What is the Chillers Market Size?

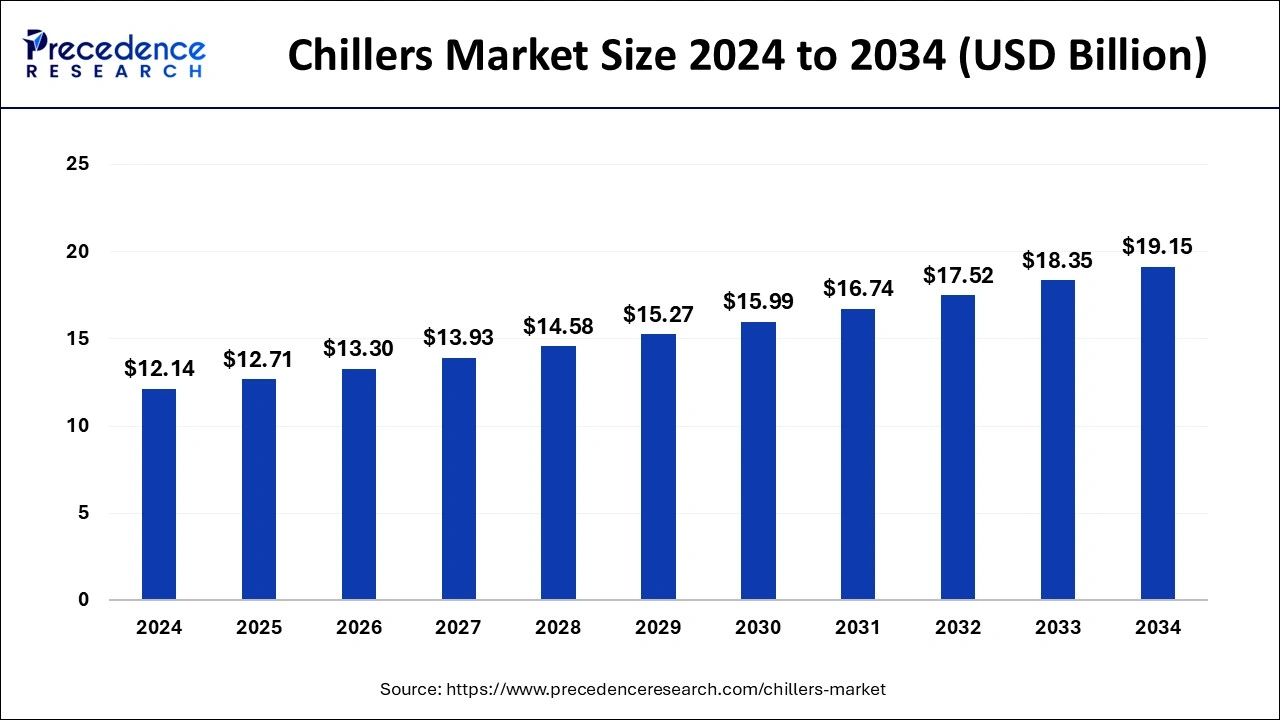

The global chillers market size is calculated at USD 12.71 billion in 2025 and is predicted to increase from USD 13.30 billion in 2026 to approximately USD 19.97 billion by 2035, expanding at a CAGR of 4.62% from 2026 to 2035.

Chillers Market Key Takeaways

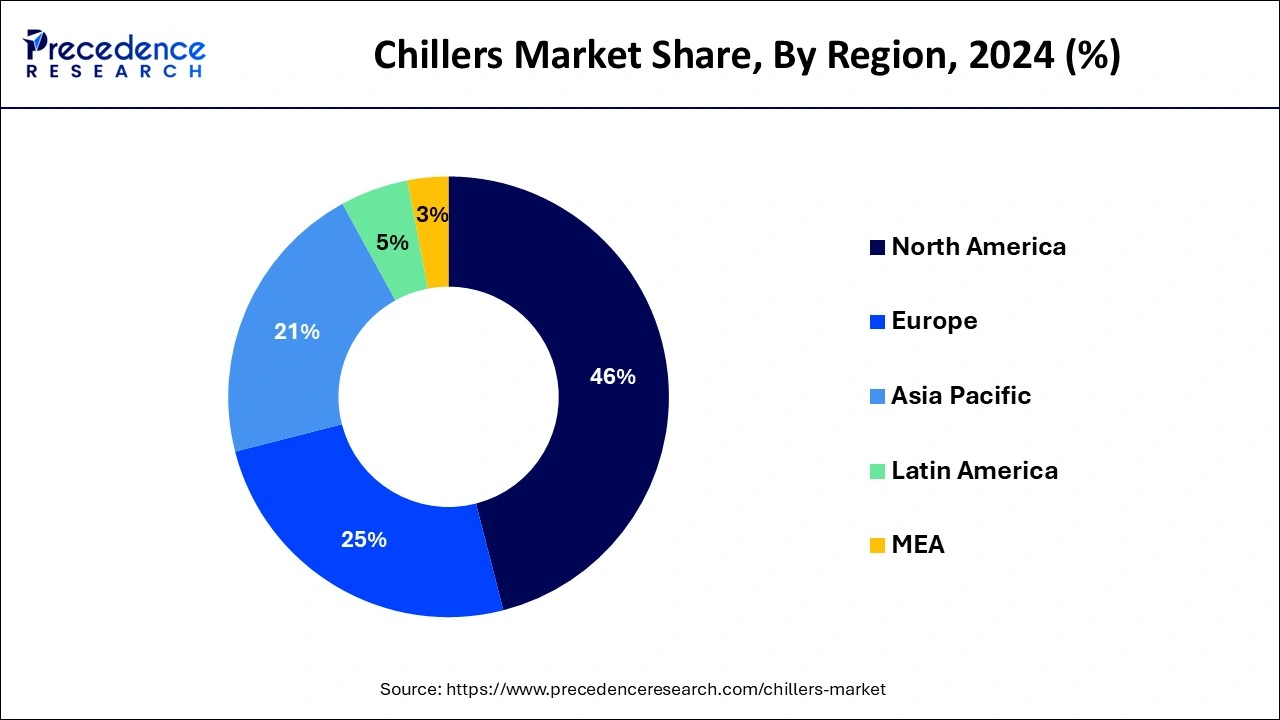

- Asia Pacific led the global market with the highest market share of 46% in 2025.

- By Type, screw chiller segment is predicted to maximum market share between 2026 and 2035.

- By Product Type, the water cooled chiller segment is expected to largest market share between 2026 and 2035.

- By End-user, the chemicals & petrochemicals segment is projected to highest market share between 2026 and 2035.

Chillers Industry Proven Overview

The chillers market refers to the industry that produces and sells chillers, which are cooling systems used in various applications such as air conditioning, refrigeration, and industrial processes. Chillers are used to lower the temperature of the water or other fluids, which can then be used to cool a space or equipment.

It includes manufacturers, distributors, and suppliers of various types of chillers, including air-cooled chillers, water-cooled chillers, absorption chillers, and centrifugal chillers. The market is driven by increasing demand for air conditioning and refrigeration in commercial and residential buildings, industrial growth, and chiller technology advancements.

Chillers are used extensively in the industrial sector for various processes, such as cooling in power generation, food and beverage processing, and pharmaceutical production. The growth of these industries has boosted the demand for chillers. Also, Government regulations regarding energy efficiency and environmental sustainability are driving the demand for high-efficiency chillers, which consume less energy and produce fewer greenhouse gas emissions.

However, high initial cost & maintenance costs and technological limitations are anticipated to impede the market growth. Chillers can be expensive to purchase and install, which could discourage some customers from investing in them. It also requires regular maintenance, which could add to the overall cost of ownership and make them less attractive to some customers. Although advancements in technology have led to the development of more efficient and cost-effective chillers, some technological limitations could hinder their growth.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have mixed impacts on the chiller market, with some negative impacts on demand and supply and some positive impacts due to increased demand from healthcare facilities. The long-term impact of the pandemic on the chiller market is still uncertain. It will depend on the duration and severity of the pandemic, as well as the pace of economic recovery.

Chillers Market Growth Factors

With the growing demand for commercial and residential buildings, the rising demand for air conditioning systems propelled market demand. The various factors are helping to drive the market are:

- Increasing demand for air conditioning

- Advancements in chiller technology

- Energy efficiency regulations

- Growth in the industrial sector

Market Outlook

- Start-up Ecosystem: The startups are magnifying any niche area in chillers suitable for semiconductor fabrication, EV battery testing, and pharmaceuticals sectors to figure out their needs for temperature control. Moreover, the start-ups are engaging with the green projects to establish sustainable chillers made of CO2 or ammonia.

- Industry Growth Overview: The industry growth is accelerating with the integration of tech-driven specialisations that unite and double the demand and business growth of chillers. The rapid adoption of Magnetic Bearing Compressors and Variable Speed Drives will be competing with the efficiency standards in the near future to uplift the industrial success.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 12.71 Billion |

| Market Size in 2026 | USD 13.30 Billion |

| Market Size by 2035 | USD 19.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 4.62% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Product Type, and End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for air conditioning to brighten the market prospect

Air conditioning systems require cooling technology to lower air temperature, and chillers are essential to many air conditioning systems. As the demand for air conditioning systems grows in response to rising global temperatures and increasing urbanization, the demand for chillers is also expected to grow. They are used in various settings, including residential buildings, commercial buildings, industrial facilities, and vehicles. Chillers are used in these settings to cool the air, which helps to improve comfort, reduce humidity, and maintain air quality.

The growth of the construction industry, particularly in emerging economies, is also expected to drive the demand for air conditioning and, in turn, the demand for chillers. As more buildings are constructed, the demand for air conditioning systems and chillers is expected to increase. Thus, the increasing demand for air conditioning systems is expected to drive the growth of the chiller market in the coming years. Using chillers in air conditioning systems also aligns with the increasing demand for energy-efficient solutions, as high-efficiency chillers can help reduce energy consumption and lower carbon emissions.

Energy efficiency regulations

Government regulations and standards regarding energy efficiency and environmental sustainability are becoming increasingly stringent in many countries, particularly developed economies. For instance, in September 2021, the European Union (EU) introduced new energy efficiency regulations under the Ecodesign Directive, which require all new air conditioning units sold in the EU to meet higher energy efficiency standards.

The new regulations apply to all air conditioning units with a cooling capacity of up to 12 kW, which includes many chillers used in commercial and residential buildings. This has led to a growing demand for high-efficiency chillers, which consume less energy and produce fewer greenhouse gas emissions. They are a significant contributor to energy consumption in buildings and industrial facilities.

As a result, improving the energy efficiency of chillers is a key focus area for reducing energy consumption and meeting sustainability goals. High-efficiency chillers use advanced technology and innovative designs to reduce energy consumption while maintaining the same cooling performance.

Regulations and standards related to energy efficiency are driving the demand for high-efficiency chillers in both new construction and retrofit projects. In some cases, government incentives and rebates are also available to encourage the adoption of high-efficiency chillers.

The demand for high-efficiency chillers is expected to grow as more countries implement energy efficiency regulations and companies seek to reduce their carbon footprint and improve their sustainability credentials. This presents an opportunity for manufacturers of high-efficiency chillers to capture a larger share of the chiller market.

Key Market Challenges

High initial and maintenance costs are causing hindrances to the market

Chillers, particularly high-efficiency models incorporating advanced technology and materials, can be expensive to purchase and install. The high initial cost of chillers can be a significant barrier to entry for small businesses or building owners with limited budgets, limiting the demand for chillers in some markets. In addition to the high initial cost, chillers can also require significant maintenance and repair over their lifespan.

Regular maintenance is essential for ensuring that chillers operate efficiently and reliably, but this can add to the overall cost of ownership. The need for periodic repairs or replacement of components can also increase the cost of ownership and reduce the overall return on investment for building owners.

To overcome these hindrances, manufacturers of chillers are increasingly offering financing options and leasing arrangements to make it easier for customers to purchase and install high-efficiency chillers. Additionally, some manufacturers are focusing on reducing the maintenance requirements of their chillers by incorporating self-diagnostic features and other advanced technologies that can detect and correct issues before they become major problems. Thus, while high initial and maintenance costs hinder the chiller market, manufacturers are addressing these issues and making chillers more accessible and cost-effective for a broader range of customers.

Key Market Opportunities

These are the following factor which is likely to create opportunity over the forecast period.

- Increased adoption of renewable energy sources

- Smart technology and the Internet of Things (IoT):

- Growing demand for energy-efficient solutions

Technological Advancement

The chillers market is evolving in distribution and production, with advanced applications for cooling systems. The technological advancement in the chillers market features compressor technologies and heat recovery systems. The smart technology for chillers includes AI and machine learning, and IoT. Magnetic bearing compressors are mostly installed in centrifugal chillers to reduce energy consumption. On the other hand, it's a supporting environment.

IoT in chillers is situated with sensors connecting to the IoT. It provides real-time monitoring, automated control, and maintenance. AI and ML are used for personalized cooling strategies. The heat recovery system in a few chillers utilizes waste heat for various purposes, like hot water production. Further advancements include a district cooling system, compact design, and modular system. The newest technology in the chillers market is variable-speed fans. The technology delivers an adjustment to the cooling capacity to balance with the building's cooling load. This energy consumption technology boosts the efficiency level. It also limits wear and tear components.

Segment Insights

Type Insights

On the basis of type, the chillers market is divided into screw chiller, scroll chiller, centrifugal chiller and others, with the screw chiller segment accounting for most of the market. Screw chillers are commonly used in commercial and industrial applications and can provide a high cooling capacity. Screw chillers are available in both air-cooled and water-cooled configurations.

In addition, the type of chiller used depends on the specific application and the cooling requirements of the building or facility. Each type of chiller has its advantages and disadvantages, and building owners and operators must choose the appropriate type based on their specific needs and budget.

Product Type Insights

On the basis of the product type, the chillers market is divided into air cooled chillers and water-cooled chillers, with the water-cooled chiller accounting for most of the market. Water-cooled chillers are more efficient and provide greater cooling capacity than air-cooled chillers. Still, they require a more extensive installation process and additional infrastructure, which can add to the overall cost. These chillers use water as the cooling medium and require a separate cooling tower or condenser to remove heat from the water. They are typically more energy-efficient than air-cooled chillers and are often used in larger commercial and industrial applications.

End User Insights

On the basis of end users, the chillers market is divided into chemicals & petrochemicals, food & beverages, medical, and others, with the chemicals & petrochemicals accounting for most of the market. Chillers are used extensively in the chemicals and petrochemicals industry for various applications, including cooling reaction vessels, distillation columns, and other process equipment. The high cooling capacity of chillers is particularly important in this industry, where precise temperature control is critical for many processes. In addition, the increasing demand for chemicals and petrochemicals is leading to the construction of new production facilities and the expansion of existing facilities, driving demand for cooling equipment such as chillers.

Regional Insights

What is the Asia Pacific Chillers Market Size?

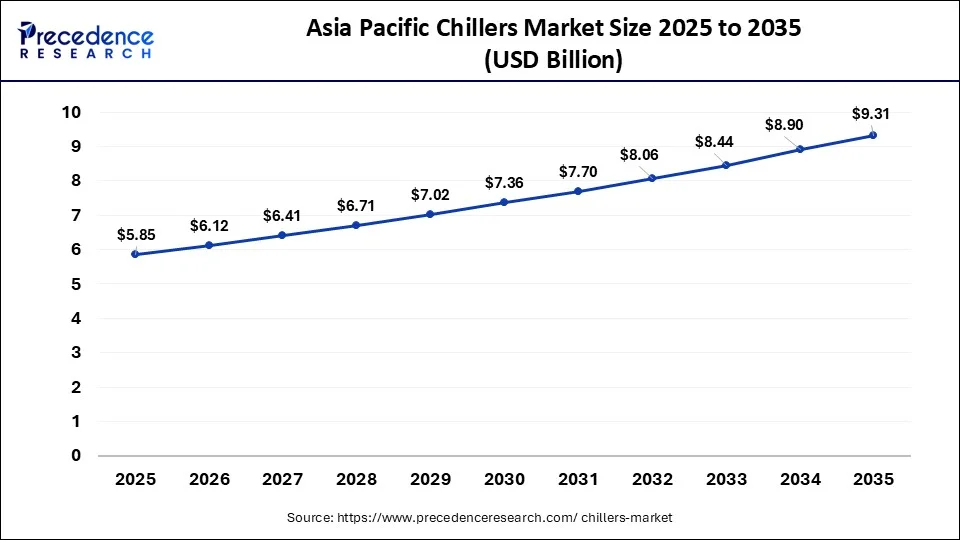

The Asia Pacific chillers market size was evaluated at USD 5.85 billion in 2025 and is projected to be worth around USD 9.31 billion by 2035, growing at a CAGR of 4.76%.

Asia Pacific is dominating the chillers market globally. The accelerated energy-efficient cooling solutions, industrialization, and urbanization make the region undoubtedly competent among all. Additionally, the extended high construction activities and industrial sectors significantly meet the exponential growth and value of the chillers companies. The heavy demand for air conditioning systems in offices and residences increases the production growth of the chillers product.

Europe is also a significant chiller market, with significant demand for cooling equipment in various end-user industries. The market is driven by the increasing demand for energy-efficient and environmentally friendly cooling solutions, the growing adoption of smart building technologies, and strict environmental regulations. Germany is the largest chiller market in Europe due to many manufacturing industries and the growing demand for energy-efficient cooling solutions.

North America chillers market is growing at notable rate. Rising cooling demand from industrial applications is a key driver boosting the North American chillers market. Industries such as manufacturing, pharmaceuticals, and food and beverage processing require precise temperature regulation for numerous industrial operations. These sectors are expanding and evolving, increasing the need for reliable and efficient cooling systems.

As these industries evolve and upgrade their infrastructure, the need for reliable and efficient cooling systems increases. The incorporation of intelligent technologies, IoT-enabled oversight and regulation systems, and enhanced predictive maintenance features is fueling the need for next-generation chillers. Companies are increasingly looking for creative solutions that maximize energy efficiency, minimize downtime, and improve overall system performance.

Latin America's Robust Advancements in the Chillers Industry

Latin America's powerful advancements are its smart use of modular systems, quick technology, and tech integration. Alongside, the eco-conscious refrigerants like HFOs are the transition to the Global Warming Potential (GWP) refrigerants. Green building standards and free cooling solutions have leveraged the use of chillers to deploy water-cooled scroll chillers and serve free cooling to the data centers, free cooling chillers, and modern adiabatic solutions.

The advancements are harnessing the cold chain logistics operations, vice versa, as transport systems also consist of multi-temperature systems and blast freezing. Mexico, Chile, and Brazil's new infrastructure use advanced chillers mainly for pharmaceutical storage and massive data facilities.

MEA's Focus on Chillers Industry

MEA's major focus is on water conservation, decarbonization, energy efficiency, and district cooling integration to achieve the growth of the regional chillers strategy. Learning about the water shortage issue, the demand for hybrid systems and air-cooled chillers is rising to somehow balance this issue or address this issue and eliminate it. In Riyadh and Dubai, the chillers are installed within District Cooling Systems.

This deployment works efficiently and promotes the smart city developments to the core. The AI-inspired controls and IoT-enabled sensors is a most popular choice of the manufacturers for recording predictive maintenance and genuine monitoring. This saves money and times of the food processing, data centers, and healthcare sectors.

Value Chain Analysis of the Chillers Market

- Resource Extraction: The resource extraction is visible in the marketing and industrial processes. The extraction offers less temperature, accurate cooling temperatures to separate heat from the content like oils, biological substances, or solvents. This analyzes the potential of the materials to protect the product.

Key Players – Daikin Industries, Ltd., Trane Technologies plc, and Carrier Global Corporation. - Power Generation: Power generation is a crucial part of the chillers built up, as chillers deliver fundamental cooling to the components to avoid downtime, equipment failure, and overheating. This enhances the generation efficiency, too, via inlet air cooling.

Key Players – Johnson Controls International plc, Mitsubishi Electric Corporation, and LG Electronics. - Energy Storage Systems: The energy storage systems in chillers feature the pathway of Thermal Energy Storage (TES), such as chilled water or an ice tank that brings a transition in the cooling production during night hours. Overall, the system refines efficiency volume by operating chillers at a low temperature (outdoor).

Key Players – Reynold India, Baltimore Aircoil Company, and Midea Building Technologies.

Chillers Market Companies

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Daikin Industries Ltd

- Dimplex Thermal Solutions

- LG Electronics

- Johnson Controls International Plc

- Gree Electric Appliances Inc of Zhuhai

- Midea Group Co. Ltd

- Thermax Ltd,

- Trane Technologies Plc.

Recent Developments

- In March 2025, Smardt Chiller Group, a top manufacturer of equipment for industrial, comfort, and data center air conditioning, launched the AeroPure AF Series, a next-generation line of air-cooled chillers featuring oil-free, magnetically suspended compressors. The AF Series chillers come in 72 preconfigured, predesigned models 36 models for cooling data centers, with capacities from 211 to 2500 kW, and 36 models for comfort air conditioning, with capacity ranges of 211 to 1800 kW.

- In March 2025, Johnson Controls, the worldwide leader in smart, safe, healthy, and sustainable buildings, has increased the distribution of its premier YORK line of YVAM air-cooled magnetic bearing chillers to Europe to address the rising demand in the data center sector.

- In February 2025, Mitsubishi Heavy Industries Thermal Systems, Ltd., a division of the Mitsubishi Heavy Industries Group, revealed the introduction of a new version of its Ene-Conductor Heat Source Control System designed for the unified management of centrifugal chillers and associated devices like chilled water pumps, cooling water pumps, and cooling towers. The upcoming EC-8 model, set to join the collection this spring, enables the management of as many as 8 centrifugal chiller units.

- In August 2024, Trane Technologies announced the launch of R290 chillers and heat pumps for the Australian market. This launch will boost the Australian chillers market growth and demand.

Segments Covered in the Report

By Type

- Screw Chiller

- Scroll Chiller

- Centrifugal Chiller

- Others

By Product Type

- Air Cooled Chiller

- Water Cooled Chiller

By End User

- Chemicals & Petrochemicals

- Food & Beverages

- Medical

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting