What is the Civil Aviation Flight Training Market Size?

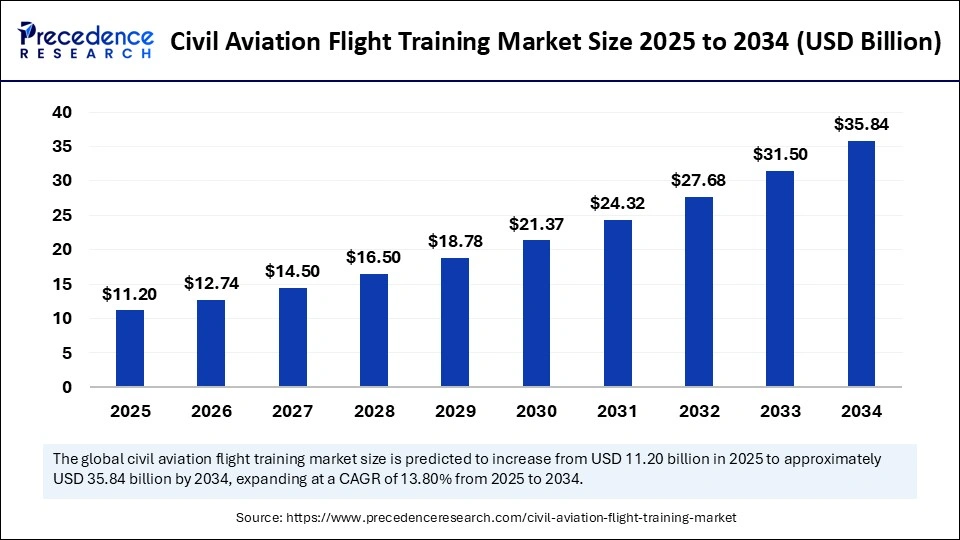

The global civil aviation flight training market size accounted for USD 11.20 billion in 2025 and is predicted to increase from USD 12.74 billion in 2026 to approximately USD 39.83 billion by 2035, expanding at a CAGR of 13.53% from 2026 to 2035. The growth of the market is attributed to the rising global demand for commercial pilots, driven by increased air travel and airline fleet expansion.

Civil Aviation Flight Training Market Key Takeaways

- In terms of revenue, the civil aviation flight training market is valued at $11.20 billion in 2025.

- It is projected to reach $39.83billion by 2035.

- The market is expected to grow at a CAGR of 13.53% from 2026 to 2035.

- North America dominated the civil aviation flight training market with the largest share in 2025.

- Asia Pacific is expected to expand at the fastest CAGR during the forecast period.

- By training type, the pilot training segment held a significant share of the market in 2025.

- By training type, the virtual reality (VR) training segment is likely to grow at the fastest rate during the forecast period.

- By simulator type, the full flight simulators (FFS) segment dominated the market with the largest share in 2025.

- By simulator type, the flight training devices (FTD) segments is expected to grow at the fastest rate between 2026 and 2035.

- By application, the commercial aviation segment led the market in 2025.

- By end-user, the airlines segment dominated the market with the largest share in 2025.

- By end-user, the flight schools segment is projected to grow at the fastest rate in the upcoming period.

Market Overview

The civil aviation flight training market is experiencing rapid growth, driven by improvements in training technologies and the growing need for commercial pilots. Increasing air travel, the growth of international airline fleets, and the use of advanced simulation tools are the main causes of this upsurge. Flight simulators, especially full flight simulators (FFS), are becoming important because they provide realistic settings for honing flying techniques and managing challenging situations. The use of virtual reality and cutting-edge motion platforms improves training effectiveness and safety while meeting the urgent global demand for qualified pilots.

How is AI transforming civil aviation flight training?

By enabling adaptive learning, improving decision-making, and increasing simulator realism, artificial intelligence (AI) is transforming flight training in civil aviation. AI-powered simulators can now more accurately simulate real-world flying conditions such as atmospheric weather patterns, air traffic, and emergencies. These intelligent systems provide individualized feedback and practice sessions based on a trainee's performance in real time. This guarantees more efficient skill development and lets trainees advance according to proficiency rather than set hours. AI also lowers operating performance evaluation and monitoring without the need for constant instructor intervention.

Currently, biometric and behavioral data are being used for predictive analytics to evaluate pilot behavior readiness and risk factors. AI-powered virtual instructors can facilitate distance learning by increasing training accessibility worldwide. AI is also being used by flight schools and airlines to predict training requirements based on retirement and fleet expansion trends, allowing for more effective resource alignment. By making training more scalable, adaptable, and accessible, artificial intelligence (AI) helps to solve the global pilot shortage in addition to modernizing the conventional training model.

Civil Aviation Flight Training Market Growth Factors

- Surging Demand for Pilots: Global expansion of airline fleets and rising air passenger traffic have led to a significant demand for trained commercial pilots.

- Advancements in Simulation Technology: The use of advanced flight simulators, virtual reality (VR), and AI-based training tools has improved training efficiency, safety, and cost-effectiveness.

- Regulatory Support: Government initiatives and aviation authorities are promoting standardized, high-quality training programs to ensure global pilot readiness.

- Fleet Modernization: New aircraft models require updated pilot training, encouraging airlines and training institutions to invest in modern simulators and curricula.

- Increased Investments in Aviation Training Infrastructure: Countries like India, the U.S., and China are investing heavily in aviation academies and flying schools to meet growing needs.

Market Outlook

- Industry Growth Overview: In recent years, the civil aviation flight training market has grown steadily. Airlines are modernising their fleet and are under regulatory pressure to comply with laws, rules, and regulations. In addition, the retirement rate of pilots is increasing, which is placing more pressure on the flight schools to meet the increasing demand for type rating certifications for pilots across the world in the commercial, cargo, and charter aviation sectors.

- Sustainability Trends: Training providers have begun incorporating environmentally sustainable practices into their training. Fuel-efficient simulators, electric flight training aircraft, paperless classrooms, and carbon-offset programs have all been implemented as part of their efforts to enhance environmental responsibility and sustainability in pilot and crew training programs through environmentally sustainable regional and global partnerships.

- Global Expansion: To address the global shortage of pilots, flight training organisations are forming alliances, such as cross-border partnerships, joint ventures, and satellite academies, that allow them to train pilots more efficiently.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 39.83Billion |

| Market Size in 2025 | USD 11.20 Billion |

| Market Size in 2026 | USD 12.74 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Training Type, Simulator Type, Application, End-User and Regions |

| Regions Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Air Traffic

The rising air traffic is a key factor driving the growth of the civil aviation flight training market. Passenger volumes have increased in the last few years due to the global revival of air travel, particularly in emerging markets. To meet operational demands, the need for a larger pool of qualified pilots is rising. This leads to the rapid expansion of flight training schools. In February 2024, United Airlines inaugurated a new 150,000 square foot building at its flight training center in Denver. This expansion allows for the addition of 12 advanced full-motion flight simulators, six of which have already been delivered. The facility can now conduct over 32,000 training events annually, training up to 860 pilots per day. This move supports the United strategy to hire more pilots in response to increased air travel demand.

Airline Fleet Expansion

The rapid expansion of airline fleets is driving the growth of the civil aviation flight training market. Airlines are continuously adding newer fuel-efficient aircraft to their fleets as part of their modernization efforts. The need for sophisticated simulators and training programs has increased as a result of this evolution, which requires pilots to receive type-specific training. In September 2023, Air Astana commissioned a new flight training center at Astana International Airport, the first in Central Asia certified by the European Aviation Safety Agency. The facility is equipped with a full-flight Airbus A320 Reality Seven simulator supplied by L3 Harris. Over 500 pilots from Air Astana and its low-cost subsidiary, FlyArystan will undertake training at the new facility, which operates 24/7 this initiative supports Air Astana fleet expansion and commitment to enhancing fleet expansion and commitments to enhancing pilot training capabilities within Kazakhstan.

Restraints

High Cost of Training Infrastructure

Establishing a flight training academy requires substantial investments in simulators, airplane maintenance instructors, and regulatory certifications. It is difficult for new competitors to compete because full flight simulators alone can cost millions of dollars. Furthermore, ongoing improvements and regulatory requirements drive up operating costs. Smaller schools have been forced to close or be acquired as a result of market consolidations. Economies of scale continue to be a crucial component of profitability.

Pilot Training Costs & Affordability Issues

High training costs hamper the growth of the civil aviation flight training market. Training costs, which can range from USD 80,000 to USD 150,000 depending on the area, are frequently unaffordable for aspiring pilots. This makes it difficult to enter the market, especially in developing nations with few options for financing and student loan arrangements. The cost burden slows the pilot pipeline by discouraging potential talent. Without airline sponsorship or cadet programs, many students also struggle to find post-training jobs. Enrollment is further discouraged by this risk factor, particularly for middle-class groups. One of the industry's ongoing concerns is the disparity between initial salaries and training expenses.

- In January 2024, a report by the Aircraft Owners and Pilots Association (AOPA) highlighted that nearly 60% of U.S. student pilots drop out due to financial constraints. Despite offering quality programs, many flight schools struggle to retain students without significant scholarship or government support.

Opportunities

Increasing Global Demand for Pilots

Qualified pilots are in high demand due to the commercial aviation industry's explosive growth, especially in emerging countries, creating immense opportunities in the civil aviation flight training market. Due to the surge in air travel in Asia, Africa, and Latin America, airlines are increasing their fleets and hiring more pilots. Flight training organizations have a great chance to expand their operations and provide more extensive programs as a result of the increased demand for pilots.

- In January 2024, Boeing announced that it would expand its pilot training programs in Southeast Asia to cater to the growing demand in the region, focusing on the aviation industry's projected need for more than 250,000 pilots in the next two decades.

Emerging Demand for Drone Pilots

The need for certified drone pilots is rising worldwide as drone technology continues to gain traction in commercial applications, such as aerial photography, surveillance, and cargo delivery. By adding drone pilot certification programs to their offerings, flight training schools can expand their clientele and capitalize on this growing market.

- In February 2024, Skytech Training Solutions, a US-based flight school, launched a new curriculum focused on unmanned aerial vehicle pilot certifications. The company expects a 20% increase in enrollment as businesses adopt drones for logistics and security operations.

Segment Insights

Training Type Insights

The pilot training segment dominated the civil aviation flight training market with a significant share in 2025. This is mainly due to the increased need for qualified commercial pilots throughout the world. Airlines and training institutions made significant investments in comprehensive standardized pilot training programs in response to the retirement of seasoned pilots. The rapid expansion of commercial fleets and a significant rise in air travel further bolstered the segmental growth. Pilot training programs, which are crucial for upholding strict safety regulations and regulatory compliance, include both initial type rating and ongoing training. Pilot proficiency is still a primary concern, strengthening this segment's dominance.

The virtual reality (VR) training segment is likely to grow at the fastest rate during the forecast period. The growth of the segment can be driven by improvements in immersive technologies and the demand for scalable, reasonably priced training programs. Without the use of real aircraft or expensive simulators, virtual reality (VR) provides cadets with an immersive, realistic environment to practice. VR training has become especially appealing to flight schools and airlines seeking to update their training infrastructure because of its adaptability and accessibility. VR is being adopted at a rapid pace, revolutionizing aviation education.

Simulator Type Insights

The full flight simulators (FFS) segment dominated the civil aviation flight training market with the largest share in 2025 because of their exceptional capacity to accurately simulate real-flight conditions. FFSs are essential for both initial and ongoing training of commercial pilots because they are outfitted with motion platforms, visual systems, and cutting-edge software. Certain training modules, especially those about type rating and emergency procedures, require the use of certified full-flight simulators as mandated by regulatory bodies like the FAA and EASA. As the focus on safety, cost-effectiveness, and realistic training experiences has grown, FFSs have become crucial to airline training programs.

The flight training devices (FTD) segment is expected to grow at the fastest rate in the coming years, driven by the increase in air travel worldwide and the resulting need for new pilots. Airlines and academies are scaling their operations to meet the worldwide pilot shortage. It includes ground school simulator sessions and in-aircraft training. The rising government programs, an increase in the number of students enrolled in aviation academies, and collaborations between OEMs and training providers further support segmental growth. The demand for thorough flight training programs keeps rising as the aviation sector recovers and grows after the pandemic, bolstering the growth of the segment.

Application Insights

The commercial aviation segment dominated the civil aviation flight training market in 2025. This is mainly due to the increased demand for air travel around the world. The need for certified pilots has increased significantly as a result of the continuous growth of commercial airline fleets, especially in emerging economies. Furthermore, investments in full flight simulators and type-rating programs have been stimulated by regulatory requirements for periodic training as well as technological advancements in simulators.

The unmanned aerial vehicles (UAVs) segment is expected to grow at the fastest rate during the projection period. The growth of the segment is attributed to the rising demand for certified UAV pilots as a result of the quick adoption of drones for ensuring public safety and infrastructure inspection. Furthermore, training providers now have more chances to offer specialized skill-focused programs, thanks to technological advancements and the growing applications of UAVs.

End-user Insights

The airlines segment dominated the civil aviation flight training market with the largest share in 2025, owing to their increased investments in training programs. A consistent supply of skilled pilots prepared for their particular aircraft types is ensured by large carriers that frequently set up their training facilities or collaborate with flight training organizations. Airlines can lower their reliance on outside suppliers, increase pilot retention, and uphold strict training standards, thanks to vertical integration. Airlines are focusing on keeping their training programs competitive and effective to maintain their market dominance.

The flight schools segment is projected to grow at the fastest rate in the upcoming period due to the rising need to address the worldwide pilot shortage and the growing number of aspiring pilots. As a vital part of the pilot training ecosystem, flight schools provide a variety of training services, ranging from commercial certifications to private pilot licenses. Flight schools can now offer more effective and scalable training options, thanks to technological advancements like simulators and AI-driven training aids. The rising number of flight schools, particularly in emerging countries, and the expansion of government-backed aviation initiatives contribute to segmental growth.

Regional Insights

North America dominated the civil aviation flight training market in 2025. This is mainly due to the presence of some of the leading aviation and training facilities, such as Florida Flyers Flight Academy, and well-established aviation infrastructure. The region is likely to sustain its position in the market due to its strong aviation industry and the rising demand for qualified pilots from North American airlines, such as United Airlines, American Airlines, and Delta. The U.S. plays a major role in the market as it boasts numerous flight schools and simulator producers. Regulatory bodies like the Federal Aviation Administration (FAA) are influencing international training standards.

Asia Pacific is expected to witness the fastest growth in the upcoming period. This is mainly due to the growing demand for skilled pilots and the rapid expansion of the aviation industry. The rapid growth in air travel and airline expansion is driving the demand for more effective and scalable flight training solutions. Governments around the region are investing heavily to expand fleets. Moreover, rising alliances between domestic airlines and foreign flight schools and a rising focus on establishing comprehensive training facilities contribute to regional market growth.

In India, the civil aviation sector is witnessing significant growth with air traffic reaching 376 million passengers in the fiscal year 2024, including 306 million domestic travelers. To meet the rising demand for pilots, the country has expanded its network of flying training organizations (FTOs) with 35 DGCA-recognized institutions as of 2023. Prominent academies like the Indira Gandhi Rastriya Uran Akademi have enhanced their training capacities, achieving record flying hours and offering comprehensive programs, including a B.Sc. degree in aviation. These changes highlight India's role in strengthening its aviation education system to meet the expanding needs of the sector.

Regulatory Excellence and Advanced Simulation Leadership in Europe

Europe is considered to be a significantly growing area. The growth of the civil aviation flight training market in Europe can be attributed to its well-established training facilities, robust aviation infrastructure, and regulatory frameworks. The region is home to some of the renowned flight schools, simulator producers, and numerous airlines that demand continuous training for their pilots. European regulatory agencies like the European Aviation Safety Agency (EASA) have set strict guidelines for pilot training, influencing the market.

Germany Civil Aviation Flight Training Market Trends

Germany's market is expected to grow steadily, supported by strong demand for pilots as airlines expand fleets and address a projected shortage of skilled personnel. Strategic partnerships among training organizations, research institutions, and industry players are fostering innovation and improving competency-based learning approaches. Regulatory frameworks under the European Union and collaborations with bodies such as EASA are shaping curriculum standards and certification processes.

Training Infrastructure and Regional Connectivity in Latin America

Growth in Latin America's aviation training market is primarily driven by the growth of regional airlines, the recovery of tourism due to a stronger economy, and increased demand for bilingual pilots. Brazil and Mexico are the dominant countries within Latin America, with the aid of national aviation authorities that are working to improve their certification frameworks and increase simulator usage in major metropolitan aviation centres.

Brazil Civil Aviation Flight Training Market Trends

Brazil has been accelerating the growth of flight academies and investing in newer simulators to meet the demand for flying with domestic airlines. The large number of aviation manufacturers based in Brazil and other parts of Latin America contributes further to improving technical training capabilities.

Middle East & Africa (MEA): Strategic Aviation Hubs and International Training Demand

Strategically located in the Middle East & Africa region (MEA), where strong national airlines are influenced by investments into aviation training facilities, including pilots, cabin crew members, and aircraft maintenance professionals, via a unified integrated aviation training system. Emphasis on safety, standardized certification, and regulatory support is driving demand for high-fidelity simulation and comprehensive training programs.

Saudi Arabia Civil Aviation Flight Training Market Trends

Saudi Arabia has the fastest-growing economy in the MEA region; thus, the aviation sector is benefiting significantly from the government's support of aviation academies for developing the future workforce. As part of its national diversification strategy, Saudi Arabia is increasing opportunities for pilots and recruits globally.

Civil Aviation Flight Training Market Companies

- CAE

- FlightSafety

- L3Harris

- TRU Stimulator

- Boeing

- Airbus

- Thales

Latest Announcement by Industry Leader

- In January 2024, Airbus and Air India entered into a partnership to establish a world-class pilot training center in Gurugram, Haryana. The Tata Airbus Training Centre will be equipped with 10 full flight simulators and is expected to train over 5,000 pilots across A320 and A350 platforms over the next decade. The facility is projected to become operational by early 2025, supporting India's growing aviation needs. Rémi Maillard, President and Managing Director of Airbus India and South Asia, stated, “As the fastest-expanding aviation market in the world, India will need 41,000 pilots and 47,000 technicians in the next 20 years to support this growth. The pilot training center with Air India is a testament to Airbus' commitment to developing human capital.”

Recent Developments

- In May 2025, Vertical Aerospace and Honeywell announced the expansion of their partnership to certify key systems for the VX4 air taxi, aiming for certification by 2028. This includes flight control and navigation systems for electric vertical take-off and landing (eVTOL) aircraft. Training programs for eVTOL pilots are also under development, anticipating future urban mobility demands. The partnership strengthens the ecosystem for advanced air mobility training.

- In March 2025, Acron Aviation announced its formal launch as a flight training provider and avionics manufacturer, following the acquisition of L3Harris' Commercial Aviation Solutions. This strategic entry combines training capabilities with avionics R&D under one brand. Acron plans to serve both civil and defense aviation markets. The acquisition includes training systems, simulation software, and maintenance support infrastructure.

- In August 2024, Air India announced an investment of over ?200 crore to set up South Asia's largest flight training academy in Maharashtra's Amravati district. The facility will feature modern training aircraft and full-flight simulators. It is expected to train around 500 pilots annually. The academy supports Air India's broader ambition of creating an in-house talent pipeline for its expanding domestic and international operations.

- In July 2024, Chimes Aviation Academy announced the expansion of its aircraft fleet with the introduction of a new DA-42 multi-engine aircraft. This addition boosts the academy's training capacity and reflects its continued investment in advanced aviation training infrastructure. With a growing fleet, the academy aims to strengthen its position as a premier pilot training institution in India.

Segments Covered in the Report

By Training Type

- Pilot Training

- Crew Training

- Virtual Reality (VR) Training

By Simulator Type

- Full Flight Simulators (FFS)

- Flight Training Devices (FTD)

- Fixed-Base Simulators

By Application

- Commercial Aviation

- Military Aviation

- Helicopter Training

- Unmanned Aerial Vehicles (UAVs)

By End-User

- Airlines

- Flight Schools

- Government/Military

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting