What is the Bubble Tea Market Size?

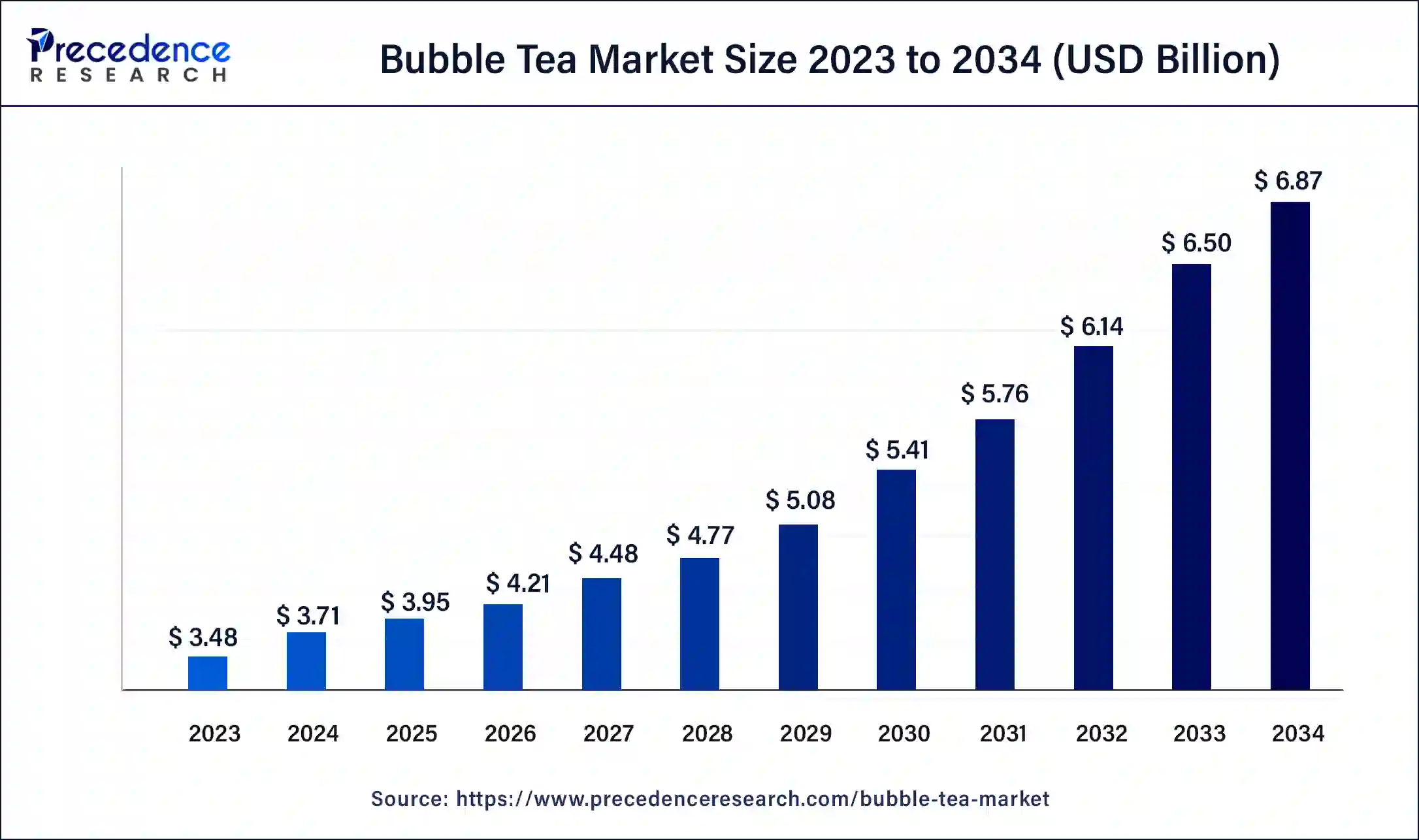

The global bubble tea market size accounted for USD 3.95 billion in 2025, and is calculated to worth around USD 4.21 billion in 2026 and is predicted to reach around USD 6.87 billion by 2034, growing at a CAGR of 6.36% from 2025 to 2034.

Market Highlights

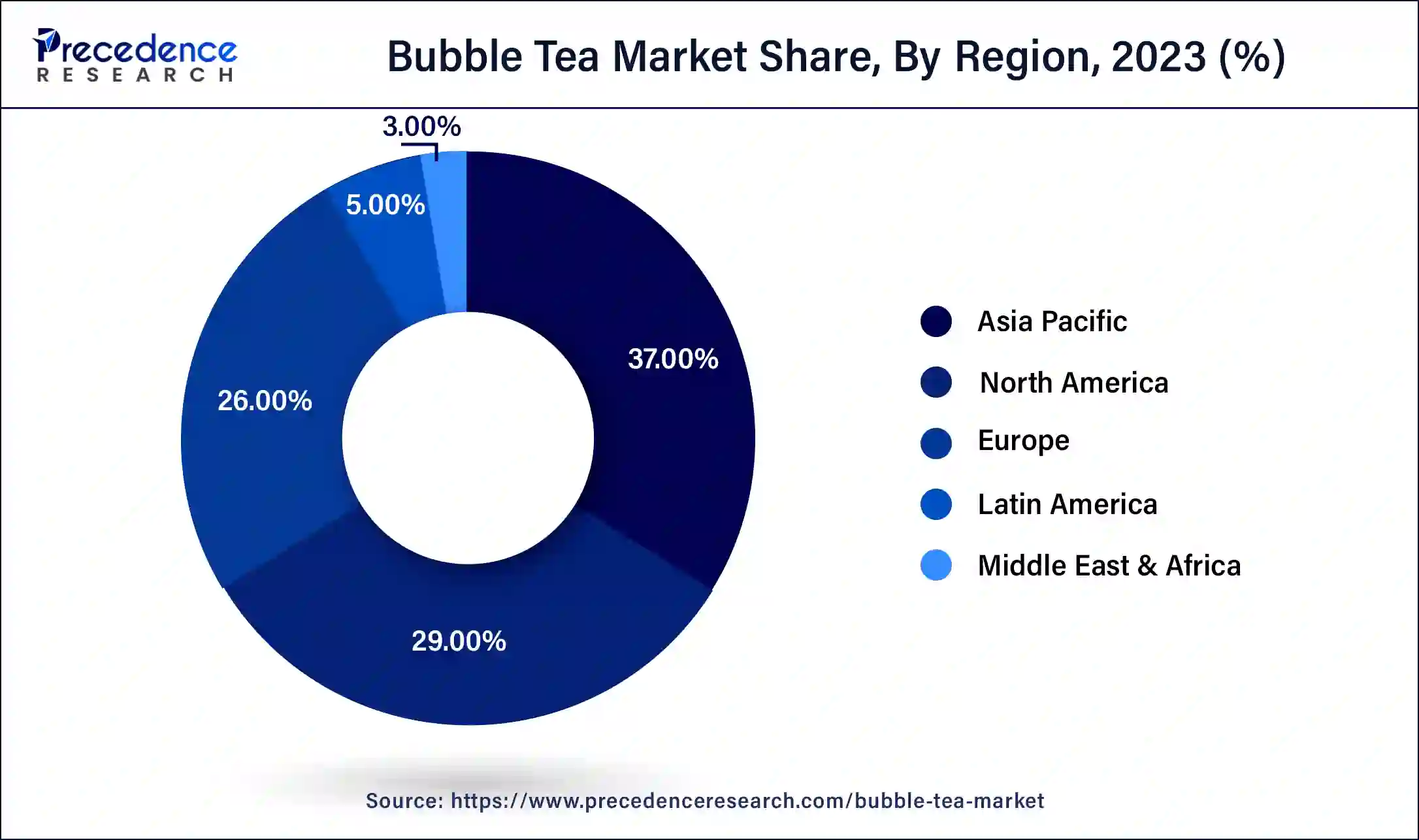

- Asia Pacific holds the majority of share of over 37% in 2025.

- North America is holds as the second-largest market.

- By product, the black tea segment captured more than 47% of revenue share in 2025.

- By product, the green tea segment is expected to record remarkable growth between 2025 and 2034.

- By component, the flavor segment is expected to expand at a CAGR of 8.5% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 3.95 Billion

- Market Size in 2026: USD 4.21 Billion

- Forecasted Market Size by 2034: USD 6.87 Billion

- CAGR (2025-2034): 6.36%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Bubble Tea Market Overview

Invented in Taiwan in the late 90s, bubble tea is a cold and frothy drink generally made with cold milk with tapioca pearls known as ‘Boba'. Bubble tea has marked its significance in the food and beverage industry with its unique taste and wide range of flavors. Bubble tea consists of tea, milk, ice, and various flavors.

The presence of tapioca pearls in bubble tea has grown its popularity in recent years, especially among the young generation. Tapioca pearls, the main ingredient of bubble tea, are made of tapioca starch which is derived from cassava. These tapioca pearls are then sweetened with honey and brown sugar to make them soft and chewy. The increased sales of bubble tea are attributed to the proven health benefits of bubble tea. The pairing of sweet and sour tastes with the presence of refreshing tea has developed the popularity of bubble tea across the globe in a brief span.

Bubble Tea Market Growth Factors

The global bubble tea market is expected to witness a significant shift during the forecast period owing to the increasing popularity of fancy drinks in urban areas across the globe. Considering the rising health concerns, consumers are turning away from carbonated and alcoholic beverages to drinks made with natural ingredients; this factor is expected to boost the popularity of bubble tea across the globe. Changing preferences of beverage consumption and easy availability of bubble tea across restaurants and coffee shops are fueling the growth of the bubble tea market.

The rapidly growing adoption of cross-continental food and beverages in many countries is another factor boosting the market's growth. Moreover, the rising adoption of healthy beverages and the availability of a wide range of flavors in bubble tea are promoting the development of the global bubble tea market. However, factors such as the availability of cheap alternatives of beverages in the market and the presence of added sugar in bubble tea are likely to hinder the growth of the bubble tea market.

Bubble Tea Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.95 Billion |

| Market Size in 2026 | USD 4.21 Billion |

| Market Size by 2034 | USD 6.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.36% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Proven health benefits of bubble tea

Variants in bubble tea, such as black and green tea, are ideal for supporting the immune system and reducing inflammation. Green bubble tea is high in flavonoids, boosting heart health by lowering blood cholesterol. Oolong is another prominent base ingredient used in the crafting of bubble tea; oolong contains theanine which can improve cognitive functioning by reducing anxiety.

Although the added excess sugar and preservatives in bubble tea may be harmful to human health, bubble tea is proven healthy when consumed with the right ingredients. While the population is turning down carbonated and alcoholic beverages, these proven health benefits of bubble tea are posed to drive the growth of the global bubble tea market by increasing consumption.

Restraint

Presence of artificial preservatives and other harmful ingredients in bubble tea

In order to extend the profit opportunities, multiple operators add preservatives to the tapioca pearls or boba. Such preservatives are proven hazardous to human health. Along with this, added sugar, sweeteners and colors to the boba tea are linked to several harmful and adverse effects on human health.

The Foundation of Consumer, Thailand recently tasted 25 different brands of bubble tea, and it was found that some of the brands have added 19 teaspoons of sugar to each serving of bubble tea. Apart from the sugar content, the researchers have found the presence of heavy metals and preservatives along with sorbic and benzoic acids in the beverage.

These harmful ingredients are linked to heart diseases, diabetes and obesity. As the majority of the population is shifting to a healthy lifestyle, the presence of such hazardous ingredients in bubble or boba tea is observed to act as a restraining factor for the market's growth.

Opportunity

Increasing the crafting of ready-to-drink bubble tea

Traditionally, bubble or boba tea is made by blending all ingredients and adding tapioca pearls with other toppings in it. With the advancements and innovations in the market, consumers deserve to experience a simple and quick bubble tea. Here, crafting ready-to-drink bubble tea can offer lucrative opportunities to the market players. Ready-to-drink bubble tea is easy to consume and provided in bottles, which makes them travel-friendly.

The rising preferences for on-the-way or pick-up beverages demand ready-to-drink bubble tea to enhance convenience for consumers. For instance, in April 2022, a New York-based startup company that focuses on crafting Asian-inspired food and beverages, BubLuv Inc, announced the launch of its highly anticipated BubLuv Bubble Tea.

BubLuv Bubble Tea is the first ready-to-drink with no added sugar or preservatives. The company has stated that the drinks are now available in three exciting flavors at their official online store- Matcha Soy Latte, Passionfruit Oolong Guava and Black Milk Tea.

Segents Insights

Product Insights

The black tea segment dominates the market generating more than 47% of the revenue share in 2023. Black tea as a base ingredient was authentically used in Taiwan for bubble or boba tea; the rising preferences for authenticity in food and beverages have boosted the growth of the black tea segment. Moreover, black tea contains polyphenols, which act as antioxidants for the body by reducing bad cholesterol. Such proven health benefits have grown the demand for black tea as a base ingredient in the global bubble tea market.

At the same time, the green tea segment is expected to witness significant growth due to growing awareness about the unmatched health benefits of green tea across the globe. Green tea also offers a subtle variant in the flavor of bubble tea by adding a nutty and earthy taste to the beverage.

Component Insights

The flavor segment is expected to witness growth at a CAGR of 8.5% during the forecast period. With its unique appearance, packaging and tapioca pearls in bubble tea, the flavor component has grabbed consumer attention; operators usually prefer adding flavored syrups, powders and purees or fresh fruits in bubble tea to enhance its taste. Fruit flavors added to bubble tea offer the beverage a sweet, sour and exciting taste. With the improvement in the beverage, the market players have started adding advanced flavors the bubble tea, such as a flavored latte or Japanese matcha flavor in the bubble tea.

The sweetener remains an attractive segment in the global bubble tea market during the forecast period. Sweetener is added to the bubble tea in order to enhance its flavor by skipping the actual sugar. Some sweeteners even add viscosity and texture to bubble tea. As consumers are becoming more alert about their calorie intake, adding sweeteners can significantly replace sugar.

Regional Insights

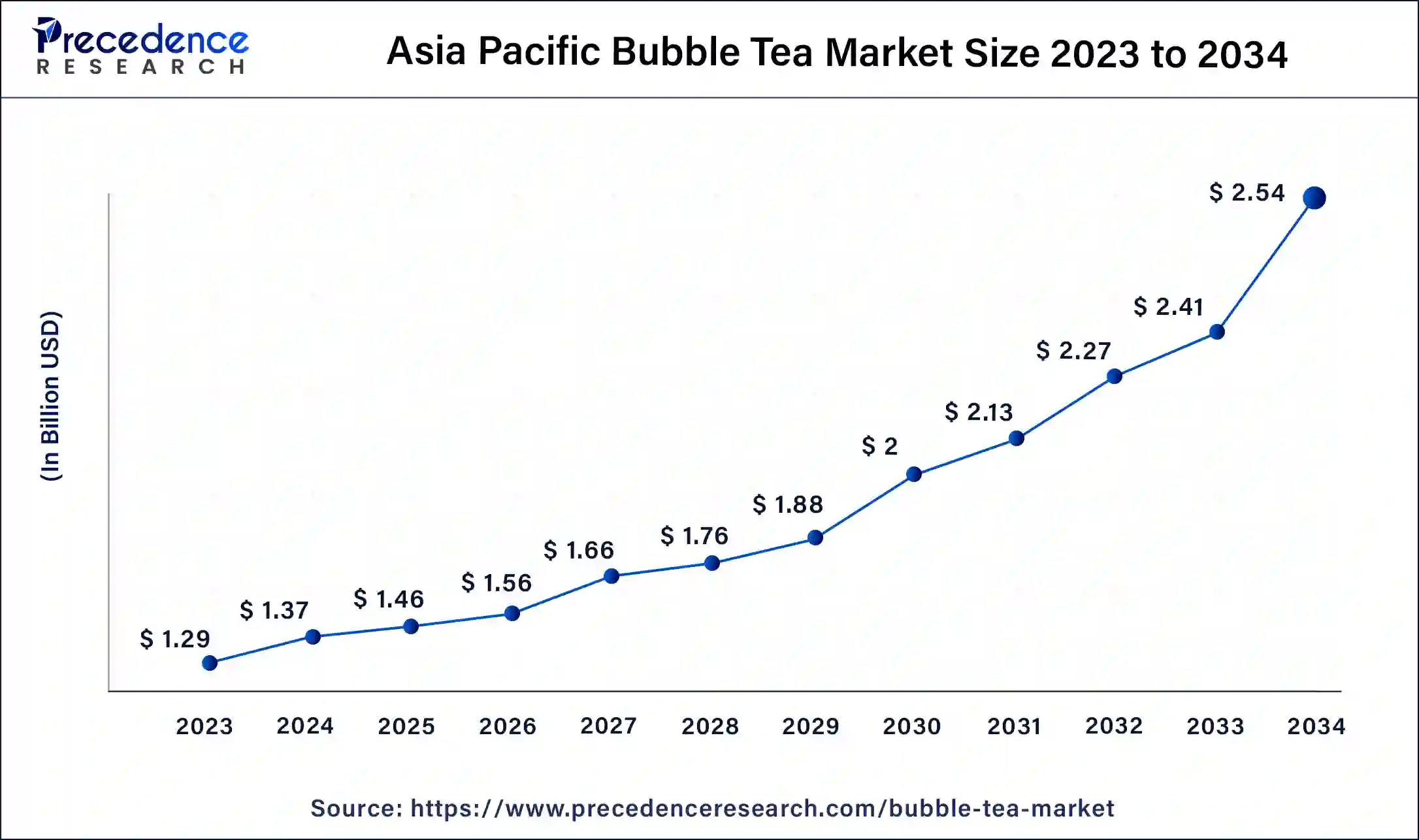

Asia Pacific Bubble Tea Market Size and Growth 2025 to 2034

The Asia Pacific bubble tea market size was valued at USD 1.46 billion in 2025 and is expected to be worth around USD 2.54 billion by 2034, at a CAGR of 6.36% from 2025 to 2034.

Asia Pacific holds the largest share of over 37% in 2024.Bubble tea originated in Taiwan, and the major consumer base for bubble tea in the country has fueled the market growth in Asia Pacific. Indonesia and Thailand are the largest markets in Southeast Asia for bubble tea. Being the third largest market for bubble tea in Southeast Asia, Vietnam remains an attractive market during the forecast period.

At the same time, the market in Singapore shows a significant increase due to rising spending power in the country. Enough room for small and large-scale players in the region with the availability of low-cost raw materials is another supportive factor for the growth of the bubble tea market in the Asia Pacific.

The presence of major key players in the region has contributed to the growth of the bubble tea market in Asia Pacific. Gong Cha, Chatime, Bubble Tea House Company, Coco Fresh, CuppoTee company and teatime are a few of the significant players headquartered in Asia Pacific.

North America is emerging as the second-largest bubble tea marketdue to the younger generation's increased consumption of caffeinated beverages. The rapid adoption of new food and beverage products by North America's food and beverage industry has supported the emergence of various Asian-based food and beverages. The growing popularity of Asia-based food and beverages in North America is expected to boost the growth of the bubble tea market during the forecast period.

The comparatively lower tea consumption in Latin America creates an obstacle to the bubble tea market's development. Similarly, the bubble tea market in the Middle East and Africa shows steady growth. However, the changing food consumption trend due to globalization is expected to show a shift in the bubble tea market in Latin America, the Middle East and Africa.

Bubble Tea Market Companies

- Chatime Group

- Gong Cha

- Yummy Towns Holdings Corporationis

- K.O.I The Co. Ltd

- Bobabox Ltd.

- T Bun International

- Troika J C

- Fokus Inc

- Lollicup USA Inc.

- The Bubble Tea Company

- Ten Ren's Tea Time

- Bubble Tea House Company

- Cuppotee

Recent Developments

- In January 2023, originally from Taiwan, a leading global bubble tea market company, Gong Cha achieved a new milestone by expanding its store line in Portugal. The company made its debut in Europe in 2019, and this store will be its first store in Portugal. According to the company's declaration, the store in Portugal will be managed by franchise Amelle Morisot.

- In September 2022, an international bubble tea operator company, Gong Cha, announced the opening of its first outlet at the Merrion Centre, Yorkshire. The operator has 1,500 outlets across the world. The Merrion Centre is planning to expand its choice of Chinese food and beverages with this new opening. Gong Cha in Yorkshire aims to offer a minimum of 20 jobs with this new outlet.

- In April 2022, Del Monte Foods launched the ‘Joyba' new bubbly beverage brand; Del Monte has partnered with New York-based brand design agency CBX in order to ensure the launch's success. Joyba aims to offer multiple flavors of bubble tea, including coffee, strawberry, cherry and lemonade.

- In May 2022, a brand known for its incredible ice cream flavors, Baskin Robbins, launched its very first bubble tea ‘Tiger Milk Bubble Tea'. Unlike the general boba, the tapioca pearls used in the drink by Baskin Robbins are made with brown sugar. The brand has stated that the new item ‘Tiger Milk Bubble Tea' will be available for a limited period of spring and summer.

- In April 2022, the world's biggest tea house franchise Chatime opened its first outlet in Blanchardstown, Dublin. With the newly opened Irish outlet, Chatime will be serving authentic Taiwanese beverages, including bubble tea in multiple flavors. The brand is set to open its second Irish outlet by June 2022 in Cork City.

Segments Covered in the Report

By Product

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

By Component

- Liquid

- Flavor

- Creamer

- Sweetener

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting