease of use as compared to other types of breathing circuits, making them a cost-effective option for many patients and health providers; furthermore, In many developing countries using open breathing circuit is effective during emergency field setting open circuit is readily available and accessible.

In addition, as open-breathing circuits are simple designs, this creates an opportunity for innovation and provides a more comprehensive product portfolio for manufacturing and meeting the needs of a wide range of patients. Nonetheless, using open circuits for training and education can create a different market segment catering to medical schools, training centers, simulation centers, and rehabilitation.

Application Insights

Based on application, the breathing circuit market is divided into anesthesia, respiratory support, and others. Breathing circuits are commonly used in anesthesia delivery systems and are the fastest-growing segment in the breathing circuit market. The primary driver of the anesthesia segment is the demand for breathing circuits in medical interventions. In addition, as there is continuous development in medical surgical produce, the need for accurate and controlled delivery of anesthesia gases is essential. Moreover, there is a growing trend of using breathing circuits with minimal airway resistance. This ensures that the patient can breathe comfortably while reducing the risk of complications during the medical producer.

Additionally, specialized design anesthesia breathing circuit is required for pediatric and neonatal patients due to their unique and delicate physiological characteristics and precise dosage of anesthesia. For instance, In March 2023, the FDA approved using the Air Life IQ breathing circuit for adults and children during general anesthesia and mechanical ventilation, as it includes innovations like built-in CO2 monitors and pressure relief valves.

End-User Insights

The breathing circuit market is segmented into hospitals, clinics, ambulatory surgical centers, and others based on end users. The hospital is dominating the segment in the breathing circuit market as they are the primary user of breathing circuit devices. The demand for breathing circuits in hospitals is due to factors like patient care and treatment. In addition, the intensive care unit in the hospital requires breathing circuits as an integral part of ventilators for patients who are not able to breathe on their own and require respiratory support.

Moreover, apart from ventilators and anesthesia, hospitals also use breathing devices in respiratory therapies like continuous positive air pressure and bilevel positive airway pressure devices to help patients with conditions such as sleep apnea breathe easily. For instance, the University of Pennsylvania Health System announced that it is now using continuous positive air pressure machines to treat patients with sleep apnea. CPAP machines are being used to help patients with ARDS breathe more easily and prevent them from developing further lung damage.

Regional Insights

What Makes North America the Largest Market for Breathing Circuits?

North America region is the largest market of the breathing circuit market in 2023. The growth of breathing circuits in this region is due to factors like the prevalence of respiratory diseases, technological advancement, research and development, advanced healthcare systems, and government initiatives. Moreover, the rise in the majority of respiratory diseases like chronic obstructive pulmonary disease, asthma, and sleep apnea. According to the Pan American Health Organization, 35.8 deaths per 100,000 population (age-standardized), which was higher in men (42.2 deaths per 100,000) than in women (31.0 deaths per 100,000 population), is due to chronic respiratory diseases. Moreover, the United States is the leading region of innovation in medical devices, contributing to the growth of the market and investment in the healthcare industry in America. In addition.

regulatory agencies in North America, like FDA, are also contributing to shaping the breathing circuit market in North America. For instance, In May 20232, the FDA approved a new drug, tobramycin liposome inhalation suspension, for the treatment of ventilator-associated pneumonia.

U.S. Breathing Circuits Market Analysis

The U.S. market is growing due to the rising prevalence of respiratory disorders, increasing use of ventilators and anesthesia systems, and strong healthcare infrastructure. Continuous medical device innovation, high healthcare spending, growing homecare respiratory support adoption, and supportive FDA regulatory approvals further accelerate market expansion. Moreover, the country is home to leading medical device manufacturers, contributing to market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Breathing Circuits Market?

Asia Pacific is expected to grow at the fastest CAGR over the forecast period, as hospitals are expanding critical care capacity and surgical volumes are increasing across emerging economies. Growing medical tourism, rising awareness of advanced respiratory care, rapid adoption of cost-effective medical devices, and expanding local manufacturing capabilities are further accelerating market growth throughout the region.

India Breathing Circuits Market Analysis

India's market is expanding due to rising surgical procedures, growing ICU admissions, and increasing focus on improving respiratory care in public and private hospitals. Expansion of healthcare infrastructure, higher demand for anesthesia and ventilator accessories, expanding medical tourism, and growth of domestic medical device manufacturing further support sustained market growth.

Europe: A Notably Growing Area

Europe is expected to grow at a notable rate in the market due to increasing surgical volumes, a rising elderly population, and higher demand for anesthesia and respiratory care devices. Strong focus on patient safety, adoption of advanced medical technologies, expansion of home-based respiratory therapy, and supportive healthcare reimbursement systems across European countries further drive market growth.

UK Breathing Circuits Market Analysis

The UK market is expanding due to growing demand for anesthesia and respiratory support in hospitals, along with rising surgical procedures and critical care admissions. Expansion of NHS infrastructure, focus on infection control, adoption of advanced disposable breathing circuits, and increasing use of home-based respiratory therapies further contribute to market growth during the forecast period.

Value Chain Analysis

- Raw Material Sourcing

This stage involves procuring medical-grade plastics, silicone, rubber, and metals used to manufacture breathing circuits.

Key players: Dow Chemical, BASF, 3M, and Medline Industries. - Component Manufacturing & Processing

Raw materials are processed into hoses, connectors, masks, valves, and other components using molding, extrusion, and precision engineering.

Key players: Medtronic, GE Healthcare, Drägerwerk AG, and Smiths Medical. - Circuit Assembly & Integration

Components are assembled into complete breathing circuits, including ventilator circuits, anesthesia circuits, and oxygen delivery systems.

Key players: Philips Healthcare, ResMed, Draeger, and Teleflex. - Quality Control & Regulatory Compliance

Finished circuits undergo rigorous testing for leaks, sterility, biocompatibility, and compliance with ISO, FDA, and CE standards.

Key players: SGS, TÜV SÜD, Intertek, and Bureau Veritas.

Breathing Circuits Market Companies

- Ambu A/S: Develops single-use breathing circuits, anesthesia accessories, and respiratory care solutions designed to enhance infection control, patient safety, and clinical efficiency.

- Altera Corp.: Provides medical-grade breathing circuits and disposable respiratory accessories focused on reliability, compatibility with ventilators, and cost-effective respiratory care delivery.

- Armstrong Medical Industries, Inc.: Specializes in anesthesia and respiratory breathing circuits, filters, and humidification systems supporting safe ventilation across neonatal, pediatric, and adult patients.

- Becton, Dickinson, and Company: Offers respiratory care and anesthesia products, including breathing circuit components and connectors, supporting safe airflow management and infection prevention in clinical settings.

- Beijing Aeonmed Bio-Med Devices: Manufactures ventilators, anesthesia machines, and compatible breathing circuits designed for hospital, emergency, and home respiratory care applications.

Other Major Key Players

- Ambu A/S

- Altera Corp.

- Armstrong Medical Industries, Inc.

- Becton, Dickinson, and Company

- Beijing Aeonmed

- Bio-Med Devices

- CR Bard Inc

- Dragerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Corporation Limited

- Flexicare Medical Ltd.

- General Electric Company

- Smith's Group plc

- Teleflex Incorporated

Recent Development

- In January 2023, Armstrong Medical launched the new 'AquaVENT VT' state-of-the-art heated breathing technology in the Middle East market. The AquaVENT VT is a heated breathing circuit that is designed to provide patients with a more comfortable and humidified breathing experience. It is also said to be effective in reducing the risk of ventilator-associated pneumonia.

- In May 2023, Smiths Medical announced the acquisition of Vyaire Medical. Vyaire Medical is a leading manufacturer of breathing circuits and other respiratory care products. The acquisition is expected to strengthen Smiths Medical's position in the breathing circuit market and expand its product portfolio.

- In May 2023, Medtronic announced that it had received FDA approval for its new Heated Humidification Module for its ventilator, the Evita V500. The Heated Humidification Module is designed to improve patient comfort.

- In March 2023, Teleflex announced that it had received a $200 million investment from Advent International. The investment is intended to help Teleflex expand its respiratory care business, which includes breathing circuit devices.

- In May 2023,Air Sep Corporation, a US-based company that manufactures a variety of respiratory care products, including oxygen concentrators and bilevel positive airway pressure (BiPAP) machines, was acquired by Fisher & Paykel Healthcare, a New Zealand-based company that manufactures a wide range of medical devices, including respiratory care products, such as ventilators and oxygen concentrators acquires

Segment Covered in the Report

By Circuit Type

- Open Breathing Circuit

- Semi-Open Breathing Circuits

- Semi-Closed Breathing Circuits

- Closed Breathing Circuits

By Application

- Anesthesia

- Respiratory Support

- Others

By End-User

- Hospitals

- Clinics

- Ambulatory Surgical Centers

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting