What is the Contact Center Software Market Size?

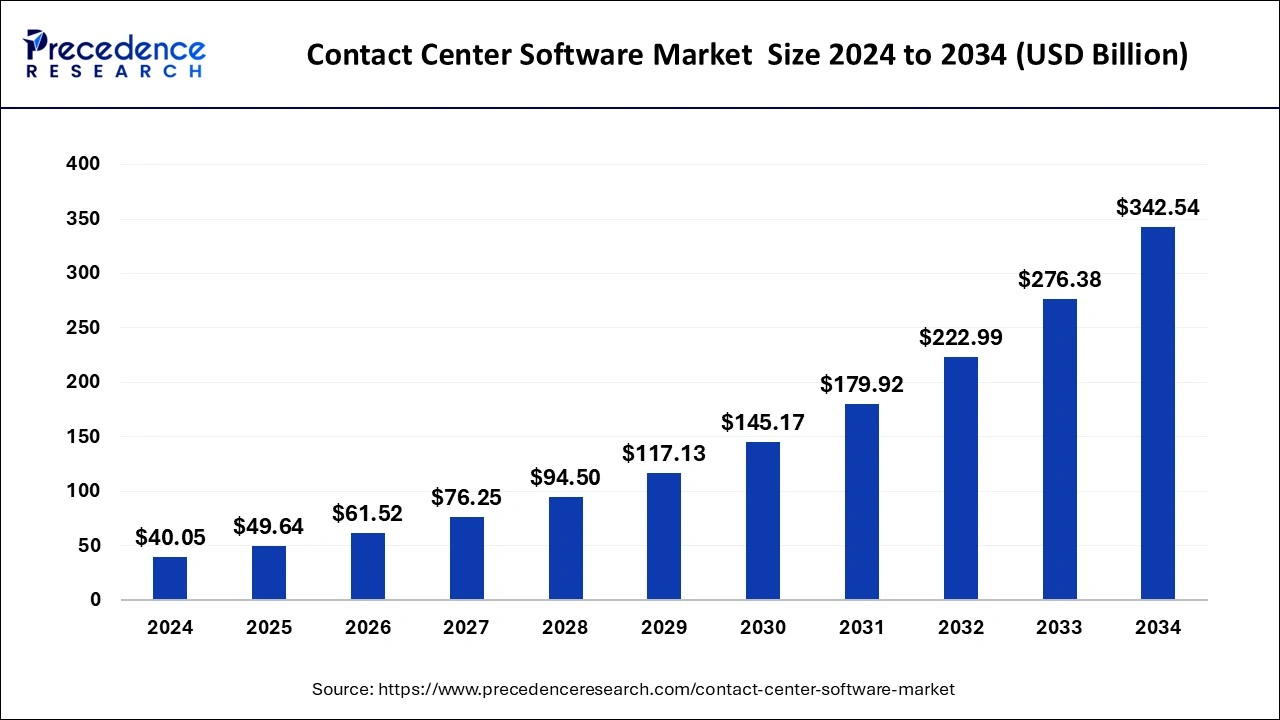

The global contact center software market size accounted for USD 49.64 billion in 2025 and is predicted to increase from USD 61.52 billion in 2026 to approximately USD 400.19 billion by 2035, growing at a CAGR of 23.21% from 2026 to 2035.

Market Highlights

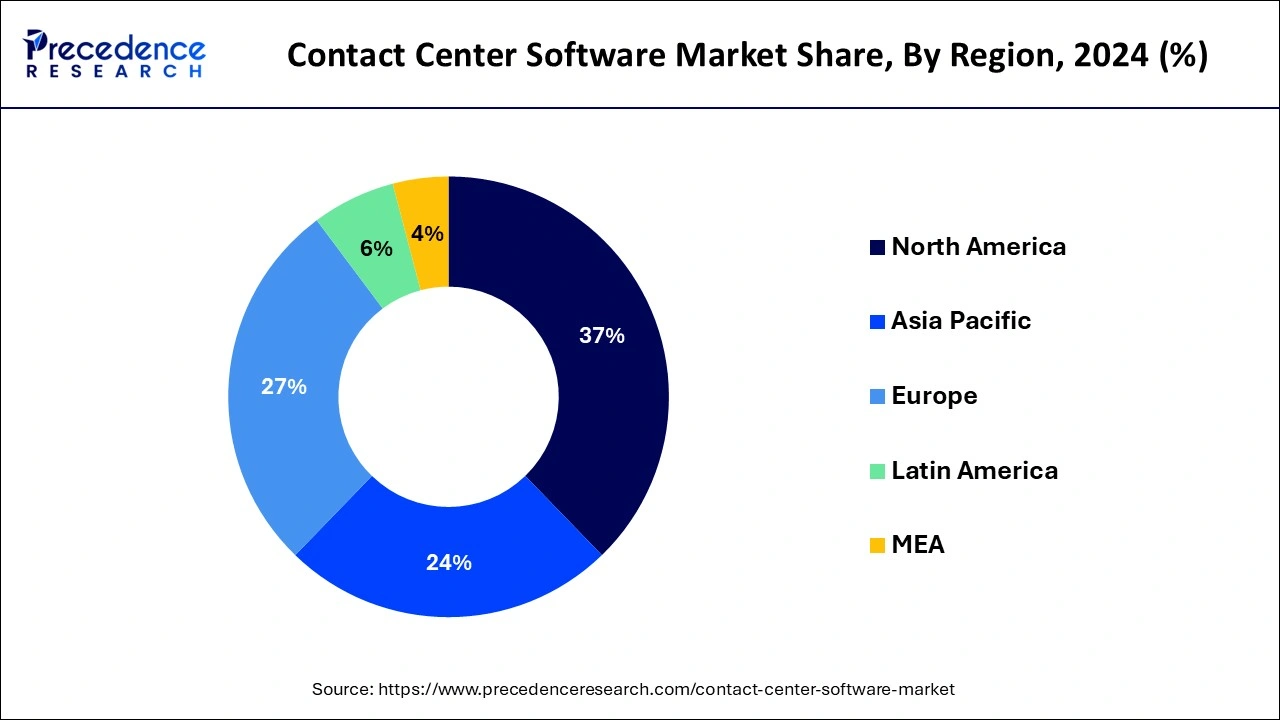

- North America dominated the global contact center software market with the largest market share of 37% in 2025.

- Asia Pacific is projected to expand at the fastest CAGR during the forecast period.

- By component, the software segment dominated the market with a 68.40% share in 2025.

- By component, the services segment is expected to grow at the highest CAGR of 13.20% over the forecast period.

- By deployment mode, the cloud-based segment held a 61.70% market share in 2025 and is expected to grow at the highest CAGR of 12.60% over the forecast period.

- By organisation size, the large enterprise segment dominated the market with a 63.10% share in 2025.

- By organisation size, the SMEs segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the customer support segment held a 42.80% market share in 2025.

- By application, the sales & lead management segment is expected to grow at the highest CAGR of 12.90% during the projected period.

- By end-use industry, the BFSI segment dominated the market by holding 21.30% share in 2025.

- By end-use industry, the healthcare & life sciences segment is expected to grow at the highest CAGR of 13.50% during the study period.

Market Size and Forecast

- Market Size in 2025: USD 49.64 Billion

- Market Size in 2026: USD 61.52 Billion

- Forecasted Market Size by 2035: USD 400.19Billion

- CAGR (2026-2035): 23.21%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

The contact center software market consists of sales of contact center software and associated services by entities (organizations, sole proprietors, and partnerships) used for streamlining business processes and interacting with customers through real-time call monitoring, assigning customer contacts to agents, and analyzing, tracking, and reporting crucial metrics through a centralized platform. By concentrating on interactions between contact center workers and clients, contact center software is a communication solution that aids in boosting a contact center's efficiency.

The market for contact center software is expanding considerably as a result of the quick uptake of cloud-based contact centers. All inbound and outgoing customer conversations are handled by the cloud-based contact center, which is housed on a web server. The market for contact center software is expanding due to the increasing use of cloud-based contact centers, which offer greater scalability and flexibility than traditional contact centers. For instance, 62% of decision-makers in contact centers have expressed interest in establishing a cloud-based contact center in the next 18 months, according to a poll done in 2020 by Cisco Systems Inc., a US-based networking hardware business. As a result, the market for contact center software is expanding quickly due to the use of cloud-based contact centers.

The primary trends gaining traction in the contact center software industry are technological developments. Businesses are incorporating AI to increase the effectiveness of contact center software. Artificial intelligence (AI) aids in consumer behavior analysis, insight provision, waiting time reduction, and real-time prediction of future behavior. For instance, NICE Systems Ltd., an Israeli software firm that specializes in contact center software, introduced ENLIGHTEN Fraud Prevention in July 2020. This platform for customer engagement uses artificial intelligence and speech biometrics to automatically identify fraudsters. Based on predictive behavioral models, the system aims to identify and rate agent actions to enhance the identification of sales opportunities and customer satisfaction. Without depending on agents to manually record dispositions, it can analyze millions of speech encounters to identify dangerous and aberrant conduct, including authentication techniques and requests for address changes. It aids businesses in preventing the disclosure of personally identifiable information, safeguarding customer loyalty, preventing account takeovers, and lowering fraud losses.

Contact Center Software Market Growth Factors

New technologies like machine learning,cloud computing,predictive analytics, and artificial intelligence are expected to improve contact center functionality. Customer inquiries have increased across industries as a result of rising consumer rights awareness. Consumer goods and retail, healthcare, the BFSI industry, and other customer service-focused industries are spending more and more in contact centers to enhance the client experience and guarantee service satisfaction. We have included the component services and solutions provided by businesses like NICE CXone, Genesys Cloud CX, 3CX, and Five9 Inc., among others, in the scope of the market analysis.

Technology development made it easier for customers to communicate with businesses through all available channels, including phone calls, video chats, emails, and social media. The contact center solution offers omnichannel solutions to connect consumers through various channels. For instance, Capital One adopted the cloud-based contact center technology from Amazon Connect to deliver a smooth and intelligent client experience. Due to the rising competition to retain repeat customers by providing seamless services, the market for contact center software is being driven.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 49.64Billion |

| Market Size in 2026 | USD 61.52 Billion |

| Market Size by 2035 | USD 400.19Billion |

| Growth Rate from 2026 to 2035 | CAGR of 23.21% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution, Service, Deployment, Enterprise Size, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Artificial intelligence integrated software to drive market growth

The creator is incorporating artificial intelligence to increase the software's effectiveness. AI-based software assists in the analysis of consumer behavior at every level of service. It anticipates consumers' future behavior and provides real-time customer information. The agents may better handle and support clients during calls by using the analysis to inform their decision-making. AI-enabled chatbots reduce customer wait times by engaging and moderating the dialogues. The analytics engine that helps with contact center process optimization receives the data collected throughout the conversation.

Similar to predictive analysis, the sentimental analysis looks for a keyword to forecast the tenor of a customer's expression. NLP and machine learning let operators make decisions that enhance callers' experiences and customer service. By 2022, adding AI and robotic process automation can cut agent assistance time by 25%, according to Kearney, a global management consulting firm.

Increased omnichannel service implementation to ensure customer satisfaction

With the aid of an Omni channel solution, customers may contact the company via a variety of digital channels, including emails, social media, SMS, phone calls, video, live chats, and more. Customer satisfaction rises as a result of the tailored communications it offers with clients. While improving the quantity of customer complaints, the contact center solution lowers customer service expenses. The growth of customer trust is facilitated by service providers' visibility across all channels. Additionally, it offers agents that interact with clients real-time information about them across channels. As a result, the agent may forge better bonds with clients and deliver a superior customer experience. This is expected to hasten the expansion of the contact center software industry.

Due to increased competition and the rising expense of on-premises solutions, businesses are embracing cloud-based software more and more. Compared to conventional contact centers, cloud-based software offers an organization more flexibility and scalability. It offers the agent rapid support so they can give the client better service. To assist the customer within the allotted time, the agents use the data stored in the cloud. As a result, customers wait for less and are more likely to recommend the brand.

Key Market Challenges

- High-cost investment to inhibit market demand - The end-user businesses are dealing with difficulties as the price of contact center solutions grows. The on-site contact center solutions demand gear that has to be maintained and serviced on a regular basis. The need for service upkeep and devoted employees lead in significant costs for the organization. Similar to this, prolonged outages for cloud-based software may be quite expensive for the company. Companies that enable cloud systems are forced to offer specialized cybersecurity solutions due to the increase in cloud threats. During the anticipated time frame, this is anticipated to impede the market growth.

Key Market Opportunities

Business appears stronger than market cloud technology suggestions

Administrators and managers of contact centers are embracing cloud technology for a variety of reasons, including improved security & efficiency. Organizations are progressively integrating various omnichannel solutions, such as video chat assistance and Chatbots, based on cutting-edge technology like Artificial Intelligence, to improve the customer experience (AI). Several businesses have already started automating some business processes using AI. Prescriptive AI, the next version of this technology, offers a variety of brand-new functions, from improved case routing to efficient query resolution and schedule management. Prescriptive AI is predicted to enhance customer interactions across the board, from discovery and onboarding to post-purchase support, giving businesses a unique perspective on how to anticipate shifting consumer expectations.

Internal applications of prescriptive AI can include optimizing the utilization of field resources and refilling stockpiles in response to demand. However, Interactive Voice Response (IVR) fraud or fraudulent activity taking place within the IVR systems may restrain the market's growth throughout the projection period.

Segments Insights

Solution Insights

The IVR sector segment contributed the highest market share in 2025. Compared to traditional speech recognition software, interactive voice response systems can recognize tones and accents with more accuracy. Businesses can use interactive voice response systems to assist allocate callers to the appropriate departments or agents as needed. Additionally, IVR services can assist customers in addressing product-related issues independently rather than relying on customer service agents. IVR systems are frequently used by contact centers with large call volumes to handle numerous calls at once without alerting the callers' callers that there are other callers on the line.

Over the projected period, it is predicted that the customer collaboration solution category would grow at the quickest rate. Solutions for customer collaboration help firms communicate more effectively with both current and future customers. These tools assist organizations in acquiring and utilizing customer feedback to enhance their product and service offerings as well as tracking, receiving, and resolving customer care concerns swiftly. Over the course of the projection period, the segment's growth is anticipated to be driven by the significant emphasis on boosting cooperation by using photos and videos to interact with clients.

Service Insights

The integration & deployment segment captured the biggest market share in 2025. Over the projection period, the market is anticipated to rise as cloud-based contact center software solutions become more widely used. Businesses all over the world are making significant investments to include various apps and technologies, includingCustomer Relationship Management (CRM), into their business operations, which are fueling the expansion of this market. The fast implementation of cloud-based solutions and the increasing need for business agility are both positive factors for the expansion of the integration and deployment segment. Over the projected period, the managed services category is expected to develop at the quickest rate.

By delegating the company's IT-related activities to managed service providers, managed services enable enterprises to concentrate on their core goods and services. By utilizing configuration management, provisioning, common change management, and patch management solutions, managed services assist enterprises in maintaining they're programmed for end users. Additionally, a variety of value-added services are included in these services to assist organizations in getting the most out of contact center solutions in terms of performance and dependability while limiting operating expenses. The expansion of cloud solutions is encouraging for the managed services market.

Deployment Insights

The on-premise segment has held the largest market share in 2025. The idea behind on-premise deployment is to set up all the gear and software needed to run and manage a contact center on the client's premises. Inerrability, dependability, customizability, and to some extent scalabilities are all features that on-premise systems provide. They can, however, occasionally be highly expensive and difficult to implement. Only when organizations make significant investments in professional services can they appreciate the benefits of on-premise systems' customizability. Over the projected period, the hosted category is predicted to have the quickest CAGR.

Due to their flexibility to expand services, businesses all over the world are choosing cloud-based contact centre systems over on-premise alternatives. Agents may access centralized contact centre applications using cloud solutions, which also provide a secure intranet for staff collaboration and communication. Executives using on-premise solutions would not be able to track detailed information about the agents and clients that cloud-based systems are capable of providing. The average speed of answer (ASA) can be decreased by as much as 50% while enhancing customer call answer rates by about 5%, according to research by RingCentral, Inc.

The cloud-based segment held a 61.70% market share in 2025 and is expected to grow at the highest CAGR of 12.60% over the forecast period. Due to their flexibility to expand services, businesses all over the world are choosing cloud-based contact centre systems over on-premises alternatives. Agents may access centralized contact centre applications using cloud solutions, which also provide a secure intranet for staff collaboration and communication. Executives using on-premises solutions would not be able to track the detailed information about the agents and clients that cloud-based systems can provide.

Component Insights

The software segment dominated the market with a 68.40% share in 2025. The dominance of the segment can be attributed to the growing demand for improved customer experience and the extensive adoption of AI and automation. Also, software solutions help to minimize overall operational costs by boosting agent productivity and enhancing call handling efficiency.

The services segment is expected to grow at the highest CAGR of 13.20% over the forecast period. The growth of the segment can be credited to the growing need for innovative implementation and deployment services to combine complex software, along with the rising popularity of managed services for functional purposes.

Organization Size Insights

The large enterprise segment dominated the market with a 63.10% share in 2025. The dominance of the segment can be linked to the growing demand for personalized and exceptional customer experiences, coupled with the strategic integration of the latest technologies. Moreover, large enterprises are using AI and ML for predictive analytics and intelligent routing to enhance response times, leading to segment growth soon.

The SMEs segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment can be driven by growing demand for enhanced customer experience through innovative features such as AI and cloud-based solutions. Additionally, SMEs are adopting these technologies to personalize interactions, centralize operations, and reduce costs.

Application Insights

The customer support segment held a 42.80% market share in 2025. Solutions for customer support help firms communicate more effectively with both current and future customers. These tools assist organizations in acquiring and utilizing customer feedback to enhance their product and service offerings, as well as tracking, receiving, and resolving customer care concerns swiftly. Over the course of the projection period, the segment's growth is anticipated to be driven by the significant emphasis on boosting cooperation by using photos and videos to interact with clients.

The sales & lead management segment is expected to grow at the highest CAGR of 12.90% during the projected period. The growth of the segment is owed to the rising need for improved customer experience (CX) across omnichannel platforms and the ongoing shift towards cloud-based solutions. Furthermore, the integration of new technologies such as predictive analytics and Big Data analytics can fuel segment growth soon.

End-Use Industry Insights

The BFSI segment dominated the market by holding 21.30% share in 2025. The dominance of the segment can be attributed to the increasing demand for data analytics to gain customer insights and the rapid integration of innovative technologies. Also, the conversion from on-premises solutions to cloud-based platforms gives BFSI organizations scalability and flexibility.

The healthcare & life sciences segment is expected to grow at the highest CAGR of 13.50% during the study period. The growth of the segment can be credited to the growing need for patient-centric services and the rapid adoption of AI-driven automation for improved, streamlined, and engaging operations. Healthcare providers are adopting omnichannel strategies for patient convenience.

Regional Insights

What is the U.S. Contact Center Software Market Size?

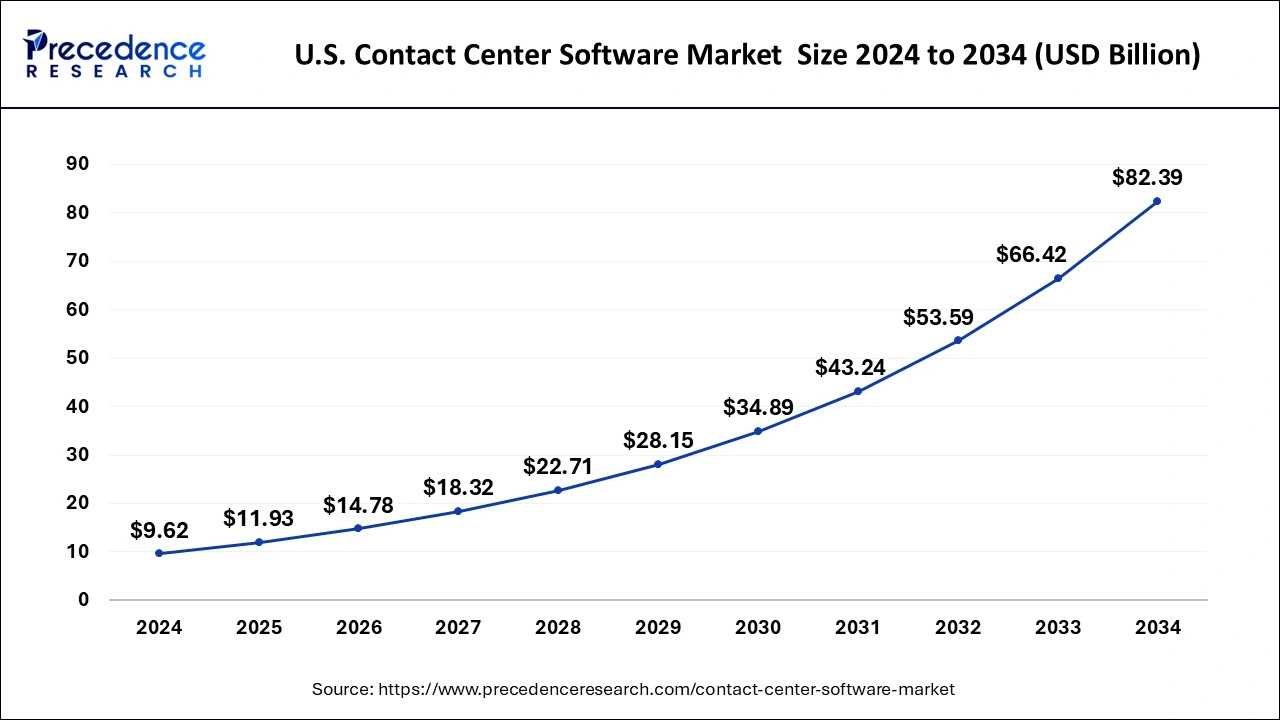

The U.S. contact center software market size is evaluated at USD 11.93 billion in 2025 and is predicted to be worth around USD 96.27 billion by 2035, rising at a CAGR of 23.22% from 2026 to 2035.

North America dominated the global contact center software market with the largest market share of 37% in 2025. Some of the major market participants are based in North America. Additionally, businesses in North American nations are making significant investments in cutting-edge technology like big data, analytics, and cloud platforms. Both major and small & medium firms in the area have increased their focus on optimizing outgoing and incoming processes to increase efficiency. The quickly expandinge-commerce sector, in conjunction with the more popular omnichannel approach to sales, is further anticipated to fuel regional market expansion.

U.S. Contact Center Software Market Trends

The U.S. market is driven by AI integration along with a shift toward cloud-based solutions to improve customer experience and operational efficiency. There is a growing need for platforms that unify communication channels, including email, voice, chat, and social media, to offer a seamless customer experience. Software tools are programmed to support distributed agent environments, guaranteeing secure access to data and tools from any location.

The presence of several Information Technology-enabled Services (ITES) and IT firms in the area is likely to make Asia Pacific the region with the quickest growth during the projection period. The regional market is expected to increase as a result of the increasing usage of contact center solutions by both small and large businesses. The positive efforts made by local governments to promote the use of cloud-based systems and the automation of corporate operations are also anticipated to play a significant part in propelling the expansion of the regional market. The fact that several businesses continue to be interested in investing in the APAC regional market is encouraging for the development of the local market.

China Contact Center Software Market Trends

In China, generative AI is rapidly scaling in acceptance, moving from basic chatbots to autonomous, scenario-specific agents. This involves AI for voice analytics and sentiment analysis to enhance customer experience. Businesses are prioritizing seamless, thus integrated communication over social media, voice, and even messaging channels. As digital platforms expand, there is a stronger focus on information security, compliance, and quality assurance software.

From Call Handling to Customer Intelligence: Europe's Contact Center Evolution

Europe's market shows significant growth during the forecast period. This evolution is driven by the demand to handle complex, omnichannel customer journeys, with Artificial Intelligence and Machine Learning acting as the main catalysts for improvement in both customer experience and operational efficiency.

UK Contact Center Software Market Trends

The UK market involves AI-powered automation, improved omnichannel experiences, and a high need for regulatory-compliant, secure platforms. The adoption of GenAI, chatbots, and virtual agents is accelerating, targeted at improving customer experience and decreasing operational expenses. There is a strong emphasis on omnichannel engagement that unifies voice, email, chat, and social media interactions and on advanced analytics that provide real-time insights for better decision-making.

Conversations Powered by Code: Latin America's Contact Center Software Market

Latin America's market shows notable growth during the forecast period. It is driven by cloud migration and AI; thus, the sector is shifting from conventional, on-premise setups to agile, omnichannel platforms that improve customer experience and operational efficiency. The integration of AI-driven chatbots, e.g., EVA, natural language processing, along with machine learning, is reducing average management times and automating routine inquiries.

Argentina Contact Center Software Market Trends

The Argentine contact center software market is driven by digital transformation, high internet penetration, along with a shift toward AI-driven, cloud-driven solutions. The market is seeing a surge in the need for AI-driven chatbots, speech analytics, and real-time sentiment analysis to enhance customer experience and efficiency.

When AI Joins the Conversation: Contact Center Software in MEA

MEA's market shows rapid growth during the forecast period. AI is rapidly changing contact centers in the Middle East and Africa, shifting from a competitive differentiator to an operational necessity by 2026. AI is used to determine customer data instantly, allowing agents to provide tailored recommendations and proactive support based on past interactions. AI voice bots and chatbots are offering round-the-clock service, decreasing wait times, and enhancing CSAT scores.

Contact Center Software Market Companies

- 8X8, Inc.

- ALE International

- Altivon

- Amazon Web Services, Inc.

- Ameyo

- Amtelco

- Aspect Software

- Avaya Inc.

- Avoxi

- Cisco Systems, Inc.

- Enghouse Interactive Inc.

- Exotel Techcom Pvt. Ltd.

- Five9, Inc.

- Genesys

- Microsoft Corp.

- NEC Corp.

- SAP SE

- Spok, Inc.

- Talkdesk, Inc.

- Twilio Inc.

- UiPath

- Unify Inc.

- VCC Live

Recent Developments

- March 2021: Microsoft Teams integration 8x8 Contact Center for Microsoft Teams was released by 8x8, Inc. Agents and staffs have access to an integrated contact center and a worldwide direct routing solution with the 8x8 cloud contact center and communication solution, which can be simply managed from any Teams endpoint.

Segments Covered in the Report

By Component

- Software

- Automatic Call Distribution (ACD)

- Computer Telephony Integration (CTI)

- Customer Collaboration

- Dialers (Predictive, Preview, Progressive)

- Interactive Voice Response (IVR)

- Reporting & Analytics

- Workforce Optimization

- Call Recording & Quality Management

- Omnichannel Routing

- Chatbots & Virtual Assistants

- Services

- Professional Services

- Consulting

- Integration & Deployment

- Support & Maintenance

- Managed Services

- Professional Services

By Deployment Mode

- On-Premise

- Cloud-Based

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Functionality

- Inbound Call Center

- Outbound Call Center

- Blended Call Center

- Multichannel/Omnichannel Communication

By Channel/Communication Mode

- Voice (Telephony)

- Chat (Live Chat, AI Chatbots)

- Social Media

- SMS/Text

- Video Calls

- Web Portals & Mobile Apps

By Application

- Customer Support

- Telemarketing

- Technical Support

- Sales & Lead Management

- Collections

- Helpdesk Services

By End-Use Industry

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare & Life Sciences

- IT & Telecommunications

- Government & Public Sector

- Retail & E-commerce

- Travel & Hospitality

- Education

- Utilities & Energy

- Manufacturing

- Media & Entertainment

By Technology Integration

- Artificial Intelligence (AI)

- Machine Learning (ML)

- Robotic Process Automation (RPA)

- Natural Language Processing (NLP)

- Speech Analytics

- Sentiment Analysis

- CRM Integration

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting